|

市場調查報告書

商品編碼

1445937

抗反射膜:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Anti-Reflective Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

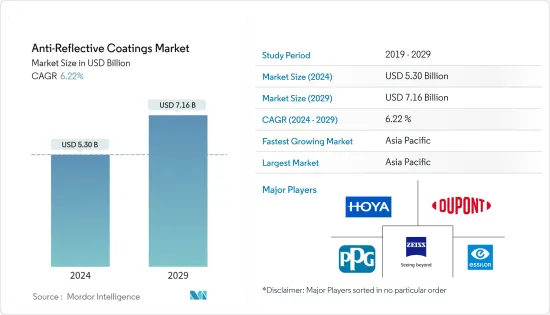

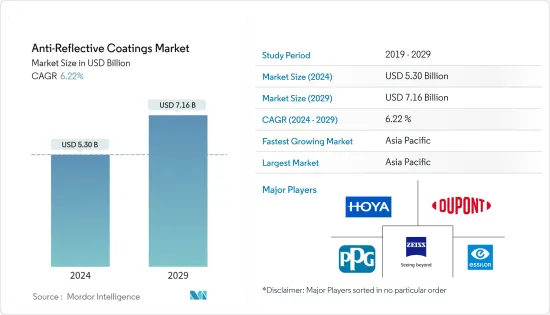

抗反射膜市場規模預計到 2024 年為 53 億美元,預計到 2029 年將達到 71.6 億美元,預測期內(2024-2029 年)年複合成長率為 6.22%。

2020年大流行期間,由於各國實施的具體規則和規定,各行業的市場需求放緩。然而,隨著所研究市場的需求復甦,該產業在 2021 年出現復甦。

推動所研究市場的主要因素是對眼鏡和電子應用的需求不斷成長。

主要亮點

- 此外,抗反射膜的高成本限制了它們在某些應用中的成長。

- 薄膜製造技術的發展對於所研究的市場來說是一個重大機會。

- 亞太地區預計將主導抗反射膜市場,並有望成為預測期內成長最快的市場。

抗反射膜市場趨勢

眼鏡產品應用需求增加

- 高穿透玻璃是一種經濟實惠的替代品,可減少電腦螢幕、電視、平板和其他電子顯示器的反射。

- 抗反射膜用於減少眩光並實現低反射率。因此,顯示器更易於閱讀,減少眼睛疲勞並增強視覺洞察力。

- 隨著越來越多人患有老花眼,對漸進的鏡片的需求迅速增加。老花眼是一種眼睛水晶體隨著老齡化而變硬,導致看清附近物體變得困難的疾病。

- 根據美國衛生與公共服務部的數據,40 歲以上的美國口中約有 23.9%(約 3,400 萬人)患有近視。

- 據世界衛生組織稱,截至 2022 年 10 月,全球約有 22 億人近視力或遠距離視力受損。此外,全球與視力障礙相關的生產力損失成本估計為 4,110 億美元。

- 預計這將增加對相應眼科鏡片的需求,同時解決這些障礙,進一步增加該國抗反射膜的需求。

中國將主導亞太地區

- 由於對半導體、電子和其他製造業務的需求不斷成長,亞太地區主導了全球市場。

- 中國是世界領先的太陽能電池製造商之一。中國雄心勃勃,到 2060 年實現碳中和,其最新的 2020 年五年計畫要求每年增加約 85 吉瓦的太陽能發電裝置,大約是目前數量的兩倍。此外,世界上大多數太陽能電池都是在中國或由中國公司製造的。

- 中國擁有全球最大的電子產品生產基地,包括智慧型手機、電視、電線、電纜、可攜式運算設備、遊戲系統和其他個人電子產品等電子產品,而電子產業的成長速度最高。我記錄下來了。該國滿足國內對電子產品的需求,並向其他國家出口電子產品。

- 中國是該地區智慧型手機的主要生產國之一。然而,智慧型手機製造商正在從中國遷出,這對研究市場產生了影響。許多全球製造商正在將其業務轉移到中國境外。

- 因此,由於上述因素,中國預計在亞太地區佔據市場主導地位。

抗反射膜產業概況

抗反射膜市場按主要企業的存在進行細分,例如(排名不分先後)杜邦公司、PPG 工業公司、豪雅視力保健公司、蔡司國際公司和依視路公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 眼鏡產品應用需求增加

- 其他司機

- 抑制因素

- 抗反射膜成本高

- 缺乏意識

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 沉澱法

- 化學沉澱

- 電子束沉澱

- 濺鍍

- 其他

- 按用途

- 半導體

- 電子設備

- 眼鏡產品

- 太陽能板

- 汽車顯示器

- 其他

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率(%)/排名分析

- 主要企業採取的策略

- 公司簡介(公司簡介、財務狀況、產品/服務、近期狀況)

- AccuCoat Inc.

- AGC Inc.

- COCO LENI

- DuPont

- Edmund Optics Inc.

- EKSMA Optics USB

- ESSILOR OF AMERICA LLC

- Evaporated Coatings Inc.

- Honeywell International Inc.

- HOYA VISION CARE COMPANY(HOYA Corporation)

- Majestic Optical Coatings

- Optical Coatings Japan

- Optics Balzers AG

- Optimum RX Group

- PPG Industries

- Quantum Coating

- Rodenstock GmbH

- Spectrum Direct Ltd

- Torr Scientific Ltd

- Viavi Solutions

- Zeiss International

- Zygo Corporation

第7章市場機會與未來趨勢

The Anti-Reflective Coatings Market size is estimated at USD 5.30 billion in 2024, and is expected to reach USD 7.16 billion by 2029, growing at a CAGR of 6.22% during the forecast period (2024-2029).

Due to specific rules and regulations imposed by countries, there was a slowdown in the market demand from various sectors during the pandemic in 2020. However, the industry witnessed a recovery in 2021, thus, rebounding the demand for the market studied.

The major factors driving the market studied are increasing demand for eyewear and electronics applications.

Key Highlights

- Additionally, the high cost of anti-reflective coatings is restraining its growth in some applications.

- The development of thin-film fabrication technologies is a significant opportunity for the market studied.

- The Asia-Pacific is expected to dominate the anti-reflective coatings market, and it is anticipated to be the fastest-growing market over the forecast period.

Anti-Reflective Coatings Market Trends

Increasing Demand from Eyewear Application

- Anti-reflective glasses are affordable alternatives to reduce glare reflected from computer screens, televisions, flat panels, and other electronic displays.

- Anti-reflective coatings are used to reduce glare and provide low reflectivity. As a result, displays are easier to read, eye strain is reduced, and visual insight is increased.

- The demand for progressive lenses has grown rapidly as more people suffer from presbyopia, a condition in which the eye's lens stiffens with age making it difficult to read at a close range.

- According to the US Department of Health & Human Services, nearsightedness occurs in about 23.9% of the population over 40 years old (about 34 million people) in the United States.

- According to the WHO, as of October 2022, around 2.2 billion people have near or distant vision impairment across the globe. Moreover, global costs of productivity losses associated with vision impairment are estimated to be USD 411 billion.

- This is likely to enhance the demand for respective eye lenses while addressing these impairments, further enhancing the demand for anti-reflective coatings in the country.

China to Dominate the Asia-Pacific Region

- The Asia-Pacific region dominated the global market due to the growing demand for semiconductors, electronics, and other manufacturing operations.

- China is one of the leading manufacturers of solar cells in the world. China is ambitious to be carbon-neutral by 2060, and the latest five-year plan in 2020 outlines that the annual solar power generation capacity installations should increase by around 85 GW, nearly twice the country's current rate. Moreover, the majority of solar cells across the world are manufactured in China or by Chinese companies.

- China has the world's largest electronics production base, which includes electronic products, such as smartphones, TVs, wires, cables, portable computing devices, gaming systems, and other personal electronic devices, and recorded the highest growth in the electronics segment. The country serves the domestic demand for electronics and exports electronic output to other countries.

- China is one of the leading producers of smartphones in the region. However, smartphone manufacturers shifting their base from China is affecting the market studied. Many global manufacturers have shifted their base outside China.

- Thus, due to the abovementioned factors, China is expected to dominate the market in the Asia-Pacific region.

Anti-Reflective Coatings Industry Overview

The anti-reflective coatings market is fragmented due to the presence of major players (not in any particular order), including DuPont, PPG Industries Inc., Hoya Vision Care Company, Zeiss International, and Essilor, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Eyewear Applications

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 High Cost of Anti-reflective Coatings

- 4.2.2 Dearth of Awareness

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Deposition Method

- 5.1.1 Chemical Vapor Deposition

- 5.1.2 Electronic Beam Deposition

- 5.1.3 Sputtering

- 5.1.4 Other Deposition Methods

- 5.2 By Application

- 5.2.1 Semiconductors

- 5.2.2 Electronic Devices

- 5.2.3 Eyewear

- 5.2.4 Solar Panels

- 5.2.5 Automotive Displays

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles (Overview, Financials, Products and Services, and Recent Developments)

- 6.4.1 AccuCoat Inc.

- 6.4.2 AGC Inc.

- 6.4.3 COCO LENI

- 6.4.4 DuPont

- 6.4.5 Edmund Optics Inc.

- 6.4.6 EKSMA Optics USB

- 6.4.7 ESSILOR OF AMERICA LLC

- 6.4.8 Evaporated Coatings Inc.

- 6.4.9 Honeywell International Inc.

- 6.4.10 HOYA VISION CARE COMPANY (HOYA Corporation)

- 6.4.11 Majestic Optical Coatings

- 6.4.12 Optical Coatings Japan

- 6.4.13 Optics Balzers AG

- 6.4.14 Optimum RX Group

- 6.4.15 PPG Industries

- 6.4.16 Quantum Coating

- 6.4.17 Rodenstock GmbH

- 6.4.18 Spectrum Direct Ltd

- 6.4.19 Torr Scientific Ltd

- 6.4.20 Viavi Solutions

- 6.4.21 Zeiss International

- 6.4.22 Zygo Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Thin Film Fabrication Technologies

- 7.2 Other Opportunities

![抗反射塗層的全球市場:各終端用戶(眼鏡產品,電子產品,太陽能,汽車,其他[通訊])的產業分析,規模,佔有率,成長,趨勢,預測(2021年~2031年)](/sample/img/cover/42/1080969.png)