|

市場調查報告書

商品編碼

1404387

茂金屬聚乙烯 (mPE):市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Metallocene Polyethylene (mPE) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

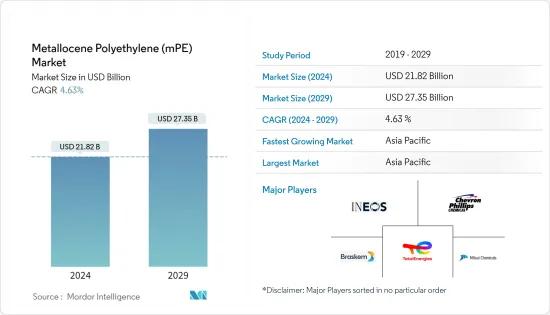

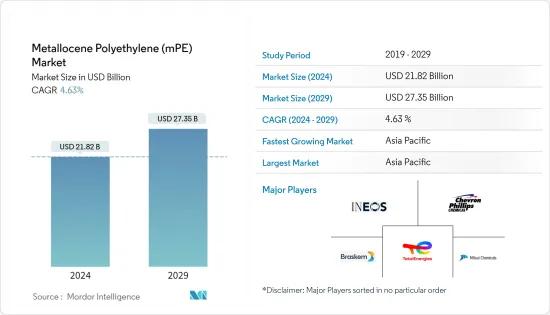

茂金屬聚乙烯市場規模預計到2024年為218.2億美元,預計到2029年將達到273.5億美元,在預測期內(2024-2029年)複合年成長率為4.63%。

主要亮點

- COVID-19 大流行對茂金屬聚乙烯產業產生了負面影響。全球封鎖和政府實施的嚴格規定摧毀了大多數生產基地。儘管如此,業務自 2021 年以來已經復甦,預計未來幾年將大幅成長。

- 從長遠來看,各個最終用戶產業對 mPE 的需求不斷增加,以及包裝產業中薄膜和片材的快速採用,預計將推動對 mPE 的需求。

- 然而,嚴格的政府法規預計將成為限制 mPE 市場成長的因素。

- mPE 領域的重大研究和開發預計將為 mPE 市場創造新的成長機會。

- 預計亞太地區將成為茂金屬聚乙烯(mPE)的最大市場,並預計在預測期內將以更快的速度成長。

茂金屬聚乙烯(MPE)市場趨勢

包裝產業對 MPE 的需求增加

- 茂金屬牌號的聚乙烯具有高衝擊強度、耐穿刺性、耐環境應力開裂性 (ESCR) 和非常好的有機性能。

- 這些產品廣泛應用於消費品、工業和商務用包裝的薄膜應用。它也適用於透過壓縮成型製造非碳酸飲料的瓶蓋和封閉件。其他典型應用包括高性能薄膜應用,例如食品包裝和醫療包裝。

- 這些聚合物的典型應用包括貨物散裝食品包裝、收穫前、收穫中期和收穫後農產品包裝薄膜、食品包裝薄膜和薄壁容器。

- 這些聚合物擴大用於包裝最終用戶行業,因為它們的薄膜厚度比 LDPE、HDPE、LLDPE 等薄得多。

- 歐洲食品和飲料進一步付加,到 2022 年,歐洲食品和飲料業將僱用 460 萬人,收益和 2,300 億歐元(2,423.7 億美元)的額外銷售額。創造價值並成為歐洲最大的製造公司之一。這導致該地區食品和飲料行業的成長,增加了對食品包裝的需求,並帶動了對 mPE 的需求。

- 近年來,由於經濟擴張和高購買力的中階不斷壯大,中國包裝產業持續快速成長。食品包裝是包裝產業的主要企業,約佔中國60%的市場佔有率。 Interpak預計,在中國食品包裝類別中,預計2023年包裝總量將達到4,470億件,顯示包裝產業對研究市場的需求不斷增加。

- 因此,上述因素正在推動預測期內調查的市場需求。

亞太地區主導市場

- 亞太地區的 MPE 需求主要受到包裝、建築、汽車、醫療保健等領域應用不斷增加的推動。

- 印度、中國和韓國等國家人口的成長、消費能力的增強、快速的都市化以及零售業的發展是推動包裝材料產業成長的因素。

- 在亞太地區,由於食品的改變、人們可支配收入的增加、工作成年人數量的增加以及對快餐的日益偏好,對包裝速食的需求不斷成長。消費者更喜歡已調理食品,因為它新鮮,準備時間短,包裝美觀且堅固,支持了所研究市場的需求。

- 據印度包裝工業協會(PIAI)稱,預計印度包裝行業在預測期內將以22%的成長率成長。此外,到2025年,印度包裝市場預計將達到2,048.1億美元,2020-2025年複合年成長率為26.7%。因此,預計該地區的 MPE 市場將會成長。

- 就就業和收益而言,醫療保健是印度經濟中最大的部門之一。根據印度品牌股權基金會(IBEF)的數據,2023會計年度印度醫療保健公共支出佔GDP的2.1%,印度醫療旅遊業在全球排名第9。印度醫療旅遊市場預計到 2026 年將達到 134.2 億美元,而 2020 年為 28.9 億美元。

- 此外,中國是世界上最大、成長最快的醫療保健市場之一。根據中國國家統計局的數據,2022年8月,中國各類藥品零售額達約519.2億元人民幣(75.11億美元)。隨著藥品需求的不斷增加,醫療保健包裝市場預計將在未來幾年擴大。

- 此外,汽車產業在亞太地區 mPE 需求不斷成長的過程中也發揮著重要作用。例如,根據OICA的數據,2022年亞太地區汽車總產量為50,020,793輛,較2021年成長7%。

- 因此,隨著各終端用戶產業的快速成長,茂金屬聚乙烯(MPE)的需求預計在預測期內將快速成長。

茂金屬聚乙烯 (MPE) 產業概覽

茂金屬聚乙烯 (mPE) 市場較為分散。主要參與者包括英力士 (INEOS)、布拉斯科 (Braskem)、雪佛龍菲利普斯化學公司 (Chevron Phillips Chemical Company)、三井化學 (Mitsui Chemicals) 和 TotalEnergies。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 各個最終用戶產業對 MPE 的需求不斷成長

- 薄膜和片材在包裝行業的快速採用

- 其他司機

- 抑制因素

- 嚴格的政府法規

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 類型

- 茂金屬線型低密度聚乙烯(mLLDPE)

- 茂金屬高密度聚苯乙烯(mHDPE)

- 其他類型(如茂金屬低密度聚乙烯(mLDPE))

- 目的

- 電影

- 床單

- 其他用途

- 最終用戶產業

- 包裝

- 農業

- 車

- 建築/施工

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太地區其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 亞太地區

第6章競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率分析(%)**/排名分析

- 主要企業策略

- 公司簡介

- Braskem

- Brentwood Plastics, Inc.

- Chevron Phillips Chemical Company LLC

- INEOS

- Mitsui Chemicals, Inc.

- Prime Polymer Co., Ltd.

- SABIC

- TotalEnergies

- Univation Technologies, LLC.

- WR Grace & Co.-Conn

第7章 市場機會及未來趨勢

- mPE 領域的重要研發

- 其他機會

簡介目錄

Product Code: 62230

The Metallocene Polyethylene Market size is estimated at USD 21.82 billion in 2024, and is expected to reach USD 27.35 billion by 2029, growing at a CAGR of 4.63% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 pandemic had a negative impact on the metallocene polyethylene sector. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the business has been recovering since 2021 and is expected to rise significantly in the coming years.

- In the long term, growing demand for mPE from various end-user industries and a surge in the adoption of films and sheets in the packaging industry are expected the drive the demand for mPE.

- However, stringent government regulations are expected to act as a restraining factor for the growth of the mPE market.

- Significant research and development in the field of mPE is expected to create new growth opportunities in the mPE market.

- Asia-Pacific is projected to be the largest market for metallocene polyethylene (mPE), and it is also expected to grow at a faster rate during the forecast period.

Metallocene Polyethylene (MPE) Market Trends

Increasing Demand for mPE from Packaging Industry

- Metallocene-based grades of polyethylene have high impact strength, puncture resistance, and environmental stress crack resistance (ESCR), along with very good organoleptic properties.

- These products are used in a wide range of film applications in the field of consumer, industrial, and institutional packaging. It is also suited for the production of caps and closures for non-carbonated drinks by compression molding. Other typical applications are high-performance film applications such as food and medical packaging, among others.

- These polymers are majorly used for applications such as wraps to cover bulk items of cargo, films in the packaging of agricultural products before, during, and after harvesting, food packaging films, In thin-walled containers, and others.

- The applications of these polymers in the packaging end-user industry are on the rise because these can significantly reduce the film thickness compared with LDPE, HDPE and LLDPE, and other products.

- Furthermore, Food Drink Europe stated that in 2022, The Europe food and beverages industry employs 4.6 million people and generates EUR 1.1 trillion (USD 1.159 trillion) in revenue and EUR 230 billion (USD 242.37 billion) in value-added, making it one of the largest manufacturing industries in Europe. Thereby, increasing the food and beverages industry in the region, the demand for food packaging increases, in turn boosting the demand for mPE.

- The Chinese packaging industry has grown at a rapid and consistent rate in recent years, owing to expanding economy and a rising middle-class population with greater purchasing power. Food packaging is a major player in the packaging industry, accounting for roughly 60% of the total market share in China. According to Interpak, in China, in the foodstuff packaging category, total packaging is expected to reach 447 billion units in 2023, thereby indicating an increased demand for the studied market from the packaging industry.

- Thus, the aforementioned factors are boosting the demand for the market studied during the forecast period.

Asia-Pacific to Dominate the Market

- The demand for mPE from the Asia Pacific region is primarily driven by its growing number of applications in packaging, building and construction, automotive, healthcare, and others.

- The rising population, increased spending power, rapid urbanization, and development of the retail sector in countries like India, China, South Korea, and others are factors augmenting the growth of the packaging materials industry.

- In Asia-Pacific, the demand for packaged food is growing, owing to lifestyle changes, the growing disposable income of people, the increasing number of working professionals, and the growing preference for fast food. Consumers prefer ready-to-consume foods because they are fresh, require considerably less time for cooking, and have attractive and sturdy packaging, supporting the demand for the market studied.

- According to the Packaging Industry Association of India (PIAI), the Indian packaging industry is expected to grow at a rate of 22% during the forecast period. Moreover, the Indian packaging market is expected to reach USD 204.81 billion by 2025, registering a CAGR of 26.7% between 2020 and 2025. Therefore, the mPE market is expected to grow in the region.

- Healthcare is one of the largest sectors of the Indian economy in terms of both employment and revenue. According to India Brand Equity Foundation (IBEF), India's public expenditure on healthcare touched 2.1 % of GDP in FY23, and India has ranked ninth globally for medical tourism. The Indian medical tourism market is expected to reach USD 13.42 billion by 2026, compared to USD 2.89 billion in 2020.

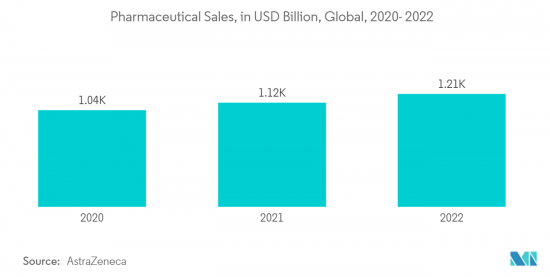

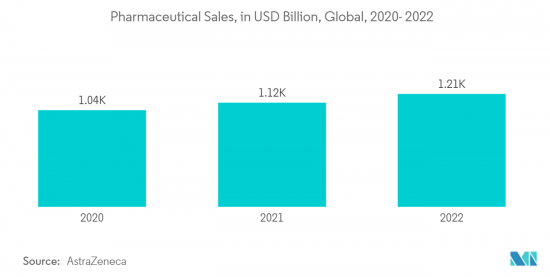

- Furthermore, China is one of the largest and fastest-growing healthcare markets in the world. According to the National Bureau of Statistics of China, in August 2022, the retail sales figure of various pharmaceuticals in China amounted to about CNY 51.92 billion (USD 7.511 Billion). With the increase in demand for pharmaceuticals, the market for healthcare packaging is expected to increase in the coming years.

- Moreover, the automotive industry also plays a significant role in the increase in demand for mPE in the Asia Pacific. For instance, according to OICA, the total motor vehicle production of Asia Pacific in 2022 accounted for 50,020,793 units which increased by 7% compared to 2021.

- Hence, with the rapid increase in various end-user industries, the demand for metallocene polyethylene (mPE) is expected to increase rapidly over the forecast period.

Metallocene Polyethylene (MPE) Industry Overview

The metallocene polyethylene (mPE) market is fragmented in nature. Some of the major players are INEOS, Braskem, Chevron Phillips Chemical Company, Mitsui Chemicals, Inc., and TotalEnergies, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for mPE from Various End User Industries

- 4.1.2 Surge in Adoption of Films and Sheets in Packaging Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Government Regulation

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Metallocene Linear Low-density Polyethylene (mLLDPE)

- 5.1.2 Metallocene High-density Polyethylene (mHDPE)

- 5.1.3 Other Types (Metallocene Low-density Polyethylene (mLDPE), etc.)

- 5.2 Application

- 5.2.1 Films

- 5.2.2 Sheets

- 5.2.3 Other Applications

- 5.3 End-User Industry

- 5.3.1 Packaging

- 5.3.2 Agriculture

- 5.3.3 Automotive

- 5.3.4 Building and Construction

- 5.3.5 Other End-User Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East & Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East & Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Braskem

- 6.4.2 Brentwood Plastics, Inc.

- 6.4.3 Chevron Phillips Chemical Company LLC

- 6.4.4 INEOS

- 6.4.5 Mitsui Chemicals, Inc.

- 6.4.6 Prime Polymer Co., Ltd.

- 6.4.7 SABIC

- 6.4.8 TotalEnergies

- 6.4.9 Univation Technologies, LLC.

- 6.4.10 W. R. Grace & Co.-Conn

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Significant Research and Development in the Field of mPE

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219