|

市場調查報告書

商品編碼

1273511

氟化乙烯丙烯 (FEP) 塗料市場 - 增長、趨勢、COVID-19 影響和預測 (2023-2028)Fluorinated Ethylene Propylene (FEP) Coatings Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,氟化乙丙 (FEP) 塗料市場的複合年增長率預計將低於 6%。

2020 年,COVID-19 對市場產生了負面影響。 但目前市場估計已達到疫情前水平,未來有望穩步增長。

主要亮點

- 電子和食品加工行業的需求增加預計將主導市場。

- 另一方面,日益嚴重的環境問題和嚴格的 EPA 法規預計會阻礙市場增長。

- 由於光纖行業的新應用,預計未來幾年市場也會增長。

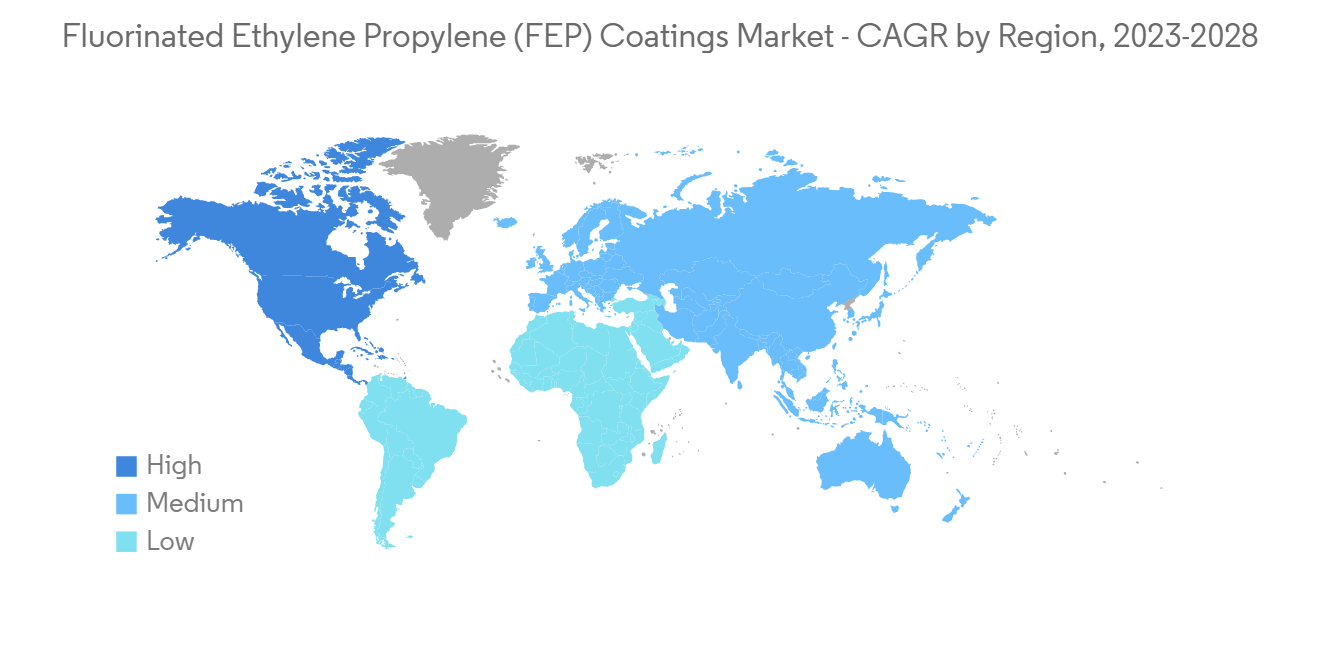

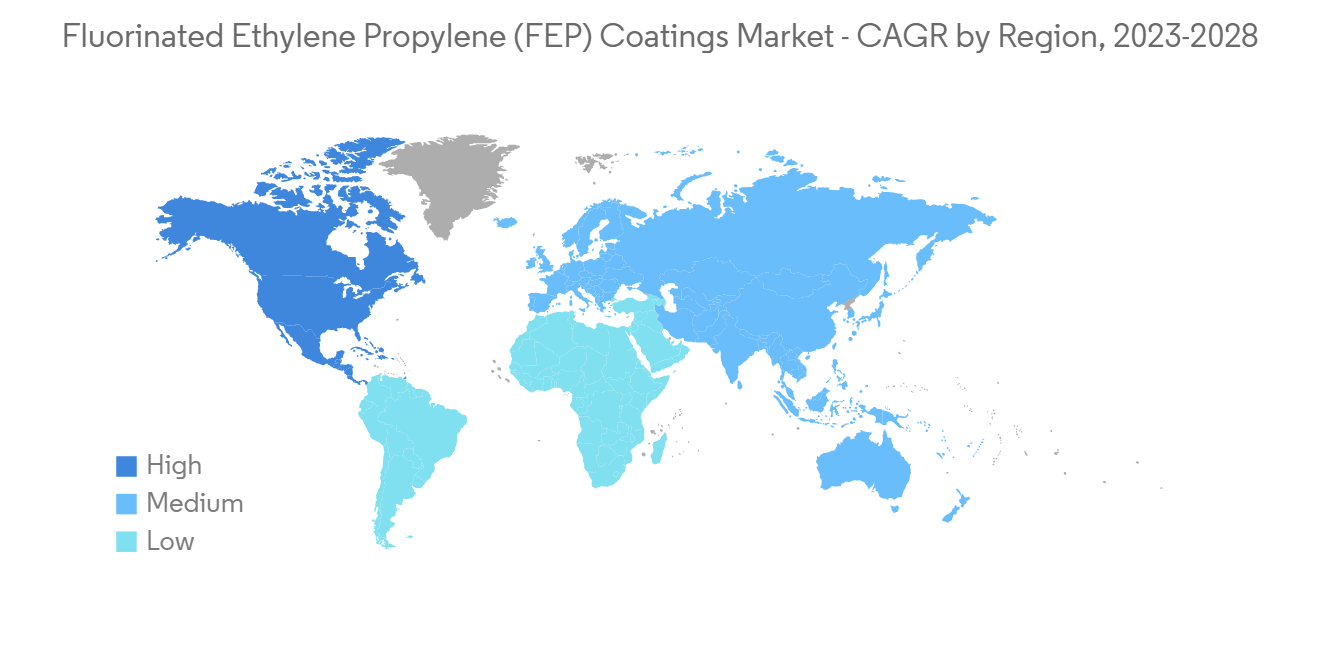

- 北美在全球市場中佔據主導地位,美國和加拿大等國家/地區的消費量最大。

氟化乙烯丙烯 (FEP) 塗料的市場趨勢

電氣和電子行業的高需求

- FEP 是一種出色的絕緣體,使其成為提供電絕緣的理想選擇,同時在收縮到電線上時還提供耐化學性,使其成為製造過程中苛刻化學應用的理想選擇。FEP 塗層可以容納和運輸物質,是電子電氣工業中重要的塗層材料之一。

- 半導體集成電路是通過光刻、蝕刻、清洗、薄膜沉積和拋光等工藝製造的。

- FEP 塗層用於製造晶圓載體、管道、配件和泵組件,這些是半導體製造中輸送高純度化學品的理想選擇,因此適用於半導體行業應用。

- 在製造個人電腦、手機和液晶/等離子/LED 顯示器等電子設備的半導體行業,已開發出特殊等級的 FEP 塗層以滿足嚴格的要求。

- 在全球範圍內,對智能手機的需求正在以顯著的速度增長。 根據 TelefonaktiebolagetLM Ericsson 的數據,2021 年全球智能手機訂閱量將達到 62.59 億,而上一年為 59.24 億。 而且,未來三年有望達到76.9億,帶動市場增長。

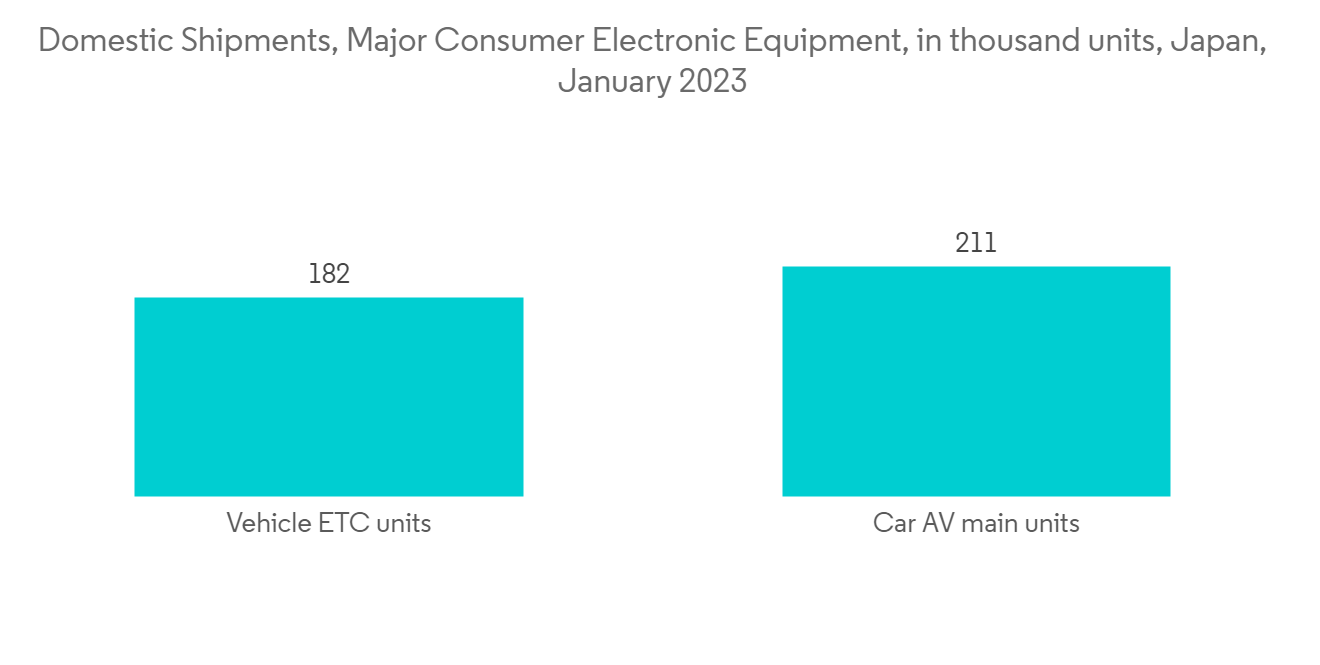

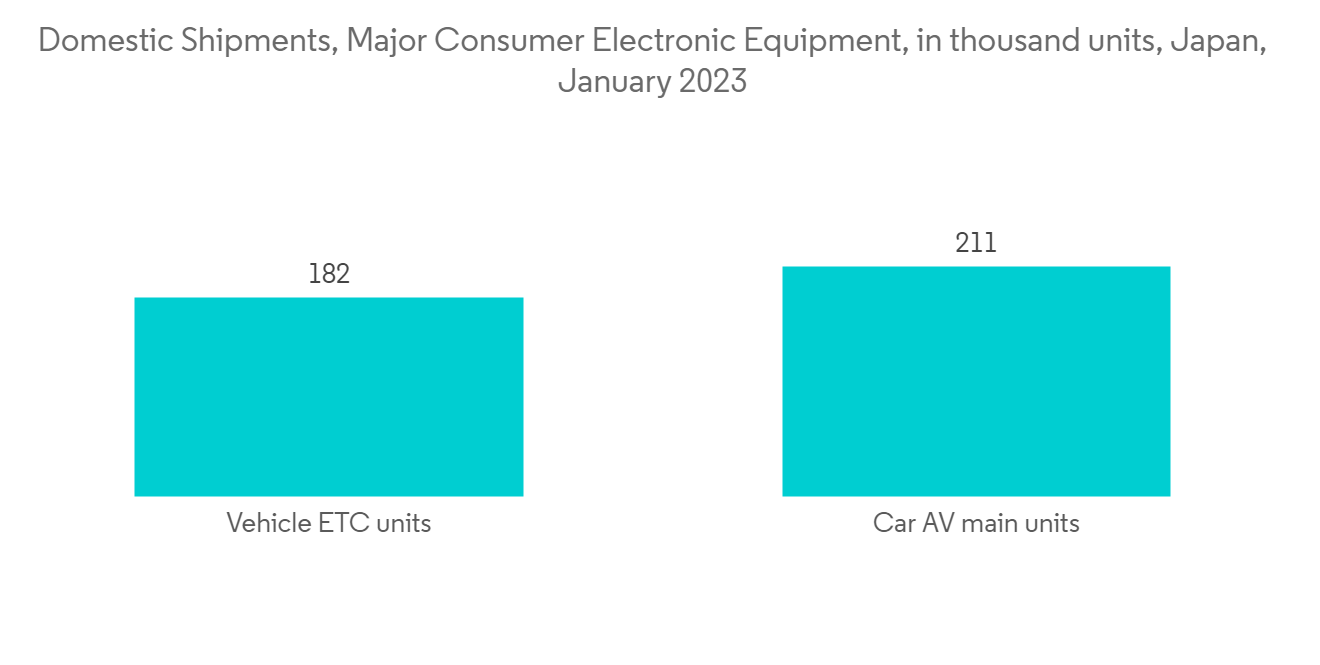

- 根據日本電子信息技術產業協會 (JEITA) 的數據,2023 年 1 月國內平板電視的出貨量將達到 365,000 台。 從而促進市場的增長。

- 在預測期內,上述所有因素預計都會增加對 FEP 塗料市場的需求。

北美主導市場

- 對氟化乙丙 (FEP) 塗料的巨大需求是北美地區電子、光纖、食品加工、化學加工以及石油和天然氣行業發展趨勢的結果。

- 在北美,尤其是美國,電子行業有望實現顯著增長。 消費技術協會預測,2022 年美國消費電子產品和技術零售額將達到 5050 億美元,高於 2021 年的 4610 億美元。

- 此外,由於人們對包裝食品的過度依賴以及食品加工公司的穩固立足點,北美食品加工行業的增長勢頭強勁。 百事可樂、泰森食品和雀巢是在該地區經營的大型食品加工公司。 因此,促進了市場的增長。

- 2022 年 3 月,由於消費者對植物性產品的需求不斷增長,雀巢將投資 6.75 億美元在美國亞利桑那州鳳凰城的新工廠生產燕麥奶咖啡奶精等飲料。宣布了以美元投資的計劃。 該工廠計劃於 2024 年開始運營,為食品加工領域的市場擴張做出貢獻。

- 因此,預計在不久的將來,對各種應用的需求不斷增加將大幅推動對氟化乙丙 (FEP) 塗料的需求。

氟化乙烯丙烯 (FEP) 塗料行業概況

氟化乙烯丙烯 (FEP) 塗料市場因其性質而部分分散。 市場上的主要參與者包括 AGC Inc.、DAIKIN INDUSTRIES, Ltd.、3M、AFT Fluorotec Limited 和 The Chemours Company(排名不分先後)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查先決條件

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 主持人

- 在食品行業的不粘應用中,一種具有成本效益的 PTFE 替代品

- 對電子設備半導體中 FEP 塗層的興趣增加

- 約束因素

- 日益增長的環境問題和嚴格的環境保護機構法規

- 其他抑製劑

- 工業價值鏈分析

- 波特的五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章市場細分

- 產品類型

- 粉末塗料

- 液體塗料

- 用法

- 炊具和食品加工

- 化學處理

- 石油和天然氣行業

- 電氣/電子

- 光纖

- 醫療

- 其他用途

- 區域信息

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第六章競爭格局

- 併購、合資、合作、合同等。

- 市場份額 (%) 分析**/市場排名分析

- 主要公司採用的策略

- 公司簡介

- 3M

- AFT Fluorotec Limited

- AGC Inc.

- DAIKIN INDUSTRIES, Ltd.

- Dongyue Chemical

- GMM Pfaudler

- fluorocarbonST

- Hubei Everflon Polymer CO., Ltd.

- Impreglon UK Limited

- INOFLON

- Praxair S.T. Technology, Inc.

- Precision Coating Company, Inc

- Rudolf Gutbrod GmbH

- Shanghai 3F New Materials Co., Ltd.

- The Chemours Company

- Toefco Engineered Coating Systems, Inc.

- Zeus Company Inc.

第七章市場機會與未來趨勢

- 光纖行業的新應用

The market for fluorinated ethylene propylene (FEP) coatings is projected to register a CAGR of less than 6% during the forecast period.

In 2020, COVID-19 negatively impacted the market. However, the market has now been estimated to have reached pre-pandemic levels and is expected to grow steadily in the future.

Key Highlights

- The increasing demand from electronic appliances and the food processing sector is expected to dominate the market.

- On the other hand, rising environmental concerns and stringent EPA regulations are expected to hinder the growth of the market.

- In the coming years, the market is also expected to grow thanks to new applications in the optical fiber industry.

- North America dominated the market across the globe, with the largest consumption in countries such as the United States, Canada, etc.

Fluorinated Ethylene Propylene (FEP) Coatings Market Trends

High Demand from Electrical & Electronics Industry

- FEP coatings are one of the important coatings material in the electrical and Electronics industry as they can hold and transport the harsh chemicals used in the manufacturing process since FEP is an excellent insulator and an ideal option to provide electrical insulation while at the same time conferring chemical resistance when shrunk over wires.

- The integrated circuits of semiconductors are manufactured using processes such as photolithography, etching, cleaning, thin film deposition, and polishing.

- The FEP coatings are well suited for applications in the semiconductor industry where they are used in the manufacture of wafer carriers, tubing, fittings and pump parts which are optimal for transporting high-purity chemicals in semiconductor manufacturing.

- Special grades of FEP coatings are being developed to meet the rigorous demands of the semiconductor industry which is involved in the production of electronic equipment such as personal computers, cellular phones, LCD, plasma and LED displays.

- Globally, the demand for smartphones is increasing at a significant rate. According to the TelefonaktiebolagetLM Ericsson, the number of smartphone subscriptions accounted for 6,259 million in 2021 globally, compared to 5,924 million in the previous year. Moreover, the subscription is likely to reach 7,690 million over the next three years, thus enhancing the market growth.

- Morever, according to the Japan Electronics and Information Technology Industries Association (JEITA), Japan shipped 365 thousand units of Flat-panel-display TVs domestically in January 2023. Thus, boosting the market growth.

- All the aforementioned factors are likely to increase the demand for the FEP coatings market over the forecast period.

North America Region to Dominate the Market

- The immense demand for fluorinated ethylene propylene (FEP) coatings is a consequence of the growing trends in electronics, fiber optics, food processing, chemical processing, and the oil and gas industries in the North American region.

- In North America, especially in the United States, the electronics industry is expected to grow significantly. The Consumer Technology Association predicted that retail sales of consumer electronics and technology in the United States would bring in 505 billion dollars in 2022, up from 461 billion dollars in 2021.

- Further, the growth of the food processing sector in North America is robust due to the excessive dependence of people on packaged food products and the strong foothold of the food processing companies. PepsiCo, Tyson Foods, and Nestle are large food processing companies operating in the region. thus boosting market growth.

- In March 2022, Nestle announced its plans to invest USD 675 million in a new plant in Metro Phoenix, Arizona, the United States, to produce beverages, including oat milk coffee creamers, as consumer demand increases for plant-based products. The plant is expected to be operational in 2024. thus helping the market grow in the food processing sector.

- Thus, the increasing demand from various applications is likely to surge the demand for fluorinated ethylene propylene (FEP) coatings in the near future.

Fluorinated Ethylene Propylene (FEP) Coatings Industry Overview

The fluorinated ethylene propylene (FEP) coatings market is partially fragmented in nature. Some of the major players in the market include AGC Inc., DAIKIN INDUSTRIES, Ltd., 3M, AFT Fluorotec Limited, The Chemours Company, etc., among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Cost-effective Alternative to PTFE in Non-stick Applications of the Food Industry

- 4.1.2 Rising Prominence of FEP Coatings in the Semiconductors of Electronic Appliances

- 4.2 Restraints

- 4.2.1 Rising Environmental Concerns and Stringent EPA Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Powder Coating

- 5.1.2 Liquid Coating

- 5.2 Application

- 5.2.1 Cookware and Food Processing

- 5.2.2 Chemical Processing

- 5.2.3 Oil and Gas

- 5.2.4 Electrical & Electronics

- 5.2.5 Fiber Optics

- 5.2.6 Medical

- 5.2.7 Othe Applications

- 5.3 By Geography

- 5.3.1 Asia Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%) Analysis **/ Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 AFT Fluorotec Limited

- 6.4.3 AGC Inc.

- 6.4.4 DAIKIN INDUSTRIES, Ltd.

- 6.4.5 Dongyue Chemical

- 6.4.6 GMM Pfaudler

- 6.4.7 fluorocarbonST

- 6.4.8 Hubei Everflon Polymer CO., Ltd.

- 6.4.9 Impreglon UK Limited

- 6.4.10 INOFLON

- 6.4.11 Praxair S.T. Technology, Inc.

- 6.4.12 Precision Coating Company, Inc

- 6.4.13 Rudolf Gutbrod GmbH

- 6.4.14 Shanghai 3F New Materials Co., Ltd.

- 6.4.15 The Chemours Company

- 6.4.16 Toefco Engineered Coating Systems, Inc.

- 6.4.17 Zeus Company Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Applications in the Optical Fiber Industry