|

市場調查報告書

商品編碼

1327506

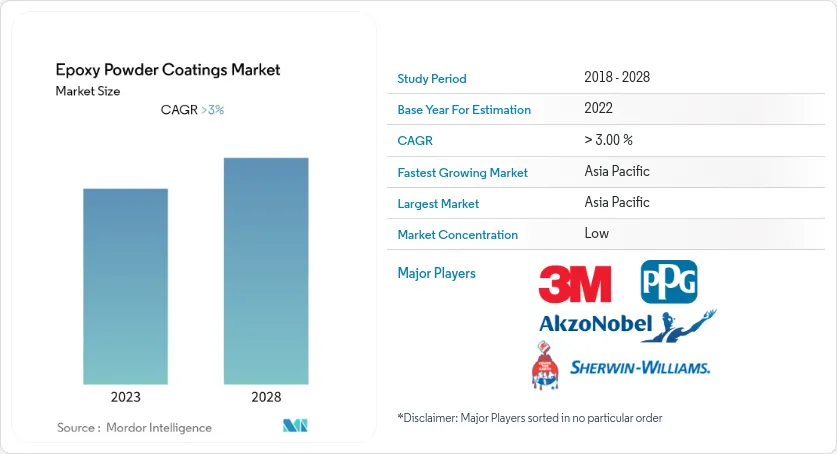

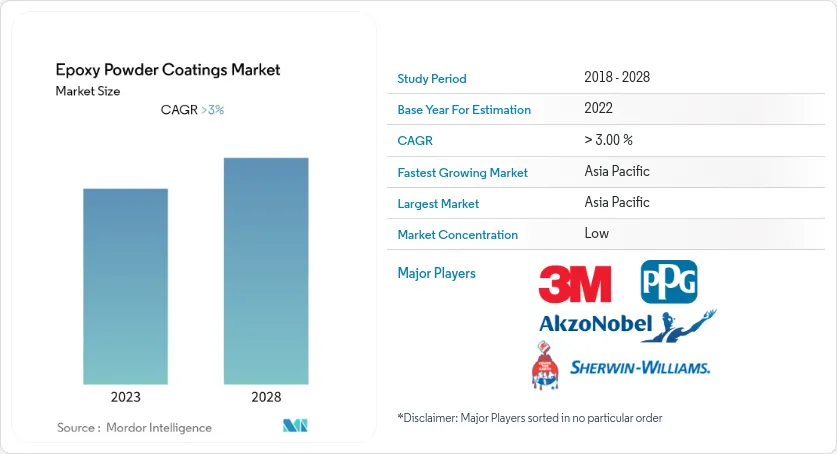

環氧粉末塗料市場規模和份額分析-增長趨勢和預測(2023-2028)Epoxy Powder Coatings Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

環氧粉末塗料市場預計在預測期內復合年增長率將超過 3%。

推動市場的主要因素是建築行業需求的不斷增長。 原材料價格上漲預計將嚴重阻礙市場增長。

主要亮點

- 預計亞太地區將在預測期內主導全球市場。

- 環氧粉末塗料應用的擴展可能是未來的一個機遇。

環氧粉末塗料市場趨勢

建築行業的需求增加

- 提高建築物能源效率的翻修涉及評估房屋狀況是否存在現有問題,並確定翻修是否會改善建築物外牆的耐用性、室內空氣質量、供暖設備性能和其他性能問題。未能預測對各種相關問題的潛在影響可能會導致意想不到的後果。 現有問題最常見的類型是牆壁、屋頂和地板的潮濕問題(例如漏水、高濕度、濕氣)、室內空氣質量問題(例如由於異味、污染物排放、土壤氣體、家用產品等) .) ) 、結構下垂、裂縫和偏轉。

- 使用環氧粉末塗料來減少家庭地基、牆壁和天花板的無意漏氣,提高能源性能和居住空間舒適度,這可能會刺激建築行業的產品需求。

- 德國擁有歐洲最大的建築業。 房屋建築業預計將保持適度高速增長。 行業專家表示,最近的積極移民正在刺激新房建設的需求。 據估計,到 2020 年,將有約 360 萬移民抵達德國,每年至少需要 35 萬套新住房。

- 在印度,政府正在積極支持住房建設,目標是為約 13 億人提供住房。 未來七年,該國預計將投資約1.3萬億美元用於住房建設,建造6000萬套住房。 預計到 2024 年,該國經濟適用房將增加約 70%。

- 因此,由於建築熱潮,環氧粉末塗料的需求預計在預測期內將會增加。

亞太地區主導市場

- 亞太地區在全球市場份額中佔據主導地位。 中國、印度和日本等國家的建築和汽車行業的需求不斷增加,導致該地區環氧粉末塗料的使用量增加。

- 中國是世界第二大經濟體,人民收入水平的提高進一步拉動經濟發展。

- 經濟在過去幾年中表現出穩定增長,並且可能會大幅復甦和擴張。

- 在“十三五”規劃(2016-2020年)中,中國政府計劃建設3萬公裡鐵路和3萬公裡公路基礎設施。

- 中國是亞太地區乃至全球主要汽車製造商之一。 此外,許多汽車製造商在該國設有生產基地,促進了環氧粉末塗料的需求。

- 此外,印度、中國、印度尼西亞、泰國、馬來西亞和新加坡等亞洲國家的持續經濟增長導致對商業和住宅新建築的需求持續增長。亞洲正在增加。

環氧粉末塗料行業概述

環氧粉末塗料市場分為多個部分。 接受調查的主要公司包括 3M、The Sherwin-Williams Company、PPG Industries, Inc.、Akzo Nobel N.V.。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第一章簡介

- 調查的先決條件

- 調查範圍

第二章研究方法

第 3 章執行摘要

第 4 章市場動態

- 促進因素

- 建築和施工行業的需求不斷增長

- 對環保塗料的需求不斷增加

- 抑制因素

- 與其他塗料的兼容性

- 原材料價格上漲

- 行業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 監管政策分析

- 價格趨勢

第五章市場細分

- 塗層類型

- 防護衣

- 其他塗層類型

- 最終用戶行業

- 航空航天

- 汽車

- 建築/施工

- 能源

- 海洋

- 石油和天然氣

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 意大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第六章競爭態勢

- 併購、合資企業、聯盟、協議

- 市場份額分析

- 各大公司的戰略

- 公司簡介

- 3M

- Arkema Group

- Akzo Nobel N.V.

- Axalta Coating Systems

- Berger Paints India Limited

- Diamond Vogel

- Durolac Paints, Inc.

- Hempel A/S

- PPG Industries, Inc.

- SolEpoxy, Inc.

- The Sherwin-Williams Company

第七章市場機會和未來趨勢

- 擴大環氧粉末塗料的應用

- 防止管道堵塞的塗層的新研究和開發

簡介目錄

Product Code: 46521

The epoxy powder coatings market is expected to register a CAGR of over 3% during the forecast period. The major factors driving the market studied include the rising demand from the building and construction industry. The increasing prices of raw materials are expected to significantly hinder the growth of the market studied.

Key Highlights

- Asia-Pacific region is expected to dominate the global market during the forecast period.

- Increasing applications of epoxy powder coatings are likely to act as an opportunity in the future.

Epoxy Powder Coatings Market Trends

Increasing Demand from Building and Construction Segment

- Building energy efficient retrofits can have unintended consequences, if consideration is not applied while assessing the condition of the house for pre-existing problems and anticipating the possible effects of the retrofit work on building envelope durability, indoor air quality, heating appliance performance, and various other performance-related issues. The most common types of pre-existing problems are moisture problems (water leaks, high humidity, dampness, etc.) in the walls, roof, and floors, indoor air quality problems (odor, pollutant emissions, soil gas, from household products, etc.) and structural sags, cracks, and deflections.

- Reducing unintentional air leakage through the foundations, walls, and ceilings of the house, to improve the energy performance and comfort of the living space through the usage of epoxy powder coatings may stimulate product demand in the construction sector.

- Germany has the largest construction industry in Europe. The residential construction segment is expected to have a moderately high growth. According to industry experts, the recent positive migration to the country is stimulating the demand for new residential construction. About 3.6 million migrants are estimated to arrive in Germany, by 2020, requiring at least 350,000 new dwellings per year, which is expected to boost the construction sector, in turn, boosting the growth of the market studied.

- In India, the government has been actively providing a boost to the housing construction, as it aims to provide homes to about 1.3 billion people. The country is likely to witness around USD 1.3 trillion of investment in housing over the next seven years, with the anticipated construction of 60 million new homes in the country. The availability of affordable housing is expected to increase by around 70%, by 2024, in the country.

- Hence, with such boom in construction activities, the demand for epoxy powder coatings is projected to increase during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region dominated the global market share. With growing demand from the construction and automotive industries in the countries such as China, India, and Japan, the usage of epoxy powder coatings is increasing in the region.

- China is the world's second-largest economy in terms of growth and the increasing level of income of the country's population is further driving the economy.

- Though the economy witnessed a steady growth in the past years, it is likely to recover and expand at a significant rate.

- Under the 13th five-year plan (2016-2020), the Chinese government plans the infrastructure development of 30,000 km of railway lines and 30,000 km of expressways.

- China is one of the major automobile manufacturers of Asia-Pacific and the world. Moreover, many automotive manufacturers have manufacturing units in the country, which contribute to the demand for epoxy powder coatings.

- Additionally, with the consistent economic growth in the Asian countries, such as India, China, Indonesia, Thailand, Malaysia, and Singapore, the demand for the construction of new buildings, both commercial and residential, is consistently increasing, which, in turn, is increasing the demand for epoxy powder coatings in the Asian region.

Epoxy Powder Coatings Industry Overview

The epoxy powder coatings market is partially fragmented in nature. Some of the major players of the market studied include 3M, The Sherwin-Williams Company, PPG Industries, Inc., and Akzo Nobel N.V., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand from the Building & Construction Industry

- 4.1.2 Increasing Demand for Eco-friendly Coatings

- 4.2 Restraints

- 4.2.1 Immiscibility with Other coatings

- 4.2.2 Increasing Prices of Raw Materials

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Regulatory Policy Analysis

- 4.6 Price Trends

5 MARKET SEGMENTATION

- 5.1 Coating Type

- 5.1.1 Protective Coatings

- 5.1.2 Other Coating Types

- 5.2 End-user Industry

- 5.2.1 Aerospace

- 5.2.2 Automotive

- 5.2.3 Buildings and Construction

- 5.2.4 Energy

- 5.2.5 Marine

- 5.2.6 Oil and Gas

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 Akzo Nobel N.V.

- 6.4.4 Axalta Coating Systems

- 6.4.5 Berger Paints India Limited

- 6.4.6 Diamond Vogel

- 6.4.7 Durolac Paints, Inc.

- 6.4.8 Hempel A/S

- 6.4.9 PPG Industries, Inc.

- 6.4.10 SolEpoxy, Inc.

- 6.4.11 The Sherwin-Williams Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Applications of Epoxy Powder Coatings

- 7.2 Emerging R&D on Coatings to Prevent Pipeline Clogging

02-2729-4219

+886-2-2729-4219