|

市場調查報告書

商品編碼

1405362

無塵室照明:市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Cleanroom Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

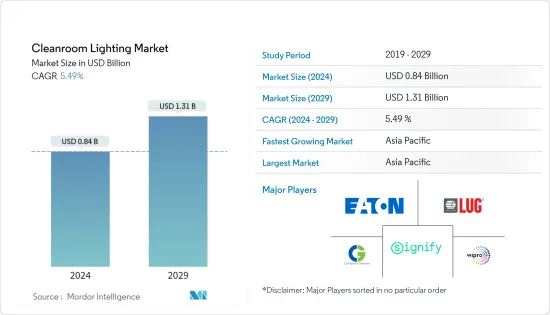

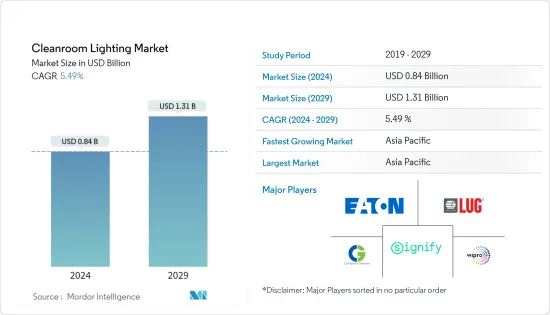

無塵室照明市場規模預計2024年為8.4億美元,預計2029年將達到13.1億美元,在市場估計和預測期間(2024-2029年)複合年成長率為5.49%。

在電子製造業,對污染物水平接近零的受控環境的需求日益成長,而在醫療和食品加工行業,世界各國政府都在加強監管以防止產品污染,這是主要因素之一帶動市場。

主要亮點

- 對電子產品需求的快速成長正在推動對微處理器、整合晶片、微控制器和記憶體的需求。家用電子電器的增加預計也將活性化半導體製造活動並推動市場。

- 照明產業新興市場的不斷開拓以及市場參與者為不同產業提供廣泛的產品系列等重要因素也促進了預測期內的市場成長。

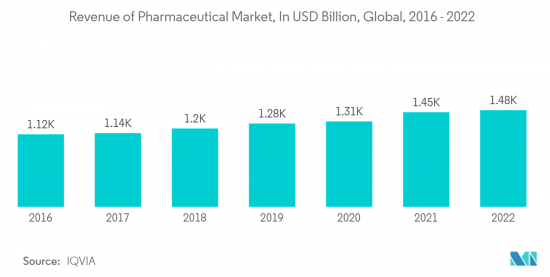

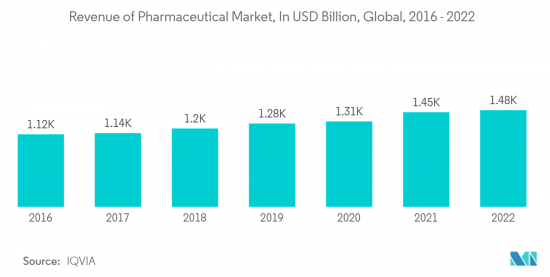

- 在製藥業,對需要對微生物、空氣顆粒、溫度、濕度和壓力進行濃度控制的受控環境的需求不斷成長,預計將推動對無塵室的需求並推動市場研究。

- 此外,重症患者和醫院的醫務人員也接觸到可透過水、空氣和血液傳播的傳染性微生物。因此,越來越需要避免所有傳染性微生物的傳播,這也是醫院對無塵室需求的主要原因之一。

- COVID-19 對全球無塵室照明市場產生了重大影響。全球範圍內的廣泛封鎖導致供應鏈中斷,對多個行業,特別是製造業產生了重大影響,導致需求放緩。然而,在藥品和其他關鍵醫療設備需求增加的推動下,製藥/醫療產業的需求增加,對需求產生了正面影響。

- 然而,無塵室照明有許多複雜性。無塵室照明取決於房間的用途、分類和天花板送風配置。照明系統必須提供良好的可視性,並且在設計時考慮污染控制問題(電磁場的產生和清潔性)。

無塵室照明市場趨勢

醫療和生命科學領域有望實現顯著成長

- 無塵室技術的目的是保護病人和流程免受各種類型的污染。被歸類為污染的有機或無機顆粒污染,無論多小,都受到嚴格監控。

- 手術室和劇院的燈光需要絕對最高的粒子密度、顯色性和適當的光強度。手術是一項重大挑戰,而照明可確保細節的可靠視覺解釋。

- 理想情況下,房間應歸類為 ISO 3 級,即手術室衛生水平較高且最低光照水平為 1,000 勒克斯。顯色性必須 CRI ≥90,以便外科醫師能夠區分不同的顏色漸層。為了滿足這些標準,在研究期間無塵室照明需求顯著增加。

- 手術室、檢查室和病患治療室等設施全天使用,必須有效率運作。此外,這些房間對照明設備的品質有特殊要求,例如清潔度和易於維護。

- 2022 年 7 月,Medical Air Technology 在 Wansbeck General Hospital 完成了第二個耗資 550 萬英鎊(680 萬美元)的計劃階段,安裝了 MAT Eco-flow Stealth 齊平 UCV座艙罩。 ECO-flow Stealth 的 UCV 系統將空氣吸入每個房間角落,以控制氣流模式並防止夾帶。

預計亞太地區將佔據最大的市場佔有率

- 預計亞太地區在預測期內將佔據最大的市場佔有率,主要原因是許多生物製藥公司和醫療設備製造商由於成本優勢和有利的法規環境而將重點放在亞太地區。希望擴大我們在太平洋地區的影響力。

- 該地區包括中國、韓國、日本、台灣、印度、澳洲和新加坡等國家,由於製造和研究活動的增加,預計將成為亞太地區無塵室照明市場的主要貢獻者。中國是一個巨大的市場,並且預計將保持這個巨大市場,因為與其他國家相比,中國擁有龐大的電子工業。

- 中國是半導體和電子製造的巨大市場,由於製造商數量眾多以及政府主導的多項促進半導體製造業發展的舉措,預計中國將繼續保持這一巨大市場。

- 例如,「中國製造2025」舉措的目標是到2025年中國國內需求的70%由國內生產,到2030年所有工業領域的最尖端科技均等化。我正在設定目標。預計此類舉措將對預測期內對無塵室和照明解決方案的需求產生正面影響。

無塵室照明產業概況

無塵室照明市場的競爭是溫和的,因為有許多大大小小的製造商向國內和國際市場供應產品。領導企業正在採取產品和服務創新、併購等策略來提高各地區的市場滲透率,增加市場形勢的競爭。該市場的主要企業包括 Signify Holding、Wipro Lighting、Eaton Corporation Inc. 和 Crompton Greaves Consumer Electricals Ltd。

2022 年 12 月,美國能源公司 Current 宣布擴大產品系列,涵蓋 Lifeshield 品牌,該品牌為醫療、行為、破壞和無塵室環境提供照明解決方案。光源選項還可透過高效 90CRI R90 TriGain 技術和 SpectraSync 顏色調諧技術來增強色彩性能。

2022 年 6 月,LosmaIndia 宣布已訂單印度孟買知名消費電子製造商的承包計劃,將在其工廠內建造無塵室。據該公司稱,無塵室將按照ISO 14644-1標準的ISO Class 6建造。該工廠佔地 5,200 平方英尺,將用於組裝用於國內和出口市場的電視和桌上型電腦的 LED 螢幕。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估主要宏觀經濟趨勢對產業的影響

第5章市場動態

- 市場促進因素

- 醫療和食品加工行業的嚴格規定

- 製藥業對無菌生產區域的需求不斷成長

- 市場抑制因素

- 無塵室及其運作相關的高成本

第6章市場區隔

- 按光源分類

- LED

- 螢光

- 按安裝類型

- 凹入式

- 表面黏著技術型

- 按最終用戶產業

- 醫學/生命科學

- 電子/半導體

- 食品和飲料

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第7章競爭形勢

- 公司簡介

- Signify Holding

- Wipro Lighting

- Crompton Greaves Consumer Electricals Ltd.

- Eaton Corporation Inc

- LUG Light Factory Sp. z oo

- Terra Universal Inc

- Solite Europe Ltd

- Paramount Industries

- Kenall Manufacturing.

- AB Fagerhult

第8章投資分析

第9章 市場機會及未來趨勢

The Cleanroom Lighting Market size is estimated at USD 0.84 billion in 2024, and is expected to reach USD 1.31 billion by 2029, growing at a CAGR of 5.49% during the forecast period (2024-2029).

The growing need for a controlled environment with a near-zero level of pollutants in the electronics manufacturing industry and the stringent regulations by governments across the globe in the healthcare sector and food processing industry to prevent the contamination of products is one of the primary factors driving the market.

Key Highlights

- The rapidly increasing demand for electronic devices has escalated the need for microprocessors, integrated chips, microcontrollers, and memory. An increase in the demand for consumer electronics is also expected to increase the manufacturing activities of semiconductors, which is expected to drive the market.

- Some important factors, such as the increasing developments in the lighting industry and the availability of a wide portfolio of products by the market players for different industries, also contribute to the market growth during the forecast period.

- In the pharmaceutical sector, the increasing need for a controlled environment that necessitates control over the concentration of microorganisms, airborne particles, temperature, humidity, and pressure is expected to drive the demand for cleanrooms, driving the market studied.

- Moreover, critical patients in the ICU and hospital medical staff are exposed to infectious microbes, which can be transmitted through water, air, or blood. Thus, the increasing need to avoid spreading any contagious microbes is one of the primary reasons for the demand for cleanrooms in hospitals.

- A notable impact of COVID-19 was observed on the global cleanroom lighting market. The supply chain disruption created due to the widespread lockdown imposed across various parts of the world significantly impacted multiple industries, especially the manufacturing industry, resulting in a slowdown in demand. However, the increased demand from the pharmaceutical/healthcare segment, driven by increased demand for medicines and other critical medical devices, has positively impacted the demand.

- However, there are many complexities involved with cleanroom lighting. Cleanroom lighting varies depending on the room's use, its classification, and ceiling air supply configuration. Lighting systems are required to provide good visibility and be designed with contamination control issues-electromagnetic field generation and cleanability.

Cleanroom Lighting Market Trends

Healthcare and Life Sciences Segment is Expected to Witness Significant Growth

- The purpose of clean-room technology is to protect patients and processes against contamination of any sort. Pollution by organic or inorganic particles of matter classified as contamination is strictly monitored, no matter how small they are.

- Light in the operating room and surgery rooms requires particle density, color rendering, and adequate light levels that are extreme and absolute. The surgery is a major challenge, and lighting ensures the visual interpretation of reliable details.

- Ideally, the room should be classified according to ISO class 3, namely, have high levels of hygiene and minimum light level at 1000 lux in the operating theater. So that the surgeon can distinguish the different color gradations, the color rendering must be CRI≥ 90. To meet such criteria, the need for cleanroom lighting has increased significantly over the studied period.

- Modern lighting installations in medical institutions provide a lucrative opportunity for improving the performance of the facility and significantly reducing energy and maintenance costs, as the premises, such as operating rooms, laboratories, patient care rooms, etc., must work efficiently as they are used throughout the day. Also, these rooms have special requirements regarding the quality of cleanliness of luminaires and ease of maintenance.

- In July 2022, Medical Air Technology completed the second GBP 5.5 million (USD 6.8 million) project phase at WansbeckGeneral Hospital by installing MAT Eco-flow Stealth flush-to-ceiling UCV canopies. The UCV system in the ECO-flow Stealth draws air to each room corner to control the airflow pattern and prevent entrainment.

Asia-Pacific is Expected to Occupy the Largest Market Share

- The Asia-Pacific region is expected to hold the largest market share during the forecast period, primarily because many biopharmaceutical companies and medical device manufacturers are seeking to expand their presence in the APAC region because of its cost advantages and favorable regulatory environment.

- The region comprises countries such as China, South Korea, Japan, Taiwan, India, Australia, and Singapore, which are expected to be the major contributors to the cleanroom lighting market in the Asia-Pacific, owing to the increased manufacturing and research activities. China is a huge market and is expected to remain the same owing to its huge electronics industry compared to other countries.

- China is a huge market for semiconductor and electronics manufacturing and is expected to remain the same owing to the presence of many manufacturers and several government-led initiatives promoting the semiconductor manufacturing industry.

- For instance, the Made in China 2025 initiative has set up broad goals for the country's semiconductor sector, including producing 70% of domestic needs within China by 2025 and reaching parity with leading-edge technology in all industry segments by 2030. Such initiatives are expected to positively impact the demand for cleanrooms and lighting solutions during the forecast period.

Cleanroom Lighting Industry Overview

The cleanroom lighting market is moderately competitive primarily due to the presence of many small and large manufacturers supplying their products in domestic and international markets. Major players are adopting strategies like product and service innovation and mergers and acquisitions to increase their market reach in various geographies and be competitive in the market landscape. Some of the major players in the market are Signify Holding, Wipro Lighting, Eaton Corporation Inc., and Crompton Greaves Consumer Electricals Ltd., among others.

In December 2022, Current, a US-based energy company, announced the expansion of its product portfolio by including the Lifeshield brand, which offers lighting solutions for health care, behavioral, vandal, and cleanroom environments. The light source options can also be enhanced for color performance with high efficacy 90CRI R90 TriGaintechnology and SpectraSynccolor tuning technology from Current.

In June 2022, LosmaIndia announced that the company received a turnkey project from a renowned consumer appliances manufacturer based in Mumbai, India, to build a cleanroom within their facility. According to the company, the cleanroom was to be built to adhere to ISO Class 6 of ISO 14644-1 standard. It was to be spread across 5,200 sqft and will be used for the assembly of LED screens used in televisions and desktop PCs both for domestic and export markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of Key Macro Economic Trends on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Stringent Regulations in Healthcare and Food Processing Industries

- 5.1.2 Rising Demand for Sterile Manufacturing Areas in Pharmaceuticals Industry

- 5.2 Market Restraints

- 5.2.1 High Cost Associated With Cleanrooms and their Operations

6 MARKET SEGMENTATION

- 6.1 By Light Source

- 6.1.1 LED

- 6.1.2 Fluorescent

- 6.2 By Mounting Type

- 6.2.1 Recessed

- 6.2.2 Surface Mount

- 6.3 By End-user Industry

- 6.3.1 Healthcare & Life Sciences

- 6.3.2 Electronics and Semiconductor

- 6.3.3 Food & Beverage

- 6.3.4 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Signify Holding

- 7.1.2 Wipro Lighting

- 7.1.3 Crompton Greaves Consumer Electricals Ltd.

- 7.1.4 Eaton Corporation Inc

- 7.1.5 LUG Light Factory Sp. z o.o.

- 7.1.6 Terra Universal Inc

- 7.1.7 Solite Europe Ltd

- 7.1.8 Paramount Industries

- 7.1.9 Kenall Manufacturing.

- 7.1.10 AB Fagerhult