|

市場調查報告書

商品編碼

1433921

真空包裝:市場佔有率分析、產業趨勢、成長預測(2024-2029)Vacuum Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

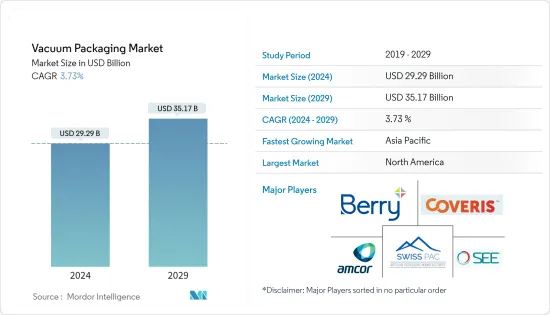

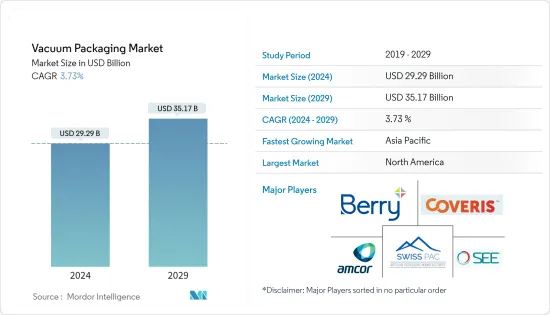

真空包裝市場規模預計2024年為292.9億美元,預計到2029年將達到351.7億美元,在預測期內(2024-2029年)複合年成長率為3.73%成長。

真空包裝是一種在密封產品之前去除產品中的空氣,從而在包裝內部形成局部真空的技術。此程序有助於延長許多產品的保存期限。

主要亮點

- 近年來,真空包裝產業穩步發展。這是由於對即食食品的需求不斷增加、減少食品廢棄物的意識不斷增強,以及需要有效的包裝解決方案來延長產品的保存期限。

- 對包裝食品的需求不斷成長和食品安全意識不斷提高是真空包裝市場的主要促進因素。消費者越來越意識到食品安全和衛生的重要性。透過降低污染風險,真空包裝對於維護食品安全非常重要。它透過最大限度地減少細菌生長和劣化的可能性來幫助保持食品的新鮮度和品質。

- 衛生和便利包裝不斷成長的需求是真空包裝市場的主要驅動力。真空包裝透過提供密封環境來幫助維持產品的衛生和完整性。透過排除容器中的空氣,產品較少暴露於細菌、黴菌和濕氣等外部污染物。這使得真空密封包裝成為食品、藥品和醫療設備等易腐爛產品的理想選擇,這些產品的清潔度非常重要。

- 真空包裝製程的高成本很可能會顯著抑制真空包裝市場。真空包裝需要使用專門的設備和技術,例如真空封口機、真空室和真空幫浦。獲得這些設備的成本可能很高,尤其是對於小型企業而言。購買和維護該設備的成本可能成為一些公司的進入障礙,限制了真空包裝解決方案的採用。

- 在 COVID-19感染疾病期間,隨著消費者開始在家做飯並減少外出外食,對加工食品的需求大幅增加。包裝食品的需求不斷增加,需要更有效率的包裝技術,例如真空包裝,以確保食品安全、延長保存期限並滿足更高的生產需求。大流行後,隨著消費者和食品製造商繼續優先考慮安全高效的包裝解決方案,市場預計將進行調整和創新,以滿足這些不斷變化的要求。

真空包裝市場趨勢

食品業預計將佔據重要市場佔有率

- 食品業有望成為真空包裝市場的重要主導產業。透過排除空氣並密封包裝,真空包裝可抑制引起腐敗的細菌的生長,並延長生鮮食品的保存期限。它受到許多食品製造商的青睞,因為它有助於保持食品的味道、質地和營養價值。

- 真空包裝用於多種食品類別,包括生鮮食品、肉類和家禽、魚貝類、乳製品、即食食品和即食食品。適用於生食品到已調理食品,並可用於包裝多種產品。真空密封包裝可防止空氣、濕氣和異味等外部污染物的影響,有助於維持包裝食品的品質和安全。

- 真空包裝廣泛應用於肉類產業,以延長產品保存期限、保持新鮮度、防止腐敗。真空密封包裝有助於保留肉類的顏色、風味和質地,使其成為對消費者有吸引力的選擇。根據經合組織和糧農組織的數據,2016年至2022年期間,肉類產量從3.17億噸增加到約3.45億噸。

- 真空包裝可最大限度地降低細菌生長和污染的風險,有助於食品安全。去除空氣並密封包裝可形成針對外部病原體的屏障,有助於維持食品安全和衛生。這對於易腐壞的食品尤其重要。

- 真空包裝顯著延長食品保存期限、減少食品廢棄物並提高永續性。真空密封包裝透過減少與氧氣的接觸來減緩自然劣化過程,例如腐敗、變色和質地變化。這些透過減少產品損失和解決世界食品廢棄物問題使製造商和零售商受益。

預計北美將佔據重要市場佔有率

- 北美真空包裝市場是由主導的食品工業、技術進步、對永續性的關注以及醫療保健和製藥行業對可靠包裝解決方案的需求所推動的。隨著消費者偏好和監管要求的發展,預計未來幾年市場將進一步成長和創新。

- 該地區繁忙的生活方式、不斷變化的消費者偏好以及對即食食品不斷成長的需求正在推動對真空包裝等有效包裝解決方案的需求。該行業也高度重視食品安全和質量,並正在推廣採用真空包裝來保護和保存食品。

- 北美以包裝技術進步和創新而聞名。該地區的製造商引進了先進的真空包裝技術,有助於提高產品保存期限、延長保存期限並滿足特定的包裝要求。

- 近年來,環境問題和不斷變化的消費者偏好增加了北美對永續包裝實踐的關注。這導致了環保真空包裝解決方案的開發,包括可回收薄膜和材料。製造商正在積極致力於透過採用永續的方法和材料來減少包裝(包括真空包裝)對環境的影響。

真空包裝產業概況

由於 Amcor Limited、Sealed Air Corporation、Berry Global Inc.、Coveris Holdings SA 和 Swiss Pac Pvt Ltd 等大公司的存在,真空包裝市場高度分散。市場參與者正在採取合作夥伴關係和收購等策略來增強其產品供應並獲得永續的競爭優勢。

2023年2月,SEE宣布完成對Liquibox的收購。 Liquibox 是針對生鮮食品、飲料、消費品和工業終端市場的襯袋紙盒永續液體和液體包裝和分配解決方案的先驅、開發商和生產商。此次收購加速了 CRYOVAC 品牌液體和液體業務的發展,這是 SEE 成長最快的部門之一。

2022年9月,Mondi與奧地利培根製造商Handl Tyrol合作,開發了一種用於培根的新型單材料聚丙烯(PP)高阻隔包裝解決方案。木質外部材料確保安全真空包裝並保護食品廢棄物。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 隨著食品安全意識的增強,對包裝食品的需求不斷增加

- 對衛生和便利包裝的需求不斷增加

- 市場限制因素

- 工藝成本高

第6章市場區隔

- 按最終用戶產業

- 食品

- 醫療保健和製藥

- 工業

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 英國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中東 非洲

- 南非

- 其他中東和非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Amcor Limited

- Sealed Air Corporation

- Berry Global Inc.

- Coveris Holdings SA

- Swiss Pac Pvt Ltd

- M&Q Packaging LLC

- Dow Inc.

- Klockner Pentaplast Group

- Plastopil Ltd.

- Mondi Group

第8章投資分析

第9章 市場機會及未來趨勢

The Vacuum Packaging Market size is estimated at USD 29.29 billion in 2024, and is expected to reach USD 35.17 billion by 2029, growing at a CAGR of 3.73% during the forecast period (2024-2029).

Vacuum packing is a technique that eliminates air from a product before sealing it, creating a partial vacuum inside the packaging. This procedure contributes to the extension of the shelf life of numerous products.

Key Highlights

- In recent years, the vacuum packing industry has grown steadily. This is due to the rising demand for convenience foods, increased awareness about food waste reduction, and the necessity for effective packaging solutions to extend product shelf life.

- The growing demand for packaged food and increasing awareness of food safety are major drivers of the vacuum packaging market. Consumers are becoming more aware of the importance of food safety and hygiene. By reducing the danger of contamination, vacuum packing is important in preserving food safety. It assists in preserving food freshness and quality by minimizing the possibility of bacterial development and deterioration.

- The increasing demand for hygienic and convenient packaging is a significant driver of the vacuum packaging market. Vacuum packing helps preserve product hygiene and integrity by providing a sealed environment. By eliminating air from the container, the product is less exposed to external pollutants such as germs, mold, and moisture. As a result, vacuum-sealed packaging is ideal for perishable commodities such as food, medicines, and medical devices, where cleanliness is critical.

- The high cost of the vacuum packaging process can significantly restrain the vacuum packaging market. Vacuum packing necessitates using specialized equipment and technology such as vacuum sealers, vacuum chambers, and vacuum pumps. These devices can be costly to acquire, especially for small and medium-sized organizations. The expense of obtaining and maintaining this equipment might be a barrier to entry for certain companies, restricting their adoption of vacuum packing solutions.

- During the COVID-19 pandemic, there was a significant rise in packaged food demand as consumers turned to at-home cooking and decreased dining out. This growth in demand for packaged food goods demanded more efficient packaging techniques, such as vacuum packing, to ensure food safety, prolong shelf life, and fulfill higher production needs. Post Pandemic, the market is expected to adapt and innovate to meet these evolving requirements as consumers and food manufacturers continue to prioritize safe and efficient packaging solutions.

Vacuum Packaging Market Trends

Food Segment is Expected to Hold Significant Market Share

- The food segment is expected to be a significant and dominant sector within the vacuum packaging market. By removing air and sealing the package, vacuum packaging helps inhibit the growth of spoilage-causing bacteria and extends the shelf life of perishable items. It helps maintain food's taste, texture, and nutritional value, making it a preferred choice for many food manufacturers.

- Vacuum packaging is used across various food categories, including fresh produce, meat and poultry, seafood, dairy products, bakery items, ready-to-eat meals, and more. It is suitable for raw and cooked foods, allowing for packaging a diverse range of products. Vacuum-sealed packages protect against external contaminants, such as air, moisture, and odors, which helps maintain the quality and safety of packaged food.

- Vacuum packaging is widely used in the meat industry to extend the shelf life of products, maintain freshness, and prevent spoilage. The vacuum-sealed packages help preserve the meat's color, flavor, and texture, making it an appealing choice for consumers. According to OECD and FAO, between 2016 and 2022, meat production volume increased from 317 million metric tons to about 345 million metric tons.

- Vacuum packaging contributes to food safety by minimizing the risk of bacterial growth and contamination. Removing the air and sealing the package creates a barrier against external pathogens, making it reliable for maintaining food safety and hygiene. This is especially important for perishable and easily spoiled food items.

- Vacuum packaging significantly extends the shelf life of food products, reducing food waste and improving sustainability. By reducing exposure to oxygen, vacuum-sealed packages slow down the natural deterioration processes, including spoilage, discoloration, and texture changes. These benefits manufacturers and retailers by reducing product losses and addressing the global issue of food waste.

North America is Expected to Hold a Significant Market Share

- The North American vacuum packaging market is driven by the dominant food industry, technological advancements, a focus on sustainability, and the need for reliable packaging solutions in the healthcare and pharmaceutical sectors. As consumer preferences and regulatory requirements evolve, the market is expected to witness further growth and innovation in the coming years.

- The region's busy lifestyles, changing consumer preferences, and the growing demand for convenience foods have fueled the need for effective packaging solutions like vacuum packaging. The industry also strongly emphasizes food safety and quality, driving the adoption of vacuum packaging to protect and preserve food products.

- North America is known for its technological advancements and innovations in packaging. Manufacturers in the region have introduced advanced vacuum packaging technologies that help enhance product preservation, improve shelf life, and address specific packaging requirements.

- In recent years, there has been an increased focus on sustainable packaging practices in North America, driven by environmental concerns and changing consumer preferences. This has led to the development of eco-friendly vacuum packaging solutions, such as recyclable films and materials. Manufacturers are actively working towards reducing the environmental impact of packaging, including vacuum packaging, by adopting sustainable practices and materials.

Vacuum Packaging Industry Overview

The vacuum packaging market is highly fragmented with the presence of major players like Amcor Limited, Sealed Air Corporation, Berry Global Inc., Coveris Holdings S.A., and Swiss Pac Pvt Ltd, among others. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In February 2023, SEE announced that it had completed the acquisition of Liquibox. Liquibox is a Bag-in-Box sustainable fluids and liquids packaging and dispensing solutions pioneer, developer, and producer for fresh food, beverage, consumer products, and industrial end-markets. This purchase accelerates the CRYOVAC brand Fluids and Liquids business, SEE's one of the fastest-growing divisions.

In September 2022, Mondi collaborated with Handl Tyrol, an Austrian bacon manufacturer, to develop a novel mono-material polypropylene (PP) high-barrier packaging solution for bacon. The wood appearance material assures safe vacuum packing and protects food waste.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Packaged Food Coupled with Increasing Awareness Towards Food Safety

- 5.1.2 Increasing Demand for Hygienic and Convenient Packaging

- 5.2 Market Restraints

- 5.2.1 High Cost of the Process

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Food

- 6.1.2 Healthcare and Pharmaceutical

- 6.1.3 Industrial

- 6.1.4 Other End-user Industries

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 France

- 6.2.2.3 United Kingdom

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 Rest of Asia-Pacific

- 6.2.4 Latin America

- 6.2.4.1 Mexico

- 6.2.4.2 Brazil

- 6.2.4.3 Argentina

- 6.2.4.4 Rest of Latin America

- 6.2.5 Middle East Africa

- 6.2.5.1 South Africa

- 6.2.5.2 Rest of Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Limited

- 7.1.2 Sealed Air Corporation

- 7.1.3 Berry Global Inc.

- 7.1.4 Coveris Holdings S.A.

- 7.1.5 Swiss Pac Pvt Ltd

- 7.1.6 M&Q Packaging LLC

- 7.1.7 Dow Inc.

- 7.1.8 Klockner Pentaplast Group

- 7.1.9 Plastopil Ltd.

- 7.1.10 Mondi Group