|

市場調查報告書

商品編碼

1433786

運輸管理系統:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Transportation Management System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

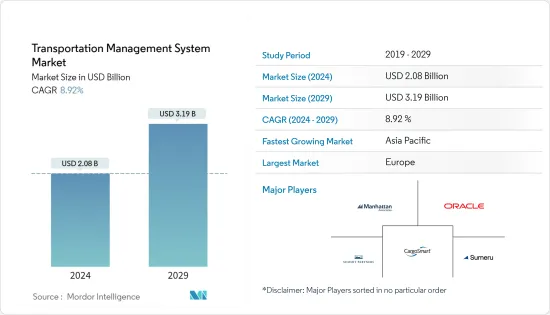

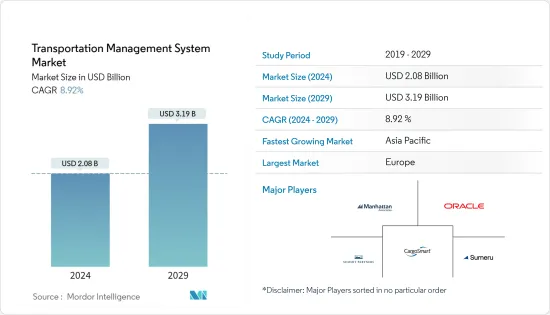

全球運輸管理系統市場規模預計將在 2024 年達到 20.8 億美元,並在 2024-2029 年預測期內以 8.92% 的複合年成長率成長,到 2029 年將達到 31.9 億美元。

零售商和物流公司使用 TMS 的成長趨勢以及逆向物流回程傳輸支援服務的增加是市場成長的主要動力。

主要亮點

- 最近的趨勢是加速區塊鏈和人工智慧等尖端技術的整合,以改善運輸管理系統的功能。此外,為了確保透明度和安全性,人們越來越偏好使用雲端基礎的防盜 GPS 和物聯網系統,這也刺激了先進運輸管理系統的採用。目前正在進行的人工智慧自動駕駛卡車的推出以及5G網路的全臉部署預計將對交通運輸行業產生重大影響並創造新的市場機會。

- 例如,今年早些時候,BluWave-ai 宣布推出 BluWave-ai EV Fleet Orchestrator 2.0 版本,並獲得 FedDev Ontario 的 170 萬美元共同資助。此軟體即服務 (SaaS) 產品可協助車隊營運商實現電氣化。這些營運商涉及最後一英里交付、市政公共交通、企業車隊、機場地面支援以及各種電動車 (EV) 車隊業務。此外,EV Fleet Orchestrator建立在BluWave-ai成熟的AI能源最佳化平台之上,並利用其技術IP組合,使電池能夠透過建築物、車庫或車庫/樞紐的區域網路進行操作,從而降低整體營運成本和碳足跡混合使用電動和石化燃料車輛的車隊運作。

- 此外,零售商現在傾向於全通路系統,將實體、線上、行動、目錄和其他銷售管道整合在一起。因此,貨運量不斷增加,TMS 有助於提高單一用戶控制下所有貨運的可視性。這種可見性使您可以在做出運輸決策時做出更好的業務決策。

- 然而,缺乏經驗豐富的專業人員、高昂的實施和維護成本預計將成為預測期內阻礙市場成長的因素。

- COVID-19 大流行嚴重影響了新的銷售和安裝。為阻止病毒傳播而實施的人員和貨物流動封鎖和限制限制了市場擴張,導致消費行為變化和供應鏈中斷。然而,基於先進技術的創新解決方案的使用總體激增,以及運輸和物流中各種資料主導解決方案的重要性日益增加,預計將有助於市場成長。

運輸管理系統 (TMS) 市場趨勢

在供應鏈管理中更多地使用雲端和人工智慧

- 行業形勢正在迅速發展,這在很大程度上是由電腦視覺和機器學習 (ML) 技術等人工智慧 (AI) 的廣泛採用所推動的。實現機器人自主以保持全球市場競爭力的需求預計將推動人工智慧解決方案和服務的採用。隨著資料驅動的人工智慧的發展和深度學習的進步,人工智慧市場正在全球擴張。

- 多重雲端功能的趨勢和對雲端基礎的智慧服務不斷成長的需求正在推動整體市場的成長。最新的人工智慧工具正在為雲端運算付加新的價值,並不斷提升其價值。這項要素對於將新技術融入該領域並提高整個流程的可行性至關重要。人工智慧軟體也有助於彌合最新突破與雲端運算之間的技術差距。

- 因此,雲端處理和人工智慧在人工智慧雲端的混合系統中得到了很好的融合,因為人工智慧雲端促進了人工智慧軟體和硬體兩種技術的融合。 AI雲幫助打造類似人腦的雲端環境。因此,市場上的公司正在透過雲端提供人工智慧軟體即服務來廣泛採用和利用人工智慧,使他們能夠利用人工智慧的能力。

- 例如,甲骨文今年宣布將向客戶開發人員和合作夥伴開放其ERP應用平台。該公司還發布了新的 B2B 商務服務,並為 Fusion Cloud 產品添加了供應鏈管理 (SCM)、企業規劃管理 (EPM) 和人力資本管理 (HCM) 方面的功能。

- 根據 Algorithmia 的數據,2021 年人工智慧和機器學習的首要使用案例是改善客戶體驗,提高了 57%。這證明了人工智慧和機器學習的不同使用案例帶來的廣泛好處。因此,隨著人工智慧的日益普及,預計市場在整個預測期內將出現顯著的成長機會。

亞太地區將成長最快

- 由於國際貿易的增加,預計亞太地區將以最快的速度成長,特別是在中國和印度等新興國家。此外,電子商務的快速成長、複雜的投資促進因素、全球貿易、製造業成長(例如中國製造)和新的基礎設施投資等因素為該地區提供了一系列有利的市場成長機會。預計會帶來機遇。

- 在亞太地區,隨著可支配收入的增加,智慧型手機的普及也不斷提高。這些因素正在支持該地區電子商務的成長。印度是 TMS 供應商視為重要新興市場的另一個地區。目前,托運人和第三方物流 (3PL) 供應商增加的投資正在擴大運輸技術和 TMS 應用的競爭環境。因此,需要合適的TMS來服務最大數量的客戶。預計這將擴大 TMS 市場的商機。

- 亞太地區為在該地區營運的公司帶來了獨特的課題。課題包括多種語言和貨幣、複雜的貿易協定(例如美國和中國)、監管和合規/法律要求、不同的經濟狀況、發展基礎設施以及綠色和永續交通的重要性等。 。全部區域面臨的這些課題是市場成長的主要推動力。

- 據波音公司稱,中國計劃在 2037 年擁有約 740 架貨持有,而 2017 年僅為 170 架。因此,隨著此類貨機的增加,對TMS的需求也會增加。 TMS 可以透過統一網路中的車隊和物流管理來大幅降低複雜性。中國也被認為是繼美國之後的第三大運輸市場。儘管大量中國公司已經在使用 TMS,但隨著經濟的成長、都市化的加速以及電子商務產業的普及,中國預計將對 TMS 市場做出重大貢獻。

- 此外,森薩塔是一家在中國、日本、韓國、馬來西亞等12個國家開展業務的電子公司,最初的運輸管理是各自為政,對運輸網路的了解甚少,地點之間的協調更是不足。今年第一季,森薩塔發布了 Xirgo OTAC(空中充電)追蹤器解決方案。該解決方案允許客戶在每個充電站一次安全地充電和儲存多達約 400 個相容的資產追蹤器,從而使他們能夠管理難以永久安裝或外部電源的資產。擁有出貨場和配送中心的車隊營運商和大型零售商是該解決方案的理想選擇,因為他們可以透過加快資產追蹤器的部署和收費來降低成本。

運輸管理系統 (TMS) 產業概述

運輸管理系統市場的競爭是溫和的。隨著工業化的快速發展,這個市場具有巨大的成長潛力。因此,供應商開始瞄準開拓的中小企業,推動該行業滲透到業務的每個角落。主要參與者包括 Oracle Corporation、SAP SE、Cerasis Inc. 等。

2022 年 6 月,將物流密集型公司與電子商務連接起來的產業先驅 Descartes Systems Group 宣布收購 XPS Technologies,這是一家為電子商務提供多承運商小包裹運輸解決方案的供應商。透過此次收購,所有小型、中型和大型電子商務托運人都將可以直接使用 XPS雲端基礎的多承運商小包裹運輸解決方案。

2022 年 5 月,最大的 TMS 獨立供應商 MercuryGate International Inc. 宣布與 Amazon Freight(由 Amazon 提供支援的貨運服務)建立合作夥伴關係。 MercuryGate 的平台使托運人能夠存取 Amazon Freight 的可靠網路和實惠的動態定價。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 整合 RFID 技術進行供應鏈活動管理

- 雲端運算技術在供應鏈管理的使用增加

- 市場限制因素

- 消費者缺乏對運輸管理系統的認知

第6章市場區隔

- 依運輸方式

- 路

- 鐵路

- 航空

- 依介紹

- 本地

- 雲

- 依公司規模

- 中小企業

- 主要企業

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- 3Gtms Inc.(Sumeru Equity Partners)

- CargoSmart Ltd

- Descartes Systems Group Inc.

- Manhattan Associates Inc.

- JDA Software Group Inc

- Oracle Corporation

- SAP SE

- Precision Software Inc.(QAD Inc)

- MercuryGate International Inc(Summit Partners)

第8章投資分析

第9章 市場機會及未來趨勢

The Transportation Management System Market size is estimated at USD 2.08 billion in 2024, and is expected to reach USD 3.19 billion by 2029, growing at a CAGR of 8.92% during the forecast period (2024-2029).

The growing trend toward utilizing TMS by retailers and logistics companies and increasing backhaul support services for reverse logistics are extensively driving the market's growth.

Key Highlights

- One of the most recent trends gaining pace is the integration of advanced technology, including blockchain and artificial intelligence, to improve the capabilities of transportation management systems. Additionally, the adoption of sophisticated transportation management systems is fueled by the growing preference for cloud-based, anti-theft GPS and IoT-enabled systems to ensure transparency and security. The introduction of AI-enabled self-driving trucks and the overall ongoing rollout of 5G networks are expected to significantly affect the transportation sector and create new market opportunities.

- For instance, recently this year, BluWave-ai declared the introduction of version 2.0 of the BluWave-ai EV Fleet Orchestrator with the support of USD 1.7 million in co-funding from FedDev Ontario. This software-as-a-service (SaaS) product supports vehicle fleet operators as they can electrify their operations. These operators involve last-mile delivery, municipal mass transit, corporate vehicle fleets, airport ground support, and various electric vehicle (EV) fleet operations. Moreover, the EV Fleet Orchestrator also lowers the overall cost of operations and carbon footprint for fleet operations with mixed battery electric and fossil fuel vehicles operating from buildings, depots, or regional networks of depot/hubs due to its built-on BluWave-ai's established AI energy optimization platform and leveraging its technology IP portfolio.

- Further, nowadays, retailers are inclining toward omnichannel systems that incorporate brick-and-mortar, online, mobile, catalog, and other sales channels under a single umbrella. That increases freight transportation, and TMS helps increase visibility to all shipments under one user's control. This visibility allows for better business decisions when making transportation decisions.

- However, the shortage of experienced professionals and higher implementation costs with higher maintenance costs are a few factors expected to hinder the market's growth during the forecast period.

- The COVID-19 pandemic has had a severe impact on new sales and installations. The market's expansion was constrained by lockdowns and the limitations on the movement of people and goods implemented to stop the spread of the virus, resulting in changes in consumer behavior and interruptions in the supply chain. Nevertheless, the surge in the overall usage of innovative solutions based on advanced technologies and the increasing significance of various data-driven solutions in transportation and logistics are anticipated to contribute to the market's growth.

Transportation Management Systems (TMS) Market Trends

Increasing Use of Cloud and Artificial Intelligence in Supply Chain Management

- Industry landscapes are evolving rapidly primarily due to the wide adoption of artificial intelligence (AI), which includes computer vision and machine learning (ML) technology. The adoption of AI solutions and services is anticipated to be augmented by the need to achieve robotic autonomy to remain competitive in a global market. The market for artificial intelligence is expanding across the globe as a result of the growth of data-based AI and advancements in deep learning.

- The growing trend of multi-cloud functionality and the expanding demand for cloud-based intelligence services are boosting the market's overall growth. Modern AI tools add new and increased value to cloud computing. This factor is essential for incorporating new technologies within the sector, improving process viability overall. AI software also helps close the technological gap between modern breakthroughs and cloud computing.

- Consequently, since the AI cloud facilitates the convergence of two technologies, AI software and hardware, cloud computing and artificial intelligence are well combined in an AI cloud hybrid system. It helps to create a cloud environment similar to the human brain. Hence, the businesses functioning in the market are widely adopting and using AI through the cloud delivery of AI software-as-a-service., enabling them to utilize AI capabilities.

- For instance, recently this year, Oracle announced that it would open up its ERP applications platform to customer developers and partners. It also unveiled new B2B commerce services and declared a wide variety of additions to its supply chain management (SCM), enterprise planning management (EPM), and human capital management (HCM) Fusion Cloud offerings.

- As per Algorithmia, in 2021, the top use cases for artificial intelligence and machine learning were for increasing customer experience, i.e., 57%, whereas the total share for generating customer insights/intelligence was around 50%; detecting fraud stood at about 46%. That indicated a vast scope of benefits associated with the various use cases for artificial intelligence and machine learning. Hence, with the rise in the adoption of artificial intelligence, the market is expected to witness significant growth opportunities throughout the forecast period.

Asia-Pacific to Witness Fastest Growth

- Asia-Pacific is expected to witness the fastest growth rate due to the increasing international trade, particularly in emerging economies like China and India. Also, factors like the rapid pace of e-commerce growth, a complex mix of investment drivers, global trade, manufacturing growth (Made in China, for instance), and new infrastructure operations are expected to provide various lucrative market growth opportunities in the region.

- In the Asia-Pacific region, smartphone penetration is increasing, along with increasing disposable income. These factors support the growth of e-commerce in the region. India is another region that can be considered a significant and emerging market for TMS vendors; it is currently experiencing increased investments from shippers and third-party logistics (3PL) providers, thus providing scope for transportation technologies and TMS applications. Therefore, a proper TMS will be required to cater to the maximum number of customers. This will provide increased opportunities for the TMS market.

- The Asia-Pacific region creates unique challenges for organizations operating in the area. Some of the challenges include multiple languages and currencies, complex trade agreements (like the United States and China), regulations and compliance/legal requirements, varied economic conditions, developing infrastructure, and the increasing importance of green and sustainable transportation. The presence of these challenges throughout the region is augmenting the market's growth significantly.

- According to Boeing, by 2037, China plans to have around 740 freighters in its cargo airplane fleet; it had only 170 freighters in 2017. Therefore, with such an increase in freighters, the need for TMS will also increase. TMS can dramatically reduce complexity by integrating fleet and logistics management throughout the network. Also, China is considered the third largest transportation market after the United States. With its growing economy, high levels of urbanization, and proliferation in the e-commerce industry, China is estimated to be a significant contributor to the TMS market, despite the considerable number of Chinese companies already using TMS.

- Moreover, Sensata, an electronics company with operations spread across 12 countries, including China, Japan, Korea, and Malaysia, initially managed its transportation in a silo, with very little transportation network visibility and even less collaboration among the company's various locations. In the first quarter of this year, the company unveiled the Sensata | Xirgo OTAC (Over the Air Charging) Tracker Solution, which enables customers to securely charge and store up to about 400 compatible asset trackers at once per charging station to manage assets where permanent attachment or external power is a challenge. Fleet operators and large retailers with shipping yards and distribution centers are the perfect candidates for the solution since they can save money by expediting the deployment and charging of asset trackers.

Transportation Management Systems (TMS) Industry Overview

The transportation management system market is moderately competitive. Due to rapid industrialization, this market has enormous potential to grow. Therefore, vendors are started to target untapped smaller companies, fueling the industry to penetrate every corner of the business. Some key players are Oracle Corporation, SAP SE, and Cerasis Inc., among others.

In June 2022, Descartes Systems Group, the industry pioneer in bringing together logistics-intensive enterprises in commerce, announced the acquisition of XPS Technologies, a supplier of multi-carrier parcel shipping solutions for e-commerce. Through this acquisition, all the small, medium, and large-sized e-commerce shippers can directly access XPS' cloud-based multi-carrier parcel shipping solutions.

In May 2022, the largest independent provider of TMS, MercuryGate International Inc., announced a partnership with Amazon Freight, an Amazon-powered freight delivery service. The MercuryGate platform would give shippers access to Amazon Freight's reliable network and affordable dynamic pricing.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Integration of RFID Technologies for Managing Supply Chain Activities

- 5.1.2 Increasing Use of Cloud Computing Technologies in Supply Chain Management

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness Regarding Transport Management System among Consumers

6 MARKET SEGMENTATION

- 6.1 By Mode of Transportation

- 6.1.1 Roadways

- 6.1.2 Railways

- 6.1.3 Airways

- 6.2 By Deployment

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By Size of Enterprise

- 6.3.1 SMEs

- 6.3.2 Large Enterprises

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 3Gtms Inc. (Sumeru Equity Partners)

- 7.1.2 CargoSmart Ltd

- 7.1.3 Descartes Systems Group Inc.

- 7.1.4 Manhattan Associates Inc.

- 7.1.5 JDA Software Group Inc

- 7.1.6 Oracle Corporation

- 7.1.7 SAP SE

- 7.1.8 Precision Software Inc. (QAD Inc)

- 7.1.9 MercuryGate International Inc (Summit Partners)