|

市場調查報告書

商品編碼

1405081

Apron Bus:市場佔有率分析、產業趨勢/統計、成長預測,2024-2029Apron Bus - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

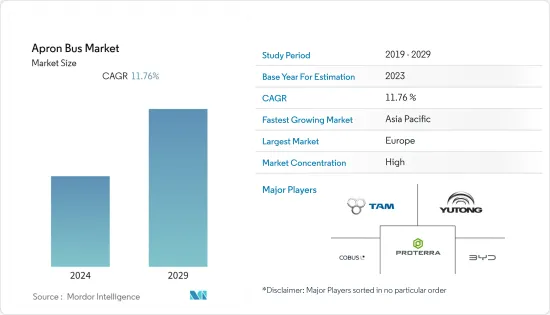

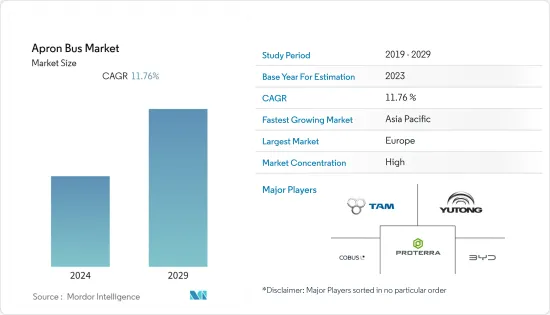

2024年,停機坪巴士市場價值為4.9797億美元,預計到2029年將達到8.6836億美元,預測期內複合年成長率為11.76%。

登機是飛機週轉時間的關鍵流程之一,直接影響航空公司成本。停機坪巴士市場的主要成長要素之一是快速登機流程。停機坪巴士是將乘客從飛機運送到航站樓的絕佳選擇,反之亦然,具體取決於機場。隨著航空公司不斷努力提高乘客滿意度,他們需要加快辦理登機手續的流程。旅客數量的增加以及航空公司持有的相應增加是市場成長的主要驅動力。另外,由於機場缺乏登機橋,有必要引進停機坪巴士。此外,它對加快登機過程和改善所有乘客舒適體驗的貢獻應該引起客戶的注意。此外,越來越多的航空公司正在採用配備 Anaba 馬達的電動巴士,以減少老化柴油引擎的排放。

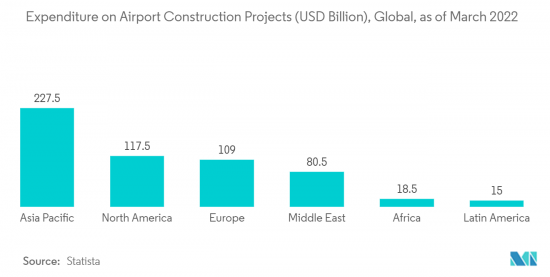

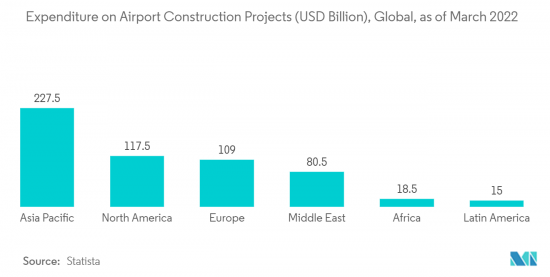

為了主導市場,客車製造商正在轉向全電動客車。預計新機場的建設將在預測期內進一步增加對停機坪巴士的需求。

停機坪巴士市場趨勢

預計電動領域在預測期內將出現顯著成長

預計在預測期內,電動市場將出現顯著成長。這一成長是由旅客數量的增加和加強機場基礎設施支出的增加所推動的。機場和航空公司正在努力透過採用先進的技術和系統來減少碳排放。在航站樓和飛機之間運送乘客的拖船、曳引機和公共汽車等地面支援車輛也對機場總排放做出了重大貢獻。航空公司和機場正在用新型電動巴士取代老化的柴油巴士,以實現碳中和。電動公車的優點是易於操作、維護成本低,最重要的是零排放。

過去十年,歐洲多個機場成功實現或減少了碳排放。隨著世界各地的機場尋求在未來 30 年內將全球航空排放減少約一半,電動巴士產業將在未來幾年加速成長。國際航空運輸 CORSIA 二氧化碳抵銷和減排計畫旨在透過要求航空公司從 2020 年起減少未來排放的增加來穩定排放水準。根據預期參與情況,在 2021 年至 2035 年期間,該計劃預計將抵消 2020 年水平以上排放的約 80%。第一階段的參與是自願的,但航空活動較少的國家除外。例如,Aviator Airport Alliance AB 設定了 2030 年達到淨零排放的目標。該公司計劃將永續燃料涵蓋其營運中,並將其地勤支援設備(GSE) 機群轉變為電力。

歐洲佔最高市場佔有率

歐洲在市場上佔有最高佔有率,並將在預測期內繼續佔據主導地位。這一成長是由於機場建設計劃的增加以及空中交通量增加對新停機坪巴士的需求增加所致。近年來,一些歐洲機場已用無排放電動巴士取代了柴油或燃氣引擎的停機坪巴士,以減少碳排放。

提供 Apronbus 服務的歐洲機場包括慕尼黑、比薩、法蘭克福、馬德里、倫敦盧頓和阿姆斯特丹史基浦機場。例如,2021 年 9 月,英國布里斯托機場啟用了電動停機坪巴士,以減少機場營運的排放。這輛電動巴士在航站樓和飛機之間運行,最多可運送 110 名乘客,由 COBUS Industries GmbH(德國)提供。這款全電動車配備了尖端功能,可最大限度地提高安全性和舒適性。機場將利用這次試運行來研究公車的營運效益,並將其與現有車隊進行比較。同樣,2023 年 6 月,Go-Ahead Group 投資 3,800 萬美元建造氫巴士車隊和加氫站,為倫敦蓋特威克機場及其周邊地區提供服務。

停機坪巴士產業概況

停機坪巴士市場因其性質而受到整合,因為它由少數現有公司主導。市場上的知名企業包括 COBUS Industries GmbH、宇通客車、比亞迪有限公司、Proterra Inc. 和 TAM-EUROPE。建造新機場或更新老化巴士為玩家提供了新的機會。客車製造商正在透過推出具有先進功能的新型客車來擴大產品系列,以贏得新合約。在全球範圍內,隨著航空公司尋求減少碳足跡,巴士製造商也在轉向電動停機坪巴士,為乘客和行李提供更多空間。

例如,Quantron(德國)是「電動交通」領域的專家,提供各種類型的電動卡車和運輸車,包括巴士。對於機場市場,我們提供多種用於餐飲、飛機供應/服務或道路清潔的車款。 2022 年 12 月,SpeediShuttle(美國美國)獲得了一份航站樓間契約,在 Daniel K. Inouye 機場(美國美國)營運 Wiki Wiki Shuttle 服務。該服務是前往機場內行李提取區或其他航站樓的快速交通方式。 SpeediShuttle 計劃推出管理系統,通知用戶到達時間。此外,阿姆斯特丹史基浦機場計劃於2023年3月進行自動駕駛巴士的試運行。該計劃將由皇家史基浦集團與 NLMTD 和 TNW (The Next Web) 合作實施,以進一步加速機場的創新。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 市場抑制因素

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 類型

- 電動的

- 柴油引擎

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 埃及

- 南非

- 其他中東/非洲

- 北美洲

第6章競爭形勢

- 供應商市場佔有率

- 公司簡介

- Yutong Bus Co., Ltd.

- COBUS Industries GmbH

- TAM-EUROPE

- BYD Company Ltd

- Xinfa Airport Equipment Ltd

- Proterra Inc.

- Xiamen King Long International Trading Co.,Ltd.

- Solaris Bus & Coach sp. z oo

- AB Volvo

- Ashok Leyland

- Mallaghan(GA)Inc

第7章 市場機會及未來趨勢

The Apron Bus Market is valued at USD 497.97 million in 2024 and is expected to reach USD 868.36 million by 2029, registering a CAGR of 11.76% during the forecast period.

Boarding is one of the major processes of aircraft turnaround time with a direct influence on airline companies' costs. One of the main growth factors in the market for apron buses is the quicker boarding process. Apron buses are the best option at some airports to transport passengers from the plane to the terminal or vice versa. As airlines continuously strive for better passenger satisfaction, they must speed up the boarding process. The increasing air passenger traffic and the corresponding growth in airline fleets are the main drivers for the market growth. Also, the lack of available boarding bridges at airports is causing the need to introduce apron buses. In addition, the faster boarding process and its contribution to improving a comfortable experience for all passengers should attract customer attention. In addition, in order to limit emissions caused by the aging diesel engines on buses, a number of airlines are adopting an electrical bus equipped with Anaba's electronic motors.

In order to dominate the market, bus manufacturers are shifting toward all-electric buses. The construction of new airports is expected to further generate the demand for apron buses during the forecast period.

Apron Bus Market Trends

Electric Segment is Expected to Show Significant Growth During the Forecast Period

The electric segment is anticipated to show significant growth in the market during the forecast period. The growth is due to the increasing number of air passengers and growing spending on enhancing airport infrastructure. Airports and airlines are striving to reduce their carbon footprint by adopting advanced technologies and systems. Of the total emissions at airports, ground support vehicles, like tugs, tractors, and buses ferrying passengers between the terminals and the aircraft are also contributing significantly. Airlines and airports, in order to achieve carbon neutrality, are replacing aging diesel engine-powered buses with new electric buses. Electric buses offer advantages like ease of operation, low maintenance, and, most importantly, zero-emission.

Several airports across Europe were successful, over the past decade, in achieving or reducing their carbon footprint. As airports across the world are trying to reduce their global aviation emissions by about half over the next three decades, the electric bus segment will experience accelerated growth in the coming years. The CORSIA CO2 offset and reduction scheme for international air transport aims to stabilize emission levels by requiring airlines to mitigate the future growth of emissions after 2020. During the period 2021-2035, and based on expected participation, the scheme is estimated to offset around 80% of the emissions above 2020 levels. Participation of states in the first phase is voluntary, and there are exceptions for those with low aviation activity. For instance, Aviator Airport Alliance AB set itself a goal of becoming net zero by 2030. The authority plans to incorporate sustainable fuel into operations and transition its Ground Support Equipment (GSE) fleet to electric power. The company can confidently accomplish this objective.

Europe Holds Highest Shares in the Market

Europe holds the highest shares in the market and continue its domination during the forecast period. The growth is due to the increasing number of airport construction projects and rising demand for new apron buses due to increased air traffic. Several airports in Europe, in order to reduce their carbon footprint, replaced their diesel or gas-powered apron buses with emission-free electric buses in the past few years.

Some of the European airports that operate apron buses are Munich, Pisa, Frankfurt, Madrid, London Luton, and Amsterdam Schiphol, among others. For instance, in September 2021, Bristol Airport (UK) ordered an electric airside bus in a bid to reduce airport operating emissions. The electric bus, capable of transporting up to 110 passengers and operating between the terminal building and an aircraft, is supplied by COBUS Industries GmbH (Germany). The fully electric vehicle includes state-of-the-art features to maximize safety and comfort. The airport will use the trial to study the operating benefits of the bus and compare it to its existing fleet. Similarly, in June 2023, the Go-Ahead Group invested USD 38 million in a hydrogen bus fleet and refueling station for services in and around London Gatwick Airport.

Apron Bus Industry Overview

The apron bus market is consolidated in nature as a few established players dominate it. Some of the prominent players in the market are COBUS Industries GmbH, YUTONG, BYD Company Ltd, Proterra Inc., and TAM - EUROPE. The construction of new airports and the replacement of aging buses will offer new opportunities to the players. Bus manufacturers, in order to gain new contracts, are expanding their product portfolios by introducing new buses with advanced features. Globally, as the airlines look forward to reducing their carbon footprint, bus manufacturers are also shifting toward electric apron buses with increased space for passengers and their baggage.

For instance, Quantron (Germany) is a specialist in 'e-mobility,' offering electric trucks and transporters of various kinds, including buses. For the airport market, it provides a number of vehicle models for catering applications and aircraft supply/service or surface sweepers. In December 2022, SpeediShuttle (Hawaii, US) was awarded the interterminal contract to operate the Wiki Wiki Shuttle service within the Daniel K. Inouye Airport (Hawaii, US). Flyers use the service as a speedy way to get across the airport to baggage claim or a different terminal. SpeediShuttle will be implementing a management system that gives riders arrival times. Moreover, in March 2023, Amsterdam Schiphol Airport plans the trials of self-driving buses. The trials are a result of the Royal Schiphol Group teaming up with nlmtd and TNW (The Next Web) to further accelerate innovation at the airport.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Electric

- 5.1.2 Diesel

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Russia

- 5.2.2.6 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Australia

- 5.2.3.6 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.4.1 Brazil

- 5.2.4.2 Mexico

- 5.2.4.3 Rest of Latin America

- 5.2.5 Middle East & Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 Egypt

- 5.2.5.4 South Africa

- 5.2.5.5 Rest of Middle East & Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share**

- 6.2 Company Profiles

- 6.2.1 Yutong Bus Co., Ltd.

- 6.2.2 COBUS Industries GmbH

- 6.2.3 TAM - EUROPE

- 6.2.4 BYD Company Ltd

- 6.2.5 Xinfa Airport Equipment Ltd

- 6.2.6 Proterra Inc.

- 6.2.7 Xiamen King Long International Trading Co.,Ltd.

- 6.2.8 Solaris Bus & Coach sp. z o.o.

- 6.2.9 AB Volvo

- 6.2.10 Ashok Leyland

- 6.2.11 Mallaghan (G.A.) Inc