|

市場調查報告書

商品編碼

1432994

海事資訊:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Maritime Information - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

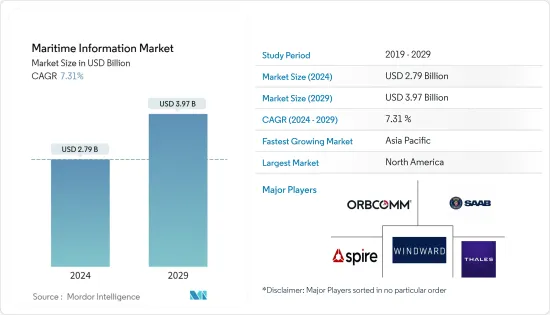

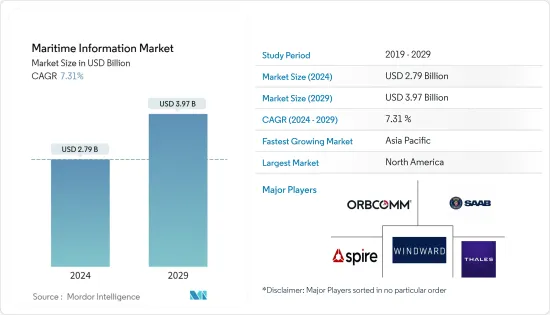

海事資訊市場規模預計到 2024 年為 27.9 億美元,預計到 2029 年將達到 39.7 億美元,在預測期內(2024-2029 年)複合年成長率為 7.31%。

海事資訊使用者收集資料以確保海上安全、海事作業的效率和生產力。海事情報有助於遵守法規、提高意識、提供科學研究資料以及對可疑或非法活動進行環境監測。

主要亮點

- 隨著船舶交通量的增加,提高船舶安全保障和保護環境至關重要。 IBEF報告顯示,印度約70%的貿易額和95%的貿易量是透過海運進行的。據報道,2022年4月至10月印度主要港口的貨運量為4.465億噸,與前一年同期比較增40%。

- 此外,資訊交流是航運業各部門相互協調、順利運作的基礎。自動識別系統(AIS)和合成孔徑雷達(SAR)等整合海上交通監視能力和有效追蹤系統的系統已成為船舶的基本需求。

- 海運業有著不斷採用和適應新技術的悠久傳統。借助海事資訊技術和系統,貨主可以輕鬆追蹤貨物,自動化和簡化海上運輸鏈中不同相關人員之間的資訊流,並改善業務。

- 貿易活動的活性化也造成了海上威脅,例如恐怖攻擊、環境破壞和非法海上移民。此外,全球貿易自由化正在增加航行於海洋的船舶數量,這影響了對此類解決方案的需求。

- 海上安全變得越來越重要,各國政府正在投資追蹤技術。中美等美國政府在促進海上安全方面發揮著重要作用,海洋產業為這些地區的經濟成長做出了貢獻。

- 世界貿易大部分透過海上進行,據 OECD 稱,到 2030 年,海上貿易量預計將達到 1,800 億噸。隨著業務的持續成長導致非法活動增加,世界各國政府正在增加海事預算,這可能會提供市場成長機會。

- 例如,2022年10月,美國運輸部宣布將透過海事管理局的港口基礎設施發展計劃,向21個州和1個領地的41個計劃投資約7.03億美元,以改善港口設施。透過這項投資,政府將對各種規模的港口進行現代化改造,以提高供應鏈的可靠性並提高營運效率。

- 由於 COVID-19 的爆發,航運和海運業受到了嚴重影響,因為這些行業的勞動力被關閉以遏制病毒的傳播。這是因為在檢疫期間(隔離期間)所有水路和空運的貨物運輸都暫停了。

海事資訊市場趨勢

主導市場的自動辨識系統

- 自動辨識系統是一種電腦化追蹤系統,可以顯示附近的其他船隻。安裝在船舶上,用於識別船舶和航行標記。在沿海水域,沿海當局使用 AIS 作為岸對船通訊的監測工具,以廣播有關潮汐、NTM 和當地天氣狀況的資訊。 AIS 還有助於監控危險貨物的流動並控制該地區的商業捕魚活動。

- 為了減少海上事故並加強海上交通管理,世界各國政府投入大量資金在船舶上安裝AIS(自動識別系統)。全球海事部門擴大採用 AIS(自動識別系統)。船舶交通管理等海事活動採用 AIS 來幫助船隊人員做出與避碰、船舶導航、船舶擱淺和船舶救援相關的明智決策。

- 國際海事組織《國際海上人命安全公約》要求國際客船和300總噸以上的客船,無論大小,均應配備自動識別系統。因此,自動識別系統的安裝迅速增加,推動了市場成長。全球海上貿易航線的增加促使海上運輸量的增加。研究表明,如今海上航行的船隻數量是 20 年前的四倍。這些因素支撐著對 AIS 的需求。

- 隨著海洋保護區(MPA)等嚴格的環境法規要求更全面的監控,以降低交通限制的風險並發現非法運輸,對海上貨船和遠洋船舶的監控變得越來越重要,並且顯著增加。世界各國政府對海洋產品和服務的支出增加、安全威脅增加以及水上運輸和貿易增加是推動市場成長的主要因素。

- 此外,一些領先公司正專注於開拓新產品,以獲得市場競爭優勢。例如,2022年5月,ACR Electronics和Ocean Signal宣佈在EPIRB上引入整合AIS(自動識別系統),允許商業和休閒用戶在發生緊急情況時通知附近的其他船隻,這提供了特殊的意義的安全性。

亞太地區實現顯著成長

- 安聯集團旗下的安聯全球企業與專業公司 (AGCS) 進行的一項研究顯示,過去四年來,亞洲各地報告的海上事故數量增加了 22%。因此,需要擴大海事資訊系統的使用。

- 目前,許多港口,特別是印度的港口,正在實施新技術,其中自動識別系統發揮關鍵作用並推動了市場成長。預計這將解決印度港口因停留時間長等限制而造成的貨物裝卸效率低下的問題。

- 世界貿易大部分透過海上進行,經合組織估計,到 2030 年,海上貿易量將達到 1,800 億噸。由於這種持續的業務成長導致非法活動數量增加,包括中國、日本和印度在內的政府正在增加其海事預算,這可能是市場的成長機會。

- 該地區各國政府也支持海運業的發展,進一步推動市場成長。例如,2023年5月,印度政府宣布了五項舉措,旨在使該國成為全球海事領導者。這五項措施也被稱為“Panch Karma Sankalp”,其中包括政府提供 30% 的財政支持,以促進綠色航運和港口數位化。

- 亞洲的港口基礎設施通常是新建的,中國、韓國、日本和馬來西亞有許多新建或擴建的港口。這就需要改進海事資訊系統來應對未來的課題。

- 海上安全變得越來越重要,各國政府正在投資追蹤技術。中國等國家的政府在促進海上安全方面發揮著重要作用,因為海運業為這些地區的經濟成長做出了貢獻。

- 此外,印度、中國、日本和韓國等國每年都在持續增加國防預算,以加強國家安全。為了確保海岸線的安全,印度政府計劃引入國家自動識別系統來應對這項威脅。

海事資訊產業概況

全球海事資訊市場競爭激烈。市場高度集中,參與者有大有小。所有主要公司都佔有重要的市場佔有率,並致力於擴大消費群。該市場的主要企業包括 Windward Limited、SAAB Group、Thales Group、ORBCOMM Inc.、Spire Global 和 Iridium Communications Inc.。為了在預測期內獲得競爭優勢,公司正在透過建立多個合作夥伴關係並推出新的解決方案來增加市場佔有率。

2023 年 5 月,Spire Global, Inc. 宣布推出新的深度導航分析 (DNA) 平台,透過三個層面為海事相關人員提供支援:可操作的情報 API、海事天氣資料API 以及決策支援解決方案和可視化。宣布將提供必要的資訊。該平台使用從該公司完全部署的衛星星系收集的無線電掩星 (RO)資料,並處理 RO資料,產生可供用戶使用的 15 天全球天氣預報,從而提供最新的天氣預報。使用權。

2022 年 6 月,Inmarsat 及其子公司與 Fameline Holding Group (FHG) 合作。這種夥伴關係表明該組織有意探索海事和能源領域的聯合舉措,以使雙方受益。兩家公司的目標是增加付加,並開發和提供海洋領域的創新解決方案。國際海事衛星組織正在推動航運業的數位化,使營運比以往更安全、更有效率。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 增強船舶安全性和合規性的好處

- 市場課題

- 濫用資訊的網路威脅

第6章市場區隔

- 依用途

- 自動辨識系統

- 合成孔徑雷達

- 船舶識別和追蹤

- 衛星影像

- 其他用途

- 依最終用戶

- 政府機關

- 商業的

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Windward Limited

- SAAB group

- Thales Group

- ORBCOMM Inc.

- Spire Global

- Iridium Communications Inc.

- Inmarsat Global Limited

- Northrop Grumman Corporation

- BAE Systems

- L3 Harris Technologies, Inc.

第8章投資分析

第9章市場的未來

The Maritime Information Market size is estimated at USD 2.79 billion in 2024, and is expected to reach USD 3.97 billion by 2029, growing at a CAGR of 7.31% during the forecast period (2024-2029).

The users of maritime information gather data to ensure safety at sea, efficiency in marine operations, and productivity. Maritime information offers regulatory compliance, enhances awareness, provides scientific and survey data, and monitors the environment for suspicious or illegal actions.

Key Highlights

- With ship traffic increasing, it has become essential to improve the security and safety of ships and safeguard their environment. According to the IBEF report, in India, approximately 70% of India's trading by value and 95% by volume is done through maritime transport. From April to October 2022, the cargo traffic at the major ports of India was reported to be 446.50 million metric tons, an increase of 40% as compared to the previous year.

- Additionally, information exchange forms the basis for different segments within the maritime industry to coordinate with each other to enable smooth functioning. Systems integrated with maritime traffic monitoring capabilities and effective tracking systems, such as automatic identification systems (AIS), synthetic aperture radar (SAR), etc., have emerged as fundamental needs for vessels.

- The maritime industry has long traditions of continuously adopting and adapting to new technology. With the help of maritime information technology or system, cargo owners can easily track their shipments and automate and streamline the flow of information between the different parties in the maritime transport chain, and improve their operations.

- The rise in trade activities has also given rise to maritime threats, such as terrorist attacks, environmental destruction, and illegal seaborne immigration. Moreover, owing to the liberalization of world trade, there has been an increase in the number of ships that traverse the oceans, which, in turn, is impacting the demand for such solutions.

- Safety at sea is gaining importance, and the governments of various countries are investing in tracking technologies. The governments of countries like China and the United States play a vital role in promoting maritime security since the maritime industry adds to the economic growth of these regions.

- Maritime information plays a vital role in economic development, as most of the global trade is conducted by sea and is estimated to reach 180 billion metric tons in volume by 2030, per the OECD. As this continuous business growth has driven up the number of illegal activities, governments worldwide are increasing their maritime budget, likely to provide market growth opportunities.

- For instance, in October 2022, the U.S. Department of Transportation announced to invest approximately USD 703 million to fund 41 projects across the 21 states and one territory to improve port facilities through the Maritime Administration's Port Infrastructure Development Program. Through this investment, the government aims to modernize ports of all sizes and improve supply chain reliability and more efficient operations.

- The outbreak of COVID-19 caused the shipping and maritime industry to be heavily impacted as the workforces in these sectors have been shut down to curb the spread of the virus. This setback was caused due to the standstill of all kinds of cargo via water or air during this quarantine period (period of isolation), as the transportation of such shipments in ships or via air can carry the virus from one port to another.

Maritime Information Market Trends

Automated Identification Systems to Dominate the Market

- An automatic identification system is a computerized tracking system that shows other nearby vessels. It is installed on ships to identify ships and nautical signs. In coastal waters, coastal authorities use AIS as a monitoring tool for land-to-ship communications to broadcast information about tides, NTMs, and local weather conditions. In addition, AIS helps monitor dangerous cargo movements and manage commercial fishing activities in the area.

- The concerned government authorities worldwide have made considerable investments to integrate AIS (Automatic Identification Systems) into ships to reduce marine accidents and enhance marine traffic management. The global maritime sector is increasingly adopting Automatic Identification Systems (AIS). Maritime activities such as vessel traffic management employ AIS by helping fleet staff make well-informed decisions pertaining to collision avoidance, vessel navigation, grounding of ships, and vessel rescue.

- The International Maritime Organization's "International Convention on the Safety of Life at Sea" requires all international passenger ships and passenger ships of 300 GT (gross tonnage) or more to install an automatic identification system regardless of their size. This is leading to a rapid increase in the installation of automatic identification systems, thereby boosting the market's growth. The rise in global trade routes through the sea is increasing ship traffic in the oceans. According to the study, there are four times as many ships at sea now than 20 years ago. Factors like these are helping in AIS demand.

- Surveillance of sea freight and oceanic vessels has significantly increased as stringent environmental regulations such as marine protected areas (MPAs) require more comprehensive surveillance to reduce traffic restrictions risks and detect illegal traffic. The increasing spending on marine products and services by various governments worldwide, increasing security threats, and the growing number of waterborne transportation and trade are the main factors driving the market's growth.

- Moreover, several leading players are focusing on developing new products to gain a competitive advantage in the market. For instance, in May 2022, ACR Electronics and Ocean Signal announced introducing integrated AIS (Automatic Identification System) within its EPIRBs to offer commercial and recreational users extra reassurance that other nearby vessels will be notified in an emergency.

Asia-Pacific to Witness the Significant Growth

- According to a survey conducted by Allianz Global Corporate & Specialty (AGCS), a unit of the Allianz Group, the number of reported shipping incidents overall in Asia increased by 22% in the past four years. This calls for increased use of maritime information systems.

- Many ports, mainly Indian ports, are now deploying new technologies where automatic identification systems play a significant role, driving the market's growth. This is expected to solve the inefficiency of Indian ports in cargo handling, owing to constraints such as long dwell time.

- Maritime information plays a vital role in economic development, as most of the global trade is conducted by sea and is estimated to reach 180 billion metric tons in volume by 2030, per the OECD. As this continuous business growth has driven up the number of illegal activities, governments of counties including China, Japan, and India are increasing the maritime budget, which will likely provide market growth opportunities.

- The government in the region is also supporting the growth of the maritime industry, further fuelling the market growth. For instance, in May 2023, the government of India announced five initiatives to make the country a global leader in the maritime sector. The five initiative, also called "Panch Karma Sankalp," includes 30% financial support from the government to promote green shipping and digitization of ports.

- In many cases, port infrastructure in Asia is new, and there are many new or expanding ports in China, Korea, Japan, and Malaysia. This calls for an improved maritime information system to address future challenges.

- Safety at sea is gaining importance, and the governments of various countries are investing in tracking technologies. The governments of countries like China play a vital role in promoting maritime security since the maritime industry adds to the economic growth of these regions.

- Further, countries like India, China, Japan, and South Korea continuously increase their defense budgets yearly to strengthen national security. The government of India is planning to handle threats by implementing a national automatic identification system to ensure the safety and security of its coastline.

Maritime Information Industry Overview

The Global Maritime Information Market is very competitive. The market is highly concentrated due to various small and large players. All the major players account for a large market share and focus on expanding their consumer base worldwide. Some of the significant players in the market are Windward Limited, SAAB Group, Thales Group, ORBCOMM Inc., Spire Global, Iridium Communications Inc., and many more. The companies are increasing the market share by forming multiple partnerships and introducing new solutions to earn a competitive edge during the forecast period.

In May 2023, Spire Global, Inc. announced to launch of its new Deep Navigation Analytics (DNA) Platform to deliver essential information to maritime stakeholders through three layers: actionable intelligence APIs, maritime weather data APIs, and decision support solutions and visualizations. The platform utilizes radio occultation (RO) data collected from the company's fully deployed constellation of satellites and a proprietary weather forecast model that processes the RO data to generate a 15-day global weather forecast that users can use and provides access to the latest weather forecasts.

In June 2022, Inmarsat collaborated with Fameline Holding Group (FHG), along with the subsidiaries. The collaboration expresses the intent of the organizations to explore joint initiatives across the maritime and energy sectors to benefit both parties. Both companies aspire to add value and develop and deliver innovative solutions for the marine sector. Inmarsat powered the maritime industry's digitalization, making operations safer and more efficient than ever before.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Advantage of Enhancing On-board Safety and Compliance Conditions on Ships

- 5.2 Market Challenges

- 5.2.1 Cyber Threats Capable of Misusing Information

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Automatic Identification Systems

- 6.1.2 Synthetic Aperture Radar

- 6.1.3 Vessel Identification and Tracking

- 6.1.4 Satellite Imaging

- 6.1.5 Other Applications

- 6.2 By End-user

- 6.2.1 Government

- 6.2.2 Commercial

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Windward Limited

- 7.1.2 SAAB group

- 7.1.3 Thales Group

- 7.1.4 ORBCOMM Inc.

- 7.1.5 Spire Global

- 7.1.6 Iridium Communications Inc.

- 7.1.7 Inmarsat Global Limited

- 7.1.8 Northrop Grumman Corporation

- 7.1.9 BAE Systems

- 7.1.10 L3 Harris Technologies, Inc.