|

市場調查報告書

商品編碼

1273445

蛋白質測序市場 - 增長、趨勢和預測 (2023-2028)Protein Sequencing Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,蛋白質測序市場預計將以 3.6% 的複合年增長率增長。

COVID-19 的檢測對市場產生了重大影響,因為它已被蛋白質測序所提供的進步所利用。 例如,正如 2022 年 7 月發表在 Frontiers 上的一篇論文所述,每天存儲在生物數據庫中的蛋白質序列數量不斷增加,病毒株之間的 N 蛋白保守性以及計算方法可能有助於 SARS。-已被使用以確定 CoV-2 和 SARS-CoV 相關病毒的潛在新靶點。 因此,這種用於識別 COVID-19 靶標的蛋白質測序技術在預測期內對市場增長產生了重大影響。 由於蛋白質測序在生物醫學研究中的應用越來越廣泛,預計未來幾年該市場將出現增長。

推動蛋白質測序市場增長的主要因素包括對靶向藥物開發的日益關注、技術進步以及蛋白質組學研究資金的增加。 例如,在 2022 年 6 月發表在 ACS Publications 上的一篇論文中,重要的是要了解具有所有特定構象的蛋白質結構,以便選擇性地靶向蛋白質和設計小分子。 AlphaFold2 是一種基於深度神經網絡的機器學習程序,能夠以非常高的準確度預測未知的蛋白質結構,這可能有助於更高效的藥物設計。 同樣,在 2022 年 9 月發表在 TechRxiv 上的一篇論文中,研究人員提出了一種通過單次二元測量識別大量或少量分子中的單個氨基酸 (AA) 的方法。 它可以與 Edman 降解(或其他方法)結合用於□測序或從子序列中鑑定母體蛋白質。 這種二進制/數字方法基於轉移 RNA (tRNA) 的超特異性,與傳統的單分子 (SM) 測序方法和使用模擬測量的新方法有很大不同。 因此,預計蛋白質測序領域的此類技術進步將在預測期內推動市場增長。

此外,增加對蛋白質組學研究的資助也有望在預測期內推動蛋白質測序市場的發展。 例如,2021 年 6 月,麻省理工學院分拆出來的 Glyphic Biotechnologies 計劃以 600 萬美元的種子資金建立一個蛋白質組學平台,以應對蛋白質組學和蛋白□□質分析市場。 此外,2022 年 5 月,Proteomics International Laboratories 根據醫學研究未來基金 (MRFF) 計劃從澳大利亞政府獲得了約 286,833 美元的資助。 預計這筆資金將用於支持 PromarkerD 測試在澳大利亞的生產。

因此,由於蛋白質測序帶來的收益增加和研究資金的增加,預計研究市場在預測期內將呈現市場增長。 然而,蛋白質測序設備的高成本預計將抑制預測期內的市場增長。

蛋白質測序市場趨勢

蛋白質工程研究有望在預測期內顯示蛋白質測序市場的增長

蛋白質工程是操縱蛋白質結構以產生所需特性,或合成具有特定結構的蛋白質。 當今市場上的大多數治療藥物都是生物製劑,例如抗體、核酸製劑和疫苗。 由於蛋白質工程研究活動的增加以及用於開發各種含蛋白質產品的資金增加,預計蛋白質工程領域的市場將出現增長。 例如,2022 年 10 月,上州醫學院的一位教授因結合蛋白質和 DNA 工程而獲得美國國家綜合醫學科學研究所超過 150 萬美元的獎勵。 在這項研究中,我們創建了幾個精心挑選的具有強大生物活性的蛋白質開關,並通過選定的 DNA 或 RNA 序列(例如來自冠狀病毒和鉅細胞病毒的序列)使用 DNA 工程打開它們。

同樣,2022 年 9 月,內華達大學化學與材料工程助理教授宣布,美國國立衛生研究院國家衰老研究所 (NIA) 的一種新型□抑製劑(一種與參與神經退行性疾□□病的□相互作用的分子)工程補助金。 研究人員正在使用最先進的蛋白質工程技術開發基於特定蛋白質的新型□抑製劑,這些蛋白質可抑制與神經退行性疾□□病有關的□。 因此,預計這種以蛋白質工程為動力的調查將在預測期內推動市場增長。 此外,2022 年 3 月,北德克薩斯大學生物醫學工程系的研究人員最近獲得了 150 萬美元的美國國立衛生研究院 (NIH) 最大化研究者研究獎 (MIRA),用於研究蛋白質和細胞工程。 這筆新資金將使研究人員有機會發現和設計生物蛋白質的新功能和特性,最終產生新的生物行為。

因此,預計增加的研究經費和蛋白質工程帶來的未來機遇將在預測期內推動該細分市場的增長。

預計在預測期內北美將佔很大份額

由於技術不斷進步和擁有出色的醫療保健基礎設施,預計北美將佔據蛋白質測序市場的很大份額。 它還為政府和非政府組織在蛋白質組學領域的研究提供資金。

此外,預計北美主要參與者的企業活動將在預測期內推動市場增長。 例如,2023 年 1 月,總部位於美國的 Quantum-Si 開始商業發貨其鉑蛋白測序系統,並在第 41 屆摩根大通醫療保健會議上提供了業務更新。 該公司已與抗體、蛋白質和免疫分析試劑產品供應商 Aviva Systems Biology 合作,與 Platinum 共同開髮用於蛋白質測序研究工作流程的樣品製備試劑盒。

此外,馬尼托巴省政府將於 2022 年 6 月發布馬尼托巴省蛋白質研究戰略,這是一項全面的研究計劃,將作為該州在這個快速增長的細分市場取得最終成功的藍圖。 MPRS 專注於可持續蛋白質食品系統的氣候變化適應力、新型可持續蛋白質產品的研發和加工、支持可持續食品系統的數字農業、廢物、水、副產品 46 個戰略研究項目分為四個主題,替代用途。

因此,由於研究資金的增加和蛋白質測序技術的進步,預計北美在預測期內的監測市場將出現增長。

蛋白質測序行業概況

由於存在各種市場參與者,這個市場是分散的。 預計主要參與者的合併、收購、聯盟和合作夥伴關係等戰略活動將在預測期內推動市場增長。 一些市場參與者是 Agilent Technologies, Inc.、Bioinformatics Solutions、Charles River Laboratories、Proteome Factory、Rapid Novor Inc.、Selvita SA、SGS SA、Shimadzu Corporation、Thermo Fisher Scientific Inc.、Waters。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場概覽

- 市場驅動因素

- 越來越關注基於靶點的藥物開發

- 增加對蛋白質組學研究的資助

- 市場製約因素

- 蛋白質測序儀成本高

- 波特五力

- 新進入者的威脅

- 買方/消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第 5 章市場細分

- 按產品/服務

- 樂器

- 質譜儀

- 埃德曼分解

- 試劑和耗材

- 軟件服務

- 樂器

- 通過申請

- 生物標誌物發現

- 蛋白質工程研究

- 生物療法

- 其他

- 最終用戶

- 製藥公司、生物技術公司

- 研發中心

- 其他

- 按地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 澳大利亞

- 韓國

- 其他亞太地區

- 中東和非洲

- 海灣合作委員會

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第六章競爭格局

- 公司簡介

- Agilent Technologies, Inc.

- Bioinformatics Solutions

- Charles River Laboratories

- Proteome Factory

- Rapid Novor Inc.

- Selvita SA

- SGS SA

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

- Waters Corporation

- Alphalyse

- Bruker

第七章市場機會與未來趨勢

The protein sequencing market is expected to register a CAGR of 3.6% over the forecast period.

COVID-19 has had a significant impact on the market since the detection of COVID-19 was utilized by the advancements offered by protein sequencing. For instance, as per the article published in July 2022 in Frontiers, the growing number of protein sequences deposited in biological databases on a daily basis, as well as the N protein conservation among viral strains along with computational approaches, were used to identify possible novel targets for SARS-CoV-2 and SARS-CoV-related viruses. Hence, such protein sequencing techniques for identifying the COVID-19 targets significantly impacted the market growth over the forecast period. The market is anticipated to witness growth in the coming years due to the increase in the utilization of protein sequencing in biomedical research.

The major factors for the growth of the protein sequencing market include the rising focus on target-based drug development and technological advancements and increasing funding for proteomics research. For instance, as per the article published in June 2022 in ACS Publications, to selectively target a protein and to design small molecules, knowing the protein structure with all its specific conformation is critical. AlphaFold2, a deep neural network-based machine learning programme, was able to predict unknown protein structures with exceptional accuracy and which helped the drug design more efficiently. Similarly, as per the article published in September 2022 in TechRxiv, the researchers presented a method for identifying single amino acids (AAs) in bulk or with a few molecules from a single binary measurement. It can be used in conjunction with Edman degradation (or another approach) to sequence a peptide or identify the parent protein from a partial sequence. This binary/digital methodology is based on the super specificity property of transfer RNAs (tRNAs), and it differs significantly from the traditional and newer single molecule (SM) sequencing approaches that use analog measurements. Hence, such technological advancements in the field of protein sequencing are likely to fuel market growth over the forecast period.

Furthermore, the rising funding for proteomic research is expected to boost the protein sequencing market over the forecast period. For instance, in June 2021, with USD 6 million in Seed Funding, MIT Spinout Glyphic Biotechnologies planned to build a proteomic platform to tackle the proteomics and protein analysis market. Additionally, in May 2022, Proteomics International Laboratories was awarded approximately USD 286,833 in funding from the Australian Government under the Medical Research Future Fund (MRFF) initiative. The funding is expected to support manufacturing the PromarkerD test in Australia.

Thus, due to the rise in advantages offered by protein sequencing and the increase in research funding, the studied market is anticipated to witness growth in the market over the forecast period. However, the high cost of protein sequencing equipment is anticipated to restrain the market growth over the forecast period.

Protein Sequencing Market Trends

Protein Engineering Studies are Expected to Witness a Growth in the Protein Sequencing Market Over the Forecast Period

Protein engineering is the manipulation of the structures of proteins to produce the desired properties or the synthesis of proteins with particular structures. The majority of therapeutic drugs in the current market are bio formulations, such as antibodies, nucleic acid products, and vaccines. The protein engineering segment is anticipated to witness growth in the market due to the rise in research activities in protein engineering and an increase in funding for developing different products involving proteins. For instance, in October 2022, the Upstate Medical University professor was awarded more than USD 1.5 million from the National Institute of General Medical Sciences for combining protein and DNA engineering. In the study, the researcher is building a few select protein switches that have powerful biological activities and using DNA engineering to turn on those activities by DNA or RNA sequences of choice, such as those from coronavirus or cytomegalovirus.

Similarly, in September 2022, a Chemical & Materials Engineering assistant professor at the University of Nevada, received a grant from the NIH's National Institute on Aging (NIA) to engineer novel enzyme inhibitors (molecules that interact with enzymes that play a role in neurodegenerative disease. The researcher is developing novel enzyme inhibitors using state-of-the-art protein engineering techniques based on a specific protein that will block the enzymes that play a role in neurodegenerative diseases. Hence, such research studies utilizing protein engineering are anticipated to drive market growth over the forecast period. Furthermore, in March 2022, the University of North Texas Department of Biomedical Engineering researcher recently received a USD 1.5 million National Institutes of Health (NIH) Maximizing Investigators' Research Award (MIRA) to study protein and cellular engineering. The new funding allows the researcher the opportunity to discover and design new functions and properties in biological proteins to ultimately generate new biological behavior.

Thus, an increase in research funding and a rise in future opportunities offered by protein engineering is anticipated to drive the segment growth over the forecast period.

North America is Expected to Hold Significant Market Share Over the Forecast Period

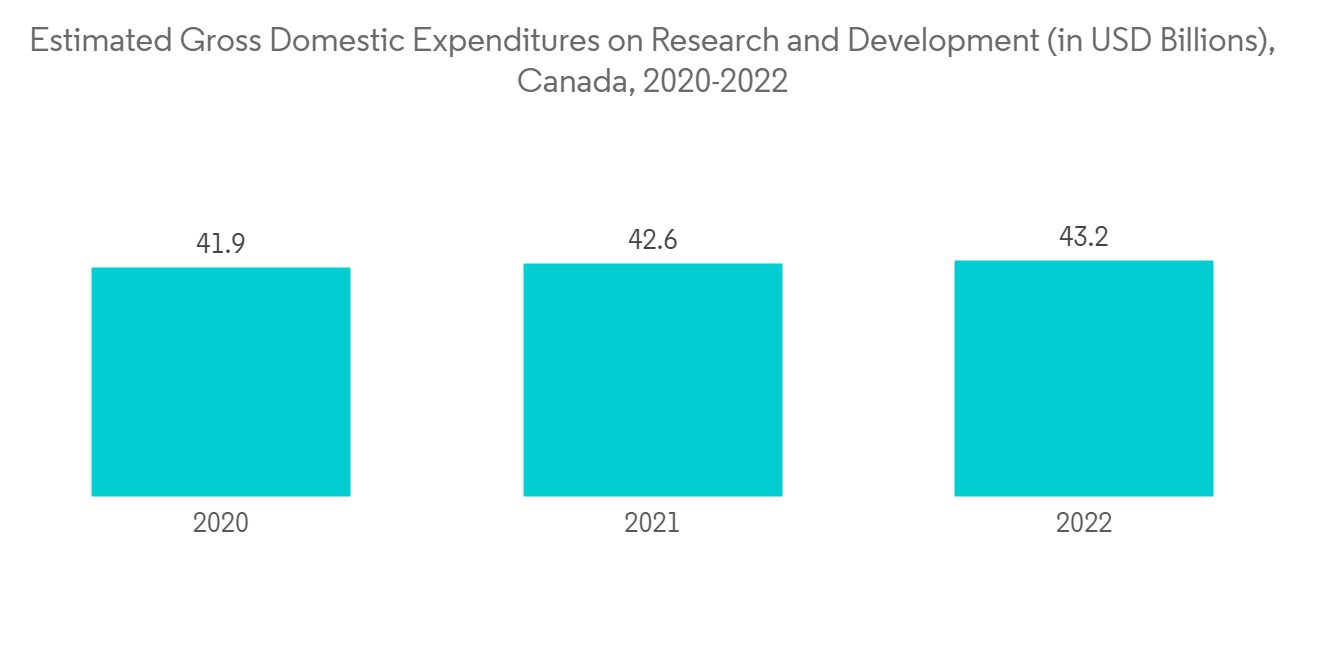

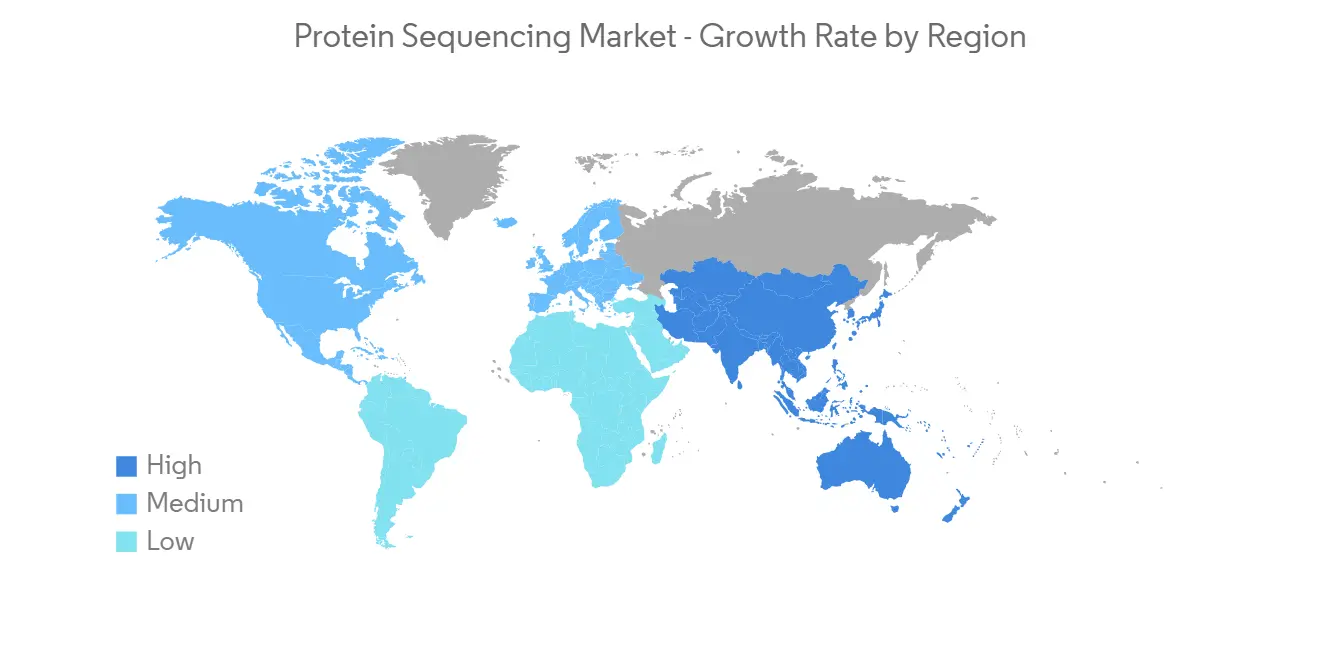

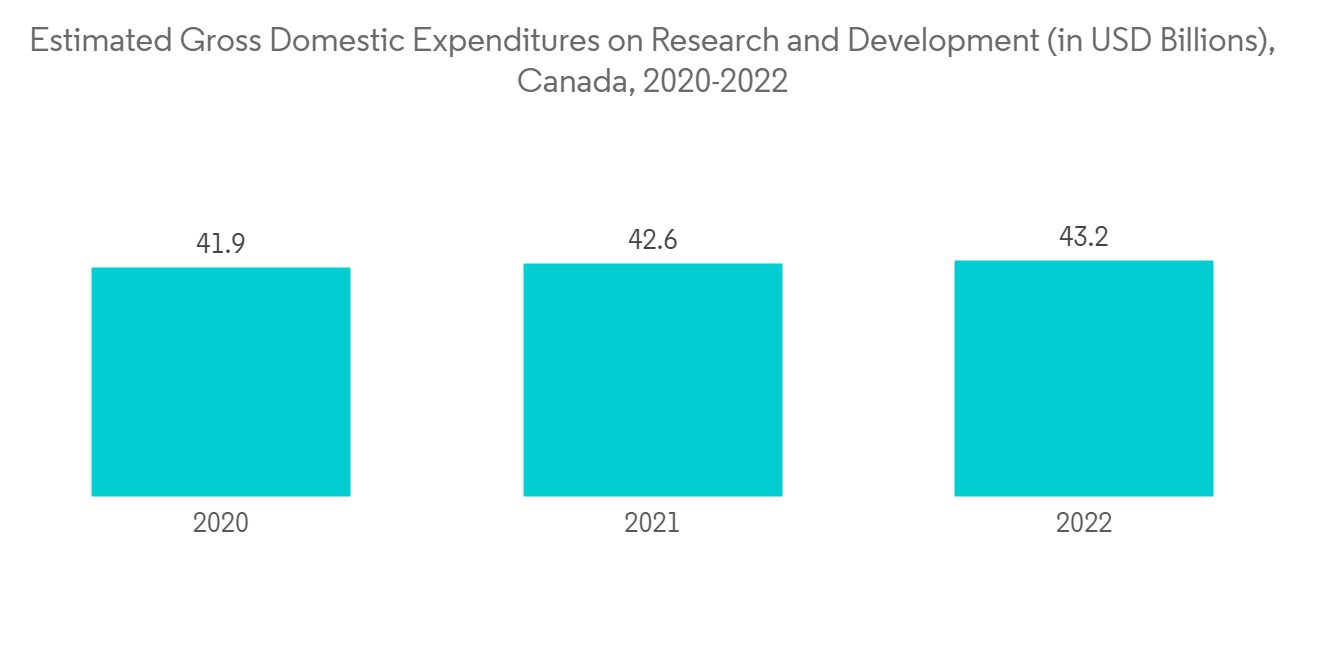

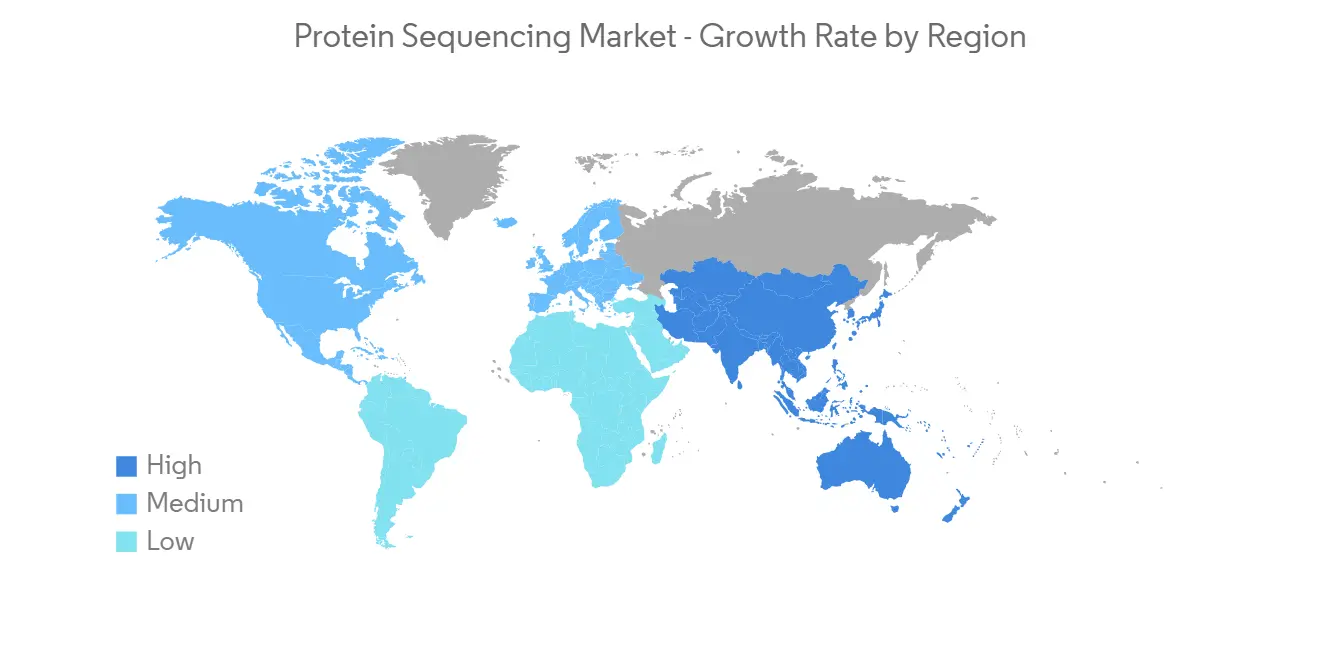

North America is expected to hold a significant share of the protein sequencing market owing to rising technological advancements and the presence of better healthcare infrastructure. Also, government and non-government organizations are providing funds to carry out research in the field of proteomics.

Furthermore, company activities by key players in North America are expected to drive market growth over the forecast period. For instance, in January 2023, United States-based Quantum-Si began commercial shipments of the platinum protein sequencing system and provided business updates at the 41st Annual J.P. Morgan Healthcare Conference. The company partnered with Aviva Systems Biology, a provider of antibody, protein, and immunoassay reagent products, to co-develop sample preparation kits for protein sequencing research workflows with Platinum.

Furthermore, in June 2022, Manitoba Government unveiled the release of the Manitoba Protein Research Strategy, a comprehensive research plan that will form the blueprint for the province's ultimate success in this burgeoning market segment. The MPRS highlights 46 strategic research projects under four main themes, including climate resilience of sustainable protein food systems, novel sustainable protein product development and processing, digital agriculture to enable sustainable food systems, and waste, water, by-product, and co-product utilization.

Thus, due to the rise in research funding, and the increase in technological advancements in protein sequencing, North America is anticipated to witness growth in the studied market over the forecast period.

Protein Sequencing Industry Overview

The market studied is a fragmented market owing to the presence of various market players. Strategic activities such as mergers, acquisitions, collaboration and partnerships by the key players are likely to bolster the market growth over the forecast period. Some of the market players are Agilent Technologies, Inc., Bioinformatics Solutions, Charles River Laboratories, Proteome Factory, Rapid Novor Inc., Selvita SA, SGS SA, Shimadzu Corporation, Thermo Fisher Scientific Inc., and Waters.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Focus on Target based Drug Development

- 4.2.2 Increasing Funding for Proteomic Research

- 4.3 Market Restraints

- 4.3.1 High Cost of Protein Sequencing Equipment

- 4.4 Porter Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 By Products and Services

- 5.1.1 Instruments

- 5.1.1.1 Mass Spectrometry

- 5.1.1.2 Edman Degradation

- 5.1.2 Reagents and Consumables

- 5.1.3 Softwares and Services

- 5.1.1 Instruments

- 5.2 By Application

- 5.2.1 Biomarker Discovery

- 5.2.2 Protein Engineering Studies

- 5.2.3 Biotherapeutics

- 5.2.4 Others

- 5.3 By End User

- 5.3.1 Pharmaceutical and Biotechnology Companies

- 5.3.2 Research Centers

- 5.3.3 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Agilent Technologies, Inc.

- 6.1.2 Bioinformatics Solutions

- 6.1.3 Charles River Laboratories

- 6.1.4 Proteome Factory

- 6.1.5 Rapid Novor Inc.

- 6.1.6 Selvita SA

- 6.1.7 SGS SA

- 6.1.8 Shimadzu Corporation

- 6.1.9 Thermo Fisher Scientific Inc.

- 6.1.10 Waters Corporation

- 6.1.11 Alphalyse

- 6.1.12 Bruker