|

市場調查報告書

商品編碼

1272667

5G 企業市場 - 增長、趨勢、COVID-19 影響和預測 (2023-2028)5G Enterprise Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計 5G 企業市場在預測期內將保持超過 42% 的健康復合年增長率。

5G 企業市場有望改變已經邁向工業革命 4.0 的行業連接設備的方式。 通過物聯網和機器對機器連接的興起,工業革命 4.0 使手機更容易連接到工業中的一切。

主要亮點

- 互聯製造(包括 M2M 應用、工業物聯網和機器人技術)將通過將裝配線上的機器無線連接到 5G 網絡來使用 5G。

- 另一個重要的介紹預計將由海上石油平台牽頭。 這樣的平台很難通過電線連接,從平台到岸上鋪設電纜。 因此,石油平台長期以來一直存在連接緩慢和斷斷續續的問題。

- 根據Ericsson Mobility的“5G for Business 2030 Market Compass”,該指南檢查了 200 多個用例、10 個行業和支持 5G 的用例集群,所有 ICT 的 18% 將用於工業數字化和服務提供商將佔支持 5G 的 B2B 價值的 47%。

- 多訪問邊緣計算 (MEC) 支持進一步開發,以實現高帶寬、低延遲的企業應用程序。 此外,在本次研究的市場中,設備和服務提供商都在根據不同的問題調整其產品和服務。

- 例如,AT&T 將移動 5G、固定無線和邊緣計算列為 5G 的三大服務支柱。 AT&T 多訪問邊緣計算 (MEC) 是一種用於構建軟件定義網絡的邊緣計算解決方案。 這將使企業客戶能夠以低延遲、高帶寬的能力實現高速訪問數據處理和靈活管理蜂窩流量。

- 此外,印度電信部 (DoT) 於 2022 年 4 月宣布,其目標是在 5G 生態系統的各個利益相關方之間建立快速合作夥伴關係,以滿足用戶和垂直行業的需求。徵求意向書 (EoI) ) 用於 5G 垂直參與和合作夥伴計劃 (VEPP) 計劃。

- 使用 O-RAN 的開放接口有可能解決由專有規範和缺乏互操作性引起的問題。

- 但是,當 COVID-19 爆發時,它影響了 5G 部署和準備工作。 一些國家推遲了頻譜拍賣,還有一些國家就支出的優先順序制定了規則。

5G 企業市場趨勢

IT/電信行業採用 5G 企業推動市場增長

- 隨著 5G 網絡的推出,運營商和市場供應商正在為這一轉變做準備。 主要電信服務提供商正在將他們的網絡升級到 5G,這主要依靠密集的小型天線陣列來提供超快的網絡和數據速度。

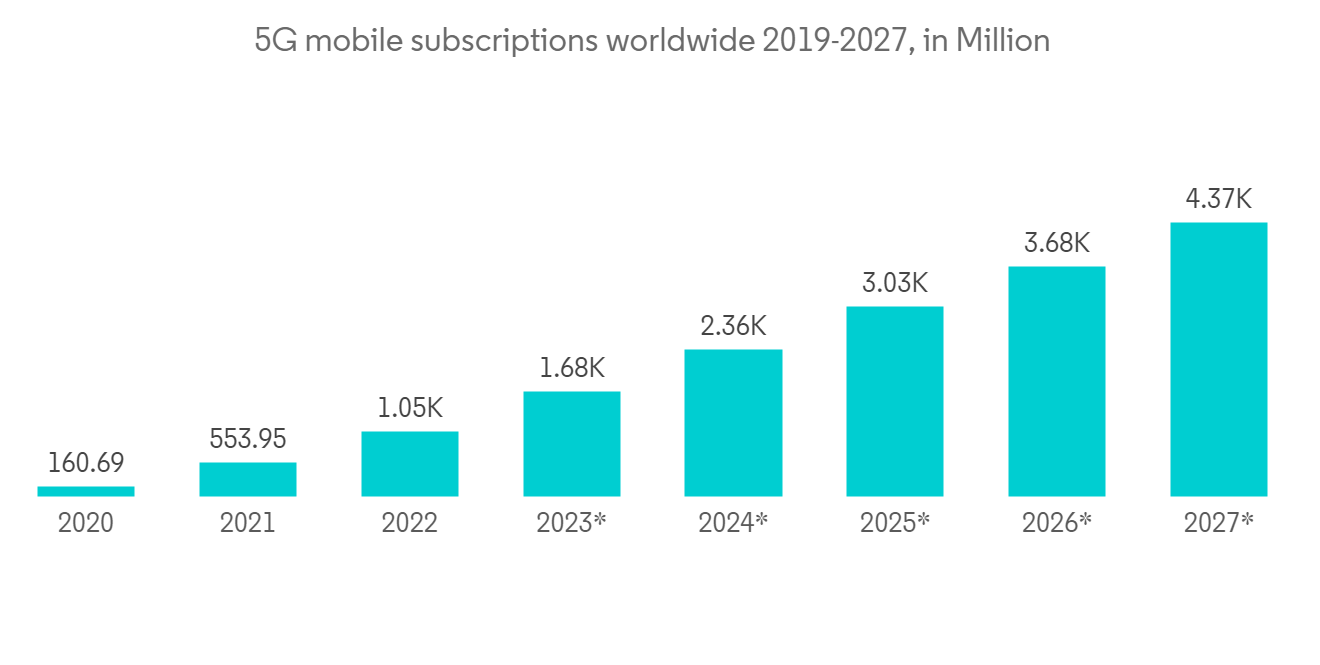

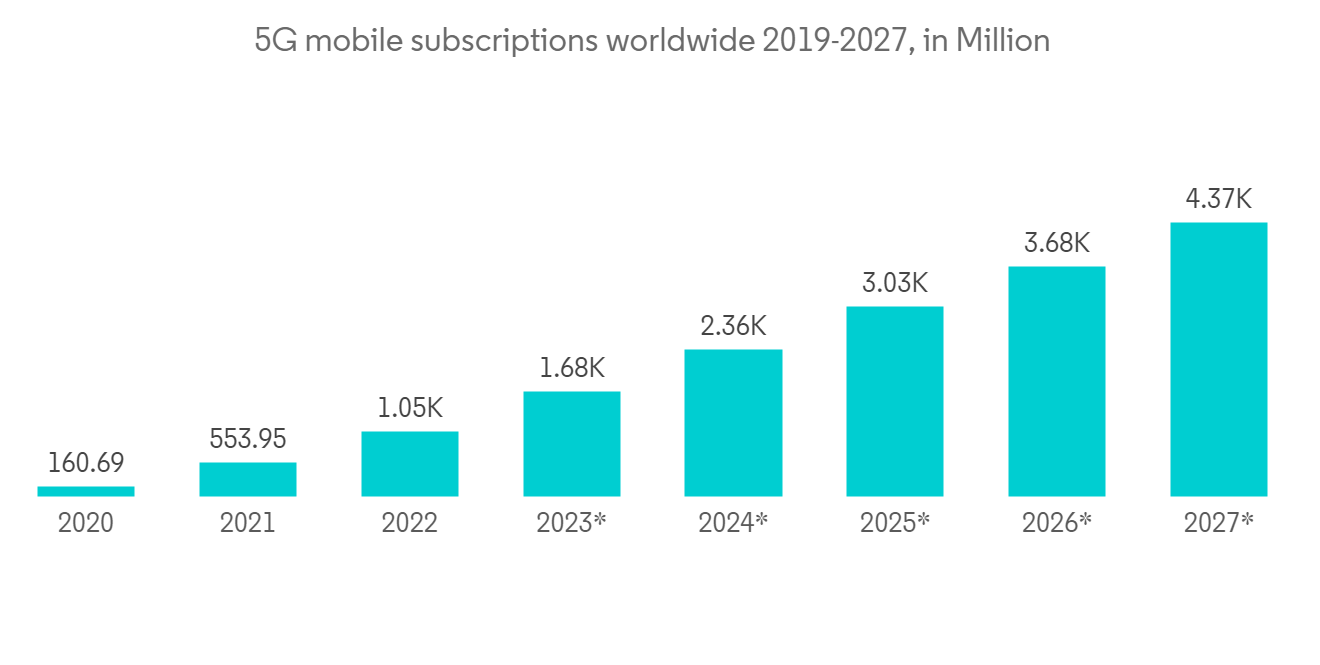

- 2022 根據Ericsson Mobility移動報告,到 2027 年底將有 44 億 5G 用戶。 這幾乎佔全球移動訂閱的 48%。 據Ericsson Mobility稱,全球擁有 5G 設備的 5G 用戶數量將增加 7000 萬,達到約 6.9 億。

- 2022 年 5 月,BT 和Ericsson Mobility宣佈建立新的合作夥伴關係,以便在英國市場提供商用 5G 專用網絡。 根據兩家公司之間的多年協議,BT 將向製造、軍事、教育、零售、醫療保健、運輸和物流等行業的公司和機構營銷和銷售下一代移動網絡技術產品。

- 市場將見證對從非獨立 5G 到獨立 5G 的 5G 語音服務的需求。 這將使運營商能夠在不依賴 VoLTE(LTE 語音)或 LTE 錨點的情況下提供高質量的語音服務。

- 該市場在全球新興經濟體中的採用率很高。 例如,美國私營服務提供商正在與城市合作部署 5G 試點網絡和創新實驗室。

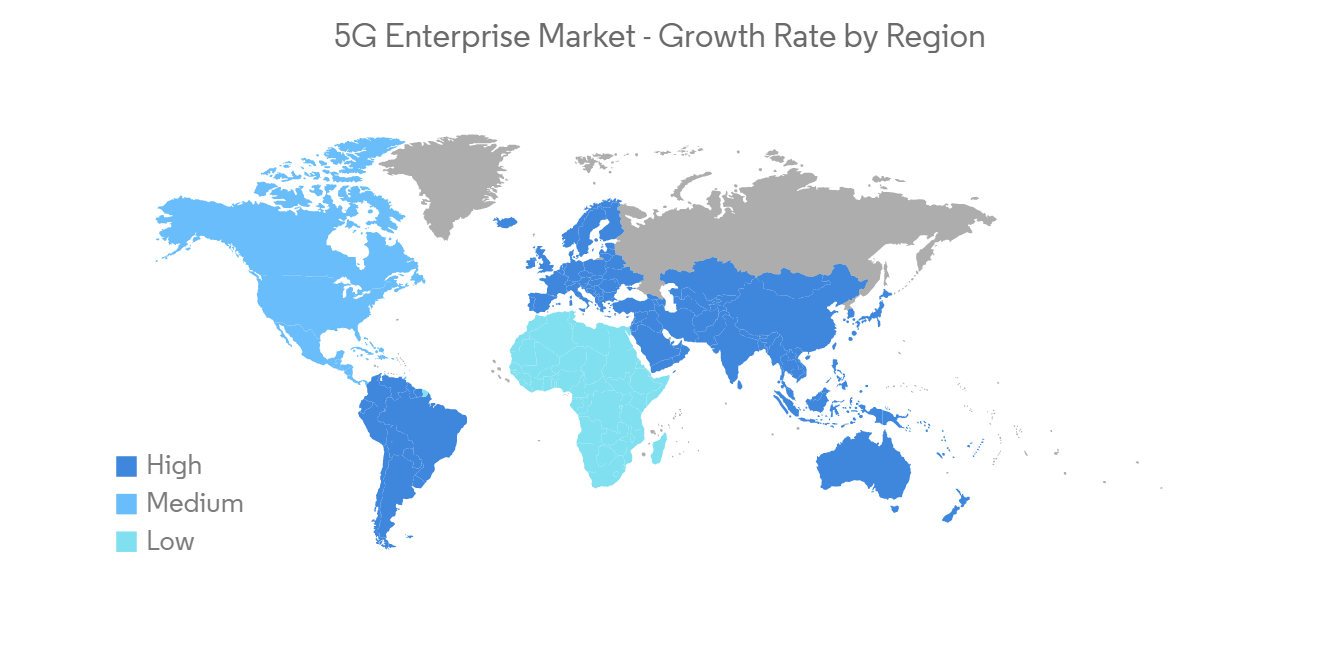

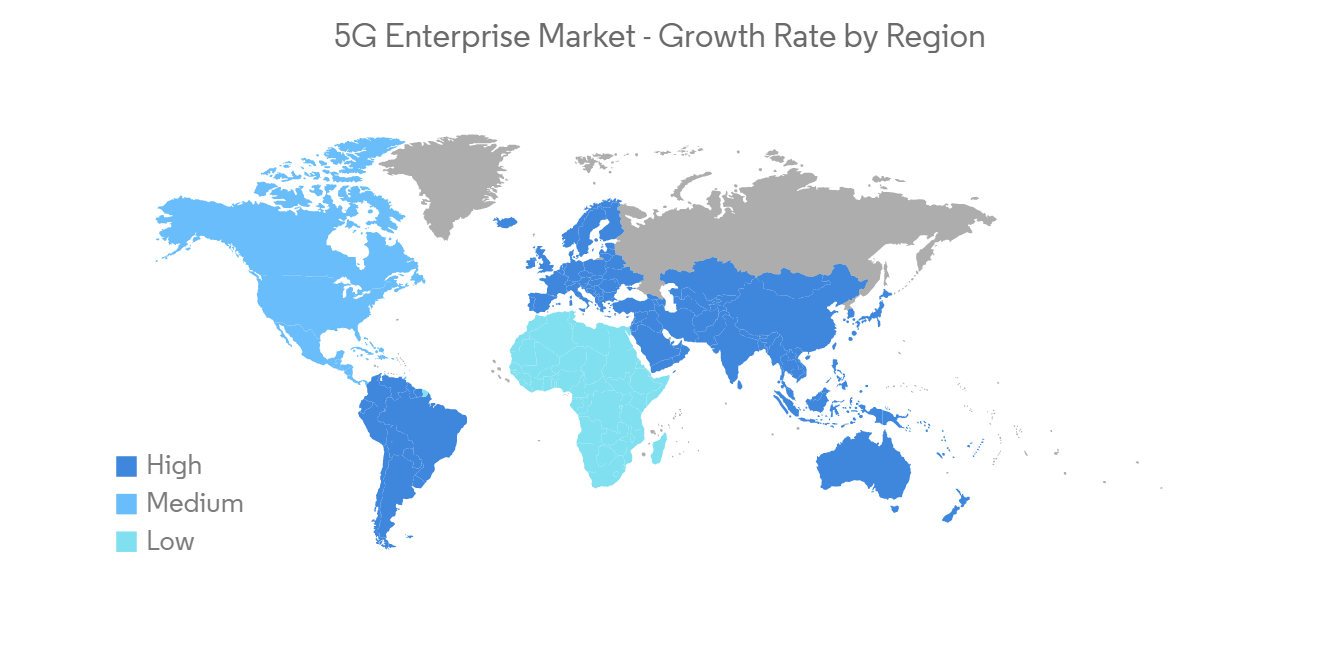

北美市場份額最大

- 基於雲的企業應用程序在北美蓬勃發展。 基於雲的解決方案依賴於互聯網連接在託管環境中發揮作用,而 5G 可能會實現更快的互聯網速度,從而進一步增強連接體驗。 與其他地區相比,該地區對機器對機器通信、聯網汽車和人工智能等先進技術的需求增長最快。 因此,5G 企業市場有望提供巨大的增長機會。

- 據Ericsson Mobility稱,到 2025 年底,5G 移動用戶將達到 3.18 億,佔北美移動用戶的 80% 以上。 這可能會進一步增加對 5G 網絡的需求。

- 因此,為了滿足未來 5G 服務的容量、覆蓋範圍和效率需求,美國網絡運營商正在對其網絡進行投資,以便以最低的每比特成本獲得最佳性能。 為此,他們正在使用網絡功能虛擬化 (NFV) 和軟件定義網絡 (SDN) 等新技術,使他們的網絡盡可能高效。

- 低延遲通信對於自動駕駛汽車的車載計算機能夠宣布其存在並對其他車輛、障礙物、交通信號燈等做出反應非常重要。 5G聯網汽車將為移動運營商帶來新的盈利方式。 大多數美國運營商已經為聯網汽車提供平台,而 AT&T 是該領域的領導者。

隨著物聯網傳感器變得越來越普遍,5G 也有望使零售供應鏈更加開放和高效。 根據 GSMA 的數據,到 2025 年,北美物聯網行業將擁有 59 億個連接。

5G企業產業概覽

5G 企業市場競爭適中,參與者數量較少。 然而,隨著電信行業網絡架構的進步,新進入者正在增加他們在市場上的存在,從而擴大他們在新興國家的業務運營。 最近的市場發展包括:

2022 年 3 月,Tata Consultancy Services 將推出其企業 5G 邊緣產品組合,包括 Microsoft Azure 上的私有移動邊緣計算。 TCS 的軟件包通過 Azure 私有 MEC 解決方案幫助設計、集成、實施和運營企業 5G 邊緣生態系統,結合完整的功能以利用 5G 應用程序邊緣計算的優勢。

通過 2022 年 10 月在佐治亞州亞特蘭大開設新的 5G 體驗中心,Cognizant 和 Qualcomm Technologies, Inc. 將能夠做更多事情來加速業務數字化轉型。它將是 它將 Qualcomm Technologies 的智能邊緣設備、人工智能和 5G 連接解決方案與 Cognizant 在 5G、物聯網、雲和數據分析方面的廣泛知識相結合。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第 4 章市場洞察

- 市場概覽

- 產業吸引力 - 波特五力分析

- 新進入者的威脅

- 買方/消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- MEC 和 5G 行業分析(技術標準(系統架構)、應用、趨勢)

- 評估 COVID-19 對 5G 企業行業的影響

第 5 章市場動態

- 市場驅動因素

- 按行業發布免許可頻段

- 為新應用開發可編程平台

- 5G 企業在 IT 和電信領域的採用

- 市場挑戰

- 缺乏技術技能

- 私有 5G 網絡部署和服務的成本和設置複雜性

- 市場機會

- 增加政府投資以升級關鍵基礎設施

第 6 章市場細分

- 按通信基礎設施類型

- 5G 無線電接入網絡

- 5G 核心網

- 交通網絡

- 按公司類型

- IT/通訊

- BFSI

- 零售/電子商務

- 製造業

- 其他最終用戶行業(醫療保健、消費品/零售、公用事業、其他)

- 地區

- 北美

- 歐洲

- 亞太地區

- 世界其他地區

第七章競爭格局

- 公司簡介

- Cisco System Inc.

- Telefonaktiebolaget LM Ericsson

- Huawei Technologies Co. Ltd.

- Nokia Networks

- NEC Corporation

- Samsung Group

- ZTE Corporation

第八章投資分析

第九章市場潛力

During the time frame of the forecast, the 5G Enterprise Market is expected to register a healthy CAGR of over 42%. The 5G enterprise market is expected to change the way industries that are already moving toward the Industrial Revolution 4.0 connect their devices.Through the rise of IoT and machine-to-machine connections, Industrial Revolution 4.0 is making it easier for cell phones to connect to everything in the industry.

Key Highlights

- Connected manufacturing with M2M applications, the IIoT, and robotics, to name a few, would use 5G by making the machines on the assembly line wirelessly connected to the private 5G network.However, the use of wireless for control applications is still at a nascent stage.

- Another significant adoption is expected to be led by offshore oil platforms. These platforms have difficulty providing connectivity by wired means, that is, running a cable from the platform to the shore. Therefore, oil platforms have been tormented with lower speeds and intermittent connectivity for many years.

- Based on Ericsson's 5G for Business 2030 Market Compass, which looked at more than 200 use cases, ten different industries, and a set of 5G-enabled use case clusters, 18% of the total ICT can be used to digitalize industries, and service providers would take up 47% of the 5G-enabled B2B value.

- Multi-access edge computing (MEC) is assisting further developments to enable high-bandwidth, low-latency enterprise applications.Also, both equipment and service providers in the market that was looked at have made their products and services fit a variety of problems.

- For instance, AT&T highlighted mobile 5G, fixed wireless, and edge computing as the three main service pillars of 5G. With its offering of an AT&T Multi-access Edge Compute (MEC), the company facilitates this edge computing solution to deploy a software-defined network. With this, the enterprise clients would have faster access to data processing and flexibility in managing cellular traffic via low-latency, high-bandwidth capabilities.

- Moreover, in April 2022, the Department of Telecommunications (DoT) in India issued an Expression of Interest (EoI) call for the 5G vertical engagement and partnership program (VEPP) initiative, which aims to forge rapid partnerships between the various stakeholders in the 5G ecosystem and address the needs of users and vertical industries.

- Businesses, regional governments, and other groups in the region should have more options for local and private 5G networks if they take these steps.By using the O-RAN open interface, problems caused by proprietary specifications and lack of interoperability may be solved.

- But when COVID-19 broke out, it had an effect on both 5G rollouts and readiness. Some countries put off their spectrum auctions, and a few others put in place rules about how spending should be prioritized.

5G Enterprise Market Trends

Adoption of 5G Enterprise in IT and Telecom Sector to Drive the Market Growth

- With the 5G networks rolling out, telecom players and market vendors have been gearing toward this shift. Major telecom service providers are upgrading their network to 5G, which primarily relies on denser arrays of small antennas to provide ultra-high network and data speeds.

- According to the 2022 Ericsson Mobility Report, there will be 4.4 billion 5G subscribers by the end of 2027. This is almost 48% of all mobile subscriptions around the world.Ericsson says that the number of 5G users with a 5G-capable device has grown by 70 million to about 690 million around the world.

- In May 2022, BT and Ericsson announced a new partnership to make commercial 5G private networks available in the UK market. A multi-year agreement between the two companies will allow BT to market and sell next-generation mobile network technology products to corporations and institutions in industries like manufacturing, the military, education, retail, healthcare, transportation, and logistics.

- The market would witness demand for voice-over 5G services, evolving from non-standalone to standalone 5G. It will allow operators to deliver high-quality voice service without relying on VoLTE (Voice over LTE) or an LTE anchor.

- The market is witnessing high adoption across the developed economies across the globe. For instance, US private service providers collaborate with cities to roll out 5G pilot networks and innovation labs.

North America Holds Maximum Market Share

- Cloud-based enterprise applications are thriving in the North American region. The cloud-based solutions depend on internet connectivity to function in the hosted environment, and with 5G enabling much faster internet speed, it may further enhance the connectivity experience. The increase in demand for advanced technologies, such as machine-to-machine communication, connected cars, and artificial intelligence, is highest in the region compared to other regions. Hence, it is anticipated to offer massive opportunities for the 5G enterprise market to grow.

- Ericsson says that by the end of 2025, there will be 318 million 5G mobile subscriptions, which is more than 80% of all mobile subscriptions in North America. This may increase the demand for 5G networks even more.

- So, to meet the needs of future 5G services in terms of capacity, coverage, and efficiency, network operators in the United States are investing in their networks to get the best performance at the lowest cost per bit. They are doing this by using new technologies like network function virtualization (NFV) and software-defined networking (SDN) to make their networks as efficient as possible.

- Low-latency communication is important for the on-board computers of self-driving cars to be able to let other cars, obstacles, traffic lights, and other cars know they are there and react to them.5G-powered connected cars give mobile operators a new way to make money. Most US operators already offer platforms for connected cars, and AT&T is the leader in this field.

As IoT sensors become more common, it is also thought that 5G will make the retail supply chain more open and efficient. According to the GSMA, the North American IoT industry will have 5.9 billion connections by 2025.

5G Enterprise Industry Overview

The 5G enterprise market is moderately competitive and consists of a few players. However, with advancements in network architecture across the telecommunications sector, new players are increasing their market presence, thereby expanding their business footprint across the emerging economies. Some of the recent developments in the market are:

In March 2022, Tata Consultancy Services will debut its Enterprise 5G Edge portfolio of products, which includes private mobile edge computing on Microsoft Azure. The TCS package combines complete capabilities to assist organizations in designing, integrating, implementing, and operating an enterprise 5G edge ecosystem using the Azure private MEC solution and leveraging edge computing benefits for 5G applications.

With the opening of a new 5G experience center in Atlanta, Ga., in October 2022, Cognizant and Qualcomm Technologies, Inc. will be able to do more to drive digital transformation in business. Qualcomm Technologies' intelligent edge devices, AI, and 5G connectivity solutions will be combined with Cognizant's extensive knowledge of 5G, IoT, the cloud, and data analytics.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 MEC and 5G Industry Analysis (Technical Standards (System Architecture), Applications and Trends)

- 4.4 Assessment of Impact of COVID-19 on the 5G Enterprise Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Release of Unlicensed Spectrum for Industry Verticals

- 5.1.2 Development of Programmable Platforms for New Applications

- 5.1.3 Adoption of 5G Enterprise in IT and Telecom Sector

- 5.2 Market Challenges

- 5.2.1 Lack of Technical Skill

- 5.2.2 Costs and Set-up Complexity across Deployment and Service of Private 5G Networks

- 5.3 Market Opportunity

- 5.3.1 Increased Government Investment to Upgrade Critical Infrastructures

6 MARKET SEGMENTATION

- 6.1 By Communication Infrastructure Type

- 6.1.1 5G Radio Access Networks

- 6.1.2 5G Core Networks

- 6.1.3 Transport Networks

- 6.2 By Enterprise Type

- 6.2.1 IT & Telecommunication

- 6.2.2 BFSI

- 6.2.3 Retail and Ecommerce

- 6.2.4 Manufacturing

- 6.2.5 Other End-user Industries (Healthcare, Consumer Goods and Retail, Utilities, etc.)

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco System Inc.

- 7.1.2 Telefonaktiebolaget LM Ericsson

- 7.1.3 Huawei Technologies Co. Ltd.

- 7.1.4 Nokia Networks

- 7.1.5 NEC Corporation

- 7.1.6 Samsung Group

- 7.1.7 ZTE Corporation