|

市場調查報告書

商品編碼

1404526

雲端 CDN:市場佔有率分析、產業趨勢/統計、成長預測,2024-2029 年Cloud CDN - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

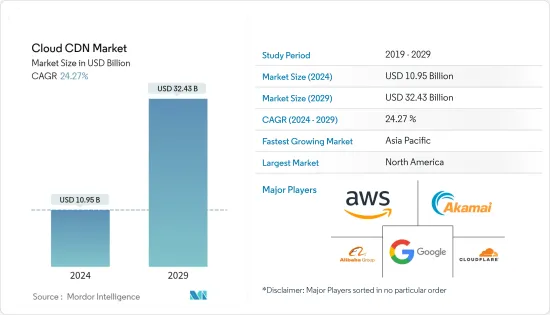

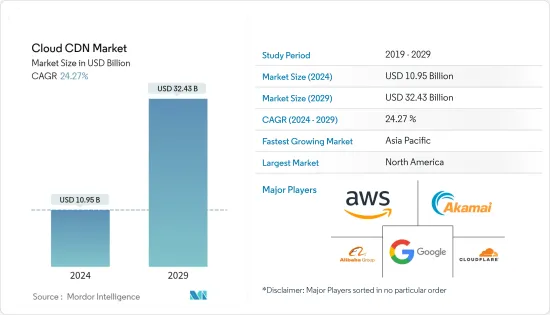

雲CDN市場規模預計到2024年為109.5億美元,預計到2029年將達到324.3億美元,在預測期內(2024-2029年)複合年成長率為24.27%。

主要亮點

- 雲端平台可讓您提供分散式阻斷服務 (DDoS) 保護、串流視訊、 網路應用程式防火牆和電子商務最佳化等服務。

- 對雲端服務的日益依賴、IT 應用程式和服務的整合、行動和連接設備的激增以及內容和廣告向線上世界的遷移是預測期內雲端 CDN 市場成長的因素。

- 不斷成長的高速內容傳送需求已成為推動雲端CDN市場成長的突出因素之一。

- 網際網路現在已成為個人的基本必需品,網際網路上不斷成長的資料消費量為雲端 CDN 供應商帶來了潛在的機會,從而在預測期內推動了市場的發展。

- 此外,企業採用雲端主要是因為其彈性、擴充性和成本效益。自 COVID-19 爆發和隨後的封鎖以來,網路供應商的流量出現了前所未有的成長。通訊服務供應商(CSP) 已做出許多努力來提高網路容量和連接性,視訊串流供應商已將視訊降級為標清品質以減少頻寬需求。

- 然而,一位專家表示,企業只能以他們認為合適的方式使用 CDN。但是,供應商可能在覆蓋範圍和效能方面有限制,客戶可能需要研究這些限制。公司往往會過度供應。因此,您必須在開發對您的業務至關重要的高效能、靈活的內容傳送網站的能力方面做出更多妥協。除此之外,影片確實帶來了挑戰。因為格式在影片中非常重要。快取影片可能會出現問題,因為 iPad、桌上型電腦和筆記型電腦各自遵循不同的協定。

雲端CDN市場趨勢

電子商務領域預計將佔據較大佔有率

- 電子商務領域嚴重依賴向最終用戶內容傳送。內容交付速度和使用者體驗是促進電子商務領域成長的關鍵因素。因此,雲端 CDN 等解決方案的實施至關重要,也是預測期內推動市場的因素。

- SalesForce 等市場主要企業向其數位客戶提供 Salesforce Commerce Cloud,這是一種嵌入式內容傳輸網路(eCDN)。這提高了網站訪問速度和內容傳送,使我們能夠為最終用戶提供可靠且安全的網路購物體驗。

- 隨著最終用戶更加依賴網路購物,零售電子商務銷售額正在成長。因此,進一步改善用戶體驗已成為零售電子商務提供者的當務之急,從而推動雲端CDN在預測期內的成長。

- 電子商務企業在節慶和活動期間會見證大量的網站流量。因此,容納這種流量對於提供者來說至關重要,以確保網站上的內容立即無延遲地傳遞給流量。因此,雲端 CDN 已成為滿足這些需求的可行選擇,從而推動預測期內的市場成長。

預計北美將佔據最大佔有率

- 北美擁有最高的網路普及,預計將在預測期內推動雲端 CDN 市場的成長。此外,幾個主要區域參與者的存在可能會在整個預測期內保持其主導地位。

- 從傳統零售購物轉變為線上電子商務網站銷售的趨勢對於電子商務提供者來說已變得至關重要。這是為了透過更快的內容傳送、與網站的無憂互動等來改善用戶體驗。預計這將在預測期內推動市場成長。

- 該地區線上媒體內容觀看量的增加也是預測期內雲端 CDN 市場成長的因素之一。

- DigitalOcean 是一家美國雲端託管公司,正在推動使用 SSD(固態硬碟)為開發人員創建平台的想法,讓客戶能夠輕鬆高效地傳輸計劃並提高生產力。我建立了它。該公司的企業客戶可以透過在多個平台上運行計劃來輕鬆利用規模經濟,而無需擔心性能。

雲CDN產業概況

雲端 CDN 領域競爭非常激烈,業界的知名企業包括 Google Inc. 和 Amazon Web Services (AWS)。這些主要企業利用策略夥伴關係、併購和收購來維持強大的市場地位。我們也透過對研發活動的大量投資來保持相對於同業的競爭優勢。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 網路資料消耗增加

- 對更快內容傳送的需求不斷成長

- 市場抑制因素

- 延遲問題

第6章市場區隔

- 解決方案服務

- 媒體發行

- 雲端安全

- 網路效能

- 部署

- 公共雲端

- 私有雲端

- 混合雲端

- 最終用戶產業

- 媒體娛樂

- 電子商務

- 資訊科技/通訊

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 韓國

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章競爭形勢

- 公司簡介

- Akamai Technologies, Inc.

- Google, Inc

- Amazon Web Services, Inc.

- Telefonaktiebolaget LM Ericsson

- Alibaba Group Holding Limited

- Fastly, Inc.

- Cloudflare, Inc.

- Internap Corporation

- Limelight Networks.

- Verizon Communications, Inc.

第8章投資分析

第9章市場的未來

The Cloud CDN Market size is estimated at USD 10.95 billion in 2024, and is expected to reach USD 32.43 billion by 2029, growing at a CAGR of 24.27% during the forecast period (2024-2029).

Key Highlights

- The cloud platforms allow users to provide services such as distributed denial-of-service (DDoS) protection, streaming video, web application firewalls, and e-commerce optimization.

- The increased dependence on cloud services, integration of IT applications and services, and a proliferation of mobile and connected devices coupled with the shift of content and advertising to the online world are some factors that would contribute to the growth of the Cloud CDN market over the forecast period.

- The rising demand for content delivery at higher speeds became one of the prominent factors fueling the growth of the Cloud CDN market.

- With the internet now being the basic necessity for an individual, the growing volume of data consumption over the internet opened up a potential opportunity for Cloud CDN providers, thereby boosting the market during the forecast period.

- Furthermore, the adoption of cloud in enterprises is primarily due to flexibility, scalability, and cost-effectiveness. Since the COVID-19 outbreak and subsequent lockdowns, the network provider saw unprecedented growth in traffic volumes. There were many efforts from communications service providers (CSPs) to ramp up network capacity and connectivity, while video streaming providers downgraded video to SD quality to decrease the bandwidth needs.

- However, according to certain experts, CDNs are only sometimes consumed by businesses in the best possible manner. The vendor, however, may have limitations with regard to coverage and performance that clients may need to look into. Businesses tend to overprovision. As a result, they needed to be more compromising on their ability to develop top-performing and flexible content delivery sites, which is essential for their businesses. In addition to this, the video certainly poses a challenge, and this is because, in the video, format matters a great deal. IPads, desktops, and laptops follow different protocols, so caching a video can present issues.

Cloud CDN Market Trends

E-Commerce Segment is Expected to Hold the Significant Share

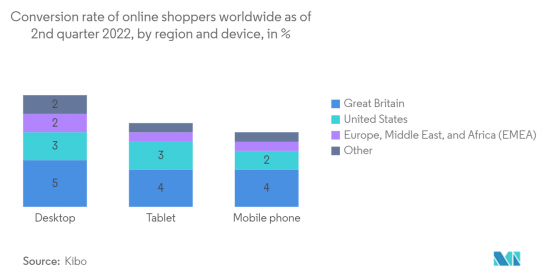

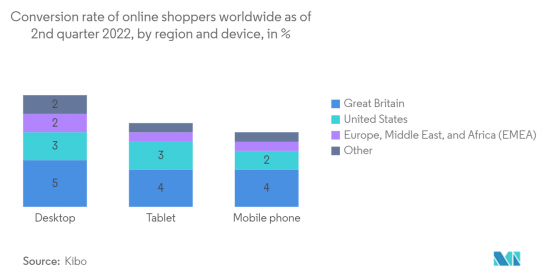

- The e-commerce segment highly depends on content delivery to its end customers. The speeds at which the content is delivered and the user experience, amongst others, are some of the important factors contributing to the growth of an E-commerce segment. It makes it imperative for them to go for solutions like Cloud CDN, thereby boosting the market over the forecast period.

- Some prominent players in the market, such as SalesForce, enable digital customers with Salesforce Commerce Cloud, an embedded content delivery network (eCDN). It allows them to increase site speed access and content delivery, allowing the end user a reliable and secure online shopping experience.

- The increasing dependence of the end customers on online shopping increased retail e-commerce sales. It is thereby making it imperative for the retail e-commerce providers to further enhance the user experience, subsequently fueling the growth of the Cloud CDN over the forecast period.

- During festive seasons or occasions, e-commerce players witness large website traffic. Therefore, catering to such traffic is of prime importance for the providers to ensure that the content on their site is delivered to the traffic immediately without any delay. Therefore, a Cloud CDN becomes a viable option for these players to cater to such needs, fueling the market's growth over the forecast period.

North America is Expected to Hold the Largest Share

- North America includes the highest internet penetration rate, which is expected to fuel the growth of the Cloud CDN market over the forecast period. It is also possible due to some major regional players, enabling it to maintain its dominance throughout the forecast period.

- The shift of trend from traditional retail shopping to online E-commerce website sales made it of prime importance for E-commerce providers. It is to enhance their user experience through faster content delivery, hassle-free interaction with the website, and many more. It is expected to boost market growth over the forecast period.

- The increase in viewing online media content in the region is also one of the factors contributing to the growth of the Cloud CDN market throughout the forecast period.

- DigitalOcean is an American cloud hosting company that pushed the idea of using a solid state drive (SSD) to create a developer-friendly platform that allows customers to transfer projects and increase production easily and efficiently. The company's enterprise customers can easily leverage the benefits of scale by executing projects across multiple platforms without worrying about performance.

Cloud CDN Industry Overview

Due to prominent industry players such as Google Inc. and Amazon Web Services (AWS), the Cloud Content Delivery Network (CDN) sector experiences intense competitive rivalry. These key players leverage strategic partnerships, mergers, and acquisitions to maintain a strong presence in the market. Substantial investments in research and development activities have enabled them to sustain a competitive edge over their peers.

In August 2023, StackPath made the significant decision to exit the Content Delivery Network (CDN) business. In response, Akamai announced its acquisition of approximately 100 CDN customers from StackPath. As part of this acquisition, Akamai secured valuable assets, including select enterprise customer contracts, following StackPath's choice to discontinue its content delivery network operations.

In September 2022, Bharti Airtel (Airtel) entered the content delivery network (CDN) market by launching Edge CDN as part of its Edge Cloud Portfolio. Concurrently with this launch, the company formed a strategic partnership with CDN enabler Qwilt to deploy Edge CDN.ai.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Impact of Covid-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Data Consumption Over Internet

- 5.1.2 Increasing Demand for Faster Content Delivery

- 5.2 Market Restraints

- 5.2.1 Latency Issue

6 MARKET SEGMENTATION

- 6.1 Solutions & Services

- 6.1.1 Media Delivery

- 6.1.2 Cloud Security

- 6.1.3 Web Performance

- 6.2 Deployment

- 6.2.1 Public Cloud

- 6.2.2 Private Cloud

- 6.2.3 Hybrid Cloud

- 6.3 End-user Industry

- 6.3.1 Media & Entertainment

- 6.3.2 E-Commerce

- 6.3.3 IT and Telecom

- 6.3.4 Other End-user Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 South Korea

- 6.4.3.4 Rest of Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Akamai Technologies, Inc.

- 7.1.2 Google, Inc

- 7.1.3 Amazon Web Services, Inc.

- 7.1.4 Telefonaktiebolaget LM Ericsson

- 7.1.5 Alibaba Group Holding Limited

- 7.1.6 Fastly, Inc.

- 7.1.7 Cloudflare, Inc.

- 7.1.8 Internap Corporation

- 7.1.9 Limelight Networks.

- 7.1.10 Verizon Communications, Inc.