|

市場調查報告書

商品編碼

1404535

視訊處理解決方案:市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Video Processing Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

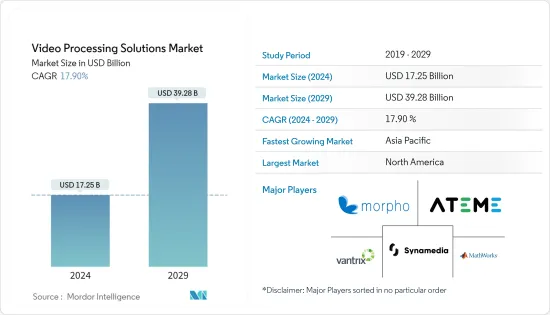

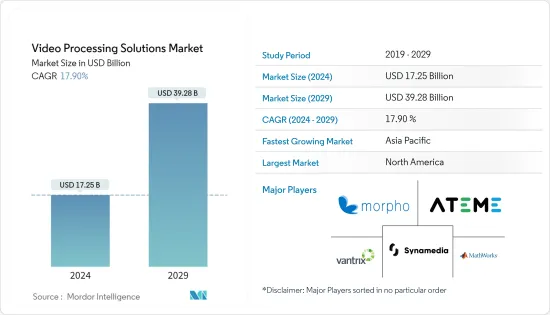

視訊處理解決方案市場規模預計到 2024 年為 172.5 億美元,預計到 2029 年將達到 392.8 億美元,在預測期內(2024-2029 年)複合年成長率為 17.90%。

主要亮點

- 隨著5G網路的全球部署,影片串流媒體產業預計將發生重大變化。 5G的高速、低延遲連接將提高影片內容的質量,使視訊處理解決方案更具吸引力,並為市場注入活力。憑藉流暢的影像內容和縮短的資料到決策時間,視訊處理解決方案在各種工業應用中都具有潛力,包括安全和監控、串流媒體和廣播等。

- 串流媒體市場正在不斷擴大,每年都有更多的串流媒體服務出現。到 2030 年,串流媒體市場將達到 3,300 億美元,增加對視訊處理解決方案的需求。根據美國觀察,2022年2月的一週內,人們觀看了1694億分鐘的串流影片。美國大約 85% 的家庭現在可以使用至少一種影片串流服務。隨著網路和智慧型手機、平板電腦和互動式顯示器等連網型設備在全世界人們中廣泛用於視訊點播應用,視訊處理解決方案將在未來幾年繼續普及,預計還會成長。

- 使用視訊分析軟體的視訊監控系統可以辨識多個事件。例如,國際機場理事會 (ACI) 採用了 OpenCV,這是一種用於物件偵測和物件追蹤的視訊處理解決方案。根據 ACI 的數據,大多數機場每小時起降約 20 架飛機,尖峰時段達到每分鐘 1 架飛機。為了管理機場內的地面交通,需要在飛機著陸後追蹤飛機的位置,這是透過與飛行員協調並在機場的CCTV網路上監控其運動來實現的。用於飛機偵測場景的內建CCTV系統與視訊處理功能整合,以實現操作自動化。

- 視訊處理產生大量資料,採用雲端技術進行儲存。然而,這些雲端基礎的系統比內部系統更安全,因此企業不願意投資視訊處理解決方案。此外,處理影像資訊,特別是在監控和影像分析等領域,可能會引發隱私和安全問題。此外,遵守資料保護條例可能會阻礙這個市場,減緩成長和機會。

- COVID-19 的爆發刺激了家庭經濟的成長,並將消費者的偏好轉向線上娛樂。影片串流服務的需求爆炸性成長,迫使串流媒體提供者在新內容,尤其是原創內容上投入更多資金。許多串流媒體營運商已採用視訊處理解決方案,以確保在內容傳送生命週期的各個層面提供無錯誤、無縫的數位體驗。在研究期間,視訊處理解決方案市場的需求預計將保持強勁。

視訊處理解決方案市場趨勢

多螢幕視訊點播應用需求快速成長

- 對監視錄影機、安全攝影機、CCTV攝影機、無人機等的需求正在增加,低成本攝影機正在增加視訊影像的數量。手動管理資訊以獲取即時資訊既困難又昂貴。公司將這項工作外包給視訊處理公司,以節省時間和精力。

- 在製造業中,工人的安全是最受關注的問題。安裝的CCTV攝影機僅用於遠端監控和追蹤設備。然而,針對安全和安保相關問題的自動化警報是必要的。這就是視訊處理的用武之地,無需專門的工作人員即時觀看視訊影像。

- 隨著智慧型手機、平板電腦等行動裝置的普及,行動螢幕已成為觀看隨選視訊隨選節目的主流平台。因此,內容提供者正在最佳化其針對行動裝置的服務並創建適合行動裝置的應用程式以改善用戶體驗。

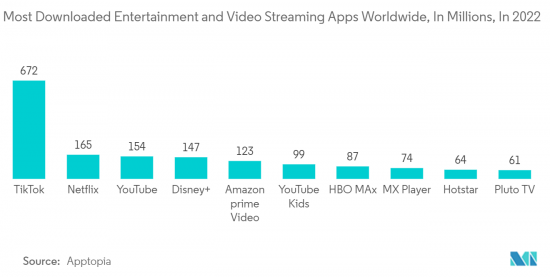

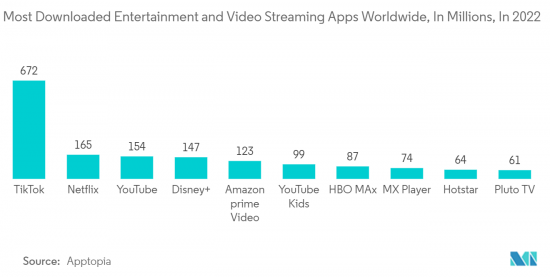

- 例如,根據 Apptopia 的數據,2022 年全球下載次數最多的娛樂應用程式是 Tiktok,總下載總合6.72 億次。位居第二的是 Netflix,下載量為 1.65 億次;排名第三的是 YouTube,來自全球用戶的下載量為 1.54 億次。串流服務行動應用程式 Disney+ 以 1.47 億次下載量排名全球第四。

- 2023 年 4 月,Shabodi 和 MegComputing 開發了一套支援網路的視訊分析解決方案,可用於各種工業應用,包括即時安全和監控。此解決方案對於智慧工廠框架中的品管、安全監控和流程最佳化非常有用。兩家公司將在漢諾威工業博覽會的工業轉型會議上展示他們的產品。

- 雖然Over-The-Top的擴張正在創造新的機會和收益來源,但它也導致服務提供者市場過度飽和。在競爭如此激烈的市場中,OTT 供應商正在投資影片處理解決方案,以獲得內容製作投資的最大回報。例如,Synamedia 開發的 Fluid EdgeCDN 提供可擴展、智慧且有效的 CDN 營運。複雜的流量預測引擎等功能使 ISP 能夠提供額外的 CDN 容量,同時將部分利潤回饋給版權所有者。

亞太地區正在經歷顯著成長

- 亞太地區的國內安全支出正在增加。隨著CCTV擴大安裝在機場和火車站等擁擠和人流量大的區域,安全機構正在轉向視訊處理解決方案來改善其監視和監控應用。例如,在印度,印多爾、海得拉巴和新德里等邦是世界上監控最嚴格的城市之一。

- 由人工智慧支援的視訊監控系統具有許多優勢,包括擴充性和適應性。

- 例如,2022 年 3 月,菲律賓國家鐵路部署了視訊分析解決方案來偵測潛在的安全隱患,例如柵欄故障。在COVID-19大流行期間,這個具有熱成像軟體功能的系統也被證明是有利的,因為它已被用來在進入鐵路設施之前識別出體溫升高的乘客和員工。

- 亞太地區的視訊消費正在快速成長。 Over-The-Top服務和社交媒體影片等視訊串流服務正在迅速普及,這增加了對能夠創建高品質內容的視訊處理解決方案的需求。例如,在亞太地區,OTT 類別不再是利基市場,隨著時間的推移,市場正在迅速成長。在印度,到 2022 年,大約有 4.54 億用戶將每月至少觀看一次線上影片,並且有 1.195 億人在 OTT 平台上活躍付費訂閱。許多 OTT 愛好者都在尋找高品質。 OTT 供應商使用視訊處理解決方案來實現詳細的高品質 4K 視訊技術。

- 內容提供者不斷探索新的壓縮技術,以滿足全球對視訊串流不斷成長的需求。隨著設備、平台和標準的激增,在以品質等級和適當的位元率提供影片時需要考慮許多最佳化點。

- 例如,2022 年 9 月,MediaKind 透過其 Aquila Streaming 解決方案啟用了在 Microsoft公共雲端平台 Azure 上運行的超高畫質 OTT VVC 的直播。該解決方案預計將滿足內容提供者對新壓縮方法的需求,以確保滿足消費者對高品質觀看體驗的期望。

視訊處理解決方案行業概覽

視訊處理解決方案市場的特點是擁有眾多滿足區域和全球需求的參與者。在各個行業中,業務營運發生了從本地到數位平台的顯著轉變。這一轉變正在加速雲端基礎的視訊處理解決方案的進步。這些解決方案包括使用雲端基礎的視訊製作工具來儲存、編輯、渲染、管理和製作點播和直播視訊內容。值得注意的是,許多影像處理供應商正在努力不斷推出改進的產品並與不同的公司建立合作夥伴關係,以擴大其市場範圍並確保主導地位。該市場的參與企業包括 Base Media Cloud、Akamai Technologies、Apriorit 軟體開發公司、Imagine Communications Corp. 和 InPixal。

2023 年 4 月,MediaKind 和 Net Insight 建立策略合作夥伴關係,共同打造全面的雲端基礎的IP 視訊分發解決方案,以滿足廣播公司和發行商的需求。這項創新解決方案旨在簡化將影像內容從現場活動場所傳輸到雲端的過程。此整合系統預計將提供強大的串流安全性,包括端對端加密以及複雜的身份驗證、授權和審核功能。

此外,2023年3月,以色列付費電視服務供應商選擇了Synamedia的安全解決方案和視訊網路技術來改善智慧電視的使用者體驗。 Synamedia 的 Go Experience Manager 讓提供者 Yes 能夠根據過去的觀看習慣和當前趨勢內容提供內容推薦,從而客製化使用者的觀看體驗。該平台透過整合來自不同來源的附加內容和管道並將其呈現為旨在個體化用戶體驗的內容集合來提高用戶參與度。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- COVID-19 對視訊處理解決方案市場的影響

第5章市場動態

- 市場促進因素

- 多螢幕視訊點播應用需求快速成長

- 增加安全和監控監視器的支出

- 視訊處理解決方案的技術進步

- 市場挑戰

- 視訊處理過程的複雜性與整合度

- 對延誤的擔憂

第6章市場區隔

- 按解決方案

- 軟體

- 按服務

- 按配置

- 本地

- 雲

- 按用途

- 安全與監控

- 串流媒體和廣播

- 其他應用

- 按行業分類

- 媒體與娛樂

- 防禦

- 政府/國防安全保障

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 其他亞太地區

- 世界其他地區

- 北美洲

第7章競爭形勢

- 公司簡介

- Morpho, Inc.

- Ateme

- Vantrix Corporation

- Synamedia

- The MathWorks, Inc.

- SRI International

- Base Media Cloud

- Akamai Technologies

- Apriorit software development company

- Imagine Communications Corp.

- InPixal

- MediaKind

- Surf Communications Solutions Ltd.

第8章投資分析

第9章市場的未來

The Video Processing Solutions Market size is estimated at USD 17.25 billion in 2024, and is expected to reach USD 39.28 billion by 2029, growing at a CAGR of 17.90% during the forecast period (2024-2029).

Key Highlights

- The rollout of 5G networks globally is anticipated to transform the video streaming industry. 5G's high-speed and low-latency connections will improve the quality of video content, thus increasing the appeal of video processing solutions and stimulating the market. With its smooth video content and quicker data-to-decision time, video processing solutions have found a possible place in various industrial applications, including security & surveillance, streaming & broadcasting, and others.

- With more streaming services becoming available yearly, the streaming market constantly expands. By 2030, the streaming market will reach USD 330 billion, increasing the demand for video processing solutions. Observations from the US revealed people watched 169.4 billion minutes of streaming video in a single week in February 2022. Approximately 85% of households in the United States now have access to at least one video streaming service. As the internet and connected devices like smartphones, tablets, and interactive displays become more widely used for video-on-demand applications among the global population, video processing solutions are expected to grow at a healthy rate in the coming years.

- A video surveillance system using video analytics software can identify several events. For instance, Airport Council International (ACI) adopted OpenCV, the video processing solution for object detection and object tracking. According to ACI, most airports have around 20 aircraft movements per hour, which reaches one move per minute during peak hours. To manage ground traffic in the airport, once a plane lands, the plane's location should be tracked, which is accomplished by coordinating with the pilot and monitoring movement on the airport's CCTV network. The built-in CCTV system for plane detection scenarios was integrated with video processing capabilities to automate the operation.

- Since a vast amount of data is generated from video processing, cloud technologies are being used to store this. However, these cloud-based systems offer more security than in-house systems, so the companies don't easily invest in video processing solutions. Moreover, processing video information, particularly in areas such as surveillance and video analysis, can raise privacy and security issues. Additionally, adherence to data protection regulations may hinder this market, resulting in slower growth and opportunities.

- The COVID-19 outbreak fueled the growth of the stay-at-home economy, and consumer preferences shifted toward online entertainment. Video streaming services saw an exploding demand, so streaming providers were compelled to spend more money on new content, especially originals. Many streaming operators adopted video processing solutions to ensure a seamless and error-free digital experience at every level of the content distribution lifecycle. The demand for the video processing solutions market will remain strong during the studied period.

Video Processing Solutions Market Trends

Surge in Demand for Multi-screen Video-on-Demand Application

- The demand for surveillance, security cameras, CCTV cameras, unmanned aerial vehicles (UAVs), etc., and the volume of video footage is rising due to low-cost cameras. It is challenging to maintain track of statistics manually to retrieve real-time information, and doing so would also cost money. Businesses are outsourcing this task to video processing companies to save a handful of time and effort.

- Worker safety is a primary concern in the manufacturing industry. The installed CCTV cameras are only used for remote facility monitoring and tracking. However, automating the alerts for any safety or security-related issue is necessary. Here, video processing comes into the picture as it eliminates the need for dedicated staff to constantly watch the video footage in real-time.

- The prevalence of mobile devices, including smartphones, tablets, and other devices, has made the mobile screen the predominant platform for viewing video-on-demand content. As a result, content providers are optimizing their services for mobile devices and creating mobile-friendly applications to improve the user experience.

- For instance, the most downloaded entertainment app globally in 2022 was Tiktok, with a total of 672 million downloads, according to Apptopia. Netflix followed in second place with 165 million downloads, and YouTube was in third place with 154 million downloads from users worldwide. Disney+, a mobile application for streaming services, ranked fourth globally with 147 million downloads.

- In April 2023, Shabodi and Megh Computing developed a network-aware video analytics solutions suite that will be effective across various industrial use cases, including real-time security and surveillance. The solution will likely help in smart factory frameworks' quality control, safety monitoring, and process optimization. The duo will showcase their product at the Hannover Messe Industrial Transformation Conference.

- While over-the-top (OTT) expansion has created new opportunities and revenue streams, it has also oversaturated the market with service providers. In such a competitive market, OTT providers invest in video processing solutions to generate the maximum return on investment in content creation. For instance, Fluid EdgeCDN, developed by Synamedia, provides scalable, smart, and effective CDN operations. With features like a sophisticated traffic prediction engine, ISPs can offer extra CDN capacity while giving the rights holder a portion of the profits.

Asia-Pacific to Witness Significant Growth

- Domestic security spending has increased in the Asia-Pacific region. Security agencies have been encouraged to use video processing solutions for improved monitoring and surveillance applications due to the increased number of CCTV installations in public gatherings or places with high footfalls, like airports and railway stations. For instance, in India, the states like Indore, Hyderabad, and New Delhi are some of the most surveilled cities in the world.

- Artificial intelligence-driven video surveillance systems offer various advantages, including scalability and adaptability, which enable them to be tailored to provide contextual information and safety in multiple settings.

- For instance, in March 2022, the National Railways of the Philippines implemented a video analytics solution to detect potential safety hazards, such as destroying boom gate barriers. During the COVID-19 pandemic, the system proved advantageous with its capability of thermal imaging software, as it was also used to identify passengers and employees with elevated body temperature indications before entering railway facilities.

- Video consumption in Asia-Pacific is growing at a rapid rate. Video streaming services, such as over-the-top (OTT) services and social media videos, have seen a surge in popularity, prompting the demand for video processing solutions that can produce high-quality content. For instance, the OTT category is no longer a niche in Asia-Pacific, and the market is surging with time. In India, about 454 million users watched an online video at least once a month in 2022, with 119.5 million active paid subscriptions across OTT platforms. Most OTT enthusiasts demand high picture quality. OTT providers use video processing solutions for detailed, high-quality 4K video technology.

- Content providers continuously explore new compression techniques to meet the increasing demand for global video streaming. With the proliferation of devices, platforms, and standards, numerous optimization points exist to consider when providing video at a quality level and appropriate bitrate.

- For instance, in September 2022, MediaKind enabled live UHD OTT VVC streaming, running entirely on Microsoft's Azure public-cloud platform through its Aquila Streaming solution. This solution is expected to fulfill the need for new compression methods required by content providers to ensure consumer expectations for a high-quality viewing experience are met.

Video Processing Solutions Industry Overview

The video processing solution market is characterized by a multitude of players catering to both regional and global demands. Across various industries, there is a noticeable shift from on-premises setups to digital platforms for corporate operations. This transition has expedited the advancement of cloud-based video processing solutions. These solutions encompass saving, editing, rendering, managing, and producing on-demand as well as live video content utilizing cloud-based video production tools. Notably, many of these video processing providers continually introduce improved products, engage in partnerships with diverse companies to extend their market reach, and strive to secure a leading position. Prominent participants in this market include Base Media Cloud, Akamai Technologies, Apriorit software development company, Imagine Communications Corp., InPixal, and others.

In April 2023, MediaKind and Net Insight forged a strategic partnership with the objective of creating a comprehensive cloud-based IP video distribution solution tailored to the needs of broadcasters and distributors. This innovative solution is poised to streamline the process of transmitting video content from live event venues to the cloud. It is anticipated that this unified system will offer robust stream security, including end-to-end encryption and sophisticated features for authentication, authorization, and auditing.

Furthermore, in March 2023, an Israeli pay TV service provider adopted Synamedia's security solutions and Video Network technologies to enhance the user experience on smart TVs. Synamedia's Go Experience Manager will empower the provider, Yes, to tailor the viewing experience for its users by offering content recommendations based on their past viewing habits and current trending content. This platform will amalgamate additional content and channels from various sources, presenting them in content collections designed to hyper-personalize the user experience, thereby increasing user engagement.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Video Processing Solutions Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Surge in Demand for Multi-screen Video-on-Demand Application

- 5.1.2 Growth in Security & Surveillance Monitoring Spending

- 5.1.3 Technological Advancement in Video Processing Solution

- 5.2 Market Challenges

- 5.2.1 Complexity and Integration in Video Processing Process

- 5.2.2 Latency Concerns

6 MARKET SEGMENTATION

- 6.1 By Solution

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By Deployment

- 6.2.1 On-Premise

- 6.2.2 Cloud

- 6.3 By Application

- 6.3.1 Security & Surveillance

- 6.3.2 Streaming & Broadcasting

- 6.3.3 Other Applications

- 6.4 By Industry

- 6.4.1 Media & Entertainment

- 6.4.2 Defense

- 6.4.3 Government/Homeland Security

- 6.4.4 Other Industries

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 Germany

- 6.5.2.2 United Kingdom

- 6.5.2.3 France

- 6.5.2.4 Rest of Europe

- 6.5.3 Asia-Pacific

- 6.5.3.1 India

- 6.5.3.2 China

- 6.5.3.3 Japan

- 6.5.3.4 Rest of Asia-Pacific

- 6.5.4 Rest of the World

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Morpho, Inc.

- 7.1.2 Ateme

- 7.1.3 Vantrix Corporation

- 7.1.4 Synamedia

- 7.1.5 The MathWorks, Inc.

- 7.1.6 SRI International

- 7.1.7 Base Media Cloud

- 7.1.8 Akamai Technologies

- 7.1.9 Apriorit software development company

- 7.1.10 Imagine Communications Corp.

- 7.1.11 InPixal

- 7.1.12 MediaKind

- 7.1.13 Surf Communications Solutions Ltd.