|

市場調查報告書

商品編碼

1273465

智能家居安裝服務市場 - 增長、趨勢、COVID-19 影響和預測 (2023-2028)Smart Home Installation Service Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,智能家居安裝服務市場預計將以 25% 的複合年增長率增長。

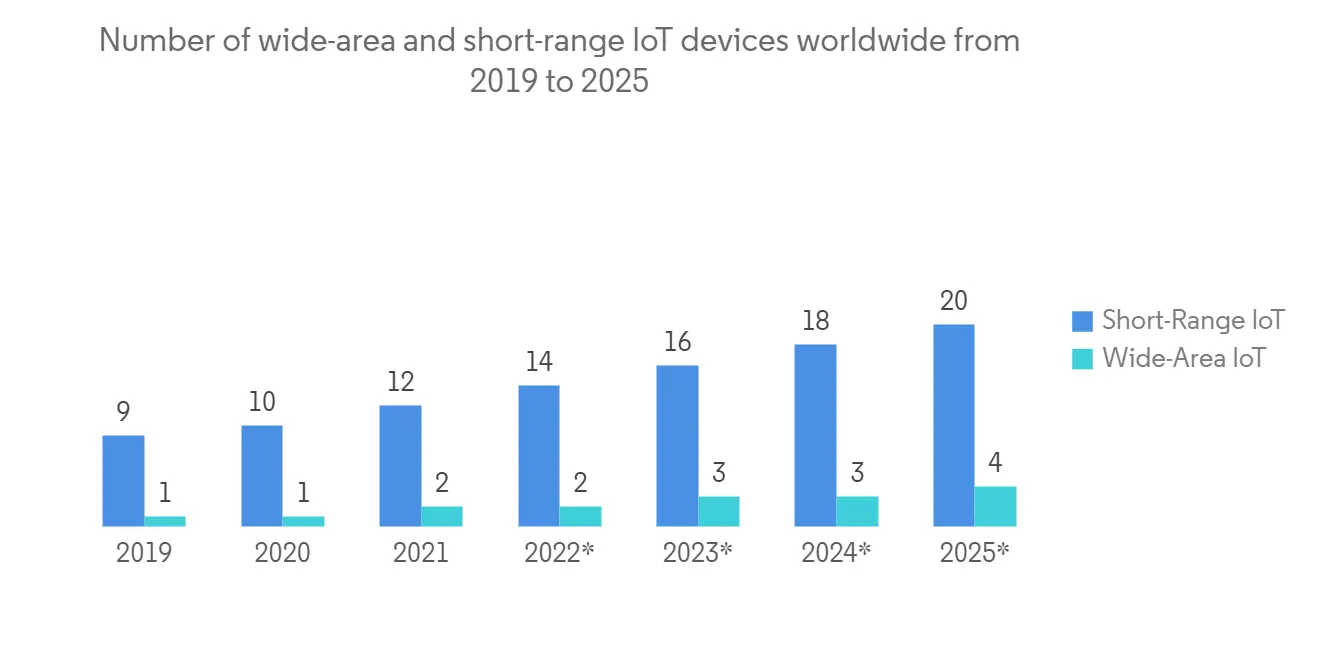

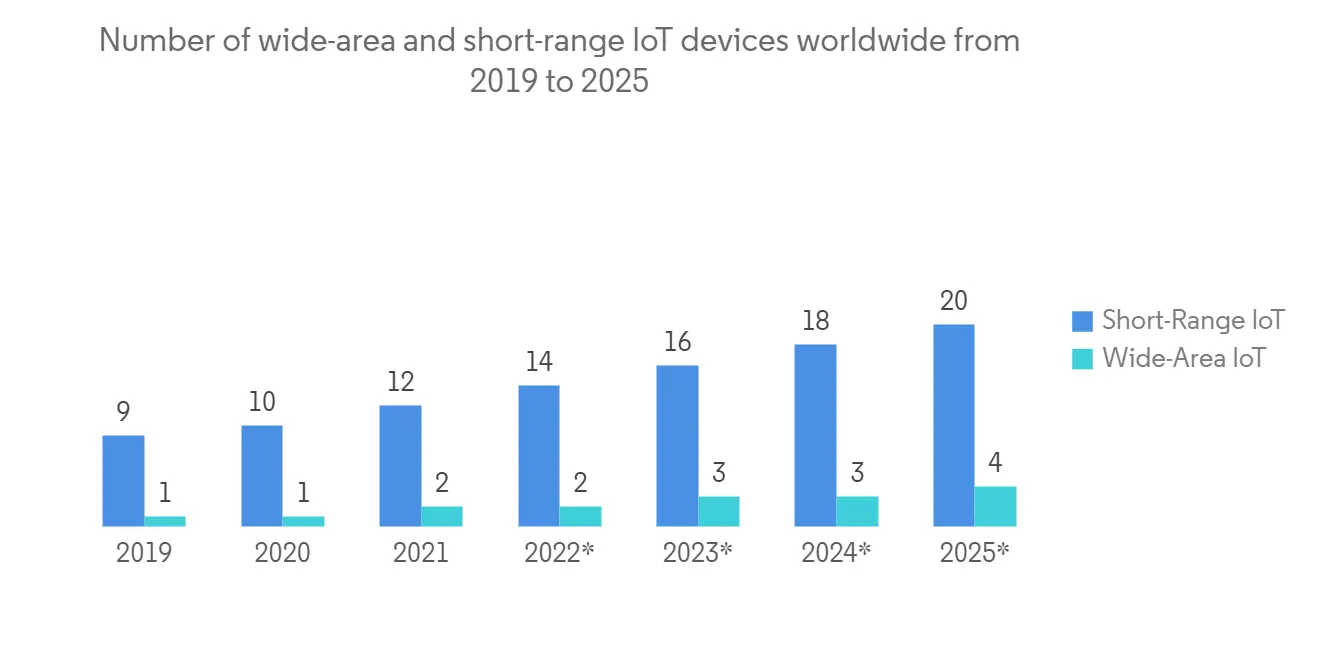

隨著數字化轉型的持續採用,物聯網和人工智能 (AI) 正在快速發展,將互聯家居的觀念從奢侈轉變為主流。 智能家居技術不斷發展,以實現更好的訪問和控制。 智能家居系統需要智能手機應用程序或門戶網站作為用戶界面來與自動化系統交互。

主要亮點

- 終端用戶越來越多地採用認知系統和連接技術,推動了智能家居安裝服務市場的發展。 由於其先進的功能,尤其是便攜性,內置智能輔助的消費設備(產品)的採用在過去幾年中迅速增長。

- 智能家居越來越多地採用個人助理,預計未來幾年將為智能家居安裝服務提供商創造新的機會。 這主要是因為消費者正在採用技術先進的設備,如智能電視、智能揚聲器,以及結合了人工智能的設備,如游戲機。

- 大型服務提供商已經對家居中心和 DIY 套件所聲稱的易於安裝提出了挑戰,並將這一策略作為擴大其在智能家居安裝服務市場的消費者群的必備武器。 智能家居行業的原始設備製造商和零售商提供一站式諮詢、產品選擇和安裝服務,以推動智能家居安裝服務行業的增長。

- 在 COVID-19 中,跨境限制導致行業停工和生產受到影響。 大流行擾亂了組織效率並影響了價值網絡。 電視和冰箱等現有智能商品的需求持續增長,以支持被迫待在家中的消費者的休閒和便利。 原材料供應對價值鏈產生了不利影響,損害了智能家居行業的發展。

- 網絡安全行業將智能家居作為他們最關心的問題之一。 因此,數據隱私和安□□全已成為阻礙智能家居安裝服務市場增長的主要因素。

智能家居安裝服務市場趨勢

電子商務推動智能家居安裝服務市場增長

- 電子商務渠道的日益普及有望在智能家居安裝服務市場創造新的機遇。 近 60% 的消費者至少擁有一台智能家居設備,消費者終於開始擁抱這些產品。 這為電子商務運營商□□提供了加入智能家居並推動設備購買的機會。

- 疫情幫助重塑了在線購物的未來,迫使企業改變許多客戶購買必需品、小工具和服裝的方式,以滿足新的需求。我來了。

- 許多企業都在與電子商務渠道合作,以擴大對目標客戶群的覆蓋面。 例如,eBay 已宣布與三個智能家居公司服務提供商建立合作夥伴關係:InstallerNet、Handy 和 Porch。 這允許最終用戶從 eBay 庫存中預訂智能家居安裝服務。

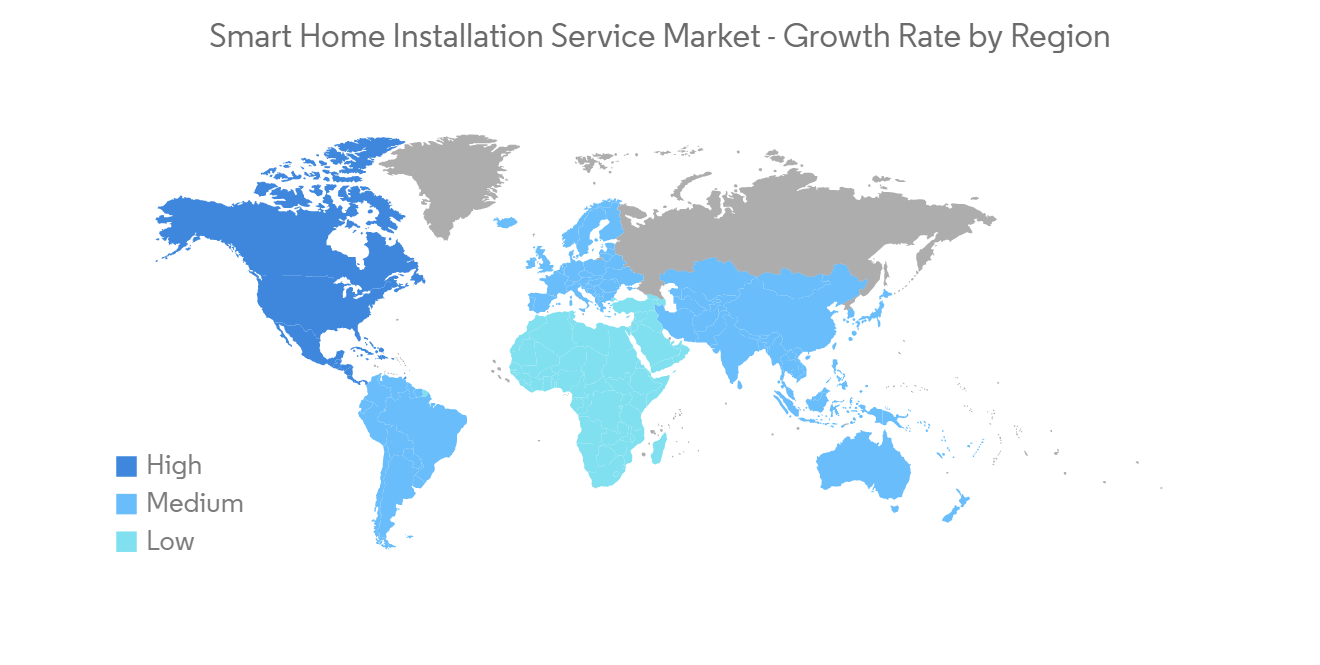

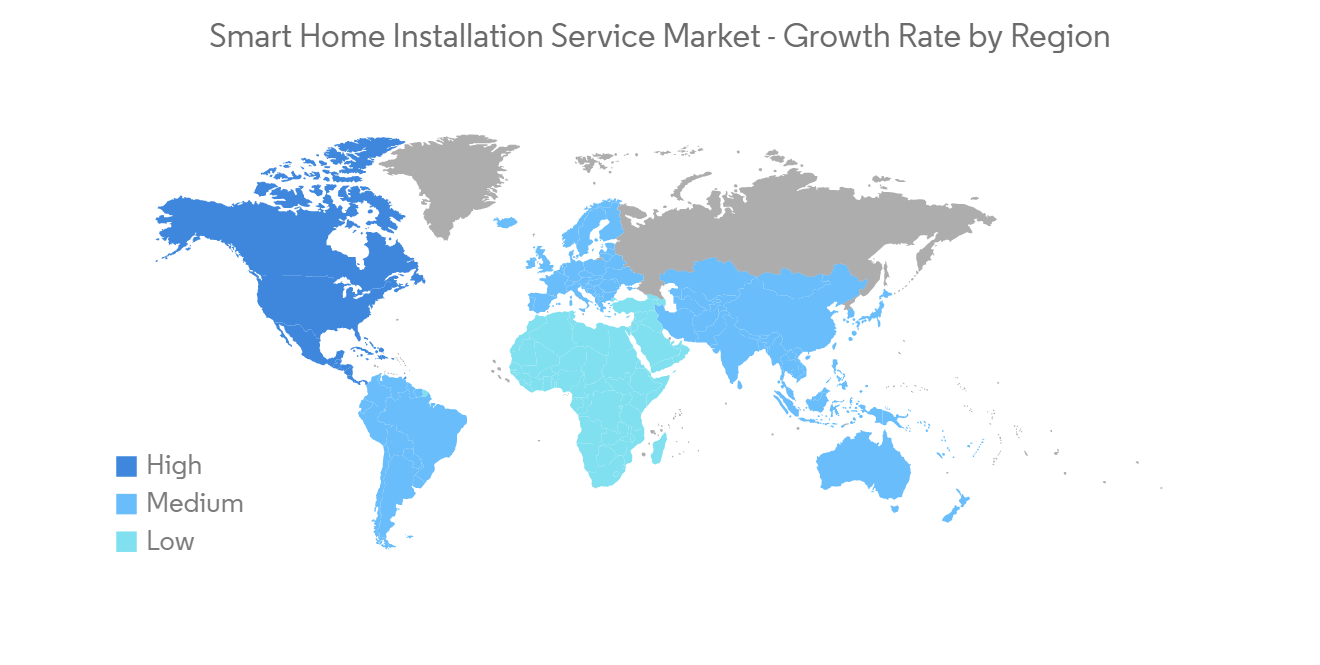

預計北美將佔據較大的市場份額

- 推動北美智能家居安裝服務市場發展的關鍵因素之一是北美越來越多地接受聯網設備。 該地區在全球智能家居安裝服務市場的主導地位很大程度上歸功於技術的早期採用者趨勢以及 Vivint, Inc.、Red River Electric 和 Miami Electric Masters 等行業參與者的存在。

- 智能家居正在興起,預計將有近 3000 萬美國家庭在不久的將來安裝智能家居技術。 消費者正在為他們的家庭添加產品,例如聯網攝像頭(需求量最大)、可視門鈴(需求量第二大)、聯網燈泡、智能鎖和現在的智能揚聲器。

- 美國最近的一項研究發現,家庭安全已成為採用智能家居技術的主要因素,增加了對以安全為重點的智能家居產品的需求。 然而,該地區市場的最大驅動因素是消費者採用智能家居技術,如智能照明和能源管理解決方案,以簡化他們的生活,帶來更大的便利。

- 同樣,Kandan 房主也是尋求解決方案以幫助他們節約能源和減少碳足蹟的返回者。 此外,施耐德電氣還將推出一系列互聯生活產品,幫助更多的房主利用這一新興技術,提供加拿大房主在購買智能家居技術時最追捧的安裝和使用功能。易用性、長期耐用性和可持續性。

智能家居安裝服務行業概覽

智能家居安裝服務市場既不分散也不統一。 每家公司都制定了一項業務戰略,重點是在全球範圍內擴展其現有的分銷商網絡。 主要參與者正在遵循產品創新、併購等戰略,以擴大影響範圍並保持市場地位。

- 2022 年 1 月 - 沃爾瑪與 Agni 攜手打造另一項安裝智能空調和其他尖端技術的專業服務。 此次合作旨在幫助您在家中安裝電視、安裝智能空調以及完成其他 DIY 任務。 Ange 說,超過 150 個受歡迎的家居項目將可以在 4,000 多家沃爾瑪商店和沃爾瑪網上購買。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查結果和假設

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場概覽

- 市場促進和製約因素介紹

- 市場驅動力

- 增加認知系統的數量

- 採用智能嵌入式設備

- 消費者對電子商務的偏好不斷上升

- 市場製約因素

- 數據隱私和安□□全問題

- 行業價值鏈分析

- 行業吸引力 - 波特五力分析

- 新進入者的威脅

- 買方/消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第 5 章市場細分

- 按系統

- 燈光控制

- 家庭監控/安全

- 恆溫器

- 視頻娛樂

- 智能家電

- 其他系統

- 按頻道

- 零售店

- 電子商務

- 貼牌生產

- 按地區

- 北美

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第六章競爭格局

- 公司簡介

- Calix Inc.

- HelloTech Inc.

- Red River Electric Inc.

- Vivint Inc.

- Meyer Electrical Services Inc.

- Finite Solutions LLC

- Handy Inc.

- Insteon Inc.

- PULS Group

- Miami Electric Masters Inc.

- Smartify Home Automation Limited

第七章投資分析

第八章市場機會與未來趨勢

The smart home installation service market is expected to register a CAGR of 25% over the forecast period. Due to the growing adoption of digital transformation, IoT and Artificial Intelligence (AI) is witnessing rampant growth, and the perception of the connected home is changing from luxury to mainstream. Smart home technologies continue to grow for greater access and control. The smart home system requires a smartphone application or web portal as a user interface to interact with an automated system.

Key Highlights

- An increase in the adoption of cognitive systems and connectivity technologies by end users drives the smart home installation service market. The adoption of intelligent assistance-embedded consumer devices (products) has increased rapidly over the last few years, owing to their advanced features, especially portability.

- The rising adoption of personal assistants in smart homes is expected to create new opportunities for smart home installation service providers in the next few years. This is primarily because consumers are adopting technologically-advanced devices, including artificial intelligence-embedded devices such as smart TVs, smart speakers, and gaming devices.

- Leading service providers are challenging the easy installation claims made by home improvement and DIY kits and using this strategy as an essential weapon for the expansion of their consumer base in the smart home installation services market. OEMs and retailers in the smart homes industry are offering consultation, product selection, and installation services under one roof to bolster their growth in the smart home installation services industry.

- During Covid-19, industries were closed down, and production was impacted due to the restrictions on crossing international and national borders; the pandemic has disrupted organizational efficiency and impacted value networks. Existing smart goods like Televisions and refrigerators continued to be in demand because they helped customers who were compelled to stay at home with their leisure and convenience needs. The supply of raw materials was negatively impacted by the value chain, which harmed the growth of the smart house industry.

- The cyber security industry has highlighted smart homes as one of the most significant concerns. Hence, data privacy and security are the primary factors hindering the growth of the smart home installation service market.

Smart Home Installation Service Market Trends

E-commerce Boosting the Growth of Smart Home Installation Service Market

- The increasing popularity of E-Commerce channels is expected to create new opportunities in the smart home installation services market. With nearly 60% of consumers having at least one smart home device, consumers are finally beginning to embrace these products. This offers a chance for e-commerce businesses to join the smart home and promote device purchases.

- The pandemic has helped to reshape the future of online purchasing and forced businesses to adapt to meet new needs and demands, forcing many customers to change how they purchase necessities, gadgets, and apparel.

- Many companies collaborate with E-Commerce channels to expand their reach into their target customer segments. For instance, eBay announced partnerships with three service providers in the smart home companies - InstallerNet, Handy, and Porch. This allowed end users to book smart home installation services on eBay's inventory.

North America Expected to Have Significant Market Share

- One of the main factors propelling the market for smart home installation services in North America is the rising acceptance of network-linked devices there. The region's dominant position in the world market for smart home installation services may be attributed to the tendency of early technology adoption and the large presence of industry players like Vivint, Inc., Red River Electric, and Miami Electric Masters.

- Smart homes are on the rise, with nearly 30 million U.S. households projected to add smart home technology in the near future. Consumers are adding products to their homes, including connected cameras (highest demand), video doorbells (2nd highest demand), connected light bulbs, smart locks, and smart speakers of late.

- According to a recent survey in the U.S., security-focused smart home products are in demand, as family safety is a significant factor in adopting smart home technology. However, the biggest driver for the market in this region is that consumers are adopting smart home technology like smart lighting solutions and energy management solutions to simplify their lives with greater convenience.

- Similarly, house owners in Candan are regressors looking for solutions that help them save on energy and reduce their carbon footprint. Further, Schneider Electric launched a suite of connected living products to help more homeowners take advantage of this emerging technology, addressing the most common demands of Canadian homeowners when shopping for smart home technology, such as ease of installation and use, long-term durability, and sustainability.

Smart Home Installation Service Industry Overview

The smart home installation market is neither fragmented nor consolidated. The companies are formulating their business strategies that reflect an increased focus on expanding their existing distributor networks across the world. The major players are following strategies like product innovation, mergers, and acquisitions to expand their reach and hold their market position.

- January 2022 - Walmart has joined Agni to create another professional service to install smart air conditioners and other modern technology. This collaboration has been launched to assist with the mounting of televisions, the installation of smart air conditioners, and the completion of other DIY tasks around the home. According to Angi, over 150 popular home projects will be available for purchase from over 4,000 Walmart locations as well as Walmart online.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables & Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increased Number of Cognitive Systems

- 4.3.2 Adoption of Intelligent Embedded Devices

- 4.3.3 Growing consumer preference towards E-Commerce

- 4.4 Market Restraints

- 4.4.1 Data Privacy and Security Concerns

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By System

- 5.1.1 Lighting Control

- 5.1.2 Home Monitoring/Security

- 5.1.3 Thermostat

- 5.1.4 Video Entertainment

- 5.1.5 Smart Appliances

- 5.1.6 Other Systems

- 5.2 By Channel

- 5.2.1 Retailers

- 5.2.2 E-Commerce

- 5.2.3 OEM

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Calix Inc.

- 6.1.2 HelloTech Inc.

- 6.1.3 Red River Electric Inc.

- 6.1.4 Vivint Inc.

- 6.1.5 Meyer Electrical Services Inc.

- 6.1.6 Finite Solutions LLC

- 6.1.7 Handy Inc.

- 6.1.8 Insteon Inc.

- 6.1.9 PULS Group

- 6.1.10 Miami Electric Masters Inc.

- 6.1.11 Smartify Home Automation Limited