|

市場調查報告書

商品編碼

1273515

虛擬專用網絡市場——增長、趨勢和預測 (2023-2028)Virtual Private Network Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,虛擬專用網絡市場預計將以 17.2% 的複合年增長率註冊。

主要亮點

- 虛擬專用網絡 (VPN) 市場的增長歸因於在線隱私和安全的重要性日益增加,以及遠程工作和虛擬協作的增加對 VPN 服務的需求增加。

- 即使在大流行消退之後,遠程工作的趨勢預計仍將繼續,因此,遠程工作的 VPN 使用率預計將保持在較高水平。公司認識到遠程工作可以是一種有效且高效的開展業務的方式,VPN 已成為確保遠程工作人員安全和生產力的重要工具。

- 網絡攻擊的顯著增加和對基於雲的安全解決方案的需求激增預計將推動虛擬專用網絡市場的發展。VPN 提供安全、加密的連接並防止各種威脅。

- 此外,許多企業和組織必須遵守數據隱私和安全法規。因此,這些公司對它的採用有所增加,推動了對 VPN 解決方案和服務的需求。VPN 可以通過提供安全和加密的連接來幫助確保遵守這些法規。

- 移動 VPN 的高價格阻礙了 VPN 市場的增長。此外,VPN服務的監管環境因國家而異,有些國家限製或完全禁止使用VPN。這可能會影響市場增長潛力和競爭格局。

- VPN 提供商不斷開發新技術和新功能,以提高其服務的速度、安全性和可用性。這還包括具有新功能的高級加密,例如多跳、服務器基礎設施和用戶界面。例如,2023 年 1 月,Surfshark 為其 VPN 引入了新的動態多跳功能 Nexus。有了這個新功能,用戶的 Internet 連接通常通過單個服務器進行路由設置,流量現在通過整個服務器網絡而不是單個 VPN 隧道進行路由。

- COVID-19 對 VPN 市場產生了積極影響。由於大流行,越來越多的人在家工作,對 VPN 服務的需求猛增。許多公司都設置了 VPN,以允許員工從家裡安全地訪問公司網絡和數據。對 VPN 的需求不斷增長也導致市場競爭加劇,出現了許多新進入者。

虛擬專用網市場趨勢

由於網絡攻擊不斷增加,對 VPN 的需求不斷增加

- VPN 提供安全和加密的連接,保護用戶的數據和活動免受網絡攻擊。已成為其中之一。隨著網絡攻擊頻率和複雜性的增加,許多個人和企業依靠 VPN 來保持在線安全。

- 網絡攻擊的增加是由更敏捷的黑客和勒索軟件推動的,這些軟件專注於利用遠程工作者和在大流行期間轉向電子學習的學校和教育機構使用的協作工具,以及對醫療保健組織的攻擊。據信這是由於大量增加

- 全球範圍內越來越多的網絡攻擊提高了人們對在線安全的認識以及對安全在線連接的需求。因此,隨著個人和企業尋找保護其在線活動和數據的方法,VPN 的採用率有望增長。

- 據 IBM 稱,到 2022 年,亞太地區將連續第二年遭受重創,佔全球補救事件的 31%。製造業是該地區受攻擊最多的行業,佔 48%,其次是金融和保險業,佔 18%。

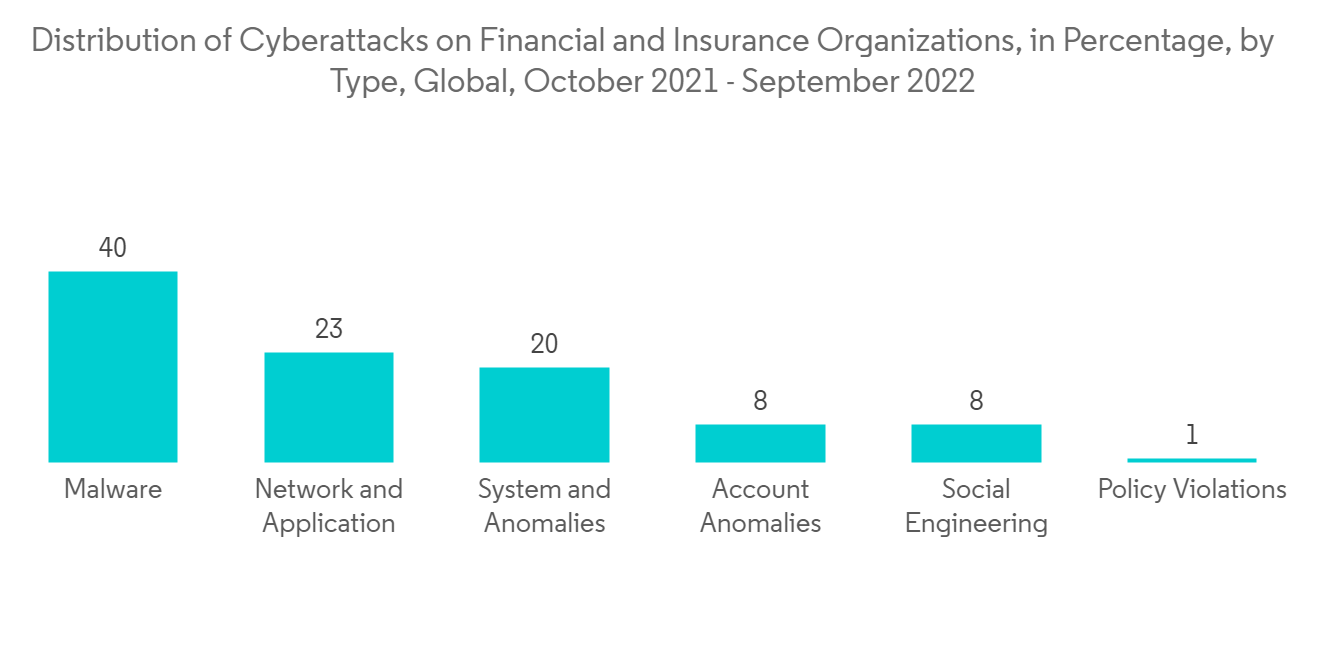

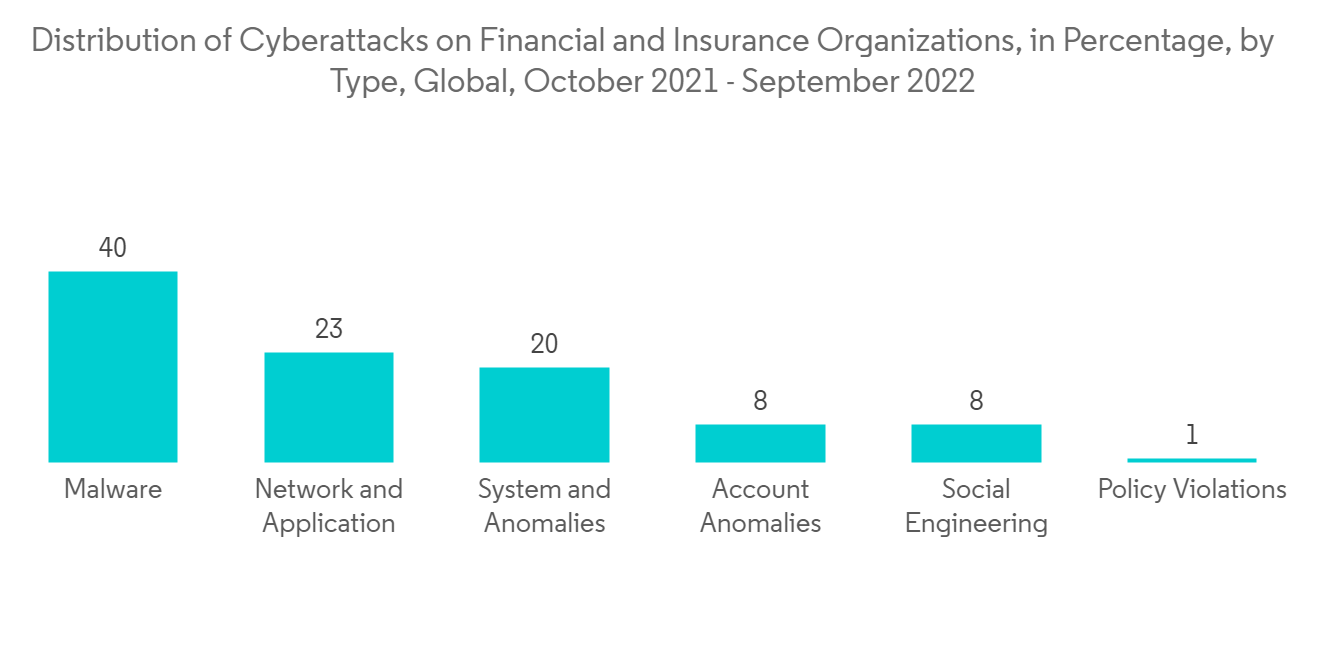

- 惡意軟件是 2021 年 10 月至 2022 年 9 月期間針對金融和保險組織的最頻繁的網絡攻擊。這種攻擊媒介襲擊了全球大約 40% 的組織。根據 Orange Cyberdefense,系統異常位居第二,20% 的組織報告了此類網絡攻擊,其次是網絡和應用程序異常,佔 23%。

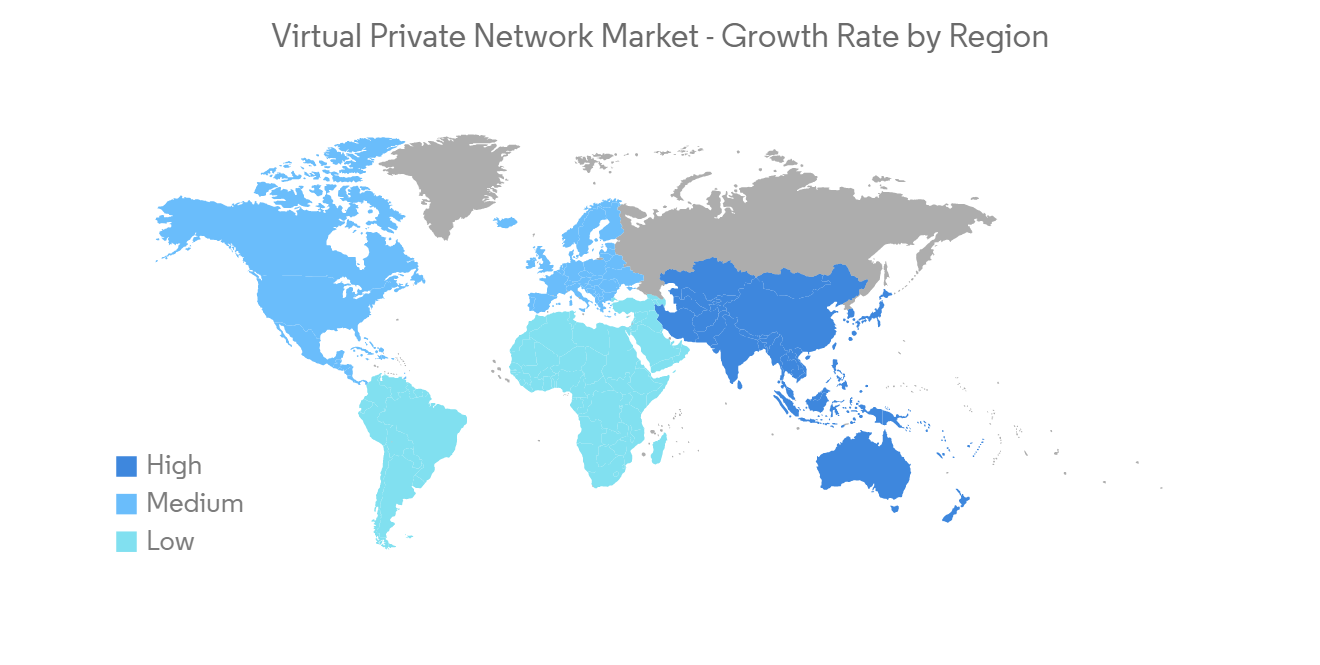

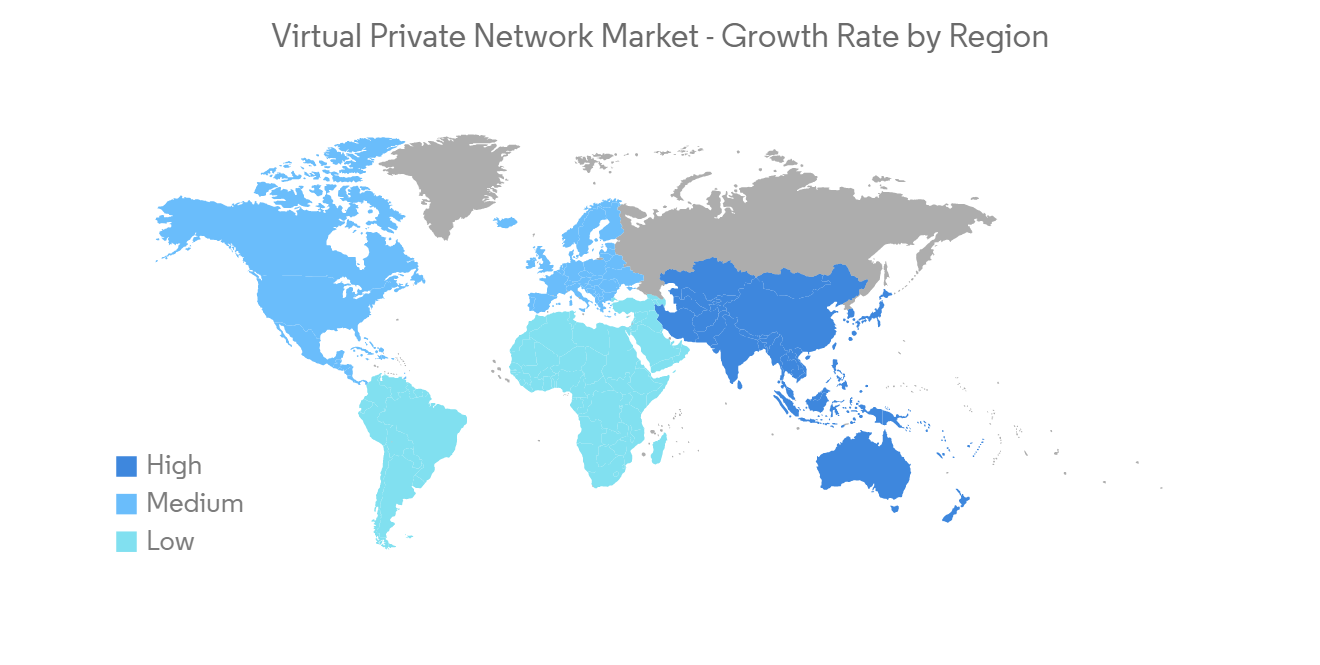

北美預計將佔據大部分市場份額

- 預計北美將主導虛擬專用網絡 (VPN) 市場。不斷上升的網絡犯罪率、數據洩露和強勁需求驅使美國擺脫服務和 IT 驅動的行業、對高端服務的需求以及對隱私的需求。

- 針對各個垂直行業公司的網絡攻擊的增加是推動該市場增長的一個因素。為此,鼓勵公司部署 VPN 解決方案以保護公司資源免受未經授權的訪問。網絡犯罪的興起對 VPN 產生了巨大需求,這推動了市場增長。

- 據 IBM 稱,到 2022 年,美國的平均數據洩露成本將達到 944 萬美元,高於 2021 年的 905 萬美元。與此同時,2022 年全球平均每次數據洩露成本為 435 萬美元。這表明美國數據洩露和網絡攻擊的頻率顯著增加,促使組織部署安全和複雜的解決方案來保護他們的數據。

- 美國的幾個州已經頒布了數據隱私法規,例如《消費者隱私法》。這些法規要求公司採取措施保護個人數據,例如虛擬專用網絡,進一步刺激該國的需求。

- 北美政府還啟動了多項網絡安全計劃,以保護關鍵基礎設施和企業免受網絡攻擊。這提高了人們對網絡安全威脅的認識以及對安全在線訪問的需求,從而促進了 VPN 的採用。

虛擬專用網行業概況

虛擬專用網絡市場高度分散,有許多知名企業。這些參與者正在採取戰略舉措,例如合併、收購、合作夥伴關係和產品創新,這些舉措有助於推動市場增長。

2022 年 11 月,安全移動通信領域的領導者之一 RadioIP 選擇了垂直定位領域的領導者 NextNav,為其行業領先的 VPN 解決方案提供任務關鍵型 Z 軸位置信息。

此外,2022 年 6 月,NordVPN 宣佈了一項名為 Meshnet 的新功能,允許用戶直接連接到其他設備,而不是通過 VPN 服務器,進一步鞏固了該公司作為行業領導者的地位。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 本次調查範圍

第二章研究方法論

第三章執行摘要

第四章市場洞察

- 市場概況

- 工業吸引力——波特五力分析

- 新進入者的威脅

- 買方/消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 評估 COVID-19 對市場的影響

第五章市場動態

- 市場驅動力

- 網絡攻擊增加

- VPN 解決方案在多個業務領域的採用率增加

- 市場製約因素

- 缺乏 VPN 標準化和數據保護

第六章市場細分

- 按組件

- 硬件

- 軟件與服務

- 按類型

- 主機類型

- 知識產權

- 多協議標籤交換

- 雲

- 移動的

- 按終端用戶行業

- BFSI更多

- 衛生保健

- 它

- 政府機構

- 製造業

- 其他終端用戶行業

- 按地區

- 北美

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳大利亞

- 亞太其他地區

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲地區

- 中東/非洲

- 阿拉伯聯合酋長國

- 沙特阿拉伯

- 其他中東和非洲

- 北美

第七章競爭格局

- 公司簡介

- Microsoft Corporation

- Cisco Systems Inc.

- Check Point Software Technologies Limited

- Radio IP Software Inc.

- IBM Corporation

- NetMotion Software Inc.

- Golden Frog GmbH

- Avast Software S.R.O.

- CyberGhost S.A.(Kape Technologies PLC)

- Array Networks Inc.

- Citrix Systems Inc.

第八章投資分析

第九章 市場潛力

The virtual private network market is expected to register a CAGR of 17.2% over the forecast period.

Key Highlights

- The growth of the virtual private network (VPN)market is attributed to the increased demand for VPN services due to the increasing importance of online privacy and security and the rise of remote work and virtual collaboration.

- The trend towards remote work is likely to continue even after the pandemic subsides, and as a result, the use of VPNs for remote work is expected to remain high. Companies realize that remote work can be an effective and efficient way of doing business, and VPNs are an essential tool for ensuring the security and productivity of remote workers.

- A significant rise in cyber-attacks and a surge in demand for cloud-based security solutions are expected to boost the virtual private network market. VPN offers a secure and encrypted connection that protects against various threats.

- Furthermore, many companies and organizations must comply with data privacy and security regulations. Thus, growing adoption from such companies drives demand for VPN solutions and services. VPN helps to ensure compliance with these regulations by providing a secure and encrypted connection.

- The high price of the mobile VPN is responsible for hampering the growth of the VPN market. Also, the regulatory environment for VPN services varies by country, with some countries restricting or banning VPN use altogether. This can impact the growth potential and competitive landscape in the market.

- VPN providers are constantly developing new technologies and features to improve their services' speed, security, and ease of use. This includes advanced encryption with new features like multihop, server infrastructure, and user interfaces. For instance, in January 2023, Surfshark launched a new dynamic multihop feature nexus for its VPN. With this new feature, instead of the usual setup of passing the user's internet connection through a single server, its traffic gets routed through a whole network of servers rather than a single VPN tunnel.

- COVID-19 positively impacted the VPN market. With more people working from home due to the pandemic, there was a surge in demand for VPN services. Many companies set up VPNs to enable their employees to access company networks and data from home securely. The increased demand for VPNs also led to more competition in the market, with many new players entering the market.

Virtual Private Network Market Trends

Growing Number of Cyberattacks to Increase Demand for VPN

- The growing number of cyberattacks worldwide is one of the key drivers for the growth of virtual private network (VPN) adoption, as it provides a secure and encrypted connection that protects user data and activity from cyberattacks. With the increasing frequency and sophistication of cyberattacks, many individuals and businesses are turning to VPNs to ensure online security.

- The increase in cyberattacks is attributed to more agile hackers and ransomware who focused on exploiting collaboration tools used by remote workers and schools and educational institutions that shifted to e-learning during the pandemic, as well as a significant increase in attacks on healthcare organizations.

- The growth in cyberattacks globally has led to an increased awareness of online security and the need for secure online connections. As a result, VPN adoption is expected to grow as individuals and businesses look for ways to protect their online activity and data.

- According to IBM, in 2022, the Asia-Pacific region was the most attacked for the second consecutive year, accounting for 31% of all incidents remediated worldwide. The manufacturing sector topped the list of industries attacked in the region with 48% of cases, followed by finance and insurance with 18%.

- Malware was the most frequent cyberattack in financial and insurance organizations between October 2021 and September 2022. The attack vector hit about 40% of the world's organizations. According to Orange Cyberdefense, system anomalies came in second, with 20% of organizations reporting such cyberattacks, followed by network and application anomalies with 23%.

North America Expected to Hold Major Market Share

- The North American region is anticipated to dominate the virtual private network (VPN) market. Due to its service and IT-led industry, demand for high-end services, and need for privacy, the United States is fed by the rising rate of cybercrime, data breaches, and strong demand.

- The increasing number of cyber-attacks on enterprises across various business verticals is responsible for the growth of this market. This encourages organizations to implement VPN solutions to shield their company resources from unsanctioned access. There is a huge demand for VPNs due to the increasing rate of cybercrime, which is propelling the market growth.

- According to IBM, as of 2022, the average data breach cost in the United States amounted to USD 9.44 million, up from USD 9.05 million in 2021. At the same time, the global average cost per data breach was USD 4.35 million in 2022. This shows the frequency of data breaches and cyber-attacks significantly increased in the United States, leading organizations to adopt secure and advanced solutions to protect their data.

- Several states in the United States have enacted data privacy regulations, such as consumer privacy legislation. These regulations require companies to implement measures to protect personal data, including virtual private networks, further creating demand in the country.

- In addition, the government of North America has launched several cybersecurity initiatives to protect critical infrastructure and businesses from cyberattacks. This has raised awareness of cybersecurity threats and the need for secure online access, contributing to adopting VPNs.

Virtual Private Network Industry Overview

The virtual private network market is highly fragmented and has many prominent players. These players are undergoing strategic initiatives such as mergers, acquisitions, partnerships, product innovation, and others, helping to propel the market's growth.

In November 2022, RadioIP, one of the leaders in secure mobile communications, selected NextNav, the leader in vertical location positioning, to empower its industry-leading VPN solutions with mission-critical z-axis location intelligence.

Further, in June 2022, NordVPN announced a new feature called Meshnet, allowing users to connect directly to other devices instead of routing their traffic through a VPN server, solidifying the company's stance as an industry leader.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Number of Cyber-Attacks

- 5.1.2 Increasing Adoption of VPN Solutions Across Multiple Business Verticals

- 5.2 Market Restraints

- 5.2.1 Lack of VPN Standardization and Data Protection

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software & Services

- 6.2 By Type

- 6.2.1 Hosted

- 6.2.2 IP

- 6.2.3 MPLS

- 6.2.4 Cloud

- 6.2.5 Mobile

- 6.3 By End-user Industry

- 6.3.1 BFSI

- 6.3.2 Healthcare

- 6.3.3 IT

- 6.3.4 Government

- 6.3.5 Manufacturing

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 The United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Australia

- 6.4.3.5 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Mexico

- 6.4.4.2 Brazil

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East & Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 Rest of Middle-East & Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Microsoft Corporation

- 7.1.2 Cisco Systems Inc.

- 7.1.3 Check Point Software Technologies Limited

- 7.1.4 Radio IP Software Inc.

- 7.1.5 IBM Corporation

- 7.1.6 NetMotion Software Inc.

- 7.1.7 Golden Frog GmbH

- 7.1.8 Avast Software S.R.O.

- 7.1.9 CyberGhost S.A. (Kape Technologies PLC)

- 7.1.10 Array Networks Inc.

- 7.1.11 Citrix Systems Inc.