|

市場調查報告書

商品編碼

1433779

資料中心轉型:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Data Center Transformation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

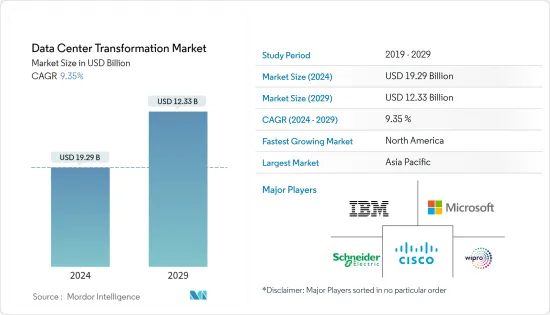

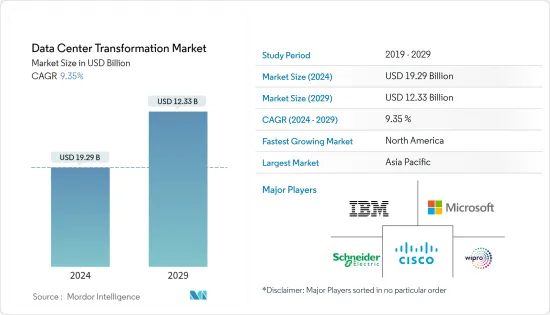

資料中心轉型市場規模預計2024年為192.9億美元,預計2029年將達到123.3億美元,預測期內(2024-2029年)複合年成長率為9.35%,預計還會成長。

世界各地的資料中心供應商正在逐步進行資料中心轉型,以降低營運成本,同時提高整體效率。作為數位轉型策略的一部分,各公司迅速採用雲端、物聯網 (IoT) 和巨量資料分析,這也增加了資料中心的負擔,導致全球資料中心的成長。

主要亮點

- 此外,思科預測,鑑於通訊設備的成長以及越來越多的公司轉向基於軟體即服務(SaaS)的應用程式,全球資料中心流量也將增加,從而推動市場發展。

- 隨著可靠性的提高和全球資料中心數量的增加,資料中心供應商發現很難保持一致性和營運效率。

- 許多依賴數位基礎設施的產業對資料中心服務的需求不斷增加,因此對資料中心網路服務的需求也不斷增加。隨著世界各地越來越多的企業和教育機構使用網際網路,對資料中心的需求也在增加,並且必須提供必要的程序可用性和資料安全性。

- 能源效率也是資料中心的重要考慮因素,因為能源佔總成本的近 40%(根據網路戰略和技術公司 Ciena 的數據)。鑑於人們嘗試提高能源效率作為降低成本的措施,作為資料中心轉型一部分的基礎設施管理預計將在未來幾年獲得關注。

- 資料中心轉型市場受到了 COVID-19 大流行的正面影響。人們越來越認知到雲端運算在提供高度安全可靠的IT基礎設施所帶來的好處,以及對建置本地資料中心的需求不斷成長,也正在推動資料中心的成長。

資料中心轉型市場趨勢

電子商務資料庫的重要性日益增加,預計將顯著成長。

- 對於電子商務公司來說,資料中心提供了許多巨大的好處。他們還需要利用收集的資料提供非常有用的客戶見解並最佳化業務流程。

- 電子商務資料庫日益重要,已成為全球資料中心擴張的關鍵驅動力。在網路上銷售的公司使用資料中心來儲存和傳輸這些資料集,以執行各種組織任務,例如品牌推廣和促銷。

- 捕獲電子商務資料使線上零售商能夠監控電子商務的各個要素,包括分析和客戶資訊。此外,新興國家數位轉型的持續推進預計將推動資料中心市場的成長。

- 因此,資料中心市場受到中國、印度等新興經濟體的極大刺激。在數位轉型的這一階段,技術進步正在開發高效的資料中心和相關解決方案。

北美佔最大市場佔有率

- 根據中國網際網路絡資訊中心(CNNIC)的數據,北美地區佔據全球雲端和網際網路資料中心最大的市場佔有率。如此高的佔有率也歸因於許多大公司的總部都設在該地區。

- 北美也對 IT、BFSI、零售和醫療保健等各個最終用戶產業的全球資料中心需求做出了重大貢獻。

- 聯邦政府的資料中心最佳化舉措(DCOI)主要旨在鼓勵資料中心營運商整合低效率基礎設施,最佳化現有設施,實現成本節約,創造更有效率的基礎設施。

- 對可靠性和永續性的日益關注要求資料中心所有者和營運商探索燃料電池能源儲存等最尖端科技。由於加密貨幣挖礦這一相對較新的需求來源,為似乎不適合現代主機代管的舊資產帶來了新的機會。

- 概括這項聲明,政府打算透過這項舉措在本財政年度結束時將實體資料中心成本降低至少 25%。這種區域市場主導地位,加上對降低營運成本日益成長的需求,為資料中心轉型解決方案的採用提供了空間,並推動了市場的發展。

資料中心轉型產業概述

資料中心改造市場是一個半獨立市場,不僅在國內市場,在國際市場也有很多參與者。市場集中度中等,主要企業均採取產品設計創新策略。市場上主要企業包括 IBM 公司、思科系統公司和 Wipro。

2023 年 9 月,Schneider ElectricSE 與投資者合作宣布與 Compass Datacenters 達成價值 30 億美元的多年期協議。該協議整合了兩家公司的供應鏈,並擴展了雙方現有的製造和交付預製模組化資料中心解決方案的關係。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場動態

- 市場促進因素

- 降低資料中心成本並提高效率的需要

- 採用雲端基礎的服務

- 電子商務資料庫的重要性日益增加,預計將顯著成長

- 市場限制因素

- 投資低載入資料中心的投資報酬率問題

第6章市場區隔

- 按服務

- 綜合服務

- 最佳化服務

- 自動化服務

- 基礎設施管理

- 按資料中心級別

- 1層級

- 2層級

- 3層級

- 4層級

- 按最終用戶

- 資料中心提供者

- 企業

- 資訊科技/通訊

- BFSI

- 衛生保健

- 零售

- 製造業

- 航太,國防與情報

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- IBM Corporation

- Cisco Systems, Inc.

- NetApp, Inc.

- NTT Communications

- Dell EMC(Dell Inc.)

- Microsoft Corporation

- Schneider Electric SE

- HCL Technologies Limited

- Accenture plc

- Wipro Technologies

- Hitachi Vantara Federal, Corporation

- Emerson Network Power, Inc

第8章投資分析

第9章 市場機會及未來趨勢

The Data Center Transformation Market size is estimated at USD 19.29 billion in 2024, and is expected to reach USD 12.33 billion by 2029, growing at a CAGR of 9.35% during the forecast period (2024-2029).

Data center providers across the globe are gradually moving towards data center transformation in order to increase overall efficiency whilst reducing operational costs. Owing to the rapidly rising adoption of cloud, Ineternet of Things (IoT), and big data analytics across various enterprises as a part of their digital transformation strategy, the burden on the data centers is also increasing, leading to the growth in the data centers globally.

Key Highlights

- Moreover, data center traffic across the world is also increasing, considering the number of increasing communicating devices and more enterprises switching to software-as-a-service (SaaS)-based applications, as forecasted by Cisco, which will also drive the market.

- With the increasing reliability and the increase in the number of data centers around the world, data center providers are finding it difficult to maintain consistency and operational efficiency

- Demand for data center services increased in many sectors which are dependent on digital infrastructures and this has resulted in an increase in the demand for Data Center Network Services. The need for data centres is increasing as a result of the rising number of enterprises and education institutions around the world who are Internet based, which means that they have to provide required program availability and data security.

- Energy efficiency considerations are also gaining importance among data centers since energy accounts for almost 40% of total costs (according to network strategy and technology company Ciena). Infrastructure management, as a part of the data center transformation, is expected to gain traction over the years, considering the attempt to increase energy efficiency as a cost-saving measure.

- The market for data center transformation was positively affected by the COVID 19 pandemic. Increasing awareness of the advantages provided by cloud computing to deliver a high security, reliable IT infrastructure and growing demand for building local data centres has also helped drive Data Centres growth.

Data Center Transformation Market Trends

Increasing Significance of E-commerce Databases are Expected to Grow at a Significant Rate

- For e commerce companies, data centres offer a number of significant advantages. In addition, they need to take advantage of the data that they collect and use it for extremely useful customer insights and business process optimisation.

- The growing importance of e commerce databases is the key driver for expanding data centres around the world. In order to store and transfer these data sets for a variety of organizational tasks, e.g. branding, promotion or anything like that, Data Centres are being used by businesses selling on the Internet.

- Through the acquisition of e-commerce data, online retailers monitor all the many components of their e-commerce, such as analytics or customer information. It is also expected that rising digital transformation in emerging nations fuels data centre market growth.

- Consequently, the market for data centres has been significantly stimulated by developing economies like China and India. At this phase of digital transformation, efficient data centers and related solutions are being developed due to the evolution of technology.

North America Occupies the Largest Market Share

- The North American region holds the largest market share of the global cloud and internet data centers, according to China Internet Network Information Center (CNNIC). This high share can also be because many major players are headquartered in this region.

- North America also contributes substantially to the global data center demand from various end-user industries such as IT, BFSI, retail, and healthcare.

- The Federal government's Data Center Optimization Initiative (DCOI) primarily aims to encourage data center players to consolidate the inefficient infrastructure, optimize existing facilities, achieve cost savings, and transition to a more efficient infrastructure.

- Due to the increased focus on dependability and sustainability, data center owners and operators must investigate cutting-edge technologies like fuel-cell energy storage. Older assets that might be deemed unsuitable for modern colocation are receiving new opportunities thanks to cryptocurrency mining, a comparatively recent source of demand.

- To generalize the statement, through this initiative, the government intends to reduce the costs of physical data centers by a minimum of 25% by the end of the fiscal year. The dominance of this region in the market, combined with the increasing need to reduce operational costs, provides scope for adopting data center transformation solutions, hence driving the market.

Data Center Transformation Industry Overview

The data center transformation market is semi-conslidated owing to the presence of many players in the market operating in the domestic as well as the international market. The market is moderately concentrated, with key players adopting product and design innovation strategies. Some of the major players in the market are IBM Corporation, Cisco Systems, Inc., and Wipro, among others.

In September 2023 - Schneider Electric SE announced at its Collobration with investors a USD 3 billion multi-year agreement with Compass Datacenters. The agreement extends the companies' existing relationship that integrates their respective supply chains to manufacture and deliver prefabricated modular data center solutions.

In October 2022, Kyndryl announced a comprehensive hybrid cloud solution in collaboration with Dell Technologies and Microsoft Corporation. This solution empowers clients in data center, remote, and mainframe environments to expedite their cloud transformation journey by leveraging the infrastructure offered by Dell, Kyndryl's managed services, and Microsoft Azure.

In January 2022, IBM launched the IBM Z and Cloud Modernization Center to facilitate the adoption of hybrid clouds. The center serves as a digital gateway to a wide range of tools, resources, training, and ecosystem partners, assisting IBM Z clients in accelerating the digitization of their applications, processes, and data in a hybrid cloud environment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Need to Reduce Costs and Increase Efficiency of Data Centers

- 5.1.2 Adoption of Cloud-based Services

- 5.1.3 Increasing Significance of E-commerce Databases are Expected to Grow at a Significant Rate

- 5.2 Market Restraints

- 5.2.1 ROI Concerns Over the Investment across Low Load Data Centers

6 MARKET SEGMENTATION

- 6.1 By Services

- 6.1.1 Consolidation Services

- 6.1.2 Optimization Services

- 6.1.3 Automation Services

- 6.1.4 Infrastructure Management

- 6.2 By Level of Data Center

- 6.2.1 Tier 1

- 6.2.2 Tier 2

- 6.2.3 Tier 3

- 6.2.4 Tier 4

- 6.3 By End User

- 6.3.1 Data Center Providers

- 6.3.2 Enterprises

- 6.3.2.1 IT and Telecom

- 6.3.2.2 BFSI

- 6.3.2.3 Healthcare

- 6.3.2.4 Retail

- 6.3.2.5 Manufacturing

- 6.3.2.6 Aerospace, Defense, and Intelligence

- 6.3.2.7 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Cisco Systems, Inc.

- 7.1.3 NetApp, Inc.

- 7.1.4 NTT Communications

- 7.1.5 Dell EMC (Dell Inc.)

- 7.1.6 Microsoft Corporation

- 7.1.7 Schneider Electric SE

- 7.1.8 HCL Technologies Limited

- 7.1.9 Accenture plc

- 7.1.10 Wipro Technologies

- 7.1.11 Hitachi Vantara Federal, Corporation

- 7.1.12 Emerson Network Power, Inc