|

市場調查報告書

商品編碼

1433806

富勒烯:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Fullerene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

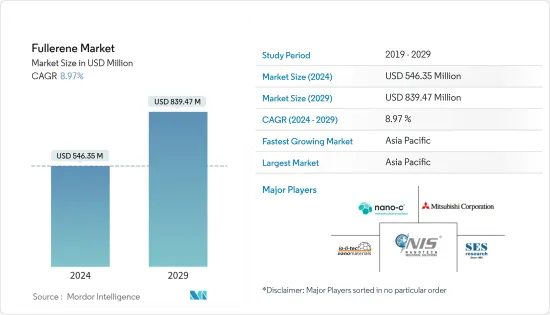

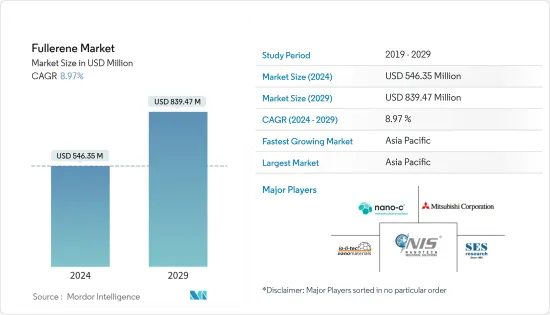

富勒烯市場規模預計到2024年為5.4635億美元,預計到2029年將達到8.3947億美元,在預測期內(2024-2029年)複合年成長率為8.97%。

2020 年,市場受到了 COVID-19 封鎖的負面影響。然而,過去兩年,市場勢頭強勁,並出現復甦跡象。

主要亮點

- 製藥業對富勒烯的需求不斷增加,由於強大的金屬基質而滲透到表面塗層行業,以及作為光學限制對富勒烯的需求不斷增加,預計將在預測期內推動市場發展。

- 然而,與內部富勒烯和造成環境污染的有毒奈米化合物相關的高成本和複雜製造將阻礙預測期內的市場成長。

- 其減少氧化壓力的特性延長了其永久應用的壽命,並且其在化妝品中作為細胞保護劑的使用可能是預測期內的市場機會。

- 亞太地區主導全球市場,其中中國、日本和印度是最大的消費國。

富勒烯市場趨勢

醫療和製藥業的需求增加。

- 在醫療和製藥行業,富勒烯可用於在靜脈或皮下注射後識別體內的特定細胞或區域。

- 當一個人接觸某物時,釋放介質的肥大細胞會引起過敏反應。為了抑制此類過敏反應,可以使用直接作用於肥大細胞的富勒烯衍生物。

- 由於其高電子親和性和共軛雙鍵,富勒烯也是令人驚奇的抗氧化劑。富勒烯作為細胞保護劑,也可以防止紫外線。富勒烯的這些特性使其成為各種製藥和醫療應用的理想選擇。

- 根據Astra Zeneca報告,到 2026 年,全球整體藥品銷售額預計將達到 2.25 兆美元。美國擁有龐大的醫藥產業,在全球醫藥市場佔有很大佔有率。

- 2022 年,美國藥品總銷售額為 6,050 億美元,而 2021 年為 5,560 億美元。 2022 年,美國佔全球銷售額的 49.8%,而 2021 年為 49.7%。

- 在亞太地區,中國是最大的醫藥市場之一。根據Astra Zeneca報告,到2026年,該國藥品銷售額預計將達到1,890億美元,增加了對高效藥物的需求。

- 因此,預計醫療和製藥行業的此類趨勢將在預測期內推動富勒烯市場。

亞太地區主導市場

- 隨著中國、印度和日本等國家航太、國防、電子、醫療和製藥業的發展,亞太地區對富勒烯的需求呈指數級成長。

- 未來20年,中國可望成為全球最大的民航機生產單一國家市場。根據波音《2022-2041年商業展望》,到2041年,中國將交付約8,485架新飛機,市場服務價值將達到5,450億美元。

- 此外,到 2041 年,東南亞將交付約 4,255 架新飛機,市場服務價值將達到 2,450 億美元。在東南亞地區,由於這些新的交付,研究市場的需求預計將會增加。

- 印度啟動了一項綜合計劃,以發展國內半導體和顯示器製造生態系統。政府宣布支出 7,600 億印度盧比(約 100 億美元)。政府將為設立顯示器工廠和半導體工廠提供計劃成本50%的財政支持,為化合物半導體工廠提供資本支出50%的財政支持。

- 所有上述因素,加上政府政策,預計將在整個預測期內推動該地區對富勒烯的需求。

富勒烯產業概況

富勒烯市場高度整合,主要企業持有大量佔有率。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 製藥業的使用量增加

- 以強大的金屬基質滲透表面塗層產業

- 對富勒烯作為光學限制的需求不斷成長

- 其他司機

- 抑制因素

- 內嵌富勒烯的製造複雜性高

- 有毒奈米化合物造成環境污染

- 其他阻礙因素

- 價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔(以金額為準的市場規模)

- 產品類別

- C60

- C70

- C76

- 其他

- 最終用戶產業

- 電力/電子

- 醫療/製藥

- 航太/國防

- 能源

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)/排名分析

- 主要企業策略

- 公司簡介

- NanoMaterials, Ltd.

- IoLiTec-Ionic Liquid Tecgnologies GmbH

- Luna Industries Incorporated

- Mitsubishi Corporation

- Nano-C

- Nanotech Industrial Solutions

- SES Research Inc.

- POWDER NANO

- Nanografi Nano technology

第7章 市場機會及未來趨勢

The Fullerene Market size is estimated at USD 546.35 million in 2024, and is expected to reach USD 839.47 million by 2029, growing at a CAGR of 8.97% during the forecast period (2024-2029).

The market was negatively impacted by the lockdowns caused by Covid-19 in the year 2020. However, in the past two years, the market has gained momentum and is showing signs of recovery.

Key Highlights

- Increasing demand for fullerene from the pharmaceutical industry, penetration in the surface coatings industry due to strong metal matrix, and growing demand for fullerene as an optical limiter are expected to drive the demand for the market, during the forecast period.

- However, the high cost and complex production associated with endohedral fullerenes and toxic nano-compounds creating environmental pollution will hinder the market growth during the forecast period.

- Growing application in perpetuating life due to its property of reducing oxidative stress and usage in cosmetics as a cytoprotector are likely to act as an opportunity for the market over the forecast period.

- Asia-Pacific dominated the market across the world, with the largest consumption coming from China, Japan, and India.

Fullerene Market Trends

Increasing Demand from Medical and Pharmaceutical Industry.

- In the medical and pharmaceutical industries, after an intravenous or subcutaneous injection, fullerenes can be used to locate specific cells and areas in the body.

- Mast cells which release mediators when a person comes into contact with something lead to allergic reactions. To control such allergic reactions, fullerene derivatives can be used by having a direct effect on the mast cells.

- Fullerenes are also amazing antioxidants owing to their high electron affinity and conjugated double bonds. Acting as cytoprotectants, fullerenes can also protect against ultraviolet radiation. Such properties of fullerenes make them an ideal choice for various pharmaceutical and medical applications.

- According to AstraZeneca report estimates, the estimated pharmaceutical sales globally will account for USD 2.025 trillion by the year 2026. The United States boasts a colossal pharmaceutical industry that holds a lion's share in the global pharmaceutical market.

- In the year 2022, the value of total sales of pharmaceutical products in the United States was USD 605 billion, while in the year 2021, it was USD 556 billion. The United States accounted for 49.8% of global sales in the year 2022 while in the year 2021, it was 49.7%.

- In the Asia-Pacific, China is one of the largest markets for pharmaceutical products. By the year 2026, according to the AstraZeneca report, the estimated pharmaceutical sales in the country will be worth USD 189 billion hence increasing the demand for efficient medicines.

- Hence, such trends in the medical and pharmceutical industry are expected to drive the market for fullerens over the forecast period.

Asia-Pacific Region to Dominate the Market

- With the growth of industries like aerospace, defense, electronics, medical, and pharmaceutical in the countries, such as China, India, and Japan, the demand for fullerene in the Asia-pacific region is growing drastically.

- Over the next 20 years, China is expected to be the world's largest singlecountry market for civil aircraft production. In China, according to the Boeing Commercial Outlook 2022-2041, around 8,485 new deliveries will be made by 2041 with a market service value of USD 545 billion.

- Moreover, in Southeast Asia, around 4,255 new deliveries will be made by 2041 with a market service value of USD 245 billion. Owing to such new deliveries in the Southeast Asian region, the demand for the studied market is likely to rise.

- India launched a comprehensive program for the development of semiconductors and display manufacturing ecosystems in the country. The government announced an outlay of INR 76 thousand crore (~USD 10 billion). Fiscal support of 50% of the project cost is provided by the government to set up display fabs, and semiconductor fabs, and fiscal support of 50% of capital expenditure for compound semiconductors fab.

- All the aforementioned factors, coupled with government policies, are expected to drive the demand for fullerene through the forecast period in the region.

Fullerene Industry Overview

The fullerene market is highly consolidated with the top players accounting for a major share of the market. Some of the top players (not in any particular order) in the fullerene market include Nano-C, SES Research Inc., IoLiTec Ionic Liquids Technologies GmbH, Nanotech Industrial Solutions, and Mitsubishi Corporation amongst others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increased usage in the Pharmaceutical Industry

- 4.1.2 Penetration in Surface Coatings Industry due to Strong Metal Matrix

- 4.1.3 Growing Demand of Fullerene as an Optical Limiter

- 4.1.4 Other Drivers

- 4.2 Restraints

- 4.2.1 High Manufacturing Complexity of Endohedral Fullerene

- 4.2.2 Toxic Nano-compounds Creating Environmental Pollution

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 C60

- 5.1.2 C70

- 5.1.3 C76

- 5.1.4 Other Product Types

- 5.2 End-user Industry

- 5.2.1 Electrical and Electronics

- 5.2.2 Medical and Pharmaceuticals

- 5.2.3 Aerospace and Defense

- 5.2.4 Energy

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 NanoMaterials, Ltd.

- 6.4.2 IoLiTec - Ionic Liquid Tecgnologies GmbH

- 6.4.3 Luna Industries Incorporated

- 6.4.4 Mitsubishi Corporation

- 6.4.5 Nano-C

- 6.4.6 Nanotech Industrial Solutions

- 6.4.7 SES Research Inc.

- 6.4.8 POWDER NANO

- 6.4.9 Nanografi Nano technology

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Application in Perpetuating Life due to its Property of Reducing Oxidative Stress

- 7.2 Usage in Cosmetics as a Cytoprotector

- 7.3 Other Opportunities