|

市場調查報告書

商品編碼

1433848

人數統計系統:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)People Counting System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

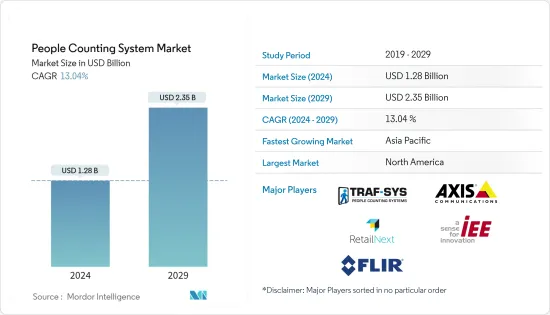

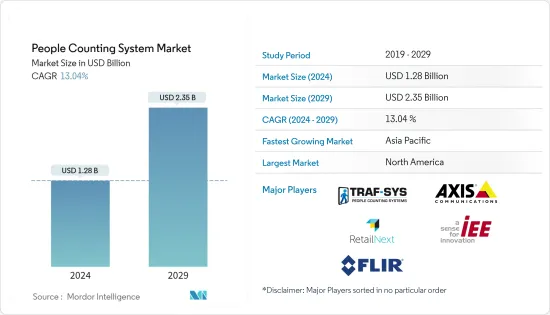

人數統計系統市場規模預計到 2024 年為 12.8 億美元,預計到 2029 年將達到 23.5 億美元,在預測期內(2024-2029 年)複合年成長率為 13.04%。

物聯網和雲端服務的整合促進建築安全,將增加對人數統計系統的需求。近年來,由於商場、活動和俱樂部中恐怖主義和暴力行為的增加,由於政府的法規和命令,此類設備的引入增加。

主要亮點

- 該系統幾乎在每個領域都獲得了市場關注,但零售和商業空間往往佔據市場主導地位。超級市場、購物中心和零售店數量的不斷增加正在推動全球人流統計技術的採用。

- 在零售商店中,這些系統用於計算轉換率、人員規劃,從而提高行銷效率。也用於商場、演唱會等人員密集場所的人群控制,除了人群控制外,也用於監控人流量大的區域。

- 另一方面,電子商務行業的快速成長和線上銷售管道的擴張對實體店構成重大威脅,並對市場成長產生負面影響。

人數統計系統市場趨勢

零售業主導市場

- 隨著先進技術的出現,零售業正在蓬勃發展,零售商店正在利用技術解決方案來最佳化業務、提高客戶滿意度並提高盈利。

- 人數統計設備可協助零售商記錄客流量、轉換率和銷售損失。透過比較這些數字,管理者可以確定消費者的行為模式。這些功能可協助您有效地設計新的行銷宣傳活動或規劃新產品發布。

- 這些設備還可以幫助商店經理改善店內營運,例如人員、客戶服務和產品補貨。除了計算客流量外,商店經理還可以有效管理人群。這些因素是預計在預測期內刺激零售業市場成長的主要因素。

- 然而,電子商務領域的大規模成長和各種網路購物網站的崛起預計將阻礙市場成長,因為預計這將減緩人員聚合設備的採用。

亞太地區預計將大幅成長

- 預計亞太地區的人數統計系統採用率將創下最高成長率,這主要是由於零售店、超級市場、購物中心等的增加。此外,印度政府支持外國零售商的努力也導致亞太地區零售店數量的增加。

- 此外,客運站、機場和火車站等基礎設施以及許多即將實施的計劃正在支持人數統計系統的實施。酒店業的擴張也推動了該地區的市場成長。

- 不斷加快的都市化、不斷成長的中階人口以及不斷變化的消費者消費習慣正在推動亞太地區零售業的成長。因此,人數統計系統市場的許多參與者都在該地區進行投資,因為零售業是人數統計系統的主要最終用戶之一。

人數統計系統產業概況

人數統計系統市場適度整合,參與者數量有限,集中在少數國家。這些參與者正在採取各種成長策略,例如併購、新產品發布、業務擴張、合資企業和聯盟,以增強市場佔有率。產品創新和技術進步對於維持市場地位至關重要。市場參與者正致力於透過合作和合併來實現投資組合多元化,以加強其市場地位。

- 2019 年 6 月 - FLIR Systems, Inc. 最近發布了 FLIR TrafiData熱感熱交通感測器解決方案,該解決方案具有改進的資料收集功能,可為交通管理提供關鍵見解,打造更智慧、更安全的城市。

- 2019 年 4 月 - 安訊士通訊推出一款經濟實惠的迷你半球,具有全高清和內建紅外線功能,適合室內和室外使用。 AXIS Companion Dome mini LE 是 AXIS Companion 的最新成員,AXIS Companion 是完整的端對端解決方案,可簡化小型企業的專業級視訊監控。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 刺激建築安全的安全、恐怖主義和威脅風險

- 整合物聯網和雲端服務

- 市場限制因素

- 電子商務的成長對市場產生負面影響

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- 有線

- 無線的

- 熱感成像

- 其他

第5章市場區隔

- 按類型

- 硬體

- 軟體服務

- 按最終用戶應用程式

- 款待

- 零售

- 運輸

- BFSI

- 體育/娛樂

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 世界其他地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第6章 競爭形勢

- 公司簡介

- FLIR Systems, Inc.

- IEE SA

- Axis Communications AB

- RetailNext Inc.

- Traf-Sys Inc.

- HELLA Aglaia Mobile Vision GmbH

- Iris GmbH

- ShopperTrak

- InfraRed Integrated Systems Ltd.

- Eurotech SPA

- SensMax

第7章 投資分析

第8章 市場機會及未來趨勢

The People Counting System Market size is estimated at USD 1.28 billion in 2024, and is expected to reach USD 2.35 billion by 2029, growing at a CAGR of 13.04% during the forecast period (2024-2029).

With the integration of IoT and cloud services for stimulating the building security is likely to augment the demand for people counting systems. The deployment of such devices has increased in recent years due to the government rules and mandates owing to the increase in acts of terrorism and violence in malls, events, and clubs.

Key Highlights

- This system has gained market traction in almost all sectors; however, retail and commercial spaces tend to dominate the market. The rising number of supermarkets, shopping malls, and retail stores are boosting the adoption of people counting technologies worldwide.

- In retail stores, these systems are deployed to calculate the conversion rates, staff planning, and hence enhance marketing effectiveness. It is also used for crowd management in crowded places such as shopping malls and concerts, where other than crowd management it is also used for monitoring high-traffic areas.

- On the other hand, the massive growth in the e-commerce industry and the expanding online sales channel pose a significant threat to the brick and mortar stores, which in turn is adversely affecting the growth of the market.

People Counting System Market Trends

Retail Sector to Dominate the Market

- As the retail sector is booming with the advent of advanced technologies, the retail stores are leveraging technological solutions to optimize operations, improve customer satisfaction, and boost profitability, hence driving the need for people counting systems.

- People counting devices helps retailers record the number of footfalls, conversion rates, lost sales opportunities. The managers can then compare these numbers and hence determine the pattern in consumer behavior. These features help them devise a new marketing campaign or plan a new product launch effectively.

- These devices also help the store managers to improve in-store operations like staffing, customer service, and product restocking. Apart from calculating footfall, the store managers are also able to manage the crowd effectively. These factors are the major factors expected to stimulate market growth in the retail sector in the forecast period.

- However, the massive growth in the e-commerce sector and the rise of various online shopping websites is expected to hinder the market growth as it is expected to slow down the adoption of the people counting devices.

Asia-Pacific Expected to Grow Significantly

- The Asia-Pacific region is expected to register the highest growth rate in terms of adoption of the people counting systems primarily due to the increasing number of retail stores, supermarkets, shopping malls, etc. Furthermore, government initiatives in favor of foreign retailers in India are also leading to the rising number of retail stores in the Asia-Pacific.

- Moreover, the presence of infrastructures such as bus stations, airports, and train stations, coupled with many upcoming projects, are triggering the deployment of people counting systems. Also, the expansion of the hospitality industry is facilitating the growth of the market in the region.

- Increasing urbanization, growing middle-class population, and changes in the spending habits of consumers have propelled the growth of the retail sector in APAC. This has led many players in the people counting system market to invest in this region as the retail sector is one of the major end-users of people counting systems.

People Counting System Industry Overview

The people counting system market is moderately consolidated due to the presence of a limited number of players concentrated in a few countries. These players have adopted various growth strategies such as mergers & acquisitions, new product launches, expansions, joint ventures, and partnerships, to strengthen their market share. Product innovation and technological advancements are most to stay relevant in the market. The market players are focusing on portfolio diversification through partnerships and mergers to strengthen their position in the market.

- June 2019 - FLIR Systems, Inc. recently announced the FLIR TrafiData intelligent thermal traffic sensor solution for improved data collection capabilities to offer transportation management with critical insights for smarter, safer cities.

- April 2019 - Axis Communications is launching an affordable mini dome with full HD and built-in IR for both indoor and outdoor use. AXIS Companion Dome mini LE is the latest member of AXIS Companion, which is a complete end-to-end solution that simplifies professional-level video surveillance for small businesses.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Security, Terrorism and Threats Risks Stimulating Building Security

- 4.2.2 Integration of IoT and Cloud Services

- 4.3 Market Restraints

- 4.3.1 Growth of E-commerce has Negatively Impacted the Market

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technology Snapshot

- 4.6.1 Wired

- 4.6.2 Wireless

- 4.6.3 Thermal Imaging

- 4.6.4 Other Technology

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Hardware

- 5.1.2 Software & Services

- 5.2 By End-user Application

- 5.2.1 Hospitality

- 5.2.2 Retail

- 5.2.3 Transportation

- 5.2.4 BFSI

- 5.2.5 Sports & Entertainment

- 5.2.6 Other End-user Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Latin America

- 5.3.4.2 Middle-East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 FLIR Systems, Inc.

- 6.1.2 IEE SA

- 6.1.3 Axis Communications AB

- 6.1.4 RetailNext Inc.

- 6.1.5 Traf-Sys Inc.

- 6.1.6 HELLA Aglaia Mobile Vision GmbH

- 6.1.7 Iris GmbH

- 6.1.8 ShopperTrak

- 6.1.9 InfraRed Integrated Systems Ltd.

- 6.1.10 Eurotech SPA

- 6.1.11 SensMax