|

市場調查報告書

商品編碼

1273424

石蠟市場 - 增長、趨勢、COVID-19 影響和預測 (2023-2028)Paraffin Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預計在預測期內,石蠟市場的複合年增長率將超過 3%。

主要亮點

- COVID-19 對 2020 年的市場產生了負面影響。 根據國際汽車製造商組織(OICA)的數據,2019 年全球汽車銷量約為 9042 萬輛,2020 年達到約 7797 萬輛,下降 13.8%。 然而,在食品和電子商務應用中越來越多地使用基於石蠟的紙包裝增加了大流行後對石蠟的需求。

- 在短期內,亞太地區對蠟燭和包裝的需求不斷增長以及個人護理行業的增長正在推動市場增長。 在線美容消費的持續增長、社交網絡使用的增加、消費者對新產品和高端產品興趣的增加、城市化進程的加速以及中上階層人口的增長正在推動亞太地區個人護理行業的增長。它是主要的驅動市場的因素。

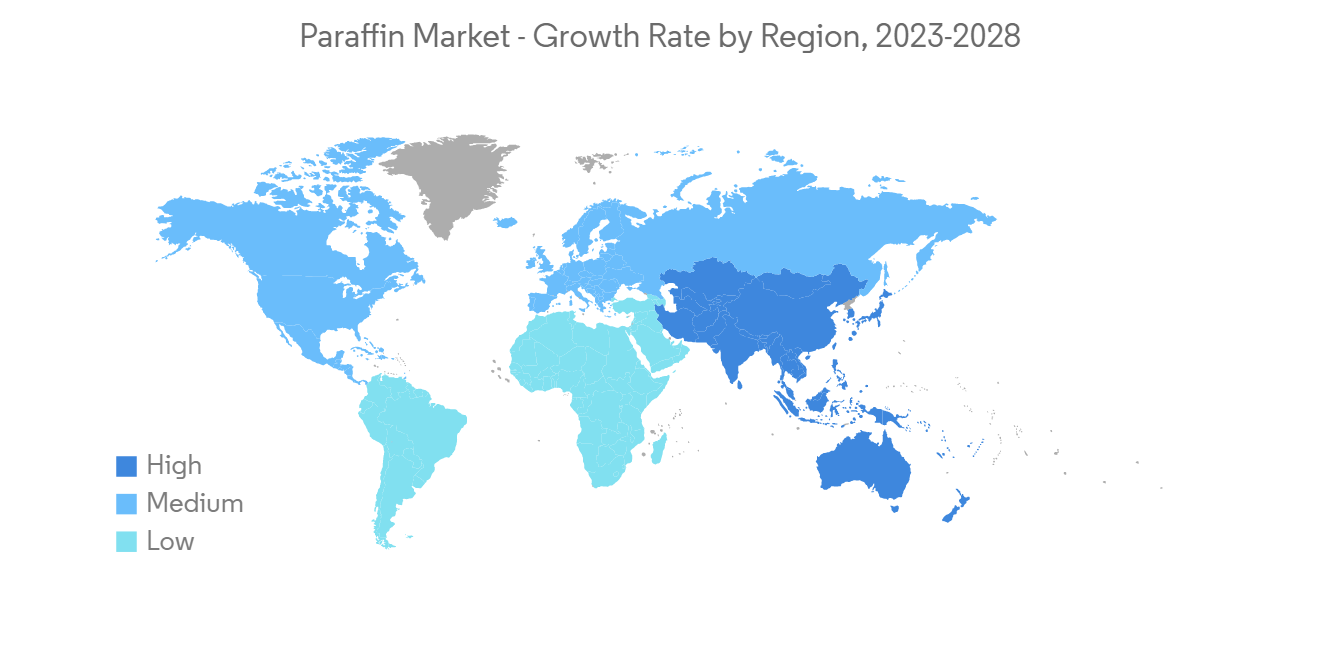

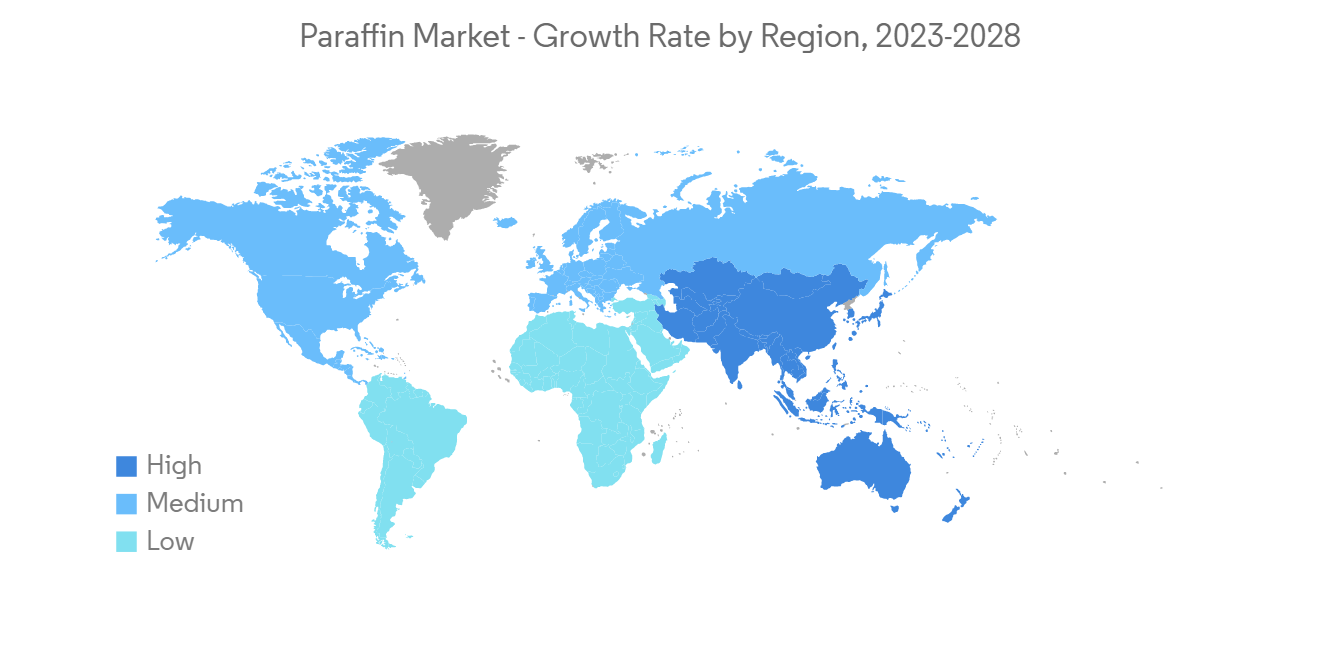

- 生物基產品的開發阻礙了市場增長。 熔模鑄造的增加預計將在未來幾年創造市場機會。 亞太地區主導市場,預計在預測期內復合年增長率最高。

石蠟市場趨勢

紙板和包裝應用的需求不斷擴大

- 石蠟非常適合軟包裝應用,因為石蠟和石蠟混合物可提供水分和油脂屏障以及光澤和保鮮密封。 使用該產品的主要優勢包括氣體和氣味阻隔(防止風味損失和污染)、提高工藝效率以及防水和防蒸汽。 此外,石油基產品具有成本效益和低粘度。 它還需要相對便宜的機器才能高速應用。

- 出於對儲存和運輸過程中的穩定性和美觀性的考慮,很大一部分工業產品都採用包裝形式提供。 皇冠軟木塞、抹布瓶蓋、塑料薄膜層壓板、牛皮紙、紙板和包裝機械是印度最大的出口產品,此外還有扁罐、印刷板材和零件。 印度增長最快的包裝類別是層壓包裝和軟包裝,尤其是 PET 和編織袋。

- 印度紙和紙板包裝市場在 2021 年的價值為 107.7 億美元,預計到 2027 年將達到約 156.9 億美元。 印度的包裝出口從 2018-19 年的 8.44 億美元增長到 2021-22 年的 11.19 億美元,複合年增長率 (CAGR) 為 9.9%。 美國仍然是包裝行業的主要出口目的地,其次是英國、阿聯酋、荷蘭和德國。

- 特別是在東歐和北美,生活水平的提高和購買收入的增加推動了對各種產品的需求,所有這些產品都需要包裝。 這導致對包裝的需求增加,從而導致石蠟消耗量增加。

- 包裝行業的大部分需求來自食品和飲料行業。 另一方面,醫療保健產品是折疊紙盒的最大用戶。 上述最終用戶部分預計將在預測期內增加對石蠟的需求。

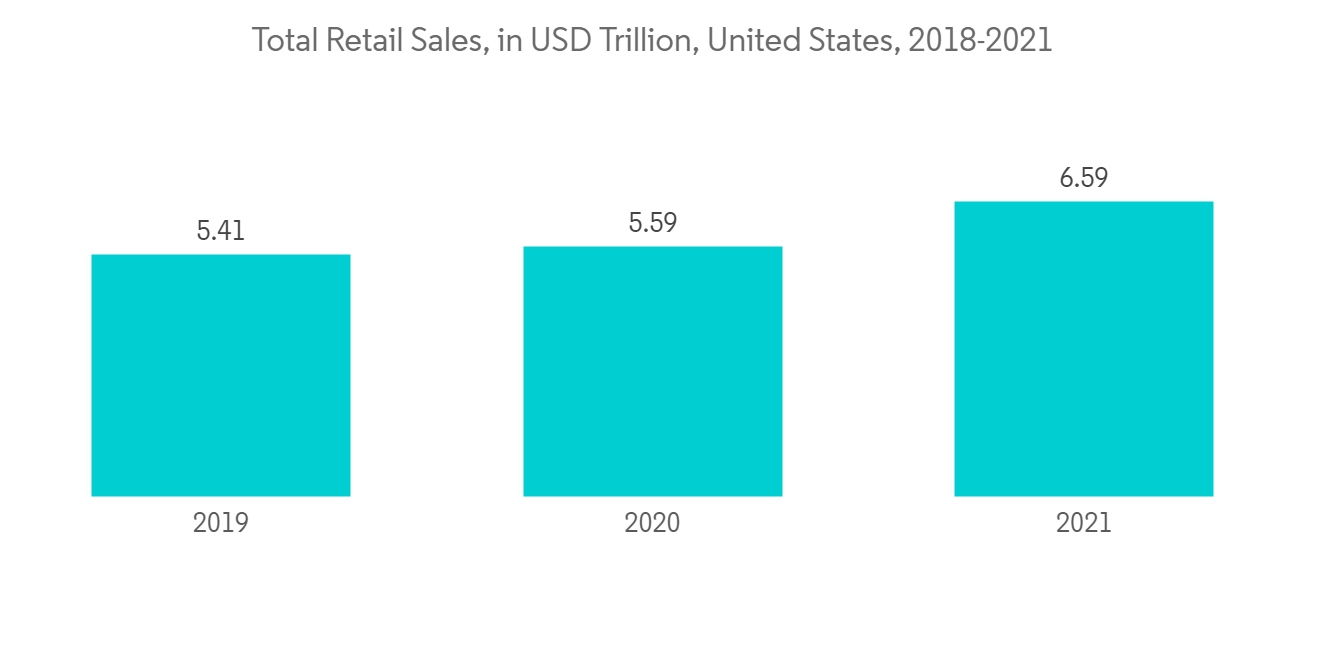

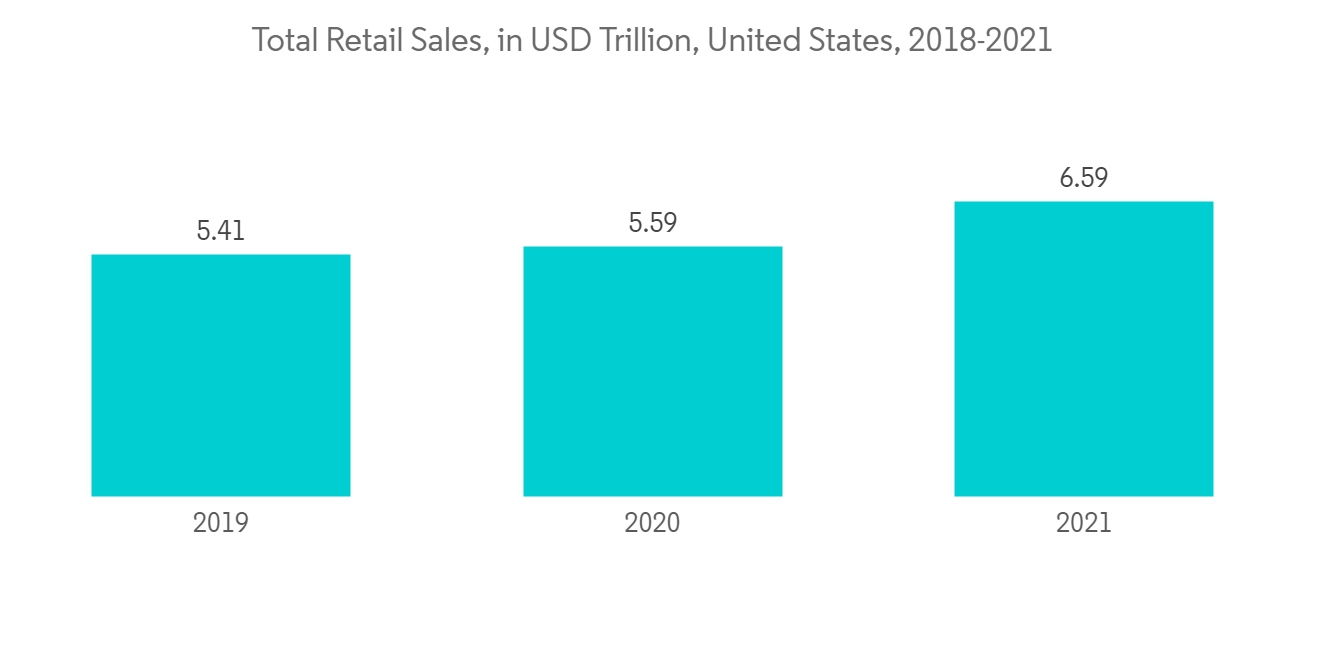

- 此外,北美是最大的紙板和包裝消費國之一。 根據包裝機械製造商協會 (PMMI) 飲料報告,北美飲料行業預計從 2018 年到 2028 年將增長 4.5%。 此外,根據美國零售聯合會 (NRF) 的數據,2020 年零售額將增長 7%,2021 年將增長 14% 以上。 到 2021 年底,美國零售總額將達到約 6.6 萬億美元。

- 由於這些因素,預計石蠟市場在預測期內將在全球範圍內增長。

亞太地區主導市場

- 亞太地區主導著全球石蠟市場,因為隨著人們對個人護理和生活質量的興趣提高,對蠟燭、紙板、包裝和化妝品等石蠟產品的需求也在增長。底部。

- 2021 年,亞太地區的潤滑油需求量最大。 2021年中國汽車銷量約為2608萬輛,較2020年的2522萬輛增長約3%。 這增加了對燃料和潤滑油的需求,這對石蠟的市場需求產生了積極影響。

- 據估計,2021 年中國美容和個人護理行業的價值將達到 510 億美元,到 2027 年將達到 729 億美元。 個人護理產品佔該收入的最大部分(超過 240 億美元),其次是護膚產品(140 億美元)。

- 根據印度包裝工業協會 (PIAI) 的數據,該行業的年增長率約為 22-25%。 印度的包裝行業在進出口方面有著良好的記錄,從而推動了技術和創新的增長,並為各個製造業增加了價值。 預計包裝行業的增長將在預測期內推動印度石蠟市場。

- 韓國是世界上最好的美容市場之一。 新的美容趨勢和創新不斷展示,以精緻的成分和美觀的包裝為特色。 2021年韓國美容及個護產品市場價值119億美元,預計2027年將達到1390萬美元,拉動市場需求。

- 因此,上述所有因素預計將在預測期內提振石蠟市場。

石蠟行業概覽

全球石蠟市場本質上是分散的。 主要公司包括沙索、埃克森美孚公司、朗盛、Eneos Corporation、中國石油化工集團公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查先決條件

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 主持人

- 對蠟燭和包裝的需求不斷擴大

- 亞太地區個人護理行業的發展

- 約束因素

- 開發生物基產品

- 行業價值鏈分析

- 行業吸引力 - 波特五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第 5 章市場細分

- 按類型

- 石蠟

- 液體石蠟

- 煤油

- 凡士林

- 通過使用

- 化妝品和個人護理

- 紙板/包裝

- 燃料

- 橡膠

- 潤滑劑

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 意大利

- 法國

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第六章競爭格局

- 併購、合資、合作、合同等。

- 市場份額 (%)**/排名分析

- 主要公司採用的策略

- 公司簡介

- Aromachimie Ltd

- Calumet Specialty Products Partners LP

- Cepsa

- China National Petroleum Corporation

- China Petroleum & Chemical Corporation

- ENEOS Corporation

- Exxon Mobil Corporation

- H&R GROUP

- HollyFrontier Refining & Marketing LLC

- Indian Oil Corporation Ltd

- Kemipex

- LANXESS

- NIPPON SEIRO CO. LTD

- PersiaParaffin

- Petrobras

- Repsol

- Sasol

- The International Group Inc.

第七章市場機會與未來趨勢

- 擴大熔模鑄造的使用

簡介目錄

Product Code: 64764

The paraffin market is projected to register a CAGR of over 3% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the market in 2020. According to Organisation Internationale des Constructeurs d'Automobiles (OICA), about 90.42 million vehicles were sold globally in 2019 and reached about 77.97 million in 2020, with a decline rate of 13.8%. However, the use of paper packaging based on paraffin has increased for food and e-commerce uses, which has increased the demand for paraffin post-pandemic.

- Over the short term, increasing demand for candles and packaging and the growing personal care industry in Asia-Pacific is driving the market growth. Continuous growth in online beauty spending, expanding use of social networks, increasing consumer interest in new and premium products, accelerating urbanization, and the growth of the upper-middle-class population are the major factors driving the paraffin market in the personal care industry in the Asia-Pacific region.

- The development of bio-based products is hindering the market's growth. Increasing investment casting will likely create market opportunities in the coming years. Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Paraffin Market Trends

Increasing Demand for the Paperboard and Packaging Application

- Paraffin wax finds applications in flexible packaging as paraffin and paraffin blends provide moisture and grease barriers along with gloss and freshness seals. The key benefits of using the product include its ability to provide a gas and odor barrier (preventing loss of flavor or contamination), improved process efficiency, and water and water vapor resistance. Besides, a product derived from petroleum is highly cost-effective and possesses low viscosity. It also needs relatively low-cost machinery for the application at high speeds.

- Due to the need for stability during storage and transportation and aesthetic considerations, a significant share of industrial products is offered in packaging. Crown corks, lug caps, plastic film laminates, craft paper, paper board, and packaging machinery are among India's top exports, along with flattened cans, printed sheets, and components. The fastest-growing packaging categories in India include laminates and flexible packaging, particularly PET and woven sacks.

- India's paper and paperboard packaging market was valued at USD 10.77 billion in 2021 and is expected to reach around USD 15.69 billion by 2027. The export of packaging materials from India grew at a compound annual growth rate (CAGR) of 9.9% to USD 1,119 million in 2021-22 from USD 844 million in 2018-19. The United States remains the major export destination for the packaging industry, followed by the United Kingdom, the UAE, the Netherlands, and Germany.

- The improvement in living standards and higher purchasing incomes, especially in eastern European and North American countries, has increased the demand for a broad range of products, all of which require packaging. Therefore, the demand for packaging is increasing, resulting in the increased consumption of paraffin.

- Most of the demand from the packaging segment is from the food and beverage industry. On the other hand, healthcare products are the largest users of folding cartons. The aforementioned end-user segments will likely boost the demand for paraffin during the forecast period.

- Furthermore, North America is one of the largest consumers of paperboard and packaging. According to Packaging Machinery Manufacturers Institute's (PMMI) Beverage Report, the North American beverage industry is expected to grow by 4.5% from 2018 to 2028. Additionally, according to the National Retail Federation (NRF), retail sales grew by 7% in 2020 and over 14% in 2021. By the end of 2021, total retail sales reached approximately USD 6.6 trillion in the United States.

- Due to all these factors, the paraffin market will likely grow globally during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific dominated the global paraffin market as the demand for paraffin-based products, like candles, paperboard, packaging, and cosmetics, is increasing with an increasing focus on personal care and quality of life.

- In 2021, the Asia-Pacific region accounted for the largest demand for lubricants. In 2021, around 26.08 million vehicles were sold in China compared to 25.22 million in 2020, witnessing an increasing growth rate of about 3%. This led to increased demand for fuel and lubricants, positively affecting the market demand for paraffin.

- The Chinese beauty and personal care industry was valued at USD 51 billion in 2021 and is estimated to reach USD 72.9 billion by 2027. Personal care products held the largest portion of this revenue (over USD 24 billion), followed by skin care products (USD 14 billion).

- According to the Packaging Industry Association of India (PIAI), the sector is growing rapidly at about 22-25% per annum. The Indian packaging industry has made a mark with its exports and imports, thus, driving technology and innovation growth and adding value to various manufacturing sectors. During the forecast period, growth in the packaging industry is expected to drive the paraffin market in India.

- South Korea has one of the world's most exceptional beauty markets. New beauty trends and innovations featuring sophisticated ingredients and aesthetically appealing packaging are constantly displayed. The South Korean beauty and personal care products market was valued at USD 11.9 billion in 2021, and it is expected to reach USD 13.9 million by 2027, which is likely to enhance the market demand.

- Therefore, all the above factors are expected to boost the paraffin market during the forecast period.

Paraffin Industry Overview

The global paraffin market is fragmented in nature. The major companies include Sasol, Exxon Mobil Corporation, Lanxess, Eneos Corporation, and China Petroleum & Chemical Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Candles and Packaging

- 4.1.2 Growing Personal Care Industry in the Asia-Pacific Region

- 4.2 Restraints

- 4.2.1 Development of Bio-based Products

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Type

- 5.1.1 Paraffin Wax

- 5.1.2 Liquid Paraffin

- 5.1.3 Kerosene

- 5.1.4 Petroleum Jelly

- 5.2 By Application

- 5.2.1 Cosmetics and Personal Care

- 5.2.2 Paperboard and Packaging

- 5.2.3 Fuel

- 5.2.4 Rubber

- 5.2.5 Lubricants

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 Asia Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aromachimie Ltd

- 6.4.2 Calumet Specialty Products Partners LP

- 6.4.3 Cepsa

- 6.4.4 China National Petroleum Corporation

- 6.4.5 China Petroleum & Chemical Corporation

- 6.4.6 ENEOS Corporation

- 6.4.7 Exxon Mobil Corporation

- 6.4.8 H&R GROUP

- 6.4.9 HollyFrontier Refining & Marketing LLC

- 6.4.10 Indian Oil Corporation Ltd

- 6.4.11 Kemipex

- 6.4.12 LANXESS

- 6.4.13 NIPPON SEIRO CO. LTD

- 6.4.14 PersiaParaffin

- 6.4.15 Petrobras

- 6.4.16 Repsol

- 6.4.17 Sasol

- 6.4.18 The International Group Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Use of Investment Casting

02-2729-4219

+886-2-2729-4219