|

市場調查報告書

商品編碼

1273544

尿醛樹脂市場 - 增長、趨勢、COVID-19 影響和預測 (2023-2028)Urea Formaldehyde Resins Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,全球尿醛樹脂市場的複合年增長率預計將超過 4.5%。

新冠疫情對尿醛樹脂市場產生了負面影響。 然而,在 COVID 之後,由於建築、汽車和農業行業的需求增加,該地區的粘合劑市場有望復蘇。

主要亮點

- 短期內,家具行業對刨花板的需求增加以及建築行業對中密度纖維板 (MDF) 的需求增加預計將推動市場增長。

- 與尿醛樹脂相關的健康危害以及 COVID-19 爆發造成的不利條件預計將阻礙市場增長。

- 建築和施工部門在市場上占主導地位,預計在預測期內會增長。

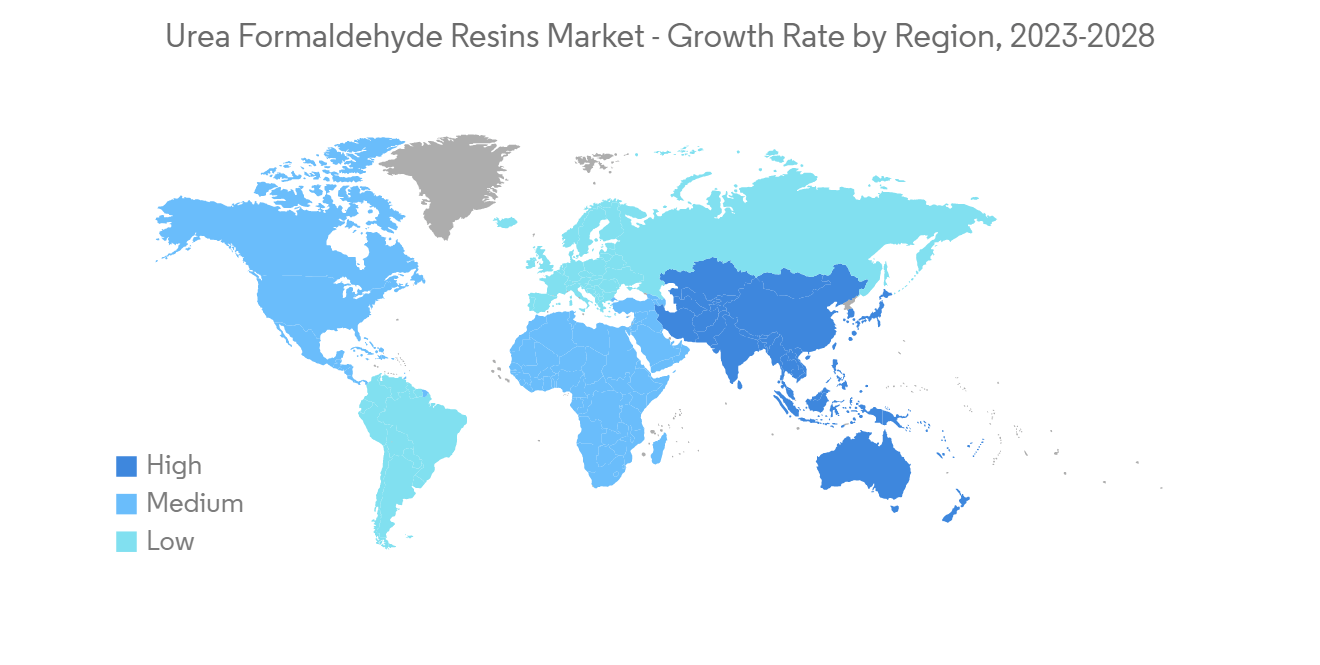

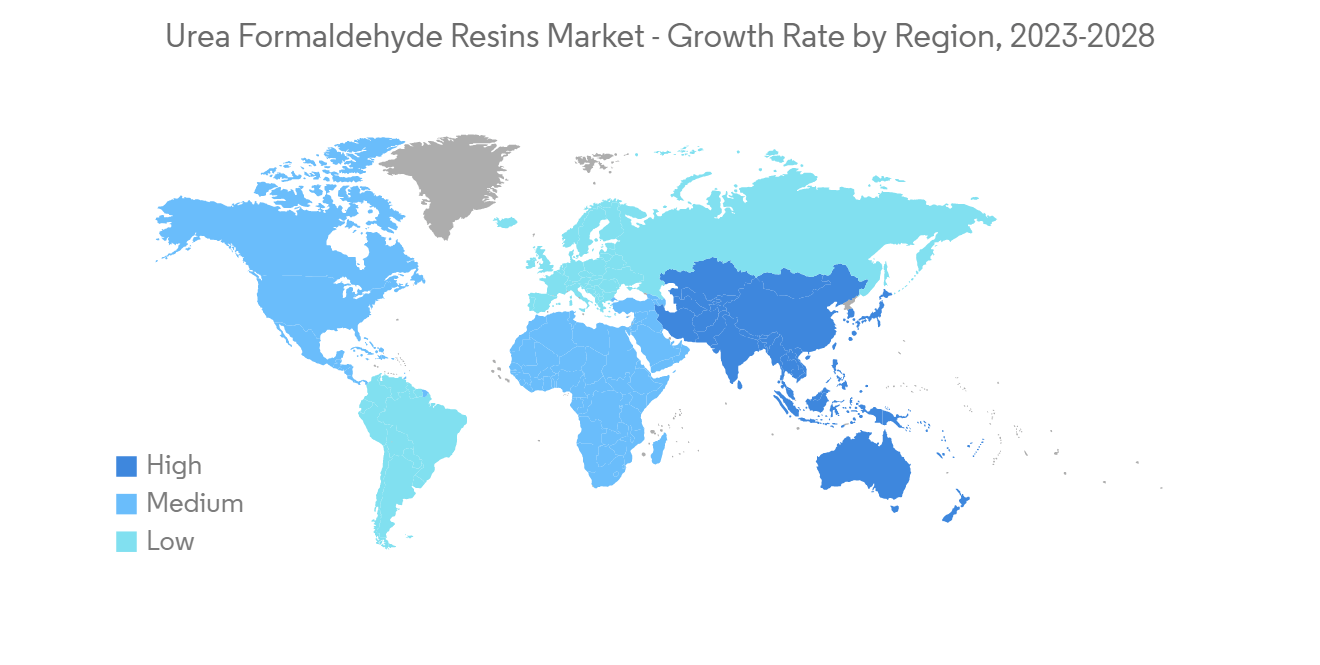

- 亞太地區在全球市場佔據主導地位,其中中國和印度等國家/地區的消費最為突出。

尿醛樹脂市場趨勢

建築終端用戶行業主導市場

- 由於刨花板、膠合板和中密度纖維板的廣泛使用,尿醛市場的增長在很大程度上受到建築行業業績的影響。

- 因此,建築產品的需求和生產將隨著建築活動的增長而增加。 尿醛廣泛用於板材和膠合板,這也影響著尿醛市場的消費和增長。

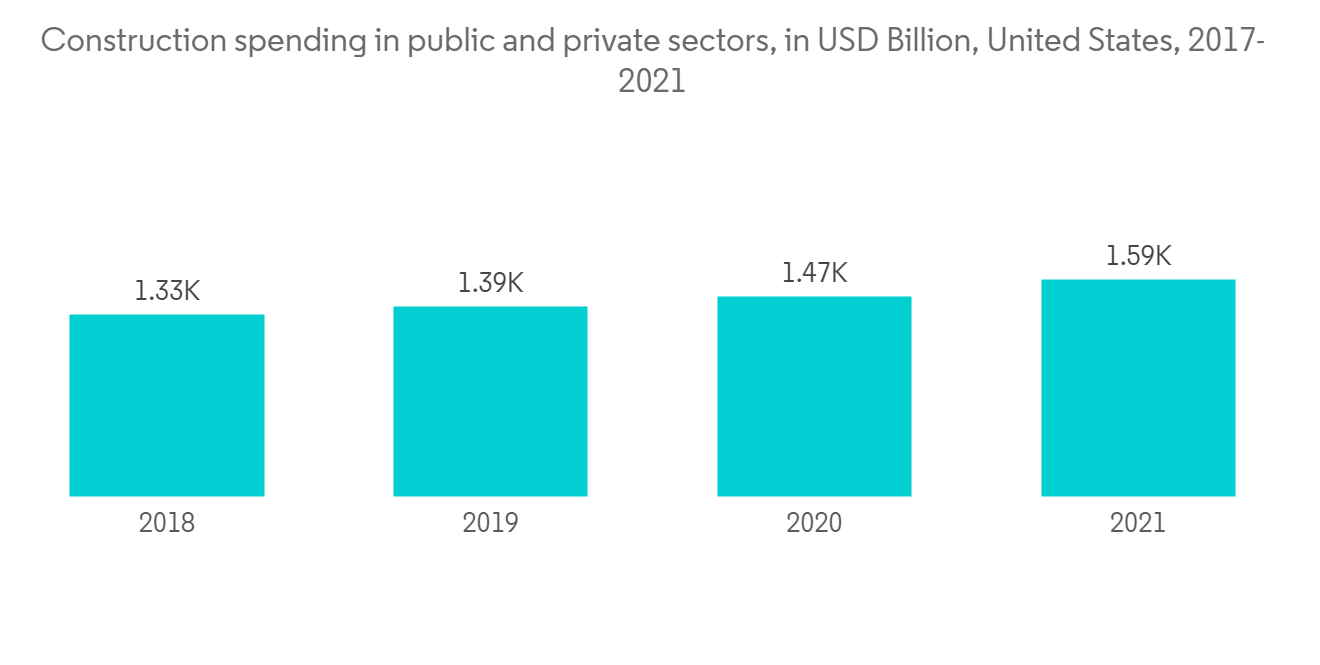

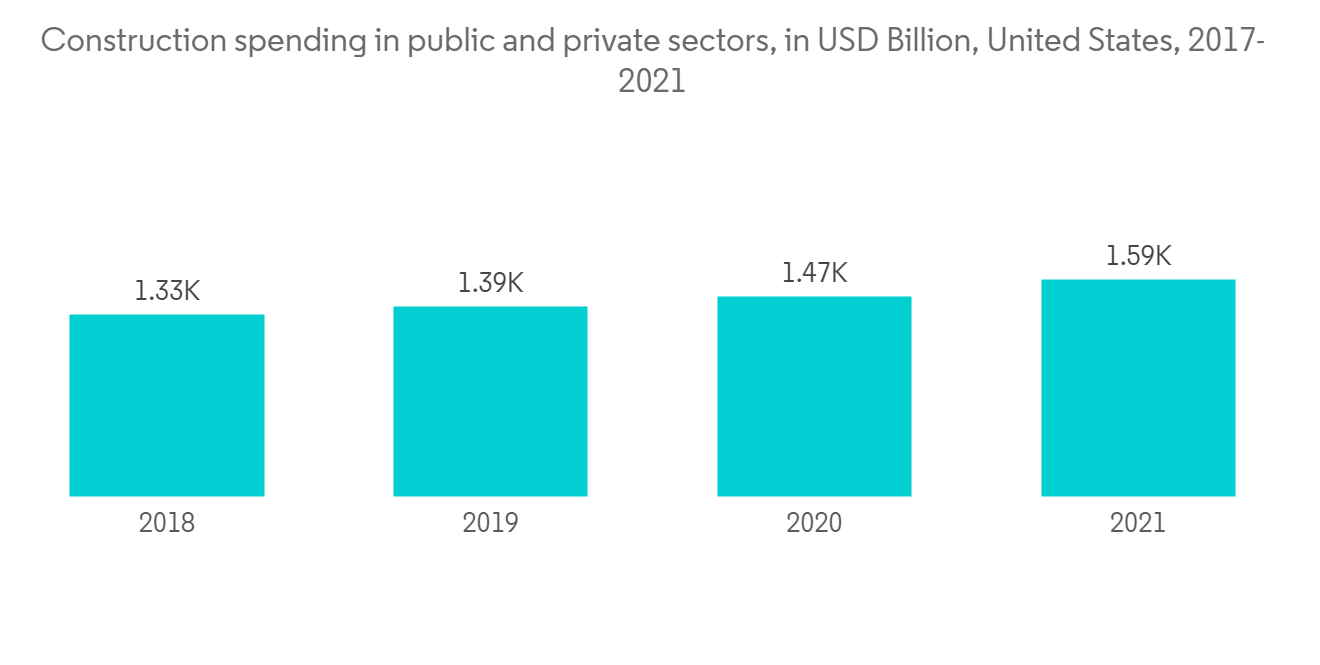

- 亞太地區和北美洲的住宅建設增長強勁。 在亞太地區,印度、中國、菲律賓、越南和印度尼西亞等國家的住宅建設增長強勁。 在北美,由於人口增長、移民增加和核心家庭趨勢導致住房需求增加,這些都是推動該地區住房建設的因素。

- 中國已經從大流行的危機中恢復過來。 中國已經開始了很多住房建設。 中國恆大集團承諾到2022年建設60萬套住房。 香港房屋委員會推出多項措施,推動廉租房建設。 目標是在到 2030 年的十年內提供 301,000 個公共住房單元。

- 根據美國人口普查局和美國住房和城市發展部的數據,2022 年 5 月北美竣工房屋的年增長率為 146.5 萬套,比 5 月份的 134 萬套年增長率高 9.3% 2021.

- 在加拿大,加拿大新建築計劃 (NBCP)、經濟適用房計劃 (AHI) 和加拿大製造等各種政府項目都在支持住房行業的擴張。

- 因此,在預測期內,建築行業將主導市場。

亞太地區主導市場

- 亞太地區在全球市場佔據主導地位,其中最大的消費量來自中國和印度等國家/地區。

- 中國是世界上最大的尿醛樹脂生產國。 隨著人口的不斷增長,對食物的需要和需求與日俱增,農業活動的進程也在逐漸發生變化。 因此,對肥料的性能和效率提出要求,尿醛樹脂的用量不斷增加。

- 中國是該地區最大的建築市場之一。 非住宅基礎設施預計將大幅擴張。 隨著人口老齡化,需要更多的醫療設施和醫院。 中國政府在2019年批准了26個基礎設施項目,價值約1420億美元,預計將於2023年完工。 中國擁有世界上最大的建築市場,佔全球建築投資的20%。 到2030年,中國將在建設上花費超過13萬億美元。

- 中國是世界上最大的家具製造國、出口國和消費國。 中國的高家具消費是由於人口眾多和城市家庭可支配收入的增加。 全球35%以上的家具貿易源自中國,全球40%的金屬家具出口量和60%以上的軟墊木製和金屬座椅產自中國。 中國家具製造商主要分佈在廣東、浙江、湖南、廣西、江西和山東等省。

- 尿醛樹脂也用於製造纖維板。 纖維板在汽車工業中用於製造自由形狀,例如儀表板、後行李架和內門殼。 與日本、美國和德國等全球主要參與者相比,中國的乘用車市場是全球最大的,2021 年佔 2141 萬輛。

- 因此,亞太地區有望在預測期內主導市場。

尿醛樹脂行業概況

全球尿醛樹脂市場分散。 市場參與者(排名不分先後)包括 BASF SE、Hexion、Kronoplus Limited 和 Georgia-Pacific Chemicals。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查先決條件

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 主持人

- 對中密度纖維板 (MDF) 的需求增加

- 家具行業對刨花板的需求增加

- 阻礙因素

- 與尿醛樹脂相關的健康損害

- 工業價值鏈分析

- 波特的五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 原材料分析

- 技術快照

- 貿易分析

- 監管政策分析

- 價格趨勢分析

第 5 章市場細分(市場規模:基於數量)

- 申請

- 刨花板

- 木頭膠

- 膠合板

- 中密度纖維板

- 其他用途

- 最終用戶行業

- 汽車

- 電器

- 農業

- 建築/施工

- 其他最終用戶行業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 意大利

- 法國

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第六章競爭格局

- 併購、合資、合作、合同等。

- 市場排名分析

- 主要公司採用的策略

- 公司簡介

- ADVACHEM

- Acron Group

- ARCL Organics Ltd.

- Ashland

- Asta Chemicals

- Arclin Inc.

- BASF SE

- Georgia-Pacific Chemicals

- Hexion

- Hexza Corporation Berhad

- Jiangsu Sanmu Group Co., Ltd.

- Kronoplus Limited

- Melamin kemicna tovarna d.d. Kocevje

- Metadynea Metafrax Group

- SABIC

- QAFCO

第七章市場機會與未來趨勢

- 汽車和家電領域對優質樹脂的需求增加

The Global Urea Formaldehyde Resins Market is projected to register a CAGR of over 4.5% during the forecast period.

The COVID pandemic negatively affected the market for Urea Formaldehyde Resins. However, post-COVID, the rising demand from the construction, automotive, and agriculture industries is expected to revive the region's adhesives market.

Key Highlights

- Over the short term, the increasing demand for particle boards from the furniture sector and the rising demand for medium-density fiberboard (MDF) from the construction industry are expected to drive the market's growth.

- Health hazards regarding urea-formaldehyde resins and unfavorable conditions arising from the COVID-19 outbreak are expected to hinder the market's growth.

- The building and construction segment dominated the market and is expected to grow during the forecast period.

- Asia-Pacific dominated the market across the world, with the most significant consumption from countries such as China and India.

Urea Formaldehyde Resins Market Trends

Building and Construction End-User industry to Dominate the Market

- Urea-formaldehyde market growth is widely influenced by the performance of the building and construction sector, owing to the extensive use of particle boards, plywood, and medium-density fiberboard.

- Owing to this, the demand and production of such building products also increase with growth in construction activities. While urea formaldehyde is extensively used in boards and plywood, it also influences the consumption and growth of the urea formaldehyde market.

- Asia-Pacific and North American regions have been witnessing strong growth in residential construction. Asia-Pacific is witnessing strong growth in residential construction in countries such as India, China, the Philippines, Vietnam, and Indonesia. Besides, in North America, high housing demand due to the growing population demand for homes, increased immigrants, and the trend of nuclear families are some factors driving residential construction in the region.

- China recovered from the pandemic doom. Many residential constructions kick-started in the country. China's Evergrande Group committed to building 600,000 homes in 2022. The housing authorities of Hong Kong launched several measures to push start the construction of low-cost housing. The officials aim to provide 301,000 public housing units in 10 years till 2030.

- According to the US Census Bureau and the US Department of Housing and Urban Development, in May 2022, housing in North America was completed at an annual rate of 1,465,000, which was 9.3% more than the annual rate of May 2021, which was 1,340,000.

- In Canada, various government projects, including the New Building Canada Plan (NBCP), the Affordable Housing Initiative (AHI), and Made in Canada, have supported the residential sector's expansion.

- Thus, the building and construction segment to dominate the market in the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific dominated the market across the world, with the most significant consumption from countries such as China and India.

- China is the largest producer of urea-formaldehyde resins in the world. With the increasing population, the need and demand for food are increasing daily, so the advancements in agriculture activities are changing gradually. To accomplish these changes, fertilizer performance and efficiency are necessary, resulting in increased consumption of urea-formaldehyde resins.

- China is one of the largest construction markets in the region. Non-residential infrastructure is likely to expand significantly. The country's aging population necessitates the construction of additional healthcare facilities and hospitals. The Chinese government approved 26 infrastructure projects worth approximately USD 142 billion in 2019, with completion due in 2023. The country boasts the world's largest construction market, accounting for 20% of all global construction investments. By 2030, the country will spend over USD 13 trillion on construction.

- China is the world's largest furniture manufacturer, exporter, and consumer. China's high furniture consumption is due to its large population and the growing disposable income of urban households. More than 35% of the world's furniture trade originates from China, and 40% of the world's metal furniture exports and over 60% of upholstered wooden and metal seats are produced in China. Chinese furniture manufacturers are primarily located in Guangdong, Zhejiang, Hunan, Guangxi, Jiangxi, and Shandong.

- Urea-formaldehyde resin is also used in fiberboard production. Fiberboard is used in the automotive industry to create free-form shapes, such as dashboards, rear parcel shelves, and inner door shells. China's automotive market for passenger vehicles is the largest in the world, as it accounted for 21.41 million units in 2021 compared to other major global players such as Japan, the United States, and Germany.

- Thus, the Asia-Pacific region is expected to dominate the market during the forecast period.

Urea Formaldehyde Resins Industry Overview

The global urea formaldehyde resins market is a fragmented one. Some major players in the market (not in a particular order) include BASF SE, Hexion, Kronoplus Limited, and Georgia-Pacific Chemicals, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Medium Density Fiberboard (MDF)

- 4.1.2 Rising Demand for Particle Board in the Furniture Sector

- 4.2 Restraints

- 4.2.1 Health Hazards Regarding Urea Formaldehyde Resins

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Feedstock Analysis

- 4.6 Technological Snapshot

- 4.7 Trade Analysis

- 4.8 Regulatory Policy Analysis

- 4.9 Price Trend Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Particle Board

- 5.1.2 Wood Adhesives

- 5.1.3 Plywood

- 5.1.4 Medium Density Fiberboard

- 5.1.5 Other Applications

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Electrical Appliances

- 5.2.3 Agriculture

- 5.2.4 Building and Construction

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ADVACHEM

- 6.4.2 Acron Group

- 6.4.3 ARCL Organics Ltd.

- 6.4.4 Ashland

- 6.4.5 Asta Chemicals

- 6.4.6 Arclin Inc.

- 6.4.7 BASF SE

- 6.4.8 Georgia-Pacific Chemicals

- 6.4.9 Hexion

- 6.4.10 Hexza Corporation Berhad

- 6.4.11 Jiangsu Sanmu Group Co., Ltd.

- 6.4.12 Kronoplus Limited

- 6.4.13 Melamin kemicna tovarna d.d. Kocevje

- 6.4.14 Metadynea Metafrax Group

- 6.4.15 SABIC

- 6.4.16 QAFCO

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rise in Demand for Good Quality Resins in Automobile and Electrical Appliances