|

市場調查報告書

商品編碼

1433783

溫度控管技術:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Thermal Management Technologies - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

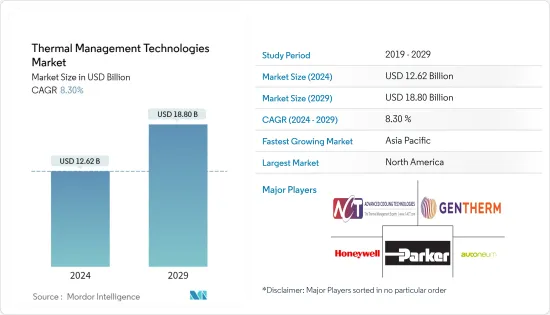

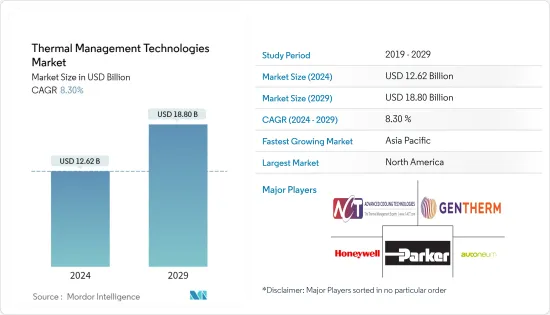

溫度控管技術市場規模預計到2024年熱感126.2億美元,到2029年達到188億美元,在市場估計和預測期間(2024-2029年)複合年成長率為8.30%。

電子封裝的趨勢帶來了性能的提高和產品尺寸的縮小。因此,功耗顯著增加,需要溫度控管來消除電子設備產生的高熱通量,從而實現卓越的系統性能和可靠性。

主要亮點

- 全球電子產業的顯著成長是推動市場成長的關鍵因素之一。隨著消費性電子產品製造技術的進步,對具有更高功率密度的較小設備的需求正在增加。這對溫度控管技術的需求產生了積極影響,以最大限度地減少這些設備產生的高熱通量。

- 在過去的幾年中,晶片冷卻解決方案不斷發展以適應不斷增加的熱通量。許多製造商正在致力於開發基於多相傳熱技術的先進冷卻解決方案。射流衝擊機制、冷板和熱蒸汽室等技術徹底改變了這些系統的未來。

- 可再生能源的日益普及也是推動能源儲存市場的主要因素。此外,全球快速工業化和對持續供電的需求不斷增加也有利於預測期內整體熱能能源儲存市場的成長。

- 然而,由於使用的電晶體種類繁多,溫度控管的複雜性,特別是電子設備中使用的組件的設計,限制了市場的成長。

- 溫度控管技術最常見的應用之一是消費性電子產品。疫情爆發之初,消費性電子產業因供應鏈中斷而面臨重大阻力。然而,隨著疫情帶來的虛擬學習、遠距工作和媒體消費需求增加,平板電腦、筆記型電腦等眾多消費性電子設備的需求近期大幅增加,市場需求可望加速。

溫度控管技術的市場趨勢

消費性電子產品需求不斷成長推動市場成長

- 電子產業的發展正在增加更小、更聰明的產品的推出。這些行業進步推動了對創新溫度控管技術的需求,這些技術可以消除設備產生的熱量並提高系統性能和可靠性。

- 智慧型手機和平板電腦材料市場在過去十年中經歷了可觀的成長。由於重量和成本敏感性,預計市場將更依賴先進材料來提供冷卻解決方案,而不是輔助散熱器。

- 此外,隨著物聯網(IoT)的日益普及,連接設備是使用網際網路和IP通訊協定實現物與物之間或物與人之間通訊的技術,其數量近年來迅速增加。例如,據思科稱,到 2023 年,連網設備數量將達到 293 億台。

- 大多數物聯網設備(穿戴式裝置、智慧家庭系統等)的外形尺寸較小,導致它們無法實施主動式溫度控管策略(冷卻風扇或液體冷卻)。對於這些產品,在基板級實施被動式溫度控管技術與電路最佳化並行是防止關鍵組件過熱的關鍵。

- 此外,隨著近年來5G的普及,對智慧型手機等5G相容設備的需求不斷增加。此類設備在較小的空間內具有更高密度和更高功率的組件。這種增加的功耗需要消耗更多的能量並產生更多的熱量。因此,這些設備對溫度控管的需求日益成長。

北美佔有很大佔有率

- 由於各領域對技術創新的投資不斷增加以及溫度控管技術的採用,北美地區預計將佔據最大的市場佔有率。該市場的知名企業總部均設在該地區,包括 Parker-Hannifin Corp.、Advanced Cooling Technologies Inc.、Honeywell International Inc. 和 Gentherm Inc.。

- 該地區消費電子產業的成長是推動市場成長的主要因素之一。根據 CTA 最近的預測,美國消費科技產業的零售收入預計將首次超過 5,050 億美元。這項預測意味著 2021 年營收將成長 2.8%,高於 2020 年令人印象深刻的 9.6% 成長。該組織表示,對智慧型手機、汽車技術、健康設備和串流媒體服務的強勁需求將推動大部分預計收益。

- 汽車產業向電動的轉型也正在推動市場需求。配備電池的 EV(電動車)的溫度控管至關重要,因為它會影響這些車輛的性能、可靠性和穩健性。

- 美國是最大的電動車市場之一,近年來電動車銷量快速成長。例如,美國能源局宣布,2020年至2021年電動車銷量成長85%,插電式混合電動車(PHEV)2021年成長一倍多,與前一年同期比較成長138%。

- 此外,近年來,日本實施了許多法規來促進電動車的普及。例如,2021 年 4 月,紐約州立法機關通過了一項法案,實際上要求到 2035 年該州銷售的所有新小客車都採用電力驅動。此外,美國也制定了2030年該國銷售的汽車一半為電動車的目標。

溫度控管技術產業概況

溫度控管技術市場高度分散,沒有一家公司佔據重要的市場佔有率。此外,市場上的本地參與者數量不斷增加,競爭加劇。

2022 年 1 月,派克漢尼汾 (Parker Hannifin) 旗下部門 Parker Lord 擴大了產品系列,添加了新型導熱黏劑和單組分 (1K) 低密度間隙填充劑,以溫度控管。我們支持該規定封裝、黏劑和間隙填充劑。

2021 年 6 月,Gentherm 宣布成為以色列 Carrar 種子輪融資的主要投資者,Carrar 是一家為電動車市場提供先進溫度控管系統的技術開發商。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究結果和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力——波特五力

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 市場促進因素

- 提高車輛能源效率和性能

- 溫度控管技術普及

- 市場挑戰

- 零件設計複雜性

- 產業價值鏈分析

- 評估 COVID-19 對產業的影響

第5章市場區隔

- 依產品類型

- 軟體

- 硬體

- 基材

- 介面

- 按用途

- 電腦

- 消費性電子產品

- 汽車電子產品

- 通訊

- 可再生能源

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第6章 競爭形勢

- 公司簡介

- Parker-Hannifin Corp.

- Advanced Cooling Technologies Inc.

- Honeywell International Inc.

- Gentherm Inc.

- Autoneum Holding AG

- Sapa Extrusions Inc.

- AllCell Technologies

- Thermacore Inc.

- Laird Technologies Inc.

- Pentair Thermal Management

- Outlast Technologies LLC

第7章 投資分析

第8章市場的未來

The Thermal Management Technologies Market size is estimated at USD 12.62 billion in 2024, and is expected to reach USD 18.80 billion by 2029, growing at a CAGR of 8.30% during the forecast period (2024-2029).

The electronic packaging trend has resulted in increased performance and reduced product sizing. This has led to a significant increase in power consumption, which, in turn, demands thermal management for good system performance and reliability by removing the high heat flux generated by electronic devices.

Key Highlights

- Significant growth in the electronics industry worldwide is one of the key factors driving market growth. There is an increasing demand for miniaturized devices with enhanced power densities, with improvements in the manufacturing technologies of consumer electronics. This, in turn, positively impacts the demand for thermal management technologies to minimize the high heat flux generated by these devices.

- Over the past few years, chip-cooling solutions have evolved to accommodate the increase in heat flux. Many manufacturers are working on the development of advanced cooling solutions based on multi-phase heat transfer technologies. Technologies like jet impingement mechanisms, cold plates, and heat vapor chambers have transformed the future of these systems.

- Also, the increasing adoption of renewable energy resources is the major factor driving the thermal energy storage market. In addition, rapid industrialization across the world has increased the need for continuous power supply, which positively leads to the overall thermal energy storage market growth during the forecast period.

- However, due to the use of various transistors, the design complexities in components used in thermal management, specifically in electronic devices, are restraining the market's growth.

- One of the most common applications of thermal management technologies is in consumer electronics. At the onset of the pandemic, the consumer electronics industry faced a heavy headwind due to supply chain disruptions. However, with an increase in demand for virtual learning, remote work, and media consumption brought about by the pandemic, the demand for many consumer electronics devices, such as tablets and laptops, has experienced significant growth in recent times, which is expected to accelerate the market demand.

Thermal Management Technologies Market Trends

Increasing Demand for Consumer Electronics will Enhance the Market Growth

- Due to developments in the electronics industry, the introduction of smaller and smarter products are increasing. These advancements in the industry have led to an increased need for innovative thermal management technologies to improve system performance and reliability by eliminating the heat generated by devices.

- The smartphone and tablet material market has witnessed considerable growth in the past decade. Due to the sensitivity toward weight and costs, the said market is expected to rely mostly on advanced materials for cooling solutions rather than secondary heat sinks.

- Further, owing to the increasing adoption of the Internet of things (IoT), the technology that enables the communication between things or between things and people using the Internet and IP-enabled protocols, the number of connected devices has been rising rapidly in recent years. For instance, as per Cisco, there will be 29.3 billion networked devices by 2023.

- Most IoT devices (wearables, smart home systems, etc.) carry such small form factors that active thermal management strategies (cooling fans or liquid cooling) cannot be implemented. In these products, implementing passive thermal management techniques at the board level alongside circuit optimization is key to preventing overheating of critical components.

- Further, with the increasing penetration of 5G in recent years, the demand for 5G-enabled devices, such as smartphones, is increasing. Such devices contain a greater density of high-power components in smaller spaces. This increased power requires more energy consumption, which generates more heat. As a consequence, there is an increased need for thermal management in such devices.

North America to Hold Major Share

- The North American region is expected to account for the largest market share, attributed to the increasing investments in technological innovation and adoption of thermal management technologies by various domains. Some of the prominent players in the market, such as Parker-Hannifin Corp, Advanced Cooling Technologies Inc., Honeywell International Inc., and Gentherm Inc., are headquartered in this region.

- The proliferating consumer electronics industry in the region is one of the primary factors driving the market's growth. According to a recent forecast from CTA, the consumer technology industry in the United States is projected to generate over USD 505 billion in retail sales revenue for the first time. The projection represents a 2.8% revenue increase from the impressive growth of 9.6% in 2021 over 2020. As per the organization, strong demand for smartphones, automotive tech, health devices, and streaming services will help propel a significant portion of the projected revenue.

- The automotive industry's transition toward electrification is also fueling the demand for the market. Thermal management in EVs (electric vehicles) powered by batteries is essential as it affects the performance, reliability, and robustness of these vehicles.

- The United States is one of the largest markets for electric vehicles, and the country has also recorded rapid growth in EV sales in recent years. For instance, as per the United States Department of Energy, EV sales grew by 85% from 2020 to 2021, while plug-in hybrid electric vehicles (PHEVs) more than doubled in 2021, with an increase of 138% over the previous year.

- Many regulations have also been implemented in recent years to promote the use of electric vehicles in the country. For instance, in April 2021, New York state lawmakers passed a bill that would essentially mandate that all new passenger cars sold in the state run on electric power by 2035. Moreover, the United States has set a target to ensure half of the vehicles sold in the country are electric by 2030.

Thermal Management Technologies Industry Overview

The thermal management technologies market is significantly fragmented, with no player accounting for a significant market share. Also, the number of local players is increasing in this market, resulting in increasing competition.

In January 2022 - Parker Lord, a division of Parker Hannifin, expanded its portfolio of products for electric vehicle manufacturers to include new thermally conductive adhesives and one-component (1K) low-density gap fillers to support their product offering of thermal management encapsulants, adhesives, and gap fillers.

In June 2021 - Gentherm announced that it had emerged as the lead investor in a seed round of financing in Israel-based Carrar, a technology developer of advanced thermal management systems for the electric mobility market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Market Drivers

- 4.3.1 Increase in Vehicle Energy Efficiency and Performance

- 4.3.2 Thermal Management Technology Proliferation

- 4.4 Market Challenges

- 4.4.1 Design Complexities in Components

- 4.5 Industry Value Chain Analysis

- 4.6 Assessment of COVID-19 Impact on the Industry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Software

- 5.1.2 Hardware

- 5.1.3 Substrate

- 5.1.4 Interface

- 5.2 By Application

- 5.2.1 Computers

- 5.2.2 Consumer Electronics

- 5.2.3 Automotive Electronics

- 5.2.4 Telecommunication

- 5.2.5 Renewable Energy

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Parker-Hannifin Corp.

- 6.1.2 Advanced Cooling Technologies Inc.

- 6.1.3 Honeywell International Inc.

- 6.1.4 Gentherm Inc.

- 6.1.5 Autoneum Holding AG

- 6.1.6 Sapa Extrusions Inc.

- 6.1.7 AllCell Technologies

- 6.1.8 Thermacore Inc.

- 6.1.9 Laird Technologies Inc.

- 6.1.10 Pentair Thermal Management

- 6.1.11 Outlast Technologies LLC