|

市場調查報告書

商品編碼

1273468

十二烷基硫酸鈉市場-增長、趨勢、COVID-19 影響和預測 (2023-2028)Sodium Lauryl Sulfate Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,十二烷基硫酸鈉 (SLS) 市場預計將保持 4% 左右的複合年增長率。

2020 年,由於原材料短缺,COVID-19 影響了全球月桂基硫酸鈉市場。 然而,個人護理產品需求的激增帶動了月桂基硫酸鈉的消費。

主要亮點

- 亞太地區對洗滌劑和清潔產品的需求不斷增長以及個人護理行業的快速增長是推動市場發展的關鍵因素。

- 但是,生物基替代品和人們對十二烷基硫酸鈉對人類和環境的毒性的日益關注預計會抑制市場增長。

- 不過,隨著各個工業領域的應用不斷取得進展,預計還會出現新的增長機會。

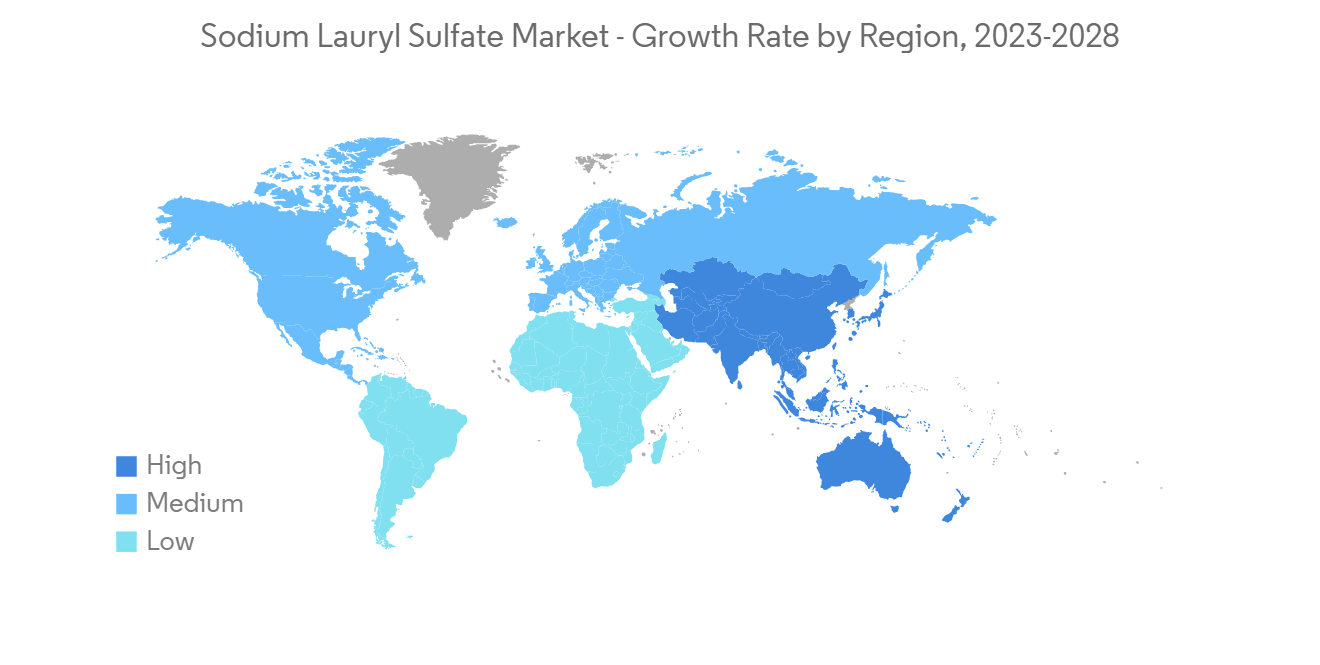

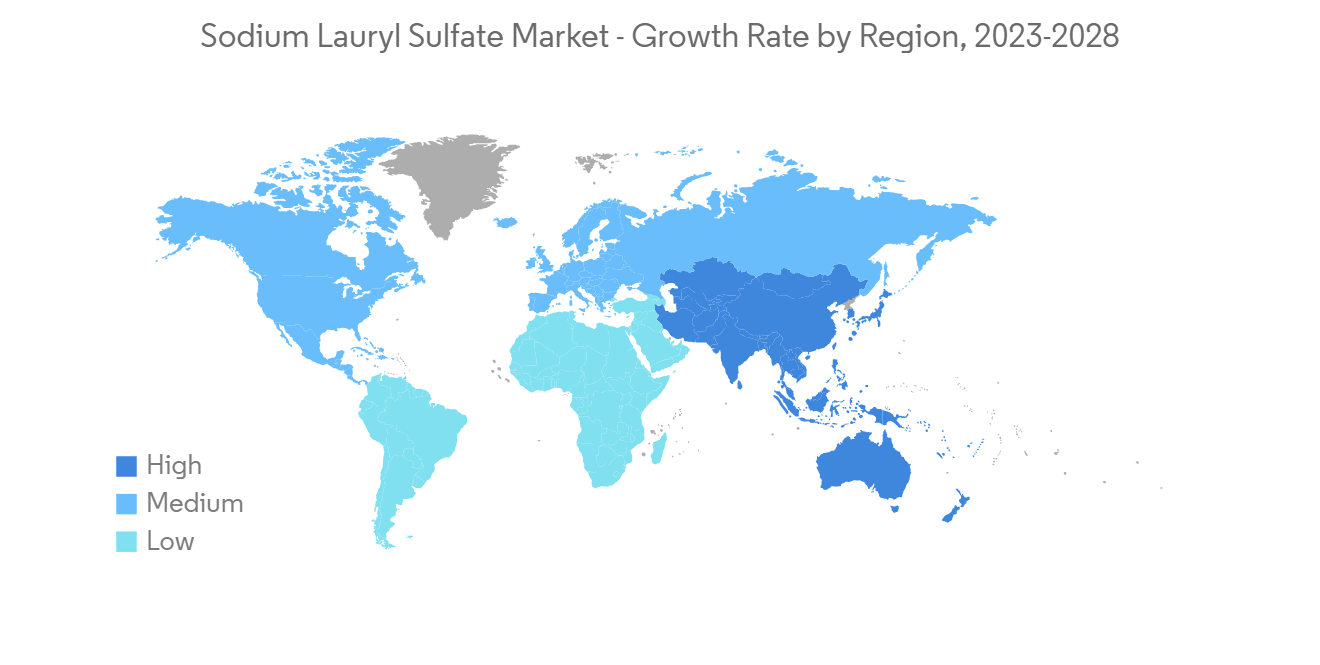

- 亞太地區主導著全球市場,中國和印度等國家/地區的消費量很大,其次是北美和歐洲。

十二烷基硫酸鈉市場趨勢

對洗滌劑和清潔劑的需求不斷擴大

- 十二烷基硫酸鈉是洗衣粉中最常見的活性成分之一。 一種合成洗滌劑,由稱為烷基硫酸鹽的中強表面活性劑製成。 當用作洗滌劑時,它的優點是能夠以低成本實現強去污力和高發泡性。

- 它也是一種高效的表面活性劑,可用於任何需要去除油漬和殘留物的任務。 在洗滌劑和清潔劑應用中,SLS 化合物的濃度遠高於其他產品應用。 使用 SLS 的洗滌劑包括地板清潔劑、織物清潔劑和洗車皂。

- 在預測期內,人們對食品安全儲存的興趣日益濃厚、對家庭表面消毒的需求、對衛生垃圾處理的需求等預計將推動對 SLS 的需求。

- 由於電子商務的興起和洗衣機在新興經濟體中的日益普及,全球對洗衣粉的需求正在迅速增長。

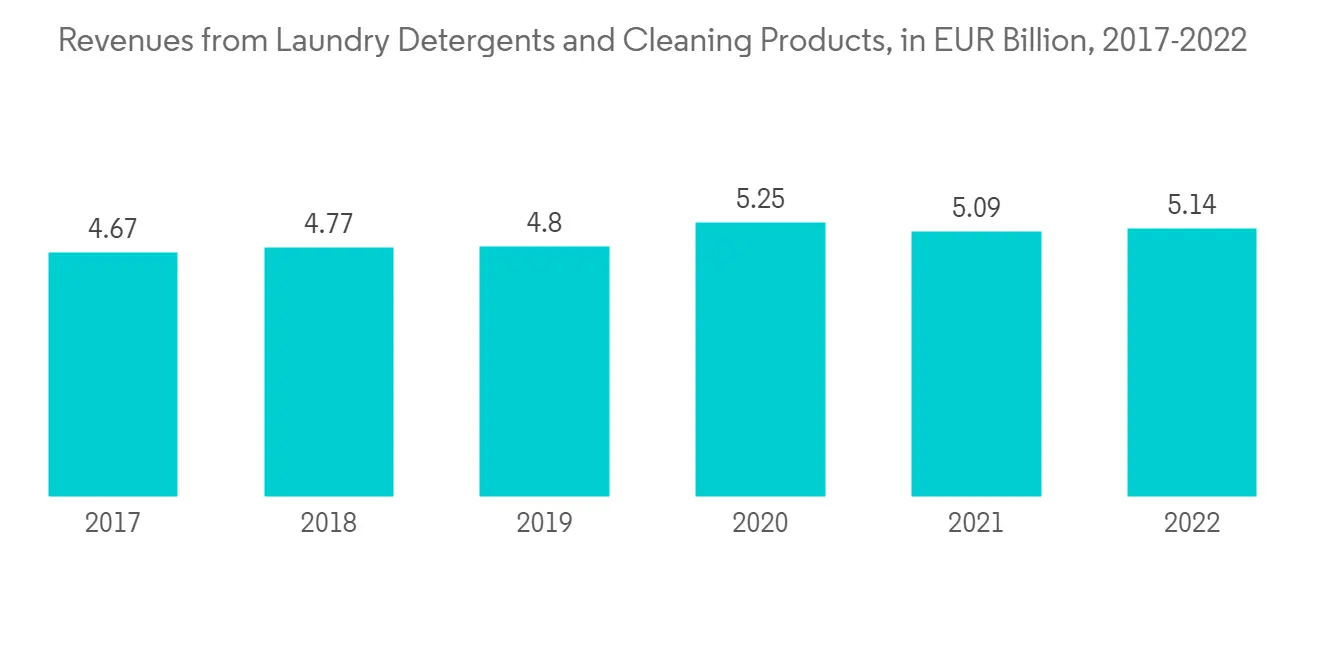

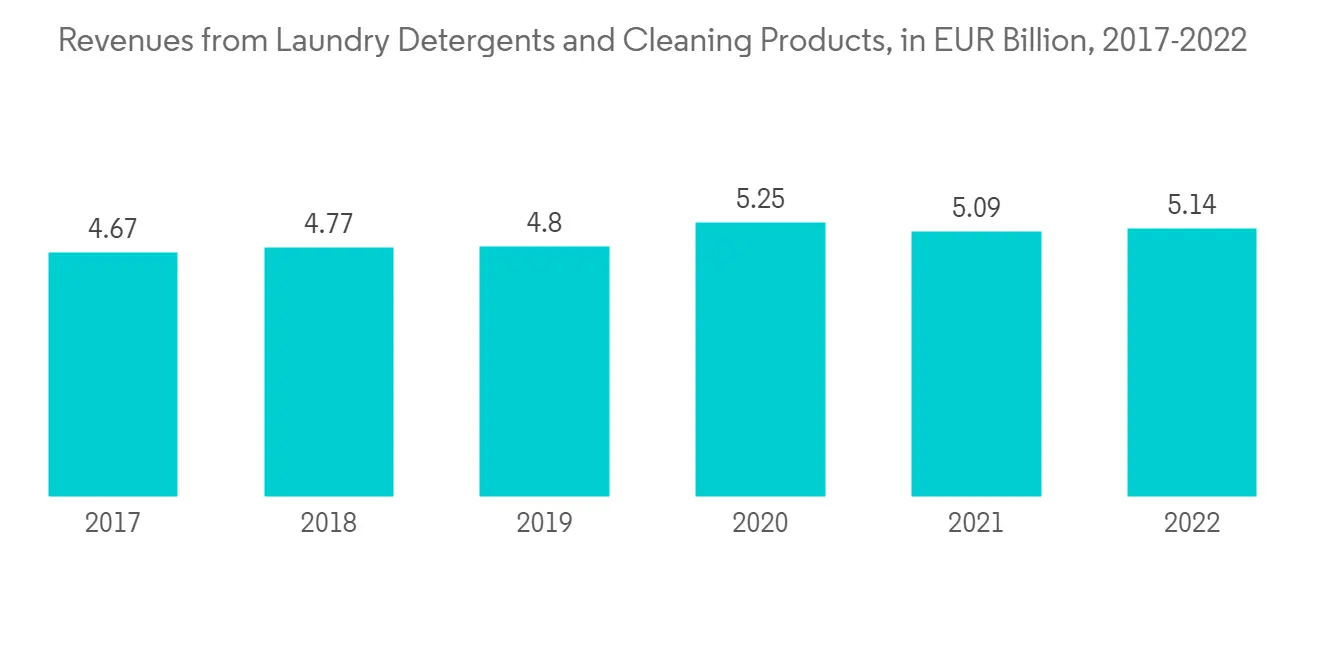

- 在德國,洗衣粉和清潔產品的使用量每年都在逐漸增加,如此圖所示。 到 2022 年,它將增長到約 510 萬歐元(590 萬美元)。

- 在意大利,家庭和洗衣護理市場將在 2021 年創造約 40 億歐元(46 億美元)的產值,並在接下來的幾年中略有增長,到 2026 年將達到約 40.7 億歐元(470 億美元)。

- 因此,預計上述趨勢將推動十二烷基硫酸鈉在洗滌劑和清潔劑應用中的消費。

亞太地區主導市場

- 亞太地區主導著全球市場份額。 中國目前是全球增長最快的洗衣市場。 在印度,隨著零售環境的變化,品牌銷售的產品種類繁多,使用洗衣機的洗衣產品脫穎而出。 洗滌劑需求的這種增長預計將推動對十二烷基硫酸鈉的需求。

- 此外,洗滌劑和清潔劑應用對十二烷基硫酸鈉 (SLS) 的需求最大。 預計該細分市場將在預測期內保持主導地位,主要是由於家庭應用的增加。

- 此外,中國的肥皂、洗衣粉和合成洗滌劑市場在過去五年中以年均 6% 以上的速度增長。 這是由於衛生意識的提高和液體肥皂行業的發展。

- 2021 年,中國生產了約 136 萬噸肥皂。 那一年,中國出口了價值約9.63億美元的肥皂。

- 此外,在印度,液體洗滌劑甚至滲透到洗手中。 2021 年 7 月,液體洗滌劑的滲透率為 15.9%,同比增長 15.9%,2022 年 7 月上升至 19.8%。 Hindustan Unilever (HUL) 和 Procter & Gamble 也分別以流行的洗滌劑品牌“Surf Excel”和“Ariel”提供液體洗滌劑。

- 在該國,在工業部門快速增長的支持下,工業清潔劑的消費量正在增加,預計這將推動十二烷基硫酸鈉市場。

- 此外,印度的美容和個人護理市場最近穩步增長。 這是由於人們對美容的興趣日益濃厚,以及印度零售商和精品店貨架空間的擴大,這些地方擺放著來自世界各地的化妝品。

- 印度是 2021 年美容和個人護理市場收入最高的國家/地區,在全球排名第四。 到 2021 年,印度美容和個人護理 (BPC) 市場規模將達到約 150 億美元。

- 對此類個人護理產品的需求不斷增長,預計將推動對十二烷基硫酸鈉的需求增長。

十二烷基硫酸鈉行業概況

十二烷基硫酸鈉市場高度分散,市場份額由許多公司瓜分。 市場參與者包括 BASF SE、Clariant、Solvay、Merck KGaA、Sasol 等(排名不分先後)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查結果

- 本次調查的假設

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 主持人

- 對洗滌劑和清潔劑的需求不斷擴大

- 亞太地區個人護理行業的快速增長

- 約束因素

- 十二烷基硫酸鈉對人體和環境的危害

- 生物基替代品的可用性

- 工業價值鏈分析

- 波特的五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章市場細分

- 產品類型

- 十二烷基硫酸鈉 (SLS) 液體

- 十二烷基硫酸鈉 (SLS) 乾品

- 用法

- 洗滌劑/清潔劑

- 個人護理產品

- 工業清潔劑

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳大利亞和新西蘭

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 意大利

- 法國

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第六章競爭格局

- 併購、合資、合作、合同等。

- 市場份額 (%)/排名分析

- 主要公司採用的策略

- 公司簡介

- Acme-Hardesty Company

- Alpha chemicals Pvt Ltd

- BASF SE

- Chemceed

- Chemmax Chemical Co. Limited

- Clariant

- Dongming Jujin Chemical Co.Ltd

- Explicit Chemicals Pvt Ltd

- Merck KGaA

- Solvay

- Spectrum Chemical Manufacturing Corp

- Stepan company

第七章市場機會與未來趨勢

- 在各個行業的應用擴展

The Sodium Lauryl Sulfate (SLS) market is expected to register at a CAGR of around 4% during the forecast period.

In 2020, COVID-19 impacted the global sodium lauryl sulfate market due to the raw material shortage. However, the surging demand for personal care products propelled sodium lauryl sulfate consumption.

Key Highlights

- One of the major factors driving the market studied is the growing demand for detergents and cleaning products and the rapidly growing personal care industry in Asia-Pacific.

- However, the bio-based alternatives and rising concern regarding the toxicity of sodium lauryl sulfate on both human health and the environment are expected to restrain the market growth.

- The growing application footprint across various industries will likely offer new growth opportunities to the market.

- Asia-Pacific dominated the global market with large consumption from countries such as China and India, followed by North America and Europe.

Sodium Lauryl Sulfate Market Trends

Increasing Demand for Detergents and Cleaners

- Sodium lauryl sulfate is one of the most common active ingredients in laundry detergent. It is a synthetic detergent from medium to strong surfactants called alkyl sulfates. When used as a detergent, it offers advantages, such as strong cleansing power and high foam production at a low cost.

- Additionally, it is a highly effective surfactant used in any task requiring oily stain and residue removal. For applications in detergents and cleaners, the SLS compound is found in a very high concentration compared to its application for other products. Some of the detergents where SLS is used include floor cleaners, cloth detergents, and car wash soaps.

- Increased focus on safe food storage, the need to disinfect household surfaces, and requirements for hygienic garbage disposal are expected to drive the demand for SLS in the forecast period.

- The demand for laundry detergents is rapidly growing worldwide owing to the growing prominence of e-commerce and the rising penetration of washing machines in developing economies.

- In Germany, laundry detergents and cleaning products are increasing gradually yearly, as seen in this graph. By 2022, it had grown to around EUR 5.1 million (USD 5.9 million).

- In Italy, the home & laundry care market generated approximately EUR 4 billion (USD 4.6 billion) in 2021 and is expected to increase slightly over the following years reaching around EUR 4.07 billion (USD 4.7 billion) by 2026.

- Therefore, these trends above are projected to boost the consumption of sodium lauryl sulfate in detergents and cleaners applications.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the global market share. China is currently the fastest-growing laundry market in the world. In India, washing machine-based laundry products gained prominence owing to the changing retail landscape with the wider availability of different products across brands. This growth in demand for detergents is expected to boost the demand for sodium lauryl sulfate.

- Moreover, the demand for Sodium Lauryl Sulfate (SLS) in detergents and cleaners applications was the largest. This segment is estimated to continue its dominance, during the forecast period, primarily due to the increasing household applications.

- Furthermore, the market for the soap, washing powder, and synthetic detergent industry in China grew at an average annual rate of over 6% in the past five years. It is due to increasing awareness about hygiene and development in the liquid soap segment.

- In 2021, China produced approximately 1.36 million metric tons of soap. That year, China exported around USD 963 million worth of soaps.

- Furthermore, liquid detergents gained penetration in India, even as handwashes. Detergent liquids had a penetration of 15.9% in July 2021 on a moving annual total basis, which went up to 19.8% in July 2022. Hindustan Unilever (HUL) and Procter & Gamble are some companies offering liquid detergents under their popular detergent brands, Surf Excel and Ariel, respectively.

- The increasing consumption of industrial cleaners in the country, supported by the rapid growth in the industrial segment, is expected to drive the market for sodium lauryl sulfate.

- Moreover, India's beauty and personal care market witnessed steady growth recently. It is owing to the increasing focus on grooming among people and increasing shelf space in retail stores and boutiques in India, which are stocking cosmetics worldwide.

- India is ranked fourth globally for generating the highest revenue from the beauty and personal care market in 2021. The Indian beauty and personal care (BPC) market accounted for approximately USD 15 billion in 2021.

- This rise in the demand for personal care products is expected to drive the growth in demand for sodium lauryl sulfate.

Sodium Lauryl Sulfate Industry Overview

The sodium lauryl sulfate market is highly fragmented, with the market share divided among many companies. Some of the key players in the market include BASF SE, Clariant, Solvay, Merck KGaA, and Sasol, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Detergents and Cleaners

- 4.1.2 Rapidly Growing Personal Care Industry in Asia-Pacific

- 4.2 Restraints

- 4.2.1 Toxic Effects of Sodium Lauryl Sulfate on Human Health and Environment

- 4.2.2 Availability of Bio-based Alternatives

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Sodium Lauryl Sulfate (SLS) Liquid

- 5.1.2 Sodium Lauryl Sulfate (SLS) Dry

- 5.2 Application

- 5.2.1 Detergents & Cleaners

- 5.2.2 Personal Care Products

- 5.2.3 Industrial Cleaners

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Australia & New Zealand

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Acme-Hardesty Company

- 6.4.2 Alpha chemicals Pvt Ltd

- 6.4.3 BASF SE

- 6.4.4 Chemceed

- 6.4.5 Chemmax Chemical Co. Limited

- 6.4.6 Clariant

- 6.4.7 Dongming Jujin Chemical Co.Ltd

- 6.4.8 Explicit Chemicals Pvt Ltd

- 6.4.9 Merck KGaA

- 6.4.10 Solvay

- 6.4.11 Spectrum Chemical Manufacturing Corp

- 6.4.12 Stepan company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Application Footprint Across Various Industries

![十二烷基醚硫酸鈉[SLES]的全球市場報告2023年](/sample/img/cover/42/1270981.png)