|

市場調查報告書

商品編碼

1441596

雲端高效能運算 (HPC):市場佔有率分析、產業趨勢與統計、成長預測(2024-2029 年)Cloud High Performance Computing (HPC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

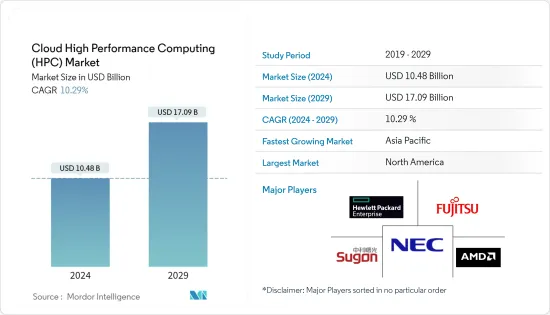

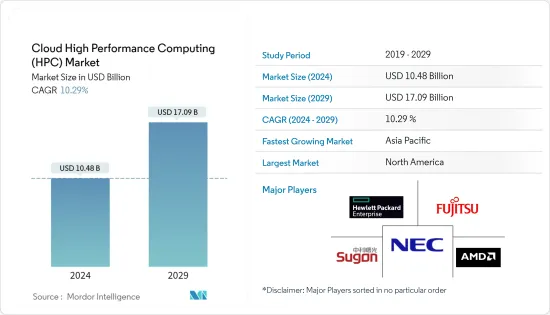

雲端高效能運算(HPC)市場規模預計到2024年為104.8億美元,在預測期內(2024-2029年)預計到2029年將達到170.9億美元,年複合成長率為10.29%。

各行業的巨量資料以及超高清工作流程和電子設計自動模擬等複雜應用的出現正在推動市場成長。

主要亮點

- 人工智慧、機器學習、物聯網和 3D 成像產生大量資料,而 HPC 對於管理這些數據至關重要。體育賽事直播期間的即時資料處理、市場模式分析以及風暴後測試新產品也需要 HPC。

- 微型伺服器和HPC系統的加速處理能力提高了效能效率,而更智慧的部署和管理以及優質的服務是推動HPC產業成長的關鍵因素。各種工業應用(例如金融建模和生命科學模擬)中的物理模擬、最佳化和機器學習 (ML) 都是 HPC 在及時解決複雜問題方面發揮關鍵作用的例子。隨著電動車、自動駕駛汽車和聯網汽車進入市場,汽車產業持續應對發展挑戰,需要將邊緣運算功能內建到這些市場領先的解決方案中。

- 基因組學研究正在迅速增加對高效能運算 (HPC) 設備的需求。這些技術幫助研究人員識別和分析與各種疾病和治療反應相關的基因突變。基因組序列測定檢查整個基因組中所有型態的遺傳變異。 HPC 系統提供顯著的速度、可靠性和準確性,使其可用於基因組研究工作中大量序列測定資料的實際分析。因此,引入次世代定序(NGS) 技術,可以使用各種體學技術來研究和識別人類健康的多個領域。

- 最近,各種組織一直在存取 HPC 系統,引發了對資料駭客攻擊的擔憂。由於 HPC 系統脆弱,可能會出現許多安全漏洞。此外,由於叢集環境和特性的不同,HPC系統的運作需要不同的管理系統。因此,對資料和網路攻擊的日益擔憂正在限制高效能運算市場的成長。

- 自 COVID-19感染疾病以來,隨著企業過渡到遠端工作並將工作負載遷移到雲端,資料消耗和雲端需求激增。對 HPC 的需求顯著增加,特別是在生物科學領域,因為 HPC 已被用於疫苗開發和應對大流行的影響。大流行後,由於數位化和 HPC 在各種最終用戶應用中的使用不斷增加,市場正在快速成長。

雲端高效能運算 (HPC) 市場趨勢

雲端驅動器市場中 HPC 的採用率不斷提高

- 在雲端採用 HPC 將推動成長。傳輸和分析資料又增加了一層複雜性。平台應整合組織內的所有現有資料來源,以偵測隱藏的威脅並做出更好的基於風險的選擇,同時保持資料完整。理想情況下,這將包括一個整合的搜尋程序,可以掃描所有來源(包括第三方來源)以查找威脅徵兆。去年 6 月,Marvell 推出了 OCTEON 10 DPU,專為 5G、雲端、營運商和企業資料中心應用的安全、網路和儲存工作負載而設計。 Marvell 的 OCTEON 10 DPU 結合了硬體加速、資料頻寬以及 PCIe 5.0 和 DDR5 等 I/O 產品。

- 雲端基礎方案正在成為各種應用程式最可行的選擇之一,因為它們以相對較低的成本滿足用戶的儲存和運算需求,但它們不能保護雲端用戶的資料和應用程式。適當的安全措施仍然存在需要涵蓋該領域。

- 此外,今年2月,IBM擴大了在通訊服務供應商領域的混合雲諮詢業務,擴大了其通訊諮詢服務並收購了解決方案供應商Sentaca。

- 設置本地系統相對昂貴,並且需要在產品許可證、設備和 IT 服務方面進行大量前期投資。相較之下,雲端基礎的技術具有高度彈性和成本效益,組織無需在硬體和軟體上花費大量資金,也無需花費大量人力資源來管理兩者。

- 根據 platform9 進行的研究,單一公有雲、混合雲或本地雲已成為組織運行其工作負載的主要關鍵環境。截至今年8月,單一公共雲端部署佔雲端部署的32.1%。

亞太地區預計將成為成長最快的市場

- 亞太地區擴大採用高效能運算 (HPC) 來處理大量資料並高速執行複雜的運算、分析、模擬和人工智慧 (AI)。然而,對於許多公司而言,初始資本投資過高,這為 HPC 即服務鋪平了道路。在這項策略中,公司透過付費使用制的消費模式訂閱硬體和軟體,而不是購買或租賃。它也廣泛應用於各種行業,從電腦輔助設計和工程到自動駕駛、生產最佳化、預測性維護、藥物發現、精準醫療、詐騙和異常檢測、金融和交易分析以及物聯網/智慧城市。其他。

- 如果沒有合適的工具和先進技術,對短產品開發週期 (PLC) 和持續品質的需求迅速成長,幾乎不可能即時回應。汽車、離散製造和醫療機器人等各行業擴大採用高效能運算 (HPC) 系統和電腦輔助工程 (CAE) 軟體進行高保真建模和模擬。亞太地區。

- 例如,今年 10 月,Subaru公司日本總部將負責提高碰撞安全性和駕駛效能的模擬和 3D 視覺化工作負載遷移到了 Oracle 雲端基礎架構。使用 OCI 上的高效能運算 (HPC),Subaru 能夠最佳化其開發週期,顯著提高效率,並透過將運算時間減少約 20% 來降低營運成本。

- 對於許多在營運中使用富士通數位退火器和高效能運算 (HPC) 等先進計算技術的公司和組織來說,成本仍然是一個主要障礙。從今年 4 月開始,富士通的 CaaS 產品組合將使消費者能夠快速存取解決這一問題的一系列服務。富士通正在引入雲端來加速數位轉型(DX),並透過提供對一些世界領先和最強大的運算技術的商業訪問來為世界各地的客戶提供支援。我們宣布推出計算即服務(CaaS)服務組合。

雲端高效能運算 (HPC) 產業概覽

由於 Advanced Micro Devices Inc.、NEC Corporation、Hewlett Packard Enterprise、Sugon Information Industry 和 Fujistu Ltd 等許多重要參與者的存在,雲端高效能運算 (HPC) 市場競爭非常激烈。產品發布、高額研發支出、合作夥伴收購等是這些公司保持競爭力的主要成長策略。

2022年5月,慧與為歐洲百億億百萬兆級超級電腦開發高效能、低功耗微處理器的公司SiPearl建立了策略合作夥伴關係,共同開發HPC解決方案。該合作夥伴關係將透過擴展超級架構的百萬兆級運算替代方案並使用歐洲架構來支援和加速歐洲百億億次系統的部署。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 行業景點-波特五力

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 產業價值鏈分析

- COVID-19 對高效能運算市場的影響

第5章市場動態

- 市場促進因素

- 高效處理大量資料的新興需求

- 雲端 HPC 的採用率提高

- 市場挑戰

- 資料安全問題

第6章市場區隔

- 按成分

- 硬體(伺服器、儲存設備、系統、網路設備)

- 軟體和服務

- 依部署類型

- 本地

- 雲

- 按工業用途

- 航太和國防

- 能源和公共

- BFSI

- 媒體和娛樂

- 製造業

- 生命科學與醫療保健

- 其他工業應用

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭形勢

- 公司簡介

- Advanced Micro Devices Inc.

- NEC Corporation

- Hewlett Packard Enterprise

- Sugon Information Industry Co. Ltd

- Fujistu Ltd

- Intel Corporation

- International Business Machines Corporation

- Microsoft Corporation

- Dell Technologies Inc.

- Dell EMC(Dell Technologies Inc.)

- Dassault Systems SE

- Lenovo Group Limited

- Amazon Web Services Inc

- NVIDIA Corporation

- Atos SE

第8章投資分析

第9章市場的未來

The Cloud High Performance Computing Market size is estimated at USD 10.48 billion in 2024, and is expected to reach USD 17.09 billion by 2029, growing at a CAGR of 10.29% during the forecast period (2024-2029).

The emergence of big data and complex applications, such as ultra-high definition workflows, electronic design automatic simulations, etc., across various industries, is driving growth in the market.

Key Highlights

- Artificial Intelligence, Machine learning, IoT, and 3D imaging generate large volumes of data, which HPC is essential for managing. HPC is also required for real-time data processing during live broadcasting of a sporting event, as well as for analyzing market patterns, following a growing storm, and testing new products.

- Faster processing capabilities of microservers or HPC systems increased performance efficiency, and smarter deployment and administration with high-quality service are some key factors driving the growth of the HPC industry. Physical simulation, optimization, and machine learning (ML) in various industrial applications, including financial modeling and life science simulation, are examples where HPC plays a critical role in solving complex problems within time. In the automotive industry, EVs, autonomous vehicles, and connected vehicles are continuously taking development challenges to enter the market and require edge computing capabilities to be incorporated in these solutions driving the market.

- In genomics research, the demand for high-performance computing (HPC) devices is rapidly growing. These technologies aid researchers identify and analyze genetic variations linked to various disorders and their responses to therapies. Genomic sequencing examines all forms of genetic changes throughout the entire genome. HPC systems provide significant speed, reliability, and precision, which aid in the practical analysis of massive amounts of sequencing data in genomic research activities. As a result, the introduction of Next Generation Sequencing (NGS) technology allows for investigating and identifying several areas of human health using various omics methodologies.

- Recently, various organizations have accessed HPC systems, raising concerns about data hacking. HPC systems are vulnerable, which has resulted in many possible security vulnerabilities. Furthermore, because of the clustered environment and varied capabilities, HPC systems require various management systems to operate. As a result, the rising concern over data integrity and cyber-attacks are restraining the growth of the High-Performance Computing Market.

- Data consumption and cloud demand have skyrocketed since the outbreak of COVID-19, owing to enterprises moving toward remote working and shifting their workloads onto the cloud. The demand for HPC saw significant growth, especially in bioscience, as HPC was used to develop a vaccine and tackle the effects of the pandemic. After the pandemic, the market is growing rapidly due to digitization and increased usage of HPC in various end-user applications.

Cloud High Performance Computing (HPC) Market Trends

Increasing Adoption of HPC in the Cloud Driving the Market

- Adoption of HPC on the cloud would drive growth. Transferring data to analyze it adds another layer of complication. The platform should integrate all existing data sources in an organization to detect hidden threats and make better risk-based choices while leaving the data alone. This should ideally include an integrated search program that can scan all sources, including third-party sources, for threat indications. In June last year, Marvell introduced the OCTEON 10 DPU designed for security, networking, and storage workloads working toward 5G, cloud, carrier, and enterprise data center applications. Marvell's OCTEON 10 DPU combines hardware acceleration, data path bandwidth, and I/O offerings, including PCIe 5.0 and DDR5.

- Although cloud-based solutions are becoming one of the most viable options for various applications since they provide the storage and computation needs for users at a relatively low cost, the area still needs to include appropriate security measures to protect the data and applications for cloud users.

- Furthermore, in February this year, IBM purchased Sentaca, a telecommunications consulting services and solutions supplier, to expand its hybrid cloud consulting business in the communications service provider area and develop scalable, cloud- and edge-enabled process automation and process safety solutions.

- Setting up an on-premise system is comparatively expensive, requiring significant upfront investments in product licenses, equipment, and IT services. Cloud-based technologies are, in comparison, extremely flexible and cost-effective for organizations to avoid spending much on hardware and software and human resources to manage both.

- According to a survey conducted by platform9, the single public, hybrid, and on-premises clouds were organizations' major significant environments to run their workloads. As of August this year, Single public-cloud deployments presented 32.1 percent of cloud deployment.

Asia Pacific is Expected to be the Fastest Growing Market

- The adoption of high-performance computing (HPC) has grown in the Asia-Pacific region for processing large volumes of data and executing complicated computations, analytics, simulations, and artificial intelligence (AI) at fast rates. However, the initial capital investment has been too expensive for many businesses, opening the path for HPC as a service. Instead of acquiring or leasing hardware and software, businesses subscribe to it through a pay-as-you-go consumption model in this strategy. And is widely used in various industries for applications ranging from computer-aided design and engineering to autonomous driving, production optimization, predictive maintenance, drug discovery, precision medicine, fraud and anomaly detection, treasury and trading analytics, IoT/smart cities, and many others.

- The surging demand for short product development cycles (PLCs) and persistent quality becomes nearly impossible to address in real time without using the right tools and advanced technologies. The adoption of high-performance computing (HPC) systems, with computer-aided engineering (CAE) software for high-fidelity modeling simulation, is on the rise among various industries, such as automotive, discrete manufacturing, and healthcare robotics, has increased in the Asia-pacific region.

- For instance, In October this year, Subaru Corporation headquarters, located in Japan, shifted its simulation and 3D visualization workloads responsible for increasing collision safety performance and driving performance to Oracle Cloud Infrastructure. With High-Performance Computing (HPC) on OCI, Subaru could optimize its development cycle, achieve significant efficiency, and cut operating expenses by lowering computational times by approximately 20%.

- Cost remains a significant barrier for many businesses and organizations using advanced computing technologies-companies in this region like Fujitsu Limited Digital Annealer and high-performance computing (HPC) in their operations. In April this year, Fujitsu's CaaS portfolio will provide consumers quick access to various services to solve this issue. Fujitsu announced the introduction of its "Fujitsu Computing as a Service (CaaS)" service portfolio to accelerate digital transformation (DX) and empower clients globally by providing commercial access to some of the major global powerful computing technologies through the cloud.

Cloud High Performance Computing (HPC) Industry Overview

The cloud high-performance computing market is very competitive because of many significant players, like Advanced Micro Devices Inc., NEC Corporation, Hewlett Packard Enterprise, Sugon Information Industry Co. Ltd, Fujistu Ltd, etc. Product launches, high expenses on research and development, partnerships and acquisitions, etc., are the prime growth strategies these companies adopt to sustain the intense competition.

In May 2022, Hewlett Packard Enterprise and SiPearl, a company developing a high-performance and low-power microprocessor for European exascale supercomputers, established a strategic partnership to develop HPC solutions. The collaboration will assist and accelerate the deployment of exascale systems in Europe by expanding heterogeneous computing alternatives for supercomputing and using European architectures.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the high-performance computing market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Emerging need to Process Enormous Amount of Data with Efficiency

- 5.1.2 Increasing Adoption of HPC in the Cloud

- 5.2 Market Challenges

- 5.2.1 Concerns regarding the Security of the Data

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware (Servers, Storage Devices, Systems, and Networking Devices )

- 6.1.2 Software and Services

- 6.2 By Deployment Type

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By Industrial Application

- 6.3.1 Aerospace and Defence

- 6.3.2 Energy and Utilities

- 6.3.3 BFSI

- 6.3.4 Media and Entertainment

- 6.3.5 Manufacturing

- 6.3.6 Life Science and Healthcare

- 6.3.7 Other Industrial Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Advanced Micro Devices Inc.

- 7.1.2 NEC Corporation

- 7.1.3 Hewlett Packard Enterprise

- 7.1.4 Sugon Information Industry Co. Ltd

- 7.1.5 Fujistu Ltd

- 7.1.6 Intel Corporation

- 7.1.7 International Business Machines Corporation

- 7.1.8 Microsoft Corporation

- 7.1.9 Dell Technologies Inc.

- 7.1.10 Dell EMC (Dell Technologies Inc.)

- 7.1.11 Dassault Systems SE

- 7.1.12 Lenovo Group Limited

- 7.1.13 Amazon Web Services Inc

- 7.1.14 NVIDIA Corporation

- 7.1.15 Atos SE