|

市場調查報告書

商品編碼

1272673

農業機器人和機電一體化市場——增長、趨勢和預測 (2023-2028)Agricultural Robots and Mechatronics Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,全球農業機器人和機電一體化市場預計將以 20.4% 的複合年增長率增長。

主要亮點

- 機器人技術將徹底改變農業。 但看看農民、農業企業和消費者如何利用機器人技術和數字機械化的力量來塑造這個行業的未來,將會很有趣。 食品需求的增長和城市化進程的加快是全球農業機器人市場的主要增長因素。 各國政府推出了幾項全球有益的政策,以提高認識和提高產量。 例如,歐盟正在資助用先進的自動化技術取代勞動密集型工作的項目。 這有望在一定程度上帶動農業機器人和機電一體化市場。

- 移動機器人有望取代半熟練工人。 但自動化農場永遠不會存在。 農民、牧場主和農學家仍然需要做出決定。 另一方面,有一些適合機器的農業工作。 因此,需要提高勞動力素質以應對高科技機械。 在日本,政府正在大力投資農業機器人並提高工人的技能水平。 結果是工人的工資更高,農村地區的生活質量更好。

- 推動這個市場增長的主要因素是勞動力短缺、勞動力成本上升、對食品和農業供應的需求增加、工作效率提高、新興技術的採用、最終結果完美的人力勞動。越來越多的研究進入各種應用程序,使生活更輕鬆。 這就是對未來幾年市場增長的預測。

農業機器人和機電一體化的市場趨勢

勞動力短缺和高成本驅動市場

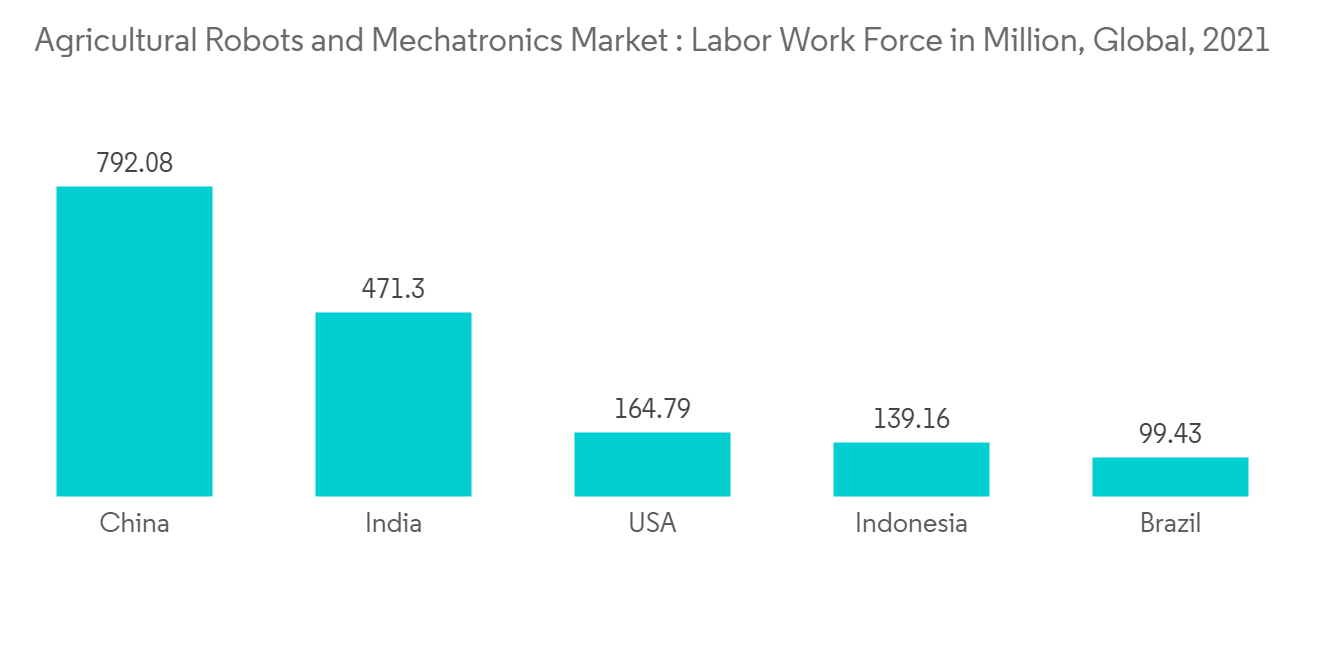

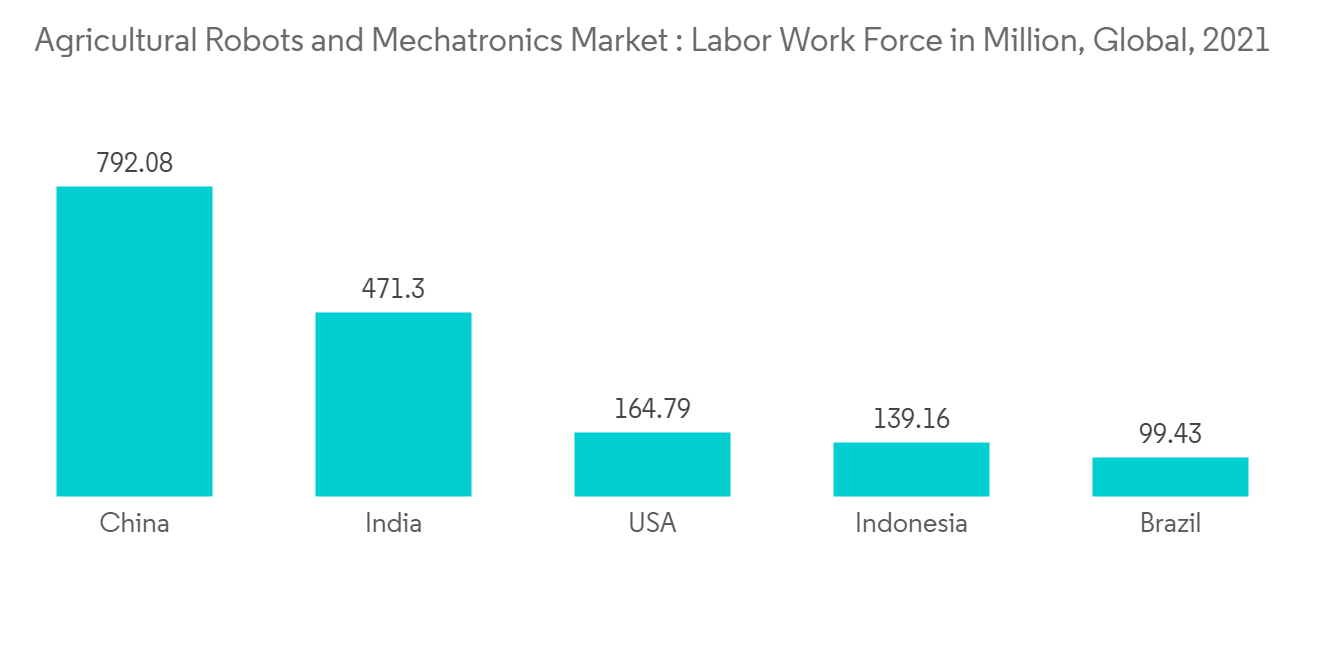

農業機器人是用於提高作物質量和效率、最大限度地減少對體力勞動的依賴並提高整體生產力的自主機器。 例如,在園藝和水果採摘方面,機器人平台上的工人效率是梯子上工人的兩倍。 採摘者短缺已經導致世界上超過 10% 的水果和蔬菜未在田間和果園收穫。 這與歐盟的年消費量相當。 對於經常受勞動力可用性影響的行業,機器人可能是一個可行的解決方案,為現代勞動力創造廣泛的就業機會。 根據國際勞工組織 (ILO) 的數據,發展中國家的農業工人比例已從 81% 下降至 48.2%。 發達國家也不例外,降幅如此之大。

世界政府峰會與奧緯諮詢合作發布了一份題為“農業 4.0 - 農業技術的未來”的報告。 報告稱,應對這些挑戰需要政府、投資者和創新農業技術的共同努力。 農業 4.0 不再依賴於在田間均勻撒施水、化肥和農藥。 相反,農民和農業經營將由傳感器、設備、機器和信息技術來管理。 未來的農業將由機器人、溫度和濕度傳感器、航空影像和 GPS 技術等先進技術驅動。 這些先進的設備、精準農業和機器人系統將使農場更有利可圖、更高效、更安全、更環保。 這將推動預測期內市場的增長。

2022 年,BT 將投資於農業自動化和可持續發展,以開發新的方法來實現軟果種植業的自動化,從而降低成本和勞動力,同時推進機器人技術和自主解決方案。推出新的機器人平台和管理系統以推動潛力和運營效率,提供傳感器技術來監測作物健康和預測潛在問題,在問題發生之前進行干預,並幫助農民避免食物浪費和更多不必要的勞動,提供將在未來幾年促進市場發展的功能。 基於上述情況,農業機器人和機電一體化市場有望在預測期內蓬勃發展。

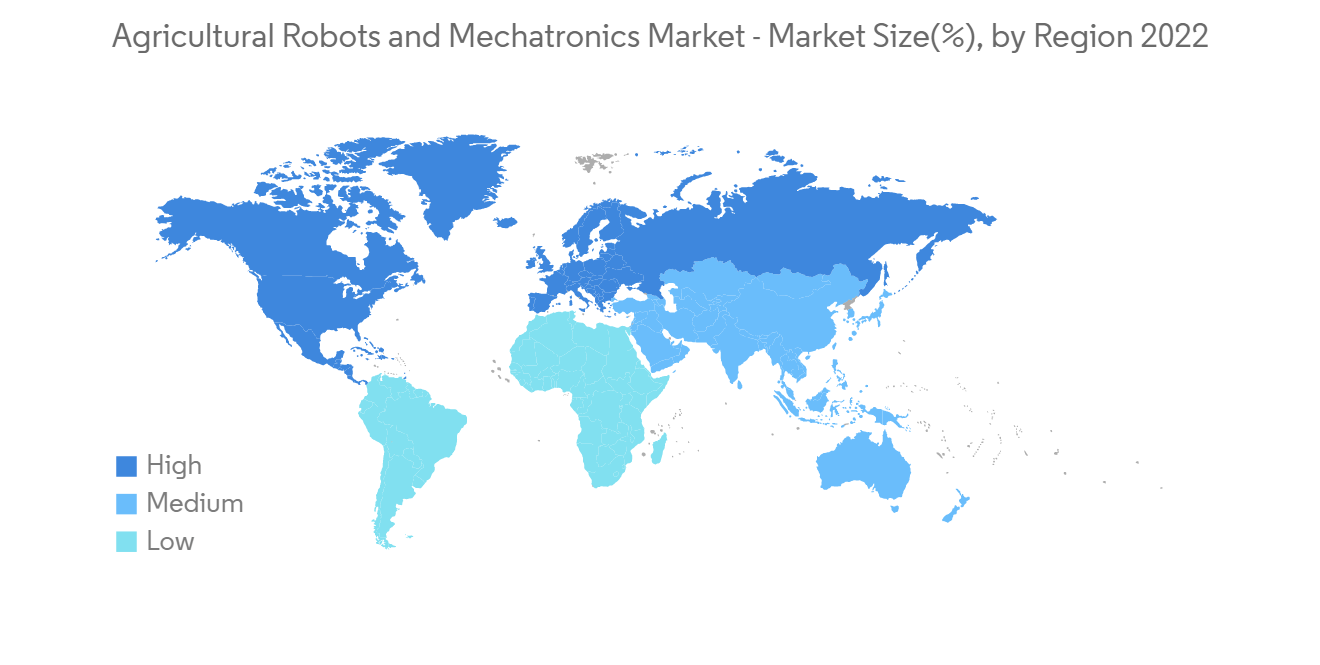

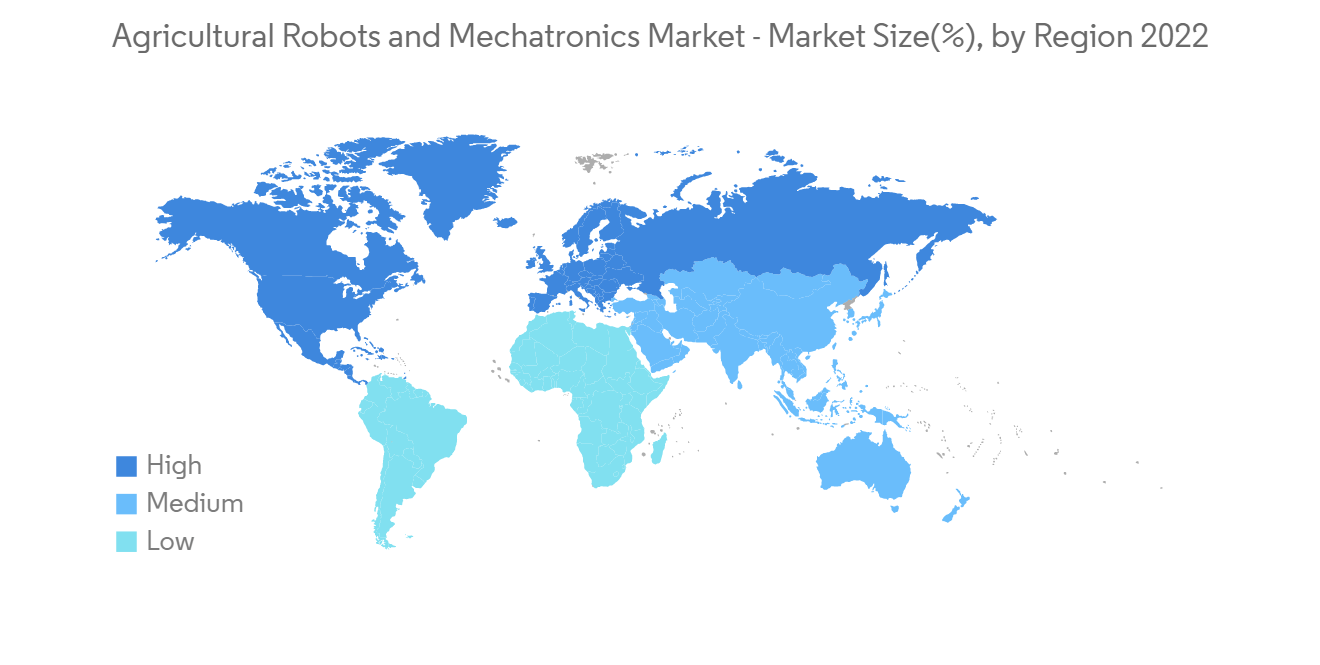

北美主導全球市場

北美之所以能夠佔據這個位置,很大程度上是美國無人機市場的結果。 美國是目前農業領域無人機部署最多的國家。 美國的農場已經在使用無人機執行各種農業任務,包括農藥噴灑、作物監測、播種和灌溉管理。 在部署無人機和自動駕駛汽車方面,我們處於該領域的前沿。 在農業領域,機器人技術的應用越來越多。 因此,技術進步正在推動全球農業機器人市場的增長。

機器人技術正在以前所未有的方式推動世界向前發展。 在過去十年中,機器人工具的進步使微創外科手術成為可能,探索機器人增強了人類在行星系統中的存在,機器人車輛自主行駛了數百萬英裡,製造機器人推動美國成為先進製造業的領導者. 聯邦政府認為,確保正確的勞動力過渡,包括 STEM 教育、培訓計劃和現有工人的再培訓以滿足未來勞動力需求,將對美國整體經濟產生重大影響。我們對未來的既得利益機器人產業。

2022年,Nio Technology將結合尖端機器人技術和人工智能技術,創造一種新的除草劑替代品,它可以保護土壤、改善工作條件並為智能農業收集數據。農業機器人“Orio”發布。 Orio 還有一個標準的 3 點附件,可以讓您將任何儀器安裝在機器人的後部。 例如,精準播種是 Orio 為種植者提供的一項附加服務,可以與除草相結合以獲得更好的效果。 該公司最近在 CES 2022 上推出了葡萄園機器人 Ted。

在北美,大規模農業、勞動力下降和農業生產力提高是推動市場發展的主要因素。 在加拿大等國家,通過有效利用技術和現代設備實現的成本降低是主要驅動力,從而導致作物產量和質量的全面提高。

農業機器人及機電一體化產業概況

全球農業機器人和機電一體化市場較為分散,前九大公司佔比不到 30-35%。 與此同時,其他公司佔據了剩餘的份額。 市場上的主要參與者是雅馬哈汽車公司、GEA Group Aktiengesellschaft、DeLaval Inc.、Dere and Company(美國)、AGCO Corporation 等。 一些公司正在迅速增加他們在市場上的存在。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場概覽

- 市場驅動因素

- 市場製約因素

- 波特的五力分析

- 供應商的議價能力

- 買方/消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第 5 章市場細分

- 類型

- 自動拖拉機

- 無人駕駛飛行器 (UAV)

- 擠奶機器人

- 其他類型

- 用法

- 作物生產

- 畜牧業

- 森林管理

- 其他用途

- 地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 其他北美地區

- 歐洲

- 西班牙

- 英國

- 法國

- 德國

- 俄羅斯

- 意大利

- 其他歐洲

- 亞太地區

- 中國

- 印度

- 日本

- 澳大利亞

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 南非

- 其他中東和非洲地區

- 北美

第6章競爭格局

- 最常採用的策略

- 市場份額分析

- 公司簡介

- AgEagle Aerial Systems

- Autonomous Solutions(ASI)

- Autonomous Tractor Corporation

- AutoProbe Technologies

- BouMatic Robotics

- Clearpath Robotics Inc.

- Conic System

- Tetra Laval(DeLaval Inc.)

- EcoRobotix Ltd

- GEA Group Aktiengesellschaft

- Harvest Automation Inc.

- Deere & Company

- Lely Industries N.V.

- Naio Technologies

- PrecisionHawk

- A/S S. A. Christensen & Co.(SAC Milking)

- SenseFly

- Vision Robotics Corporation

- Vitirover

- Wall-Ye

- Yamaha Motor Co. Ltd

第7章 市場機會與將來動向

The global agricultural robots and mechatronics market are anticipated to grow at a CAGR of 20.4% during the forecast period.

Key Highlights

- Robotics will bring the agricultural revolution. However, it would be interesting to see how the farmers, agri-businessmen, and consumers will utilize the power of robotics and digital mechanization to shape the future of this industry. The growing demand for food and increasing urbanization are among the major growth drivers of the global agricultural robot market. Governments have launched several beneficial policies globally to improve awareness and enhance yields. For instance, the European Union has funded projects to replace labor-intensive tasks with advanced automated technologies. This is likely to drive the agricultural robots and mechatronics market to an extent.

- Mobile robots will replace semi-skilled workers. However, there is never going to be an automated farm. There is still a need for farmers, farm managers, and agronomists people to make decisions. On the other hand, some agricultural tasks are better suited for machines. So we will require an increased workforce quality to deal with high-tech machines. In Japan, The government there is investing a lot of money in agricultural robotics to increase the workers' skill level. This, in turn, increases the workers' pay and the quality of life in rural areas.

- The key factors propelling this market's growth are labor shortage, increasing labor cost, increasing demand for food and agriculture supply, the efficiency of work, adoption of emerging technologies, and increasing research on different applications to make human life easier with perfect end results. This will anticipate the growth of the market during the coming years.

Agricultural Robots and Mechatronics Market Trends

Shortage and Cost of Labor is Driving the Market

Agricultural robots are autonomous machines used to improve crop quality and efficiency, minimize reliance on manual labor and increase overall productivity. For example, workers on robotic platforms in horticulture and fruit picking are twice as efficient as workers using ladders. The shortage of pickers is already causing more than 10% of fruits and vegetables worldwide to be left unpicked in fields and orchards. This is equivalent to annual consumption in the European Union. Robots may be a viable solution for an industry frequently impacted by labor availability, and they will create different employment opportunities in a modern workforce. According to International Labor Organization(ILO), the agricultural labor percentage of the workforce declined from 81% to 48.2% in developing countries. Also, developed countries are not an exception in such a huge decline.

The World Government Summit launched a report called Agriculture 4.0 - The Future of Farming Technology in collaboration with Oliver Wyman. The report states that meeting these challenges will require a concerted effort by governments, investors, and innovative agricultural technologies. Agriculture 4.0 will no longer depend on applying water, fertilizers, and pesticides uniformly across entire fields. Instead, farmers, agricultural operations will run on sensors, devices, machines, and information technology. Future agriculture will use sophisticated technologies such as robots, temperature and moisture sensors, aerial images, and GPS technology. These advanced devices, precision agriculture, and robotic systems will allow farms to be more profitable, efficient, safe, and environmentally friendly. This will boost the growth of the market during the forecast period.

In 2022, BT unveiled a new robotics platform and management system to automate the agricultural industry and drive sustainability and operational efficiencies to develop novel ways of automating the soft fruit farming industry in ways that will cut costs and labor while promoting robotic and autonomous solutions and offers features sensor technology to monitor crop health and forecast potential issues, helping farmers to intervene before a problem arises, and avoid food waste and unnecessary labor further down the line and which will drive the market in coming years. Owing to the above factors, the market for agricultural robotics and mechatronics is expected to boom during the forecast period.

North America Dominates the Global Market

North America has this position mostly as a result of the US drone market. Currently, the United States is the country that has adopted drones the most in the agricultural industry. Farms are already using drones in the United States for various agricultural tasks, such as pesticide spraying, crop monitoring, sowing, irrigation control, and more. In terms of the deployment of drones and autonomous cars, they are at the forefront of the sector. Robotics is being used in an increasing number of applications in the agricultural space. As such, technological advances are driving growth in the global agricultural robot market.

Robotics is driving the world forward in ways previously unimaginable. In the past decade, advances in robotic tools have enabled less invasive surgical procedures, exploration robots have enhanced human presence in planetary systems, robotic vehicles have autonomously driven millions of miles, and manufacturing robotics have positioned the United States as a leader in advanced manufacturing. The Federal government has a vested interest in the future of the US robotics industry as it will greatly affect the overall US economy to ensure proper workforce transition, including in STEM education, training programs, and re-skilling current workers, so they are prepared to meet future workforce needs.

In 2022, Naio Technologies introduced a new Orio agricultural robot alternative to herbicides that respects soils, improves working conditions, and collects data for smart farming by combining high-edge technology in robotics and AI. Orio can also have a standard three-point attachment and carry any implement at the robot's rear. For instance, high-accuracy seeding is an additional service Orio provides to growers allowing enhanced results when combined with weeding. The company recently released its vineyard robot Ted during CES 2022.

The major factors driving the market studied in North America are large-scale farming operations, the decline in labor, and the need to enhance the productivity of agriculture. In countries like Canada, major driving factors are cost savings achieved through efficient utilization of technology and modern equipment, leading to an overall increase in yield and quality of the crops.

Agricultural Robots and Mechatronics Industry Overview

The global agricultural robots and mechatronics market is moderately fragmented, with the top nine companies accounting for less than 30-35%. In contrast, the rest of the companies account for the remaining share. The major players in the market are Yamaha Motor Company, GEA Group Aktiengesellschaft, DeLaval Inc., Deere and Company (US), and AGCO Corporation, among others. Several companies are rapidly expanding their market presence.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Force Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Autonomous Tractors

- 5.1.2 Unmanned Aerial Vehicles (UAVs)

- 5.1.3 Milking Robots

- 5.1.4 Other Types

- 5.2 Application

- 5.2.1 Crop Production

- 5.2.2 Animal Husbandry

- 5.2.3 Forest Control

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Germany

- 5.3.2.5 Russia

- 5.3.2.6 Italy

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 AgEagle Aerial Systems

- 6.3.2 Autonomous Solutions (ASI)

- 6.3.3 Autonomous Tractor Corporation

- 6.3.4 AutoProbe Technologies

- 6.3.5 BouMatic Robotics

- 6.3.6 Clearpath Robotics Inc.

- 6.3.7 Conic System

- 6.3.8 Tetra Laval(DeLaval Inc.)

- 6.3.9 EcoRobotix Ltd

- 6.3.10 GEA Group Aktiengesellschaft

- 6.3.11 Harvest Automation Inc.

- 6.3.12 Deere & Company

- 6.3.13 Lely Industries N.V.

- 6.3.14 Naio Technologies

- 6.3.15 PrecisionHawk

- 6.3.16 A/S S. A. Christensen & Co. (SAC Milking)

- 6.3.17 SenseFly

- 6.3.18 Vision Robotics Corporation

- 6.3.19 Vitirover

- 6.3.20 Wall-Ye

- 6.3.21 Yamaha Motor Co. Ltd