|

市場調查報告書

商品編碼

1273541

熱噴塗塗料市場 - 增長、趨勢、COVID-19 影響和預測 (2023-2028)Thermal Spray Coatings Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,熱噴塗塗層市場預計將以超過 6% 的複合年增長率增長。

2020 年,由於飛機產量下降和原材料短缺,COVID-19 嚴重影響了行業的發展。 然而,大流行後航空航天業的增長預計將增加熱噴塗塗層的消耗。

主要亮點

- 熱噴塗塗層在航空航天領域的廣泛使用、在醫療設備中的使用增加以及熱噴塗陶瓷塗層的日益普及正在推動市場增長。

- 政府對熱噴塗塗層的嚴格監管以及工藝可靠性和一致性問題可能會限制市場增長。

- 在石油和天然氣行業的應用不斷增加、熱噴塗技術的進步以及熱噴塗處理材料的回收利用有望為所研究市場中的製造商提供許多機會。

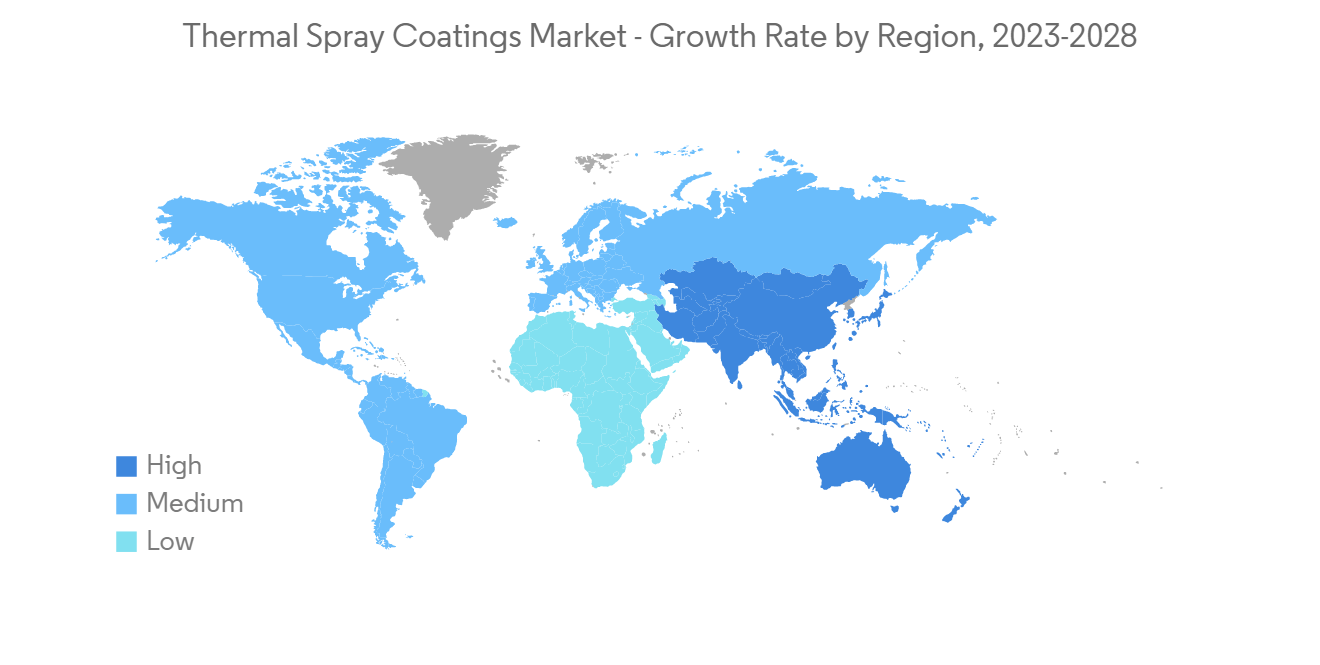

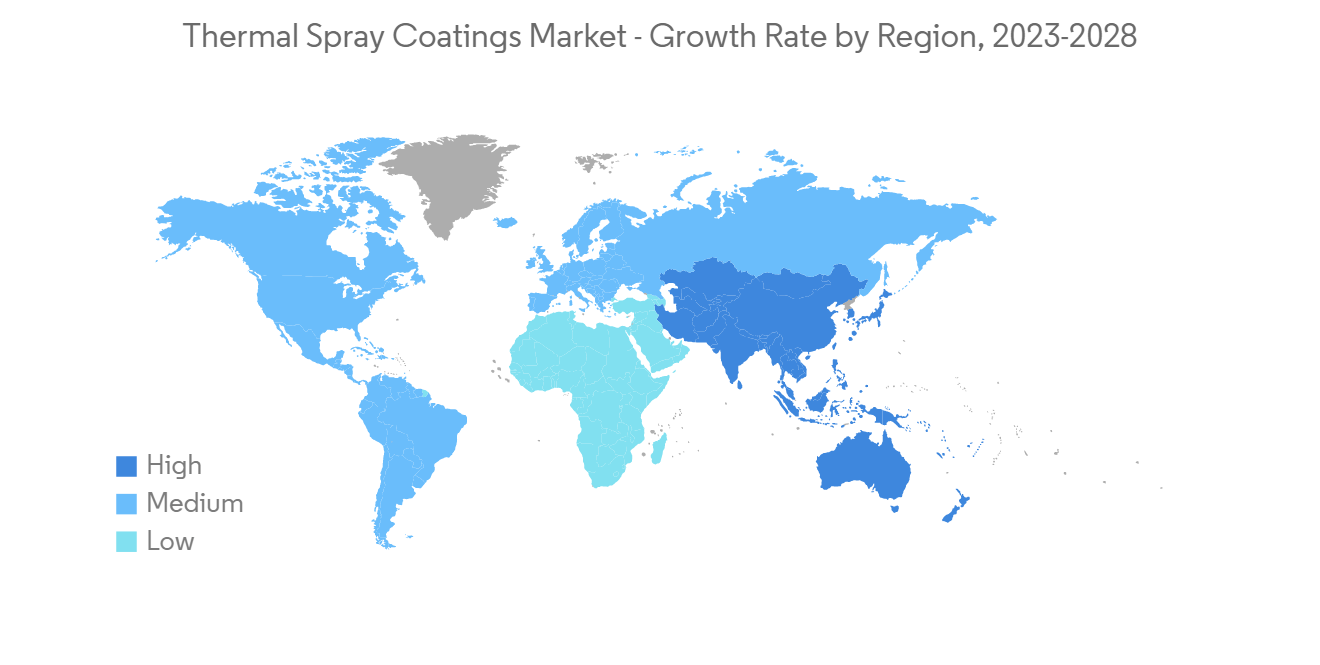

- 由於在航空航天工業和醫療設備中的應用越來越多,北美在全球熱噴塗塗料市場佔據主導地位。

熱噴塗層市場趨勢

航空航天業的需求不斷增長

- 在航空航天領域,熱噴塗層被廣泛用於保護飛機部件和修復老化部件。 在飛機燃氣輪機上使用熱噴塗塗層可提高耐腐蝕性、抗污染物性、提高熱效率、減少氮氧化物 (NOx) 排放、驅動系統、高耐熱性和提高部件性能。它具有多種優勢,比如更長的壽命。

- 熱噴塗主要用於曲軸、活塞環、氣缸和閥門等噴氣發動機零件的各種用途。 除此之外,起落架塗層(起落架內的軸承和軸)也用於承受著陸和起飛期間的力。

- 許多用於製造飛機零件和設備的超級合金材料具有良好的氧化性能,但不耐腐蝕或侵蝕。 飛機部件暴露在極端高溫、高壓和磨蝕等惡劣環境中。 熱噴塗塗層通過延長部件壽命和提高性能為昂貴的發動機部件提供重要保護

- 氧化鋯、鋁青銅和鈷鉬等熱噴塗塗層分別用於火箭燃燒室、壓縮機空氣密封件和高壓噴嘴的塗層。 渦輪氣封、燃料噴嘴和渦輪葉片均塗有鈷鉻、氧化鋁和碳化鉻。 高速氧燃料 (HVOF) 噴塗和等離子噴塗工藝是該領域使用的主要工藝。

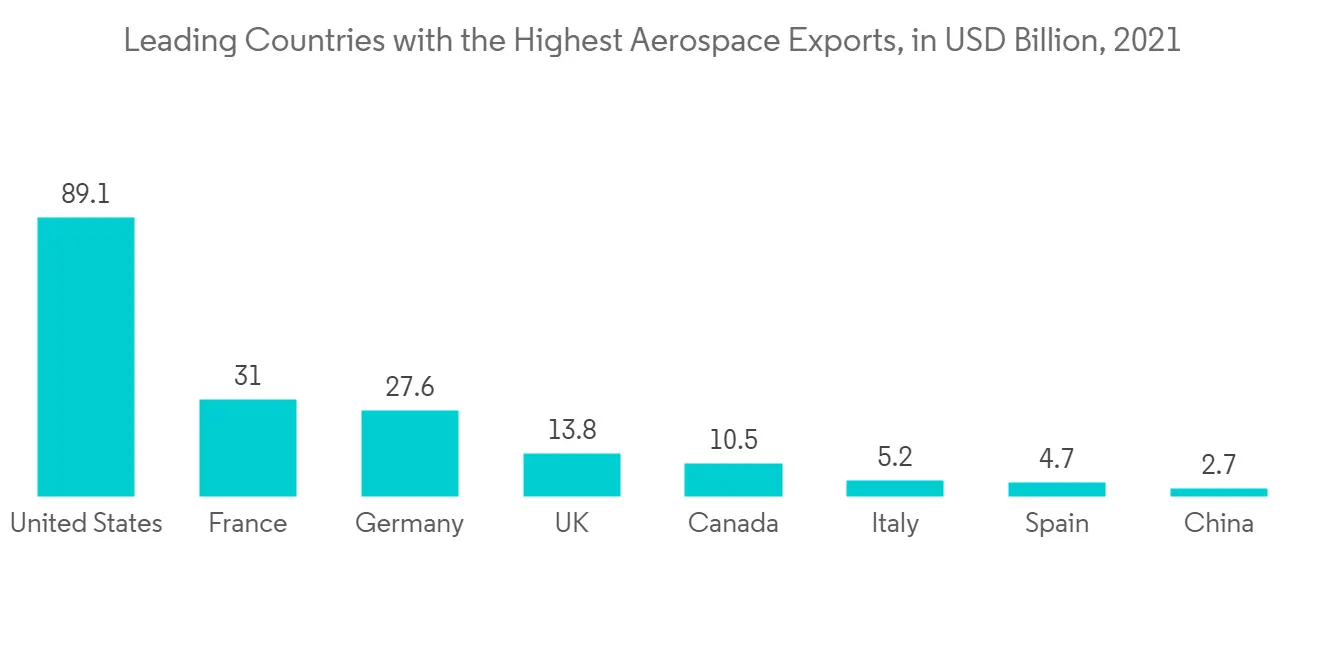

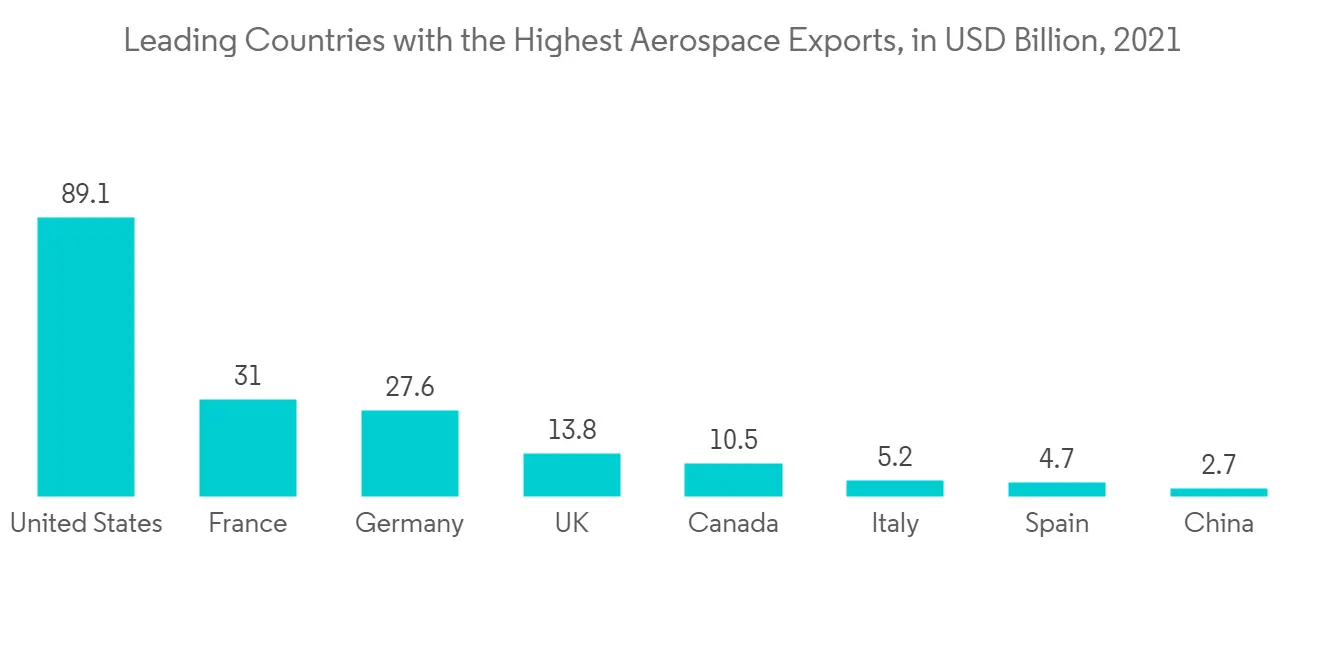

- 到 2021 年,美國將貢獻約 891 億美元的航空航天出口,成為領先的航空航天出口國。 該國是波音和洛克希德馬丁等主要航空航天製造商的所在地。 截至 2021 年,12 家最大的航空航天和國防公司中有 6 家位於美國。

- 由於消費者收入的增加和對交通基礎設施的投資,預計亞太和中東/非洲地區的航空業將快速擴張。

- 亞太航空公司連續第四個月實現強勁的國際增長,5 月份同比恢復 453.3%,高於 2022 年 1 月的 103.5%。

- 此外,預計 2021 年航空航天製造業的產值約為 1.48 萬億日元(139.6 億美元),高於上一財年的約 1.61 萬億日元(151.9 億美元)。

- 在預測期內,諸如此類的因素預計會增加航空航天業熱噴塗塗層的消耗量。

北美主導市場

- 北美是全球熱噴塗塗料市場中最大的區域市場。 由於對以有競爭力的成本提高性能以及遵守所有法規和行業標準的需求不斷增長,預計美國仍將是該地區熱噴塗塗層的主要市場。

- 美國是世界上最大的汽車工業生產國之一。 大流行後,該國的汽車產量在 2021 年實現了穩健增長。 2021年汽車產量將達到917萬輛,同比增長4%。

- 此外,航空航天零部件向法國、中國和德國等國家/地區的強勁出口,以及美國強勁的消費者支出,都在推動航空航天業的製造活動。

- 根據美國聯邦航空管理局 (FAA) 的數據,由於航空貨運量增加,商用飛機機隊總數預計將從 2021 年的 5,791 架增加到 2037 年的 8,270 架。 此外,由於現有飛機的老化,預計美國主線航空公司的機隊將增加到每年 54 架飛機。

- 2021 年,加拿大的航空航天業對該國的 GDP 貢獻了約 240 億美元。 加拿大的航空航天業將其 75% 以上的產品出口到六大洲的 190 多個國家。

- 在預測期內,上述因素將反過來增加該地區對熱噴塗塗層的需求。

熱噴塗層行業概況

全球熱噴塗塗料市場較為分散,頂級企業之間為爭奪全球市場份額展開了激烈的競爭。 許多市場領導者都是垂直整合的,擁有廣泛的材料和設備產品組合,是整個熱噴塗塗層市場的一部分。 市場上的主要參與者包括 OC Oerlikon Management AG、Praxair S.T. Technologies Inc. Linde PLC)、Chromalloy Gas Turbine LLC、Kennametal Inc.、TOCALO 等(排名不分先後)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查先決條件

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 主持人

- 熱噴塗層在醫療設備中的使用增加

- 熱噴塗陶瓷塗層越來越受歡迎

- 擴大在航空航天工業中的應用

- 約束因素

- 流程可靠性和一致性問題

- 嚴格的熱噴塗塗層政府法規

- 工業價值鏈分析

- 波特的五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章市場細分

- 粉末塗料

- 陶瓷氧化物

- 硬質合金

- 金屬

- 聚合物和其他粉末塗料

- 過程

- 燃燒

- 電能

- 最終用戶行業

- 航空航天

- 工業燃氣輪機

- 汽車

- 電子產品

- 醫療設備

- 能源/電力

- 石油和天然氣

- 其他最終用戶行業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳大利亞和新西蘭

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 意大利

- 法國

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第六章競爭格局

- 併購、合資、合作、合同等。

- 市場份額 (%)/排名分析

- 主要公司採用的策略

- 公司簡介

- APS Materials Inc.

- ASB Industries Inc.

- Bodycote PLC

- Chromalloy Gas Turbine LLC

- Chromalloy Gas Turbine LLC

- Eurocoating SpA

- FM Industries Inc.

- FW Gartner Thermal Spraying(Curtis-Wright)

- Kennametal Inc.

- Oerlikon Metco

- Praxair S.T. Technology, Inc.

- The Fisher Barton Group(Thermal Spray Technologies)

- Thermion

- TOCALO Co. Ltd

第七章市場機會與未來趨勢

- 石油和天然氣行業的應用增加

- 先進的熱噴塗技術(冷噴塗工藝)

The market for thermal spray coatings is expected to register a CAGR of more than 6% during the forecast period.

In 2020, COVID-19 severely impacted industry growth due to decreased aircraft production and raw materials shortage. However, the growing aerospace industry post-pandemic is expected to increase thermal spray coatings consumption.

Key Highlights

- The extensive usage of thermal spray coatings in the aerospace sector increased usage in medical devices, and the rising popularity of thermal spray ceramic coatings primarily drives the market's growth.

- Stringent government regulations for thermal spray coatings and issues regarding process reliability and consistency will likely restrain the market growth.

- The increasing applications in the oil and gas industry, advancements in spraying technology, and recycling of thermal spray processing materials are expected to provide numerous opportunities for the manufacturers in the market studied.

- North America dominated the global spray coatings market due to increased application in the aerospace industry and medical devices.

Thermal Spray Coatings Market Trends

Increasing Demand from the Aerospace Industry

- In the aerospace sector, thermal spray coatings are extensively used as protective coatings to protect aircraft components and repair old ones. The usage of thermal spray coatings for aircraft gas turbines provides various advantages, such as better corrosion resistance, resistance from contaminants, improved thermal efficiency, reduced emissions of nitrogen oxide (NOX), actuation systems, and to provide high thermal resistance, and increased component life.

- Thermal sprays are primarily employed for various purposes in jet engine components, such as crankshafts, piston rings, cylinders, valves, etc. In addition to these, they are also applied in the landing gear coating (bearings and axles inside the landing gear) to withstand the forces during landing and take-off.

- Most superalloy materials used to manufacture aircraft components and equipment possess good oxidation characteristics but are not corrosion and erosion resistant. Aviation components are subjected to harsh environments, exceptionally high heat, pressures, and abrasive chemicals. Thermal spray coatings significantly protect expensive engine components by extending the component life and improving performance.

- Thermal spray coatings, such as zirconium oxide, aluminum bronze, and cobalt-molybdenum, are used for coating purposes in rocket combustion chambers, compressor air seals, and high-pressure nozzles, respectively. In addition, chromium cobalt, aluminum oxide, and chromium carbide coatings are employed in turbine air seals, fuel nozzles, and turbine vanes. High-velocity oxy-fuel (HVOF) spray and plasma spray processes are the majorly used processes in this sector.

- In 2021, the United States contributed some USD 89.1 billion in aerospace exports, making it the leading country in aerospace exports. The country is home to some of the leading manufacturers in the aerospace sector, including Boeing and Lockheed Martin. As of 2021, six of the 12 leading aerospace and defense companies are based in the United States.

- Asia-Pacific and the Middle East & African regions are expected to witness rapid expansion in the aviation sector, owing to rising consumer incomes and investments in transportation infrastructure shortly.

- Asia-Pacific airlines registered substantial international growth four months in a row, reaching a year-on-year recovery rate of 453.3% in May, a significant increase from 103.5% in January 2022.

- Moreover, in 2021, the production value in the aerospace manufacturing industry was estimated to amount to approximately JPY 1.48 trillion (USD 13.96 billion), down from around JPY 1.61 trillion (USD 15.19 billion) in the previous fiscal year.

- All the factors mentioned above are expected to boost the consumption of thermal spray coatings in the aerospace industry during the forecast period.

North America to Dominate the Market

- North America represented the largest regional market for global thermal spray coatings. The United States is expected to remain the region's primary market for thermal spray coatings, owing to the increasing demand for improved performance at competitive costs and meeting all the regulations and industry standards.

- The United States is one of the world's largest producers of the automotive industry. The country's automotive production recorded robust growth in 2021 after the pandemic. In 2021, automotive production stood at 9.17 million units 2021, a 4% growth from the previous year.

- Additionally, strong exports of aerospace components to countries such as France, China, and Germany, along with robust consumer spending in the United States, are driving the manufacturing activities in the aerospace industry.

- According to the Federal Aviation Administration (FAA), the total commercial aircraft fleet is expected to reach 8,270 by 2037 from 5,791 in 2021, owing to the growth in air cargo. Also, the US mainliner carrier fleet is expected to grow to 54 aircraft per year due to the existing fleet getting older.

- The Canadian aerospace industry contributed around USD 24 billion to the country's GDP in 2021. The Canadian aerospace industry exports over 75% of its products to over 190 countries across six continents.

- Such factors above, in turn, increase the demand for thermal spray coatings in the region during the forecast period.

Thermal Spray Coatings Industry Overview

The global thermal spray coatings market is fragmented, with intense competition among the top players to capture a significant global market share. Most market leaders are vertically integrated, with a broad product portfolio of materials and equipment that is part of the overall thermal spray coatings market. Major players in the market include OC Oerlikon Management AG, Praxair S.T. Technologies Inc. (Linde PLC), Chromalloy Gas Turbine LLC, Kennametal Inc., and TOCALO Co. Ltd, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increased Usage of Thermal Spray Coatings in Medical Devices

- 4.1.2 Rising Popularity of Thermal Spray Ceramic Coatings

- 4.1.3 Growing Application in Aerospace Industry

- 4.2 Restraints

- 4.2.1 Issues Regarding Process Reliability and Consistency

- 4.2.2 Stringent Government Regulations for Thermal Spray Coatings

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Powder Coating Materials

- 5.1.1 Ceramic Oxides

- 5.1.2 Carbides

- 5.1.3 Metals

- 5.1.4 Polymers and Other Powder Coating Materials

- 5.2 Process

- 5.2.1 Combustion

- 5.2.2 Electric Energy

- 5.3 End-user Industry

- 5.3.1 Aerospace

- 5.3.2 Industrial Gas Turbines

- 5.3.3 Automotive

- 5.3.4 Electronics

- 5.3.5 Medical Devices

- 5.3.6 Energy and Power

- 5.3.7 Oil and Gas

- 5.3.8 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Australia & New Zealand

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 APS Materials Inc.

- 6.4.2 ASB Industries Inc.

- 6.4.3 Bodycote PLC

- 6.4.4 Chromalloy Gas Turbine LLC

- 6.4.5 Chromalloy Gas Turbine LLC

- 6.4.6 Eurocoating SpA

- 6.4.7 FM Industries Inc.

- 6.4.8 FW Gartner Thermal Spraying (Curtis-Wright)

- 6.4.9 Kennametal Inc.

- 6.4.10 Oerlikon Metco

- 6.4.11 Praxair S.T. Technology, Inc.

- 6.4.12 The Fisher Barton Group (Thermal Spray Technologies)

- 6.4.13 Thermion

- 6.4.14 TOCALO Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Applications in the Oil and Gas Industry

- 7.2 Advancements in Spraying Technology (Cold Spray Process)