|

市場調查報告書

商品編碼

1404316

航空燃油:市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Aviation Fuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

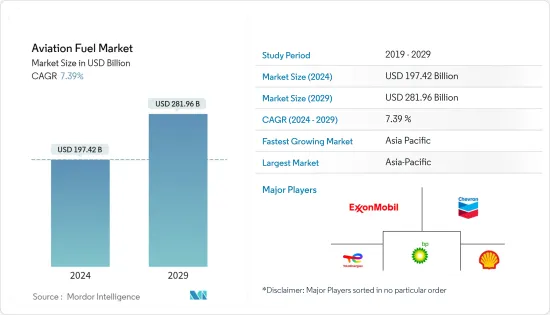

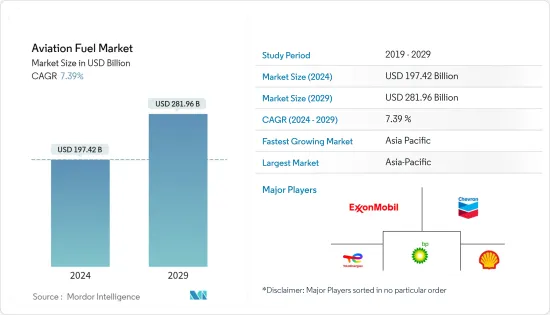

航空燃油市場規模預計到2024年為1974.2億美元,預計到2029年將達到2819.6億美元,在預測期內(2024-2029年)複合年成長率為7.39%。

年終,航空燃油市場規模預估為1,838.3億美元,預估未來五年將達到2,625.6億美元,預測期內複合年成長率超過7.39%。

主要亮點

- 從中期來看,航空需求的增加和飛機持有的成長預計將在預測期內推動市場。

- 另一方面,對空氣污染的環境擔憂日益加劇預計將阻礙預測期內的市場成長。

- 然而,永續航空燃油技術的持續進步預計將在航空燃油市場創造重大商機。

- 由於該地區航空旅行和飛機持有的增加,預計亞太地區將成為航空燃油市場的主導地區。

航空燃油市場趨勢

航空渦輪燃料可望主導市場

- 航空渦輪燃料(ATF),俗稱噴射機燃料,是一種成分類似煤油的石油基燃料。全球有多種等級,包括 Jet A、Jet A-1 和 Jet B,其中 Jet A-1 是最常使用的。 Jet A-1 適用於各種飛機渦輪引擎。最低閃點為攝氏 38 度(100 華氏度),最高冰點為攝氏 -47 度。

- 航空渦輪燃料用於多種飛機,包括商用客機、軍用飛機和噴射機。現今使用的大多數飛機,尤其是大型民航機,都依賴噴射機燃料作為其初級能源。噴射機燃料在各種類型的飛機中的廣泛使用有助於噴射機燃料在市場上的主導地位。

- 此外,民航機和軍用飛機中普及的噴射引擎需要航空渦輪燃料才能有效運作。這些引擎的設計充分利用了噴射機燃料的能量含量和燃燒特性。只要噴射引擎仍然是航空業的主導推進技術,對航空渦輪燃料的需求就會持續很大。

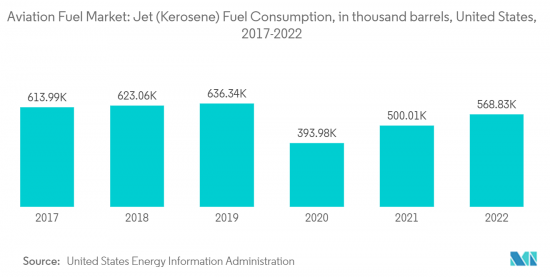

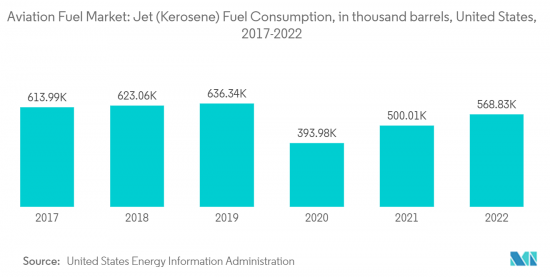

- 例如,根據美國能源資訊署的數據,2022年至2021年間,美國的噴射機燃料消費量增加了約14%,顯示飛機運作和燃油消耗量增加。

- 航空渦輪燃料比活塞引擎飛機中使用的其他燃料(例如航空汽油)具有更高的能量密度。這意味著噴射機燃料每單位體積可以提供更多的能量,這對於遠距飛行和大型飛機至關重要。航空渦輪燃料的高能量密度使其非常適合為噴射引擎動力來源,使其能夠有效且長時間地飛行。

- 2023年1月,印度石油公司(IOC)開始出口航空燃油,以滿足小型飛機和無人機(UAV)的需求。此舉將使印度能夠透過冒險石油出口進入價值約27億美元的全球市場。賈瓦哈拉爾尼赫魯港口信託公司 (JNPT) 已協助出貨其第委託80 桶航空燃料運往巴布亞紐幾內亞。一桶容量為16公升,可運輸大量航空氣體。

- 因此,正如所討論的,航空渦輪燃料市場預計將在預測期內萎縮。

亞太地區預計將主導市場

- 亞太地區正在經歷顯著的經濟成長,其中中國、印度和東南亞國家等國家引領了這一擴張。航空需求隨著經濟成長而增加,直接導致航空燃油消費量的增加。該地區經濟的強勁成長正在增強航空燃油市場的主導地位。

- 亞太地區航空業蓬勃發展,航空公司數量眾多,機持有數量不斷增加。該地區的航空公司不斷擴大業務,增加新航線並增加航班頻率。這種擴張需要增加對航空燃料的需求,並有助於佔據該地區航空燃料市場的主導地位。

- 此外,亞太地區快速的都市化和不斷成長的中產階級人口導致航空旅行激增。隨著該地區越來越多的人使用航空運輸,對航空燃料的需求也在增加。都市化的加速和中階的崛起是推動亞太地區市場主導地位的關鍵因素。

- 此外,亞太地區正在見證廉價航空公司(LCC) 的出現和發展。這些航空公司提供價格實惠的機票,吸引了更多的人口並刺激了航空旅行的需求。低成本航空企業通常以高負載率營運,導致燃油消費量增加,從而增強其在該地區航空燃油市場的主導地位。

- 此外,亞太地區許多國家正在大力投資機場基礎設施。新機場正在建設中,現有機場正在擴建和現代化。這些基礎設施投資為增加空中交通和燃油消費量創造了有利條件,進一步增強了該地區在航空燃油市場的主導地位。

- 例如,2023年5月,由於航空公司實現脫碳目標所需的全球供應嚴重短缺,印度石油公司宣布將採購1.22億美元的永續航空燃料(SAF)工廠。規劃中的工廠將具備每年生產 88,000 噸 SAF 的能力。

- 基於上述情況,預計亞太地區將在預測期內主導市場。

航空燃油產業概況

航空燃油市場較為分散。市場上的主要企業(排名不分先後)包括埃克森美孚公司、雪佛龍公司、殼牌公司、TotalEnergies SE 和 BP Plc。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 2028年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 航空需求增加

- 航空材料拓展

- 抑制因素

- 油價不穩定

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 汽油種類

- 空氣渦輪燃料

- 噴射機A-1

- 噴射A

- 噴射B

- 生質燃料

- AVGAS

- 空氣渦輪燃料

- 最終用戶

- 商業的

- 防禦

- 通用航空

- 按地區分類的市場分析(到 2028 年的市場規模和需求預測(僅按地區))

- 北美洲

- 美國

- 加拿大

- 其他北美地區

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 埃及

- 南非

- 中東和非洲其他地區

- 北美洲

第6章競爭形勢

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Exxon Mobil Corporation

- Chevron Corporation

- Shell Plc.

- TotalEnergies SE

- BP Plc

- Gazprom Neft'PAO

- Neste Oyj

- Swedish Biofuels AB

- Red Rock Biofuels LLC

- Abu Dhabi National Oil Company

- Bharat Petroleum Corp. Ltd.

- Indian Oil Corporation Ltd.

- Emirates National Oil Company

- Valero Energy Corporation

- Allied Aviation Services Inc.

第7章 市場機會及未來趨勢

- 生質燃料和永續替代燃料

簡介目錄

Product Code: 57160

The Aviation Fuel Market size is estimated at USD 197.42 billion in 2024, and is expected to reach USD 281.96 billion by 2029, growing at a CAGR of 7.39% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, the increasing demand for air travel and an increasing fleet of aircraft is expected to drive the market during the forecasted period.

- On the other hand, the increasing environmental concerns for air pollution are expected to hinder the growth of the market during the forecasted period.

- Nevertheless, the increasing advancements in sustainable aviation fuel technology are expected to create huge opportunities for the aviation fuel market.

- Asia-Pacific is expected to be a dominant aviation fuel market region due to the increasing air travel and aircraft fleets in the region.

Aviation Fuel Market Trends

Aviation Turbine Fuels Expected to Dominate the Market

- Aviation Turbine Fuel (ATF), commonly known as jet fuel, is a petroleum-derived fuel with a composition resembling kerosene. It is available in different grades globally, including Jet A, Jet A-1, and Jet B, with Jet A-1 being the most commonly utilized. Jet A-1 is compatible with a wide range of aircraft turbine engines. It exhibits a minimum flash point of 38 degrees Celsius (100°F) and a maximum freeze point of -47 degrees Celsius.

- Aviation turbine fuels are used in various aircraft, including commercial airliners, military, and business jets. Most aircraft in service today, especially larger commercial aircraft, rely on jet fuel as their primary energy source. The widespread usage of jet fuel in various aircraft types contributes to its dominance in the market.

- Moreover, jet engines, prevalent in commercial and military aviation, require aviation turbine fuels to operate efficiently. These engines are designed to utilize jet fuel's energy content and combustion properties. As long as jet engines remain the dominant propulsion technology in the aviation industry, the demand for aviation turbine fuels will continue to be significant.

- For instance, according to the United States Energy Information Administration, the consumption of jet fuel in the United States increased by almost 14% between 2022 and 2021, signifying the increasing air ravels and fuel consumption.

- Aviation turbine fuels have a higher energy density than other fuels, such as avgas used in piston-engine aircraft. This means that jet fuel can provide more energy per unit of volume, which is crucial for long-haul flights and larger aircraft. The high energy density of aviation turbine fuels makes them ideal for powering jet engines and allows for efficient and extended flight operations.

- In January 2023, The Indian Oil Corporation (IOC) initiated the export of aviation fuel, catering to the requirements of small aircraft and unmanned aerial vehicles (UAVs). This move allows India to enter the global market, valued at approximately USD 2.7 billion, by venturing into petroleum exports. The Jawaharlal Nehru Port Trust (JNPT) facilitated the shipment of the first consignment comprising 80 barrels of aviation fuel to Papua New Guinea. Each barrel has a capacity of 16 kiloliters, enabling the transport of a significant quantity of aviation gas.

- Therefore as per the points discussed, aviation turbine fuel is expected to diminish the market during the forecasted period.

Asia-Pacific Expected to Dominate the Market

- The Asia-Pacific region is experiencing significant economic growth, with countries like China, India, and Southeast Asian nations driving this expansion. As economies grow, there is a corresponding increase in air travel demand, directly translating to higher aviation fuel consumption. The region's robust economic growth fuels the dominance of the aviation fuel market.

- The Asia-Pacific region has a flourishing airline industry with numerous carriers and a growing fleet of aircraft. Airlines in the region continuously expand their operations, adding new routes and increasing flight frequencies. This expansion necessitates a higher demand for aviation fuel, contributing to the dominance of the market in the region.

- Moreover, rapid urbanization in the Asia-Pacific region and the rise of the middle-class population has led to a surge in air travel. As more people in the region access air transportation, the demand for aviation fuel grows. The increasing urbanization and a burgeoning middle-class population are key factors driving the dominance of the market in the Asia-Pacific region.

- Furthermore, Asia-Pacific region has witnessed the emergence and growth of low-cost carriers (LCCs). These airlines offer affordable airfares, attracting a larger segment of the population and stimulating air travel demand. LCCs typically operate with higher load factors, leading to increased fuel consumption and subsequently driving the aviation fuel market's dominance in the region.

- Additionally, many countries in the Asia-Pacific region are investing heavily in airport infrastructure development. New airports are being built, and existing ones are undergoing expansion and modernization. These infrastructure investments create favorable conditions for increased air traffic and fuel consumption, further contributing to the region's dominance in the aviation fuel market.

- For instance, in May 2023, Indian Oil Corp. intends to construct a sustainable aviation fuel (SAF) plant worth USD 122 million due to the substantial shortfall in global supplies required by airlines to achieve decarbonization targets. The planned facility will have the capability to manufacture 88,000 tons of SAF annually.

- Therefore as per the above-mentioned points the Asia-Pacific region is expected to dominate the market during the forecasted period.

Aviation Fuel Industry Overview

The Aviation fuel market is fragmented. Some of the major players in the market (in no particular order) include ExxonMobil Corporation, Chevron Corporation, Shell Plc., TotalEnergies SE, and BP Plc. among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Air Travel Demand

- 4.5.1.2 Expanding Airline Fleet

- 4.5.2 Restraints

- 4.5.2.1 Volatile Crude Oil Prices

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Fuel Type

- 5.1.1 Air Turbine Fuel

- 5.1.1.1 Jet A-1

- 5.1.1.2 Jet A

- 5.1.1.3 Jet B

- 5.1.2 Aviation Biofuel

- 5.1.3 AVGAS

- 5.1.1 Air Turbine Fuel

- 5.2 End-User

- 5.2.1 Commercial

- 5.2.2 Defence

- 5.2.3 General Aviation

- 5.3 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Chile

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Egypt

- 5.3.5.4 South Africa

- 5.3.5.5 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Exxon Mobil Corporation

- 6.3.2 Chevron Corporation

- 6.3.3 Shell Plc.

- 6.3.4 TotalEnergies SE

- 6.3.5 BP Plc

- 6.3.6 Gazprom Neft' PAO

- 6.3.7 Neste Oyj

- 6.3.8 Swedish Biofuels AB

- 6.3.9 Red Rock Biofuels LLC

- 6.3.10 Abu Dhabi National Oil Company

- 6.3.11 Bharat Petroleum Corp. Ltd.

- 6.3.12 Indian Oil Corporation Ltd.

- 6.3.13 Emirates National Oil Company

- 6.3.14 Valero Energy Corporation

- 6.3.15 Allied Aviation Services Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Biofuels and Sustainable Alternatives

02-2729-4219

+886-2-2729-4219