|

市場調查報告書

商品編碼

1433494

紫外線固化黏劑:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)UV-Curable Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

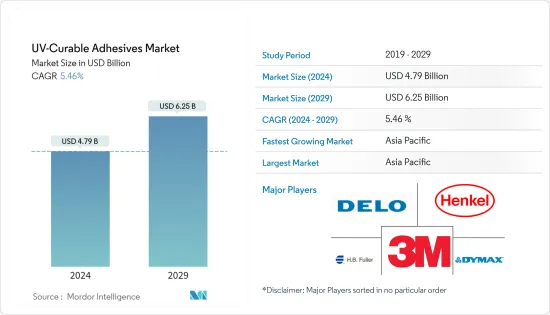

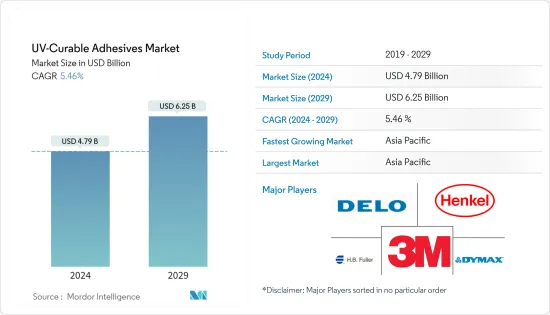

UV固化黏劑市場規模預計2024年為47.9億美元,預計到2029年將達到62.5億美元,預計在預測期內(2024-2029年)將以5.46%的複合年成長率成長。

新型冠狀病毒感染疾病(COVID-19)的爆發導致世界各地的國家封鎖,擾亂了製造活動和供應鏈,並導致生產停止,這對 2020 年的市場產生了負面影響。然而,到了2021年,情況開始好轉,從而恢復了市場的成長軌跡。

主要亮點

- 推動該市場研究的主要因素是軟包裝應用中對紫外線黏劑的需求不斷成長,以及由於有利的環境法規而導致的需求不斷成長。

- 另一方面,紫外線固化黏劑的高製造成本和替代黏劑的可用性預計將阻礙市場成長。

- 醫療產業不斷成長的需求以及具有環境和社會效益的新製程的研發預計將為所研究的市場提供機會。

- 亞太地區主導全球市場,最大的消費來自中國、日本和印度等國家。

UV固化黏劑的市場趨勢

包裝產業實現強勁成長

- 紫外光固化黏劑用於包裝領域,因為它可以快速黏合塑膠、橡膠、金屬、玻璃和陶瓷等不同材料。

- 卓越的強度和彈性、耐受惡劣環境的能力以及出色的防潮性等特性使紫外線固化黏劑非常適合包裝應用。

- 由於人們越來越認知到使用紫外線固化黏劑的好處,歐洲和北美塑膠包裝產業對紫外線固化黏劑的需求一直在增加。這些黏劑消除了翻蓋式封裝中對熱和射頻 (RF) 密封的需要。

- 根據印度包裝工業協會(PIAI)統計,2019年印度包裝市場規模約505億美元。預計到2025年將達到2,048.1億美元,2020年至2025年複合年成長率為26.7%。因此,包裝行業的成長預計將增加對UV固化黏劑的需求。

- 軟包裝用於南美洲、非洲和亞太地區低收入國家的食品包裝應用。在經濟持續擴張和食品和飲料產業加速發展的支持下,軟包裝在新興經濟體中越來越受歡迎,需求也越來越大。

- 在需要耐候性的產品包裝應用中,紫外線固化黏劑擴大用於層壓薄膜、紙張和箔片。

- 隨著電子商務、電子零售、線上食品訂購和配送服務的不斷發展,對包裝材料特別是軟包裝的需求不斷增加。這可能會增加預測期內對紫外線固化黏劑的需求。在德國,2021年和2022年紙包裝產業與前一年相比顯著成長。

- 上述因素正在推動UV固化黏劑市場的成長。

亞太地區主導市場

- 預計亞太地區將主導全球紫外線固化黏劑市場。中國、印度和日本等國家對包裝和醫療行業投資的增加以及電氣和電子設備產量的增加正在增加該地區紫外線固化黏劑的使用。

- 在亞太地區,由於生活方式的改變、人們可支配收入的增加、專業人士數量的增加以及對快餐的日益偏好,對加工食品的偏好正在增加。消費者更喜歡即食食品,因為它們所需的烹飪時間顯著減少、新鮮、包裝美觀且耐用,並且能夠滿足調查市場的需求。

- 人均收入的上升和電商巨頭的崛起,使中國成為全球最大的包裝材料消費國。根據印度塑膠工業協會統計,印度包裝工業位居世界第五,每年以約22-25%的速度成長。由於高技術純熟勞工和低廉的人事費用,食品包裝和加工成本可比歐洲低40%。人口的成長和對包裝的需求的增加預計將推動市場的發展。

- 此外,由於經濟擴張和高購買力中階的壯大,近年來中國包裝產業持續快速成長。食品包裝是包裝產業的主要參與者,在中國總市場中佔有很大佔有率。根據Interpack統計,在中國食品包裝領域,預計2023年包裝總數將達到4,470億件,顯示包裝業對紫外光固化黏劑的需求不斷增加。

- 另一方面,日本是技術進步中心,擁有活躍的研發基地,用於研發更新、更高效的紫外線固化黏劑。這些因素導致了該國用於包裝、電氣和汽車應用的新型紫外線固化黏劑產品的出現。

- 上述因素預計將增加預測期內紫外線固化黏劑市場成長的需求。

UV固化黏劑產業概況

紫外線固化黏劑市場得到整合,少數廠商佔據了市場需求的很大一部分。這些主要企業包括 Dymax Corporation、3M、HB Fuller、Henkel AG &Company KGaA 和 DELO Industrial Adhesives。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 軟包裝應用中對 UV黏劑的需求增加

- 由於有利的環境法規,需求增加

- 其他司機

- 抑制因素

- 生產紫外線固化黏劑的高成本

- 替代黏劑的可用性

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 樹脂型

- 矽膠

- 丙烯酸纖維

- 聚氨酯

- 環氧樹脂

- 其他樹脂類型

- 最終用戶產業

- 醫療保健

- 電力/電子

- 運輸

- 包裝

- 家具

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- 3M

- DELO

- Dymax

- Epoxy Technology Inc.

- HB Fuller Company

- Henkel AG & Co. KGaA

- Master Bond Inc.

- Panacol-Elosol GmbH

- Parson Adhesives, Inc.

- Permabond

- Sika AG

- Heraeus Holding

- Dexerials Corporation

- EpoxySet, Inc.

第7章 市場機會及未來趨勢

- 醫療產業需求增加

- 研究和開發可帶來環境和社會效益的新工藝

The UV-Curable Adhesives Market size is estimated at USD 4.79 billion in 2024, and is expected to reach USD 6.25 billion by 2029, growing at a CAGR of 5.46% during the forecast period (2024-2029).

Due to the COVID-19 outbreak, nationwide lockdowns worldwide, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, the conditions started recovering in 2021, thereby restoring the growth trajectory of the market

Key Highlights

- The major factors driving the market studied are the rising demand for UV adhesives in flexible packaging applications and increasing demand due to favorable environmental regulations.

- On the flip side, the high cost of producing UV-curable adhesives and the availability of alternative adhesives are expected to hinder the market's growth.

- An increase in demand from the medical industry and research and development in novel processes offering environmental and social benefits are expected to act as opportunities for the market studied.

- Asia-Pacific dominated the market worldwide, with the largest consumption from countries like China, Japan, and India.

UV-Curable Adhesives Market Trends

Packaging Segment to Witness Strong Growth

- UV-curable adhesives find their applications in the packaging sector, owing to their ability to create quick bonds between different materials, such as plastic, rubber, metal, glass, and ceramic.

- Properties such as superior strength and flexibility, ability to withstand extreme environments, and excellent moisture resistance make UV-curable adhesives suitable for packaging applications.

- The demand for UV-curable adhesives from the plastic packaging industry is consistently increasing in Europe and North America, with growing awareness about the benefits of using UV-curable adhesives. These adhesives eliminate heat and Radio Frequency (RF) sealing of clamshell packages.

- According to the Packaging Industry Association of India (PIAI), Indian Packaging Market accounted for around USD 50.5 billion in 2019. It is expected to reach USD 204.81 billion by 2025 growing at a CAGR of 26.7% during 2020-2025. Therefore, the growth in the packaging industry is expected to increase the demand for UV-curable adhesives.

- Flexible packaging is used in food packaging applications in low-income South America, Africa, and Asia-Pacific countries. The popularity and demand for flexible packaging are rising in emerging economies, and the demand is supported by continued economic expansion and an acceleration in the food and beverage industry.

- The UV-curable adhesive usage as laminating films, papers, and foils is increasing in product packaging applications where weather resistance is required.

- With the growing trend of e-commerce, e-retail, and online food orders and delivery services, the demand for packaging materials, especially flexible packaging, is increasing. It will likely drive the demand for UV-curable adhesives during the forecast period. In Germany, the paper packaging industry grew significantly in 2021 and 2022 compared to previous years.

- The factors above are driving the UV-curable adhesives market growth.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to dominate the global UV-curable adhesives market. With growing investments in the packaging and medical industry and increasing electrical and electronics production in countries such as China, India, and Japan, the usage of UV-curable adhesives is increasing in the region.

- In Asia-Pacific, the demand for packaged food is growing, owing to lifestyle changes, the growing disposable income of people, the increasing number of working professionals, and the growing preference for fast food. Consumers prefer ready-to-consume foods because they require considerably less time for cooking, are fresh, and contain attractive and sturdy packaging, supporting the demand for the market studied.

- China is the world's largest packaging consumer globally, owing to growing per capita income and rising e-commerce giants. India's packaging industry is the fifth-largest globally, growing at about 22-25% per year, as per the Plastics Industry Association of India. Packaging and processing food costs can be 40% lower than in Europe because of highly skilled labor and cheap labor costs. The growing population and increasing demand for packaging are expected to drive the market.

- Furthermore, the Chinese packaging industry grew rapidly and consistently in recent years, owing to the expanding economy and rising middle class with greater purchasing power. Food packaging is a major player in the packaging industry, accounting for a significant share of the total market in China. According to Interpak, in China, in the foodstuff packaging category, total packaging is expected to reach 447 billion units in 2023, indicating an increased demand for UV-curable adhesives from the packaging industry.

- On the other hand, Japan is a hub for technological advancements and hosts an active R&D base for R&D of newer and more efficient UV-curable adhesives. Due to these factors, novel UV-curable adhesive products are emerging for applications in the country's packaging, electrical, and automotive sectors.

- The abovementioned factor is expected to boost the demand for UV-curable adhesives market growth during the forecast period.

UV-Curable Adhesives Industry Overview

The UV-curable adhesives market is consolidated, where few players account for a significant portion of the market demand. These major players include Dymax Corporation, 3M, H.B. Fuller, Henkel AG & Company KGaA, and DELO Industrial Adhesives.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand for UV Adhesives in Flexible Packaging Application

- 4.1.2 Increasing Demand Due to Favourable Environmental Regulations

- 4.1.3 Others Drivers

- 4.2 Restraints

- 4.2.1 High Cost Associated with the Production of UV-Curable Adhesives

- 4.2.2 Availability of Alternative Adhesives

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin Type

- 5.1.1 Silicone

- 5.1.2 Acrylic

- 5.1.3 Polyurethane

- 5.1.4 Epoxy

- 5.1.5 Other Resin Types

- 5.2 End-user Industry

- 5.2.1 Medical

- 5.2.2 Electrical and Electronics

- 5.2.3 Transportation

- 5.2.4 Packaging

- 5.2.5 Furniture

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 DELO

- 6.4.3 Dymax

- 6.4.4 Epoxy Technology Inc.

- 6.4.5 H.B. Fuller Company

- 6.4.6 Henkel AG & Co. KGaA

- 6.4.7 Master Bond Inc.

- 6.4.8 Panacol-Elosol GmbH

- 6.4.9 Parson Adhesives, Inc.

- 6.4.10 Permabond

- 6.4.11 Sika AG

- 6.4.12 Heraeus Holding

- 6.4.13 Dexerials Corporation

- 6.4.14 EpoxySet, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increase in Demand From Medical Industry

- 7.2 Research and Development in Novel Processes Offering Environmental and Social Benefits