|

市場調查報告書

商品編碼

1433486

資料科學平台:市場佔有率分析、產業趨勢、成長預測(2024-2029)Data Science Platform - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

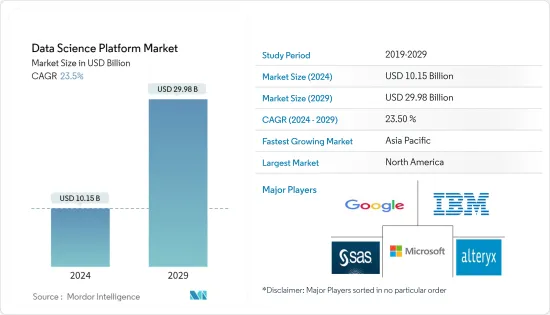

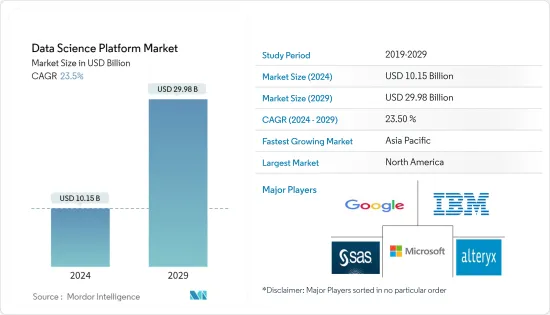

資料科學平台市場規模預計到 2024 年為 101.5 億美元,預計到 2029 年將達到 299.8 億美元,在預測期內(2024-2029 年)成長 23.5%,複合年成長率成長。

資料科學的興起為組織提供了解決方案,將資料集轉化為寶貴的資源,幫助他們透過可行的見解獲得商業價值。隨著商業企業和組織數量的指數級成長,資料科學已成為商業各個方面不可或缺的一部分,並在經營模式中發揮關鍵作用。

主要亮點

- 資料科學平台提供了一組工具和服務,使組織能夠管理、存取和分析資料,簡化資料分析流程並擴展資料分析能力。由於預測分析、明智決策以及更好地利用資料進行自動化機器學習流程等優勢,資料科學平台的採用正在增加。

- 公司越來越注重增加內部資料科學資源,以建立機器學習模型並縮小所需專業人員的招募差距,導致資料科學即服務 (DSaaS) 的採用率不斷上升。它對許多企業來說變得至關重要,因為它可以幫助他們擴展分析能力以滿足關鍵需求並實現期望的業務成果。

- 隨著人工智慧(AI)和機器學習(ML)等技術的快速發展,企業正在接收極其大量的資料,包括基於先前存在的資料集的新資料集和新格式的資料。因此,為了使用這些資料,公司傾向於實施適合其要求的資料科學解決方案。

- 缺乏熟練勞動力造成的主要障礙之一是組織無法從其產生的大量資料中獲得有意義的見解。資料科學平台旨在幫助使用者分析和解釋複雜的資料集,但缺乏能夠指導這些平台的熟練專業人員會降低其有效性。組織努力彌合資料科學平台的先進功能與最佳利用這些功能所需的專業知識之間的差距。

- COVID-19感染疾病加速了商業和工業的數位化,對資料驅動的見解的需求激增。來自各行業的組織已轉向資料科學來管理資源和風險,並就客戶行為做出明智的決策。此外,向遠端工作的轉變促進了雲端基礎的資料科學平台和工具的採用,使資料科學家能夠在任何地方進行有效協作。這種彈性和可訪問性進一步增加了對資料科學專業知識的需求。

資料科學平台市場趨勢

中小企業實現顯著成長

- 小型組織的員工人數少於 100 人,中型公司的員工人數在 100 至 999 人之間。資料科學在中小型企業中的主要用途之一是利用資料科學在銷售週期的各個階段追蹤客戶。小型企業可以使用資料分析來確定可能購買的特定消費者群體。資料主導產業的發展將使企業能夠透過基於證據的結論來實現永續發展,從而提高銷售、績效、營運等。

- 小型企業的營運資源通常有限,因此每個決策都很重要。資料科學平台使中小型企業能夠做出更準確、更明智的決策並降低風險。該平台可協助中小型企業識別其業務和供應鏈中的低效率問題並降低成本。

- 2023 年 8 月,Infor Nexus 與星展銀行合作宣佈為 Infor Nexus 供應鏈生態系統內的中小企業 (SME) 供應商推出出貨前融資。該解決方案利用 Infor Nexus 平台的歷史資料提供基於資料庫的融資解決方案,幫助供應商滿足營運成本需求。

- 雲端的採用預計將推動市場成長。它徹底改變了中小型企業存取和利用資料科學平台的方式。雲端基礎設施是擴充性的,允許小型企業根據需求的變化無縫地擴展或縮減其資料科學能力。 2023 年 11 月,AnniQ 推出了一項專注於資料分析的新服務,以支援中小企業 (SME) 的策略能力。該服務旨在增強中小型企業在業務營運中參與和利用資料的方式,重點是提供可行的見解並推動策略執行。

北美佔有很大的市場佔有率

- 在資料量和複雜性不斷增加的推動下,美國不斷創新其資料科學平台並加強其在全球市場的地位。在所研究的市場中採用高級分析、人工智慧 (AI) 和機器學習 (ML) 等先進技術也對國家經濟產生直接影響。

- 根據 Telecom Advisory Services 的數據,美國的網路流量預計已從 2021 年的每月 6,400 萬Exabyte躍升至 2023 年的每月 9,864 萬Exabyte。資料流量的顯著增加需要更先進的資料科學解決方案來大規模管理資料流量。了解您的資料量並根據提取的資料改進您的解決方案。此外,組織正在產生比以往更多的資料,而這些資料變得越來越複雜和多樣化。這使得使用傳統方法分析資料和提取見解變得困難。資料科學平台提供了用於管理和分析大型複雜資料庫的工具和基礎設施。

- 而且,市場上接受調查的主要供應商均位於美國。此外,該國正處於第四次工業革命的邊緣,資料被用於大規模生產,整合整個供應鏈中不同的製造系統和資料。這正在加速日本先進技術的引進。

- 該地區各國政府也透過努力支持市場中新興技術的成長來加速機器人技術的採用。例如,美國聯邦政府啟動了國家機器人舉措(NRI)計劃,以加強美國國內機器人建立能力並鼓勵該領域的研究活動。預計這些舉措將為市場成長帶來積極的前景。

- 此外,加拿大非常注重醫療保健、人工智慧和可再生能源等領域的研究和創新,這需要資料科學平台來分析複雜的資料集並得出研究見解,為市場提供支援。加拿大的科技產業蓬勃發展,並齊心協力吸引科技人才。銀行、醫療保健、金融、保險、媒體和娛樂、通訊、電子商務等行業都需要合格的資料科學家和人工智慧專家。目前對專家的需求量超出了能力範圍。不斷擴大的技術力和對高階 IT 解決方案、人工智慧和機器學習的需求將推動加拿大資料科學平台市場的發展。

資料科學平台產業概述

資料科學平台市場是半整合的,其特點是產品差異化程度高、產品普及不斷提高、技術進步迅速,導致難以保持競爭優勢和解決方案的持續開發。創新。主要參與者包括 Alteryx、IBM 公司、Google LLC (Alphabet Inc.)、SAS、Alteryx 和微軟公司。

- 2023 年 11 月 - IBM 與 Amazon Web Services (AWS) 合作推出 Amazon for Db2,這是一款完全託管的雲端產品,旨在協助資料庫客戶管理人工智慧 (AI)資料。關聯式資料庫服務(Amazon RDS) 現已全面推出。跨混合雲端環境的工作負載。這將使用戶能夠利用公司在 AWS 上整合的資料和人工智慧功能集來管理資料並擴展他們的人工智慧工作負載。

- 2023 年 8 月 - Google Cloud 和 NVIDIA 推出新技術來推進 AI 運算、軟體和服務,幫助客戶建置和部署用於產生 AI 的大規模模型並加速資料科學工作負載。我們宣布擴大合作夥伴關係。此次合作將為全球最大的 AI 客戶提供端到端機器學習服務,包括使用基於 NVIDIA 技術構建的 Google Cloud 服務輕鬆運行 AI超級電腦的能力。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 宏觀經濟趨勢的影響

第5章市場動態

- 市場促進因素

- 巨量資料的爆炸

- 資料科學和機器學習有前景的使用案例的出現

- 組織轉向資料集中方法和決策

- 市場限制因素

- 勞動力缺乏技能

- 資料安全和可靠性問題

- 主要使用案例

- 生態系分析

- 定價及定價模式分析

- 資料科學平台的主要功能(人工智慧和機器學習、分析、視覺化、探索、建模)

第6章市場區隔

- 透過提供

- 平台

- 按服務

- 按配置

- 本地

- 雲

- 按公司規模

- 中小企業

- 主要企業

- 按行業分類

- 資訊科技/通訊

- BFSI

- 零售/電子商務

- 石油/天然氣/能源

- 製造業

- 政府/國防

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 希臘

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 東南亞

- 印尼

- 菲律賓

- 馬來西亞

- 新加坡

- 其他東南亞

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 沙烏地阿拉伯

- GCC

- 阿拉伯聯合大公國

- 其他海灣合作理事會

- 南非

- 其他中東和非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- IBM Corporation

- Google LLC(Alphabet Inc.)

- Microsoft Corporation

- SAS

- Alteryx

- The MathWorks Inc.

- RapidMiner

- Databricks

- Amazon Web Services Inc.(AMAZON.COM INC.)

- DataRobot Inc.

第8章廠商市場佔有率分析

第9章 廠商地域排名

第10章投資分析

第11章投資分析市場的未來

The Data Science Platform Market size is estimated at USD 10.15 billion in 2024, and is expected to reach USD 29.98 billion by 2029, growing at a CAGR of 23.5% during the forecast period (2024-2029).

Data Science is emerging to provide solutions to organizations to transform data sets into a valuable resource that helps get business value with actionable insights. As the number of business enterprises and organizations grows exponentially, data science is becoming essential in various aspects of business and plays a pivotal role in business models.

Key Highlights

- The data science platforms offer a suite of tools and services that allow organizations to manage, access, and analyze their data and enable organizations to streamline their data analysis processes and scale their data analysis capabilities. The adoption of data science platforms is growing due to benefits such as predictive analytics to automated machine learning processes, informed decisions, and better utilization of their data.

- There is an increasing emphasis on businesses boosting their internal data science resources to build machine learning models and fill the hiring gap of in-demand professionals, resulting in increased adoption of data science as a service (DSaaS). For many businesses, it becomes essential as it helps them scale their analytics capabilities to meet critical needs and get the desired outcomes of business.

- As technologies such as artificial intelligence (AI) and machine learning (ML) are advancing rapidly, businesses are receiving a significantly larger amount of data, including new data based on previously existing datasets and new forms of data altogether. Thus, to use these data, businesses are moving to adopt data science solutions that are compatible with their requirements.

- One of the primary obstacles arising from the lack of a skilled workforce is the inability to derive meaningful insights from the vast volumes of data organizations generate. Data science platforms are designed to allow users to analyze and interpret complex datasets, but the shortage of skilled professionals capable of guiding these platforms diminishes their effectiveness. Organizations struggle to bridge the gap between the advanced functionalities of data science platforms and the expertise needed to leverage these functionalities optimally.

- The COVID-19 pandemic accelerated the digitization of businesses and industries, leading to a surge in the need for data-driven insights. Organizations across sectors turned to data science to make informed decisions about resource and risk management and customer behavior. Further, the shift to remote work spurred the adoption of cloud-based data science platforms and tools, enabling data scientists to collaborate effectively from any location. This flexibility and accessibility further fueled the demand for data science expertise.

Data Science Platform Market Trends

Small and Medium Enterprises to Witness Major Growth

- Small-sized organizations have less than 100 employees, whereas medium-sized enterprises have between 100 to 999 employees. One of the major applications of data science for small businesses is using it to track clients throughout the various stages of the sales cycle. Small businesses can utilize data analytics to determine a particular segment of consumers willing to buy. Data-driven industry growth is making evidence-based conclusions to enhance sales, performance, and operations, among others, through which businesses can achieve sustainable development.

- SMEs often operate with limited resources, making every decision critical. Data science platforms empower SMEs to make more precise and informed decisions, reducing risks. The platforms help SMEs identify inefficiencies in their operations and supply chains, reducing costs.

- In August 2023, Infor Nexus and DBS Bank, in partnership, announced the launch of pre-shipment financing for small and medium-sized enterprises (SME) suppliers in the Infor Nexus supply chain ecosystem. This solution utilizes historical data from the Infor Nexus platform to provide data-based lending solutions that help suppliers meet their working capital requirements.

- Cloud adoption is expected to boost the market's growth. It has revolutionized how SMEs access and utilize data science platforms. Cloud infrastructure offers scalability, allowing SMEs to seamlessly scale their data science capabilities up or down based on their changing needs. In November 2023, AnniQ launched a new service focusing on data analytics to support the strategic capabilities of small and medium-sized enterprises (SMEs). This service is designed to enhance how SMEs engage with and utilize data in their business operations, emphasizing providing actionable insights and facilitating strategic execution.

North America to Hold Significant Market Share

- Fueled by data's increasing volume and complexity, the United States continues to innovate and consolidate its position in the global market in the data science platforms. The embracing of advanced technologies such as advanced analytics, Artificial Intelligence (AI), and Machine Learning (ML) in the market studied has also directly impacted the national economy.

- According to Telecom Advisory Services, the estimated Internet traffic in the United States has jumped from 64 million exabytes per month in 2021 to 98.64 million exabytes per month in 2023. Such a significant increase in data traffic needs more advanced data science solutions to manage a large amount of data and improve the solutions based on extracted data. Additionally, organizations are generating more data than ever, which is becoming increasingly complex and diverse. This makes it difficult to analyze and extract insights from data using traditional methods. Data science platforms provide the tools and infrastructure to manage and analyze large and complex databases.

- Moreover, all the major vendors studied in the market are US-based. Additionally, the country is on the brink of the fourth industrial revolution, where data is being utilized in large-scale production while integrating the data with a wide variety of manufacturing systems throughout the supply chain. This is accelerating the adoption of advanced technologies in the country.

- The government in the region is also promoting the adoption of robotics by taking initiatives to support the growth of modern technologies in the market. For instance, the US federal government has launched the National Robotics Initiative (NRI) program to strengthen the capabilities of building domestic robots in the nation and encourage research activities in the field. Such initiatives are further expected to create a positive outlook for the market growth.

- In addition, the strong focus on research and innovation in Canada in sectors like healthcare, artificial intelligence, and renewable energy supports the market requiring data science platforms to analyze complex data sets and gain research insights. Canada's tech industry is flourishing, and the country has made a concerted effort to attract technological know-how. A rising number of sectors, including banking, healthcare, finance, insurance, media and entertainment, telecom, and e-commerce, need qualified Data Scientists and AI experts. Professionals are in greater demand right now than they are available. Expanding technological capabilities and the demand for high-end IT solutions, AI, and ML will drive the market for data science platforms in Canada.

Data Science Platform Industry Overview

The Data Science Platform Market is semi-consolidated and is characterized by high product differentiation, growing levels of product penetration, and rapid advancements in technology, leading to difficulty in maintaining a competitive advantage, forcing them to continuously adopt and innovate solutions. Some of major players include Alteryx, IBM Corporation, Google LLC (Alphabet Inc.), SAS, Alteryx, Microsoft Corporation.

- November 2023 - IBM collaborated with Amazon Web Services (AWS) on the general availability of Amazon Relational Database Service (Amazon RDS) for Db2, a fully managed cloud offering designed to make it easier for database customers to manage data for artificial intelligence (AI) workloads across hybrid cloud environments. It will allow the users to leverage an array of the company's integrated data and AI capabilities on AWS to manage data and scale AI workloads.

- August 2023 - Google Cloud and NVIDIA announced a partnership expansion to advance AI computing, software, and services for customers to build and deploy massive models for generative AI and speed data science workloads. The partnership will bring end-to-end machine learning services to some of the largest AI customers in the world - including by making it easy to run AI supercomputers with Google Cloud offerings built on NVIDIA technologies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of Macroeconomic Trends

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Increase in Big Data

- 5.1.2 Emerging Promising Use Cases of Data Science and Machine Learning

- 5.1.3 Shift of Organizations Toward Data-intensive Approach and Decisions

- 5.2 Market Restraints

- 5.2.1 Lack of Skillset in Workforce

- 5.2.2 Data Security and Reliability Concerns

- 5.3 Key Use Cases

- 5.4 Ecosystem Analysis

- 5.5 Analysis of Pricing and Pricing Models

- 5.6 Key Capabilities of Data Science Platforms (AI & Ml, Analytics, Visualization, Exploration, Modelling)

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Platform

- 6.1.2 Services

- 6.2 By Deployment

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By Size of Enterprises

- 6.3.1 Small and Medium Enterprises

- 6.3.2 Large Enterprises

- 6.4 By Industry Vertical

- 6.4.1 IT and Telecom

- 6.4.2 BFSI

- 6.4.3 Retail and E-commerce

- 6.4.4 Oil Gas and Energy

- 6.4.5 Manufacturing

- 6.4.6 Government and Defense

- 6.4.7 Other Industry Verticals

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 Germany

- 6.5.2.3 France

- 6.5.2.4 Italy

- 6.5.2.5 Spain

- 6.5.2.6 Greece

- 6.5.2.7 Rest of Europe

- 6.5.3 Asia Pacific

- 6.5.3.1 China

- 6.5.3.2 India

- 6.5.3.3 Japan

- 6.5.3.4 Australia

- 6.5.3.5 Southeast Asia

- 6.5.3.5.1 Indonesia

- 6.5.3.5.2 Philippines

- 6.5.3.5.3 Malaysia

- 6.5.3.5.4 Singapore

- 6.5.3.5.5 Rest of Southeast Asia

- 6.5.3.6 Rest of Asia Pacific

- 6.5.4 Latin America

- 6.5.4.1 Brazil

- 6.5.4.2 Argentina

- 6.5.4.3 Mexico

- 6.5.4.4 Rest of Latin America

- 6.5.5 Middle East and Africa

- 6.5.5.1 Saudi Arabia

- 6.5.5.2 GCC

- 6.5.5.2.1 United Arab Emirates

- 6.5.5.2.2 Rest of GCC

- 6.5.5.3 South Africa

- 6.5.5.4 Rest of Middle East and Africa

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Google LLC (Alphabet Inc.)

- 7.1.3 Microsoft Corporation

- 7.1.4 SAS

- 7.1.5 Alteryx

- 7.1.6 The MathWorks Inc.

- 7.1.7 RapidMiner

- 7.1.8 Databricks

- 7.1.9 Amazon Web Services Inc. (AMAZON.COM INC.)

- 7.1.10 DataRobot Inc.