|

市場調查報告書

商品編碼

1433487

微型移動資料中心:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Micro Mobile Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

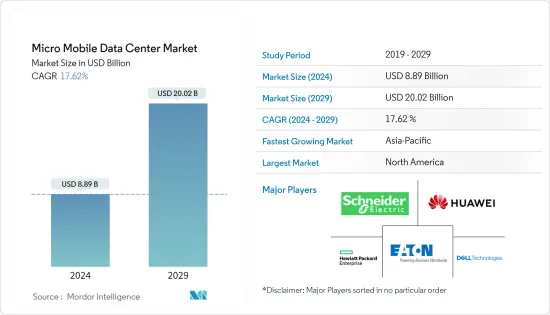

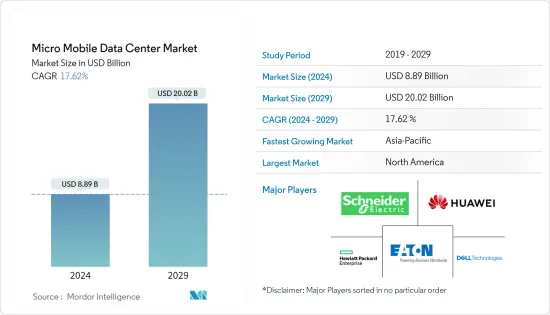

微型行動資料中心市場規模預計到 2024 年為 88.9 億美元,預計到 2029 年將達到 200.2 億美元,在預測期內(2024-2029 年)市場規模將增加 176.2 億美元。複合年成長率為 %。

微型移動資料中心是一個類似盒子的容器,具有與常規資料中心相同的儲存、運算能力和網路,但位於一個緊湊的單元中。此外,技術進步提供了整合的雲端連接,完成了邊緣的承包包。

主要亮點

- 由於其規模、多功能性和即插即用功能,微型行動資料中心非常適合在遠端位置臨時部署。它也適合位於洪水或地震高風險地區的企業臨時使用。換句話說,微型資料中心最大限度地減少了傳統模型的實體足跡和能源消耗。

- 世界日益數位化、網際網路的普及、智慧技術的相關性、物聯網設備的發展、巨量資料和5G網路等因素預計將推動微型行動資料中心市場的趨勢。愛立信預計,2019年至2028年,全球5G用戶數預計將從1,200萬以上大幅增加至45億以上。

- 此外,隨著企業辦公室定期遷移其基礎設施,對容器化資料中心的需求也在增加。此外,隨著工作負載的增加,企業正在加大投資來擴展其微型移動資料中心。這些因素為未來幾年的市場擴張創造了巨大的機會。

- 此外,企業正在增加其雲端存在,需要採用可攜式資料中心,而低成本和低延遲正在推動中小型組織對微型行動資料中心的需求。因此,預計未來市場將會成長。然而,與傳統資料中心的整合阻礙了市場成長。

- COVID-19 的爆發對市場成長產生了積極影響,微型行動資料中心技術正在幫助組織滿足其對資料儲存的高容量需求。在資料儲存需求不斷成長的時期,對微移動資料中心營運商的要求越來越高,以確保自己有能力和能力提供高效能的微移動資料中心。大流行後,由於數位化技術和永久性在家工作的增加,市場正在快速成長。對軟體即服務 (SaaS) 不斷成長的需求正在為資料中心帶來比以往更多的流量。因此,玩家正在投資這些解決方案。

微型行動資料中心市場趨勢

醫療保健最終用戶領域預計將佔據重要的市場佔有率

- 部署微型行動資料中心有助於為醫療保健帶來彈性、有效性、安全性和低成本模式。預計全球醫療保健產業的成長將進一步增加對微型行動資料中心的需求。

- 電子健康記錄 (EHR) 的成長進一步增加了醫療保健提供者對微型行動資料中心的需求。許多公司選擇讓其 EHR 供應商在安全設施中託管文檔,而不是用伺服器室取代文件室。

- 巨量資料的成長也是將資料傳輸到雲端的動機之一。透過將雲端中不同的資料集整合在一起,業務、臨床和資料資料集中到巨量資料分析流程中。這些因素正在增加醫療保健產業中微型行動資料中心的採用。

- 物聯網設備(尤其是智慧型手機)的普及正在增加醫療保健產業對微型行動資料中心的需求。據愛立信稱,今年全球短距離物聯網(IoT)設備數量達1,66億台。預計未來三年將增加至 224 億。本會計年度廣域物聯網設備數量將達32億個,預計未來三年將達52億個。患者希望按照自己的條件獲得醫療保健。這些醫療保健設備使豐富的資料能夠安全地流向所有臨床環境,有助於不斷改善患者體驗和健康結果。

- 隨著物聯網和雲端技術融入醫療保健,區塊鏈等概念也越來越受到關注,增加了對資料儲存和微型行動資料中心的需求。

- 區塊鏈技術在醫療保健產業有著廣闊的應用前景,就像微型行動資料中心在醫療保健產業中具有廣闊的應用前景一樣,由於醫療保健服務中透過區塊鏈產生的資料高度敏感,因此保護敏感記錄並為使用者提供安全的資料非常重要。用於儲存和驗證與您的身分相關的資料。因此,在預測期內,醫療保健產業中微型行動資料中心的採用預計將大幅增加。

亞太地區預計將成為成長最快的市場

- 亞太地區是全球資料中心成長最快的地區之一。該地區中小型企業對自動化和商業智慧工具的採用也有所增加。因此,該地區所研究市場的成長潛力巨大。

- 這種成長很大程度上歸因於過去十年政府機構廣泛採用資料中心,特別是在中國和澳洲等國家。政府對資料中心的重大投資旨在刺激該地區的數位經濟,正在推動雲端服務、巨量資料和物聯網的採用。

- 隨著中國對雲端運算和其他資訊服務的需求不斷增加,資料中心技術的進步將有助於這些技術與現代製造業的融合以及中國逐步向服務經濟轉型,預計將發揮重要作用。

- 中國網際網路普及的擴大也可能導致對微型行動資料中心的需求增加。隨著企業擴大業務並尋求提高品質和網路安全,中國對更快、更穩定的寬頻連線的需求不斷成長。

- 澳洲資料中心的投資前景依然光明,因為主機代管和雲端供應商推出了大量重大建設計劃和小型企業設施,為在加速發展的數位未來中發揮作用做好準備。

- 此外,醫療保健、零售、電子商務和 BFSI 行業的高普及等因素預計將進一步推動市場成長。此外,職場擴大採用 BYOD 和物聯網設備,這將增加透過多個來源產生的資料量。該地區資料的激增迫使企業投資微型資料中心。

- 在當前趨勢的推動下,混合雲端已成為亞太地區流行的雲端採用方法,根據應用程式的合規性和安全性要求提供基礎架構選擇。

微型行動資料中心產業概況

微型行動資料中心市場高度分散,主要參與者包括施耐德電氣、戴爾易安信、華為技術、惠普企業、Development LP 和伊頓公司。市場參與者正在採取合作夥伴關係、併購和收購等策略來增強其產品供應並獲得永續的競爭優勢。

- 2022 年 11 月 - 針對混合IT基礎設施管理,施耐德電機推出 EcoStruxure 微型資料中心 R 系列 42U 中密度。新的微型資料中心解決方案專為具有工業條件的遠端位置的 IT 應用而設計,並且完全整合,易於設定。它還具有強大的承載能力和巨大的工業腳輪,方便移動。

- 2022 年 4 月 - IBM 公司宣布與印度跨國電訊公司 Airtel 建立合作夥伴關係,在印度提供邊緣雲端服務。兩家公司將透過遍布印度20個主要城市的120個資料中心為企業提供邊緣雲端服務。這種協作透過減少延遲來改善使用者體驗和企業績效,同時滿足工作負載轉移到邊緣時的關鍵主權需求和資料安全性。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 物聯網設備公司的普及

- 提高數位資料產生的速度和數量

- 市場限制因素

- 加密劫持威脅

第6章市場區隔

- 按類型

- 25RU 或更少

- 25~40RU

- 40RU或更多

- 按公司類型

- 中小企業 (SME)

- 主要企業

- 按最終用戶產業

- 零售/電子商務

- 教育

- BFSI

- 資訊科技/通訊

- 衛生保健

- 政府/國防

- 能源/公共產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Schneider Electric SE

- Dell EMC Inc.

- Huawei Technologies Co. Ltd

- Hewlett Packard Enterprise Development LP

- Eaton Corporation PLC

- Panduit Corp.

- Zellabox Pty Ltd

- Hitachi Ltd

- IBM Corporation

- Vertiv Co.

- Instant Data Centers LLC

- Dataracks

- Rittal GmbH & Co. Kg

- Canovate Group

第8章投資分析

第9章市場的未來

The Micro Mobile Data Center Market size is estimated at USD 8.89 billion in 2024, and is expected to reach USD 20.02 billion by 2029, growing at a CAGR of 17.62% during the forecast period (2024-2029).

Micro mobile data centers are box-like containers filled with the same storage, compute power, and networking needed in a regular data center but delivered in a compact unit. Moreover, with technological advancements, they come with integral cloud connectivity, completing a turnkey package for the edge.

Key Highlights

- The size, versatility, and plug-and-play features of micro mobile data centers make them ideal for use in remote locations for temporary deployments. They are also well suited for temporary use by businesses in locations that are in high-risk zones for floods or earthquakes. In other words, a micro data center minimizes the traditional model's physical footprint and energy consumed.

- Factors such as increasing global digitalization, internet penetration, the relevance of smart technologies, IoT-powered devices, big data, and the development of 5G networks are likely to drive the micro-mobile data center market trends. According to Ericsson, 5G subscriptions are forecast to increase drastically worldwide from 2019 to 2028, from over 12 million to over 4.5 billion, respectively.

- Furthermore, there is a rising need for containerized data centers as corporate offices migrate their infrastructure regularly. Furthermore, corporations spend more on micro-mobile data center growth as workloads increase. Such factors create significant chances for market expansion in the next years.

- Furthermore, businesses are increasing their cloud presence, necessitating the deployment of portable data centers and rising demand for micro mobile data centers for SMEs organizations due to low cost and lower latency. As a result, there would be more prospects for market growth in the future. However, integration with traditional data centers hampers the growth of the market.

- The COVID-19 outbreak positively impacted market growth, and micro-mobile data center technologies are assisting organizations in meeting the high capacity need for data storage. There is a rising requirement to guarantee that micro-mobile data center operators have the ability and capacity to offer high-performance micro-mobile data centers during periods of elevated data storage demand. After the pandemic, the market is growing rapidly with the increased digitization technologies and permanent work from home jobs. Increased demand for software as a service (SaaS) has driven traffic to data centers like never. Hence, players are investing in these solutions.

Micro Mobile Data Center Market Trends

Healthcare End User Vertical is Expected to Hold a Significant Market Share

- Adopting a micro mobile data center helps the healthcare industry bring flexibility, effectiveness, security, and a low-cost model to the healthcare sector. The global healthcare industry's growth is estimated further to drive the demand for micro mobile data centers.

- The growth of electronic health records (EHRs) further increases healthcare providers' demand for micro mobile data centers. Rather than replacing file rooms with server rooms, many opt to have documents hosted by the EHR vendor at a secure facility.

- The growth of Big Data is another motivational factor for transferring data to the cloud. Pulling different datasets together in the cloud allows operational, clinical, and financial data to be aggregated in Big Data analytics processes. These factors contribute to the growing adoption of micro mobile data centers in the healthcare industry.

- The penetration of IoT devices, especially smartphones, boosts the demand for micro mobile data centers in the healthcare industry. According to Ericsson, the number of short-range internet of things (IoT) devices reached 16.6 billion worldwide in the current year. That number is forecast to increase to 22.4 billion by the next three years. The wide-area IoT devices amounted to 3.2 billion in the current year and are predicted to reach 5.2 billion by the next three years. Patients want access to their health organization on their terms. These devices for Healthcare enable enriched data to flow securely through every point of care to help continuously improve the patient experience and health outcomes.

- With IoT and cloud technologies integration into Healthcare, concepts like blockchain are also gaining traction, increasing the demand for data storage and micro mobile data centers.

- Blockchain technology is being used to protect sensitive records and store and authenticate the data related to a user's identity as data generated through blockchain is extremely confidential in healthcare services, like micro mobile data centers have a great healthcare industry scope. Hence, the adoption of micro mobile data centers in the healthcare industry is expected to grow significantly over the forecast period.

Asia-Pacific is Expected to be the Fastest Growing Market

- Asia-Pacific is one of the world's fastest-growing areas for data centers. The adoption of automation and BI tools among SMEs is also high in the region. Hence, the region offers significant potential for the growth of the market studied.

- Much of this growth can be attributed to government agencies' widespread adoption of data centers during the last decade, especially in countries like China and Australia. Major government investments in data center advances, targeted at stimulating the region's digital economy, are boosting the adoption of cloud services, Big Data, and IoT.

- While the demand for cloud computing and other data services continues to increase in China, advancements in data center technology are expected to play a vital role in the integration of these technologies with modern manufacturing and China's gradual transition to a service economy.

- Increasing internet penetration in China would also help increase the demand for micro mobile data centers. Demand for faster, more stable broadband connections is growing in China as companies look to enhance their presence and provide enhanced quality and cybersecurity.

- The Australian investment outlook for data centers remains positive as colocation and cloud providers launch major construction projects and an armada of smaller enterprise facilities to prepare for a role in the accelerating digital future.

- In addition, factors, including high penetration rates in healthcare, retail, e-commerce, and BFSI verticals, are expected to drive the market's growth further. Moreover, the data generated through multiple sources is high due to the high adoption of BYOD and IoT devices in the workplace. The exponential growth of data proliferation in the region is forcing enterprises to invest in micro data centers.

- In the backdrop of current trends, hybrid cloud is emerging as a popular way forward for cloud adoption in Asia-Pacific, as it offers a choice of infrastructure depending on application requirements for compliance and security.

Micro Mobile Data Center Industry Overview

The micro mobile data center market is highly fragmented, with the presence of major players like Schneider Electric SE, Dell EMC Inc., Huawei Technologies Co. Ltd, Hewlett Packard Enterprise, Development LP, and Eaton Corporation PLC. Players in the market are adopting strategies such as partnerships, mergers, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- November 2022 - For hybrid IT infrastructure management, Schneider Electric launched the EcoStruxure Micro Data Center R-Series 42U Medium Density. The new Micro Data Center solution is designed for IT applications in distant locations with industrial conditions, and it delivers fully integrated for easy setup. It also has a hefty weight capacity and huge industrial casters for convenient mobility.

- April 2022 - IBM Corporation announced a collaboration with Airtel, an Indian multinational telecommunications company, to provide edge cloud services in India. Together companies would supply edge cloud services to enterprises through 120 data centers spread across 20 major Indian cities. The collaboration improves the user experience and company performance by reducing latency while fulfilling sovereignty needs and data security, which is crucial as workloads travel to the edge.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Penetration of IOT Devices Enterprises

- 5.1.2 Increasing Speed and Volume of Digital Data Generation

- 5.2 Market Restraints

- 5.2.1 Cryptojacking Threats

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Up to 25 RU

- 6.1.2 25-40 RU

- 6.1.3 Above 40 RU

- 6.2 By Enterprise Type

- 6.2.1 Small and Medium Enterprise (SME)

- 6.2.2 Large Enterprise

- 6.3 By End-user Vertical

- 6.3.1 Retail and E-commerce

- 6.3.2 Education

- 6.3.3 BFSI

- 6.3.4 IT and Telecommunication

- 6.3.5 Healthcare

- 6.3.6 Government and Defense

- 6.3.7 Energy and Utilities

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schneider Electric SE

- 7.1.2 Dell EMC Inc.

- 7.1.3 Huawei Technologies Co. Ltd

- 7.1.4 Hewlett Packard Enterprise Development LP

- 7.1.5 Eaton Corporation PLC

- 7.1.6 Panduit Corp.

- 7.1.7 Zellabox Pty Ltd

- 7.1.8 Hitachi Ltd

- 7.1.9 IBM Corporation

- 7.1.10 Vertiv Co.

- 7.1.11 Instant Data Centers LLC

- 7.1.12 Dataracks

- 7.1.13 Rittal GmbH & Co. Kg

- 7.1.14 Canovate Group