|

市場調查報告書

商品編碼

1433510

代幣化解決方案 -市場佔有率分析、行業趨勢/統計、成長預測(2024-2029)Tokenization Solution - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

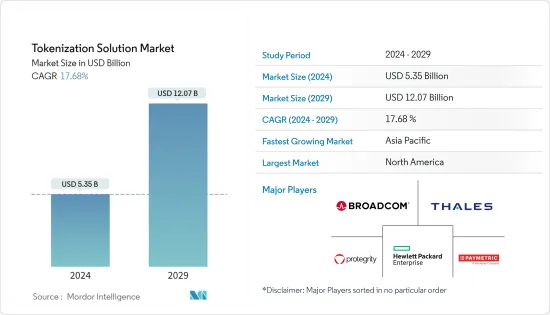

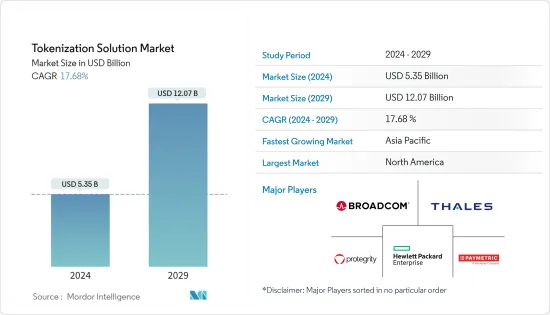

預計 2024 年代幣化解決方案市場規模為 53.5 億美元,預計到 2029 年將達到 120.7 億美元,在預測期內(2024-2029 年)複合年成長率為 17.68%。

預計推動代幣化市場發展的主要因素是需要保持合規性並滿足監管報告標準、需要確保持續的客戶體驗以及由於金融詐騙的增加而保持一定程度的詐騙預防。公司數量以及降低資料外洩風險的需要。

主要亮點

- 資料將成為智慧財產權,能夠資料提取情報的公司,無論是創新醫院還是自動駕駛汽車,都將引領潮流。然而,隨著資料重要性的增加,安全性的需求和成本也隨之增加。因此,這種需求正在創造對代幣化解決方案的需求。

- 雲端服務中資料的激增也是推動代幣化解決方案採用的主要因素。雲端服務的易用性和經濟性正在幫助大型企業和中小型企業採用雲端為基礎的模式。隨著資料轉移到雲端,標記化解決方案擴大用於保護儲存在雲端的資料。

- 幾乎每個行業擴大採用區塊鏈技術也推動了對代幣化解決方案的需求。房地產行業擴大採用代幣化解決方案,也提高了該行業的可及性。代幣化解決方案還提供將資產轉換為任何代幣價值的能力,從而降低與投資相關的高成本。這使得投資者甚至可以購買小型房地產股票。

- 安全付款閘道的需求持續成長。由於付款閘道的日益普及,客戶正在轉向與貨幣相關且更安全的付款閘道選項。

- 代幣化解決方案,即使用替代品替代敏感價值的概念,在付款和金融服務領域已被廣泛使用一段時間了。然而,消費者主導智慧型設備的需求和快速變化的技術推動了行業代幣化解決方案的創新和進步。

- 新冠肺炎 (COVID-19) 過後,數位付款接受度預計將得到改善,並在長期內發揮重要作用。現金被認為是 COVID-19 的載體,因此政府和監管機構不鼓勵使用現金。因此,COVID-19 對代幣化解決方案市場產生了積極影響。

代幣化解決方案市場的趨勢

BFSI 佔最大市場規模

- 銀行、金融和保險機構從內部和第三方來源取得敏感資料。因此,我們預期代幣化的採用將在 BFSI 領域中變得更加突出和頻繁。這是因為標記化為卡片和線上交易期間經常面臨風險的敏感資料提供了安全性。

- 代幣化解決方案的另一個好處是,它們可以顯著減少與 PAN 洩漏相關的詐欺損失,這主要推動了它們在銀行中的日益普及。銀行卡和付款詐欺的減少也意味著糾紛的減少。此外,銀行可以設定精確的風險比率和限額,並為善意客戶核准高價值交易。使用傳統的基於 PAN 的解決方案很難實現這些優勢。因此,代幣化解決方案市場正在蓬勃發展。

- 令牌化解決方案的採用也減少了銀行卡片詐騙的數量。此外,它為 BFSI 部門帶來了彈性、有效性、安全性和低成本模式。詐欺案件的減少預計將增加全球 BFSI 行業的收益,並進一步推動代幣化解決方案市場的發展。

- 隨著數位化和資料分析的融合,保險業正經歷一場由科技主導的巨大變革。代幣化解決方案可協助保險公司保護客戶資料、安全支付保費並進行分析。代幣化解決方案可協助保險公司保護客戶資料、確保保費支付和分析安全。它還有助於減少詐騙案件,並幫助保險公司將其模式從「檢測和修復」轉變為「預測和預防」。

- 此外,2023 年 5 月,卡片付款提供者 Visa 推出了一項功能,如果卡片是令牌化的,則允許客戶無需輸入持卡人驗證值 (CVV) 即可進行線上交易。印度推出的免 CVV 功能旨在簡化線上交易。利用此優勢的企業將不再需要要求客戶在每筆國內交易中輸入 CVV。卡片背面的這個 3 位數字在令牌化過程中只驗證一次。

- 區塊鏈在加密貨幣和 NFT 等金融應用中的日益使用可能會在研究期間推動代幣化。例如,從2022年4月15日到2023年4月,藝術領域的非同質化代幣(NFT)的總銷售額波動劇烈。

預計北美將佔據較大市場佔有率

- 由於付款閘道產業較早採用先進技術,北美已成為代幣化解決方案市場的主導地區。大多數代幣化解決方案供應商都位於美國,佔代幣化解決方案市場收益的大部分。

- 北美是一個受到嚴格監管的地區,網路攻擊、常見付款詐騙以及 CCPA 等法規都會影響整個產業。預計該地區對代幣化的需求將會增加。客戶偏好也在發生變化,向數位信用卡和非接觸式付款的轉變預計將推動代幣化市場的成長。

- 推動北美代標記化市場成長的因素包括智慧型手機、電子商務、線上遊戲、線上串流媒體和政府服務的日益使用。由於網路購物和交易增加了網路威脅的可能性,各國政府也在努力改善網路安全和線上交易。

- 該地區雲端技術的採用率最高,是代幣化解決方案日益採用的關鍵因素。該地區也是主要電子商務公司的所在地,並且代幣化解決方案的採用率最高。

- 該地區零售和電子商務行業的顯著成長預計將進一步擴大代幣化解決方案市場。 BFSI 產業也在該地區實現健康成長。由於該地區對區塊鏈技術的採用率最高,因此代幣化解決方案的市場預計將進一步擴大。

代幣化解決方案產業概述

由於許多在國內和國際範圍內營運的參與者,代幣化解決方案市場競爭非常激烈。市場高度分散,主要參與者包括 Paymetric, Inc.、Protegrity USA, Inc.、Broadcom Inc.、Thales Group 和 Hewlett Packard Enterprise。公司正在提高其在該領域的專業知識和安全性,以獲得競爭優勢。

- 2022 年 8 月-印度儲備銀行(RBI)將把代幣化功能從傳統的基於設計的代幣化框架升級為卡文件標記化(COFT),以確保付款系統的安全性和保障性)得到了擴展。數位付款提供商 Paytm 宣布了一項針對線上信用卡和簽帳金融卡交易的代幣化計劃。印度央行宣布了支付聚合商(PA)和支付閘道器(PG)的規則,這標誌著這項發展的開始。

- 2022 年 5 月 - 泰雷茲宣布其 CipherTrust 令牌化是第一個經過 SAP檢驗的SAP 用戶端令牌化解決方案,可用於保護敏感資料。泰雷茲的標記化解決方案可透過 SAP Data Custodian 訪問,提供更精細的資料安全和使用者存取限制,加快企業將更多應用程式和工作負載遷移到雲端的合規性,並顯著縮短時間。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 安全付款閘道的需求不斷成長

- 電子商務和行動付款的採用率提高

- 加強政府對資料安全的監管

- 市場限制因素

- 透過 EMV 標準解決漏洞

- 由於產品相似而缺乏認知

第6章市場區隔

- 按類型

- 解決方案

- 按服務

- 按配置

- 本地

- 雲

- 按最終用戶產業

- 零售/電子商務

- 運輸/物流

- BFSI

- 資訊科技/通訊

- 衛生保健

- 政府機關

- 能源與公共產業

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 澳洲

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Paymetric, Inc.(A Worldpay Company)

- Protegrity USA, Inc.

- Broadcom Inc.

- Thales Group

- Hewlett Packard Enterprise

- First Data Corporation

- Cardconnect Corporation

- 3delta Systems, Inc.

- Ciphercloud Incorporation

- Cybersource Corporation

- Liaison Technologies Inc

- Fiserv, Inc.

- Tokenex, LLC

第8章市場的未來

第9章投資分析

The Tokenization Solution Market size is estimated at USD 5.35 billion in 2024, and is expected to reach USD 12.07 billion by 2029, growing at a CAGR of 17.68% during the forecast period (2024-2029).

The main factors anticipated to propel the development of the tokenization market are the need to remain compliant and meet regulatory reporting standards, the growing need to guarantee continuous customer experience and maintain fraud prevention levels due to increasing financial frauds, and the need to reduce risk from data breaches.

Key Highlights

- Data has become an intellectual property and companies that can distill intelligence from their data, whether in an innovative hospital or from an autonomous car, are expected to be the ones to lead. But, as the importance of data increases, the need for security and the cost of security also increases simultaneously. Hence, this need is generating the demand for tokenization solutions.

- The data proliferation in cloud services is also a significant factor in the growing adoption of tokenization solutions. Easy and affordable accessibility of cloud services is not only helping large enterprises but also SMEs in adopting a cloud-based model. As more data moves to the cloud, tokenization solutions are being used to secure data stored in the cloud.

- The increasing adoption of blockchain technology in almost every industry is another factor thriving the demand for tokenization solutions. The rising adoption of tokenization solutions in the real estate industry is also enhancing the accessibility of the sector. Tokenization solutions also mitigate high costs associated with the investment by providing the ability to convert assets into any token value. Through this, investors can buy even a tiny property share.

- There has been a continuously growing demand for secure payment gateways. Due to the increased adoption rate of payment gateways, customers are switching to more secure payment gateway options due to the currency involved.

- A tokenization solution, the concept of a surrogate being used to replace the sensitive value, has been prominently used in payments and financial services for a considerably long period. However, the consumer-driven demand for smart devices, coupled with rapidly changing technologies, has the industry buzzed about tokenization solutions innovations and advancements.

- Accepting digital payment methods is anticipated to improve post-COVID-19 and play a crucial role in the longer term. With cash being seen as a carrier for COVID-19, governments and regulatory bodies have discouraged its use. Therefore, COVID-19 has had a positive impact on the Tokenization Solution Market.

Tokenization Solution Market Trends

BFSI to hold the largest market size

- Banking, financial, and insurance institutions are privy to sensitive data from internal and third-party sources. Hence, adopting Tokenization is expected to be more prominent and frequent in the BFSI sector, as it provides security for sensitive data, which is prone to risk during card or online transactions.

- The other benefit of tokenization solutions, primarily resulting in growing adoption for banks, is the significant reduction of fraud losses related to PAN compromise. Reduced card and payment fraud also mean fewer disputes. Furthermore, banks can set accurate risk ratios and limits and authorize high-value transactions for genuine customers. These advantages are more difficult to achieve with a traditional PAN-based solution. Hence, a thriving market for tokenization solutions.

- Adopting tokenization solutions has also reduced the number of card fraud cases in banks. Besides, it also brings flexibility, effectiveness, security, and a low-cost model to the BFSI sector. Reduction in fraud cases would increase the revenue of the BFSI industry globally, which is estimated to drive the market for Tokenization solutions further.

- Due to the digitization and data analytics integration, the Insurance industry is on the verge of a seismic, tech-driven shift. Tokenization solutions are helping insurance companies in customer data protection and secure payment of premiums and their analysis. It is also assisting in reducing fraud cases and the transformation of insurance companies' model of "detect and repair" to "predict and prevent."

- Futhermore, in May 2023, Visa, a firm that provides card payments, has introduced a feature that, if the card has been tokenized, enables customers to conduct online transactions without having to enter the cardholder verification value (CVV). The CVV-free function, which was introduced in India, aims to simplify online transactions. Those businesses that use it won't need to ask clients for their CVV each time they do a domestic transaction. This three-digit number on the back of the card will only be verified once, during the tokenization process.

- The increasing usage of blockchain in financial applications such as cryptocurrencies and NFTs will drive Tokenization in the studied period. For instance, the total value of sales involving non-fungible tokens (NFTs) in the art area fluctuated wildly between April 15, 2022, and April 2023.

North America is Expected to Hold Significant Market Share

- North America is the dominating region in the tokenization solution market, owing to the earliest adoption of advanced technology in the payment gateway industry. Most tokenization solution vendors are American based, accounting for the major portion of the revenue of the tokenization solution market.

- North America is a highly regulated region, with the regulations like a surge in cyber attacks, generally fraud of payments, and CCPA across the industry. It is expected that the need for tokenization will grow in this region. Customers' preferences are also changing; their inclination toward digital credit cards and contactless payments is expected to fuel the tokenization market growth.

- The factors that are also intending the North American tokenization market growth are increasing usage of smartphones, E-Commerce, and services like online gaming, online streaming, and government services. The government is also taking initiatives to improve cyber security and online transactions because online shopping or transactions are increasing the chances of cyber threats.

- The adoption of cloud technology is highest in the region, a vital reason for the growing adoption of tokenization solutions. The region is also the home of all the major e-commerce major companies, where the adoption of tokenization solutions is highest.

- The significant growth of the retail and e-commerce industry in the region is further estimated to grow the tokenization solution market. The BFSI sector has also shown healthy growth in the region. The highest adoption of blockchain technology in the region is estimated to further expand the tokenization solution market significantly.

Tokenization Solution Industry Overview

The Tokenization solution market is competitive because of the presence of many players running their businesses within national and international boundaries. The market is highly fragmented, with significant players like Paymetric, Inc., Protegrity USA, Inc., Broadcom Inc., Thales Group, and Hewlett Packard Enterprise. The companies improve their expertise in the field and security to gain a competitive advantage.

- August 2022 - The Reserve Bank of India (RBI) has expanded the tokenization facility from an earlier designed-based tokenization framework to Card on File Tokenization (COFT) to ensure the payment system's safety and security. The digital payment provider Paytm has unveiled a tokenization method for online credit and debit card transactions. The RBI released rules for payment aggregators (PA) and payment gateways (PG), which sparked the beginning of this development.

- May 2022 - Thales declared that their CipherTrust Tokenization is the first tokenization solution for SAP clients validated by SAP and can be used to safeguard sensitive data. The tokenization solution from Thales, accessible through SAP Data Custodian, offers more granular levels of data security and user access restrictions, significantly reducing the time to compliance for businesses that are shifting more apps and workloads to the cloud.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 IMPACT OF COVID-19 ON THE MARKET

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Secure Payment Gateways

- 5.1.2 Rising Adoption in E-commerce and Mobile payments

- 5.1.3 Growing Government Regulations On Data Security

- 5.2 Market Restraints

- 5.2.1 Addressing Vulnerabilities From EMV Standards

- 5.2.2 Lack of Awareness Due to Similar Products

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Solutions

- 6.1.2 Services

- 6.2 By Deployment

- 6.2.1 On-Premise

- 6.2.2 Cloud

- 6.3 By End-User Industry

- 6.3.1 Retail & E-commerce

- 6.3.2 Transportation & Logistics

- 6.3.3 BFSI

- 6.3.4 IT & Telecommunications

- 6.3.5 Healthcare

- 6.3.6 Government

- 6.3.7 Energy & Utilities

- 6.3.8 Other End-User Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Australia

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Argentina

- 6.4.4.4 Rest of Latin America

- 6.4.5 Middle East & Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.5.4 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Paymetric, Inc. (A Worldpay Company)

- 7.1.2 Protegrity USA, Inc.

- 7.1.3 Broadcom Inc.

- 7.1.4 Thales Group

- 7.1.5 Hewlett Packard Enterprise

- 7.1.6 First Data Corporation

- 7.1.7 Cardconnect Corporation

- 7.1.8 3delta Systems, Inc.

- 7.1.9 Ciphercloud Incorporation

- 7.1.10 Cybersource Corporation

- 7.1.11 Liaison Technologies Inc

- 7.1.12 Fiserv, Inc.

- 7.1.13 Tokenex, LLC