|

市場調查報告書

商品編碼

1445868

燃氣引擎:市場佔有率分析、行業趨勢和統計、成長預測(2024-2029)Gas Engine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

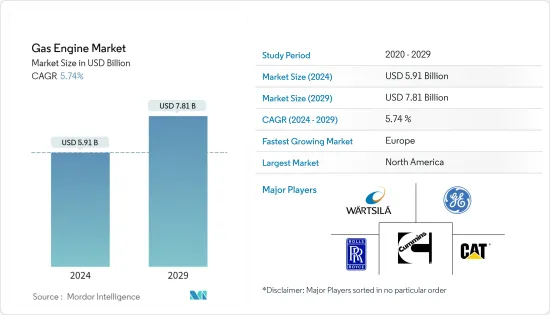

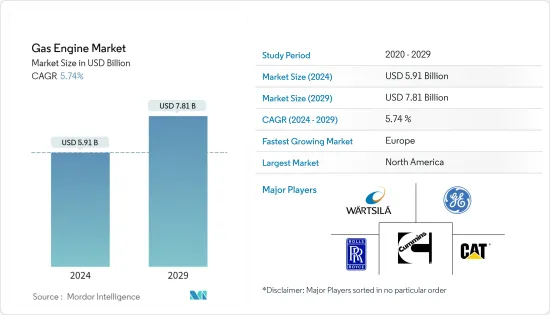

燃氣引擎市場規模預計2024年為59.1億美元,預計到2029年將達到78.1億美元,在預測期內(2024-2029年)年複合成長率為5.74%成長。

主要亮點

- 從中期來看,燃氣引擎市場主要受到全球天然氣的大量供應以及發電和汽車行業對無排放氣體燃料系統的需求的推動。

- 另一方面,再生能源來源的成長趨勢正在阻礙燃氣引擎的未來繁榮。

- 儘管如此,生產更好版本燃氣引擎的技術進步正在為市場發展創造充足的機會。近日,德國曼恩能源解決方案引擎公司在紐倫堡沼氣會議及貿易博覽會上首次展示了其新型曼恩E3872燃氣引擎系列。該引擎設計為四衝程火花點火式燃氣引擎,排氣量為29.6升,缸徑為138毫米,衝程為165毫米。光是 12 個汽缸,效率就提高了 44%。

燃氣引擎市場趨勢

電力公共事業預計將顯著成長

- 電力公共事業更喜歡燃氣引擎來提供基本電力負載。此外,使用燃氣引擎發電機被認為對於應對尖峰負載需求非常有用。世界各地的一些電力公共事業正面臨尖峰負載需求的突然激增,特別是在早上和晚上。

- 在全球發電結構中,天然氣發電僅次於煤炭。 2022年發電量為6,631.39TWh,約佔總發電量的23%。如此大規模引入燃氣引擎的最顯著原因是電力產業的脫碳。許多天然氣發電工程正在被添加到全球發電組合中。

- 據全球能源監測機構稱,截至2022年,全球有超過600吉瓦的天然氣發電廠處於開發階段,其中160吉瓦已建成。

- 2022 年 1 月,瓦錫蘭宣布從泰米爾納德邦石油產品有限公司 (TPL)訂單兩台 34SG燃氣引擎,用於印度清奈的一座 15.5 兆瓦自備發電廠。

- 2023年10月,濟能(舟山)燃氣發電有限公司與哈爾濱電力公司合作,向GE Vernova訂購了兩台9HA.02複合迴圈燃氣渦輪機。中國國營電力公共事業祖農(舟山)燃氣發電有限公司宣佈在群島最大的島嶼舟山開始建造一座新的複合迴圈發電廠。該發電廠預計將於年終年底投入營運,預計將為舟山市提供總計總合1.7 吉瓦 (GW) 的電力。 9HA.02 DLN2.6e 燃燒系統設計為使用高達 50% 體積的氫氣運行,大大超出了工廠最初的使用高達 10% 氫氣的目標。

- 由於這些類型的發展,預計電力業務部門在預測期內將在燃氣引擎系統的所有應用中佔據重要佔有率。

歐洲預計將出現顯著成長

- 歐洲地區在大規模部署各種應用的燃氣引擎方面具有最大的潛力。旨在向綠色能源轉型的政府政策成為市場成長的催化劑,因為基於氫和天然氣的技術可實現無排放氣體環境。

- 此外,該地區行業領先公司的存在正在推動燃氣引擎行業的進一步技術發展。許多公司正在推出更好的燃氣引擎系統,為新應用提供更多的多功能性。

- 2023 年 4 月,Clark Energy 收到訂單,為 VPI 在伊明翰能源中心的擴建設施交付50MW 氫動力 INNIO Jenbacher燃氣引擎。 Clarke Energy 安裝的 50MW 燃氣往復式調峰設施計劃於明年初投入運行,299MW 開式循環燃氣渦輪機(OCGT) 計劃於 2025 年夏季投入運行,從而提高對能源成功至關重要的容量的 VPI。投資。

- 2023 年 1 月,羅爾斯·羅伊斯宣布已成功測試使用 100% 氫燃料的 MTU 系列 4000 L64 引擎的 12 缸燃氣版本。該公司表示,在其動力系統業務部門進行的測試中,該引擎在效率、性能、排放氣體和燃燒方面表現出優異的特性。

- 預計這些發展將使歐洲地區成為預測期內的市場王牌。

燃氣引擎產業概況

燃氣引擎市場是半整合的。該市場的主要企業包括(排名不分先後)通用電氣公司、瓦錫蘭公司、勞斯萊斯控股公司、Caterpillar和康明斯公司。

康明斯聲稱與各種獨立引擎製造商和發電機組組裝以及為其產品製造引擎的原始設備OEM進行良性競爭。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 調查先決條件

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 2028 年之前的市場規模與需求預測(十億美元)

- 最新趨勢和發展

- 政府政策法規

- 市場動態

- 促進因素

- 各最終用戶產業的天然氣系統供應和消耗增加

- 全球實施更嚴格的廢氣法規

- 抑制因素

- 對可再生資源的興趣日益濃厚

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 最終用戶

- 電力公共事業

- 車

- 船

- 產業

- 其他

- 汽油種類

- 天然氣

- 氫

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲

- 北美洲

第6章 競爭形勢

- 併購、合資、合作與協議

- 主要企業採取的策略

- 公司簡介

- Caterpillar Inc.

- Cummins Inc.

- Siemens AG

- Rolls-Royce Holdings PLC

- Wartsila Oyj Abp

- Mitsubishi Heavy Industries Ltd

- Hyundai Heavy Industries Co. Ltd

- Man SE

- General Electric Company

- Kawasaki Heavy Industries Ltd

- JFE Engineering Corporation

- Liebherr Group

第7章市場機會與未來趨勢

The Gas Engine Market size is estimated at USD 5.91 billion in 2024, and is expected to reach USD 7.81 billion by 2029, growing at a CAGR of 5.74% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, the gas engine market is largely driven by high natural gas supply at the global level and the demand for the emissions-free fuel system in the power generation and automotive sector.

- On the other hand, the thriving future of gas engines is thwarted by the growing inclination towards renewable sources of energy.

- Nevertheless, the technical advancements to produce the better versions of gas engines create ample opportunities for market development. Recently, the German company MAN Energy Solutions Engines introduced a new MAN E3872 gas-engine series for the first time at Biogas Convention & Trade Fair in Nuremberg. It is designed as a four-stroke spark-ignition gas engine with a displacement of 29.6 liters, a bore of 138mm, and a stroke of 165mm. It has 44% greater efficiency from just 12 cylinders.

Gas Engine Market Trends

Power Utilities Expected to Witness Significant Growth

- Electric Utilities prefer gas engines to serve base electrical loads. In addition, the use of gas engine generators is also considered highly useful for handling peak load demand. Several utilities worldwide have faced a rapid spike in the peak load demand, especially during the morning and evening time periods.

- Natural gas-based power generation stands at second place in the global electricity generation mix, after coal. The output was recorded as 6631.39 TWh in 2022, making around 23% of total power generation. The most highlighted reason for such a huge deployment of gas-based engines was the decarbonization of the power sector. Many gas-to-power projects are still on the way to be added to the global power generation portfolio.

- According to global energy monitor, over 600 gigawatts of natural gas power plants are in the development stage worldwide as of 2022, of which 160 gigawatts have already been constructed.

- In Nomeber 2022, Wartsila announced to receive order for two 34SG gas engines by the Tamilnadu Petroproducts Limited (TPL) for 15.5 MW captive power plant in Chennai, India.

- In October 2023, Jineng (Zhoushan) Gas Power Generation Co. placed an order with GE Vernova for two of its 9HA.02 combined-cycle gas turbines in collaboration with Harbin Electric Corporation. China's state-owned utility Jineng (Zhoushan) Gas Power Generation Co. announced starting construction of a new combined-cycle power plant on Zhoushan, the archipelago's largest island. Scheduled to begin operations by the end of 2025, the plant is expected to deliver a total of nearly 1.7 gigawatts (GW) of electricity for Zhoushan. The 9HA.02 DLN2.6e combustion system is designed to operate on up to 50% hydrogen by volume, well above the plant's initial goal to operate on up to 10% hydrogen.

- Owing to such kind of developments, the power utility segment is expected to have a significant share among all the applications of gas engine systems during the forecast period.

Europe Expected to Have a Significant Growth

- The European region has the maximum potential to allow high deployment of gas engines in various applications. The government policies to have a greener energy transition act as a catalyst for the growth of the market, as hydrogen and natural-gas-based technologies render an emission-free environment.

- Furthermore, the presence of industry-leading companies in the region propels a higher techno-growth of the gas engine industry. Many companies have come out with better gas engine systems with more versatility for new applications.

- In April 2023, Clarke Energy recieved order to deliver 50MW of hydrogen ready INNIO Jenbacher gas engines to VPI's expansion at Immingham energy hub. A 50MW gas reciprocating peaking facility installed by Clarke Energy, scheduled to begin operation early next year, and a 299MW open cycle gas turbine (OCGT), scheduled to begin operation by summer 2025, represent VPI's investment in capacity essential to the success of the energy transition.

- In January 2023, Rolls-Royce announced that it had conducted successful tests of a 12-cylinder gas variant of the mtu Series 4000 L64 engine running on 100% hydrogen fuel. In the tests carried out by the Power Systems business unit, the company stated that the engine showed excellent characteristics in terms of efficiency, performance, emissions, and combustion.

- Owing to such developments, the European region is expected to ace the market during the forecast period.

Gas Engine Industry Overview

The gas engine market is semi-consolidated. The key players in this market include (in not particula order) General Electric Company, Wartsila Oyj Abp, Rolls-Royce Holdings PLC, Caterpillar Inc., and Cummins Inc., among others.

Cummins Inc claims to participate in healthy competition with a variety of independent engine manufacturers and generator set assemblers as well as OEMs who manufacture engines for their own products. Some of the company's major competitors in the region include CAT, MTU (Rolls Royce Power Systems Group) and Kohler/SDMO (Kohler Group), Generac, Mitsubishi Heavy Industries (MHI), etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Supply and Consumption of Gas-based Systems in Various End-user Industry

- 4.5.1.2 Implementation of stricter emission regulations worldwide

- 4.5.2 Restraints

- 4.5.2.1 Growing Inclination towards Renewable Sources

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 End-User

- 5.1.1 Power Utilities

- 5.1.2 Automotive

- 5.1.3 Marine

- 5.1.4 Industrial

- 5.1.5 Others

- 5.2 Fuel Type

- 5.2.1 Natural Gas

- 5.2.2 Hydrogen

- 5.2.3 Other Fuel Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Caterpillar Inc.

- 6.3.2 Cummins Inc.

- 6.3.3 Siemens AG

- 6.3.4 Rolls-Royce Holdings PLC

- 6.3.5 Wartsila Oyj Abp

- 6.3.6 Mitsubishi Heavy Industries Ltd

- 6.3.7 Hyundai Heavy Industries Co. Ltd

- 6.3.8 Man SE

- 6.3.9 General Electric Company

- 6.3.10 Kawasaki Heavy Industries Ltd

- 6.3.11 JFE Engineering Corporation

- 6.3.12 Liebherr Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Technical Advancements to Produce the Better Versions of Gas Engines