|

市場調查報告書

商品編碼

1445875

區塊鏈即服務 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Blockchain-as-a-Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

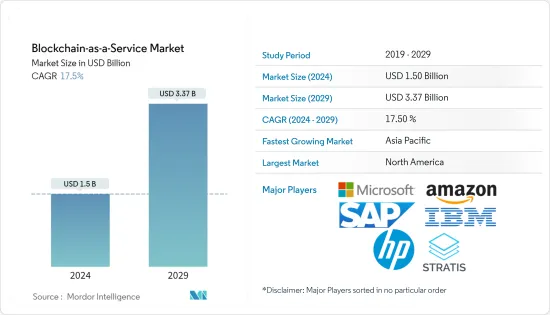

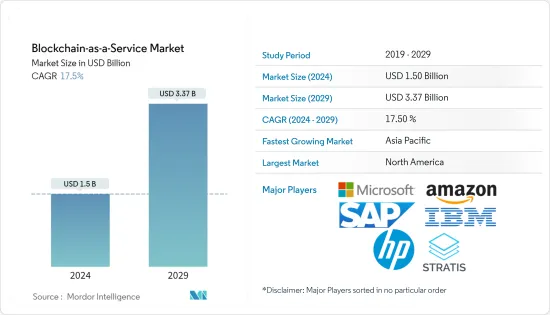

區塊鏈即服務市場規模預計到2024年將達到 15 億美元,預計到2029年將達到 33.7 億美元,在預測期內(2024-2029年)CAGR為 17.5%。

主要亮點

- 隨著加密貨幣市場的擴大,2017年12月,許多新用戶已經了解了區塊鏈和加密貨幣,並開始探索。因此,區塊鏈和加密貨幣用戶迅速增加。比特幣區塊鏈市場在過去幾年中經歷了急劇成長。

- 區塊鏈通常被稱為信任技術,因為它們沒有單點故障,也無法透過單一電腦進行更改。此外,區塊鏈允許使用「智慧合約」等工具,這些工具可能會自動化手動流程,從合規性和索賠處理到分發遺囑內容。這些是一些理想的功能,鼓勵 BFSI 產業利用區塊鏈。

- 區塊鏈在建立和維護基礎設施方面需要巨額投資。與傳統資料庫相比,它的資源消耗要大得多。它還消耗大量能源,需要龐大的頻寬,這是發展中國家努力爭取的。

區塊鏈即服務市場趨勢

BFSI預計佔最大市場佔有率

- 區塊鏈即服務產品徹底改變 BFSI 產業,因為銀行和金融服務公司是探索區塊鏈技術投資最多的企業之一。

- 這是由於該技術有許多非常有價值的去中心化應用,在各個領域催生了新的商業模式,例如跨境支付、匯款、兌換、網路銀行、貿易金融、了解你的客戶(KYC)、以及風險和合規性。

- 然而,它仍處於市場的初級階段,因此銀行和金融機構探索這項技術的可行可能性,並對其進行投資,這可能會促進市場成長。

亞太地區預計將出現最高成長率

- 2018年5月後,由於區塊鏈技術的多重優勢,中國政府一直在推動區塊鏈技術的採用。大部分採礦作業發生在中國。

- 全球領先的ICT(資訊和通訊技術)解決方案供應商華為宣佈於2018年4月在中國推出基於超級帳本的區塊鏈服務,使企業能夠在分散式帳本網路之上開發智慧合約,以供多種用途 - 案例場景。

- 此外,在泰國,政府積極接受加密貨幣計畫。泰國監管機構於2018年頒發了加密貨幣許可證,以支援交易所和 ICO。為外國區塊鏈企業制定了明確且具體的指導方針。

- 此外,韓國政府2019年還花費了8.8億美元用於區塊鏈開發。由於所有這些因素,預計亞太地區將在預測期內實現最快的成長。

區塊鏈即服務業概述

少數全球最大的軟體公司已經認知到區塊鏈即服務的潛力。亞馬遜、微軟和 IBM 三大雲端供應商已經開發了區塊鏈即服務平台,並已可供其雲端客戶使用。區塊鏈新創公司也在招募自由工作者,以建立更好的人才庫。

- 2019年 3月 - 塔塔諮詢服務公司(TCS)與微軟和 R3 技術(R3)合作,採用可擴展的跨產業區塊鏈平台。在這些平台上建立的一些主力解決方案包括技能市場、奢侈品防偽、負擔得起的行動性、5G 共享電信基礎設施以及忠誠度和獎勵計劃。

- 2019年 2月 -IBM 使 IBM Food Trust 解決方案「普遍可用」,最新試驗該解決方案的公司是 Albertsons Companies,依銷售額計算,Albertsons Companies 是全球第二大超市公司。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究成果

- 研究假設

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場概覽

第5章 市場動態

- 市場促進因素與限制簡介

- 市場促進因素

- 提高區塊鏈技術意識有助於擴大市場

- 對交易安全性的需求推動區塊鏈的成長

- 市場限制

- 網路速度和成本的波動可能是限制因素

- 價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

第6章 市場細分

- 最終用戶垂直領域

- BFSI

- 衛生保健

- 資訊科技和電信

- 能源和公用事業

- 零售

- 製造業

- 其他最終用戶垂直領域

- 地理

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 西班牙

- 歐洲其他地區

- 亞太

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 埃及

- 中東和非洲其他地區

- 北美洲

第7章 競爭格局

- 公司簡介

- Microsoft Corporation

- Hewlett-Packard Enterprise

- IBM Corporation

- SAP SE

- Stratis

- Amazon Web Services

- Oracle Corporation

- Huawei Technologies Co. Ltd

- Blockstream Inc.

- PayStand Inc.

第8章 投資分析

第9章 市場機會與未來趨勢

The Blockchain-as-a-Service Market size is estimated at USD 1.5 billion in 2024, and is expected to reach USD 3.37 billion by 2029, growing at a CAGR of 17.5% during the forecast period (2024-2029).

Key Highlights

- With the expansion of the cryptocurrency market, in December 2017, many new users have gained knowledge about blockchain and cryptocurrency, and started exploring the same. Thus, there has been a rapid rise of blockchain and cryptocurrency users. The bitcoin blockchain market has witnessed a steep rise over the past few years.

- Blockchain is often called the technology of trust, as they do not have a single point of failure and cannot be changed from a single computer. Furthermore, blockchain allows for the use of tools, like 'smart contracts,' which may potentially automate manual processes, from compliance and claims processing, to distributing the contents of a will. These are some of the desirable features, which are encouraging the BFSI industry to leverage blockchain.

- Blockchain requires huge investment when it comes to setting up infrastructure and maintaining it. It is much more resource intensive, as compared to traditional databases. It also consumes a huge amount of energy and requires huge bandwidth, which the developing countries are struggling for.

Blockchain as a Service Market Trends

BFSI is Expected to Occupy the Largest Market Share

- Blockchain-as-a-service offerings are revolutionizing the BFSI industry, as banks and financial service companies are among the most heavily invested enterprises exploring blockchain technology.

- This is due to the many, highly valuable decentralized applications of this technology, thereby giving rise to new business models in various areas, such as cross-border payments, remittance, exchanges, internet banking, trade finance, Know Your Customers (KYC), and risk and compliance.

- However, it is still in the nascent stage in the market, owing to which the banks and financial institutions are exploring the viable possibilities of this technology, and investing into the same, which is likely to boost the market growth.

Asia-Pacific is Expected to Witness the Highest Growth Rate

- After May 2018, the Chinese government has been promoting the adoption of blockchain technology, due to its multiple advantages. Majority of mining operations take place in China.

- A leading global ICT (information and communications technology) solutions provider, Huawei, announced the launch of its hyperledger-based blockchain service in April 2018, in China, to enable companies to develop smart contracts on top of a distributed ledger network for several use-case scenarios.

- Moreover, in Thailand, the government positively accepted cryptocurrency projects. Thai regulators established cryptocurrency licenses in 2018, to enable exchanges and ICOs. Clear and specific guidelines have been drawn for foreign blockchain businesses.

- Furthermore, the South Korean government also spent USD 880 million on blockchain development for 2019. Owing to all these factors, Asia-Pacific is expected to witness the fastest growth rate over the forecast period.

Blockchain as a Service Industry Overview

The potential of blockchain-as-a-service has been recognized by few of the world's largest software companies. The three big cloud providers, Amazon, Microsoft, and IBM, have developed blockchain-as-a-service platforms that are already available for their cloud customers. Blockchain startups are also hiring freelancers for a better talent pool.

- March 2019 -Tata Consultancy Services (TCS) collaborated with Microsoft and R3 technology (R3), to adopt a scalable cross-industry blockchain platform. Some of the anchor solutions that are being built on these platforms include skills marketplace, anti-counterfeiting of luxury goods, affordable mobility, and shared telecom infrastructure for 5G, and loyalty and rewards programs.

- February 2019 -IBM made the IBM Food Trust solution "generally available", and the latest company to experiment with this solution isAlbertsons Companies, the world's second-largest supermarket company, by sales.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

5 MARKET DYNAMICS

- 5.1 Introduction to Market Drivers and Restraints

- 5.2 Market Drivers

- 5.2.1 Increasing Awareness of Blockchain Technology is Helping to Expand the Market

- 5.2.2 Need for Security in Transactions is Driving the Blockchain's Growth

- 5.3 Market Restraints

- 5.3.1 Volatility of Network Speed and Cost Involved Can be a Restraining Factor

- 5.4 Value Chain Analysis

- 5.5 Industry Attractiveness - Porter's Five Forces Analysis

- 5.5.1 Threat of New Entrants

- 5.5.2 Bargaining Power of Buyers/Consumers

- 5.5.3 Bargaining Power of Suppliers

- 5.5.4 Threat of Substitute Products

- 5.5.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 End-user Vertical

- 6.1.1 BFSI

- 6.1.2 Healthcare

- 6.1.3 IT and Telecom

- 6.1.4 Energy and Utilities

- 6.1.5 Retail

- 6.1.6 Manufacturing

- 6.1.7 Other End-user Verticals

- 6.2 Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.2.4 Russia

- 6.2.2.5 Spain

- 6.2.2.6 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 South Korea

- 6.2.3.5 Rest of Asia-Pacific

- 6.2.4 Latin America

- 6.2.4.1 Brazil

- 6.2.4.2 Argentina

- 6.2.4.3 Rest of Latin America

- 6.2.5 Middle East & Africa

- 6.2.5.1 United Arab Emirates

- 6.2.5.2 Saudi Arabia

- 6.2.5.3 South Africa

- 6.2.5.4 Egypt

- 6.2.5.5 Rest of Middle East & Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Microsoft Corporation

- 7.1.2 Hewlett-Packard Enterprise

- 7.1.3 IBM Corporation

- 7.1.4 SAP SE

- 7.1.5 Stratis

- 7.1.6 Amazon Web Services

- 7.1.7 Oracle Corporation

- 7.1.8 Huawei Technologies Co. Ltd

- 7.1.9 Blockstream Inc.

- 7.1.10 PayStand Inc.