|

市場調查報告書

商品編碼

1326382

BDaaS(大數據即服務)的市場規模和份額分析 - 增長趨勢和預測(2023-2028)Big Data As A Service Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

BDaaS(大數據即服務)市場規模預計將從 2023 年的 254.4 億美元增長到 2028 年的 867.6 億美元,預測期內(2023-2028 年)複合年增長率為 27.81%。

主要亮點

- 技術的進步導致了基於服務的解決方案的興起,從而催生了軟件即服務 (SaaS)、平台即服務 (PaaS) 和數據即服務 (DaaS)。由於這些服務所提供的優勢,大數據供應商正在認識到這些服務是潛在的增長機會。隨著公司越來越多地採用數據驅動的營銷策略、移動和混合工作環境以及全球供應網絡,雲計算變得越來越普遍。

- 雲計算不斷發展,為各種規模和行業的企業提供了購買、使用雲投資並從中獲利的新方式。在政府的支持下,開放數據技術正在獲得關注,阿根廷布宜諾斯艾利斯、秘魯拉利伯塔德和巴西聖保羅等城市都歡迎政府透明度等舉措。

- Abrelatam、美洲開發銀行 (IADB) 和拉丁美洲開放數據倡議 (ODI) 等組織正在共同努力,擴大整個拉丁美洲的開放數據工作,以減少腐敗、提高城市復原力等。減少暴力侵害婦女行為並改善醫療保健服務的提供。

BDaaS市場趨勢

私有雲的日益普及推動市場發展

- 私有雲服務是專門為滿足組織的需求而設計的,通常通過私有網絡或企業 WAN 而不是開放的互聯網資源進行訪問。這些服務使企業能夠建立具有指定安全性和服務級別協議要求的 IT 架構,從而實現雲託管和本地應用程序的無縫集成。

- 在私有雲中,基礎設施和服務都在私有網絡上進行管理,並使用專用於客戶的軟件和硬件。這樣可以確保數據不會錯放或丟失,並且您可以根據需求靈活更改資源配置。

- 對雲的訪問更加安全,因為對私有雲環境的訪問使用私有的、受保護的網絡線路,而不是公共互聯網。此外,與即用即付定價不同,私有雲提供固定定價模式,使企業能夠更有效地長期規劃增長和預算。

- 這些優勢對於具有可預測工作負載、需要專門定制、在受監管區域運營且必須遵守治理和安全標準的企業尤其有吸引力。私有雲解決方案在金融和政府等行業很受歡迎,因為專用基礎設施可以讓您完全控制數據和應用程序。

美國占據最大市場份額

- 預計在預測期內,美國將主導區域和全球 BDaaS 市場。這是因為市場上的大多數主要供應商都位於美國,並且大數據服務在離散製造、銀行、流程製造、專業服務和聯邦/中央等區域部門中廣泛採用政府。是主要原因。

- 儘管大數據最近在美國備受關注,但各領域的許多企業仍然沒有完全理解它。然而,採用大數據服務來提高內部效率的趨勢日益明顯。事實上,在最近的一項調查中,43% 的公司將內部流程效率視為數字化轉型的關鍵驅動力。

- 跨國公司Intel是發現大數據巨大價值的美國公司的一個著名例子。該公司利用大數據來加速芯片開發、識別製造缺陷並警告安全威脅。通過採用大數據,Intel實現了預測分析並提高了質量,同時節省了約 3000 萬美元的質量保證成本。

- 預計製造業的增長速度也將快於整體經濟。根據生產力與創新製造商聯盟 (MAPI) 的數據,到 2022 年產量預計將增長約 3.5%。此外,本地中小企業對 SaaS 的採用正在增加,預計研究市場的範圍將在預測期內擴大。

BDaaS行業概述

大數據服務有可能通過提供差異化和增值服務的新機會來擾亂競爭。然而,開源工具的出現極大地擴展了大數據分析技術的能力,使得企業很難在不放棄太多產品性能的情況下趕上競爭對手。這種環境增加了成本並降低了行業盈利能力。為了保持競爭力,領先的大數據解決方案提供商正在收購初創公司並投資支持其整個產品的新技術。隨著技術進步為公司提供可持續的競爭優勢,市場還見證了多種合作和合併。

2022 年 11 月,Wipro Ltd. 發布了 Wipro 數據智能套件,這是一個加速雲現代化和數據貨幣化的一站式服務。該套件旨在升級 Amazon Web Services (AWS) 上運行的數據存儲、管道和可視化等數據資產。

2022 年 8 月,混合數據初創公司 Cloudera 宣布發布 Cloudera Data Platform (CDP) One。CDP One 是一款軟件即服務 (SaaS) 產品,可為所有類型的數據提供快速、簡單的自助分析和探索性數據科學。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查假設

- 調查範圍

第二章研究方法論

第三章執行摘要

第四章市場動態

- 市場概況

- 市場驅動因素和市場限制簡介

- 市場驅動力

- 雲採用率不斷提高,生成的數據量不斷增加

- 組織內部對效率的需求不斷增長

- 私有雲的採用率增加

- 市場製約因素

- 數據安全問題

- 價值鏈/供應鏈分析

- 行業吸引力——波特五力分析

- 新進入者的威脅

- 買方/消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第五章市場細分

- 通過部署

- 本地

- 雲

- 私人的

- 上市

- 雜交種

- 按最終用戶

- IT/通訊

- 能源/電力

- BFSI更多

- 衛生保健

- 零售

- 製造業

- 其他最終用戶

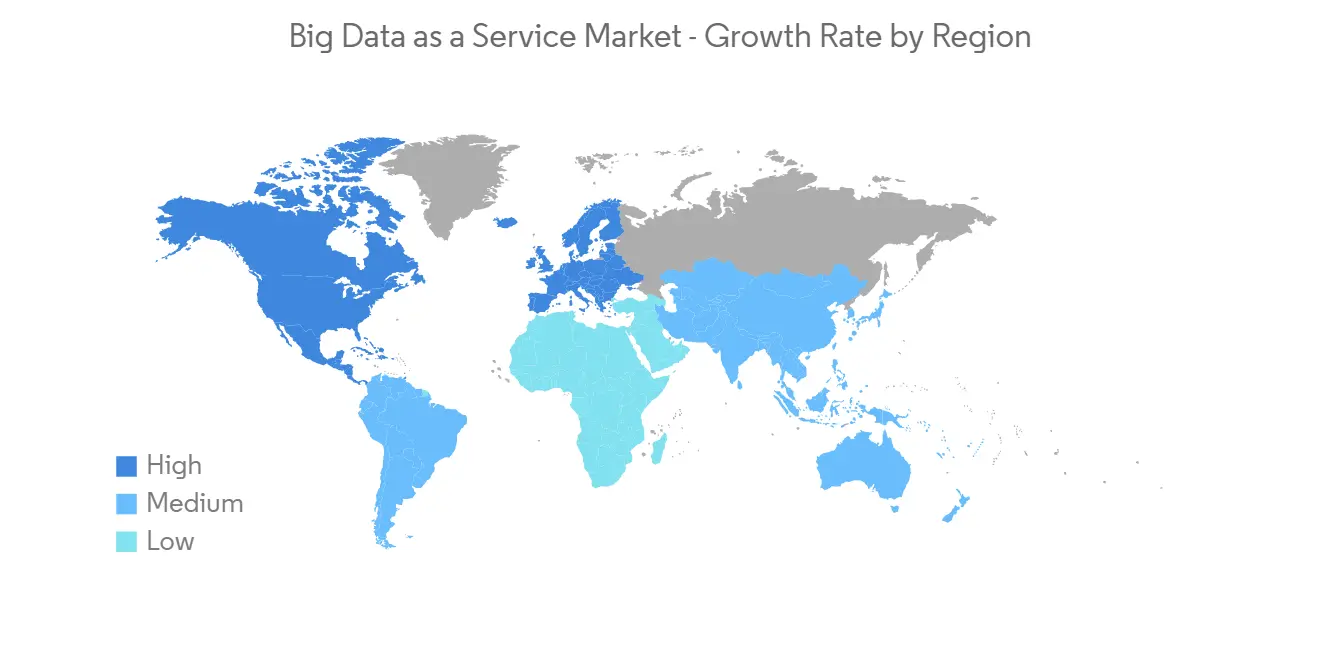

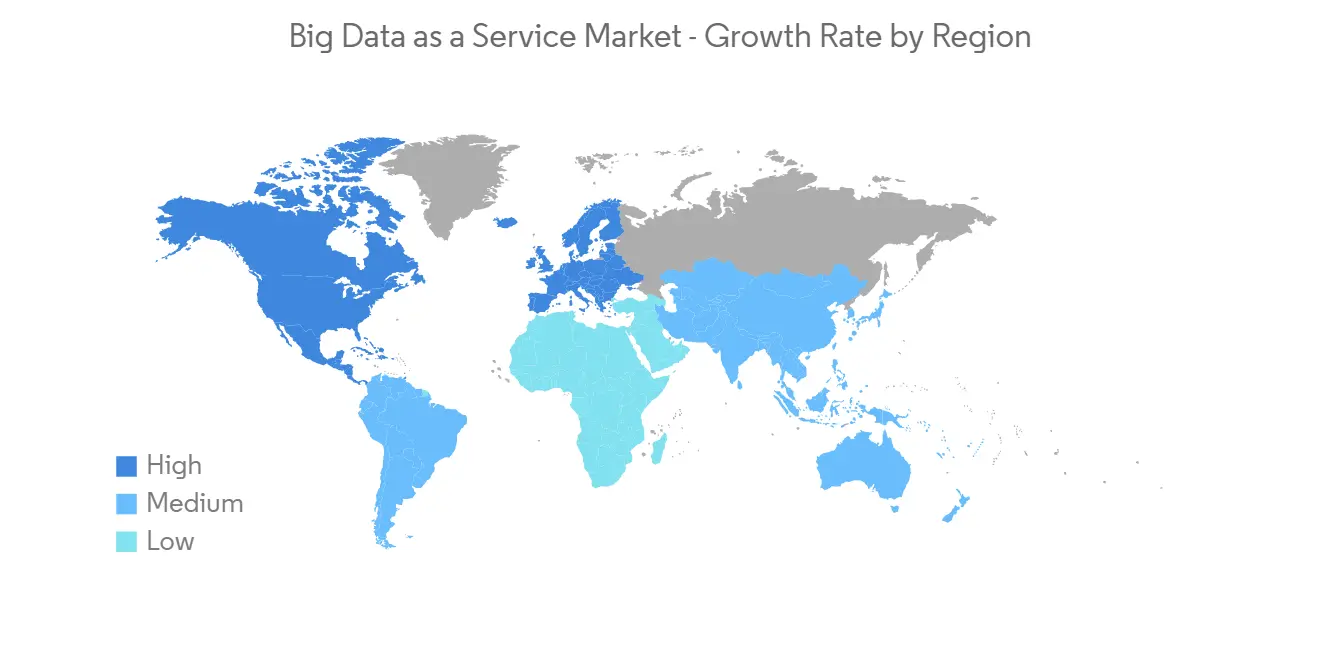

- 按地區

- 北美

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 北美

第 6 章 競爭信息

- 公司簡介

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Hewlett-Packard Company

- SAS Institute Inc.

- Accenture PLC

- Information Builders Inc.

- Google LLC

- Amazon Web Services Inc.

- Alteryx Ltd

- Wipro Ltd

- Opera Solutions LLC

- Guavus Inc.

第七章 市場投資

第八章市場機會及未來趨勢

The Big Data as a Service Market size is expected to grow from USD 25.44 billion in 2023 to USD 86.76 billion by 2028, at a CAGR of 27.81% during the forecast period (2023-2028).

Key Highlights

- Advancements in technology have led to the rise of service-based solutions, which have given birth to Software as a Service (SaaS), Platform as a Service (PaaS), and Data as a Service (DaaS). Big data vendors have identified these as potential growth opportunities due to the benefits these services offer. As businesses increasingly adopt data-driven marketing strategies, mobile and hybrid working environments, and worldwide supply networks, cloud computing is becoming more ubiquitous.

- Cloud computing continues to evolve, providing businesses of all sizes and industries with new ways to purchase, utilize, and benefit from their cloud investments. With the support of governments, open data technology is gaining traction, and cities like Buenos Aires in Argentina, La Libertad in Peru, and Sao Paolo in Brazil are welcoming initiatives such as government transparency.

- Organizations such as Abrelatam, the Inter-American Development Bank (IADB), and Latin America Open Data Initiative (ODI) are working together to scale open data initiatives across Latin America, helping to reduce corruption, increase the resilience of cities, decrease violence against women, and improve the delivery of healthcare services.

Big Data as a Service Market Trends

Growing Adoption of Private Cloud is Driving the Market

- Private cloud services are specifically designed to cater to an organization's needs and are generally accessed through a private network or corporate WAN rather than an open Internet source. These services allow organizations to establish their IT architectures by specifying their requirements for security and service-level agreements and enable seamless integration between cloud-hosted applications and in-house applications.

- In a private cloud, both infrastructure and services are maintained on a private network, and software and hardware are exclusively dedicated to the client organization. This ensures that data is not misplaced or lost and provides the flexibility to modify resource configuration in response to demand.

- Because a private cloud environment is accessed using private and protected network lines rather than the public internet, cloud access is more secure. Furthermore, private clouds offer a set pricing model, as opposed to a pay-as-you-go method, enabling organizations to plan expansion and budget more efficiently in the long run.

- These advantages are particularly appealing to enterprises that can predict their workloads, require specialized customization, operate in regulated sectors, and must comply with governance and security standards. Since the dedicated infrastructure provides complete control over data and applications, industries such as finance and government are more likely to adopt a private cloud solution.

United States Occupied the Largest Share In the Market

- The United States is poised to dominate the regional and global big data as a service market over the forecast period. This is largely because most major vendors in the market are based in the United States, and the adoption of big data services is widespread in regional sectors such as discrete manufacturing, banking, process manufacturing, professional services, and federal/central government.

- Although big data has recently gained attention in the US, it is still not fully understood by many businesses across different sectors. However, there is a growing trend in adopting big data services to enhance internal efficiency. In fact, 43% of companies in a recent survey identified internal process efficiency as the primary driving force behind their digital transformation.

- One notable example of a US-based company that has found significant value in big data is Intel, a multinational corporation. The company uses big data to speed up chip development, identify manufacturing glitches, and warn about security threats. By adopting big data, Intel has enabled predictive analysis and saved approximately USD 30 million on its quality assurance spend, while still improving quality.

- The manufacturing sector is also expected to grow faster than the general economy. According to the Manufacturers Alliance for Productivity and Innovation (MAPI), production is projected to increase by around 3.5% until 2022. Additionally, the rising adoption of SaaS among local SMEs is anticipated to expand the studied market scope over the forecast period.

Big Data as a Service Industry Overview

Big data services have the potential to disrupt competition by providing new opportunities for differentiation and value-added services. However, the availability of open-source tools has led to a significant expansion of capabilities in Big Data analytics technology, making it challenging for companies to keep up with rivals without giving away too much product performance. This environment can escalate costs and erode industry profitability. To stay competitive, major Big Data solution providers are acquiring or investing in startups and new technologies that support their overall product offerings. The market is also witnessing multiple partnerships and mergers as technological advancements bring sustainable competitive advantages to companies.

In November 2022, Wipro Ltd. launched the Wipro Data Intelligence Suite, a one-stop shop for accelerating cloud modernization and data monetization. The suite is designed to upgrade data estates, including data stores, pipelines, and visualizations, that run on Amazon Web Services (AWS).

In August 2022, Cloudera, a hybrid data startup, announced the release of Cloudera Data Platform (CDP) One. CDP One is a software-as-a-service (SaaS) product that provides quick and simple self-service analytics and exploratory data science on any type of data.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Cloud Adoption And Rise In The Data Volume Generated

- 4.3.2 Increasing Demand For Improving Organization's Internal Efficiency

- 4.3.3 Growing Adoption of Private Cloud

- 4.4 Market Restraints

- 4.4.1 Data Security Concerns

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.1.2.1 Private

- 5.1.2.2 Public

- 5.1.2.3 Hybrid

- 5.2 By End User

- 5.2.1 IT and Telecommunication

- 5.2.2 Energy and Power

- 5.2.3 BFSI

- 5.2.4 Healthcare

- 5.2.5 Retail

- 5.2.6 Manufacturing

- 5.2.7 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 US

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 UK

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Mexico

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE INTELLIGENCE

- 6.1 Company Profiles

- 6.1.1 IBM Corporation

- 6.1.2 Microsoft Corporation

- 6.1.3 Oracle Corporation

- 6.1.4 SAP SE

- 6.1.5 Hewlett-Packard Company

- 6.1.6 SAS Institute Inc.

- 6.1.7 Accenture PLC

- 6.1.8 Information Builders Inc.

- 6.1.9 Google LLC

- 6.1.10 Amazon Web Services Inc.

- 6.1.11 Alteryx Ltd

- 6.1.12 Wipro Ltd

- 6.1.13 Opera Solutions LLC

- 6.1.14 Guavus Inc.