|

市場調查報告書

商品編碼

1432997

VoWiFi:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)VoWiFi - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

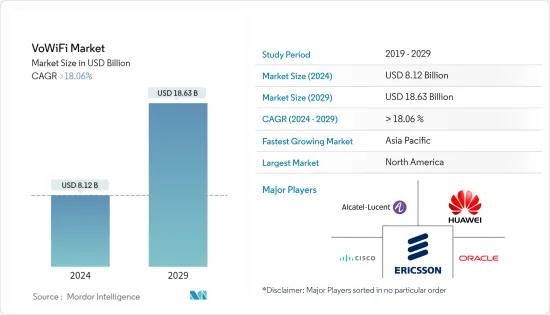

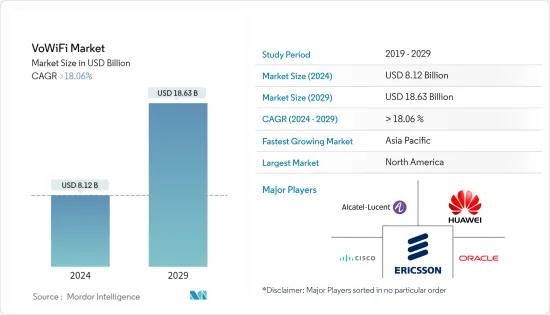

2024 年 VoWiFi 市場規模估計為 81.2 億美元,預計到 2029 年將達到 186.3 億美元,在預測期間(2024~2029 年)以超過 18.06% 的複合年增長率增長。

作為邁向基於 IP 的通訊的自然步驟,大多數通訊業者預計將提供 VoWiFi 和 VoLTE 服務,這可以改善室內網路覆蓋範圍。

主要亮點

- 使用WiFi網路提供語音服務稱為「WiFi 語音」(VoWiFi)。 支援WiFi網路和音訊系統的語音元件通常是最終使用者的個人財產。 隨著越來越多的人習慣於WiFi技術,移動運營商(電信運營商)正在尋求通過向房主和企業提供VoWiFi來利用這些潛在的商機。 他們還希望通過引入更快的寬頻連接,能夠在更多地方使用他們的服務。

- 市場是由解決室內覆蓋問題所驅動的。對於用戶來說,在家中、職場和商店中行動電話接收不良是一個嚴重的問題。沒有足夠室內覆蓋的人可能會採取極端措施,例如探出窗外接收訊號。 VoWiFi 讓客戶即使在室內也能可靠地撥打和接聽電話,而無需升級手機或安裝新硬體。

- 高速網路的普及和寬頻服務的日益普及正在對市場產生重大影響。與2022年12月相比,2023年6月中國網民增加了1,100萬人。根據 Speedtest 的數據,截至 2023 年 4 月,卡達擁有世界上最快的平均行動網際網路連接,約為 190Mbps。其次是阿拉伯聯合大公國 (UAE) 和澳門,這兩個國家的中位數平均速度均超過 170Mbps。

- 然而,維護成為一個課題,因為通訊業者不負責診斷和修復 WiFi 網路。住宅WiFi 用戶和企業 IT 團隊需要承擔責任。此外,VoWiFi尚不支援E-911,這限制了市場。

- 由於大規模封鎖和社會隔離的需要,冠狀病毒 (COVID-19) 大流行增加了我們對互聯網的依賴。 這使得家人和朋友可以溝通,企業和政府可以運作,學生可以學習,患者可以接受醫療保健服務。 對互聯網的日益依賴使得建立互聯網和彌合數位鴻溝變得更加重要。

- 在 COVID-19感染疾病期間,由於家庭中更多地使用 WiFi 來改善通話連線, VoWiFi 市場的收入激增。該行業的快速成長是由於企業需要改善員工溝通,並利用人工智慧(AI)和物聯網(IoT)等尖端技術來實現業務順利營運,預計這也將得到促進經過

VoWiFi市場趨勢

公共 WiFi 熱點獲得顯著的市場佔有率

- 即使附近沒有行動電話塔,用戶也可以繼續透過通用接取網路撥打電話。除了覆蓋行動電話接收不良的區域之外,公共 WiFi 熱點的可用性增加了對額外 VoWiFi 的需求。農村地區的行動電話覆蓋率遠低於都市區,因此越來越多的消費者轉向公共 WiFi。

- 作為數位連接國家的巨大努力的一部分,印度政府已強制要求在每 250,000 克 panchayat(村莊街區)中安裝 5 個 WiFi 熱點,用於公共事業服務。為了支援公共資料辦公室,政府希望在 2022 年安裝 1,000 萬個 WiFi 熱點。

- 透過使用 WiFi 熱點而不是營運商網路進行呼叫,客戶可以利用 WiFi 熱點的激增,從而使通訊業者能夠釋放頻譜。因此,營運商可以減少資本支出。

- 為了減少客戶流失,通訊業者預計將使用 VoWiFi 來擴大通訊,特別是在室內和行動電話通訊較弱的地方。這一策略可能會推動未來市場的成長。

- 根據電信諮詢服務的數據,2018年免費Wi-Fi流量總量約為34.37億GB。預計到 2023 年,交通量將增加約三倍。

預計北美將佔據重要市場佔有率

- 由於對高品質和無縫語音通訊服務的需求不斷成長,北美 WiFi 語音 (VoWiFi) 市場預計在未來幾年將成長。遠距工作和自帶設備 (BYOD) 趨勢的興起也推動了該地區 VoWiFi 的成長。

- 許多公司現在鼓勵員工使用行動裝置遠端執行與工作相關的任務。 BYOD(自帶設備)越來越受歡迎,為員工提供了更多自由來遠程辦公和存取公司資訊資源。保護員工隱私並確保從個人裝置存取組織資料時的安全既是一個問題,也是一個威脅。

- 北美地區的漫遊資費非常高,漫遊時間也是其他地區中最長的。因此,使用VoWiFi可以降低漫遊費用,並可以鼓勵更多人在該地區使用資料漫遊。

- 北美通訊業者和服務供應商正在投資 VoWiFi 技術的開發和部署,以滿足對先進通訊服務不斷成長的需求。該市場的特點是存在多個大型和成熟企業以及眾多新興企業和小型企業。

- 例如,2023 年 2 月,Virgin Media O2 和 Mavenir 宣布將把 O2 行動客戶全面遷移到提供 LTE 語音 (VoLTE) 和 WiFi 語音的虛擬IP 多媒體子系統 (IMS) 解決方案。 Mavenir 是一家網路軟體供應商,利用可在任何雲端上運行的雲端原生應用程式 (VoWiFi) 來建立未來網路。 Virgin Media O2 透過虛擬網路打破了硬體和軟體之間的連結。虛擬允許用戶在同一平台上存取各種應用程式,使 Virgin Media O2 的網路更加靈活和有效。它還降低了成本,並為改進和新服務的可能性打開了大門。

VoWiFi產業概述

隨著競爭公司之間的敵對關係加劇,WiFi 語音 (VoWiFi) 市場正在走向分散。全球市場參與者正在創新新技術,以使消費者更加方便和有效率。該市場的主要企業是阿爾卡特朗訊、思科系統公司和甲骨文公司。市場的最新發展包括:

- Vodafone Idea (Vi) 計劃在全國 12 個州提供 VoWi-Fi 通話服務。這是一項重要的服務,特別是對於改善消費者的賠償體驗。由於室內行動網路沒有得到很好的覆蓋,許多人在家裡依賴這種方式。 Vodafone Idea 僅在 12 個邦提供服務,包括馬哈拉斯特拉邦拉邦和果阿邦、UP West、加爾各答、拉賈斯坦邦、古吉拉突邦、旁遮普邦、UP 酵母、德里以及孟加拉邦、孟買和哈里亞納邦的其餘地區。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進與市場約束因素介紹

- 市場促進因素

- 提高網路普及

- 減少室內覆蓋問題

- 市場限制因素

- 營運商造成的維護問題

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 音訊客戶端

- 整合 VoWiFi 用戶端

- 獨立的 VoWiFi 用戶端

- 瀏覽器 VoWiFi 用戶端

- 設備類型

- 智慧型手機

- 平板電腦/筆記型電腦

- 其他設備類型

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章 競爭形勢

- 公司簡介

- Alcatel-Lucent

- Oracle Corporation

- Cisco Systems Inc.

- Ericsson AB

- Huawei Technologies Co. Ltd.

- Aptilo Networks

- KT Corporation

- Mitel Networks Corporation

- Nokia Corporation

- Ribbon Communications

第7章 投資分析

第8章 市場機會及未來趨勢

The VoWiFi Market size is estimated at USD 8.12 billion in 2024, and is expected to reach USD 18.63 billion by 2029, growing at a CAGR of greater than 18.06% during the forecast period (2024-2029).

As a natural step toward IP-based communication, most operators are expected to offer both VoWiFi and VoLTE services, which could improve indoor network coverage.

Key Highlights

- The use of a WiFi network for voice services is known as "voice over WiFi" (VoWiFi). The WiFi network and the voice components that support the voice system are typically the end user's personal property. Mobile operators (Telcos) are attempting to take advantage of these potential business opportunities as more and more people become accustomed to WiFi technology by providing VoWiFi to homeowners and businesses. They also want to make their service available in more places by putting in faster broadband connections.

- The market is being driven by the elimination of the indoor coverage issue. For users, poor cellular reception in homes, workplaces, and stores is a serious problem. People with inadequate interior coverage may take extreme measures to receive a signal, such as leaning out of windows. VoWiFi enables customers to reliably place and receive calls, even while they are indoors, without having to upgrade their handsets or install new hardware.

- The proliferation of high-speed internet and increased accessability to broadband services have significantly impacted the market. China's internet population increased by 11 million in June 2023 compared to December 2022. According to Speedtest, as of April 2023, Qatar had the fastest average mobile internet connections globally, nearly 190 Mbps. The United Arab Emirates (UAE) and Macau followed, with each of these countries registering average median speeds above 170 Mbps.

- Maintenance, however, presents a challenge because carriers are not accountable for diagnosing and fixing WiFi networks. Residential WiFi users and corporate IT teams should be held accountable. Additionally, VoWiFi does not yet support E-911, which is restricting the market.

- Because of extensive lockdowns and the need to socially isolate oneself, the coronavirus (COVID-19) pandemic increased dependency on the Internet. It enabled family and friends to communicate, businesses and governments to operate, students to study, and patients to get healthcare services. This increased reliance on the Internet made it more important to both build out the Internet and close the digital divide.

- Due to the rising use of WiFi in homes for better call connectivity during the coronavirus disease (COVID-19) epidemic, the VoWiFi market experienced a surge in income creation. The rapid growth of the industry was also expected to be driven by the need for businesses to improve employee communication for smooth operations and the need to use cutting-edge technology like artificial intelligence (AI) and the Internet of Things (IoT).

VoWiFi Market Trends

Public WiFi Hotspot to Gain Significant Market Share

- Users can continue to place calls over a general access network without the need for a nearby cell tower. The availability of public WiFi hotspots is driving the need for additional VoWiFi in addition to providing coverage for areas with poor cell reception. Because cell tower coverage is substantially weaker in rural regions than it is in cities, this encourages more consumers to use public WiFi.

- In India, the government has mandated five WiFi hotspots in each of the 250,000 gram panchayats, or village blocks, for public utility services as part of the mega initiative to digitally connect the nation. To help public data offices, the government wants to set up 10 million WiFi hotspots by 2022.

- By using WiFi hotspots rather than the carrier network to make calls, customers may exploit the increase in WiFi hotspots to assist operators in freeing up their spectrum. Operators might reduce their capital expenditures as a result.

- In order to reduce churn, operators are expected to use VoWiFi to extend coverage, especially indoors and in places with weak cellular coverage. This strategy could boost market growth in the future.

- According to Telecom Advisory Service, in 2018, there were roughly 3,437 million gigabytes of total free Wi-Fi traffic. By 2023, the volume of traffic is anticipated to increase by roughly threefold.

North America is Expected to Hold Significant Market Share

- The Voice over WiFi (VoWiFi) market in North America is expected to grow in the coming years due to increasing demand for high-quality, seamless voice communication services. The rise of remote work and bring-your-own-device (BYOD) trends have also driven the growth of VoWiFi in the region.

- Nowadays, a lot of companies encourage their staff to conduct work-related tasks remotely using their own mobile devices. BYOD (bring your own device), an increasingly popular trend, gives employees more freedom to telework and access company information resources. Protecting the privacy of employees and making sure that an organization's data is safe when it is accessed through personal devices are both problems and threats.

- In North America, roaming rates are very high, with the time spent on roaming trips being the highest among all other regions. So, with VoWiFi, roaming charges are likely to go down, and the area may see more people using data roaming.

- North American telecom operators and service providers are investing in the development and deployment of VoWiFi technology to meet the growing demand for advanced communication services. The market is characterized by the presence of several large and established players, as well as a number of start-ups and small players.

- For instance, in February 2023, Virgin Media O2 and Mavenir announced the full migration of O2 mobile customers to its virtualized IP Multimedia Subsystem (IMS) solution, which offers voice over LTE (VoLTE) and voice over WiFi. Mavenir is a network software provider building the networks of the future with cloud-native applications that work on any cloud (VoWiFi). Virgin Media O2 is cutting the link between hardware and software by virtualizing its network. By letting users access a variety of apps that are all on the same platform, virtualization makes Virgin Media O2's network more flexible and effective. It also cuts costs and opens the door for possible improvements and new services.

VoWiFi Industry Overview

The voice-over WiFi (VoWiFi) market is moving toward fragmentation as the competitive rivalry increases. Global players in the market are innovating new technologies to make them more helpful and efficient for consumers. Key players in the market are Alcatel-Lucent, Cisco Systems, Inc., and Oracle Corporation. Recent developments in the market are:

- In 12 states nationwide, Vodafone Idea (Vi) were to provide VoWi-Fi calling service. It is a crucial service, especially for improving consumers' coverage experiences. Many individuals utilize it inside their homes because they don't have adequate indoor mobile network coverage. Only 12 states, including Maharashtra and Goa, UP West, Kolkata, Rajasthan, Gujarat, Punjab, UP East, Delhi, the rest of Bengal, Mumbai, and Haryana, provide Vodafone Idea.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Internet Penetration

- 4.3.2 Reduction of Indoor Coverage Problems

- 4.4 Market Restraints

- 4.4.1 Maintenance Problems Due to Carriers

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Voice Client

- 5.1.1 Integrated VoWiFi Client

- 5.1.2 Separate VoWiFi Client

- 5.1.3 Browser VoWiFi Client

- 5.2 Device Type

- 5.2.1 Smartphones

- 5.2.2 Tablets and Laptops

- 5.2.3 Other Device Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Alcatel-Lucent

- 6.1.2 Oracle Corporation

- 6.1.3 Cisco Systems Inc.

- 6.1.4 Ericsson AB

- 6.1.5 Huawei Technologies Co. Ltd.

- 6.1.6 Aptilo Networks

- 6.1.7 KT Corporation

- 6.1.8 Mitel Networks Corporation

- 6.1.9 Nokia Corporation

- 6.1.10 Ribbon Communications