|

市場調查報告書

商品編碼

1432992

可程式 ASIC:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029 年)Programmable ASIC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

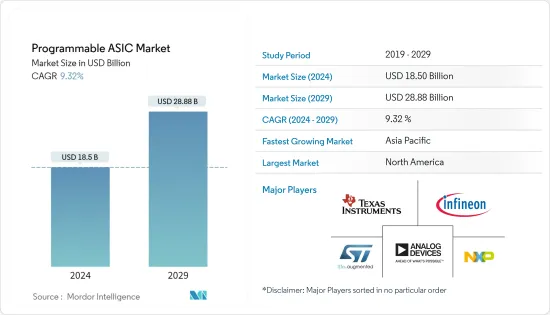

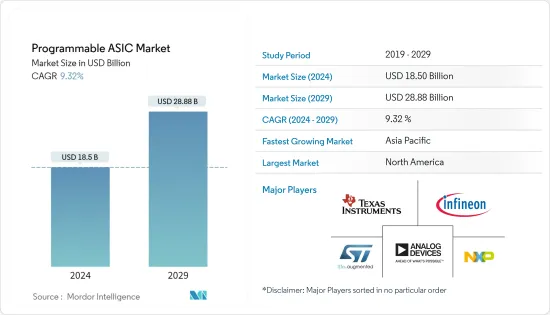

可程式ASIC市場規模預計在2024年為185億美元,預計到2029年將達到288.8億美元,在預測期內(2024-2029年)複合年成長率為9.32%,預計將會成長。

全球對智慧型手機、平板電腦和其他行動裝置的需求迅速成長,對消費性電子領域對可編程 ASIC 的需求產生了積極影響。

主要亮點

- 新產品開發步伐的加快、每功能成本的降低和 IC 功能的提高以及產品更換週期的縮短正在對市場成長產生積極影響。

- 對各種通訊應用(例如晶片系統(SoC)應用)的需求不斷成長,預計將在未來幾年增加市場收益。此外,專用積體電路在消費性電子產品以及各種工業和汽車應用中的使用越來越多,預計將進一步提振市場。

- 推動市場的另一個因素是物聯網設備的出現。專用積體電路也用於環境監測、汽車排放控制和個人數位助理等應用。專用積體電路可以整合模擬和邏輯功能,使得在單一晶片上形成完整的機製成為可能,預計將推動市場成長。

- 可程式 ASIC 市場的主要限制之一是相關的高設計成本。設計和開發過程需要大量的資源和時間投資,這對中小型企業來說成本過高。例如,採用5奈米製程設計的蘋果A14 Bionic晶片的設計和開發成本估計約為4億美元。

- 在可程式 ASIC 設計中使用第三方智慧財產權 (IP) 可能會導致授權問題和法律糾紛。例如,2020年,英偉達和Arm Holdings因在英偉達產品中使用Arm的智慧財產權而捲入法律糾紛。這場糾紛可能會影響英偉達產品未來的開發和可用性。

- COVID-19 大流行對全球供應鏈造成了重大干擾,影響了可程式化 ASIC 的生產和交貨。疫情導致產品發布延遲,並影響了可編程 ASIC 市場的企業收益。例如,賽靈思因疫情而面臨 2020 年 Versal ACAP 產品線延遲上市的情況,影響了其 2021 年的收益。

- 世界各國政府為半導體產業提供支持,以減輕疫情的影響。例如,根據《經濟時報》報道,在美國,作為《美國晶片法案》的一部分,政府將在 2021 年提供 520 億美元資金支持半導體產業。這筆資金預計將支持新興國家可程式 ASIC 的開發和生產。俄羅斯和烏克蘭之間的戰爭也正在影響整個包裝生態系統。

可程式ASIC市場趨勢

消費性電子產業需求的成長推動市場

- 製造商正在將人工智慧 (AI)、機器學習 (ML) 和物聯網 (IoT) 等最尖端科技融入消費性電子產品中。可程式 ASIC 提供支援這些技術所需的處理能力和彈性,使其成為消費性電子製造商的最佳解決方案。

- 為了最大限度地延長電池壽命,家用電器應消耗盡可能少的電量。可程式 ASIC 旨在消耗更少的功率,使其成為消費性電子設備的理想選擇。

- 人工智慧和機器學習在消費性電子產品中變得越來越重要,尤其是智慧型手機和智慧揚聲器。可程式 ASIC 提供支援這些技術所需的運算能力,使其成為消費性電子製造商的理想選擇。

- 在消費性電子領域,物聯網設備的使用正在迅速增加。可程式 ASIC 是希望製造物聯網設備的消費性電子製造商的最佳選擇,因為它們可以滿足物聯網設備的連接和處理需求。

亞太地區正在經歷高速成長

- 在亞太地區,消費性電子市場不斷成長,可程式 ASIC 擴大在這些產品中使用。例如,三星在 2021 年宣布開發出全新的可程式 ASIC,用於 5G 裝置。這款新處理器可提供更高的資料傳輸速度和更高的能源效率,使其成為 5G 裝置的理想選擇。

- 亞太地區汽車產業正在實施 ADAS 等最尖端科技,並需要可編程 ASIC 等高效能運算選項。例如,領先的可程式 ASIC 製造商賽靈思 (Xilinx) 在 2021 年宣布與中國汽車製造商上汽集團合作開發新的 ADAS 平台。該平台利用 Xilinx 的可程式 ASIC 提供最先進的安全功能,例如車道偏離警告和自動緊急煞車。

- 亞太地區半導體產業持續獲得大量投資。例如,2021年,台灣政府承諾在未來五年內以3.34億美元開發可程式ASIC等最尖端科技。這項投資將幫助台灣保持其作為該地區最大半導體生產商的地位。

- 半導體產業的成長持續得到亞太地區政府的支持。例如,印度政府於 2021 年推出了針對半導體產業的生產連結獎勵(PLI) 計畫。該計劃為半導體製造商,特別是製造可編程 ASIC 的製造商提供經濟獎勵,鼓勵他們在印度建立和發展業務。

- 雲端運算和其他數位技術的日益普及導致亞太地區對資料中心的需求大幅增加。根據中國頂級雲端服務供應商阿里雲的公告,一款名為X-Engine的全新雲端基礎可程式ASIC平台已於2021年推出。該平台利用可程式 ASIC 提供更快、更有效率的處理效能,使其成為資料中心應用的理想選擇。

可程式專用積體電路 (ASIC) 產業概述

可程式專用積體電路(ASIC)市場競爭適中,許多主要供應商活躍於國內和國際市場。市場被認為適度集中,進入適度競爭階段,主要企業採取產品創新、合資、合作、併購等策略。該市場的主要參與者包括 Analog Devices, Inc.、Infineon Technologies AG、STMicroElectronics 和 Texas Instruments Inc.。

- 2022 年 9 月 - 全球先進記憶體技術領導者三星電子現實用化開發出業界首款 512 GB 的 Compute Express Link (CXL) DRAM。與三星之前的 CXL 產品相比,新型 CXL DRAM 的記憶體容量提高了四倍,系統延遲降低了五倍,並且採用專用整合電路 (ASIC) CXL 控制器構建。

- 2022 年 7 月 - ASIC 設計服務和 IP 的領先製造商之一智原科技公司 (Faraday Technology Corporation) 宣布推出 FPGA-Go-ASIC原型製作平台。客戶可以利用 Faraday 的 SoCreative! 解決方案驅動的 SoC 平台和可選的 FPGA原型製作平台快速進入電路創建和系統檢驗流程。結合廣泛的FPGA-Go-ASIC解決方案,智原不僅能幫助客戶提升晶片效能,還能加速產品開發並降低成本。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 市場促進因素

- 電子產業需求增加

- 各種應用對微電子的需求不斷成長

- 市場挑戰

- 小批量生產相對昂貴

第5章市場區隔

- 按最終用戶

- 消費性電子產品

- 通訊

- 車

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 英國

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 其他亞太地區

- 世界其他地區

- 北美洲

第6章 競爭形勢

- 公司簡介

- AT&T Inc.

- Verizon Communications Inc.

- Vodafone Group Plc

- T-Mobile US Inc.(Sprint Corporation)

- Telstra Corporation Ltd

- Telefonica SA

- China Telecommunications Corporation

- Deutsche Telekom

- IDEMIA

- Nippon Telegraph and Telephone

第7章 投資分析

第8章 市場機會及未來趨勢

The Programmable ASIC Market size is estimated at USD 18.5 billion in 2024, and is expected to reach USD 28.88 billion by 2029, growing at a CAGR of 9.32% during the forecast period (2024-2029).

The rapidly rising demand for smartphones, tablets, and other mobile devices across the globe is positively impacting the programmable ASIC demand in the consumer electronics segment.

Key Highlights

- The increased pace of new product development, declining cost per function of ICs, and their increasing functionality, and shortened product replacement cycles are some of the factors that are positively influencing the growth of the market.

- The growing demand for various telecommunications applications such as system-on-chip (SoC) applications is expected to boost the revenue of the market in the coming years. Additionally, the growing use of application-specific integrated circuits in consumer electronics and various industrial and automotive applications is further expected to drive the market forward.

- Another factor driving the market is the emergence of IoT devices. These circuits are also used in applications such as environmental monitoring, automotive emission control, and personal digital assistants among others. As the application-specific integrated circuits are capable of integrating both analog and logic functions, hence they enable the formation of a complete mechanism on a single chip, which is expected to boost the growth of the market.

- One of the major restraints in the Programmable ASIC market is the high design cost associated with it. The design and development process requires a significant investment in terms of resources and time, which may be prohibitive for small and medium-sized enterprises. For instance, Apple's A14 Bionic chip, which was designed on a 5nm process, is estimated to have cost around $400 million in design and development.

- The use of third-party intellectual property (IP) in Programmable ASIC design can lead to licensing issues and legal disputes. For instance, in 2020, Nvidia and Arm Holdings were involved in a legal dispute over the use of Arm's IP in Nvidia's products. This dispute could potentially impact the development and availability of Nvidia's products in the future.

- The COVID-19 pandemic led to significant disruptions in the global supply chain, which impacted the production and delivery of Programmable ASICs. The pandemic led to delays in product launches, which impacted the revenue of companies in the Programmable ASIC market. For instance, Xilinx faced delays in the release of its Versal ACAP product line in 2020 due to the pandemic, which impacted its revenue in the fiscal year 2021.

- Governments across the world provided support to the semiconductor industry to mitigate the impact of the pandemic. For instance, as per Economic times, in the United States, the government provided USD 52 billion in funding to support the semiconductor industry in 2021 as part of the CHIPS for America Act. This funding is expected to support the development and production of Programmable ASICs in the country. There has also been an impact of the Russia-Ukraine war on the overall packaging ecosystem.

Programmable Application Specific Integrated Circuit (ASIC) Market Trends

Increasing Demand from Consumer Electronics Segment to Drive the Market

- Manufacturers are incorporating cutting-edge technology such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) into their consumer electronics products. Programmable ASICs are the greatest solution for consumer electronics manufacturers because they provide the processing power and flexibility required to support these technologies.

- To maximize battery life, consumer electronics gadgets must consume as little electricity as possible. Programmable ASICs are designed to consume less power, making them an excellent choice for consumer electronics gadgets.

- AI and machine learning are becoming increasingly important in consumer electronics, particularly in smartphones and smart speakers. Programmable ASICs provide the computing power required to support these technologies, making them the ideal choice for consumer device manufacturers.

- In the consumer electronics sector, the use of IoT devices is rapidly increasing. Programmable ASICs are an excellent choice for consumer electronics manufacturers looking to produce IoT devices because they can meet the connectivity and processing needs of IoT devices.

Asia-Pacific to Witness High Growth

- In the Asia Pacific region, there is a growing market for consumer electronics, and programmable ASICs are being employed in more and more of these products. For instance, Samsung declared that it had created a brand-new Programmable ASIC for usage in its 5G devices in 2021. The new processor is the best option for 5G handsets since it delivers higher data transfer rates and increased power efficiency.

- The Asia Pacific region's automobile industry is implementing cutting-edge technologies like ADAS, which need for high-performance computing options like Programmable ASICs. For instance, a top producer of programmable ASICs, Xilinx, revealed in 2021 that it had teamed up with Chinese carmaker SAIC Motor to create a new ADAS platform. The platform offers cutting-edge safety features including lane departure warnings and autonomous emergency braking thanks to Xilinx's Programmable ASICs.

- Asia Pacific continues to see tremendous investment in the semiconductor sector. For instance, the Taiwanese government declared in 2021 that it will spend USD 334 million over the following five years on the development of cutting-edge technologies, such as Programmable ASICs. The investment will help Taiwan maintain its position as the region's top producer of semiconductors.

- The growth of the semiconductor sector has continued to get assistance from governments in the Asia Pacific area. The Production-Linked Incentive (PLI) scheme for the semiconductor industry, for instance, was introduced by the Indian government in 2021. The programme offers financial incentives to semiconductor manufacturers, particularly those working on Programmable ASICs, to entice them to establish or grow their operations in India.

- The increasing usage of cloud computing and other digital technologies is fueling a significant increase in demand for data centres throughout the Asia Pacific region. A new cloud-based Programmable ASIC platform named X-Engine was created in 2021, according to an announcement made by Alibaba Cloud, one of China's top cloud service providers. The platform leverages Programmable ASICs to give processing performance that is faster and more effective, making it the perfect option for data centre applications.

Programmable Application Specific Integrated Circuit (ASIC) Industry Overview

The programmable application-specific integrated circuit (ASIC) market is moderately competitive owing to the presence of many large vendors operating in domestic as well as international markets. The market appears to be moderately concentrated moving towards the moderately competitve stage with the major players adopting strategies like product innovation, joint ventures, partnerships, and mergers and acquisitions. Some of the major players in the market are Analog Devices, Inc., Infineon Technologies AG, STMicroelectronics, and Texas Instruments Inc. among others.

- September 2022 - In a significant step towards the commercialization of CXL, which will enable extremely high memory capacity with low latency in IT systems, Samsung Electronics Co., Ltd., the world leader in advanced memory technology, today announced its development of the industry's first 512 gigabytes (GB) Compute Express Link (CXL) DRAM. The new CXL DRAM, which boasts four times the memory capacity and a fifth of the system latency compared to the prior Samsung CXL offering, is constructed using an application-specific integrated circuit (ASIC) CXL controller.

- July 2022 - The FPGA-Go-ASIC prototyping platform was introduced by Faraday Technology Corporation, one of the top producers of ASIC design services and IP. Customers can quickly enter the circuit creation and system verification process with the help of Faraday's SoCreative! SoC platforms and optional FPGA prototyping platforms with this solution. In conjunction with its extensive FPGA-Go-ASIC solution, Faraday can assist clients in improving chip performance as well as hastening and reducing the cost of product development.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Rising Demand from the Electronics Industry

- 4.3.2 Growing Demand for Microelectronics in Several Applications

- 4.4 Market Challenges

- 4.4.1 Comparatively Expensive if Manufactured in Small Quantity

5 MARKET SEGMENTATION

- 5.1 By End User

- 5.1.1 Consumer Electronics

- 5.1.2 Telecommunication

- 5.1.3 Automotive

- 5.1.4 Other end user

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 India

- 5.2.3.2 China

- 5.2.3.3 Japan

- 5.2.3.4 Rest of Asia-Pacific

- 5.2.4 Rest of the World

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 AT&T Inc.

- 6.1.2 Verizon Communications Inc.

- 6.1.3 Vodafone Group Plc

- 6.1.4 T-Mobile US Inc. (Sprint Corporation)

- 6.1.5 Telstra Corporation Ltd

- 6.1.6 Telefonica SA

- 6.1.7 China Telecommunications Corporation

- 6.1.8 Deutsche Telekom

- 6.1.9 IDEMIA

- 6.1.10 Nippon Telegraph and Telephone