|

市場調查報告書

商品編碼

1433017

電腦數值控制(CNC):市場佔有率分析、產業趨勢與統計、成長預測(2024-2029 年)Computer Numerical Controls (CNC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

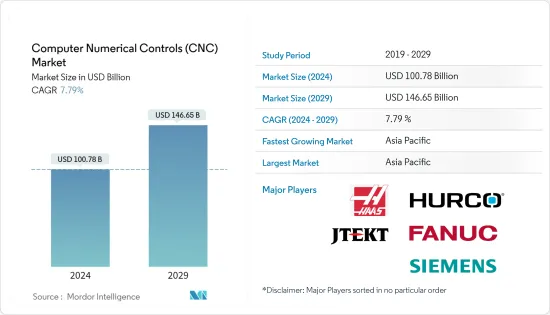

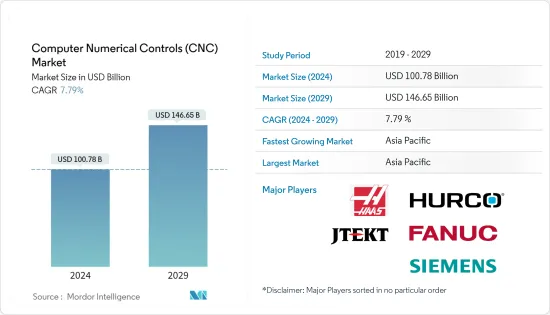

電腦數值控制(CNC)市場規模預計2024年為1007.8億美元,預計2029年將達到1466.5億美元,在預測期內(2024-2029年)複合年成長率為7.79%,預計將成長。

對生產效率的需求不斷增加將在預測期內推動市場。

主要亮點

- 電腦數值控制(CNC) 機器透過減少生產時間和最大限度地減少人為錯誤來簡化許多業務流程,從而提高了對生產效率的需求。

- 此外,激烈的市場競爭迫使企業專注於高效率的製造技術。他們正試圖透過重新設計他們的設備(包括CNC工具機)來獲得競爭優勢。除此之外,3D 列印和 CNC 機器的整合是幾個新生產設施的獨特補充,預計將提供更好的多材料能力,同時減少資源浪費。

- 工業領域對自動化製造的需求不斷成長,促使CNC工具機的使用增加。此外,亞太地區製造設施的建立也刺激了電腦數值控制在該領域的使用。

- 另一方面,由於自動化汽車製造的增加,汽車產業是未來幾年將快速發展的產業。

- 此外,對全球暖化和能源蘊藏量枯竭的日益擔憂促使太陽能和水力發電等各種替代能源的生產,進一步推動市場成長。因為CNC工具機也積極用於發電,而這個過程需要廣泛的自動化。

電腦數值控制(CNC) 市場趨勢

工業領域自動化製造需求不斷成長

- 工業領域對自動化製造的需求不斷成長,促使CNC工具機的採用不斷增加。亞太地區製造設施的建立也刺激了電腦數值控制(CNC)在該領域的使用。

- 數控機床也積極應用於發電領域。

- 如今,CNC在汽車領域發揮著重要作用。從晶粒類似零件到製造一體式框架,現代汽車中的許多零件都由 CNC 工具和機器負責製造。

- 事實上,化油器殼體、懸吊零件、車軸、軸承蓋、引擎殼體等都是使用數控工具機製造的。用於車頭燈、車外燈和車內燈的壓克力/PMMA 加工是汽車行業零件製造時使用數值控制加工的另一個範例。由於自動化汽車製造的增加,汽車產業是未來幾年將快速發展的領域。

亞太地區在電腦數值控制(CNC)市場中佔據最大佔有率

- 中國和印度等新興經濟體正在經歷工業化的快速成長,這正在推動市場。由於該地區汽車需求不斷成長,預計汽車行業在預測期內將大幅成長。

- 由於勞動力容易取得和零件價格下降,製造商正在將生產轉移到該地區,進一步提振市場。靠近供需區域是推動該地區採用的關鍵因素之一。

- 此外,亞太地區製造設施的建立正在刺激電腦數值控制(CNC)在該領域的使用。另一方面,汽車行業在未來幾年將是一個快速發展的行業,這主要是由於汽車製造的自動化率不斷提高。汽車和製造業等金屬加工行業的效率、時間效率、精度和準確度的提高預計將推動 CNC 市場的發展。

電腦數值控制(CNC) 產業概況

主要參與者包括 Hurco Companies Inc.、Protomatic Inc.、Metal Craft、AMS Micromedical LLC、JTEKT Corporation、Haas Automation、Fanuc Corporation、Siemens AG 和 DMG Mori Seiki Co., Ltd.。由於缺乏競爭,預計市場集中度將適度。工業系統的配套軟體和可操作性對於這些系統的選擇至關重要,也是市場供應商創新的關鍵策略之一。

- 2019 年 4 月 - 西門子向市場推出了用於自動化網路規劃和模擬的新版本軟體工具。 Sinetplam V2.0 支援自動化系統的工廠規劃者、建構者和操作者。該公司將在 2019 年漢諾威工業博覽會上展示整合數位規劃和工程工作流程的新功能。

- 2018 年 5 月 - 人工智慧Start-UpsBonsai 和西門子在測試環境中將人工智慧引入現實世界的機器,其中深度強化學習首次成功地自動校準了現實世界的電腦數值控制(CNC) 機器。西門子專家使用 Bonsai 的 AI 平台訓練 AI 模型,自動校準 CNC 工具機,速度比熟練的人類操作員快 30 倍以上。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素與市場約束因素介紹

- 市場促進因素

- 對生產效率的要求不斷提高

- 客製化生產需求不斷成長

- 市場限制因素

- 安裝和維護高成本

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 依機器類型

- 車床

- 鏡面機

- 雷射

- 焊接機

- 繞線機

- 其他機器

- 依最終用戶

- 車

- 產業

- 電力/能源

- 航太/國防

- 其他最終用戶

- 依地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第6章 競爭形勢

- 公司簡介

- Hurco Companies Inc.

- Protomatic Inc.

- Metal Craft

- AMS Micromedical LLC

- JTEKT Corporation

- Haas Automation

- Fanuc Corporation

- Dr. Johannes Heidenhain GmbH

- Siemens AG

- DMG Mori Seiki Co.

- Takisawa Machine Tool Co. Ltd

第7章 投資分析

第8章 市場機會及未來趨勢

The Computer Numerical Controls Market size is estimated at USD 100.78 billion in 2024, and is expected to reach USD 146.65 billion by 2029, growing at a CAGR of 7.79% during the forecast period (2024-2029).

The increase in demand for productions efficiency will drive the market in the forecast period.

Key Highlights

- There is an increasing demand for production efficiency, as these computer numerical control machines streamline many operational processes by reducing production time and minimizing human error.

- Also, a highly competitive market has compelled players to focus on efficient manufacturing techniques. They are trying to gain a competitive advantage by redesigning their facilities, which include CNC machines. Apart from this, the integration of 3D printing with CNC machines is a unique addition to some of the new production units, which is expected to offer better multi-material capability, with little resource wastage.

- The growing demand for automated manufacturing in the industrial sector has resulted in the increasing usage of CNC machines. Also, the establishment of manufacturing facilities in Asia-Pacific has spurred the usage of computer numerical controls in the sector.

- On the other hand, the automotive sector is set to be a rapidly developing one in the coming years, mainly due to the increasing rate of automated automobile manufacturing.

- Also, rising concerns over global warming and depleting energy reserves have led to the production of alternative sources of power, such as solar and water, among various others, which are further promoting market growth. CNC machines are also actively used in power generation, as this process requires wide-scale automation.

Computer Numerical Controls (CNC) Market Trends

Growing Demand for Automated Manufacturing in the Industrial Sector

- Growing demand for automated manufacturing in the industrial sector has resulted in the increasing uptake of CNC machines. Also, the establishment of manufacturing facilities in the Asia Pacific has also spurred the usage of computer numerical controls in this sector.

- CNC machines are also actively used in power generation, as this process requires wide-scale automation.

- In the automotive sector, CNC plays a vital role recently. From die-casting similar components to crafting unibody frames, CNC tools and machines are solely responsible for a large number of parts present in modern vehicles.

- In fact, carburetor housings, suspension components, axles, bearing caps as well as engine housings are all manufactured using CNC machines. Acrylic/PMMA machining for headlights, exterior lights as well as interior lights are another paradigm on how numerical control machining is being utilized when components are being made in the automotive sector. The automotive sector is set to be the rapidly developing segment in the coming years mainly due to the increasing rate of automated automobile manufacturing.

Asia-Pacific Holds the Largest Share in the Computer Numerical Controls Market

- Developing economies, such as China and India, have been witnessing rapid growth in terms of industrialization, thereby driving the market. The automotive sector is expected to grow significantly during the forecast period, owing to the rising demand for automobiles in the region.

- The easy availability of labor and the declining prices of components have resulted in manufacturers shifting their production units in this region, which is further promoting the market. nearness to the supply and demand region is among the critical factor that drives the adoption in this region.

- Moreover, the establishment of manufacturing facilities in the Asia Pacific has spurred the usage of computer numerical controls in this sector. On the other hand, the automotive industry is set to be a rapidly developing segment in the coming years, mainly due to the increasing rate of automated automobile manufacturing. Increased efficiency, time effectiveness, and precision & accuracy provided across metalworking industries such as the automobile and manufacturing industries are expected to drive the CNC market.

Computer Numerical Controls (CNC) Industry Overview

The major players include Hurco Companies Inc., Protomatic Inc., Metal Craft, AMS Micromedical LLC, JTEKT Corporation, Haas Automation, Fanuc Corporation, Siemens AG, DMG Mori Seiki Co., and others. The market concentration is expected to be moderate because there is no competition among the players. The accompanying software and its operability on industrial systems are of critical importance for the selection of these systems and is among the major strategy of the market vendors for innovations.

- April 2019 - Simens launched a new version of the software tool for planning and simulating automation networks on the market. Sinetplam V2.0 supports the plant planner, builders, and operators of the automation system. The company plans to showcase its new features which integrate into the digital planning and engineering workflow, at the Hannover Messe 2019.

- May 2018 - Bonsai, the AI startup, and Siemens deployed Artificial Intelligence on a real-world machine in a test environment that marked the first time deep reinforcement learning had been successfully applied to auto-calibrate real-world computer numerical control (CNC) machines. Siemens experts trained an AI model, using Bonsai's AI platform, to auto-calibrate a CNC machine more than 30 times faster than an expert human operator.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Growing Demand for Production Efficiency

- 4.3.2 Increasing Demand for Customized Production

- 4.4 Market Restraints

- 4.4.1 High Costs Associated with Installation and Maintenance

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Machine Type

- 5.1.1 Lathe Machine

- 5.1.2 Miller Machine

- 5.1.3 Laser

- 5.1.4 Welding Machine

- 5.1.5 Winding Machine

- 5.1.6 Other Machine Types

- 5.2 By End Users

- 5.2.1 Automotive

- 5.2.2 Industrial

- 5.2.3 Power and Energy

- 5.2.4 Aerospace and Defense

- 5.2.5 Other End Users

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Hurco Companies Inc.

- 6.1.2 Protomatic Inc.

- 6.1.3 Metal Craft

- 6.1.4 AMS Micromedical LLC

- 6.1.5 JTEKT Corporation

- 6.1.6 Haas Automation

- 6.1.7 Fanuc Corporation

- 6.1.8 Dr. Johannes Heidenhain GmbH

- 6.1.9 Siemens AG

- 6.1.10 DMG Mori Seiki Co.

- 6.1.11 Takisawa Machine Tool Co. Ltd