|

市場調查報告書

商品編碼

1331332

雲工作負載調度軟件市場規模和份額分析 - 增長趨勢和預測(2023-2028)Cloud-Based Workload Scheduling Software Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

雲工作負載調度軟件市場規模預計將從 2023 年的 15.3 億美元增長到 2028 年的 24.3 億美元,預測期內(2023 年)複合年增長率為 9.67%。

隨著企業採用新技術,並需要考慮和規劃與分佈式和雲環境中關鍵應用程序的工作負載處理和可用性相關的影響,更好的工作負載調度。預計未來對軟件的需求將會增長。

可用的雲工作負載調度軟件可以整合、監控和操作工作負載、執行分析並對未來進行預測。 這使組織能夠管理其資產並解決未來可能出現的問題。

雲工作負載調度軟件有助於改進工作負載調度,無需人工干預。 複雜的調度和分析功能使組織能夠提高員工效率。 這是雲工作負載調度軟件背後的一大推動力。

同樣,各跨國公司對基於雲的服務的快速採用和日益增長的偏好將在預測期內推動基於雲的工作負載調度軟件市場的擴張,我認為這會提供大量新機會。

然而,開源軟件的可用性和快速採用是雲工作負載調度軟件增長的主要製約因素。 滿足嚴格合規性和法規的需求不斷增長,這可能對雲工作負載調度軟件的增長構成挑戰。

疫情期間,出於公共衛生考慮,世界許多國家都強制要求在家工作,這增加了對遠程工作基礎設施的需求。 因此,包括政府機構在內的各級運營組織都意識到對虛擬服務不斷增長的需求、公民對提供這些服務的期望不斷提高、重組政府勞動力的長期潛力以及適應和適應的能力。我們預計會產生一系列潛在影響,包括需要提供動態監管模型。 因此,需要雲工作負載調度軟件。 疫情過後,企業轉向雲服務,市場蓬勃發展。

雲工作負載調度軟件市場趨勢

轉向基於雲的服務的公司推動市場增長

企業正在轉向基於雲的服務以有效控製成本。 管理大量數據是這一轉變解決的另一個問題。 免費、開源和高度可定制的基於雲的服務的可用性不斷增加,推動了這一趨勢。

對於尋求經濟高效的工作負載管理選項的中小型企業來說,轉向雲工作負載調度軟件是一□□種快速增長的趨勢。

例如,2022 年 12 月,全球領先的自主數字企業軟件解決方案之一 BMC 宣布,其基於雲的 BMC Helix 解決方案將幫助 Buchanan Technologies 和 Mphasis 等公司的數字化轉型之旅。為尋求打破員工、工具和數據孤島的ServiceOps 功能的現代企業提供的選擇。

創業文化增加了對雲服務的需求,而雲服務的激增仍然是創業趨勢出現的重要因素。

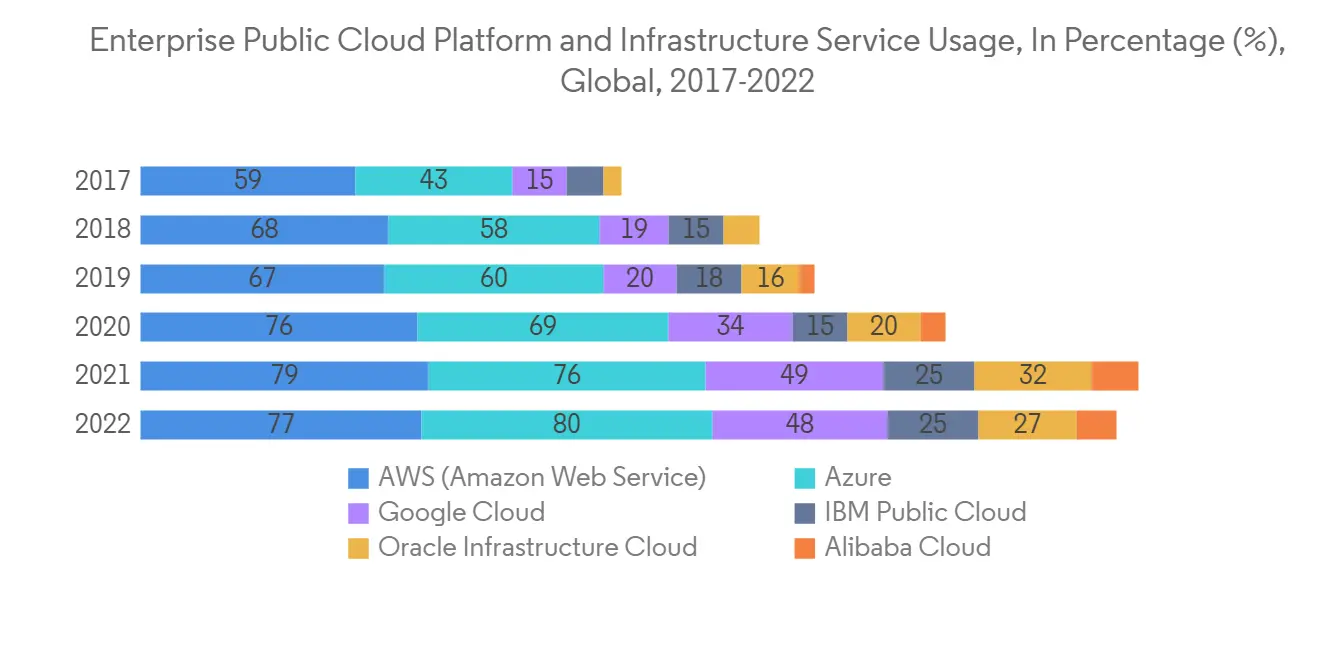

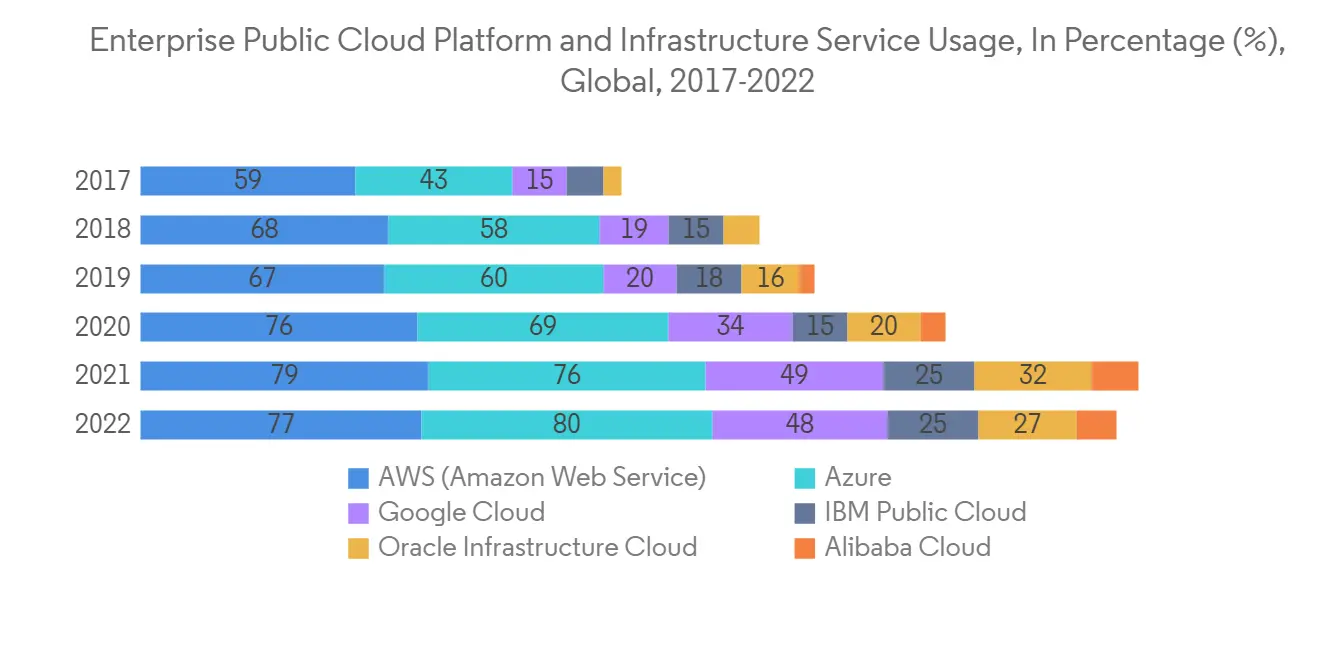

根據 Flexera Software 的調查,80% 的企業受訪者將 Microsoft Azure 用於公共雲目的。 亞馬遜、微軟 Azure 和谷歌雲被稱為超大規模提供商,是全球最大的雲計算平台提供商之一。 截至 2022 年 3 月,80% 的企業受訪者表示他們的組織已採用混合雲。 遷移到混合雲通常會以運營單一私有雲和公共雲為代價。

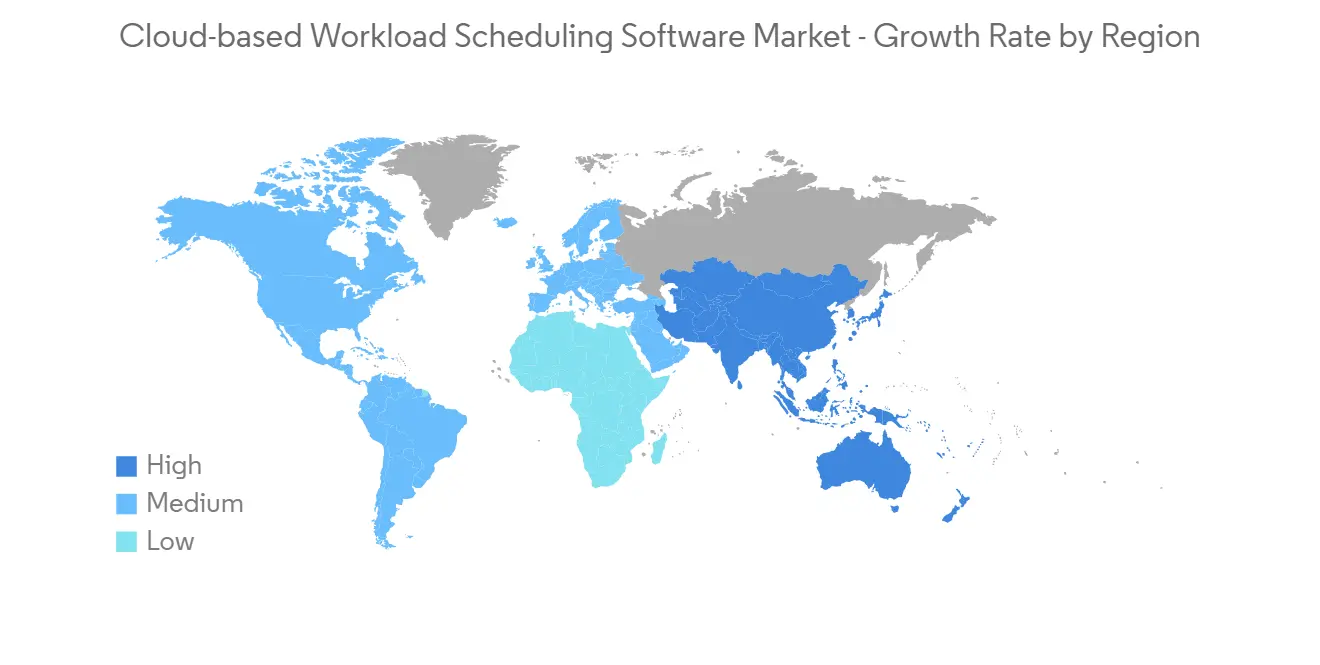

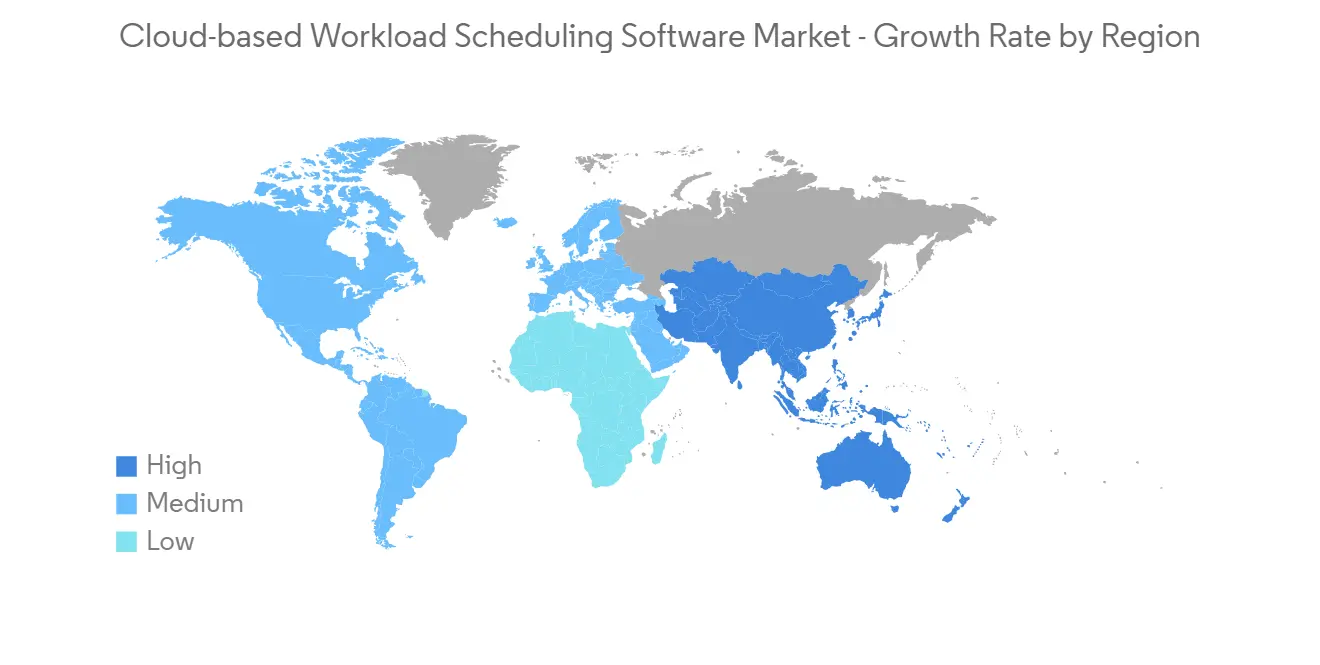

北美市場預計將創下最大市場規模

在北美地區,由於 IT 基礎設施的增加和新組織的出現,對雲工作負載調度軟件的需求不斷增加。

在北美,完全自動化、基於雲的組織的趨勢正在增加並推動市場發展。 北美是自帶設備 (BYOD) 文化的先驅,導致 BYOD 得到廣泛採用。 因此,組織正在轉向混合雲模型,通過私有雲保證敏感業務信息的安全,同時通過公共雲解決方案向員工提供更多應用程序。 這種趨勢有利於生產力,預計在預測期內將持續並擴大。

在北美,大型公司和 Workfront 等成長型初創公司正在興起雲工作負載調度軟件產品。 體式、敏銳度安排等

此外,該地區正在經歷混合雲和多雲環境中採用的新雲工具的爆炸式增長。 與此同時,現有的雲平台正在轉變以適應新的混合現實。 領先的公共雲提供商正在增強其管理、工作負載調度軟件、計算、網絡、安全和其他工具,以支持混合雲運營。 此外,在研究期間,對基於數據完整性和隱私的雲平台的需求不斷增加,進一步增加了工作負載調度軟件市場的採用,從而增加了主要供應商在市場中增長的機會。

雲工作負載調度軟件行業概述

雲工作負載調度軟件市場由 BMC Software (Boxer Parent Company, Inc)、CA, Inc (Broadcom Inc)、VMware, Inc、IBM Corporation、AdaptiveComputering Enterprises, Inc (ALA Services LLC) 等主要參與者主導存在並且高度分散。 市場參與者正在採取聯盟和收購等策略來增強其軟件產品並獲得可持續的競爭優勢。

2022 年 5 月,IBM 宣布與 Amazon Web Services, Inc. (AWS) 簽署戰略合作協議 (SCA),以在 AWS 上以軟件即服務 (SaaS) 的形式提供該公司廣泛的軟件產品組合。 IBM 和Amazon 之間的合作涵蓋自動化、數據、人工智能、安全和可持續發展能力,並基於AWS 上的紅帽OpenShift 服務(ROSA),提供對在AWS 上雲原生運行的IBM 軟件的快速、簡單的訪問。現在是可能的。 IBM Consulting 和 IBM Security Services 可以幫助公司使用 IBM Software 在 AWS 上開發和部署現代、安全和智能的流程。

2022 年 3 月,全球自主數字企業軟件解決方案先驅之一 BMC 宣布推出運行在 Oracle 雲基礎設施 (OCI) 上的 Oracle Exadata Cloud,為 BMC Helix 平台提供支持。我選擇了服務。 通過在 OCI 上領先的 Oracle Exadata 雲服務上部署企業級 BMC Helix ITSM 產品組合,企業客戶可以獲益匪淺。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 三個月的分析師支持

目錄

第一章簡介

- 研究假設和市場定義

- 調查範圍

第二章研究方法

第 3 章執行摘要

第 4 章市場洞察

- 市場概覽

- 工業價值鏈分析

- 行業吸引力 - 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 新冠肺炎 (COVID-19) 對市場的影響

第五章市場動態

- 市場驅動因素

- 企業轉向基於雲的服務

- 雲工作負載調度軟件中分析工具的可用性

- 市場製約因素

- 開源免費軟件阻礙市場增長

第六章市場細分

- 通過雲

- 公開

- 私人

- 混合動力

- 按最終用戶

- 公司

- 政府機構

- 其他最終用戶

- 按地區

- 北美

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章競爭格局

- 公司簡介

- BMC Software(Boxer Parent Company, Inc.)

- CA, Inc.(Broadcom Inc.)

- VMware, Inc.

- IBM Corporation

- Adaptive Computing Enterprises, Inc.(ALA Services LLC)

- ASG Technologies Group, Inc.

- Cisco Systems Inc.

- Hitachi, Ltd.

- ManageIQ, Inc.(Red Hat, Inc.)

第8章 市場機會與將來動向

第9章 投資分析

The Cloud-based Workload Scheduling Software Market size is expected to grow from USD 1.53 billion in 2023 to USD 2.43 billion by 2028, at a CAGR of 9.67% during the forecast period (2023-2028).

As enterprises roll out new technologies, they need to consider and plan for impacts related to workload processing and the availability of critical applications across distributed and cloud environments; hence the need for better workload scheduling software is projected to increase in the future.

The cloud-based workload scheduling software available can integrate, monitor, and operate workloads, perform analysis, and give predictions for the future. This empowers organizations with abilities to tackle problems that can arise in the future and also manage assets.

Cloud-based workload scheduling software helps to improve workload scheduling without the need for human intervention. Sophisticated scheduling and analytical abilities help organizations increase employee efficiency. This is a significant drive for the cloud-based workload scheduling software.

Similarly, the rapid adoption and increasing preference for cloud-based services by various multinational businesses would provide enough new opportunities, driving the expansion of the cloud-based workload scheduling software market during the forecasted period.

However, the ease of availability, and the rapid growth of open-source software, are acting as major constraints for the growth of cloud-based workload scheduling software. The growing need to meet strict compliance and regulations has the potential to challenge the growth of cloud-based workload scheduling software.

During the pandemic, many countries across the globe mandated work from home based on public health safety concerns that drove the need for remote working infrastructure. Therefore, organizations operating at all levels, including government bodies, expected a wide range of potential impacts, such as increased demand for virtual services coupled with rising citizen expectations around the delivery of these services, the longer-term potential for reshaping the government workforce, and the need to provide adaptive and dynamic regulatory models. Thus, such impacts necessitated the cloud-based workload scheduling software for enhanced service experience. Post-pandemic, the market grew rapidly, with enterprises shifting towards cloud-based services.

Cloud Based Workload Scheduling Software Market Trends

Enterprises Shifting Towards Cloud-Based Services Drives the Market Growth

Enterprises are shifting towards cloud-based services effectively manage costs. Large data management is another problem eliminated due to this shift. Adding to this trend is the growing availability of free, open-source, and highly customizable cloud-based services.

The change to cloud-based workload scheduling software is a trend fast catching up the Small and Medium Enterprises that would like to take up cost-effective alternatives to manage their workloads.

For instance, in December 2022, BMC, one of the global leaders in software solutions for the Autonomous Digital Enterprise, confirmed that its cloud-based BMC Helix solution is offering a choice for modern enterprises exploring ServiceOps capabilities to break down staff, tool, and data siloes on their digital transformation journeys, such as Buchanan Technologies and Mphasis.

The startup culture has increased the demand for cloud-based services, and the proliferation of cloud-based services remains an essential factor for the emergence of the startup trend.

According to Flexera Software, 80 percent of enterprise respondents used Microsoft Azure for public cloud purposes. Amazon, Microsoft Azure, and Google Cloud, known as hyper scalers, are among the largest global cloud computing platform providers. As of March 2022, 80 percent of enterprise respondents stated they had implemented a hybrid cloud in their firm. The transition to hybrid cloud solutions is typically done at the expense of operating single private and public clouds.

North America is Expected to Register the Largest Market

Increasing IT infrastructure and the emergence of new organizations in the North American region have led to increasing demand for cloud-based workload scheduling software.

The growing trend of an entirely automated and cloud-based organization in the American region drives the market. North America pioneered the bring-your-own-device (BYOD) culture, resulting in widespread incorporation. This has led organizations to shift toward hybrid cloud models to ensure the safety of sensitive business information via private cloud while providing a greater reach of applications to employees through public cloud solutions, which is necessary for some applications requiring on-field access. This trend benefits productivity and is expected to continue and grow during the forecast period.

North America has witnessed an increase in cloud-based workload scheduling software products from the major players and growing new players like Workfront. Asana, Inc., Acuity Scheduling, and Inc., among others.

Further, the region is witnessing an explosion of new cloud tools adopted for hybrid and multi-cloud environments. At the same time, established cloud platforms are pivoting to fit into the new hybrid reality. The large public cloud providers are ramping up tools, including offerings in management, workload scheduling software, computing, networking, and security, to support hybrid cloud operations. In addition, the ongoing increase in demand for cloud platforms based on data integrity and privacy is further expected to increase the workload schedule software market adoption in the study period and enable leading vendors with more opportunities to grow in the market.

Cloud Based Workload Scheduling Software Industry Overview

The Cloud-based Workload Scheduling Software Market is highly fragmented, with the presence of major players like BMC Software (Boxer Parent Company, Inc.), CA, Inc. (Broadcom Inc.), VMware, Inc., IBM Corporation, and Adaptive Computing Enterprises, Inc.(ALA Services LLC). Players in the market are adopting strategies such as partnerships and acquisitions to enhance their software offerings and gain sustainable competitive advantage.

In May 2022, IBM announced a Strategic Collaboration Agreement (SCA) with Amazon Web Services, Inc. (AWS), with ambitions to provide a wide range of its software portfolio as Software-as-a-Service (SaaS) on AWS. The collaboration between IBM and Amazon would enable clients with rapid and simple access to IBM Software that covers automation, data and AI, security, and sustainability capabilities, is based on Red Hat OpenShift Service on AWS (ROSA), and runs cloud-native on AWS. IBM Consulting and IBM Security Services may assist companies in developing and deploying contemporary, secure, and intelligent processes on AWS using IBM Software.

In March 2022, BMC, one of the global pioneers in software solutions for the Autonomous Digital Enterprise, chose Oracle Exadata Cloud Service, which runs on Oracle Cloud Infrastructure (OCI), to power its BMC Helix platform. Enterprise clients will benefit significantly from deploying the enterprise-grade BMC Helix ITSM portfolio on the flagship Oracle Exadata Cloud Service on OCI.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Enterprises Shifting Towards Cloud-Based Services

- 5.1.2 Availability of Analytical tools in Cloud based Workload Scheduling Software

- 5.2 Market Restraints

- 5.2.1 Opensource-Free Software Hampering the Growth of Market

6 MARKET SEGMENTATION

- 6.1 By Cloud

- 6.1.1 Public

- 6.1.2 Private

- 6.1.3 Hybrid

- 6.2 By End User

- 6.2.1 Corporate

- 6.2.2 Government

- 6.2.3 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 BMC Software (Boxer Parent Company, Inc.)

- 7.1.2 CA, Inc. (Broadcom Inc.)

- 7.1.3 VMware, Inc.

- 7.1.4 IBM Corporation

- 7.1.5 Adaptive Computing Enterprises, Inc. (ALA Services LLC)

- 7.1.6 ASG Technologies Group, Inc.

- 7.1.7 Cisco Systems Inc.

- 7.1.8 Hitachi, Ltd.

- 7.1.9 ManageIQ, Inc. (Red Hat, Inc.)