|

市場調查報告書

商品編碼

1404325

Cloud VPN -市場佔有率分析、產業趨勢與統計、2024 年至 2029 年成長預測Cloud VPN - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

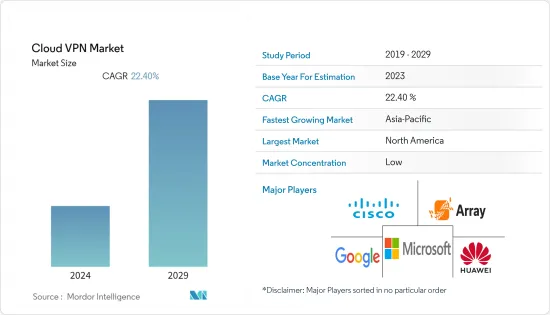

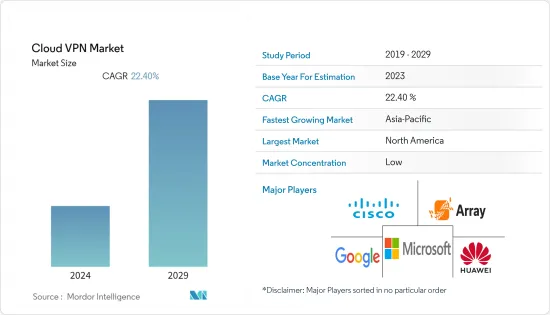

本會計年度雲端VPN市值將達76.7億美元。

預計五年內將達到 260.1 億美元,預測期內複合年成長率為 22.4%。雲端VPN或VPNaaS(虛擬私人網路即服務)是利用雲端基礎的網路基礎架構提供VPN服務的VPN。它提供VPN訪問,並允許用戶從公共網際網路上的雲端平台訪問它。

主要亮點

- BYOD 和企業移動性趨勢的上升、對資料的日益關注以及在家工作的採用正在推動對雲端 VPN 的需求。此外,大多數企業將敏感資料儲存在雲端中,這導致越來越多的企業轉向雲端,並且世界各地的企業擴大使用 VPN。

- 此外,隨著企業將雲端策略從本地工作負載轉移到資料中心,對雲端 VPN 的需求預計將會增加。對安全遠端存取的需求不斷成長以及私有雲端的日益採用也擴大了受訪市場中的供應商數量。

- 許多託管保全服務提供者 (MSSP) 和雲端提供者都提供 VPNaaS。管理您的 VPN 環境對於有效的安全至關重要。這些職責可以外包給託管託管 VPN 解決方案或保證 VPN 管理的提供者。

- 隨著企業擁抱數位化以及雲端基礎伺服器採用的增加,員工部署數位化的技術知識有限,這給雲端 VPN 市場帶來了進一步的挑戰。

- 由於全球工廠大範圍關閉導致供應鏈中斷,COVID-19 的傳播對市場產生了正面影響。出於公共衛生安全考慮,世界上許多國家都強制要求在家工作,這增加了對遠距工作基礎設施的需求。

雲端VPN市場趨勢

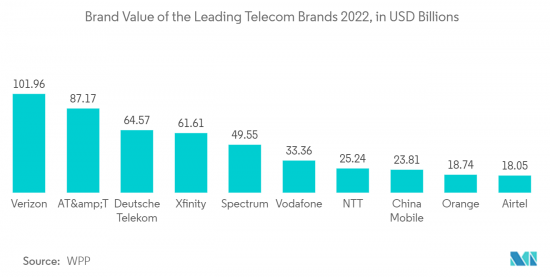

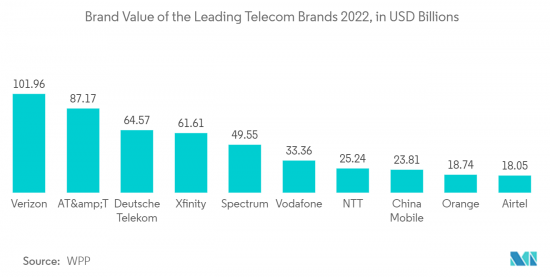

電信和IT領域顯著成長

- 由於通訊業對安全和快速 VPN 網路的新興需求,雲端 VPN 變得越來越普及,推動了該領域的收益發展。由於通訊業對 VPN 服務的需求不斷成長,許多公司正在推出新的解決方案以增加市場佔有率。

- 例如,2022年,華為與廣東移動聯合發布了行動VPN解決方案。此解決方案使企業用戶能夠隨時隨地安全地存取網際網路和校園內網。行動VPN讓行動辦公更加靈活,有助於創造更數位化、資訊的校園。這些優勢使行動 VPN 成為專用網路的完美選擇。

- 隨著PC、行動電話等功能強大的裝置數量的增加,也需要靈活的VPN技術。現代 VPN 技術的軟體定義 WAN (SD-WAN) 功能透過提供精細的彙報和複雜的網路資訊,正在推動雲端 VPN 產業的發展。

- 通訊業對加密網路流量、分散式全球IP 位址、可部署專用伺服器、網路活動管理功能、地理定位功能、品質保證等的需求變得越來越普遍。這些是雲端VPN 的其他優勢,進一步推動了市場的發展擴張。

- 雲端基礎的VPN 在過去五年中顯著成長,對業務、技術和 IT 產業產生了影響。因此,全球範圍內對雲端運算的投資正在增加。假設 VPN 連接另一端的使用者和裝置是安全的。

亞太地區佔最大

- 大多數區域 VPN 提供者都非常積極地擴大其 VPN 覆蓋範圍並在各種最終用戶中採用。隨著雲端服務提供增強的特性,雲端 VPN 市場存在巨大的成長機會。

- 該地區的 VPN 提供者提供各種功能,允許用戶存取其他方式無法獲得的資訊和內容。隨著雲端 VPN 服務的推出,這一點將會進一步增強。

- COVID-19 爆發後,日本政府採取了各種措施,包括封鎖和社交疏遠,以阻止病毒的傳播。因此,在家工作和遠距工作的引入取得了進展。因此,日本的各個組織出於商業目的迅速採用了 BYOD 政策。 BYOD 和在家工作政策促使企業採用雲端 VPN 解決方案。

- 然而,該地區的網路安全問題限制了雲端 VPN 在該國的採用。據縣警局稱,在 47 起因明顯安全漏洞而檢測到勒索軟體的案例中,70% 是由於使用 VPN 造成的。

雲端VPN產業概況

雲端 VPN 市場變得越來越分散,多家公司幾乎為每個最終用戶行業銷售服務和軟體。此外,由於雲端的使用和進入門檻較低,參與企業數量正在增加。公司正在採取收購策略來增加市場佔有率。

2023 年 3 月,Google Inc. 宣布向所有 Google One用戶推出虛擬私人網路 (VPN) 服務,以增強安全性和隱私服務。此外,Google 的 VPN 服務將向所有用戶提供,包括基本套餐,適用於所有平台,包括 Android、iOS、Windows 和 MacOS。

根據微軟的支援頁面,2022年8月,微軟將透過免費整合內建虛擬專用網路服務來升級其Edge瀏覽器的安全性和隱私。這項新功能將允許使用者使用虛擬IP 位址瀏覽網頁,從而隱藏自己的位置。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 對雲端服務的需求不斷成長

- BYOD 和企業移動性的成長趨勢

- 人們對資料安全的擔憂日益加深

- 市場抑制因素

- 實施成本高

第6章市場區隔

- 按公司規模

- 中小企業

- 主要企業

- 按類型

- 遠端存取VPN

- 站對站 VPN

- 按最終用戶產業

- 政府/公共工程

- 資訊科技/通訊

- BFSI

- 醫療保健

- 零售

- 製造業

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 北美洲

第7章競爭形勢

- 公司簡介

- Cisco Systems, Inc.

- Microsoft Corporation

- Huawei Technologies Co., Ltd.

- Google LLC

- Array Networks, Inc.

- Oracle Corporation

- Contemporary Control Systems, Inc.

- NCP engineering GmbH

- Cohesive Networks, LLC

- Robustel

- Singapore Telecommunications Limited

- Amazon Web Services

第8章投資分析

第9章 市場機會及未來趨勢

The Cloud VPN market is valued at USD 7.67 billion in the current year. It is expected to register a CAGR of 22.4% during the forecast period, reaching USD 26.01 billion in five years. Cloud VPN or Virtual Private Network as a Service (VPNaaS) is a VPN that utilizes a cloud-based network infrastructure to deliver VPN services. It offers VPN access, where the user can access through a cloud platform over the public Internet.

Key Highlights

- The increasing trend towards BYOD and enterprise mobility, growing data concerns, and the adoption of work-from-home drive the demand for cloud VPNs. Furthermore, the growth of cloud migrations increased VPN usage in various businesses worldwide, as most organizations store sensitive data in the cloud.

- Furthermore, as enterprises migrate away from on-premise workloads toward data centers via their cloud strategies, the need for cloud VPN is also expected to grow. The increasing demand for secure remote access and increased adoption of private clouds are also expanding the scope for vendors in the market studied.

- Many Managed Security Service Providers (MSSPs) and cloud providers offer VPNaaS. Effective security mandates the management of VPN environments. These mandates can be outsourced to providers that either host a managed VPN solution or ensure the management of the VPN.

- As enterprises are embracing digitalization and leading to the growing adoption of cloud-based servers, the limited technical knowledge among the employees to deploy digitalization further poses a challenge to the cloud VPN market.

- The spread of COVID-19 positively impacted the market due to disruptions in the supply chain owing to extended factory closures globally. Many countries across the globe mandated work-from-home situations on public health safety concerns that drove the need for remote working infrastructure.

Cloud VPN Market Trends

Telecom and IT Segment to Grow Significantly

- Cloud VPN is becoming increasingly popular due to new, increasing needs from the telecom industry for security and quick VPN networks, which is boosting this segment's revenue development. With the growing requirement for VPN services in the telecom sector, many companies are launching new solutions to increase their market share.

- For instance, in 2022, Huawei and China Mobile Guangdong jointly released a Mobile VPN Solution. This solution allows enterprise users to access the Internet and campus intranet anytime and anywhere securely. Mobile VPN makes the mobile office more flexible and helps build a more digital and information-based campus. These advantages make Mobile VPN an optimal choice for campus dedicated networks.

- Flexible VPN technology is also required due to the rise in powerful devices like PCs, phones, and others. Modern VPN technology's software-defined WAN (SD-WAN) capabilities, which provide granular reporting and sophisticated network information, are also propelling the cloud VPN industry.

- The need for encrypted network traffic, distributed global IP addresses, deployable private servers, the ability to manage network activity, the ability to conduct geo-targeting, and quality assurance are additional benefits of cloud VPNs that are becoming more widely known in the telecom industry and are further boosting the market's expansion.

- Cloud-based VPNs have grown significantly during the last five years, impacting the business, technology, and information technology sectors. Due to this, there has been an increase in global investment in cloud computing. It is assumed that the user and device on the other end of a VPN connection are safe.

Asia Pacific to Hold Largest Share

- Most regional VPN providers are highly active in expanding the VPN scope and adoption among various end users. Cloud services provide enhanced characteristics, so the cloud VPN market has a massive growth opportunity.

- VPN providers in the region offer various features enabling their subscribers to access information and content unavailable. And with the availability of cloud VPN services, this can be enhanced further.

- With the onset of COVID-19, there were various steps taken by the government of Japan to contain the spread of the virus, such as lockdowns, social distancing, and many more. These led to increased adoption of work-from-home and remote working. This created an upsurge in adopting BYOD policies in various organizations for business uses in the country. With BYOD and work-from-home policies, cloud VPN solutions have been adopted for businesses to function.

- However, cyber security concerns in the region are restricting the implementation of cloud VPNs in the country. According to the prefectural police departments, out of 47 ransomware cases detected that had an apparent reason for the security breach, 70% of them were caused by using a VPN.

Cloud VPN Industry Overview

The cloud VPN market is inclined towards fragmentation, with several firms selling services and software to practically every end-user industry. In addition, new firms are entering the industry due to cloud usage and low entry barriers. The companies are pursuing acquisition tactics to increase their market share in the cloud VPN industry.

In March 2023, Google Inc. announced the launch of a virtual private network (VPN) service to all Google One subscribers to strengthen its security and privacy offering. Additionally, Google's VPN service will be available to all subscribers, including those on basic plans, across all platforms, such as Android, iOS, Windows, and MacOS.

In August 2022, Microsoft is upgrading the security and privacy of its Edge browser by integrating a free built-in virtual private network service, according to a Microsoft support page. By allowing users to browse the web using a virtual IP address, the new function also will enable them to conceal their location.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Cloud Services

- 5.1.2 Increasing Trend Towards BYOD and Enterprise Mobility

- 5.1.3 Increasing Data Security Concerns

- 5.2 Market Restraints

- 5.2.1 High Implementation Cost

6 MARKET SEGMENTATION

- 6.1 By Enterprise Size

- 6.1.1 Small and Medium Enterprise

- 6.1.2 Large Enterprise

- 6.2 By Type

- 6.2.1 Remote Access VPN

- 6.2.2 Site-to-site VPN

- 6.3 By End-user Industries

- 6.3.1 Government and Public Utilities

- 6.3.2 IT and Telecommunication

- 6.3.3 BFSI

- 6.3.4 Healthcare

- 6.3.5 Retail

- 6.3.6 Manufacturing

- 6.3.7 Other End-users Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 South Korea

- 6.4.3.4 India

- 6.4.3.5 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Argentina

- 6.4.4.4 Rest of Latin America

- 6.4.5 Middle East & Africa

- 6.4.5.1 UAE

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.5.4 Rest of Middle East & Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems, Inc.

- 7.1.2 Microsoft Corporation

- 7.1.3 Huawei Technologies Co., Ltd.

- 7.1.4 Google LLC

- 7.1.5 Array Networks, Inc.

- 7.1.6 Oracle Corporation

- 7.1.7 Contemporary Control Systems, Inc.

- 7.1.8 NCP engineering GmbH

- 7.1.9 Cohesive Networks, LLC

- 7.1.10 Robustel

- 7.1.11 Singapore Telecommunications Limited

- 7.1.12 Amazon Web Services