|

市場調查報告書

商品編碼

1433019

類比混合訊號 IP:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029 年)Analog and Mixed Signal IP - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

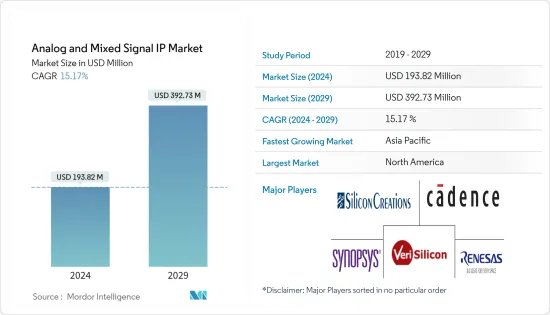

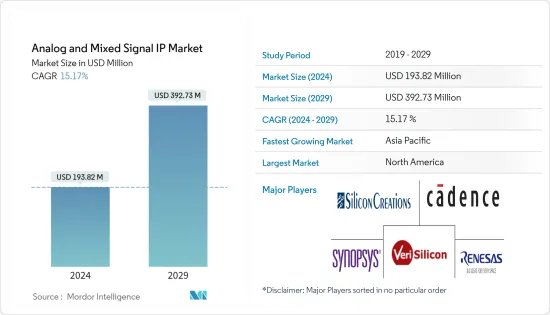

預計2024年類比混合訊號IP市場規模為1.9382億美元,預估至2029年將達3.9273億美元,複合年成長率預估為15.17%。

2020年初半導體市場的低迷很大程度上是由於COVID-19大流行對整個產業的影響。由於 COVID-19 在全球蔓延而實施的封鎖不僅影響了設備製造,也減少了消費者需求。

根據消費者科技協會統計,2020年美國消費性電子產業成長率下降2.2%,這是美國消費性電子產業幾年來首次出現成長下滑。

主要亮點

- 在過去的十年中,積體電路變得越來越複雜和昂貴。業界已開始採用新的設計和重用技術,統稱為晶片系統(SoC)、系統級封裝 (SiP) 和板載系統 (SoB) 設計。隨著這種向小型化的轉變,採用此類解決方案的公司已經開始面臨這種模式轉移帶來的重複使用和整合挑戰。為了解決此類問題,IP封鎖已成為業界最有希望為最終用戶提供的解決方案。

- 隨著這種向小型化的轉變,採用此類解決方案的公司已經開始面臨這種模式轉移帶來的重複使用和整合挑戰。為了解決此類問題,IP封鎖已成為業界最有希望為最終用戶提供的解決方案。

- 可重複使用元件也稱為智慧財產權 (IP) 區塊或 IP 核,通常是稱為軟核心的可合成暫存器傳輸級 (RTL) 設計,或稱為硬核心的佈局級設計。重複使用的概念運行在模組、平台和晶片級別,涉及使 IP 足夠通用、可配置或可編程,以便在廣泛的應用中使用。

模擬混合訊號IP市場的趨勢

通訊預計將佔據較大佔有率

- 通訊基礎設施是推動市場的關鍵因素之一,主要得益於4G網路和部分5G網路的出現。無線基礎設施(特別是 4G 和 5G 網路)製造商不斷減小新無線基礎設施安裝的尺寸和成本,同時維持高標準的效能、功能和服務品質。

- 5G 基礎設施預計將徹底改變各種寬頻服務領域,並增強多個最終用戶的垂直連線。據GSMA稱,新的5G網路部署路線已實現約45%的城市覆蓋率。中國和印度等國家也計劃在2020年之前引入5G網路,而開發5G網路將需要對5G相容基礎設施進行大量資本投資。

- 英特爾等重要廠商於 2019 年 1 月宣布推出專用下一代行動基地台設計的新晶片系統(SoC)。同樣,覆銅板 (CCL) 專業公司 Iteq 預計將獲得來自中國的 5G 基礎設施訂單。中國政府正大力投資5G服務的開發與部署,華為等本土企業也積極參與。

- Zinwell是有線和無線廣播及寬頻通訊設備的領先製造商,推出了jjPlus最新的65W磁共振無線電源模組,整合了MaxLinear的AirPHY多Gigabit調變解調器技術和類比混合訊號IP,厚度高達20厘米到第三代ZRA-003 設備,可以透過玻璃窗和結構牆傳輸電力和Gigabit資料。該解決方案將推動對類比混合訊號 IP 整合的需求,因為它支援Gigabit速度的 4G/LTE 或 5G 毫米波無線寬頻服務。

預計北美將佔據最大的市場佔有率

- 對類比/數位混合訊號 IP 的需求是由於擴大使用這些產品作為建構模組而推動的。美國通訊業正在積極投資5G基礎設施。該國的終端用戶產業佔全球5G技術消費的大部分。在北美地區,美國在地區5G投資、部署和應用方面佔據主導地位。

- 由於成長放緩,5G 的超高速無線網路特性預計將為電訊業帶來急需的推動力。美國美國電訊協會估計,到 2025 年,美國通訊業者將花費約 1,040 億美元。預計通訊服務供應商必須將其現有的 4G 網路升級到即將推出的 5G 標準,從而全臉部署 5G 無線服務。

- 2019 年 10 月,Analogue 宣布推出 Analog Game Boy Pocket,這是復古遊戲裝置的現代版本。該公司推出的關鍵組件是第二個 FPGA(除了用於影像處理的FPGA 之外,該 FPGA 可以在比原始 Game Boy 更高解析度 10 倍的顯示器上顯示高解析度影像)。第二個 FPGA 將允許復古遊戲社群建立和移植核心,以便在他們的口袋裡運行其他遊戲,類似於 MiSTER FPGA 裝置的工作方式。

- 預計加拿大將為軍事計劃(包括服飾)提供足夠的支出和資金。加拿大政府正在重點關注「綜合士兵系統」計劃,該項目將把士兵套裝與電子設備、武器結合起來,並在士兵穿越戰場時提供士兵之間的通訊。預計這將對該地區的市場成長產生積極影響。

類比和混合訊號 IP 產業概述

隨著全球廠商致力於消費性電子、汽車等各種應用中的訊號整合,類比混合訊號IP高度分散,從而在競爭對手之間造成激烈的競爭。主要參與者包括 Cadence Design Systems Inc.、台積電、Global Foundries Inc. 和三星電子。

- 2020 年 5 月 - Synopsys, Inc. 宣布推出基於台積電 5nm 製程技術的最廣泛的高品質 IP 產品組合,用於高效能運算晶片系統(SoC)。基於台積電製程的 DesignWare IP 產品組合包括適用於最廣泛使用的高速通訊協定的介面和基礎 IP,加速了高階雲端運算、AI 加速器、網路和儲存應用的 SoC 的開發。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 市場促進因素

- 提高 AMS 區塊的再生性

- 無線通訊的普及

- 市場限制因素

- 類比混合訊號 (AMS) 設計複雜性和靈敏度

- 評估 COVID-19 對產業的影響

第5章市場區隔

- 設計

- 硬/軟IP

- 硬IP

- 產品

- A2D 和 D2A 轉換器

- 電源管理模組

- RF

- 其他產品

- 最終用戶產業

- 消費性電子產品

- 通訊業

- 車

- 工業

- 其他最終用戶產業

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章 競爭形勢

- 公司簡介

- Cadence Design Systems Inc.

- Silicon Creations LLC

- VeriSilicon Holdings Co. Ltd

- Renesas Electronics Corporation

- Synopsys Inc.

- ARM Holdings PLC

- Xilinx Inc.

- Intel Corporation

- Analog Devices Inc.

- Maxim Integrated Products Inc.

- Texas Instruments Limited

第7章 投資分析

第8章市場的未來

The Analog and Mixed Signal IP Market size is estimated at USD 193.82 million in 2024, and is expected to reach USD 392.73 million by 2029, growing at a CAGR of 15.17% during the forecast period (2024-2029).

The semiconductor market's downturn at the start of 2020 is significantly owing to the COVID-19 pandemic's impact on the entire industry. The lockdowns that have been enforced by the spread of COVID-19 across the world have not only affected the manufacturing of devices but also reduced consumer's demand.

According to the Consumer Technology Association, the growth rate of the consumer electronics industry in the United States fell by 2.2% in 2020, which was the first decrease in the growth rate in the consumer electronics landscape of the United States after several years.

Key Highlights

- Over the past decade, the integrated circuits have become increasingly complex and expensive. The industry started to embrace new design and reuse methodologies that are collectively referred to as system-on-chip (SoC), System-in-Package (SiP), and System-on-Board (SoB) design. With this shift toward miniaturization, the companies incorporating such solutions started facing the challenges for the re-usage and integration issues encountered in this paradigm shift. To solve such problems, IP blocks emerged as the most prominent solution for the industry end-users.

- Over the past decade, integrated circuits have become increasingly complex and expensive. The industry started to embrace new design and reuse methodologies that are collectively referred to as system-on-chip (SoC), System-in-Package (SiP), and System-on-Board (SoB) design.

- With this shift toward miniaturization, the companies incorporating such solutions started facing the challenges for the reusage and integration issues encountered in this paradigm shift. To solve such issues, IP blocks emerged as the most prominent solution for the industry end-users.

- The reusable components, also called intellectual property (IP) blocks or IP cores are typically synthesizable register-transfer level (RTL) designs referred to as soft cores or layout level designs, referred to as hard cores. The concept of reusage can be carried out at the block, platform, or chip levels and involves making the IP sufficiently general, configurable, or programmable for use in a wide range of applications.

Analog & Mixed Signal IP Market Trends

Telecommunication is Expected Hold a Significant Share

- Telecommunication infrastructure is one of the key factors driving the market, primarily owing to the advent of the 4G network and some parts of the 5G network. Manufacturers of wireless infrastructure, especially 4G and 5G networks, are continuously reducing the size and cost of their newly installed wireless infrastructure while holding towards the high standards of performance, functionality, and quality of service.

- 5G Infrastructure is expected to revolutionize the domain of various broadband services and is expected to empower connectivity across multiple end-user verticals. According to GSMA, around 45% urban coverage level has been achieved for 5G networks in the new deployment trails. Countries like China and India are also planning to implement the 5G network by 2020, and the development of 5G networks requires large amounts of capital investment in 5G capable infrastructure.

- Significant players like Intel have announced a new system on chip (SoC) designed specifically for next-generation mobile base stations in Jan 2019. Similarly, Copper-clad laminate (CCL) specialist Iteq expects orders for 5G infrastructure to pull in from China. The country is investing significantly in the development and deployment of 5G services with the government and local players like Huawei actively taking part

- Zinwell, a leading manufacturer of wired and wireless broadcast and broadband communication equipment has integrated MaxLinear's AirPHY multi-gigabit modem technology with jjPlus's latest 65W magnetic resonant wireless power module integrated with analog mixed-signal IP into its 3rd generation ZRA-003 device, which can transfer power and gigabit data through glass windows or structural walls up to 20cm thick. The solution will enhance the demand of the analog mixed-signal IP integration as the solution will enable 4G/LTE or 5G millimeter wave wireless broadband service with gigabit speeds.

North America is Expected to Hold the Largest Market Share

- The demand for the analog and digital mixed-signal IP is driven by the growing utilization of these products as building blocks. The telecommunication sector in the US has been actively investing in 5G infrastructure. The end-user industry in the country accounts for the significant portion of the global consumption of 5G technology. In the North American region, the US dominates the regional 5G market, regarding investment, adoption, and applications.

- The nature of the 5G superfast wireless networks is expected to provide the needed primary impetus to the telecom industry, which has been experiencing slow growth. The US Telecom Association has estimated that the US telecom operators are expected to spend around USD 104 billion by 2025. It is expected to be essential for the telecom service providers to upgrade existing 4G networks to the upcoming 5G standards and, consequently, execute the full installation of 5G wireless services.

- In October 2019, Analogue announced the launch of its Analogue Game Boy Pocket, which is a modern version of the retro-gaming device. The critical component the company has introduced is the second FPGA (apart from one for image processing to deliver high-resolution image on its 10X high-resolution display compared to the original Game Boy). This second FPGA enables the retro-gaming community to build and port their cores to run other games on the Pocket, similar to how the MiSTER FPGA device works.

- Canada is expected to provide sufficient expenditure and funding for its military programs (including clothing). The Canadian government has been focusing on the Integrated Soldier System Project, which is assimilating the soldier suit with electronic devices, weapons, and feed communication among soldiers as they move through the battlefield. This is expected to impact the market's growth positively in the region.

Analog & Mixed Signal IP Industry Overview

The analog and mixed signal IP is quite fragmented as the global players are engaged in integrating the signal in various applications like consumer electronics, automotive, etc., which gives an intense rivalry among the competitors. Key players are Cadence Design Systems Inc., Taiwan Semiconductor Manufacturing Company Limited, Global foundries Inc., and Samsung Electronics Co. Ltd.

- May 2020 - Synopsys, Inc. announced the broadest portfolio of high-quality IP on TSMC's 5nm process technology for high-performance computing system-on-chips (SoCs). The DesignWare IP portfolio on the TSMC process, encompassing interface IP for the most widely used high-speed protocols and foundation IP, accelerates the development of SoCs for high-end cloud computing, AI accelerators, networking, and storage applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Increasing Reusability of AMS Block

- 4.4.2 Growing Prevalence of Wireless Communications

- 4.5 Market Restraints

- 4.5.1 Complexity and Sensitivity of Analog/Mixed-Signal (AMS) design

- 4.6 An Assessment of the Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 Design

- 5.1.1 Firm/Soft IP

- 5.1.2 Hard IP

- 5.2 Product

- 5.2.1 A2D and D2A Converter

- 5.2.2 Power Management Modules

- 5.2.3 RF

- 5.2.4 Other Products

- 5.3 End-user Industry

- 5.3.1 Consumer Electronics

- 5.3.2 Telecommunication

- 5.3.3 Automotive

- 5.3.4 Industrial

- 5.3.5 Other End-user Industries

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles*

- 6.1.1 Cadence Design Systems Inc.

- 6.1.2 Silicon Creations LLC

- 6.1.3 VeriSilicon Holdings Co. Ltd

- 6.1.4 Renesas Electronics Corporation

- 6.1.5 Synopsys Inc.

- 6.1.6 ARM Holdings PLC

- 6.1.7 Xilinx Inc.

- 6.1.8 Intel Corporation

- 6.1.9 Analog Devices Inc.

- 6.1.10 Maxim Integrated Products Inc.

- 6.1.11 Texas Instruments Limited