|

市場調查報告書

商品編碼

1403809

汽車活塞引擎系統 - 2024年至2029年市場佔有率分析、產業趨勢與統計、成長預測Automotive Piston Engine System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

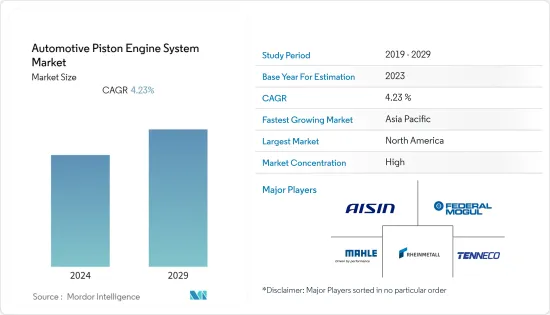

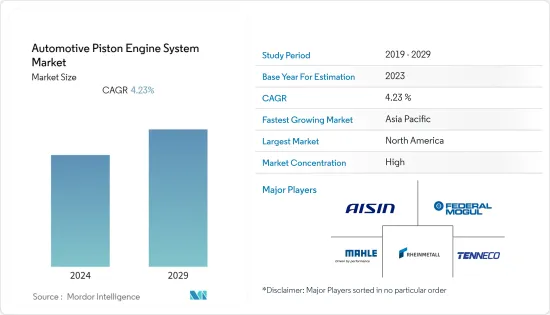

汽車活塞引擎系統市場目前價值42.6億美元。

預計未來五年將達52.4億美元,複合年成長率為4.23%。

主要汽車製造商和目標商標產品製造商 (OEM) 的引擎創新和原型設計,加上消費者對高性能和節能車輛的偏好,是推動市場成長的一些關鍵因素。小型引擎的趨勢正在興起,汽車製造商正在開發具有更好燃油噴射系統的小型引擎。此外,汽車產業將輕量化零件融入車型的快速轉型正在推動汽車活塞引擎系統市場的成長。這是由於技術進步和多個零件製造商致力於開發有助於提高車輛效率的先進活塞。

隨著越來越多的政府專注於推廣普及電動車作為減少二氧化碳排放的措施,燃油動力車的銷售趨勢正在受到顯著影響。電動車中是否包含活塞是可選的,這給汽車活塞引擎系統市場帶來了重大挑戰。同時,由於汽車持有的增加,活塞系統的生產在售後市場管道中越來越受歡迎。購買二手車的消費者總是需要對汽車的零件進行升級。這些對汽車活塞引擎系統市場的需求產生正面影響。

中國、印度和日本正在成為世界汽車製造商的成長中心,而亞太地區液化石油氣 (LPG)、壓縮天然氣 (CNG) 和柴油引擎等替代燃料汽車的產量正在增加。因此,預計將繼續作為汽車活塞系統的主要市場。此外,新興市場預計將看到各種輕質活塞零件市場的進一步開拓,以提高車輛效率和燃油效率。

汽車活塞引擎系統市場趨勢

小客車領域預計將主導市場

越來越多的消費者更喜歡液化石油氣壓縮天然氣汽車等替代燃料汽車,這預示著活塞引擎系統市場的成長。各汽車製造商不斷花費大量資金開發新時代汽車,汽車上使用的輕量化活塞零件有需求。同時,一些地區對二手車的需求正在增加,並且由於消費者偏好使用私人交通途徑而導致汽車持有的增加對汽車活塞引擎系統市場的需求產生了積極影響。隨著車輛老化並持續需要升級,燃油汽車售後市場中活塞系統的改造預計將推動該細分市場的市場發展。

另一方面,電動車銷量的增加正在阻礙汽車活塞系統市場的成長。銷售量的快速成長是各個組織和政府加強監管標準以控制廢氣水平和普及零排放汽車的結果。因此,汽車製造商持續致力於增加電動車研發支出。

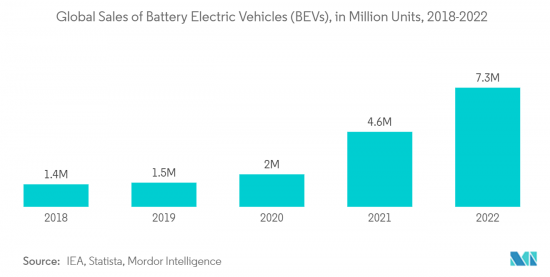

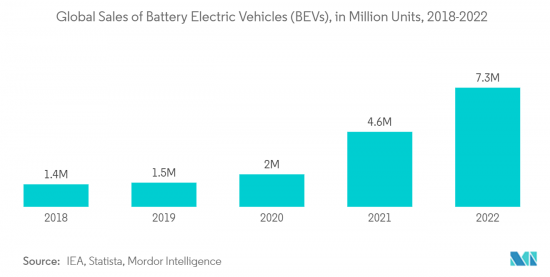

自2018年以來,全球電動車市場(包括純電動車、燃料電池電動車和插電式混合)的註冊車銷量每年都大幅成長。幾乎所有細分市場都出現了這一成長,包括小客車和商用車。例如

- 2022年全球純電動車(BEV)銷量達730萬輛,而2021年為460萬輛,2021年至2022與前一年同期比較增58.7%。

在預測期內,汽車產業的電動車可能會成為市場的主要抑制因素,因為人們對電動車的偏好不斷增加,政府提供補貼,以及對自動化和排放的需求不斷成長。

亞太地區將在預測期內主導市場

預計在預測期內,亞太地區將成為汽車活塞引擎系統市場的領先地區。這主要是由於嚴重依賴內燃機,特別是在商用車領域。例如

- 2022年印度商用車與前一年同期比較為93.3萬輛,而2021年為67.7萬輛,2021年至2022年年增37.8%。

- 同樣, 與前一年同期比較22.7萬輛。

在亞太地區,電動商用車近年來已成為驅動力,但內燃機商用車市場在2022年仍將保持強勁。然而,由於內燃機商用車在亞太市場的普及不斷提高,汽車活塞引擎系統市場的成長在未來幾年可能會放緩。

都市化的提高、汽車持有的增加以及消費者人均可支配收入的增加正在推動亞太汽車市場的發展。隨著越來越多的消費者遷移到都市區尋找更好的工作和經濟機會,對使用私人交通的偏好不斷增加,對該地區的小客車市場產生了積極影響。這對該地區的小客車市場產生正面影響,也對該地區的定位引擎系統市場產生正面影響。

儘管電動車的普及不斷加速,活塞製造商在售後市場上仍然有巨大的機會來迎合燃油動力二手車的消費者。在亞太地區,儘管人們越來越傾向於電動車,但由於傳統電動車市場龐大,預計汽車活塞引擎系統在預測期內的成長潛力將很高。

汽車活塞引擎系統產業概況

汽車活塞引擎系統市場整合且競爭激烈,只有少數公司佔據市場主導地位。市場上營運的一些主要企業包括愛信精機、輝門控股有限責任公司、馬勒有限公司、天納克公司、萊茵金屬汽車股份公司、日立汽車系統和理研公司。這些參與企業正在積極努力與汽車製造商建立長期合作夥伴關係,透過為汽油和柴油車提供各種活塞零件來加強其品牌組合。

- 2023年1月,萊茵金屬正式將大直徑活塞的生產轉移至瑞典哥德堡的Koncentra Verkstads AB (KVAB)。 2022年10月,萊茵金屬宣布了此次出售。這反映了杜塞爾多夫技術集團的策略轉變,專注於小缸徑活塞的開發。

- 2022年8月,日本活塞環與理研株式會社宣布簽署合作備忘錄(MoU)協議,透過相互股權轉讓方式成立聯合控股公司。兩家公司將在同等條件下整合。根據協議,新合資企業的商號將為 NPR-Riken Corporation。該公司旨在加速汽車行業先進定位解決方案的開發。

預計市場將在未來幾年內推出各種先進的輕型活塞部件,這些參與企業希望透過多樣化的產品系列來競爭。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 對輕質活塞的需求不斷增加

- 市場抑制因素

- 電動車普及阻礙市場成長

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔(市場規模-美元)

- 依原料類型

- 鑄鐵

- 鋁合金

- 其他原料(例如鋼材)

- 按車型

- 小客車

- 商用車

- 按燃料

- 汽油

- 柴油引擎

- 按成分

- 活塞

- 活塞環

- 活塞銷

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 歐洲其他地區

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區 中東/非洲

- 南美洲

- 中東/非洲

- 北美洲

第6章競爭形勢

- 供應商市場佔有率

- 公司簡介

- Aisin Seiki

- Capricorn Automotive

- Federal Mogul Holding LLC

- Mahle GmbH

- Rheinmetall

- Hitachi Automotive Systems

- Shriram Pistons & Rings Ltd

- Magna International

- Tenneco Inc

- Riken Corporation

- PT Astra Otoparts Tbk

第7章 市場機會及未來趨勢

- 由於二手汽油/柴油車的成長,售後市場的機會不斷擴大

The automotive piston engine system market is valued at USD 4.26 billion in the current year. It is anticipated to reach a net valuation of USD 5.24 billion within the next five years, registering a CAGR of 4.23% over the forecast period.

Innovations and prototypes of engines from major automakers and original equipment manufacturers (OEMs), coupled with consumer preferences for high-performance and fuel-efficient automobiles, are some of the major factors propelling the market growth. Engine downsizing trends are on the rise, with automakers developing smaller engines with better fuel injection systems. Further, the rapid transformation of the automotive industry in integrating lightweight components in their vehicle models is propelling the growth of the automotive piston engine system market. It is owing to the enhancement in technology and commitment by several parts and component manufacturers to develop advanced pistons, which assist in improving vehicle efficiency.

With the increasing focus of the government to promote the usage of electric vehicles to combat carbon emissions, the sales trends of fuel-operated vehicles are significantly being affected. It poses a major challenge for the automotive piston engine system market, as the integration of pistons in electric vehicles is optional. On the other hand, the production of piston systems is gaining traction in the aftermarket channels, owing to the growth in vehicle parc. Consumers availing of used cars are constantly in need of upgrading their vehicle's parts and components. These positively impact the demand for the automotive piston engine systems market.

With China, India, and Japan growing as global automotive manufacturer hubs, the Asia-Pacific region is expected to continue as a major market for automotive piston systems due to the increase in manufacturing of alternative fuel vehicles such as liquefied petroleum gas (LPG), compressed natural gas (CNG), and diesel engines. Further, the market is anticipated to witness the development of various lightweight piston components to improve the efficiency of vehicles and better fuel consumption capability.

Automotive Piston Engine System Market Trends

Passenger Car Segment is Anticipated to Dominate the Market

Increasing preference of consumers to avail alternative fuel vehicles, such as LPG CNG operated cars, is anticipated the growth of the piston engine system market. Various auto manufacturers are constantly spending hefty sums in developing new-age vehicles, which require lightweight piston components to be utilized in the vehicles. Coupled with that, the growing demand for used cars in several regions and increasing vehicle parc, owing to consumers' preference towards availing private transportation medium, is positively impacting the demand for automotive piston engine system market. The increasing age of vehicles requires constant upgradation, and therefore, changing piston systems in the aftermarket for fuel-operated vehicles is expected to drive this segment of the market.

On the other hand, the rise in sales of electric vehicles is hindering the growth of the automotive piston system market. The spike in sales is the result of an increase in regulatory norms by various organizations and governments to control emission levels and to propagate zero-emission vehicles. As a result, automakers are continually working and focusing on increasing their expenditure on the R&D of electric vehicles, which may aid OEMs in marketing electric vehicles in the future.

The global electric vehicles (including battery electric vehicles, fuel cell electric vehicles, and plug-in hybrid vehicles) market observed a tremendous increase in the number of sales registered every year since 2018. This increase was registered in almost all segments of vehicles, which include passenger vehicles and commercial vehicles. For instance-

- In 2022, global sales of battery electric vehicles (BEVs) touched 7.3 million units, compared to 4.6 million units in 2021, representing a 58.7% Y-o-Y growth between 2021 and 2022.

With the increased inclination toward electric vehicles, governments of different countries offering subsidies, and the growing need for automation and reduced emissions, the electrification of the automotive industry will serve as a major restraint for the market during the forecast period.

Asia-Pacific to Dominate the Market during the forecast period

Asia-Pacific region is projected to be the leading region for the automotive piston engine system market during the forecast period. It is mainly due to the heavy reliance on internal combustion engines, especially in the commercial vehicles sector. For instance,

- In 2022, India witnessed sales of 933 thousand units of commercial vehicles, compared to 677 thousand units in 2021, recording a Y-o-Y growth of 37.8% between 2021 and 2022.

- Similarly, new sales of commercial vehicles in Indonesia touched 264 thousand units in 2022, compared to 227 thousand units in 2021, representing a 16.3% Y-o-Y between 2021 and 2022.

Although electric commercial vehicles in the Asia-Pacific region gained traction in recent years, the market of ICE commercial vehicles remained strong as of 2022. However, with the increasing penetration of ICE commercial vehicles in the Asia-Pacific market, the automotive piston engine system market might witness falling growth in the coming years.

The increasing urbanization rate, growing vehicle parc, and the rising per capita disposable income of consumers are driving the automotive market in the Asia-Pacific region. As more consumers migrate to urban for better employment and financial opportunities, the preference towards availing private transportation medium shoots up, which positively impacts the passenger car market in the region. It, in turn, positively impacts the position engine system market in this region.

Despite the ramping penetration of electric vehicles at a faster rate, there remains a massive potential in the aftermarket for piston manufacturers to cater to consumers who avail of fuel-operated used cars. With the immense market for conventional IC engines in the regions, despite the growing inclination toward electric vehicles, the growth potential for automotive piston engine systems is expected to be high in Asia-Pacific during the forecast period.

Automotive Piston Engine System Industry Overview

The automobile piston engine system market is consolidated and highly competitive, with only a few companies dominating the market. Some of the major companies operating in the market are Aisin Seiki, Federal-Mogul Holding LLC, Mahle GmbH, Tenneco Inc, Rheinmetall Automotive AG, Hitachi Automotive Systems, and Riken Corporation, among others. These players actively engage in forming long-term partnerships with auto manufacturers to enhance their brand portfolio by offering various piston components for gasoline or diesel vehicles.

- In January 2023, Rheinmetall officially transferred its large-bore pistons production to Koncentra Verkstads AB (KVAB) of Gothenburg, Sweden. In October 2022, Rheinmetall announced the sale, which reflected the Dusseldorf tech group's strategic reorientation towards an improved focus on developing small-bore pistons.

- In August 2022, Nippon Piston Ring and Riken Corporation announced a Memorandum of Understanding (MoU) agreement to establish a joint holding company formed by mutual stock transfer. It is to consolidate the two companies on equal terms. As per the agreement, the trading name of the new joint company will be NPR-Riken Corporation. The company aims to facilitate the development of advanced position solutions for the automotive industry.

The market is anticipated to witness the launch of various advanced lightweight piston components in the coming years as these players try to gain a competitive edge with the diversification of their product portfolio.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Demand for Lightweight Pistons

- 4.2 Market Restraints

- 4.2.1 Increasing Adoption of Electric Vehicles Deters the Growth of the Market

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Raw Material Type

- 5.1.1 Cast Iron

- 5.1.2 Aluminum Alloy

- 5.1.3 Other Raw Materials (Steel, etc.)

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commerical Vehicles

- 5.3 By Fuel Type

- 5.3.1 Gasoline

- 5.3.2 Diesel

- 5.4 By Component Type

- 5.4.1 Piston

- 5.4.2 Piston Ring

- 5.4.3 Piston Pin

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 South America

- 5.5.4.2 Middle-East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Aisin Seiki

- 6.2.2 Capricorn Automotive

- 6.2.3 Federal Mogul Holding LLC

- 6.2.4 Mahle GmbH

- 6.2.5 Rheinmetall

- 6.2.6 Hitachi Automotive Systems

- 6.2.7 Shriram Pistons & Rings Ltd

- 6.2.8 Magna International

- 6.2.9 Tenneco Inc

- 6.2.10 Riken Corporation

- 6.2.11 PT Astra Otoparts Tbk

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Opportunity in the Aftermarket owing to the Growth in Used Gasoline/Diesel Cars