|

市場調查報告書

商品編碼

1273432

石膏板市場 - 增長、趨勢、COVID-19 影響和預測 (2023-2028)Plasterboard Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,全球石膏板市場預計將以超過 5% 的複合年增長率增長。

由於建築行業增長放緩,COVID-19 疫情影響了 2020 年石膏板市場的增長。 由於社會上相當一部分人的收入受到影響,貨幣流動性受到不利影響,進而對建築業的表現產生不利影響。 原材料和工人的可用性問題也是 2020 年建設放緩的最大因素之一。 然而,大流行後建築項目的增加增加了對石膏板的需求。

主要亮點

- 石膏板行業的增長主要是由於住宅建設的增加和對耐火建築材料的需求。

- 住宅終端用戶缺乏意識,而且沒有地方可以處理廢石膏板,預計這將減緩市場增長。

- 未來,新型輕質石膏板有望引發市場增長。

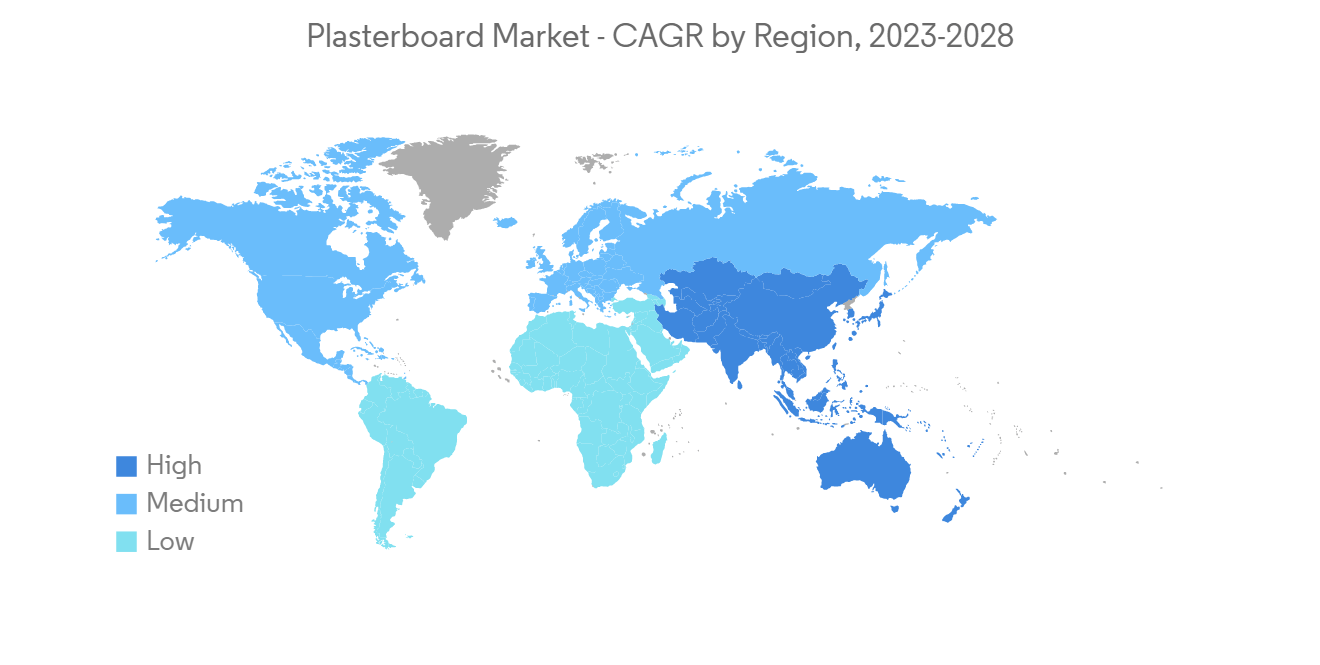

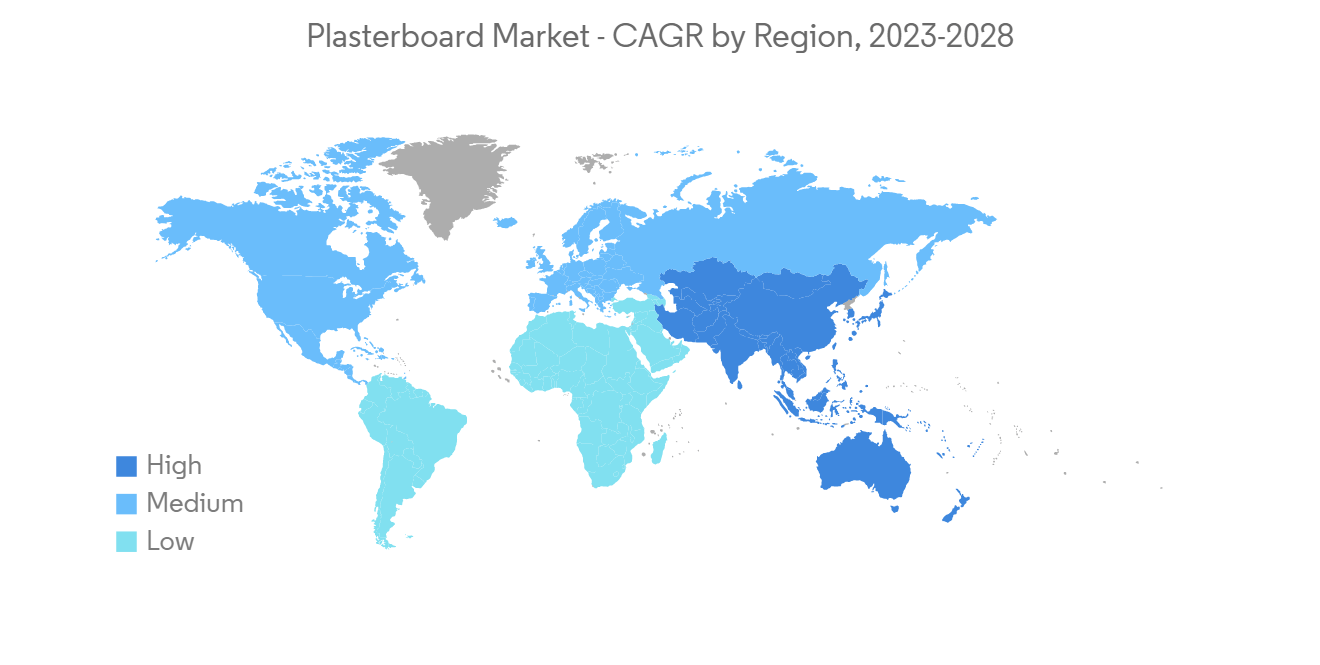

- 亞太地區是最大的石膏板市場,因為中國、印度和印度尼西亞等新興國家/地區的建築業發展迅速。

石膏板市場趨勢

住房建設導致需求增加

- 中產階級的數量在增加,他們的可支配收入也在增加。 因此,預計未來幾年中產階級住房市場將擴大,石膏板的使用量將增加。

- 雖然需求有所增加,但世界上的住房仍然嚴重短缺。 這為投資者和開發商提供了建立新夥伴關係以使用各種施工方法推進開發的絕佳機會。

- 由於中國和印度不斷擴大的住宅建築市場,亞太地區預計增長最快。 中國、印度和東南亞國家負責亞太地區最大的低成本住房建設領域。

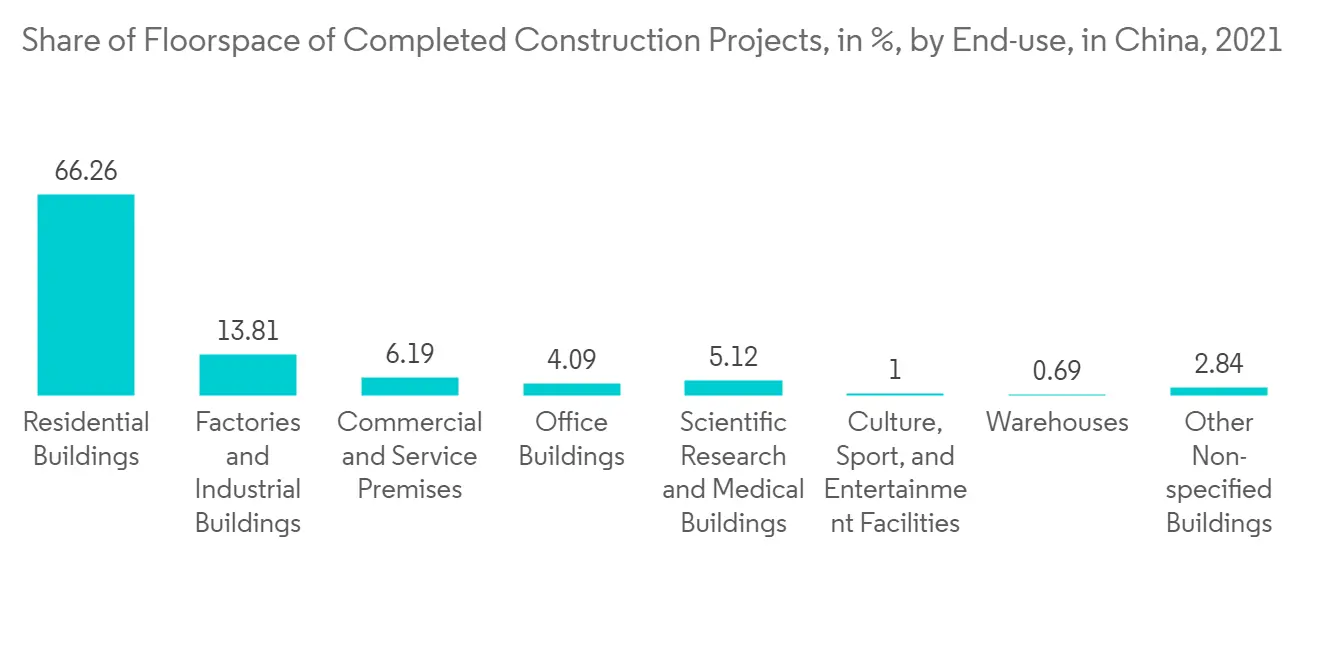

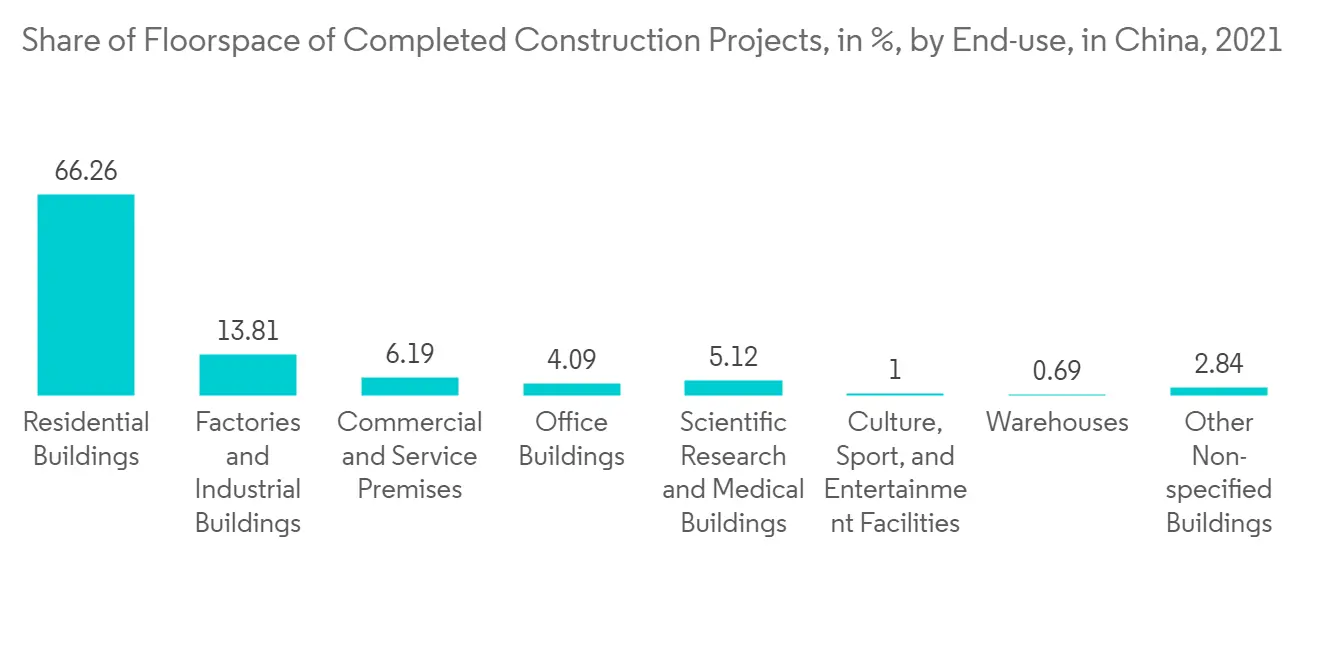

- 2021年,我國新建住宅房地產開發麵積將達到約1.46萬億平方米。 到 2021 年,住宅將佔中國已竣工建築的最大份額。 將近 67% 的已竣工建築面積屬於指定用於住宅用途的建築物。

- 此外,在美國,2021 年 1 月完工的私人獨棟住宅數量超過 100 萬套,而 2020 年 1 月為 942,000 套。 此外,按季節性調整後的年率計算,2022 年 12 月建築許可證允許的私人擁有住房達到 133 萬套。 這比 11 月修訂後的 135 萬套低 1.6%,比 2021 年 12 月的 190 萬套低 29.9%。

- 在印度,政府啟動了一個名為“到 2022 年人人享有住房”的項目,預計該項目將在整個預測期內顯著引領該國的經濟適用房建設行業。

- 在預測期內,受中產階級人口增長、住房建設以及政府舉措和投資的推動,預計所有地區住宅行業對石膏板的需求都會增加。

亞太地區主導市場

- 在亞太地區,中國是國內生產總值最大的經濟體。 儘管該國的增長率仍然很高,但隨著人口老齡化和經濟從投資轉向消費、從製造業轉向服務業、從外需轉向內需,增速正在逐漸下降。

- 中國的建築業發展迅速,因為政府推動基礎設施投資以維持經濟增長。 2021 年,中國建築企業新簽合同約 34.5 萬億元人民幣(4800 億美元),佔總數的一半以上。

- 儘管房地產市場的增長不可預測,但中國政府對鐵路和公路基礎設施進行了大量投資,以適應不斷增長的工業和服務業。 由於大多數建築公司歸政府所有,政府支出的增加正在幫助國內建築業。

- 中國的城市化程度越來越高,預計到 2050 年將有超過 2.55 億人居住在城市。 政府開始幫助農民工獲得保障性住房並擴大大城市的城市設施。 政府還宣布花費超過 1620 億美元來修復該市的“分流鎮”。

- 在接下來的幾年裡,印度將在住房方面投資約 1.3 萬億美元,同時預計將建造 6000 萬套新住房。 到 2024 年,印度經濟適用房的數量預計將增長 70% 左右。 2022 年 6 月,鄉鎮、住房、建築基礎設施和基礎設施發展項目建設和開發的 FDI 達到 286.4 億美元。

- 總體而言,本次考察的市場預計將實現高增長率。 這是由於該國家和地區建築業的快速發展。

石膏板行業概況

全球石膏板市場只有幾家大型企業。 前五名的公司佔據了很大一部分市場。 石膏板市場的主要參與者包括 Etex Group、National Gypsum Services Company、Saint-Gobain、Georgia-Pacific 和 AWI Licensing LLC(排名不分先後)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查先決條件

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 主持人

- 對乾式施工方法的需求超過濕式施工方法

- 住房建設需求增加

- 對耐火建築材料的需求增加

- 約束因素

- 認知度低

- 石膏板廢物處理場短缺

- 工業價值鏈分析

- 波特的五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章市場細分

- 形狀

- 方邊

- 錐形

- 類型

- 防潮石膏板

- 耐火石膏板

- 抗衝擊石膏板

- 保溫石膏板

- 防潮石膏板

- 隔音石膏板

- 標準石膏板

- 導熱石膏板

- 最終用途領域

- 住宅

- 非住宅

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東盟國家

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 意大利

- 法國

- 北歐國家

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 其他南美國家

- 中東和非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第六章競爭格局

- 併購、合資、合作、合同等。

- 市場份額 (%)/排名分析

- 主要公司採用的策略

- 公司簡介

- AWI Licensing LLC

- Ahmed Yousuf & Hassan Abdullah Co.(AYHACO GROUP)

- ATISKAN STRUCTURE AND INDUSTRIAL GYPSUM PRODUCTS INDUSTRY. VE TIC. Inc.

- Etex Group

- Fletcher Building

- Georgia-Pacific

- Gyprock

- Gypsemna

- Gyptec Iberica

- Jason Plasterboard Co. Ltd.

- LafargeHolcim

- Mada Gypsum

- National Gypsum Services Company

- ECPlaza Network Inc.

- Saint-Gobain

- USG Boral

- CERTAINTEED

- JN Linrose

- American Gypsum

第七章市場機會與未來趨勢

- 輕質石膏板新開發

- 其他商業機會

During the time frame of the forecast, the global plasterboard market is expected to grow at a CAGR of more than 5%.

The outbreak of COVID-19 impacted plasterboard market growth in 2020 due to slowed construction industry growth. Because the income of a relatively large part of society was affected, it had a negative effect on the liquidity of money, which in turn had a negative effect on the performance of the construction sector. Also, problems with getting raw materials and workers were some of the biggest things that slowed down construction in 2020.But the increase in building projects after the pandemic has made more people want plasterboard.

Key Highlights

- Most of the growth in the plasterboard industry can be attributed to the rise in residential construction and the need for more fire-resistant building materials.

- Lack of awareness among residential end-users and a lack of places to get rid of waste plasterboard are likely to slow the growth of the market.

- In the future, it is expected that new lightweight plasterboards will give the market a chance to grow.

- Asia-Pacific was the biggest market for plasterboard because the building industry in developing countries like China, India, and Indonesia was growing so quickly.

Plasterboard Market Trends

Increasing Demand from Residential Construction

- The number of people in the middle class is growing, and their disposable income is also going up. This has helped the middle-class housing market grow, which will increase the use of plasterboard over the next few years.

- Even though there is more demand, there is still a big shortage of housing around the world.This gives investors and developers a big chance to use different ways of building and make new partnerships to move development forward.

- The Asia-Pacific region is expected to have the most growth because the housing construction market in China and India is growing. China, India, and Southeast Asian nations are in charge of the largest low-cost housing construction segment in Asia-Pacific.

- In 2021, the floor space of new residential real estate construction will amount to around 1.46 trillion square meters in China. Residential buildings accounted for the largest share of completed construction in China in 2021. Almost 67 percent of the completed floor space belonged to buildings designated for housing.

- Furthermore, in the United States, privately owned single-family housing that had finished construction had more than 1 million units in January 2021, as compared to 942 thousand units in January 2020. Moreover, privately owned housing units authorized by building permits were at a seasonally adjusted annual rate of 1.33 million units in December 2022. This is 1.6 percent below the revised November rate of 1.35 million units and 29.9 percent below the December 2021 rate of 1.9 million units.

- In India, the government initiated a project called "Housing for All by 2022," which is expected to immensely drive the low-cost residential construction segment in the country throughout the forecast period.

- Due to the increasing middle-class population and residential building construction, coupled with government initiatives and investments, the demand for plasterboard in the residential sector across all regions is expected to increase during the forecast period.

The Asia-Pacific Region to Dominate the Market

- In Asia-Pacific, China is the largest economy in terms of GDP. The growth rate in the country remains high, but it is gradually diminishing as the population is aging and the economy is rebalancing from investment to consumption, manufacturing to services, and external to internal demand.

- China's construction industry grew quickly because the government pushed for investments in infrastructure to keep the economy growing. The value of new contracts signed by Chinese construction companies in 2021 was approximately CNY 34.5 trillion (USD 0.48 trillion), which is more than half of the total.

- Even though the growth of the real estate market is unpredictable, the Chinese government has put a lot of effort into building rail and road infrastructure to keep up with the growing industrial and service sectors. This has led to a lot of growth in the Chinese construction industry in recent years.Since most construction companies are owned by the government, the increase in government spending is helping the construction business in the country.

- China is becoming more and more urban, and by 2050, 255 million more people are expected to live in cities. started by the government to help migrants find social housing and to expand urban facilities in big cities.The government has also said it will spend more than USD 162 billion to fix up "shantytowns" in cities.

- India is likely to witness an investment of around USD 1.3 trillion in housing over the next few years, during which the country is likely to witness the construction of 60 million new homes. By 2024, the number of affordable homes in India is expected to have grown by about 70%.In June 2022, FDI in the construction and development of townships, housing, built-up infrastructure, and infrastructure development projects stood at USD 28.64 billion.

- Overall, the market that was looked at is expected to grow at high rates. This is because the construction industry in the country and region is growing quickly.

Plasterboard Industry Overview

There are only a few big players in the global plasterboard market. The top five players make up a big chunk of the market. Key players in the plasterboard market include Etex Group, National Gypsum Services Company, Saint-Gobain, Georgia-Pacific, and AWI Licensing LLC, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Strong Demand for Dry Construction Methods over Wet Methods

- 4.1.2 Increasing Demand from Residential Construction

- 4.1.3 Rising Demand for Fire-resistant Construction Materials

- 4.2 Restraints

- 4.2.1 Lack of Awareness

- 4.2.2 Lack of Availability of Plasterboard Waste Disposal Plants

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Form

- 5.1.1 Square-edge

- 5.1.2 Tapered

- 5.2 Type

- 5.2.1 Damp-roof Plasterboard

- 5.2.2 Fire-resistant Plasterboard

- 5.2.3 Impact-resistant Plasterboard

- 5.2.4 Insulated Plasterboard

- 5.2.5 Moisture-resistant Plasterboard

- 5.2.6 Sound-resistant Plasterboard

- 5.2.7 Standard Plasterboard

- 5.2.8 Thermal Plasterboard

- 5.3 End-use Sector

- 5.3.1 Residential

- 5.3.2 Non-residential

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 NORDIC Countries

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AWI Licensing LLC

- 6.4.2 Ahmed Yousuf & Hassan Abdullah Co. (AYHACO GROUP)

- 6.4.3 ATISKAN STRUCTURE AND INDUSTRIAL GYPSUM PRODUCTS INDUSTRY. VE TIC. Inc.

- 6.4.4 Etex Group

- 6.4.5 Fletcher Building

- 6.4.6 Georgia-Pacific

- 6.4.7 Gyprock

- 6.4.8 Gypsemna

- 6.4.9 Gyptec Iberica

- 6.4.10 Jason Plasterboard Co. Ltd.

- 6.4.11 LafargeHolcim

- 6.4.12 Mada Gypsum

- 6.4.13 National Gypsum Services Company

- 6.4.14 ECPlaza Network Inc.

- 6.4.15 Saint-Gobain

- 6.4.16 USG Boral

- 6.4.17 CERTAINTEED

- 6.4.18 JN Linrose

- 6.4.19 American Gypsum

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Lightweight Plasterboards

- 7.2 Other Opportunities