|

市場調查報告書

商品編碼

1273482

超疏水塗層市場 - 增長、趨勢、COVID-19 影響和預測 (2023-2028)Superhydrophobic Coatings Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預計在預測期內,超疏水塗層市場的複合年增長率為 25.48%。

主要亮點

- COVID-19 對 2020 年的市場產生了負面影響。 由於大流行的情況,世界上多個國家已被封鎖以遏制病毒的傳播。 紡織品和鞋類、汽車、建築和建築等各種終端用戶行業對超疏水塗層的需求受到其生產過程停工的嚴重影響。 然而,2021 年情況有所改善,有利於預測期內的市場增長。

- 對電動汽車的需求不斷增長以及紡織行業的需求不斷增長是推動市場增長的主要因素。 另一方面,製造過程中有機物和生物殘留物的表面污染預計會阻礙市場增長。

- 由於對高級紡織品和高端鞋類的需求不斷增加,紡織和鞋類行業在市場中佔據主導地位,預計在預測期內將會增長。 太陽能行業不斷增長的需求預計將成為未來的市場機遇。

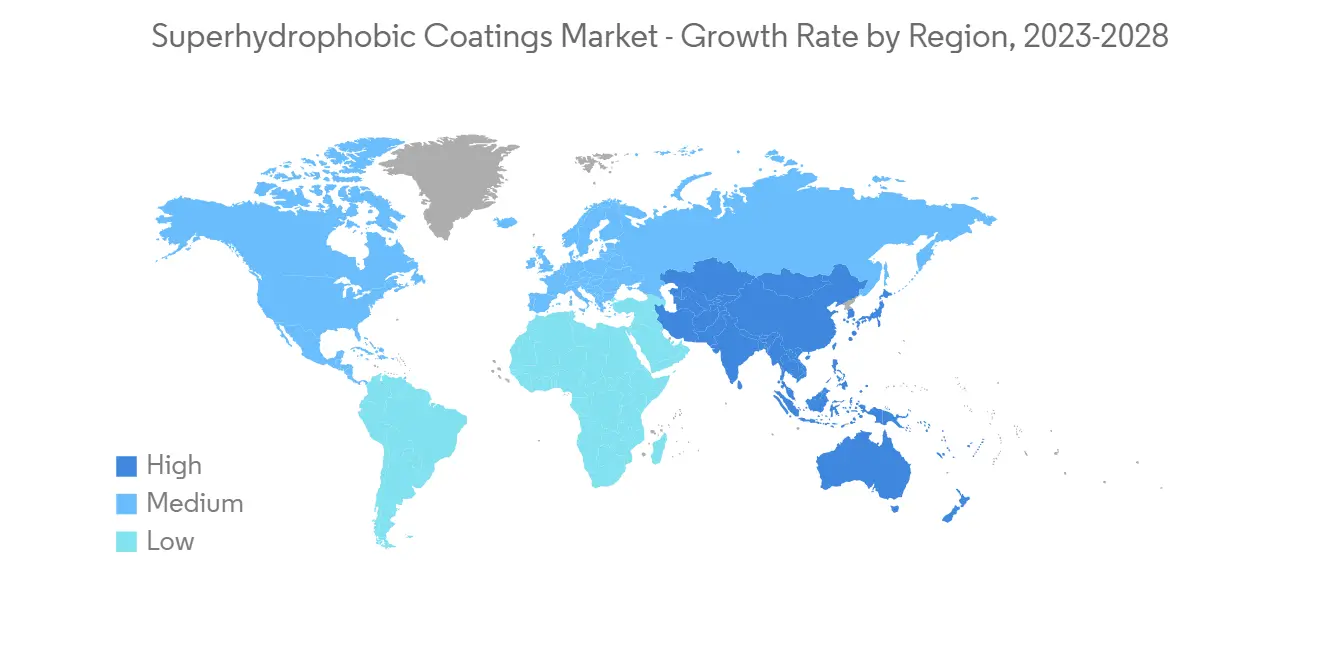

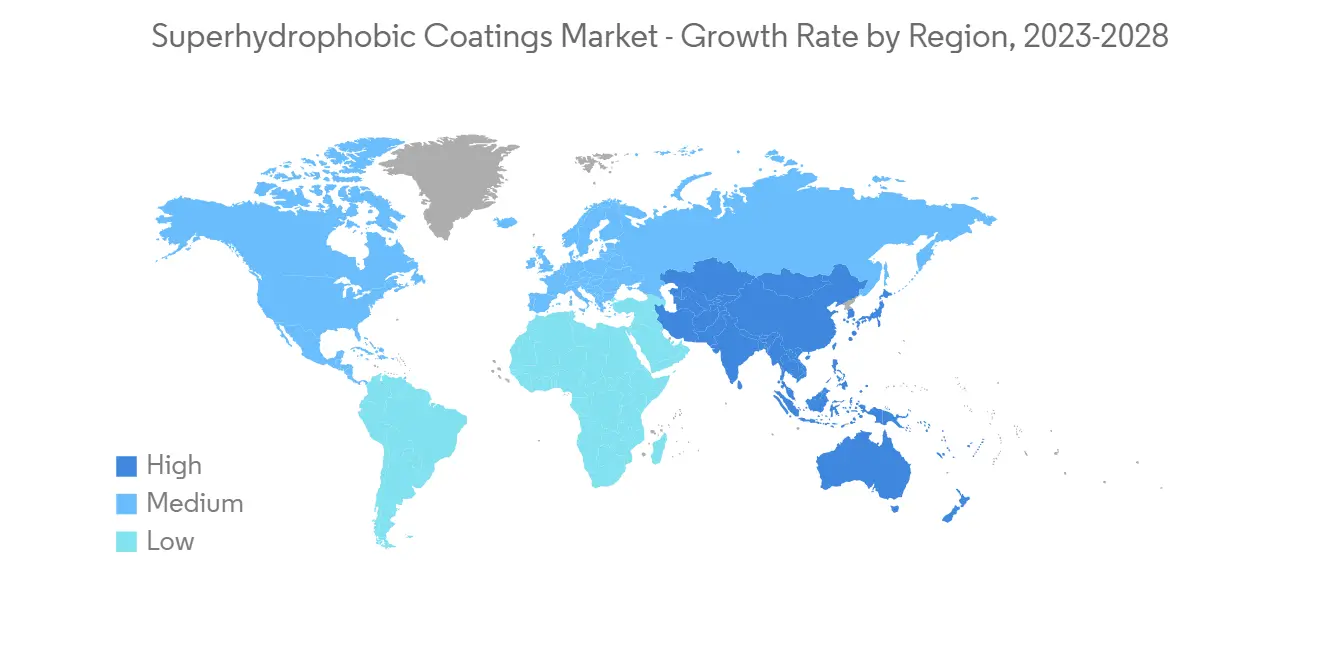

- 美國在全球市場佔據主導地位,預計將在預測期內推動對超疏水塗層的需求。

超疏水塗層的市場趨勢

紡織品和鞋類領域主導市場

- 在過去十年中,各種組織都將研究重點放在製造防污紡織品和防水劑上。 然而,這些塗料已□□經在雨衣上使用了好幾年了。 目前對自清潔紡織品的需求非常高。

- 這些塗料在紡織行業的使用極大地增加了節約清潔所需的水和能源的潛力,以及清潔劑製造中使用的化學品的使用。 此外,由於省去了洗滌的麻煩,預計可以使用更長時間並提高耐用性。 自潔面料比傳統面料具有更強的排污能力,可以催化分解不同類型的污垢。

- 超疏水紡織品最受醫院歡迎,因為它們可以通過自清潔技術避免病原體、異味和微生物。 這有助於防止感染和疾病的傳播。

- 這種紡織品在國防領域也有一些好處。 身處敵對環境的士兵,往往需要洗衣服的機會。 自清潔服裝為士兵提供了更清潔、更衛生的解決方案。

- 中國是世界上最大的紡織品生產國和出口國。 過去二十年的快速增長使中國的紡織工業成為該國經濟的主要支柱之一。 2022年2月,中國紡織品出口創下247.41億美元的歷史新高。

- 2022 年 10 月,中國生產了近 30 億米的服裝面料。 根據國家統計局(NBS)的數據,2022 年 11 月,紡織品生產將達到 460 億美元的歷史新高。

- 超疏水塗層具有強大的抗菌和防霧性能,這就是它們廣泛應用於製鞋業的原因。 2021 年,全球生產了 222 億雙鞋。 亞洲佔全球鞋類產量的近 90%。

- 基於上述方面,紡織品和鞋類領域將主導全球超級防水劑市場。

美國主導世界市場

- 由於汽車和工業應用等各種終端用戶行業對產業用紡織品的需求不斷增長,該國的紡織業總體呈現積極趨勢。

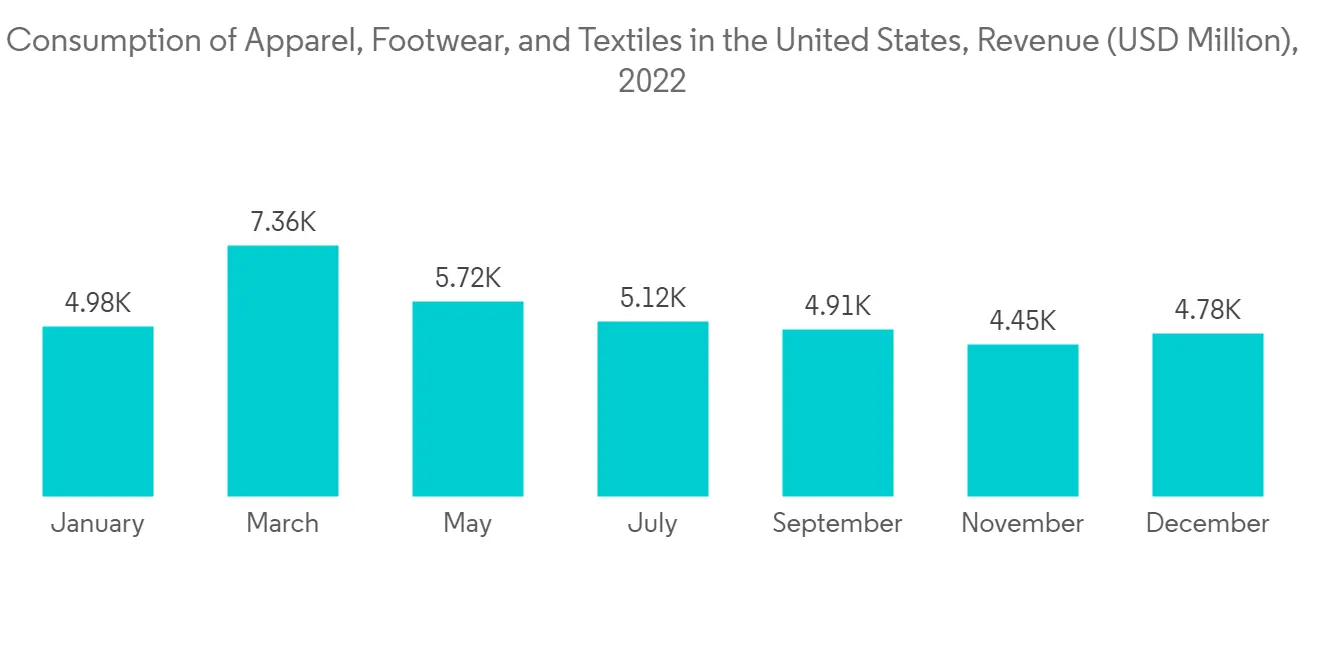

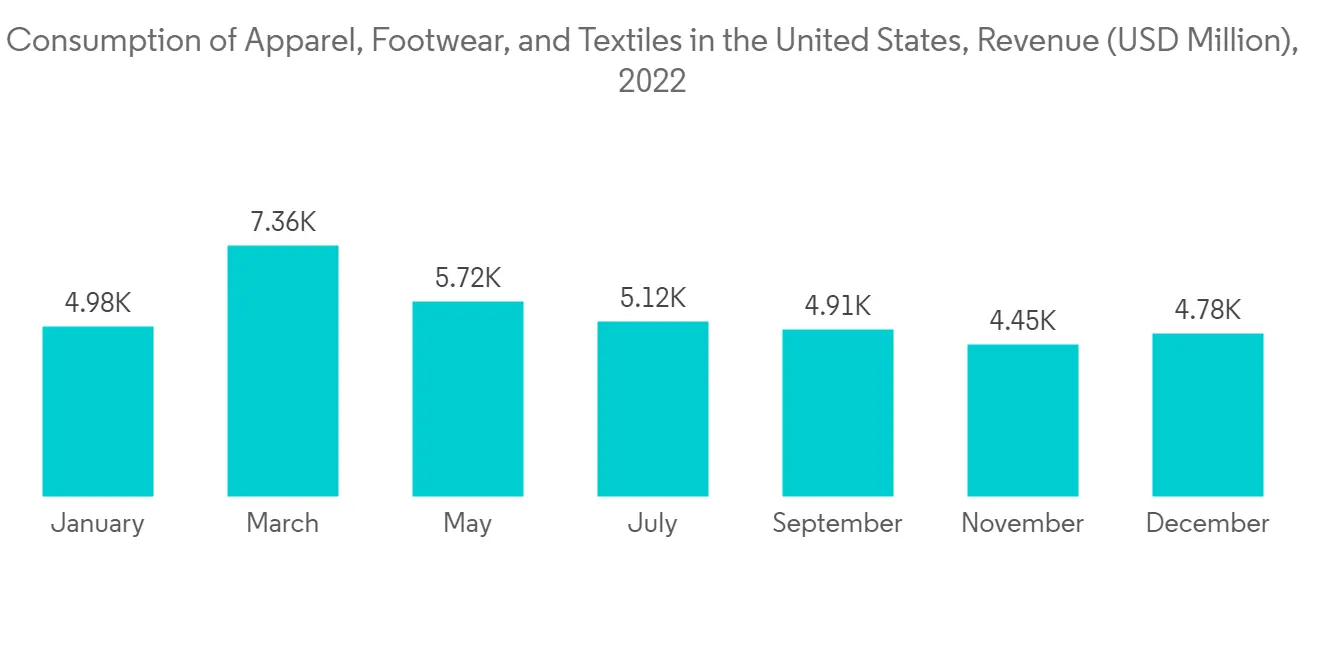

- 美國紡織品市場分為三個部分,服裝消費近 12%。 家紡和地板行業佔原材料消耗量的 40% 左右。 產業用紡織品所佔份額最大,近一半的原材料在美國生產。

- 隨著全球經濟的增長,未來幾年對產業用紡織品的需求預計也將保持在較高水平。 美國是世界上最大的服裝市場。 該國還從中國、印度、越南、孟加拉國和墨西哥進口紡織品和服裝。

- 此外,由於拜登政府的 1 萬億美元計劃,美國是最大的汽車製造商之一,並擁有最大的建築業之一。

- 從 2011 年到 2020 年,美國紡織業將投資 202 億美元用於新廠房和設備。 最近,美國製造商在整個紡織品生產鏈中開設了新設施,包括將紡織品和其他廢物轉化為新的紡織品應用和樹脂的回收設施。

- 根據全國紡織組織理事會 (NCTO) 的數據,2021 年美國人造纖維、紡織品和服裝的出貨量將達到 608 億美元,而此前的估計為 650 億美元。

- 美國商務部下屬紡織服裝管理局 (OTA) 的數據顯示,2022 年上半年,美國紡織品服裝出口額同比增長 13.10%。 與2021年同期相比,出口額從109.9億美元增加到124.4億美元。

- 此外,美國定期對光伏和聚光光伏進行研究。 太陽能發電量是世界上最高的之一。 因此,在預測期內,美國有望成為全球市場中最大的地區。

超疏水塗層行業概況

全球超疏水塗層市場高度分散,沒有一家公司佔據主要市場份額。 市場上的主要參與者(排名不分先後)包括 Rust-Oleum、NEI Corporation、UltraTech International Inc.、P2i Ltd 和 Cytonix。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查先決條件

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 主持人

- 紡織業的需求不斷擴大

- 對電動汽車的需求增加

- 約束因素

- 在製造過程中受到有機化合物的表面污染

- 其他抑製劑

- 工業價值鏈分析

- 波特的五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 專利分析

第 5 章市場細分

- 產品類型

- 防銹

- 防凍

- 自清潔

- 防止潤濕

- 最終用戶行業

- 紡織品和鞋類

- 汽車相關

- 建築/施工

- 未來的最終用戶行業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 其他歐洲

- 世界其他地方

- 亞太地區

第六章競爭格局

- 併購、合資企業、合作、合同

- 主要參與者分析

- 主要參與者採用的策略

- 公司簡介

- Aculon

- Advanced Nanotech Lab

- Beijing Neatrition Tech Co Ltd

- Cytonix

- DryWired

- Lotus Leaf Coatings Inc.

- Nanex Co.

- Nasiol Nano Coating

- NEI corporation

- NTT Advanced Technology Corporation

- P2i Ltd

- Pearl Nano LLC

- Rust Oleum

- The Sherwin Williams Company

- UltraTech International Inc.

第七章市場機會與未來趨勢

- 對太陽能電池板的需求不斷增長

簡介目錄

Product Code: 51887

The market for superhydrophobic coatings is expected to register a CAGR of 25.48% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the market in 2020. Owing to the pandemic scenarios, several countries worldwide went into lockdown to curb the spreading of the virus. The demand for superhydrophobic coatings from various end-user industries, such as textile and footwear, automotive, building, and construction, was severely affected due to a halt in their production processes. However, the condition recovered in 2021, benefiting the market growth over the forecast period.

- Increasing demand for electric vehicles and the growing demand from the textile industry are the major factors driving the market's growth. On the flip side, the contamination of surfaces with organic substances and biological residues during its production is expected to hinder the market's growth.

- The textile and footwear industry dominated the market and is expected to grow during the forecast period, owing to the increasing demand for advanced textile and high-end footwear. Growing demand from the solar industry is likely to act as an opportunity for the market in the future.

- The United States dominates the global market and will likely drive the demand for superhydrophobic coatings over the forecast period.

Superhydrophobic Coatings Market Trends

Textile and Footwear Segment to Dominate the Market

- During the past decade, various organizations have directed their research efforts to create stain-resistant textiles and water repellents. However, these coatings have been used for several years in raincoats. Currently, there is a huge demand for self-cleaning textiles.

- Using these coatings in the textile sector has greatly increased the potential to save water and energy needed in cleaning and the use of chemicals used in the manufacturing of cleaning agents. With reduced washing requirements, these textiles are expected to be long-lasting and more durable. Self-cleaning textiles are much better repellers of dirt than conventional fabrics and can degrade several types of stains based on some catalytic mechanism.

- Superhydrophobic textiles are most appreciated in hospitals since the self-cleaning technique of these garments will lead to avoiding pathogens, odors, microorganisms, etc. Hence, these textiles help reduce the chances of infection and the spread of diseases.

- These textiles also offer several benefits in the defense sector. Soldiers posted in difficult and inhospitable areas often need to get the chance to wash their clothes. Self-cleaning garments offer cleaner and more hygienic solutions for them.

- China is the largest textile-producing and exporting country in the world. With its rapid growth over the last two decades, the Chinese textile industry has become one of the main pillars of the country's economy. In February 2022, the Chinese textile export reached an all-time high of USD 24,741 million.

- Approximately three billion meters of clothing fabric were produced in China in October 2022. According to the National Bureau of Statistics (NBS), the textile production volume reached an all-time high of USD 46 billion in November 2022.

- The superhydrophobic coating has intense applications as antibacterial and antifogging, due to which it is extensively used in the footwear industry. In 2021, 22.2 billion pairs of footwear were produced around the world. Asia is responsible for over slightly less than 90% of global footwear production.

- Based on the aforementioned aspects textile and footwear segment will dominate the global superhydrophobic market.

United States to Dominate the Global Market

- The textile industry in the country, overall, has shown a positive trend due to the growing technical textile demand from various end-user industries, such as automotive and industrial applications.

- The US textile market is divided into three segments - apparel, which consumes nearly 12%. The home textiles and floor covering segment accounts for almost 40% of raw material consumption. Technical textiles hold the largest share, with nearly half of the raw material produced in the United States.

- The demand for technical textiles is also expected to remain high in the coming years due to growth in the global economy. The United States is the world's largest apparel market. The country also imports textiles and clothing from China, India, Vietnam, Bangladesh, and Mexico.

- Moreover, the United States is one of the largest automotive manufacturers and boasts one of the largest construction industries, with the trillion-dollar plan from Biden Administration.

- The United States textile industry invested USD 20.2 billion in new plants and equipment from 2011 to 2020. Recently US manufacturers have opened new facilities throughout the textile production chain, including recycling facilities to convert textile and other waste to new textile uses and resins.

- According to the National Council of Textile Organizations (NCTO), in 2021, the value of United States man-made fiber, textile, and apparel shipments totaled an estimated USD 65 billion, compared to USD 60.8 billion in shipments in 2021.

- According to data from the Office of Textiles and Apparel (OTA), a division of the United States Department of Commerce, in the first half of 2022, the United States exports of textiles and clothing increased by 13.10% from the previous year. Compared to the same period in 2021, exports increased to USD 12.44 billion from USD 10.99 billion.

- Moreover, the United States regularly researches photovoltaics and concentrated solar power. It is among the top countries in the world in electricity generated by solar power. Hence, the United States is set to be the largest region in the global market during the forecast period.

Superhydrophobic Coatings Industry Overview

The global superhydrophobic coatings market is highly fragmented, with no single player occupying a major share of the market. The major players in the market (not in any particular order) include Rust-Oleum, NEI Corporation, UltraTech International Inc., P2i Ltd, and Cytonix, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Textile Industry

- 4.1.2 Increasing Demand for Electric Vehicles

- 4.2 Restraints

- 4.2.1 Contamination of Surfaces with Organic Compounds During Its Production

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Patent Analysis

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Anti-corrosion

- 5.1.2 Anti-icing

- 5.1.3 Self-cleaning

- 5.1.4 Anti-wetting

- 5.2 End-user Industry

- 5.2.1 Textile and Footwear

- 5.2.2 Automotive

- 5.2.3 Building and Construction

- 5.2.4 Upcoming End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Major Player Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aculon

- 6.4.2 Advanced Nanotech Lab

- 6.4.3 Beijing Neatrition Tech Co Ltd

- 6.4.4 Cytonix

- 6.4.5 DryWired

- 6.4.6 Lotus Leaf Coatings Inc.

- 6.4.7 Nanex Co.

- 6.4.8 Nasiol Nano Coating

- 6.4.9 NEI corporation

- 6.4.10 NTT Advanced Technology Corporation

- 6.4.11 P2i Ltd

- 6.4.12 Pearl Nano LLC

- 6.4.13 Rust Oleum

- 6.4.14 The Sherwin Williams Company

- 6.4.15 UltraTech International Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Solar Panels

02-2729-4219

+886-2-2729-4219