|

市場調查報告書

商品編碼

1432524

飽和聚酯樹脂:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Saturated Polyester Resins - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

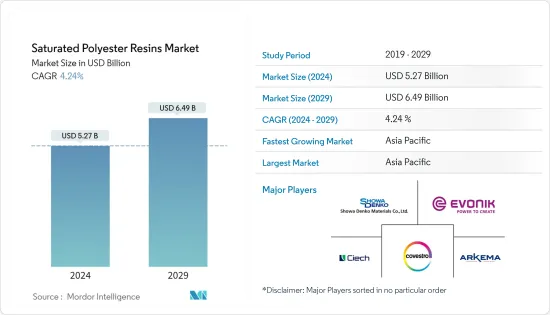

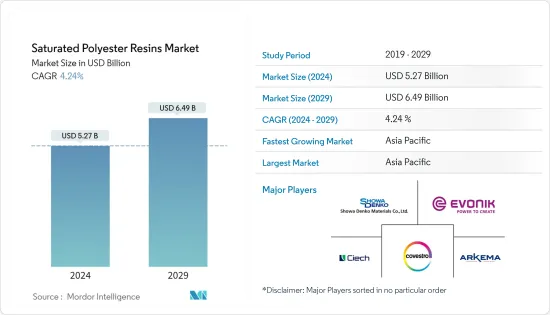

飽和聚酯樹脂市場規模預計到2024年為52.7億美元,預計到2029年將達到64.9億美元,在預測期內(2024-2029年)複合年成長率為4.24%。

在 COVID-19 大流行期間,由於全球營運和供應鏈限制,飽和聚酯樹脂市場出現低迷。這些因素對油漆和塗料行業等主要最終用戶的需求產生了負面影響。然而,一旦2021年限制放鬆,聚酯樹脂的需求就會上升到疫情前的水平。

主要亮點

- 中期推動市場成長的主要因素是由於卓越的機械性能,與替代品相比具有卓越的性能。

- 另一方面,飽和聚酯樹脂的高加工和製造成本預計將阻礙市場成長。

- 非 BPA 罐頭塗料的趨勢正在為飽和聚酯樹脂創造新的成長機會。

- 亞太地區在市場中佔據主導地位,預計在預測期內仍將保持最高的複合年成長率。

飽和聚酯樹脂市場趨勢

粉末塗料需求增加

- 飽和聚酯樹脂主要用於生產無溶劑粉末油漆和被覆劑。飽和聚酯樹脂具有良好的耐候性、良好的衝擊強度和對金屬的黏合(即使在潮濕條件下)等優異性能,用於室外和室內建築應用、機械、電器產品、鋼鐵、家具和花園的塗漆首選工具。

- 在全球範圍內,電子產業的技術進步和研發活動的快速創新正在推動對更新、更快、更可靠的電子產品的需求,從而增加了對塗層元件的需求。

- 根據日本電子情報技術產業協會(JEITA)預測,全球電子資訊科技產業產值將從2021年的3.36兆美元成長到2022年,與前一年同期比較成長1%。4,400億。此外,2023年預計與前一年同期比較成長3%。根據消費者科技協會的數據,2022 年美國消費性電子產品或科技的零售額預計將達到 5,050 億美元,而 2021 年為 4,610 億美元。

- 在歐洲,德國的電子工業是該地區最大的。根據 ZVEI 的數據,2022 年 11 月德國電子和數位產業銷售額達 211 億歐元(217 億美元),較 2021 年 11 月成長 14.4%。

- 同樣,不斷成長的建築業預計將推動使用飽和聚酯樹脂生產的無溶劑粉末塗料的使用。這將推動預測期內受調查市場的成長。

- 亞太地區、中東和非洲的建築業正在經歷強勁成長。在中東和非洲地區,各國政府正努力發展非石油部門。例如,沙烏地阿拉伯政府根據其經濟轉型計畫「2030 年願景」啟動了一系列基礎設施計劃。這些計劃主要涉及電力、水利、碳氫化合物、建築、公路、鐵路、港口和機場領域。

- 因此,各終端用戶產業對粉末塗料的需求正在穩步成長,預計將帶動對飽和聚酯樹脂的需求。

亞太地區主導市場

- 由於中國、印度和日本等經濟體的需求不斷成長,亞太地區在全球市場佔有率中佔據主導地位。

- 預計在預測期內,亞太地區對飽和聚酯樹脂的需求將健康成長。這是由於該地區建築、汽車和電子行業的油漆和塗料應用預計將顯著成長。

- 據國家發展委員會 (NDC) 稱,2022 年 2 月,中國政府機構提案了1,800 億元新台幣(64.7 億美元)的基礎設施發展計畫。該計劃包括前瞻性基礎設施發展計劃第四階段的預算提案,將於 2023 年至 2024 年使用。

- 在中國,2021年住宅在已竣工開發案中所佔比例最大。住宅建築面積佔竣工占地面積的67%以上。隨著經濟成長,越來越多的人從農村地區遷移到都市區,增加了對住宅的需求。此外,中國擁有全球最大的建築市場,佔全球整體建築投資的20%。預計到2030年,中國將在建築方面花費約13兆美元,使得全球飽和聚酯樹脂市場前景樂觀。

- 亞太地區是世界上一些最有價值的汽車製造商的所在地。它的總部位於中國、印度、日本和韓國等新興國家。基於飽和聚酯樹脂的油漆和被覆劑由於其對金屬表面的高黏合而擴大用於汽車工業。

- 根據中國工業協會統計,中國是全球最大的汽車生產基地,預計2022年汽車產量將達到2,700萬輛,比去年的2,600萬輛成長3.4%。此外,2022年前7個月,中國生產汽車1,457萬輛,與前一年同期比較成長31.5%。此外,2022年7月電池式電動車保有量較2021年1-7月成長117.2%。預計 2022 年 7 月該國電動車銷量約為 61.7 萬輛。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 包裝產業需求增加

- 亞太和中東歐快速工業化

- 其他司機

- 抑制因素

- 加工製造成本高

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 種類

- 液體飽和聚酯樹脂

- 固態飽和樹脂

- 目的

- 粉末塗料

- 卷材和罐頭塗料

- 汽車漆

- 包裝塗料

- 工業漆

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)/排名分析

- 主要企業策略

- 公司簡介

- ALLNEX GMBH

- Arkema Group

- CIECH SA

- Covestro AG

- DIC CORPORATION

- Eternal Materials Co. Ltd

- Evonik Industries AG

- Showa Denko Materials Co. Ltd

- Hitech Industries FZE

- Hexion

- Novaresine SRL

- DSM

- Sir Industriale

- Stepan Company

- Nippon Gohsei

第7章 市場機會及未來趨勢

- 由於揮發性有機化合物排放低,飽和聚酯樹脂的使用增加

- 其他機會

The Saturated Polyester Resins Market size is estimated at USD 5.27 billion in 2024, and is expected to reach USD 6.49 billion by 2029, growing at a CAGR of 4.24% during the forecast period (2024-2029).

During the COVID-19 pandemic, the saturated polyester resin market witnessed a downturn due to operational and supply chain restrictions in various countries across the globe. Factors like these negatively impacted the demand from key end users like Paints and Coatings industry, among others. However, as the restriction eased in 2021, the demand for polyester resin rose to pre-pandemic levels.

Key Highlights

- Over the medium term, the major factor driving the market's growth is their better performance compared to their alternatives because of their superior mechanical properties.

- On the flip side, the high processing and manufacturing cost of saturated polyester resins is expected to hinder the studied market's growth.

- The growing trend of non-BPA can coatings creates new growth opportunities for saturated polyester resins.

- The Asia-Pacific region is expected to dominate the market and will likely witness the highest CAGR during the forecast period.

Saturated Polyester Resins Market Trends

Increasing Demand for Powder Coatings

- Saturated polyester resins are primarily used to manufacture solvent-free powder paints and coatings. Its superior properties, such as good weather resistivity, excellent impact strength, and adhesion to metals (even under humid conditions), saturated polyester resins are favored for exterior and interior architectural applications, coating machinery, domestic appliances, steel furniture, and garden tools.

- Globally the rapid pace of innovation in terms of the advancement of technologies and R&D activities in the electronics industry is driving the demand for newer, faster, and more reliable electronic products, thus increasing the need for coated components.

- According to the Japan Electronics and Information Technology Industries Association (JEITA), the production by the global electronics and IT industry was estimated at USD 3.44 trillion in 2022, registering a growth rate of 1% year on year, compared to USD 3.36 trillion in 2021. Moreover, the industry is expected to grow by 3% year on year by 2023. According to the Consumer Technology Association, the retail revenue from consumer electronics or technology sales in the United States was estimated at USD 505 billion in 2022, compared to USD 461 billion in 2021.

- In Europe, the German electronics industry is the largest in the region. According to the ZVEI, Germany's electro and digital industry turnover accounted for EUR 21.1 billion (USD 21.7 billion) in November 2022, witnessing a growth rate of 14.4% compared to November 2021.

- Similarly, the growing construction sector is expected to drive the usage of solvent-free powder coatings manufactured using saturated polyester resins. It is thereby boosting the growth of the market studied during the forecast period.

- The construction sector is witnessing robust growth in Asia-Pacific, Middle East & Africa. In the Middle East & Africa region, governments are trying to develop the non-oil sectors. For Instance, Under the Vision 2030 economic transformation plan, the Saudi Arabian government initiated numerous infrastructure projects. These projects majorly cover projects related to the power, water, hydrocarbons, construction, road, rail, seaport, and airport sectors.

- Hence, the robust growth in the demand for powder coatings from various end-user industries is expected to drive the demand for saturated polyester resins.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the global market in terms of share, owing to the growing demand from economies like China, India, and Japan.

- Asia-Pacific is expected to witness healthy growth in the demand for saturated polyester resins during the forecast period. It is due to the expected noticeable growth of paints and coatings applications in industries like construction, automotive, and electronics industries, among others in the region.

- In February 2022, the Chinese government agencies proposed a TWD 180 billion (USD 6.47 billion) infrastructure development plan, according to the National Development Council (NDC). It includes the proposed budget for the fourth stage of the Forward-looking Infrastructure Development Program would be used from 2023-2024.

- In China, residential buildings comprised the largest portion of finished development in 2021. Construction intended for housing accounted for over 67% of the completed floor space. As the economy grows, more people move from rural to urban regions, increasing the need for residential accommodation. In addition, the country includes the largest construction market in the world, encompassing 20% of all construction investments globally. China is expected to spend nearly USD 13 trillion on buildings by 2030, creating a positive market outlook for the global saturated polyester resins market.

- The Asia-Pacific region is home to some of the world's most valuable vehicle manufacturers. Developing countries such as China, India, Japan, South Korea. As paints and coatings based on saturated polyester resins offer high adhesion to metallic surfaces, These are increasingly used in the automotive industry.

- According to the China Association of Automobile Manufacturers (CAAM), China contains the largest automotive production base in the world, with a total vehicle production of 27 million units in 2022, registering an increase of 3.4 % compared to 26 million units produced last year. Further, in the first 7 months of 2022, the country produced 14.57 million units of cars, registering a growth rate of 31.5% Year on Year. Furthermore, in July 2022, the number of battery-powered electric vehicles increased by 117.2% compared to January-July in 2021. In July 2022, the country's electric vehicle sales were estimated at around 617 thousand units.

- Moreover, in India, during FY 2021-22 (April 2021 to March 2022), according to the Society of Indian Automobile Manufacturers (SIAM), the country's automotive industry produced a total of 22.03 million vehicles compared to 22.66 million units during April 2020 to March 2021. Further, according to the Centre for Monitoring Indian Economy (CMIE), car production increased to 193.63 thousand units in July 2022 from 169.52 thousand units in June 2022. Such factors are likely to increase the demand for the studied market

- The factors above are expected to drive the demand for saturated polyester resins in the region during the forecast period.

Saturated Polyester Resins Industry Overview

The saturated polyester resins market is partially fragmented, with the top players accounting for a small chunk of the market. These major players include Arkema Group, Covestro AG, Showa Denko Materials Co. Ltd, Evonik Industries AG, and CIECH SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Packaging Industry

- 4.1.2 Rapid Industrialization in Asia-Pacific and Central and Eastern Europe

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Processing and Manufacturing Cost

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Liquid Saturated Polyester Resin

- 5.1.2 Solid Saturated Resin

- 5.2 Application

- 5.2.1 Powder Coatings

- 5.2.2 Coil and Can Coatings

- 5.2.3 Automotive Paints

- 5.2.4 Packaging

- 5.2.5 Industrial Paints

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ALLNEX GMBH

- 6.4.2 Arkema Group

- 6.4.3 CIECH SA

- 6.4.4 Covestro AG

- 6.4.5 DIC CORPORATION

- 6.4.6 Eternal Materials Co. Ltd

- 6.4.7 Evonik Industries AG

- 6.4.8 Showa Denko Materials Co. Ltd

- 6.4.9 Hitech Industries FZE

- 6.4.10 Hexion

- 6.4.11 Novaresine SRL

- 6.4.12 DSM

- 6.4.13 Sir Industriale

- 6.4.14 Stepan Company

- 6.4.15 Nippon Gohsei

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Usage of Saturated Polyester Resins Due to Low VOC Emissions

- 7.2 Other Opportunities