|

市場調查報告書

商品編碼

1444398

智慧電錶:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Smart Electricity Meter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

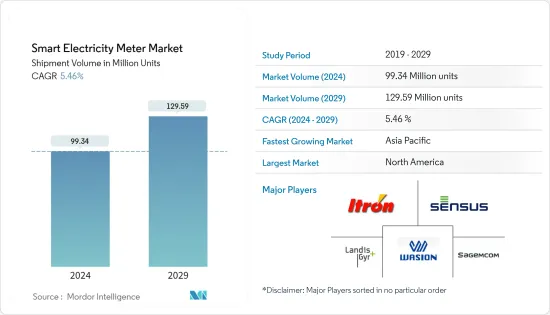

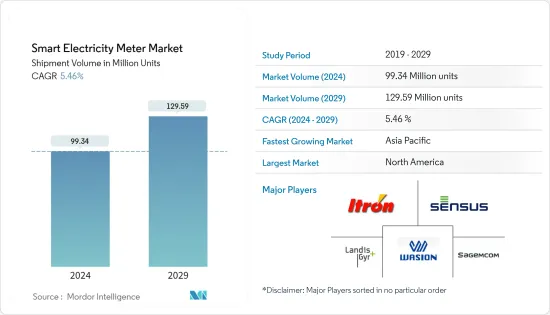

以出出貨量計的智慧電錶市場規模預計將從2024年的9934萬台成長到2029年的12959萬台,預測期間(2024-2029年)年複合成長率為5.46%,預計。

智慧電錶的引入使得引入家庭能源管理系統(HEMS)和建築能源管理系統(BEMS)成為可能,這些系統可以可視化單一住宅和整個建築物的電力情況。

主要亮點

- 能源效率日益成為全球關注的焦點,因為經濟活動的增加導致能源消耗率上升,並將世界電網推向極限。據BP稱,2021年全球發電量為28,466兆瓦時。

- 數位化正在進一步加速能源效率措施的現代化,導致智慧電網的引入,智慧電網可以動態最佳化供應並促進太陽能光伏等再生能源來源能源的大量電力供應,在全球範圍內不斷增加。

- 最近的 COVID-19 爆發和世界各地的國家封鎖影響了全球智慧電錶的整體部署。 COVID-19 全球大流行已導致世界許多地區實施封鎖,多個行業的業務停止。智慧電錶的出貨和安裝也因此受到影響。

- 然而,隨著COVID-19限制的逐步放鬆,從長遠來看,智慧電錶的安裝數量預計將會增加。在許多已開發地區,大多數能源供應商都鼓勵客戶升級到智慧電錶。這意味著智慧電錶最大限度地減少人與人之間的直接互動,鼓勵節約能源並促進輕鬆的申請支付,提供遠端抄表,提高申請和收款效率,並改善技術和商業性並遏制竊電。

- 當非主要模式時,消費性電子產品、辦公室設備和其他插入負載消耗住宅和商業總合電力的近 15% 至 20%。大部分能量在低功耗模式下運作時消耗(即使不使用時)。消費者擴大安裝智慧型能源管理系統來追蹤此類情況。

智慧電錶市場趨勢

住宅錄得顯著成長

- 智慧電錶在住宅領域發揮著重要作用,因為它們可以測量消費者消耗的能源。已開發國家智慧電網投資的增加以及可再生能源併網率的大幅提高預計將支持智慧電錶市場的成長。

- 此電錶測量電力消耗量並將其通訊至中央公共系統。在全球範圍內,在住宅領域安裝這些設備將有助於減少二氧化碳排放,因為消費者越來越傾向於在尖峰時段節省能源。

- 由於住宅建設活動增加以及歐盟 20-20-20 政策旨在將超過 80% 的已安裝電錶轉換為智慧電錶,智慧電錶市場的成長前景現已確定。

- 此外,隨著消費者轉向獨立能源產出系統,智慧電網的互動功能預計將變得越來越重要。屋頂太陽能發電系統和小型風力發電機現在已被許多住宅和企業廣泛普及且具有成本效益。智慧電錶安裝有助於將所有這些小型發電系統有效地連接到電網,並使整個配電和計量過程有效且有效率。

- 此外,隨著都市化的加速和對發展城市生活方式的重視,人們擴大採用智慧家庭技術和設備,這些技術和設備可以自動控制電力、照明和能源,以避免浪費。因此,全球家庭擴大採用智慧家庭設備和技術,預計將進一步推動住宅領域的智慧電錶成長。

美國佔有很大的市場佔有率

- 在美國,自動抄表解決方案市場已趨於成熟,成長正在放緩。此外,根據美國美國電氣創新研究所的數據,到 2021 年,美國將安裝 1.15 億個智慧電錶。

- 第一代電錶的更換和向先進電錶基礎設施(具有更高功能和改進技術)的過渡預計將推動未來智慧電錶市場的發展。

- 美國公用事業公司正在利用智慧電錶資料來監控電網健康狀況,在停電時更快恢復電力服務,整合分散式能源(DER)並連接能源服務。我們為客戶提供解決方案。此外,美國公用事業公司正在大力投資以加強能源網路。

- 此外,該地區的供應商將利用智慧電錶的潛力,將其與客戶參與工具和其他獎勵策略等其他工具電錶,從而推動智慧電錶在市場上的採用。例如,每當安裝智慧電錶時,巴爾的摩天然氣和電力公司就會將客戶涵蓋其智慧型能源福利計畫。客戶收到回饋,在尖峰時段獲得回饋獎勵,並幫助降低能源成本。

- 同樣,美國Pacific Gas & Electric 報告稱,AMI 的目標是住宅維修計劃,為符合條件的住宅實現 3.5 倍的節能。此外,智慧電錶和資料分析等技術的整合預計將進一步推動該地區研究市場的成長。

智慧電錶產業概況

智慧電錶市場競爭適度,由幾個主要企業組成。市場適度分散,參與者規模各異。這些公司利用策略創新和協作舉措來擴大市場佔有率並提高盈利。進入市場的公司正在收購致力於企業網路設備技術的新興企業,以增強其產品能力。

2022年10月,安得拉邦電力公司宣布大幅增加智慧電錶計劃的推出。印度聯邦政府決定根據智慧電錶國家計畫 (SMNP) 在印度各地用智慧電錶取代約 2.5 億個傳統電錶。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 主要地區政府扶持規定

- 智慧城市採用率增加

- 市場限制因素

- 高成本和安全問題

- 與智慧電錶整合困難

第6章市場區隔

- 按最終用戶

- 住宅

- 商業的

- 產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 西班牙

- 德國

- 義大利

- 法國

- 土耳其

- 北歐的

- 比荷盧三國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲/紐西蘭

- 韓國

- 東南亞(馬來西亞、新加坡、泰國等)

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 哥倫比亞

- 智利

- 其他拉丁美洲

- 中東/非洲

- GCC

- 南非

- 埃及

- 其他非洲

- 其他中東地區

- 北美洲

第7章 競爭形勢

- 公司簡介

- Landis+gyr Group AG

- Wasion Group Holdings

- Elster Group GMBH(Honeywell International Inc.)

- Jiangsu Linyang Energy Co. Ltd

- Sagemcom SAS

- Ningbo Sanxing Electric Co. Ltd

- Kamstrup A/S

- Hexing Electric Company Ltd

- Itron Inc.

- Holley Technology Ltd

- Nanjing Xinlian Electronics Co. Ltd

- Sensus USA Inc.(Xylem Inc)

- Shenzhen Hemei Group Co. Ltd

第8章投資分析

第9章市場的未來

The Smart Electricity Meter Market size in terms of shipment volume is expected to grow from 99.34 Million units in 2024 to 129.59 Million units by 2029, at a CAGR of 5.46% during the forecast period (2024-2029).

Smart meters deployment enabled the implementation of a Home Energy Management System (HEMS) or Building Energy Management System (BEMS) that allows visualization of the electric power usage in individual homes or entire buildings.

Key Highlights

- Energy efficiency is increasingly becoming the primary focus globally, owing to the increasing economic activities, which led to high energy consumption rates and pushed global electricity grids to their limits. The global electricity generation in 2021 stood at 28,466 Terawatt-hours, according to BP.

- Digitization has been further accelerating and modernizing energy efficiency measures due to which the deployment of smart grids has been increasing globally, as they are capable of dynamically optimizing supply and fostering supply of large amounts of electricity from renewable energy sources, such as solar power.

- The recent COVID -19 outbreak and nationwide lockdown across the globe impacted the overall rollout of Smart meters globally. The global COVID -19 pandemic resulted in lockdowns in various parts of the world, which halted several operations across industries. As a result, the shipments and installations of smart meters were also affected.

- However, as the COVID-19 regulations are slowly being eased, the number of smart meters being installed is also expected to witness an increase in the long term. In many developed regions, most energy suppliers have been motivating their customers to upgrade to smart meters as it minimizes direct human interaction and offers several other benefits across the entire value chain, such as incentivizing energy conservation and facilitating easy bill payments, remote meter reading, improving billing and collection efficiency, reducing aggregate technical and commercial losses, and curbing power theft, among others.

- Consumer electronics, office equipment, and other plug loads consume nearly 15% to 20% of the total residential and commercial electricity while not in the primary mode. Most of this energy is consumed when they operate in low-power modes (even while they are not in use). Consumers are increasingly tending to install a smart energy management system to track such scenarios.

Smart Electricity Meter Market Trends

Residential Segment to Register Significant Growing

- Smart electric meter plays a significant role in the residential sector, as this meter measures the energy consumed by the consumers. The increasing smart grid investments and the surge in the rate of integration of renewable sources of power generation to the existing grids in developed economies are expected to support the growth of the smart electricity meter market.

- The meter measures the electricity consumption and communicates this to the central utility system. Globally, installations of these devices in the residential sector help in the reduction of CO2 emissions, owing to the increased consumer's inclination toward peak time savings of energy.

- The increasing residential construction activities and government mandates, like the EU 20-20-20 policy aiming to convert over 80% of the installed meter base to a smart one, have ensured growth prospects for the smart electricity meters market.

- Furthermore, as consumers move toward stand-alone energy generation systems, the interactive capacity of the Smart Grid will become more and more important. Rooftop solar electric systems and small wind turbines are now widely available and have become cost-effective for many homeowners and businesses. Installations of smart meters will help to effectively connect all these mini-power generating systems to the grid to help the overall power distribution and measurement process be effective and more efficient.

- Moreover, increasing urbanization and the increasing inclination toward the focus on developing urban lifestyles led to the expansion of deployment of smart home technologies and devices, which involves automatic control of electricity, light, and energy to avoid wastage. Hence, the increasing adoption of smart home devices and technologies across the homes globally is further expected to foster the growth in smart meters in the residential segment.

United States to Hold Significant Market Share

- The automatic meter reading solutions market has been reaching maturity in the United States, resulting in sluggish growth. Furthermore, according to the Institute for Electric Innovation in the United States, 115 million smart meters have been installed in the US by 2021.

- The replacement of first-generation meters and the shift to advanced metering infrastructure (with higher capabilities and improved technology) are expected to drive the smart electricity meters market in the future.

- Electric companies across the United States are leveraging smart meter data to monitor the health of the energy grid, restore electric service more quickly when outages occur, integrate distributed energy resources (DERs), and deliver energy services and solutions to customers. Furthermore, electricity companies in the United States are making significant investments to enhance the energy grid.

- Moreover, vendors in the region leveraging smart electric meters' potential by pairing them with additional tools, such as customer engagement tools and other incentive strategies, are expected to drive the adoption of smart electric meters in the market. For instance, Baltimore Gas and Electric enrolls its customers into its smart energy rewards program whenever the Smart electricity meter is installed. Customers receive feedback, peak time rebate incentives, and help reduce energy costs.

- Similarly, Pacific Gas & Electric, in the United States, reported AMI targeting a home retrofit program that delivers 3.5 times more energy savings in the targeted homes. Additionally, the integration of smart electric meters with technologies, such as data analytics, is expected to further foster the growth of the market studied in the region.

Smart Electricity Meter Industry Overview

The smart electricity meters market is moderately competitive and consists of several major players. The market is moderately fragmented, owing to the presence of many small and large players. These companies are leveraging strategic innovations and collaborative initiatives to increase their market share and increase their profitability. The companies operating in the market are also acquiring start-ups working on enterprise network equipment technologies to strengthen their product capabilities.

In October 2022, the power utilities of Andhra Pradesh announced a great up for rolling out a smart electricity meter project. The Union government decided to replace around 25 crore conventional meters with smart meters across India under the Smart Meter National Programme (SMNP).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Supportive Government Regulations in Key Regions

- 5.1.2 Rise in Smart City Deployment

- 5.2 Market Restraints

- 5.2.1 High Costs and Security Concerns

- 5.2.2 Integration Difficulties with Smart Meters

6 MARKET SEGMENTATION

- 6.1 By End-user

- 6.1.1 Residential

- 6.1.2 Commercial

- 6.1.3 Industrial

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Spain

- 6.2.2.3 Germany

- 6.2.2.4 Italy

- 6.2.2.5 France

- 6.2.2.6 Turkey

- 6.2.2.7 Nordics

- 6.2.2.8 Benelux

- 6.2.2.9 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 Japan

- 6.2.3.4 Australia and New Zealand

- 6.2.3.5 South Korea

- 6.2.3.6 Southeast Asia (Malaysia, Singapore, Thailand and Others)

- 6.2.3.7 Rest of Asia-Pacific

- 6.2.4 Latin America

- 6.2.4.1 Brazil

- 6.2.4.2 Mexico

- 6.2.4.3 Columbia

- 6.2.4.4 Chile

- 6.2.4.5 Rest of Latin America

- 6.2.5 Middle East & Africa

- 6.2.5.1 GCC

- 6.2.5.2 South Africa

- 6.2.5.3 Egypt

- 6.2.5.4 Rest of Africa

- 6.2.5.5 Rest of Middle East

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Landis+gyr Group AG

- 7.1.2 Wasion Group Holdings

- 7.1.3 Elster Group GMBH (Honeywell International Inc.)

- 7.1.4 Jiangsu Linyang Energy Co. Ltd

- 7.1.5 Sagemcom SAS

- 7.1.6 Ningbo Sanxing Electric Co. Ltd

- 7.1.7 Kamstrup A/S

- 7.1.8 Hexing Electric Company Ltd

- 7.1.9 Itron Inc.

- 7.1.10 Holley Technology Ltd

- 7.1.11 Nanjing Xinlian Electronics Co. Ltd

- 7.1.12 Sensus USA Inc. (Xylem Inc)

- 7.1.13 Shenzhen Hemei Group Co. Ltd