|

市場調查報告書

商品編碼

1273347

鉿市場 - 增長、趨勢和預測 (2023-2028)Hafnium Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

在預測期內,鉿市場預計將以超過 7% 的複合年增長率增長。

主要亮點

- COVID-19 大流行對鉿市場產生了負面影響。 生產設施的封鎖和短期中斷已對某些應用造成嚴重破壞,並限制了鉿的消耗。 儘管如此,市場自 2020 年以來一直在溫和發展,關鍵終端用戶類別的持續努力,我們預計它會繼續沿著這條道路前進。

- 推動市場發展的主要因素是航空航天業對鉿的需求不斷增長,以及鉿在半導體和潛艇中的使用越來越多。 然而,飛漲的鉿價格及其提取和分離的難度可能會阻礙市場增長。

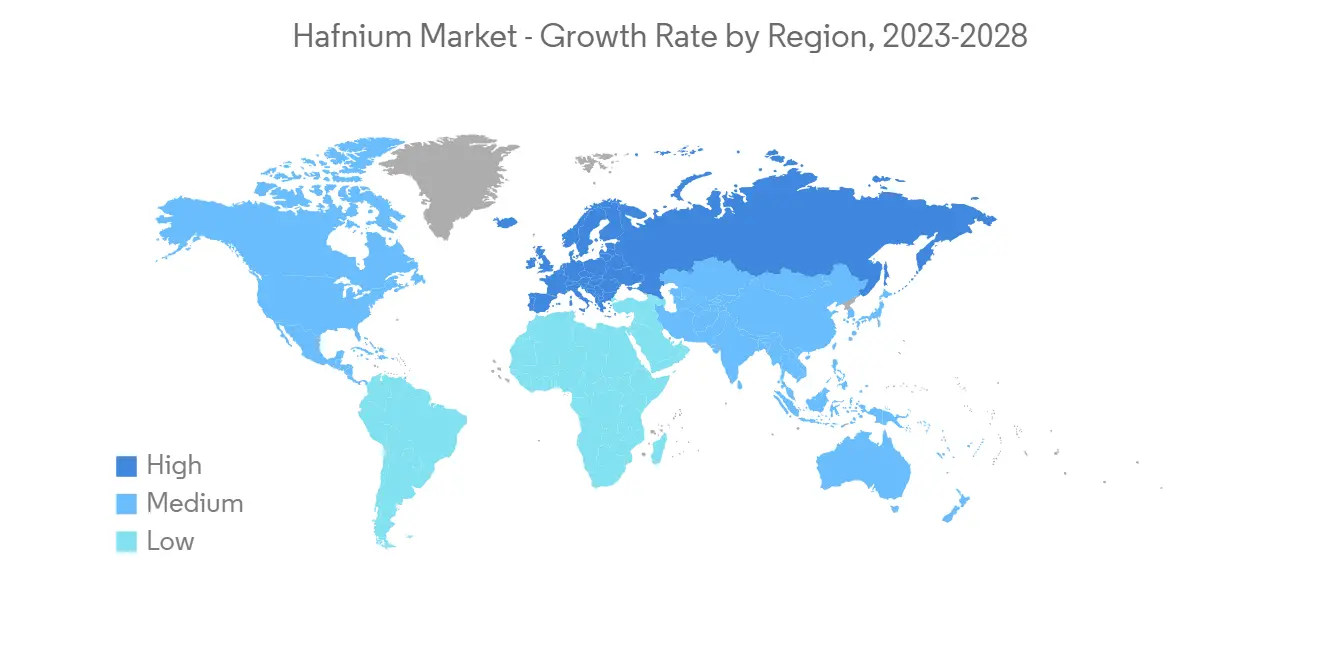

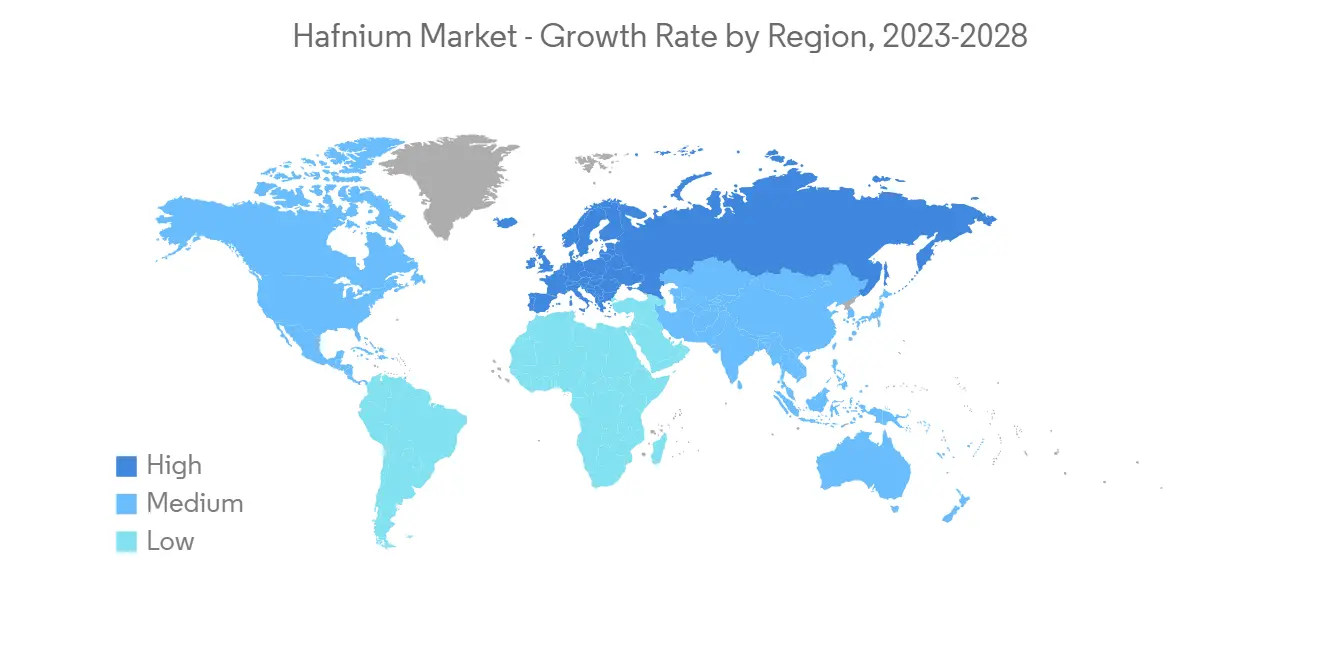

- 各種鉿產品的使用量不斷增加,預計在預測期內會提供許多增長機會。 預計中國將主導全球市場。 然而,歐洲被認為是世界上增長最快的地區。

鉿市場趨勢

高溫合金應用主導市場

- 鉿主要用作高溫合金,該應用佔鉿總用量的 50% 以上。 由於鉿在極高溫度下具有高強度和穩定性,因此在航空航天和工業渦輪機應用中用作超級合金。

- 鉿高溫合金廣泛用於噴氣發動機和火箭發動機。 鉿約佔火箭發動機噴嘴所用鈮合金的 10%。 它是 MAR M 247 高溫合金的組成部分,用於噴氣發動機的熱部件(渦輪葉片和葉片)。

- 鉿超級合金可用於主要用於發電的工業渦輪機。 因此,發電行業和風力發電的趨勢有利於鉿高溫合金的發展。

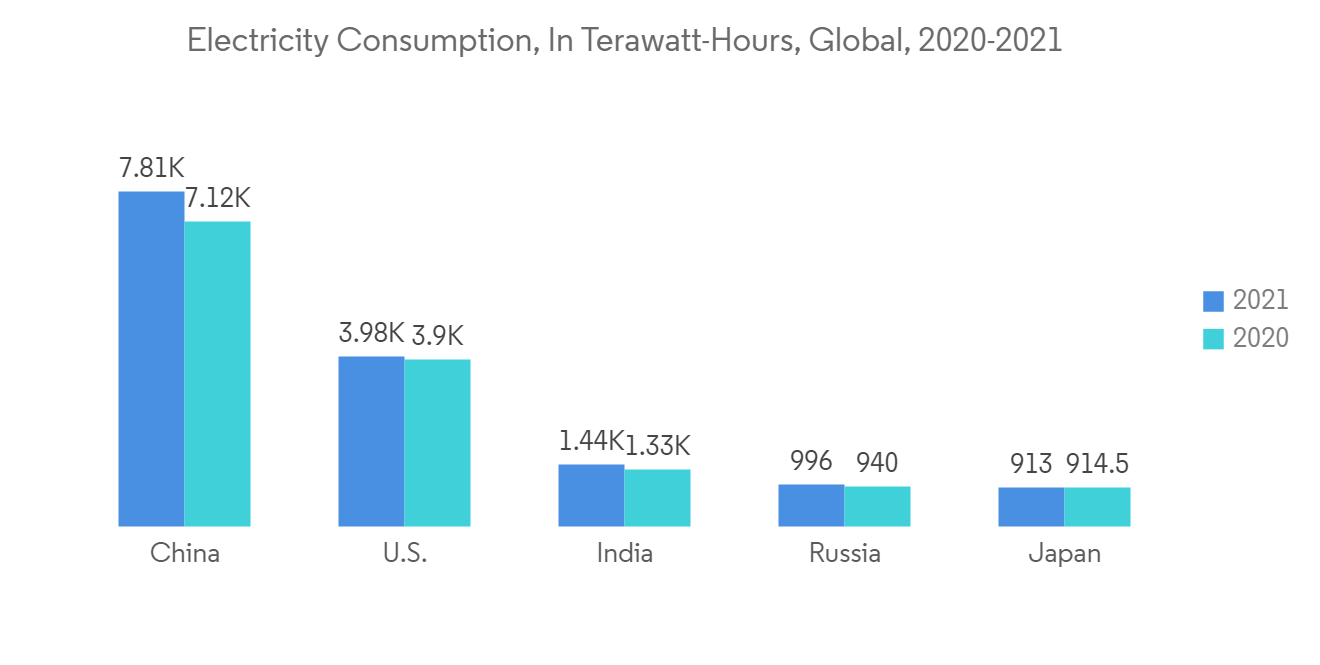

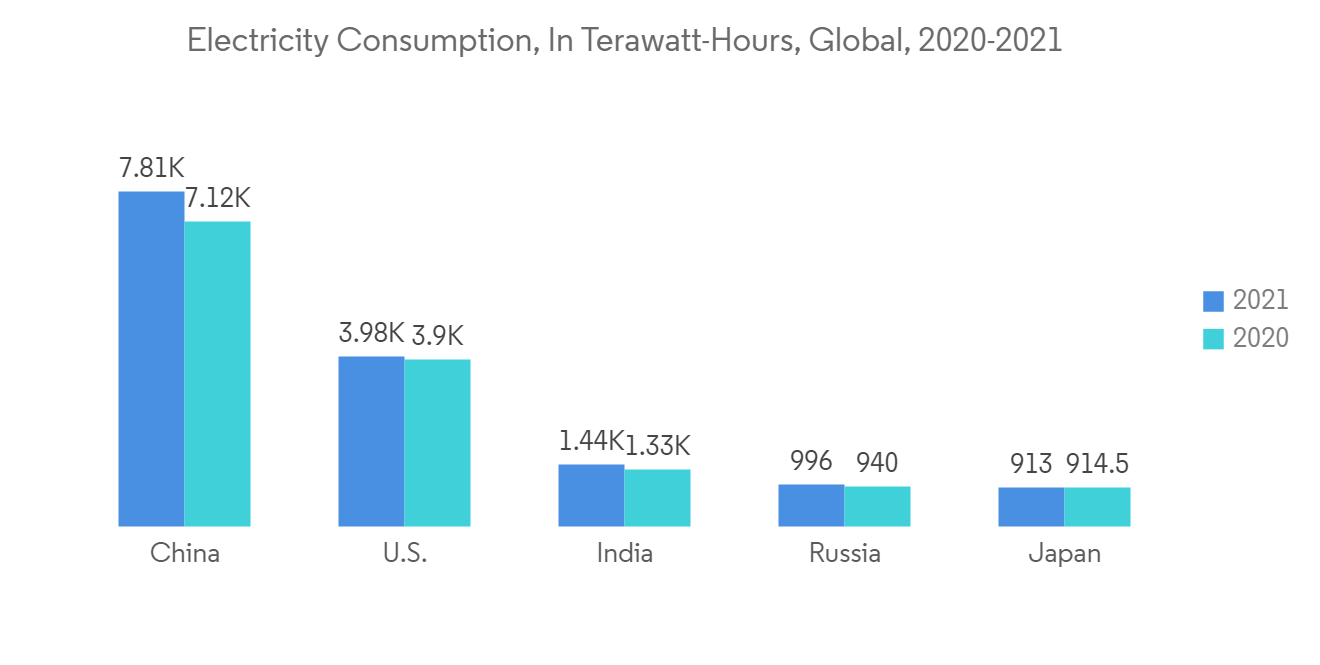

- 根據英國石油公司 (BP) Plc 的統計數據,2021 年全球發電量將達到 28,466.3 太瓦時 (TWh),與 2020 年的 26,889.2 TWh 相比,增長率為 6.2%。 2021年總發電量中,石油和天然氣分別佔720.3TWh、6518.5TWh,煤炭佔10244.0TWh。

- 2022 年 5 月,J-POWER USA Development(以下簡稱 J-POWER USA)宣佈在美國伊利諾伊州埃爾伍德的傑克遜電力項目(1,200 兆瓦 (MW) 聯合循環發電廠)在北美首次投產。安裝了兩台三菱電機 M501JAC 燃氣輪機,實現了商業運行。

- 由於高溫合金在各個行業中的重要性日益增加,預計預測期內對鉿市場的需求將會擴大。

中國主導亞太

- 在中國,鉿以海綿、合金等形式用於核反應堆、飛機、工業渦輪機和其他行業。 鉿由於具有大的中子俘獲截面和高中子吸收能力,被用作核反應堆中的控制棒材料。

- 鉿在中國得到廣泛應用,截至 2022 年 6 月,中國擁有 53 座在運核電站,裝機容量為 55.78 吉瓦。 該國有 20 座工廠在建,這可能會在預測期內增加鉿的消費量。

- 2022 年 9 月,中國批准了價值 115 億美元的兩座核電站,完成了 2022 年國家批准的 10 座核電站名單。 該電廠有望解決該國嚴重的電力短缺問題,並增加鉿的消耗。

- 2021 年 12 月,中國宣佈了一項 4400 億美元的投資計劃,以在未來 15 年內開發至少 150 座新反應堆。 目前,中國有 19 座反應堆在建,43 座反應堆正在等待批准,還有多達 166 座反應堆已經宣佈。 這228座反應堆的總發電量將達到246GW。 預計核電站的發展將在預測期內推動鉿市場。

- 中國還是主要的飛機製造商之一,也是該國最大的航空客運市場之一。 此外,該國航空零部件及總成製造業發展迅速,擁有200多家小型航空零部件製造企業。 中國民用航空總局 (CAAC) 預計國內客運量將恢復至疫情前水平的 85% 左右。

- 根據波音《2021-2040 年商業展望》,到 2040 年,中國將交付約 8,700 架新飛機,市場服務價值將達到 1.8 萬億美元。 隨著該國的這些新交付,預計對鉿的需求將增加。

- 這些因素預計會增加該國鉿的消費量。

鉿產業概況

鉿市場高度整合,前兩家公司約佔鉿金屬生產和供應的 80%。 市場上的主要參與者(排名不分先後)包括 Framatome (EDF)、Alkane Resources Ltd.、American Elements、Nanjing Youtian Metal Technology 和 ACI Alloys。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第 1 章介紹

- 調查結果

- 本次調查的假設

- 本次調查的範圍

第 2 章研究方法論

第 3 章執行摘要

第 4 章市場動態

- 促進因素

- 航空航天業的需求增加

- 增加在半導體和潛艇中的使用

- 抑制因素

- 價格飆升,分離/提取困難

- 其他抑制因素

- 行業價值鏈分析

- 波特的五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 價格分析

第 5 章市場細分(市場規模:基於金額)

- 類型

- 氧化鉿

- 碳化鉿

- 其他類型(包括金屬鉿)

- 用途

- 高溫合金

- 光學鍍膜

- 核能

- 等離子切割

- 其他用途

- 地區

- 生產分析

- 法國

- 美國

- 中國

- 世界其他地方

- 消費分析

- 美國

- 歐盟

- 俄羅斯

- 中國

- 印度

- 日本

- 世界其他地方

- 生產分析

第 6 章競爭格局

- 併購、合資、合作、合同等。

- 市場份額分析

- 主要公司採用的策略

- 公司簡介

- ACI Alloys

- Alkane Resources Ltd

- American Elements

- Baoji ChuangXin Metal Materials Co. Ltd(CXMET)

- China Nulear JingHuan Zirconium Industry Co. Ltd.

- Framatome(EDF)

- Nanjing Youtian Metal Technology Co. Ltd

- Phelly Materials Inc.

- Starfire Systems Inc.

第 7 章市場機會與未來趨勢

- 鉿產品的使用基數增加

簡介目錄

Product Code: 52510

The market for hafnium is expected to register a CAGR of over 7% during the forecast period.

Key Highlights

- The COVID-19 pandemic negatively impacted the hafnium market. Due to the lockdown and brief halts in production facilities, several applications suffered significant damage, limiting hafnium consumption. Nonetheless, beyond 2020, the market has developed slowly due to ongoing efforts in the main end-user categories and is likely to continue on its path.

- Major factors driving the market are the rising demand for hafnium in the aerospace industry and its increasing usage in semiconductors and submarines. However, higher prices of the material as well as difficulties faced in extraction and separation, are likely to hinder the market growth.

- The increasing application base for various hafnium products is anticipated to provide numerous growth opportunities over the forecast period. China is expected to dominate the market across the world. However, Europe is considered to be the fastest-growing region in the world.

Hafnium Market Trends

Super Alloys Application to Dominate the Market

- Hafnium is majorly used as a superalloy, and this application accounts for more than 50% of the total usage of hafnium. Due to its high strength and stability when operating at very high temperatures, hafnium is used as a superalloy for applications in aerospace and industrial turbines.

- Hafnium superalloys are mostly found in jet and rocket engines. Hafnium makes up roughly 10% of the niobium-based alloy used in rocket engine nozzles. It is regarded as indispensable in the MAR M 247 superalloy, used in the hot section of jet engines (turbine blades and vanes).

- Hafnium superalloys are potentially used in industrial turbines, which are majorly used to produce electricity. Hence the growing trends in the power generation industry and wind energy generation will favor the growth of hafnium superalloys.

- According to the British Petroleum (BP) Plc statistics, global electricity generation in 2021 was 28,466.3 Terawatt-hours (TWh), registering a growth rate of 6.2%, compared to 26,889.2 TWh in 2020. In 2021, out of the total electricity generated, oil, natural gas, and coal-based electricity generation accounted for 720.3 TWh, 6518.5 TWh, and 10,244.0 TWh, respectively.

- In May 2022, J-Power USA Development Co. Ltd. (J-POWER USA) achieved commercial operation with the first two Mitsubishi Power M501JAC gas turbines manufactured in North America at its Jackson generation project, a 1,200 megawatt (MW) combined-cycle power plant in Elwood, Illinois, United States.

- Owing to the rising importance of superalloys in various industries, the demand for the hafnium market is expected to grow during the forecast period.

China to Dominate the Asia-Pacific Region

- In China, hafnium is used in nuclear reactors, aircraft, industrial turbines, and other industries in the form of sponges, alloys, and other forms. Hafnium is used in nuclear reactors to make control rods due to its strong neutron-capture cross-section and neutron-absorbing capabilities.

- Hafnium is widely used in China, which, as of June 2022, has 53 working nuclear power plants with 55.78 GW capacity. The country has 20 under-construction plants, which may increase the consumption of hafnium during the forecast period.

- In September 2022, China approved 2 nuclear plants worth USD 11.5 billion, completing the list of 10 nuclear power units sanctioned by the country in 2022. The power plants are expected to sort out the country's crippling power shortage condition and trigger higher consumption of hafnium.

- In December 2021, China unveiled a USD 440 billion investment plan to develop at least 150 new nuclear reactors over the following 15 years. The country currently has 19 reactors under construction, 43 reactors seeking permits, and a whopping 166 reactors announced. These 228 reactors have a total capacity of 246GW. Throughout the projected period, the development of nuclear power plants is expected to drive the hafnium market.

- China is also one of the leading aircraft manufacturers and one of the largest domestic air passenger markets. Furthermore, the country's aviation parts and assembly manufacturing sector has been quickly expanding, with over 200 minor aircraft parts manufacturers present. The Civil Aviation Administration of China (CAAC) estimates that domestic traffic will recover roughly 85% of pre-pandemic levels.

- According to the Boeing Commercial Outlook 2021-2040, in China, around 8,700 new deliveries will be made by 2040, with a market service value of USD 1,800 billion. The demand for hafnium will likely rise due to such new deliveries in the country.

- All the aforementioned factors, in turn, are expected to augment the consumption of hafnium in the country.

Hafnium Industry Overview

The hafnium market is highly consolidated, with the top two players accounting for approximately 80% of the production and supply of hafnium metal. Some of the market's major players (not in any particular order) include Framatome (EDF), Alkane Resources Ltd., American Elements, Nanjing Youtian Metal Technology Co. Ltd., and ACI Alloys, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand from the Aerospace Industry

- 4.1.2 Increasing Usage in Semiconductors and Submarines

- 4.2 Restraints

- 4.2.1 Higher Prices and Difficulties in Seperation and Extraction

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Analysis

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Hafnium Oxide

- 5.1.2 Hafnium Carbide

- 5.1.3 Other Types (including Hafnium Metal)

- 5.2 Application

- 5.2.1 Super Alloy

- 5.2.2 Optical Coating

- 5.2.3 Nuclear

- 5.2.4 Plasma Cutting

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Production Analysis

- 5.3.1.1 France

- 5.3.1.2 United States

- 5.3.1.3 China

- 5.3.1.4 Rest of the World

- 5.3.2 Consumption Analysis

- 5.3.2.1 United States

- 5.3.2.2 European Union

- 5.3.2.3 Russia

- 5.3.2.4 China

- 5.3.2.5 India

- 5.3.2.6 Japan

- 5.3.2.7 Rest of the World

- 5.3.1 Production Analysis

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ACI Alloys

- 6.4.2 Alkane Resources Ltd

- 6.4.3 American Elements

- 6.4.4 Baoji ChuangXin Metal Materials Co. Ltd (CXMET)

- 6.4.5 China Nulear JingHuan Zirconium Industry Co. Ltd.

- 6.4.6 Framatome (EDF)

- 6.4.7 Nanjing Youtian Metal Technology Co. Ltd

- 6.4.8 Phelly Materials Inc.

- 6.4.9 Starfire Systems Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Application Base for Hafnium Products

02-2729-4219

+886-2-2729-4219