|

市場調查報告書

商品編碼

1432406

管包裝:市場佔有率分析、產業趨勢、成長預測(2024-2029)Tube Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

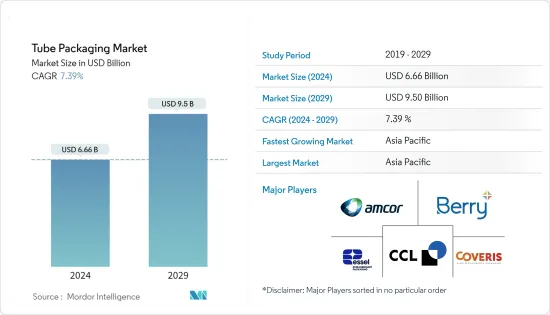

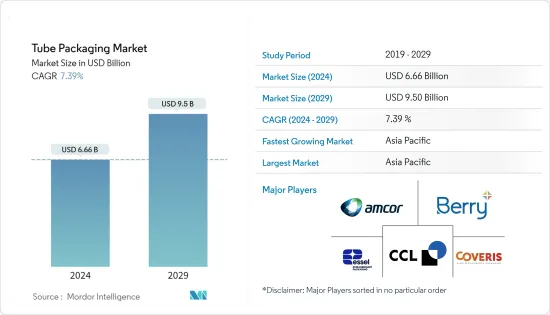

管材包裝市場規模預計到2024年為66.6億美元,預計到2029年將達到95億美元,在預測期內(2024-2029年)複合年成長率為7.39%。

管狀包裝是化妝品和個人護理領域最受歡迎的包裝型態之一,主要是因為它們在容納和分配各種產品方面具有便利性、攜帶性和彈性。

主要亮點

- 都市化的加速、千禧世代人口的增加以及消費者可支配收入的增加等因素對所研究市場的成長做出了重大貢獻。都市化在增加可支配收入和提高人們對各種化妝品的可用性的認知方面發揮著作用,從而為市場相關人員創造了各種機會,極大地刺激了對管包裝的需求。

- 由於其多層屏障結構,層壓管目前在市場上佔據主導地位。這些管材的需求量很大,因為它們具有出色的阻隔性能,可以延長產品的保存期限,最大限度地減少氧氣和光的傳輸,並提供細菌防護。

- 藥品市場也在推動市場成長,特別是廣泛使用管包裝的皮膚科藥物。據Astra Zeneca稱,2018年全球藥品銷售額為1,100億美元,未來製藥業的成長將特別推動對管瓶包裝的需求。

- 此外,透過專注於增強用戶體驗來實現化妝品包裝的技術進步,例如在帶有泵和其他創新塗抹器的管子中包含刷子和海綿頭,人們越來越頻繁地要求這樣做。

- 由於都市化和人們對各種化妝品的可用性的廣泛認知而增加的可支配收入將極大地刺激對管包裝的需求。

- 然而,包裝法規因地區和國家而異,這可能會阻礙市場成長。

管材包裝市場趨勢

塑膠推動市場成長

- 塑膠因其成本低、重量輕、彈性和耐用而成為管包裝的重要材料。此外,它無味且外觀舒適。

- 塑膠管在化妝品、個人護理、食品和藥品等各行業的使用減少了運輸成本和能源浪費。這種類型的包裝還可以確保產品安全並延長保存期限。

- 隨著便利性和衛生在每個地區變得越來越重要,對塑膠管的需求正在增加,特別是在化妝品行業。

- 也就是說,永續包裝確保了材料技術的創新,從而促進了環保塑膠包裝解決方案的開發和大量塑膠回收再利用。此外,為了更好地平衡經濟性和永續性,領先公司正在透過使用可重複使用和可堆肥的塑膠材料轉向可回收包裝。

- 歐盟 (EU) 和美國工業理事會塑膠部門最近宣布了各自地區到 2025 年和 2040 年使用 100% 可回收、可重複使用和可堆肥塑膠的目標。這些法規預計將塑造未來的塑膠管包裝產業。

- 然而,在過去的十年中,由於塑膠對環境的影響,這一領域的發展速度已經放緩。

亞太地區實現顯著成長

- 亞太地區人口的生活方式和生活水準日益改善。這一因素,加上化妝品和藥品的趨勢以及健康和衛生意識的提高,正在推動該地區的市場。

- 除了該地區對化妝品的需求外,亞太國家也大幅增加對美國的化妝品出口。根據國際貿易管理局的數據,美國全球出口的 20% 以上會經過亞洲國家。

- 此外,該國對醫療保健和衛生的需求也很高。在中國這個擁有13.7億人口的國家,口腔疾病對政府的醫療體系造成了巨大的負擔,給個人帶來了更大的經濟負擔。牙周病在印度也很常見。這些因素增加了對牙膏和其他使用管包裝的口腔護理產品的需求。

- 此外,根據廢品回收業協會的數據,2018年中國佔全球塑膠廢品進口量的52%。據估計,對塑膠回收再利用的重視也正在擴大塑膠管包裝領域,從而支持管包裝的成長。

管材包裝產業概況

由於參與者眾多,管包裝市場高度分散。此外,可以透過創新(設計、技術、應用)和合作夥伴關係獲得永續的競爭優勢。此外,新進入者的可能性相當大,進一步加劇競爭。因此,市場上的現有企業肯定會採取以收購、併購和研發為特徵的強力的競爭策略。該市場的主要市場參與者包括Amcor、Bemis、Tetrapack等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素與市場約束因素介紹

- 市場促進因素

- 軟包裝的成長

- 便利包裝的需求增加

- 市場挑戰

- 包裝行業法規

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 依封裝類型

- 擠

- 捻

- 戳

- 墨水匣

- 其他

- 按材質

- 塑膠

- 紙

- 鋁

- 其他

- 按用途

- 化妝品/洗護用品

- 醫療保健/製藥

- 食品

- 居家護理

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東和非洲

- 北美洲

第6章 競爭形勢

- 公司簡介

- Amcor PLC

- Berry Global Inc.

- Essel Propack Ltd.

- Clariant International Ltd.

- Coveris Holdings SA

- CPP Global Holdings Ltd.

- Essel Propack Ltd.

- CCL Industries Inc.

- IntraPac International Corporation

- Albea SA

- VisiPak Inc.

- HCT Packaging Inc.

- IntraPac International LLC

- Printpack Inc.

- Unicep Packaging, Inc.

- Silgan Holdings Inc.

- Fischbach KG.

- CTL-TH Packaging Group SL

- Viva Group Inc.

第7章 投資分析

第8章 市場機會及未來趨勢

The Tube Packaging Market size is estimated at USD 6.66 billion in 2024, and is expected to reach USD 9.5 billion by 2029, growing at a CAGR of 7.39% during the forecast period (2024-2029).

Tubes are one of the most popular packaging formats in the cosmetic and personal care segment, primarily attributed to their convenience, portability, and flexibility to hold and dispense a wide variety of products.

Key Highlights

- Factors like the increasing urbanization, growing millennial population, and rising disposable incomes of consumers are the major contributors to the growth of the market studied. Urbanization has been responsible for boosting disposable income and creating awareness about the availability of different cosmetics products, thus creating several opportunities for market players and significantly spurring the demand for Tube packing.

- The laminated tubes are currently governing the market owing to its multi-layered barrier structure. These tubes improve the shelf-life of the product by providing excellent barrier properties and minimize the transfer of oxygen and light, offering protection against bacteria, due to which the demand is rising.

- The pharmaceutical market is also driving the growth of the market especially medicines that are used in Dermatology where tube packing is extensively used. Global pharmaceutical sales globally in 2018 were 110 billion USD according to AstraZeneca and the future growth of the pharmaceutical sector will drive the demand for tubes and bottles packaging particularly.

- Further, technological advancements in cosmetic packaging due to focus on enhancing the user's experience such as by including a brush or sponge head, on a tube with a pump and other innovative applicators, are being requested more often.

- Urbanization has created several opportunities for market players, by boosting disposable income and creating awareness about the availability of different cosmetics products thereby significantly spurring the demand for Tube packing.

- However, regulations vary across regions and countries for packing which may hamper the growth of the market.

Tube Packaging Market Trends

Plastics to Drive the Market Growth

- Plastic is a prominent material used in tube packaging, due to its low cost, lightweight, flexibility, durability, and other factors. In addition, it is odorless and offers a pleasant appearance.

- The usage of plastic tubes in various industries that include cosmetic and personal care, food, and pharmaceutical, among others, leads to fewer transportation costs and energy waste. This type of packaging also ensures product safety and prolongs shelf life.

- As convenience and hygiene are gaining importance across regions, the demand for plastic tubes is propelling, specifically in the cosmetic industry.

- Nevertheless, sustainable packaging has ensured significant amounts of plastic recycling and innovations in material technology that have enabled the development of environment-friendly plastic packaging solutions. Further, to strike a balance between better economics and sustainability, major players are shifting to recyclable packaging by using reusable and compostable plastic material.

- The European Union (EU) and the American Chemical Council's Plastics Division recently announced the target of 100% use of recyclable, reusable and compostable plastics by 2025 and 2040 in their regions. These regulations are expected to shape the plastic tube packaging industry in the future.

- However, over the last decade, the environmental impacts of plastic have resulted in a slowdown of the segment.

Asia-Pacific to Execute a Significant Growth Rate

- The population in Asia-Pacific is increasingly improving its lifestyle and living standards. This factor coupled with the rising trends in cosmetic and pharmaceutical products and awareness for health and hygiene is driving the market in the region.

- Apart from cosmetic demand from the region, Asia-Pacific countries are significantly exporting cosmetic products to the US. According to the International Trade Administration, over 20% of US. global exports are via Asian countries.

- Moreover, the demand for healthcare and hygiene in the country is also high. In China with a population of 1.37 billion, the oral disease has a large burden on the government healthcare system and is an even greater economic burden on individuals. Periodontal diseases are common in India as well. these factors have resulted in an increased demand for toothpaste and other oral care products that use tube packaging.

- Besides, China accounted for 52% of the world's plastic scrap imports in 2018, according to the Institute of Scrap Recycling Industries. This emphasis on plastic recycling is also estimated to expand the plastic tube packaging sector, thereby, supporting the growth of tube packaging.

Tube Packaging Industry Overview

Thetube packaging market is highly fragmented due to the presence of a large number of players. Moreover, sustainable competitive advantage can be gained through innovation (design, technology, and application) and partnerships.In addition, there is a fairly high probability of new players entering the market studied, further intensifying the competition. Therefore, the market incumbents have been identified to adopt a powerful competitive strategy, characterized by acquisitions, mergers and acquisitions, and a strong emphasis on R&D.Some key market players in the market are Amcor, Bemis, Tetrapack among others.Some key recent developments in the market include:

- March 2018 -Packaging companies, Amcor and SIG, partnered for aluminum sourcing. The collaboration aimedat ensuring the supply chain of aluminum foil meets the statutes of the Aluminum Stewardship Initiative (ASI).

- February 2018 -Berry Global Group, Inc. acquired the Clopay Plastic Products Company, Inc. a subsidiary of Griffon Corporation for USD 475 million in cash on a debt-free, cash-free basis. The acquisition of Clopay is directly aligned with the company's fundamental strategic initiatives.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Growth in Flexible Packaging

- 4.3.2 Increasing Demand for Convenience Packaging

- 4.4 Market Challenges

- 4.4.1 Regulations in the Packaging Industry

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type of Package

- 5.1.1 Squeeze

- 5.1.2 Twist

- 5.1.3 Stick

- 5.1.4 Cartridges

- 5.1.5 Others

- 5.2 By Material

- 5.2.1 Plastic

- 5.2.2 Paper

- 5.2.3 Aluminum

- 5.2.4 Others

- 5.3 By Application

- 5.3.1 Cosmetics & Toiletries

- 5.3.2 Healthcare & Pharmaceutical

- 5.3.3 Food

- 5.3.4 Homecare

- 5.3.5 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of Latin America

- 5.4.5 Middle-East & Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle-East & Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amcor PLC

- 6.1.2 Berry Global Inc.

- 6.1.3 Essel Propack Ltd.

- 6.1.4 Clariant International Ltd.

- 6.1.5 Coveris Holdings SA

- 6.1.6 CPP Global Holdings Ltd.

- 6.1.7 Essel Propack Ltd.

- 6.1.8 CCL Industries Inc.

- 6.1.9 IntraPac International Corporation

- 6.1.10 Albea S.A

- 6.1.11 VisiPak Inc.

- 6.1.12 HCT Packaging Inc.

- 6.1.13 IntraPac International LLC

- 6.1.14 Printpack Inc.

- 6.1.15 Unicep Packaging, Inc.

- 6.1.16 Silgan Holdings Inc.

- 6.1.17 Fischbach KG.

- 6.1.18 CTL - TH Packaging Group SL

- 6.1.19 Viva Group Inc.