|

市場調查報告書

商品編碼

1329860

光電子市場規模和份額分析 - 增長趨勢和預測(2023-2028)Optoelectronics Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

光電子市場規模預計將從2023年的449.8億美元增長到2028年的594.6億美元,在預測期內(2023-2028年)複合年增長率為5.74%。

先進製造和加工技術的日益採用正在推動利用激光和機器視覺系統的工業應用中對光電元件的需求。

主要亮點

- 光電子學的進步極大地促進了通過光纖的有效信息傳輸(包括處理設備之間和處理設備內的通信)、激光盤中的高容量光存儲以及其他一些特定應用。此外,汽車行業不斷增長的需求,特別是電動汽車、自動駕駛卡車和自動駕駛汽車的採用,預計將推動光電器件的採用,進一步推動市場發展。

- 激光二極管是用於激光產生的最廣泛使用的光電元件。當前光電子市場的趨勢是縮小各種器件的尺寸,並實現在同一芯片上集成其他電子元件的系統的更高集成度,例如發光二極管陣列、激光陣列和集成系統。

- 激光二極管在多種應用中都有需求,包括光纖通信、條形碼讀取器、DVD/藍光播放器、打印和通信技術。相比之下,工業領域對激光器的需求不斷增長也推動了市場的增長。

- 光電類產品的價格高於傳統產品,這是限制行業增長的因素之一。與 LED 顯示器相比,客戶可能更喜歡基於光電產品的替代技術,例如 LCD 顯示器。另外,與普通商品相比,備件的更換成本更大。自 COVID-19 以來,市場增長勢頭強勁,生產設施恢復全面生產,以滿足各工業領域對光電元件不斷增長的需求。

光電市場趨勢

激光二極管預計將大幅增長

- 激光二極管是廣泛用於產生激光的光電器件,其功能範圍從光纖 DVD/藍光刻錄機到打印、網絡技術、光通信和條形碼讀取器。此外,電子設備的高使用率已經建立了標準的顯示技術,消費者要求更高的分辨率和效率。

- 高功率激光器在工業領域有著廣泛的需求,其應用範圍廣泛,包括切割、焊接和機械加工。公司正在轉向激光技術來利用高性能和可靠性,這推動了對高功率激光二極管的需求。

- 激光二極管應用於多種行業,包括汽車行業。激光二極管在汽車領域用於生產汽車頭燈,可提高駕駛因素的可見性並提高道路安全性。此外,汽車車頭燈小型化的趨勢也增加了對激光二極管的需求。

- 此外,汽車行業的不斷發展預計將有助於預測期內該細分市場的增長。例如,2022年11月,京瓷公司宣布將推出一款汽車夜視系統,能夠在雨、夜、雪、霧、煙等低能見度駕駛條件下可靠識別潛在碰撞物品。該技術旨在最大限度地減少道路事故並鼓勵更安全的駕駛。

- 激光二極管市場開發的增加預計將在預測期內推動市場需求。例如,2022 年 4 月,Lumentum 開發了 FemtoBlade 激光技術,作為該公司高精度、超快工業激光器系列的第二個版本。這種新穎的系統具有靈活的架構和強大的功能。

亞太地區預計將佔據較大份額

- 亞太地區的快速擴張主要是由該地區最大的消費電子產品和汽車市場推動的。此外,光電器件有望在智慧城市計劃、虛擬現實和模擬現實等新創新、大數據、物聯網(IoT)和智能工業設備等其他領域得到發展。

- 亞太地區是半導體元件製造的中心。該地區是光電子行業主要企業的集中地,包括ROHM, Sony Corporation, Renesas, Samsung Electronics, Panasonic Corporation, Hamamatsu Photonics K.K., Sharp Corporation,以及一些小型地區公司。

- 印度和中國等新興經濟體政府加大市場開發力度預計將有助於預測期內的市場增長。例如,2022 年 4 月,Navi Mumbai Municipal Corporatio選擇將所有路燈轉換為 LED 照明。今年將更換 35,000 盞路燈,每年可節省 7 印度盧比(850,000 美元)。該市所有道路,包括高速公路,都將安裝LED照明。部分地點將於 2021 年更換,但大部分地點將於 2022 年更換。該項目的招標工作已經開始

- 現代汽車使用光電技術來實現車輛操作的自動化,例如製動信號和前燈。因此,豪華和超豪華汽車的收入不斷增加,刺激了光電行業的需求。印度汽車經銷商全國組織 FADA(Federation of Automotive Dealers Associations)預計,由於庫存增加以及與 OEM 廠商的合作關係,2021 年 12 月豪華車零售額將增長 19.7%。因此,豪華和超豪華汽車銷量的增加將在預測期內推動光電業務的發展。

光電產業概況

由於General Electric Company、Panasonic Corporation、Samsung Electronics、Omnivision Technologies Inc.、Sony Corporation等主要參與者的存在,光電子市場上競爭公司之間的競爭非常激烈。他們的產品創新能力,加上在研發方面的大量投資,使他們能夠比競爭對手獲得競爭優勢。戰略合作夥伴關係、併購使公司得以發展、獲得顯著的市場份額並在市場上保持牢固的立足點。

鎵芯光電於2022年9月從中國南京大學分拆出來,提供以碳化矽(SiC)和氮化鎵(GaN)等寬帶隙半導體為核心的紫外(UV)探測器和模塊,並正式推出了首款紫外探測器和模塊。商用 SiC 基極紫外 (EUV) 光電二極管。

2022年7月,位於中國的國星光電與華為正式簽署“合作協議”,生產Mini LED和Micro LED顯示技術。此次合作本著優勢互補、互惠互利、共同發展的原則。它將聚焦雙方公司的基礎技術和產業資源。兩家公司都打算進行廣泛的創新和研究,以擴大潛在的經濟影響力。

2022 年 6 月,Synopsys和Juniper出資新成立的獨立公司 OpenLight 宣布推出全球首個集成激光器的開放式矽光子架構。這家總部位於加利福尼亞州的公司旨在為芯片製造商提供一種構建光子集成電路(PIC)的方法,以最大限度地發揮其性能潛力。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究結果和市場定義

- 調查範圍

第二章研究方法論

第三章執行摘要

第四章市場動態

- 市場概況

- 價值鏈/供應鏈分析

- 行業吸引力——波特五力

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 市場驅動力

- 對智能家電和下一代技術的需求不斷增長

- 增加技術的工業應用

- 市場製約因素

- 製造加工成本高

第五章市場細分

- 元件類型

- 引領

- 激光二極管

- 傳感器

- 光耦

- 太陽能電池

- 其他

- 終端用戶行業

- 汽車

- 航空航天與國防

- 消費類電子產品

- 信息技術

- 衛生保健

- 住宅/商業

- 行業

- 其他

- 區域

- 北美

- 美國

- 加拿大

- 歐洲

- 英國

- 法國

- 德國

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲

- 中東/非洲

- 北美

第六章 競爭狀況

- 公司簡介

- General Electric Company

- Panasonic Corporation

- Samsung Electronics

- Omnivision Technologies Inc

- Sony Corporation

- Osram Licht AG

- Koninklijke Philips N.V.

- Vishay Intertechnology, Inc

- Texas Instruments Inc

- Stanley Electric Co

- Rohm Co., Ltd(ROHM SEMICONDUCTOR)

- Mitsubishi Electric

第七章投資分析

第八章市場機會與未來趨勢

The Optoelectronics Market size is expected to grow from USD 44.98 billion in 2023 to USD 59.46 billion by 2028, at a CAGR of 5.74% during the forecast period (2023-2028).

The increasing adoption of advanced manufacturing and fabricating technologies is driving the demand for optoelectronic components in the industrial sector using laser and machine vision systems.

Key Highlights

- Advances in optoelectronics have made considerable contributions to the efficient transmission of information via optical fibers (including communication between processing machines and within them), to the high-capacity mass storage of information in laser disks, and several other specific applications. Moreover, the increasing demand in the automotive industry, specifically with the adoption of electric vehicles, self-driven trucks, and autonomous vehicles, is expected to boost optoelectronic devices' adoption, further driving the market.

- Laser diodes are the most widely adopted optoelectronic components deployed in laser generation. The current market trends in optoelectronics are toward scaling down the sizes of different devices and attaining high levels of integration in systems, such as arrays of light-emitting diodes, laser arrays, and integrated systems, with other electronic elements on the same chip.

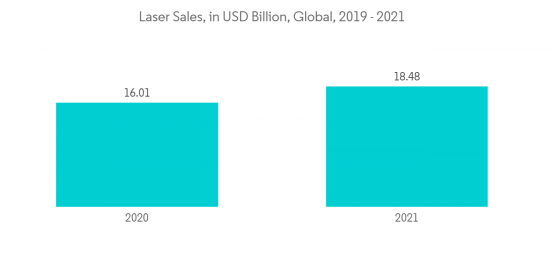

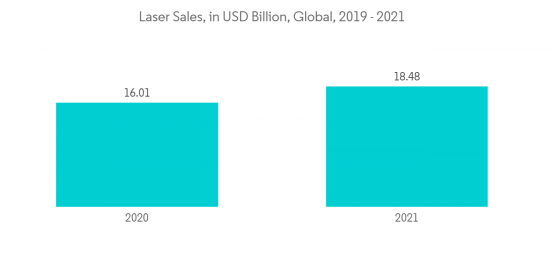

- Laser diodes are witnessing demand across various applications, including fiber optic communications, barcode readers, DVD/Blu-ray players, printing, and communication technologies. In comparison, growing demand for lasers in the industrial sector has also been identified to boost the market's growth.

- The price of optoelectronics-based goods is higher than that of traditional products, which is among the factors limiting industry growth. Customers may prefer substitute technologies to optoelectronics-based goods, including LCD displays, over LED displays since LCD is a more cost-effective solution. Further, compared to typical goods, the cost of replacing spare components is more significant. Post-COVID-19, the market has gained impetus, with production facilities restarting full-capacity production to fulfill the increased demand for optoelectronic parts throughout various industrial verticals.

Optoelectronics Market Trends

Laser Diodes are Expected to Witness a Significant Growth

- Laser diodes are widely utilized optoelectronic elements in laser generation, with capabilities ranging from fiber DVD/Blu-ray recorders to printing and networking technologies, optic communications, and barcode readers. Furthermore, high usage of electronic equipment has established standard display technology, with consumers wanting better resolution and efficiency, driving the rising demand for electronic devices and increasing the optoelectronics industry.

- High Power lasers are finding extensive demand in industrial sectors for a wide range of applications, including cutting, welding, and fabrication. Companies are moving towards laser technologies to take advantage of high performance and reliability, which is driving the demand for high-power laser diodes.

- Laser diodes are employed in a variety of industries, including automobile industries. Laser diodes are utilized in the automobile sector to produce car headlights that improve driver visibility, leading to better road safety. Furthermore, the tendency to downsize vehicle headlights is increasing demand for laser diodes.

- Moreover, increasing development in the automobile industry is expected to contribute to segment growth over the forecast period. For instance, in November 2022, Kyocera Corporation announced the introduction of an Automotive Night Vision System capable of reliably identifying collision-risk items in low-visibility operating circumstances such as rain, night, snow, fog, or smoke. The technology is designed to minimize traffic accidents and encourage safer driving.

- Increasing development in laser diodes is expected to drive market demand over the forecast period. For instance, in April 2022, The FemtoBlade laser technology was developed by Lumentum as the second version of the company's line of high-precision ultrafast industrial lasers. The novel system has a flexible architecture and a lot of power.

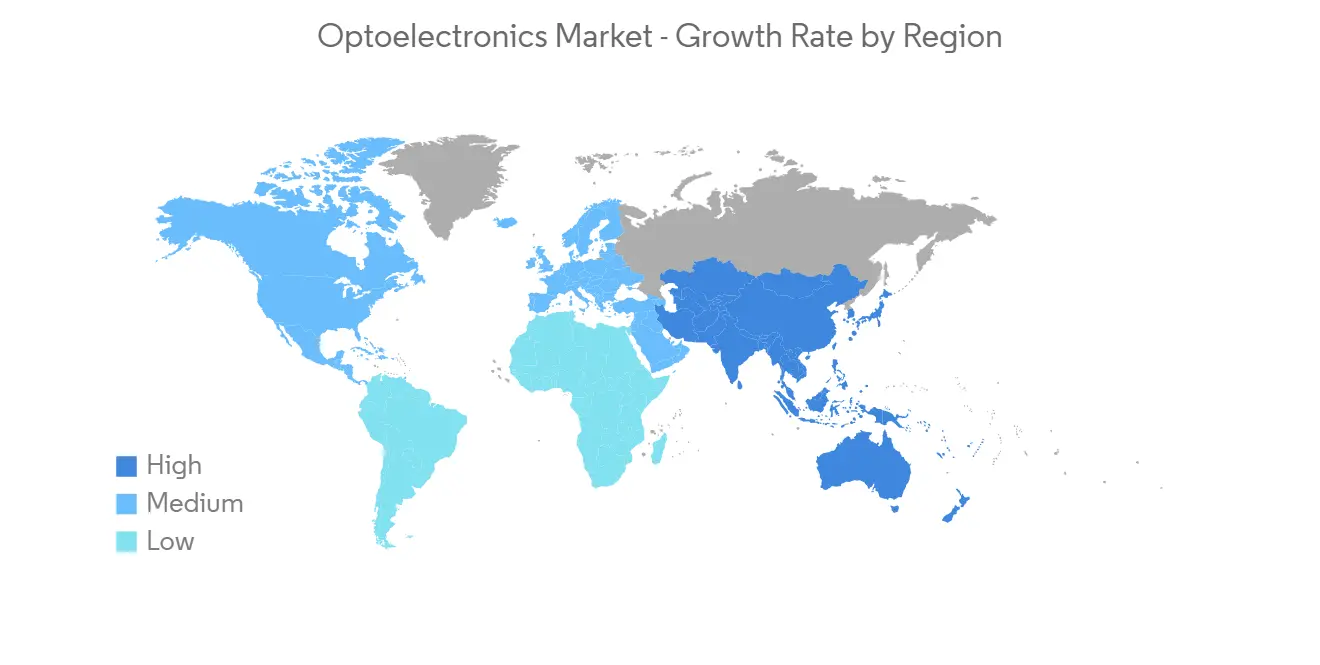

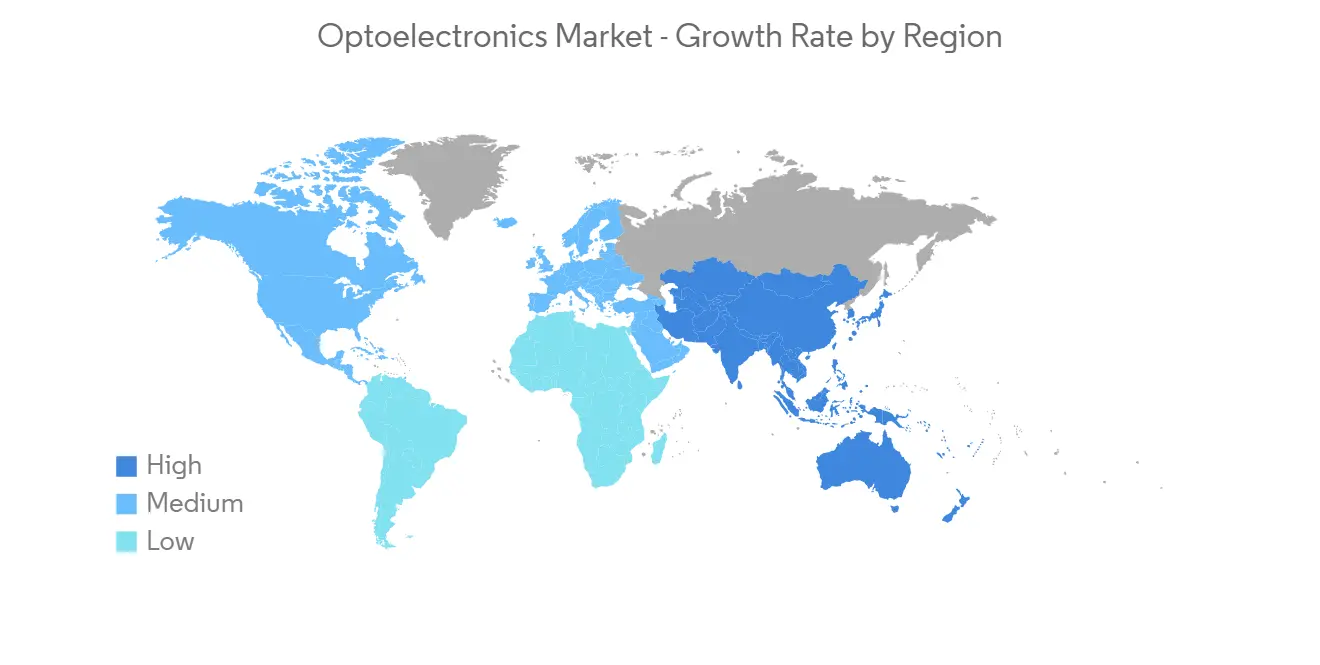

Asia Pacific is Expected to Hold a Significant Share

- The region's rapid expansion is primarily attributable to the region's foremost consumer electronics and automobile markets. Furthermore, development in optoelectronic devices is expected in other areas, including smart city initiatives, emerging innovations including virtual and simulated reality, big data, the Internet of Things (IoT), and intelligent industrial appliances.

- Asia-Pacific is the manufacturing center for semiconductor components. The region is home to the bulk of significant companies in the optoelectronics industry, including Rohm Co., Ltd, Sony Corporation, Renesas, Samsung Electronics Co., Ltd., Panasonic Corporation, Hamamatsu Photonics K.K., and Sharp Corporation, as well as several minor regional businesses which in turn is expected to drive market growth over the forecast period.

- Increasing developments by governments in emerging economies such as India and China are expected to contribute to market growth over the forecast period. For instance, in April 2022, the Navi Mumbai Municipal Corporation chose to convert all streetlights to LED lights; 35,000 streetlights were to be replaced this year, resulting in an INR 7 Crore (USD 0.85 million) yearly savings. All city roadways, including motorways, will have LED illumination installed. While several were changed in the fiscal year 2021, the majority will be changed in the fiscal year 2022. The bidding procedure for the project has begun

- In modern automobiles, optoelectronics automates vehicle operations, including brake signals and headlights. As a result, rising revenues from luxury and ultra-luxurious automobiles boost demand for the optoelectronics sector. As per the Federation of Automotive Dealers Associations (FADA), a nationwide organization comprising automobile sellers in India, retail luxury car sales in December 2021 would increase by 19.7% due to increasing inventory and partnerships with OEMs. As a result, rising sales of premium and ultra-luxury automobiles propel the optoelectronics business over the forecast period.

Optoelectronics Industry Overview

The competitive rivalry in the optoelectronics market is high owing to the presence of major players like General Electric Company, Panasonic Corporation, Samsung Electronics, Omnivision Technologies Inc., and Sony Corporation, among others. Their ability to innovate their products, coupled with hefty investments in research and development, has allowed them to gain a competitive advantage over their competitors. Strategic partnerships, mergers, and acquisitions have allowed the companies to grow and gain a substantial market share and maintain a strong foothold in the market.

In September 2022, GaNo Optoelectronics Inc., a spin-off from Nanjing University in China that provides ultraviolet (UV) detectors and modules centered on wide-bandgap semiconductors like silicon carbide (SiC) and gallium nitride (GaN), officially launched the first commercialized SiC-based extreme ultraviolet (EUV) photodiodes.

In July 2022, Nationstar Optoelectronics, located in China, established a formal "cooperation agreement" with Huawei to manufacture mini-LED and micro-LED display technology. The collaboration is founded on complementary advantages, reciprocal benefits, and joint development principles. It will focus on both parties' fundamental technology and industrial resources. The two firms want to conduct extensive innovation and research to broaden their potential economic coverage.

In June 2022, OpenLight, a newly created independent business funded by Synopsys and Juniper, revealed the world's first open silicon photonics architecture with integrated lasers. The California-based corporation aims to give chip makers a way to construct photonic integrated circuits (PICs) with the greatest potential performance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter Five Forces

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Growing demand for Smart Consumer Electronics and Next Generation Technologies

- 4.4.2 Increasing Industrial Applications of the Technology

- 4.5 Market Restraints

- 4.5.1 High Manufacturing and Fabricating Costs

5 MARKET SEGMENTATION

- 5.1 Component type

- 5.1.1 LED

- 5.1.2 Laser Diode

- 5.1.3 Image Sensors

- 5.1.4 Optocouplers

- 5.1.5 Photovoltaic cells

- 5.1.6 Others

- 5.2 End-User Industry

- 5.2.1 Automotive

- 5.2.2 Aerospace & Defense

- 5.2.3 Consumer Electronics

- 5.2.4 Information Technology

- 5.2.5 Healthcare

- 5.2.6 Residential and Commercial

- 5.2.7 Industrial

- 5.2.8 Others

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Germany

- 5.3.2.4 Spain

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Mexico

- 5.3.4.2 Brazil

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle-East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 General Electric Company

- 6.1.2 Panasonic Corporation

- 6.1.3 Samsung Electronics

- 6.1.4 Omnivision Technologies Inc

- 6.1.5 Sony Corporation

- 6.1.6 Osram Licht AG

- 6.1.7 Koninklijke Philips N.V.

- 6.1.8 Vishay Intertechnology, Inc

- 6.1.9 Texas Instruments Inc

- 6.1.10 Stanley Electric Co

- 6.1.11 Rohm Co., Ltd (ROHM SEMICONDUCTOR)

- 6.1.12 Mitsubishi Electric