|

市場調查報告書

商品編碼

1403908

X光檢測器:市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測X-Ray Detectors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

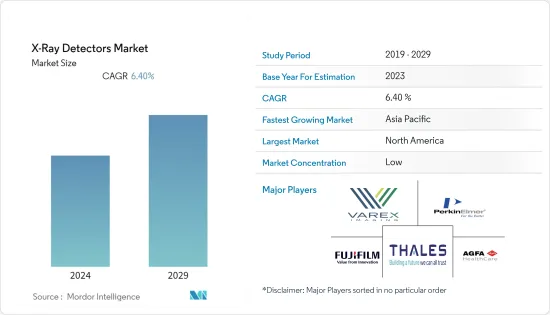

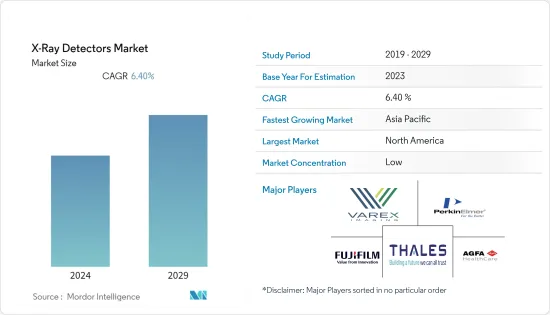

上年度X光檢測器市值為35.5478億美元,預計未來五年將達51.5778億美元,預測期內複合年成長率為6.40%。

由於技術進步和創新改善了醫療保健服務和護理質量,醫療保健行業的趨勢正在迅速發展。對診斷的需求不斷成長,促使世界各地的市場參與企業競相推出和創新。因此,X光檢測器的研發活動和研發成本不斷擴大。

主要亮點

- 由於技術的進步和各種最終用戶需求的增加,過去幾十年來,X光檢測器在尺寸和性能方面經歷了許多創新。此外,分析程序的顯著進步,例如在較小空間中組合儀器以及間接激發 X光頻譜的大量樣品,預計將在預測期內激增市場需求。科技的進步使X光檢查更安全、更有效、更方便。

- 最終用戶(尤其是石油天然氣和發電行業)對行動設備的需求不斷成長,以檢查位於傳統 X光檢測解決方案無法訪問的偏遠地區的設備,這正在推動市場創新。主要享受行動X光偵測設備好處的偵測服務供應商也在推動行動X光偵測設備的量產。為了應對這一需求,製造商正在產品系列多樣化,以滿足工業用戶的需求。

- 多家OEM正計劃拓展該市場。例如,2022年6月,總部位於旁遮普邦的X光管、平板檢測器和監視器製造商Arranger OEM(印度)也在擴大在檢測器。此外,影響FPDS產業成長的兩個重要因素是FPD(平板檢測器)成本的下降和改裝FPD(平板檢測器)的使用增加。

- 此外,對數位成像技術不斷成長的需求可能會推動所研究的市場需求。例如,2022 年 10 月,Google雲端發布了醫療影像套件。醫學影像套件是一項新技術,可以支援放射學和其他影像資料的可存取性和互通性。據 Google Cloud 稱,新套件包括專注於儲存、實驗室、資料集、儀表板和用於影像處理的 AI 管道的組件。

- 此外,俄羅斯和烏克蘭之間持續的衝突預計將對電子產業產生重大影響。這場爭端已經加劇了已經影響該產業的半導體供應鏈問題和晶片短缺問題。這種干擾可能導致鎳、鈀、銅、鈦、鋁和鐵礦石等關鍵原料的價格波動,進而導致材料短缺。這似乎為X光膠片的製作帶來了問題。

X光檢測器市場趨勢

預測期內醫療應用將大幅成長

- 過去幾年,由於診斷和醫學影像領域的擴展,全球對醫用X光檢測器的需求不斷增加。在醫療設備醫療設備業,由於對診斷放射學測試的日益關注、慢性病負擔的增加以及由於整合和合併而引入高效 X光設備,每年診斷成像測試的數量正在增加。醫療器械市場。

- 根據聯合國《世界人口展望》,65歲及以上的人口數量正在穩定增加。到2050年,全球60歲及以上人口預計將達到20億,其中80%將居住在低收入和中等收入國家。

- 因此,老年人口的增加以及整形外科和心血管手術的增加可能會進一步推動醫用 X 光檢測器的採用。此外,創傷、運動傷害和癌症發生率的增加意味著每年有更多的患者,特別是在新興國家,選擇診斷影像。肺部疾病的增加進一步增加了對有效篩檢方法來檢測胸部異常的需求,從而支持了對 X 光檢測器的需求。

- 例如,2022年11月,威脅檢測和安全檢查技術提供商InsmithDetection宣布與Navratna國防PSU(公共部門事業)BharatElectronics簽署契約,在印度製造先進的X光篩檢技術。它已與BEL Limited 簽署了一份合作備忘錄。這些戰略聯盟正在推動 X光檢測器市場的需求。

- 據印度品牌資產基金會稱,印度醫療保健產業的價值過去已達到 1,900 億美元,預計到 2024 年至 2025 年將達到 3,700 億美元。這一成長是由於對專業和優質醫療設施的需求不斷成長。此外,到 2025 年,印度醫療保健公共支出預計將成長 2.5%。

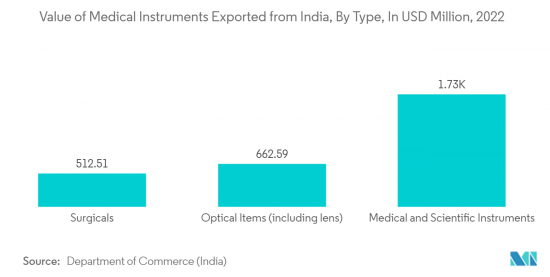

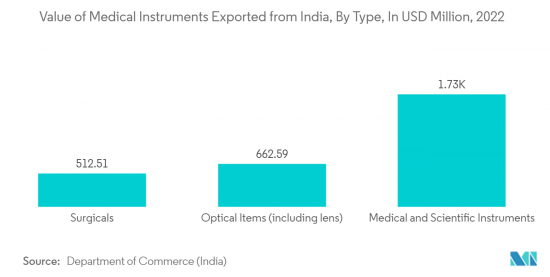

- 據印度商務部稱,截至2022會計年度末,印度手術器械出口額約5.12億美元。過去幾年,此類設備的出口額持續成長。

預計美國將佔較大市場佔有率

- 醫療領域的快速技術發展正在與先進 X 光檢測器等技術融合。迫切需要改善人們的健康並對抗日益增加的健康疾病和感染疾病的負面影響。因此,需要持續提供領先美國市場的診斷和監測服務。

- 在美國,衛生與公共服務部 (HHS) 擁有內閣級管轄權,在資助和維持醫學科學技術研究方面擁有很大的自由度。根據醫療保險和醫療補助服務中心的數據,從2022年到2031年,NHE的平均成長率(5.4%)將超過GDP的平均成長率(4.6%),導致近期醫療支出佔國民所得的比重上升。 GDP預計到2031年將從18.3%成長到19.6%。

- 美國人口老化不斷加劇,久坐的生活方式和不健康的飲食習慣導致的慢性病迅速增加。此外,醫療設施增加帶來的醫療基礎設施新興市場的開拓預計將推動美國醫用X光檢測器市場的需求。

- 例如,根據美國心臟協會發布的2022年統計數據,美國心臟衰竭盛行率為600萬人,佔上上年度總人口的1.8%。此外,根據國際糖尿病聯盟2022年發布的統計數據,預計到2030年,糖尿病患者人數將達到328.82萬人,到2045年將達到346.85萬人。

- 三星電子、佳能和美國FUJIFILM Medical系統等公司正在策略性投資生產使用 X光檢測器的新型 X光系統和使用 X光檢測器的行動 X光系統。這些系統的生產預計將增加 X光檢測器的使用。

- 例如,2022年11月,Canon Inc.子公司Canon Medical Components 美國在北美放射學會(RSNA)上宣布了新產品陣容。 Canon Medical Components USA 的 CXDI-Elite 系列具有高靈敏度、高影像品質、超輕量、符合人體工學的設計,可實現長電池壽命、易於操作和 AED4 功能。 CXDI-Elite 是一款數位 X 光檢測器高靈敏度、高影像品質、超輕重量、長電池壽命、易於操作和 AED4 功能,使其成為行動應用和一般放射線照相的理想選擇。獨特的功能、智慧型NR 和內建 AEC5 有助於擴展數位放射成像的可能性。

X光檢測器產業概況

X 光檢測器市場高度分散,主要企業透過策略聯盟、協議、擴張、合作夥伴關係、新產品發布、合資、收購等方式擴大在該市場的影響力。市場主要企業包括 Varex Imaging Corporation、PerkinElmer Inc.、Thales Group、Fujifilm Medical Systems、Agfa Healthcare、Konica Minolta Inc.、Canon Inc.、Teledyne DALSA Inc.、Analogic Corporation、Comet Holding AG、Hamamamatsu Photonics KK、Rayence ETC 。

2022 年 11 月,Block Imaging 宣布與 Fujifilm Healthcare Solutions 建立 X-RAY 合作夥伴關係。透過大多數FUJIFILM產品,提供者可以體驗先進的影像處理技術。 Block Imaging 計畫提供各種新產品,涵蓋創新、經濟高效和節能的技術。醫療保健供應商提供行動數位放射成像設備,例如 FDR ES檢測器、FDR D-EVO III 和 FDR D-EVO II檢測器、Clinica X OTC 和FDR Clinica X FS 套件、FDR Go Plus 和FDR AQRO。您可以信賴塊成像提供此類X光產品。透過與FUJIFILM Healthcare Solutions 合作,Block 能夠為美國各地的醫療保健專業人員帶來創新技術。

2022 年 11 月,Teledyne DALSA 收購了 Sigma 篩檢 BV 用於篩檢壓感乳房 X 光攝影的專利和智慧財產權組合。檢測器和壓感壓縮的獨特組合有望為乳房X光照相術中的即時診斷資訊和生物標記物開發新的可能性。該集團打算透過新的子系統產品擴展其乳房 X 光檢查 CMOS X 光檢測器產品線,以最佳化和提高乳房 X 光檢查期間患者的舒適度。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 宏觀經濟走勢對市場的影響

第5章市場動態

- 市場促進因素

- 數位成像技術的公共和私人投資成長

- 數位檢測器的價格下降和效益增加

- 市場挑戰

- 配備數位放射線攝影 (DR) 裝置的數位 X 光系統成本較高

第6章市場區隔

- 按類型

- 平板探測器

- 間接平板檢測器

- 直接平板檢測器

- 電腦放射線攝影(CR)檢測器

- 電荷耦合元件檢測器

- 其他類型

- 平板探測器

- 行動性愛

- 固定檢測器

- 攜帶式檢測器

- 按用途

- 醫療用途

- 牙科用

- 安全

- 工業的

- 其他用途

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章競爭形勢

- 公司簡介

- Varex Imaging Corporation

- PerkinElmer Inc.

- Fujifilm Medical Systems

- Thales Group

- Agfa Healthcare

- Konica Minolta Inc.

- Canon Inc.

- Teledyne DALSA Inc.

- Analogic Corporation

- Comet Holding AG

- Hamamatsu Photonics KK

- Rayence Co. Ltd

第8章投資分析

第9章 市場的未來

The X-ray detectors market was valued at USD 3554.78 million the previous year and is expected to register a CAGR of 6.40% during the forecast period to become USD 5157.78 million in the next five years. The healthcare industry trends rapidly evolve due to technological advancements and innovation, improving healthcare services and care quality. Following the escalating demand for diagnostics, numerous global market participants are vying for product launches and innovations. This factor has expanded research and development (R&D) activity and expenditure to build X-ray detectors.

Key Highlights

- X-ray detectors have undergone several innovations in size and performance over the past few decades, aided by technological advancements and increasing demand from various end-user verticals. Further, the considerable advances in analytical procedures, such as combinations of instruments in a smaller space and indirect excitation of X-ray spectra bulk samples, are expected to surge the demand for the market over the foreseen period. With technological advancements, X-ray detection in the market has become safer, more effective, and more convenient.

- Increasing demand for mobile equipment in the market, especially from end-users, such as oil and gas, power generation, etc., to inspect the equipment installed in remote places that are not accessible through traditional X-ray inspection solutions, is pushing several innovations in the market. Also, inspection service providers in the market, which primarily benefit from mobile equipment, are encouraging mobile X-ray equipment's mass production. Owing to such demand, manufacturers are diversifying their product portfolios to suit the needs of industrial users.

- Several OEMs are planning to expand their footprint in the market. For instance, In June 2022, Punjab-based Allengers OEM (India), manufacturers of X-ray tubes, flat panel detectors, and monitors, is also expanding its capacity in the state, thus driving the demand for X-ray detectors. Two further significant factors impacting the growth of the FPDS industry are the declining cost of FPD (Flat Panel Detectors) and the increasing use of retrofit FPD (Flat Panel Detectors)

- Furthermore, the increasing demand for digital imaging technologies may propel the studied market demand. For instance, in October 2022, Google Cloud announced Medical Imaging Suite, a new technology it says can help with the accessibility and interoperability of radiology and other imaging data. According to Google Cloud, the new suite includes components focused on storage, lab, datasets, dashboards, and AI pipelines for imaging.

- Moreover, the ongoing conflict between Russia and Ukraine is expected to significantly impact the electronics industry. The conflict has already exacerbated the semiconductor supply chain issues and the chip shortage that have affected the industry for some time. The disruption may result in volatile pricing for critical raw materials such as nickel, palladium, copper, titanium, aluminum, and iron ore, resulting in material shortages. This would obstruct the manufacturing of X-ray film.

X-Ray Detectors Market Trends

Medical Applications to Grow Significantly Over the Forecast Period

- Over the past few years, the expansion of the diagnostics and medical imaging sector has indicated a global demand for medical X-ray detectors. The medical devices industry is witnessing a growth in the number of imaging and diagnostic tests performed yearly owing to increasing focus on radiological diagnostic tests, rising chronic disease burden, and introduction of efficient X-ray instruments through consolidation and mergers in the medical appliances market.

- According to the UN data on World Population Prospects, the number of people over 65 is steadily increasing. By 2050, the world's population aged 60 years and older is anticipated to reach 2 billion, of which 80% will live in lower and middle-income nations.

- Hence, the rising geriatric population and an increasing number of orthopedic and cardiovascular procedures would further drive the adoption of X-ray detectors in medical applications. Also, the growing incidence of trauma, sports injuries, and cancer denotes a significant patient pool opting for diagnostic imaging tests annually, particularly in emerging countries. The ever-increasing prevalence of lung diseases further drives the need for effective screening methods to detect chest abnormalities, which supports the demand for X-ray detectors.

- For instance, in November 2022, In Smiths Detection, a provider of threat detection and security inspection technologies, announced that it had signed a memorandum of understanding (MoU) with Navratna Defence PSU (public sector undertakings) Bharat Electronics Limited (BEL) for the manufacture of advanced X-ray screening technologies in India. Such strategic collaborations are driving the demand for the X-ray detector market.

- The Indian healthcare industry reached USD 190 billion previously, and according to the India Brand Equity Foundation, it is expected to reach USD 370 billion by 2024-2025. This increase is due to the growing demand for specialized, higher-quality healthcare facilities. In addition, public spending on healthcare in India is predicted to increase by 2.5% by 2025.

- According to the Department of Commerce (India), at the end of fiscal year 2022, the export value for surgical instruments from India was approximately USD 512 million. A consistent increase in the export value of such devices was seen over the past several years.

United States is Expected to Account for Significant Market Share

- The rapid technological development in the medical field is now being merged with the technologies, such as advanced X-ray detectors. There is a strong focus on improving the health conditions of people, as well as tackling the adverse effects of rising health diseases and infections. Therefore, there needs to be a constant diagnostic and monitoring service driving the Market in the United States.

- In the United States, Health and Human Services (H.H.S.), governed by the cabinet-level department of the United States, is highly liberal in funding and maintaining technological research in medical sciences. According to Centers for Medicare & Medicaid Services, over 2022-2031, average growth in NHE (5.4%) is projected to outpace that of average G.D.P. growth (4.6%), resulting in an increase in the health spending share of G.D.P. from 18.3% in recently to 19.6% in 2031.

- The United States is witnessing a rise in the senior population and a surge in chronic diseases due to sedentary lifestyles and unhealthy eating habits. Moreover, rising medical infrastructure developments with increased medical facilities are expected to propel the demand for the medical X-ray detectors market in the United States.

- For instance, according to 2022 statistics published by the American Heart Association, the prevalence rate of heart failure in the United States is 6 million, 1.8% of the total population in the previous year. Additionally, according to 2022 statistics published by the International Diabetes Federation, people with diabetes are projected to reach 3,288.2 thousand by 2030 and 3,468.5 thousand by 2045.

- Companies such as Samsung Electronics, Cannon, and Fujifilm Medical Systems U.S.A. are strategically investing in producing new X-ray systems, which use X-ray detectors, and mobile X-ray systems, which use X-ray detectors. The production of these systems is anticipated to increase the use of X-ray detectors.

- For instance, in November 2022, Canon Medical Components U.S.A. Inc., a subsidiary of Canon Inc., announced a new product line-up at the Radiology Society of North America (RSNA) conference. Canon Medical Components U.S.A., Inc. displays several innovative products, some of which are available for the first time in the U.S. The CXDI-Elite series of Canon Medical Components U.S.A. has high sensitivity, high image quality, ultra-lightweight, ergonomic design for extended battery life, ease of handling, and AED4 function. This factor makes the CXDI-Elite the ideal digital radiography detector for mobile applications or any general X-ray need. The unique functions, Intelligent N.R., and Built-in AEC5 assistance expand the digital radiography possibilities.

X-Ray Detectors Industry Overview

The X-ray detectors market is highly fragmented, and the essential players have formed strategic collaborations, agreements, expansions, partnerships, new product launches, joint ventures, acquisitions, and others to increase their footprints in this Market. Key players in the Market are Varex Imaging Corporation, PerkinElmer Inc., Thales Group, Fujifilm Medical Systems, Agfa Healthcare, Konica Minolta Inc., Canon Inc., Teledyne DALSA Inc., Analogic Corporation, Comet Holding AG, Hamamatsu Photonics KK, Rayence Co. Ltd, and many more.

In November 2022, Block Imaging announced an X-RAY partnership with Fujifilm Healthcare Solutions. With most Fujifilm products, providers can experience advanced image processing technology. Block Imaging is to offer a variety of new products that encompass innovative, cost-effective, and energy-efficient technology. Healthcare suppliers can rely on Block Imaging to deliver X-ray products such as the FDR ES detector, FDR D-EVO III and FDR D-EVO II detectors, Clinica X OTC and FDR Clinica X FS suites, and mobile digital radiography units like the FDR Go Plus and FDR AQRO. Now partnered with Fujifilm Healthcare Solutions, Block can strive to bring innovative technology to healthcare providers across the U.S.

In November 2022, Teledyne Dalsa has acquired the Sigmascreening B.V. patents and IP portfolio on pressure-sensitive mammography for screening. The unique combination of the detector and pressure-sensitive compression is expected to develop new possibilities for immediate diagnostic information and biomarkers for mammography. The group intends to expand the CMOS X-ray detector product line for mammography with new subsystem products for optimizing and improving patient comfort during mammographic screening.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of Public and Private Investments in Digital Imaging Technologies

- 5.1.2 Declining Prices and Increasing Number of Benefits Offered by Digital Detectors

- 5.2 Market Challenges

- 5.2.1 High Cost of Digital X-ray Systems Due to the Digital Radiography (DR) Unit

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Flat Panel Detectors

- 6.1.1.1 Indirect Flat Panel Detectors

- 6.1.1.2 Direct Flat Panel Detectors

- 6.1.2 Computed Radiography (CR) Detectors

- 6.1.3 Charge Coupled Device Detectors

- 6.1.4 Other Types

- 6.1.1 Flat Panel Detectors

- 6.2 By Portability

- 6.2.1 Fixed Detectors

- 6.2.2 Portable Detectors

- 6.3 By Application

- 6.3.1 Medical

- 6.3.2 Dental

- 6.3.3 Security

- 6.3.4 Industrial

- 6.3.5 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Rest of the Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Varex Imaging Corporation

- 7.1.2 PerkinElmer Inc.

- 7.1.3 Fujifilm Medical Systems

- 7.1.4 Thales Group

- 7.1.5 Agfa Healthcare

- 7.1.6 Konica Minolta Inc.

- 7.1.7 Canon Inc.

- 7.1.8 Teledyne DALSA Inc.

- 7.1.9 Analogic Corporation

- 7.1.10 Comet Holding AG

- 7.1.11 Hamamatsu Photonics KK

- 7.1.12 Rayence Co. Ltd