|

市場調查報告書

商品編碼

1403103

模組化 UPS -市場佔有率分析、行業趨勢與統計、2024-2029 年成長預測Modular UPS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

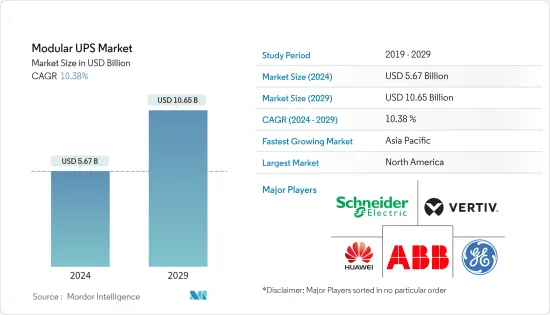

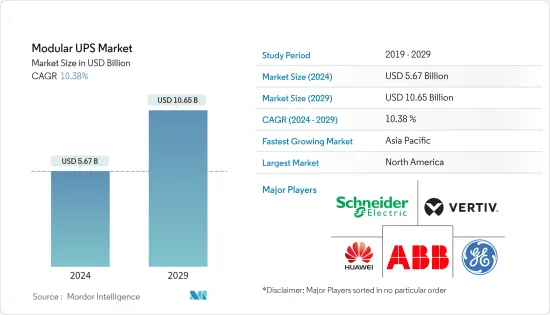

模組化UPS市場規模預計到2024年將達到56.7億美元,預計到2029年將達到106.5億美元,在預測期內(2024-2029年)複合年成長率為10.38%。

對不間斷業務的不斷成長的需求以及對資料中心的日益依賴可能會推動該行業的擴張。

主要亮點

- 模組化不斷電系統(UPS) 是一種彈性且適應性強的電源保護系統,可調整 UPS 的效能。這些模組可熱插拔,並在連接時自動識別。該產品的零功耗停機時間、可靠和穩健的實施預計將提高其採用率。模組化 UPS 系統在需要為重要基礎設施提供可靠電力的企業中越來越普及。

- 模組化不斷電系統(UPS)系統是透過整合多個協調工作的單獨模組而建構的。每個 UPS 模組均包含所有必要的組件,包括整流器、逆變器、電池轉換器、靜態旁通交換器和回饋保護。這些模組化 UPS 系統通常安裝在以堆疊配置排列的機架中。該領域正在快速發展,伊頓、Riero 和 APC 等知名 UPS 製造商提供了一流的模組化 UPS 系統,可根據不同的規格進行客製化。

- 模組化不斷電系統(UPS) 系統的主要優點是可擴展容量和降低維護成本。超大規模資料中心和主機代管供應商正在採用模組化 UPS 技術並採用各種架構,以最大限度地降低營運成本並保持冗餘容量。由於與多個並聯 UPS 系統相比,N+1 設計提供了經濟高效的冗餘、卓越的負載和效率,因此許多組織選擇支援 10 kV-A 至 50kVA 的較小模組。同時,2N設計保證了精確的負載匹配。

- 此外,冗餘封裝是模組化 UPS 系統的關鍵優勢。當模組發生故障時,機架內的冗餘模組可以無縫滿足電源需求。與獨立 UPS 系統不同,實施警報系統無需為整個系統提供冗餘電源保護。可以將一個或兩個模組指定為冗餘模組,以補償另一個模組的故障。這種 N+1 冗餘是模組化系統的基本特徵,也是相對於傳統獨立 UPS 系統的關鍵優勢。

- 模組化系統簡化了維護方法並使其更易於管理。這些模組設計為可熱插拔,允許在系統保持運作的情況下無縫拆卸、更換和測試。模組化UPS系統的功率容量為10-100 kVA、100-250 kVA、215 kVA和500 kVA或以上。這些系統廣泛應用於不同領域,包括資料中心、工業、通訊、商業、BFSI、政府和其他垂直產業。

- 多家供應商不斷投資重大產品推出,這是市場成長的主要動力。例如,2023 年 4 月,Schneider Electric推出了 Easy UPS 3 相模組化,這不斷電系統(UPS),可保護關鍵負載並結合第三方檢驗的即時交換功能。 Easy UPS 三相模組化的容量範圍為 50-250kW,具有 N+1 可擴展設置,與 EcoStruxure 框架相容,並提供遠端監控服務。

- 然而,模組化 UPS 系統的初始安裝成本通常超過傳統集中式 UPS 解決方案。儘管模組化方法提供了可擴展性和適應性,但初始資本投資可能會阻礙注重預算的客戶,特別是財務資源有限的小型企業和組織。

- 2020 年初,COVID-19 大流行對所研究市場的供應鏈和生產產生了重大影響。疫情迫使許多IT公司關閉營運,導致對UPS系統的需求減少。然而,由於疫情期間主機代管和雲端服務的日益普及以及各行業雲端應用程式使用量的增加,模組化 UPS 市場預計將在預測期內成長。

模組化UPS市場趨勢

IT 和通訊預計將推動市場發展

- 近年來,主機代管領域顯著擴大,主要是由於許多公司越來越依賴利用多個雲端資源的大規模應用程式。因此,這些公司希望主機代管提供者能夠提供卓越的服務水平,以整合其基礎設施並根據需要整合其他雲端服務。這一趨勢正在為模組化 UPS 市場創造新的前景。

- 近年來,全球範圍內網際網路使用的擴展、政府有關資料保護法規的實施以及對各種服務的需求不斷成長,迫使雲端供應商在全球範圍內建立資料中心。隨著BFSI、醫療保健、政府、娛樂媒體、教育等領域擴大採用巨量資料和物聯網技術,對此類設施的需求將進一步增加。為了確保停電期間不間斷、可靠的供電,資料中心越來越依賴模組化不斷電系統(UPS)。因此,資料中心數量的增加預計將顯著促進模組化 UPS 市場的成長。

- 資料中心的增加正在推動模組化不斷電系統(UPS)市場的成長。這些現有和未來的資料中心都採用模組化 UPS 系統,以實現更高的標準化、彈性和可擴展性。隨著國際雲端服務供應商和高科技Start-Ups的崛起,柏林正在成為重要的數位中心。德國政府也積極致力於改善該國的數位經濟。到2025年,計畫投資30.9億美元用於人工智慧研發。這些因素預計將進一步推動主機代管服務的需求,並推動模組化UPS市場的成長。

- 2023 年 3 月,Maincubes 宣布已獲得在德國柏林 GoWest 園區建造 BER01資料中心所需的建築許可證。 BER01資料中心符合德國聯邦環境局的「藍色天使」要求,以及德國TUV測試和ISO認證。該公司旨在幫助客戶減少 IT 硬體對環境的影響,同時透過最尖端科技和最先進的架構提高能源節約和成本效率。此類投資預計將為模組化 UPS 市場創造機會。

- 模組化不斷電系統(UPS) 製造商正在努力打造符合未來基礎設施發展趨勢並迎合模組化資料中心趨勢的創新產品。例如,華為最近在其智慧模組化資料中心和SmartLi UPS系列中新增了兩款新產品。其中包括適用於中小型資料中心的模組化解決方案FusionModule2000 6.0,以及與SmartLi Mini配合使用的緊湊型電源解決方案UPS 2000-H。這些產品旨在為通路合作夥伴提供市場競爭優勢,並促進企業經濟高效的生態數位化。

- 此外,對各種應用程式和雲端服務的日益依賴,顯著增加了對主機代管服務的需求,為模組化 UPS 市場創造了新的前景。這些關鍵系統可確保不間斷運行,並有助於避免資料遺失、硬體故障和財務挫折,使其成為資料中心提供者的重要投資。

北美在模組化UPS市場中佔據最大佔有率

- 在 IT、通訊、醫療和製造業的高需求推動下,北美預計將成為模組化 UPS 市場的領先地區。這些組織擁有龐大的業務基礎,對資料中心和主機代管服務產生巨大需求,並對模組化 UPS 解決方案的需求不斷增加。

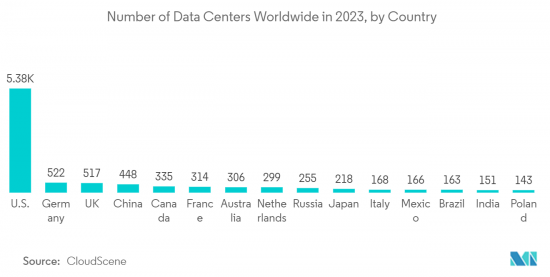

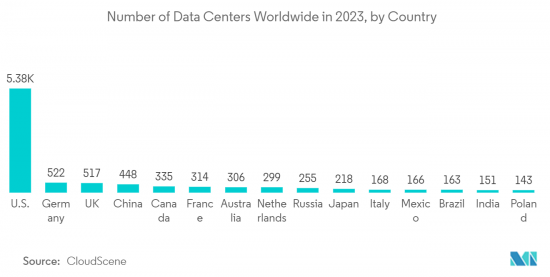

- 由於企業投資增加以及資料中心和主機代管服務需求不斷成長,北美地區預計將保持其作為模組化不斷電系統(UPS)解決方案最大市場的地位。資料中心的增加將進一步推動模組化UPS市場的成長。根據 CloudScene 的數據,截至 2023 年 9 月,光是美國就擁有 5,375 個資料中心,為全球最多。這些增強的功能將支援投資並推動模組化 UPS 市場。

- 例如,2023 年 1 月,亞馬遜公司的雲端部門宣布,打算在 2040 年到維吉尼亞投資 350 億美元建造新資料中心,從而領先競爭微軟公司和 Alphabet 公司。他強調了自己的決心維持這項投資將分佈在多個地點,預計將為維吉尼亞創造約 1,000 個就業機會。維吉尼亞是亞馬遜網路服務最重要的所在地,擁有許多資料中心為美國東部的客戶提供應用程式支援。

- 模組化 UPS 系統是一種靈活且可擴展的解決方案,適用於希望保護關鍵設備免受斷電影響的醫療機構。透過為新的和現有的醫療機構提供模組化 UPS 系統,您可以實現更高的標準化、更大的彈性和可擴展性。因此,該地區醫療保健設施、政府措施和供應商開拓的投資增加預計將提供重要的市場機會。

- 例如,透過《2023年預算-加拿大製造計畫》,加拿大政府正在進行戰略投資,以加強中產階級、培育負擔得起的經濟並確保加拿大人的福祉。 2023 年預算強調政府承諾在 10 年內撥款約 2,000 億美元,以加強加拿大的全民健保體系。這筆撥款包括專門用於新斯科細亞省的超過 50 億加元,用於促進及時獲得家庭健康團隊和醫療保健提供者的服務,建立永續的衛生人力隊伍,並提供優質的精神衛生保健,旨在改善獲得衛生服務的機會。政府加強醫療設施的這些努力強調了對不斷電系統(UPS) 的需求。不斷電系統對於提供可靠的備用電源以支援基本的患者照護、關鍵醫療設備、緊急照明和資料中心功能至關重要。

- 模組化不斷電系統(UPS) 系統可在發生不可預見的情況時提供可靠的備用電源,從而有可能減少停機時間和相關的製造成本。快速成長的製造業和不斷增加的投資預計將推動市場成長。根據經濟分析局 (BEA) 的數據,2022 年製造業為美國國內生產總值(GDP) 貢獻了 2.79 兆美元,略高於上一年的 2.5 兆美元。

模組化UPS產業概況

不斷電系統(UPS)市場高度分散,參與者眾多,包括ABB Ltd、艾默生網路能源、台達電力解決方案、華為技術、施耐德電氣、通用電氣和Gamatronic Electronic Industries Ltd. Masu。這表示市場集中度較低。

2022年11月,華為在中國三亞坡園區發表了兩款新產品。第一個是FusionModule2000 6.0,適合中小型資料中心的模組化資料中心解決方案。第二個產品是 UPS2000-H,這是 SmartLi Mini 提供支援的緊湊型電源解決方案。

2022 年 12 月,Vertiv 發布了最新產品 Vertiv Liebert APM Plus。這是一種高密度、模組化、無變壓器 UPS 系統,具有高效率。 Eco模式效率高達99%,雙轉換模式效率高達97%。 Liebert APM Plus 目前在印度上市,功率範圍為 50 至 500kW。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素與市場抑制因素簡介

- 市場促進因素

- 主機代管和雲端服務高速成長

- 低擁有成本和營運成本

- 市場抑制因素

- 缺乏對資料中心外應用程式的認知

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按電源容量

- 0-50 kVA

- 51-100 kVA

- 101-300 kVA

- 301kVA以上

- 按最終用戶

- 資料中心

- 工業的

- 通訊

- 商業的

- BFSI

- 政府/基礎設施

- 其他最終用戶

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第6章競爭形勢

- 公司簡介

- ABB Ltd

- Emerson Network Power

- Huawei Technologies Co. Ltd

- Schneider Electric SE

- General Electric

- Delta Electronics Inc.

- AEG Power Solutions

- Riello Elettronica Group

- Eaton Corporation

第7章 投資分析

第8章 市場機會及未來趨勢

The Modular UPS Market size is estimated at USD 5.67 billion in 2024, and is expected to reach USD 10.65 billion by 2029, growing at a CAGR of 10.38% during the forecast period (2024-2029).

The rising need for uninterrupted operations and heightened reliance on data centers could propel sector expansion.

Key Highlights

- The modular uninterruptible power supply (UPS) is a resilient and adaptable power protection system that regulates UPS performance. The modules are hot-swappable and automatically recognized when connected. The product's adoption is expected to be strengthened by its robust implementation of zero and dependable power downtime. Modular UPS systems are becoming more prevalent among companies that require a dependable power source for their essential infrastructure.

- A modular uninterruptible power supply (UPS) system is constructed by integrating multiple individual modules that collaborate harmoniously. Each UPS module has all the necessary components, such as a rectifier, inverter, battery converter, static bypass switch, and back-feed protection. These modular UPS systems are typically housed in racks arranged in a stacked configuration. This sector is experiencing rapid growth, and renowned UPS manufacturers like Eaton, Riello, and APC provide top-notch modular UPS systems that can be tailored to meet diverse specifications.

- The primary benefits of a modular uninterruptible power supply (UPS) system lie in its capacity for scalable expansion and decreased maintenance expenses. Hyperscale data centers and colocation providers employ modular UPS technology, employing various architectures to minimize operational costs and maintain redundant capacity. Many organizations opt for smaller modules supporting 10-kilovolt amperes to 50 kVA, as N+1 designs offer cost-effective redundancy, superior loading, and efficiency compared to multiple parallel UPS systems. Meanwhile, 2N designs ensure precise load matching.

- Moreover, the redundancy package is a significant advantage of Modular UPS systems. In the event of a module failure, the redundant module within the rack can seamlessly fulfill the power requirements. Unlike standalone UPS systems, the need for redundant power protection throughout the entire system is eliminated by implementing an early warning system. One or two modules can be designated as redundant to compensate for the failure of another module. This N+1 redundancy is a fundamental feature of modular systems and represents a critical benefit over traditional standalone UPS systems.

- Modular systems offer a simplified and more manageable approach to maintenance. The modules are designed to be hot-swappable, allowing for seamless removal, replacement, and testing while the system remains operational. Modular UPS systems have power capacities ranging from 10-100 kVA, 100-250 kVA, 215 kVA, and 500 kVA and above. These systems are widely utilized in diverse sectors, including data centers, industries, telecommunications, commercial, BFSI, government, and other verticals.

- Several vendors are constantly investing in significant product launches, which are acting as a major driver of the market's growth. For instance, in April 2023, Schneider Electric unveiled the Easy UPS 3-Phase Modular, a resilient uninterruptible power supply (UPS) that safeguards vital loads and incorporates third-party validated Live Swap capability. The Easy UPS 3-Phase Modular is accessible in a range of 50-250 kW capacity, featuring an N+1 scalable setup, and is compatible with the EcoStruxure framework, providing remote monitoring services.

- Moroever, the initial installation expenses associated with modular UPS systems typically exceed those of conventional centralized UPS solutions. Although the modular approach provides scalability and adaptability, the upfront capital investment may dissuade budget-conscious clients, particularly those in smaller enterprises or organizations with limited financial resources.

- The global outbreak of COVID-19 had a profound impact on the supply chain and production of the market under study in early 2020. The pandemic forced numerous IT companies to cease operations, resulting in a decreased demand for UPS systems. However, amidst the pandemic, the modular UPS market is expected to experience growth in the forecast period due to the rising popularity of colocation and cloud services, along with increased usage of cloud applications across various industries.

Modular UPS Market Trends

IT and Telecommunications is Expected to Drive the Market

- The colocation sector has witnessed substantial expansion in recent years, primarily attributed to the growing dependence of numerous enterprises on large-scale applications that employ the resources of multiple clouds. Consequently, these enterprises anticipate their colocation providers to provide superior service levels to consolidate their infrastructure and integrate additional cloud services as required. This trend is generating fresh prospects in the modular UPS market.

- In recent years, the global expansion of Internet usage, the implementation of government regulations for data protection, and the growing need for various services have compelled cloud providers to establish data centers worldwide. The rising adoption of big data and IoT technologies in sectors like BFSI, healthcare, government, entertainment & media, education, and others will further drive the demand for such facilities. To ensure uninterrupted and reliable power supply during power outages, data centers are increasingly relying on modular uninterruptible power supply (UPS) systems. Consequently, the increasing number of data centers is expected to contribute to the modular UPS market's growth significantly.

- An increasing number of data centers is driving the growth of the modular uninterruptible power supply (UPS) market. These data centers, both existing and upcoming, are adopting modular UPS systems to achieve higher standardization, flexibility, and expandability. Due to international cloud service providers and a thriving tech startup, Berlin has emerged as a critical digital hub. The German government is also actively working towards improving the country's digital economy. By 2025, they plan to invest USD 3.09 billion in AI research and development. These factors will further boost the demand for colocation services and drive the growth of the modular UPS market.

- In March 2023, Maincubes declared that it had obtained the necessary building permit to construct its BER01 data center on the Berlin GoWest campus in Germany, with a completion date set for 2025. The BER01 data center will adhere to the "Blue Angel" requirements of the German Federal Environment Agency, as well as being German TUV-tested and ISO-certified. The company aims to assist its clients in reducing the environmental impact of their IT hardware while increasing energy savings and cost-effectiveness due to its cutting-edge technology and state-of-the-art architecture. Such investments are expected to create opportunities for the Modular UPS Market.

- The manufacturers of modular uninterruptible power supplies (UPS) are working on creating innovative products that align with the future infrastructure development trend and cater to the demands of modular data centers. For example, Huawei has recently introduced two new additions to its Smart Modular Data Center and SmartLi UPS series. These additions include the FusionModule2000 6.0, a modular solution for small to medium-sized data centers, and the UPS 2000-H, a compact power supply solution that operates on SmartLi Mini. These products aim to provide channel partners with a competitive advantage in the market while promoting cost-effective green digitalization for businesses.

- Furthermore, The increasing dependence on extensive applications and cloud services has led to a significant rise in the need for colocation services, generating fresh prospects for the modular UPS market. These pivotal systems are instrumental in ensuring uninterrupted operations and averting data loss, hardware impairment, and monetary setbacks, making them an indispensable investment for data center providers.

North America Holds the Largest Share in Modular UPS Market

- North America is estimated to be the leading region in the modular UPS market, driven by high demand from the I.T. and telecommunications, healthcare, and manufacturing sectors. These organizations have large operational bases, creating a massive demand for data centers and colocation services, increasing the demand for modular UPS solutions.

- The North American region is projected to retain its status as the largest market for modular uninterruptible power supply (UPS) solutions due to the rising investments by companies and the escalating demand for data centers and colocation services. The increasing number of data centers further fuels the growth of the modular UPS market. According to CloudScene, the United States alone had 5,375 data centers as of September 2023, the highest number globally. These substantial capabilities will bolster investments and propel the Modular UPS market.

- For instance, in January 2023, Amazon.com Inc.'s cloud division declared its intention to invest USD 35 billion in new data centers in Virginia by 2040, highlighting its resolve to maintain its lead over competitors Microsoft Corp. and Alphabet Inc. The investments, spread across various locations, are expected to generate approximately 1,000 employment opportunities in Virginia. Virginia is the most crucial hub for Amazon Web Services, with numerous data centers powering applications for clients throughout the Eastern U.S. These investments are anticipated to create substantial market demand.

- Modular UPS systems represent a flexible and scalable solution for healthcare facilities seeking to safeguard their critical equipment against the impact of power disruptions. The provision of modular UPS systems to upcoming and existing healthcare facilities enables them to achieve higher standardization, greater flexibility, and expandability. Consequently, the increasing investments, government initiatives, and vendor developments in the region's healthcare facilities are expected to present significant market opportunities.

- For instance, The Government of Canada, through Budget 2023-A Made-in-Canada Plan, is making strategic investments to bolster the middle class, foster an affordable economy, and ensure the well-being of Canadians. Budget 2023 emphasizes the government's commitment to allocate nearly USD 200 billion over 10 years to fortify Canada's universal public health care system. This allocation includes over USD 5 billion, designated explicitly for Nova Scotia, aimed at facilitating timely access to family health teams or providers, establishing a sustainable health workforce, and improving accessibility to high-quality mental health services. These governmental initiatives to enhance healthcare facilities will underscore the necessity for Uninterruptible Power Supplies (UPS), which are crucial in providing reliable backup power to support essential patient care, critical medical equipment, emergency lighting, and data center functionality.

- Modular Uninterruptible Power Supply (UPS) systems have the potential to mitigate downtime and its associated expenses in the manufacturing realm by offering dependable backup power during unforeseen circumstances. The burgeoning manufacturing sector and escalating investments are anticipated to propel market growth. As per the Bureau of Economic Analysis (BEA), the manufacturing industry contributed USD 2.79 trillion to the United States' gross domestic product (GDP) in 2022, representing a marginal upturn from the preceding year's 2.5 trillion U.S. dollars.

Modular UPS Industry Overview

The market for uninterruptible power supply (UPS) systems is highly fragmented, with a large number of players including ABB Ltd, Emerson Network Power, Delta Power Solutions, Huawei Technologies Co. Ltd, Schneider Electric SE, General Electric, Gamatronic Electronic Industries Ltd, and others. This implies that the market concentration is low.

In November 2022, Huawei launched two new products at its Sanyapo Campus in China. The first is FusionModule2000 6.0, which is a modular data center solution that is suitable for small- to medium-sized data centers. The second product is the UPS2000-H, which is a compact power supply solution that SmartLi Mini powers.

In December 2022, Vertiv introduced its latest product, the Vertiv Liebert APM Plus. This is a high-density, modular, and transformer-free UPS system that offers high efficiency. It has an eco-mode efficiency of up to 99 percent and a double conversion mode efficiency of up to 97 percent. The Liebert APM Plus is now available in India and is offered in a power output range of 50 to 500 kW.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 High growth in Colocation and Cloud Services

- 4.3.2 Low Cost of Ownership and Operations

- 4.4 Market Restraints

- 4.4.1 Lack of Awareness Amongst Non-data Center Applications

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Power Capacities

- 5.1.1 0 - 50 kVA

- 5.1.2 51 - 100 kVA

- 5.1.3 101 - 300 kVA

- 5.1.4 301 and Above kVA

- 5.2 By End User

- 5.2.1 Data Centers

- 5.2.2 Industrial

- 5.2.3 Telecommunication

- 5.2.4 Commercial

- 5.2.5 BFSI

- 5.2.6 Government/Infrastructure

- 5.2.7 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Germany

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ABB Ltd

- 6.1.2 Emerson Network Power

- 6.1.3 Huawei Technologies Co. Ltd

- 6.1.4 Schneider Electric SE

- 6.1.5 General Electric

- 6.1.6 Delta Electronics Inc.

- 6.1.7 AEG Power Solutions

- 6.1.8 Riello Elettronica Group

- 6.1.9 Eaton Corporation