|

市場調查報告書

商品編碼

1273530

無線資產管理市場——增長、趨勢和預測 (2023-2028)Wireless Asset Management Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計無線資產管理市場在預測期內將以 13.03% 的複合年增長率增長。

由於幫助每個公司開展業務的實時應用程序,對無線資產管理系統的需求正在增長。該系統執行任務、診斷故障代碼並跟蹤預防措施。這使您可以更好地實時瞭解運營總成本。

主要亮點

- 用於無線資產管理的 RTLS 解決方案開闢了業務可能性,對運輸服務、醫院和醫療保健等各種組織具有巨大價值。RTLS 資產管理系統將 RFID 標籤附加到資產上,以實時識別資產組的存儲位置。

- 無線資產管理可最大限度地降低安全和欺詐風險,有效管理容量和可用性,並在整個組織內自動進行退款。來自有組織和非國家行為者的網絡威脅是市場的主要製約因素。然而,公司正在逐步引入新的解決方案來提高資產利用率。

- 無線資產管理市場的一個主要驅動力是對便攜式監控和管理解決方案不斷增長的需求,以提高運營效率。研究表明,公司正專注於應用無線技術來提高其資產的運營水平。及時獲取信息可以提高工作效率。計算機、筆記本電腦和移動設備用於監控。

- 預計部署無線資產管理系統的高初始成本將阻礙市場擴張。作為一個創新系統,在其運作和收益方面缺乏知識和經驗。預計這將進一步限制市場增長。此外,當前系統存在各種兼容性問題。

- COVID-19 的傳播使無線資產管理市場受益。COVID-19 給各種企業帶來了額外的障礙。COVID-19 流行病強調了採用數字技術和利用軟件資產管理解決方案和服務的能力來提高運營效率的重要性。此外,在大流行之後,隨著全球數字化進程的推進,該市場正在迅速增長。

無線資產管理市場趨勢

實物資產監控應用領域有望佔據較大市場份額

- 實物資產監控的數字化有望增加市場份額,集成電路技術的快速進步正在推動數字市場的發展。GPS 和地理標記功能、生物認證功能和智能手機自動駕駛功能是這些產品的特點。GPS 通過啟用距離跟蹤和測量實時位置信息來促進物理資產的監控。

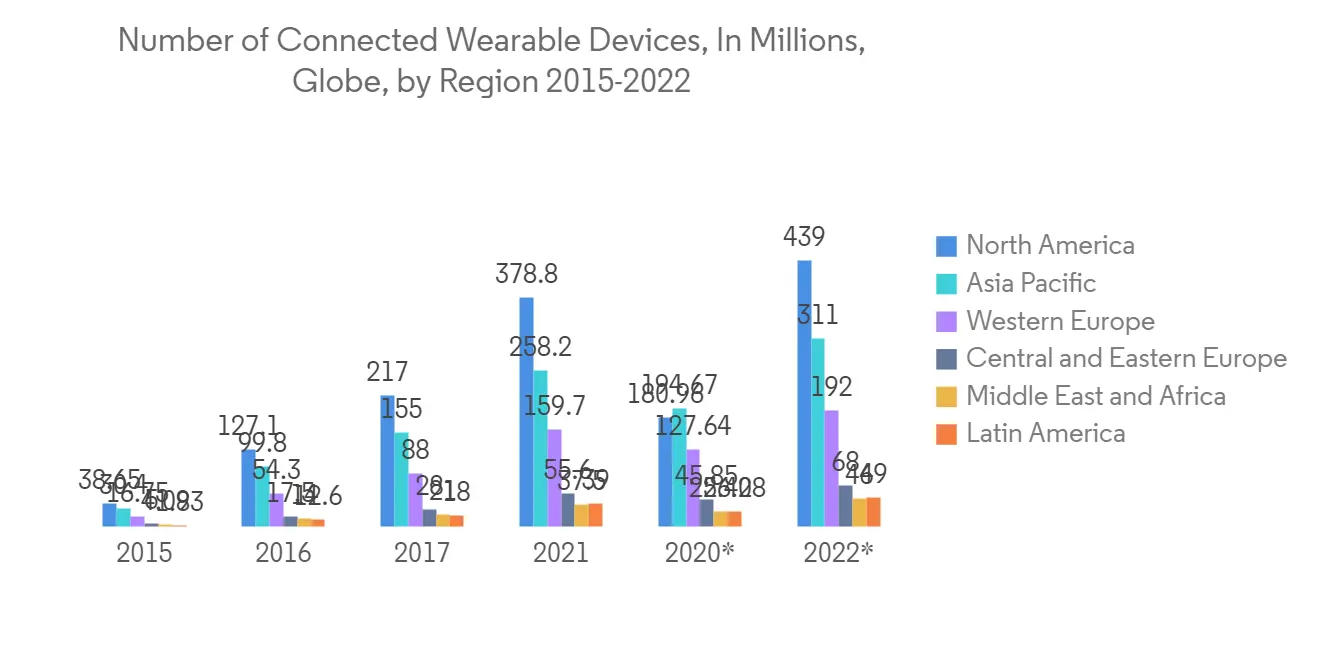

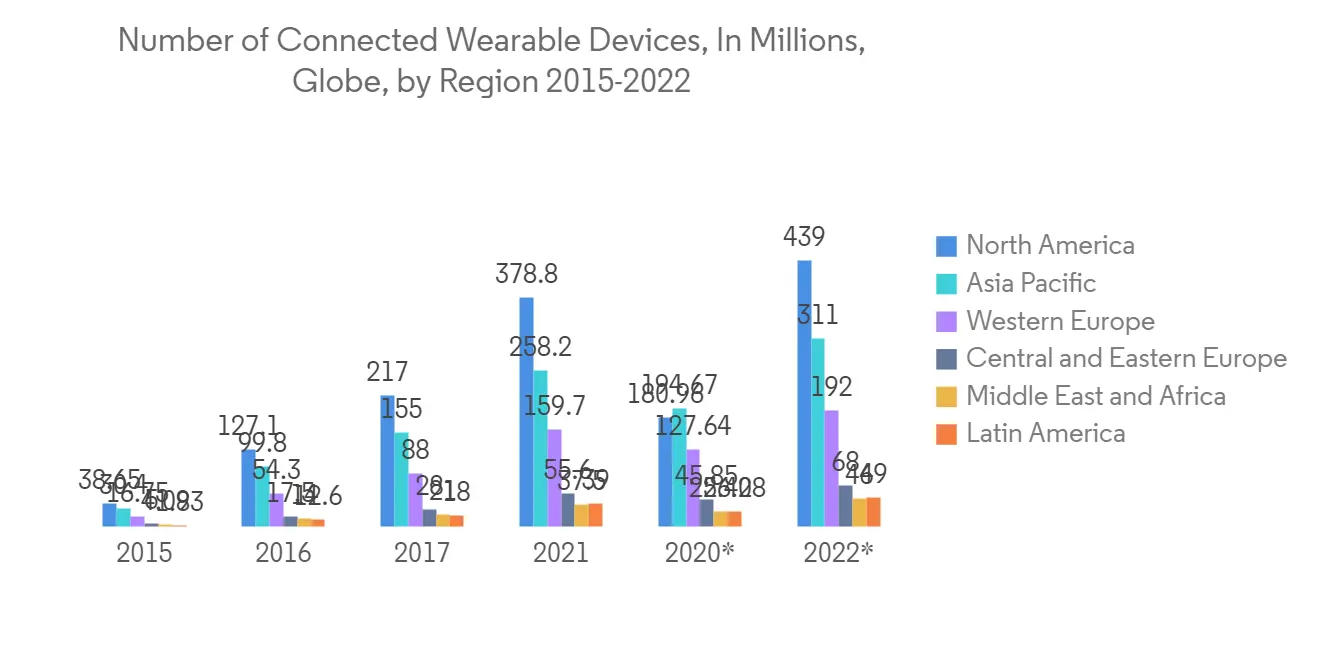

- 隨著物聯網和3D打印等顛覆性技術的出現,結合物聯網技術的可穿戴標籤將進一步增強可穿戴標籤的功能,讓一個設備服務於所有目的,而不是多個應用程序和設備。看起來像據Cisco Systems稱,預計去年北美和亞太地區使用的聯網可穿戴設備將佔全球可穿戴 5G 連接數的 70% 左右。

- 此外,據Ericsson稱,今年全球短距離物聯網 (IoT) 設備數量達到 166 億台。未來四年,這一數字預計將增長到 224 億。今年廣域物聯網設備數量將達到32億台,未來四年有望達到52億台。

- 在 LF 和 HF 波段工作的標籤在無線電波長下工作。根據頻段使用的頻率,閱讀器和標籤之間的信號傳輸以幾種不同且不兼容的方式進行。這些標籤還提供電子商品防盜系統 (EAS),能夠進行自助結帳以進行自動識別以促進庫存系統。

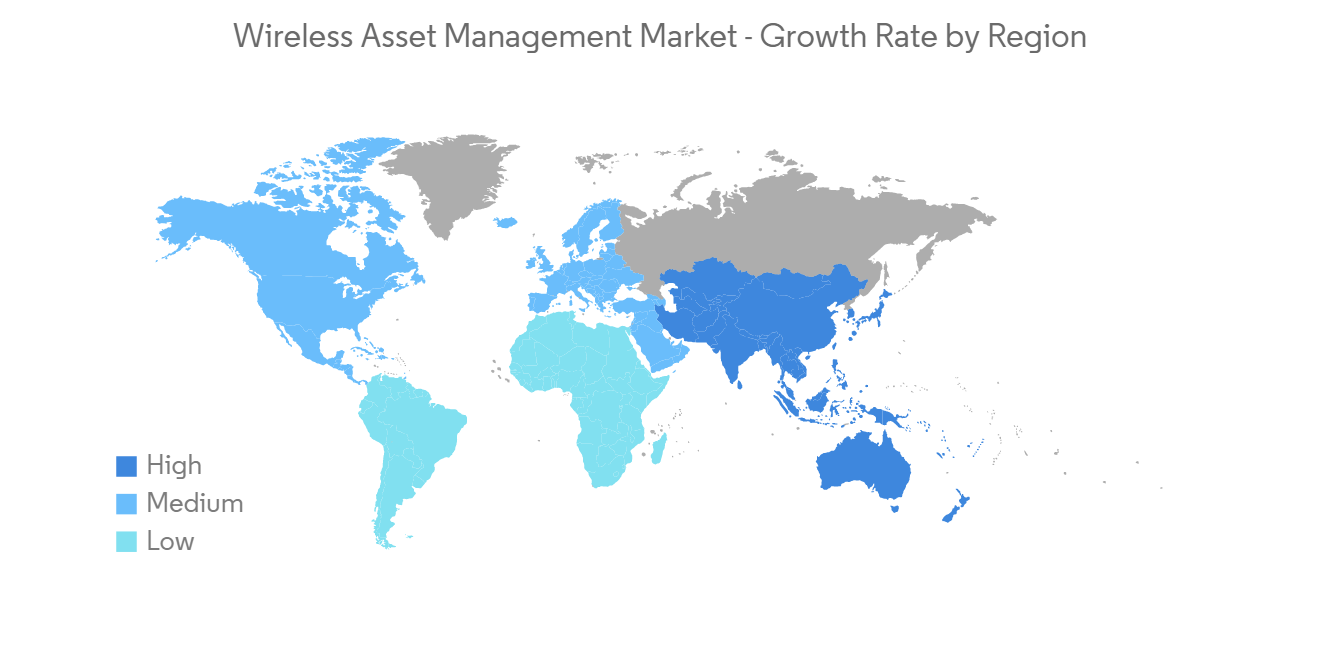

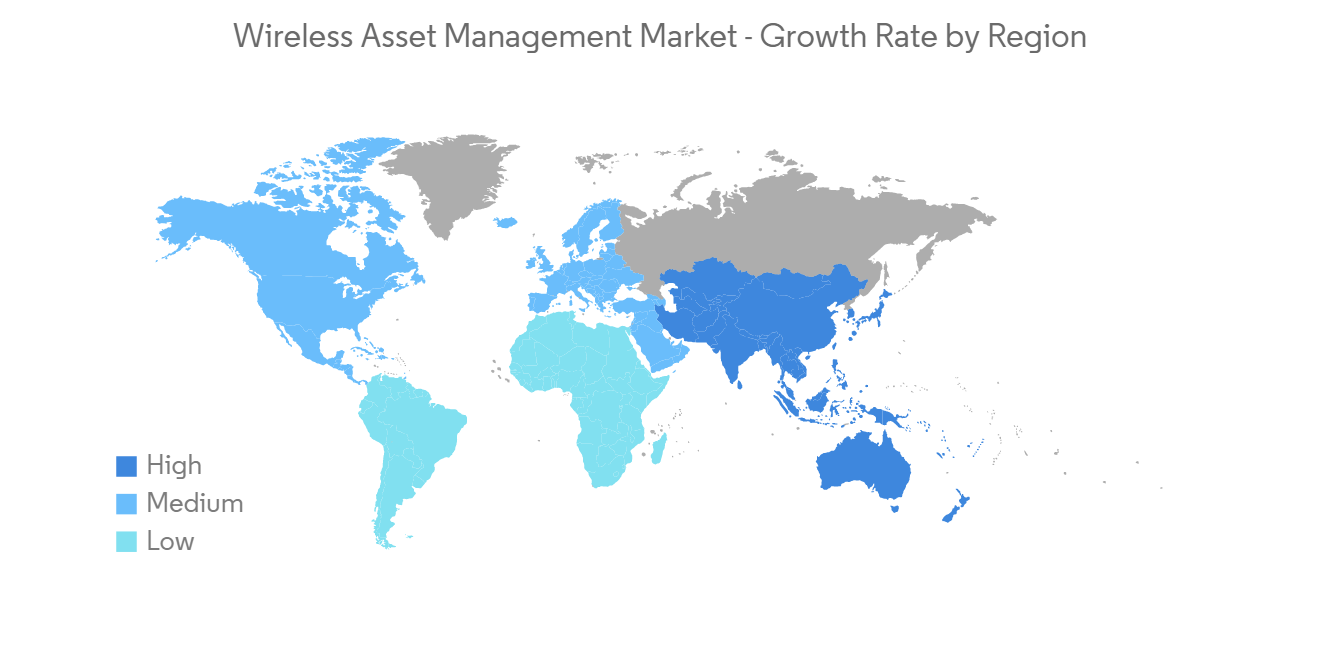

亞太地區有望成為增長最快的市場

- 由於該地區越來越多地採用各種技術進步以及該地區新興國家的重大貢獻,預計亞太地區在預測期內將呈現最高增長率。該地區幾乎所有終端用戶行業對物聯網和人工智能的採用激增,預計將成為一個巨大的推動力。

- 預計物聯網在未來幾年將經歷巨大的增長,而移動技術將在促進該行業的增長方面發揮關鍵作用。先進工業部門是高度都市化的,並且在構成和深度上因地區而異。據Cisco Systems Inc.稱,去年亞太地區連接的可穿戴設備數量約為 3.11 億。

- 此外,印度是亞洲最強大的新興市場之一。智能先進製造和快速轉型中心 (SAMARTH) Udyog Bharat 4.0 計劃旨在提高印度製造業對製造 4.0 的認識,並使利益相關者能夠應對與製造環境中的資產監控相關的挑戰。該地區資產跟蹤應用程序的進步正在推動市場增長。

- 根據 IBEF 的數據,印度電子商務市場預計將從 2017 年的 385 億美元增長到 2026 年的 2000 億美元。上述新興市場的發展預計將在預測期內推動市場增長。

- 此外,韓國政府已決定到2025年在全國建設30,000家智能工廠,並根據 "智能工廠發展和推進戰略" 制定了目標。此外,電子商務的成倍增長預計將推動該地區的市場發展,以及向有組織的零售業的轉變。

- 因此,政府為加速各區域行業數字化採用的援助和合作增加了對無線資產管理解決方案的需求。

無線資產管理行業概況

無線資產管理市場高度分散,主要參與者包括 Cisco Systems Inc.、Siemens AG、AeroScout Inc.、Boston Networks Ltd.、TVL Inc. (WiseTrack)。市場參與者正在採用合作夥伴關係和收購等戰略來加強他們的產品供應並獲得持續的競爭優勢。

- 2022 年 12 月 - Cisco在亞太地區推出了一項新的 SMB 計劃,以提高其合作夥伴的銷售效率和盈利能力。Partner Deal Express 計劃為 SMB 定制的重點產品組合提供前期折扣,使 Cisco 合作夥伴能夠為 SMB 快速完成交易。這消除了合作夥伴為符合該計劃資格的合同獲得許可的需要。您還可以提供最優惠的價格和促銷活動,以改善客戶體驗,通過可預測的定價提高合作夥伴的盈利能力,並更輕鬆、更快速地完成 SMB 交易。為此,Cisco定期分析歷史定價和競爭數據,並進行快速跟蹤(定價)更改,為中小企業提供最佳的初始成本。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 本次調查範圍

第二章研究方法論

第三章執行摘要

第四章市場洞察

- 市場概況

- 工業吸引力——波特五力分析

- 新進入者的威脅

- 買方/消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 行業價值鏈分析

- 技術快照

- COVID-19 對市場的影響

第五章市場動態

- 市場驅動力

- 擴大便攜式監控和管理解決方案的使用

- 完善資產跟蹤應用程序以提高運營效率

- 市場製約因素

- 初始設置需要大量投資

- 與現有系統的同步和兼容性問題

第六章市場細分

- 按類型

- 硬件

- 軟件

- 按申請

- 實物資產監控

- 自動化庫存管理

- 精準的維修管理

- 損失預防

- 其他應用

- 區域信息

- 北美

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第七章競爭格局

- 公司簡介

- Cisco Systems Inc.

- Siemens AG

- AeroScout Inc.

- Boston Networks Ltd

- TVL Inc.(WiseTrack)

- Intelligent Insites Inc.

- ASAP Systems

- Teletrac Inc.

- Moog Inc.

- Verizon Communications Inc.

第八章投資分析

第 9 章 市場機會和未來趨勢

The wireless asset management market is expected to grow at a CAGR of 13.03% over the forecast period. The necessity of the wireless asset management system is increasing, owing to its real-time applications that can help any enterprise in conducting its business. It performs tasks, impacts diagnose trouble codes, and tracks preventive methods. This helps in better understanding the total cost of operation on a real-time basis.

Key Highlights

- RTLS solutions for wireless asset management would increase business potential and is incredibly valuable for various organizations, such as transportation services, hospitality, healthcare, and others. The RTLS asset management system is attached to the asset with RFID tags to locate where the group of assets is stored and located on a real-time basis.

- Wireless asset management minimizes security and fraud risks, effectively manages capacity and availability, and automates chargebacks across the organization. Cyber threats from organized and non-state actors are a major constraint for the market. However, companies are gradually adopting new solutions to improve their asset utilization.

- A key driver for the Wireless Asset Management Market is the growing need for portable monitoring and management solutions to improve operational efficiency. With the help of research, organizations focus on applying wireless technologies to improve asset operating levels. Obtaining information on time boosts operational productivity. Computers, laptops, and mobile devices are used for monitoring.

- The high initial expenses of adopting wireless asset management systems are projected to hinder market expansion. As an innovative system, there is a lack of knowledge and experience about its operation and advantages. This is expected to limit the market growth further. Furthermore, there are various compatibility difficulties with the current system.

- The proliferation of COVID-19 benefitted the wireless asset management market. COVID-19 has posed additional obstacles for various businesses. The COVID-19 outbreak has underlined the importance of embracing digital technologies and utilizing the capabilities of software asset management solutions and services to boost operational productivity. Post-pandemic also, the market is growing rapidly with the increased digitization throughout the globe.

Wireless Asset Management Market Trends

Physical Asset Monitoring Application Segment is Expected to Hold Significant Market Share

- Digitalization across physical asset monitoring is expected to boost its market share and rapid advances in integrated circuit technology are boosting the digital market. GPS & geotagging capability, biometric functionality, and autonomous smartphone functionality are some of the exclusive features of these products. GPS tracking enables distance tracking and measures real-time location, fueling physical asset monitoring.

- IoT and 3D printing, among other disruptive technologies, are boosting wearable tags that are integrated with IoT technology which can further enhance the functionality of wearable tags, where one device can serve all the purposes rather than multiple apps and devices. According to Cisco Systems, Connected wearables used in North America and Asia Pacific are together forecast to account for approximately 70 percent of the wearable 5G connections worldwide in the previous year.

- Moreover, according to Ericsson, the number of short-range internet of things (IoT) devices reached 16.6 billion worldwide in the current year. That number is forecast to increase to 22.4 billion by the next four years. The wide-area IoT devices amounted to 3.2 billion in the current year and are predicted to reach 5.2 billion by the next four years.

- Tags working on LF and HF bands work in terms of radio wavelength. Depending on the frequency used by the band, signaling between the reader and the tag is done in several different incompatible ways. These tags also provide electronic article surveillance (EAS), where self-checkout can be made for automatic identification to ease inventory systems.

Asia Pacific is Expected to be the Fastest Growing Market

- Asia-Pacific is expected to witness the highest growth rate over the forecast period, owing to the increasing adoption of various technological advancements in the region and the region's emerging economies' significant contributions. The rapid increase in IoT and AI adoption in almost every end-user industry in the area is expected to be a substantial driver.

- IoT is predicted to undergo massive growth in the coming years, with mobile technologies playing a vital role in enabling the industry to grow. The advanced industries sector is highly metropolitan and varies considerably in its composition and depth across the regions. According to Cisco systems, the number of connected wearable devices in the Asia Pacific region was approximately 311 million in the previous year.

- Further, India is one of the strongest emerging economies in the Asian markets. The Smart Advanced Manufacturing and Rapid Transformation Hub (SAMARTH) Udyog Bharat 4.0 initiative aimed at enhancing awareness about manufacturing 4.0 within the Indian manufacturing industry and helping stakeholders address the challenges related to asset monitoring in the manufacturing environment. The advancement in asset-tracking applications in the region drives market growth.

- According to the IBEF, the Indian e-commerce market is expected to grow to USD 200 billion by 2026 from USD 38.5 billion in 2017. The above developments would boost the market's growth during the forecast period.

- Moreover, The Korean government has decided and set targets to build 30,000 smart factories around the country by 2025, in line with its Smart Factory Roll-out and Advancement Strategy. Additionally, with the transition toward organized retailing, multifold growth of e-commerce is expected to drive the development of the region's market.

- Therefore, the growing government aid to boost the adoption of digitalization in various regional industries and collaborations bolstered the demand for wireless asset management solutions.

Wireless Asset Management Industry Overview

The wireless asset management market is highly fragmented with the presence of major players like Cisco Systems Inc., Siemens AG, AeroScout Inc., Boston Networks Ltd, and TVL Inc. (WiseTrack). Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- December 2022 - Cisco introduced a new SMB program in the Asia Pacific to increase partner sales productivity and profitability. Because it offers an upfront discount on a focused portfolio customized for SMBs, the Partner Deal Express program enables Cisco's partners to conduct faster transactions for SMBs. This eliminates the requirement for partners to obtain clearance for agreements that fit under this program. It also provides the best price and promotions to improve customer experience and boosts partner profitability through predictable pricing, making SMB deals/transactions easier and faster to close. To do this, Cisco regularly analyzes historical pricing and competitive data and alters Fast Track (price) to deliver the best upfront savings for SMBs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industrial Value Chain Analysis

- 4.4 Technological Snapshot

- 4.5 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Application of Portable Monitoring and Management Solution

- 5.1.2 Advancement in the Asset Tracking Applications with Improved Operational Efficiency

- 5.2 Market Restraints

- 5.2.1 High Investment is Required during Initial Setup

- 5.2.2 Synchronization and Compatibility Issue with the Existing System

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware

- 6.1.2 Software

- 6.2 By Application

- 6.2.1 Physical Asset Monitoring

- 6.2.2 Automate Inventory Control

- 6.2.3 Precise Maintenance Management

- 6.2.4 Loss Prevention

- 6.2.5 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Siemens AG

- 7.1.3 AeroScout Inc.

- 7.1.4 Boston Networks Ltd

- 7.1.5 TVL Inc. (WiseTrack)

- 7.1.6 Intelligent Insites Inc.

- 7.1.7 ASAP Systems

- 7.1.8 Teletrac Inc.

- 7.1.9 Moog Inc.

- 7.1.10 Verizon Communications Inc.